Key Insights

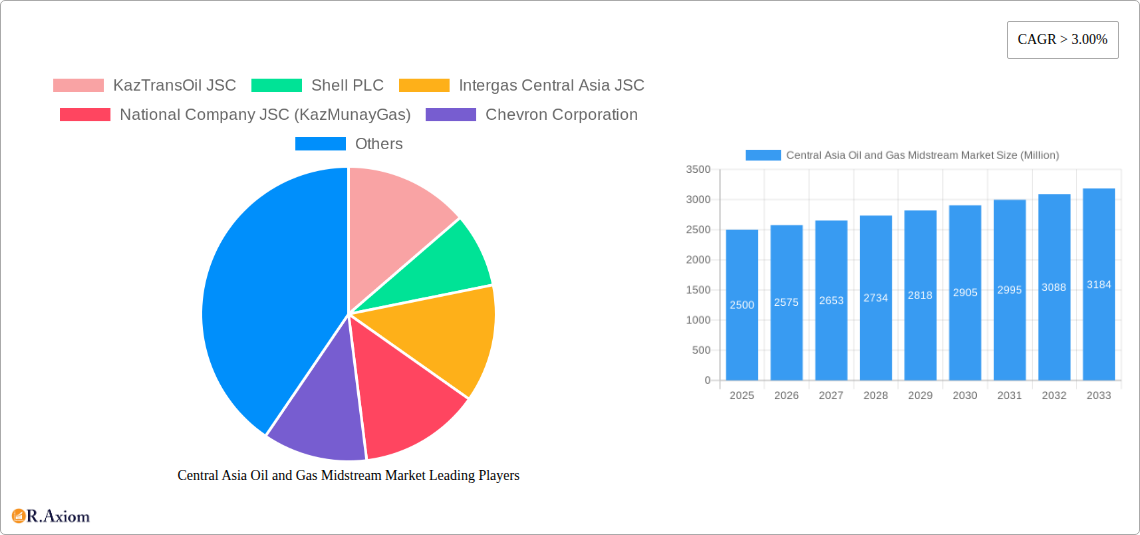

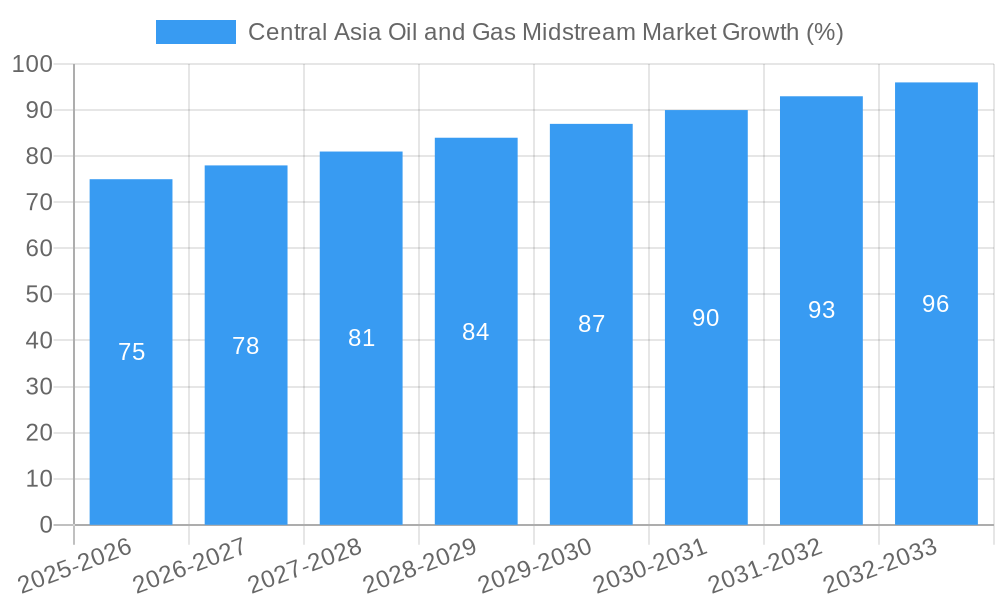

The Central Asia oil and gas midstream market, encompassing transportation, storage, and terminal operations, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 3.0% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing energy demand from both domestic consumption within Central Asian nations and export markets fuels the need for enhanced midstream infrastructure. Secondly, government initiatives focused on modernizing existing infrastructure and attracting foreign investment play a significant role. Furthermore, the strategic geographic location of Central Asia, connecting major energy producers to global markets, enhances its attractiveness for pipeline projects and storage facilities. Key players such as KazTransOil JSC, Shell PLC, and KazMunayGas are actively involved in shaping the market landscape, investing in capacity expansion and technological advancements.

However, the market also faces challenges. Geopolitical instability in the region presents a significant risk, impacting investment decisions and operational continuity. Additionally, the fluctuating global prices of oil and gas influence project profitability and investment attractiveness. Competition from alternative energy sources is also gradually emerging as a long-term restraint. Despite these challenges, the continued growth of the energy sector in Central Asia, coupled with substantial investments in infrastructure modernization, suggests a positive outlook for the midstream market, although the pace of expansion will likely be influenced by geopolitical factors and global energy market dynamics. The Asia-Pacific region, specifically countries like China, India, and Japan, represents a significant market for Central Asian oil and gas exports, further driving the demand for efficient midstream services.

Central Asia Oil & Gas Midstream Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Central Asia Oil & Gas Midstream Market, covering the period from 2019 to 2033. With a focus on actionable insights, this study is essential for industry stakeholders, investors, and strategic decision-makers seeking to understand the dynamics of this evolving market. The report leverages extensive data analysis, encompassing historical data (2019-2024), a base year of 2025, and a forecast period extending to 2033. Key segments analyzed include Transportation and Storage & Terminals.

Central Asia Oil & Gas Midstream Market Market Concentration & Innovation

This section analyzes the competitive landscape of the Central Asia oil and gas midstream market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market is characterized by a mix of both large international players and national oil companies. Market share is highly concentrated among the leading players, with KazTransOil JSC and KazMunayGas holding significant positions.

- Market Concentration: The market exhibits moderate concentration, with a few dominant players controlling a significant share of the transportation and storage segments. Precise market share figures for each company will be detailed in the full report.

- Innovation Drivers: Technological advancements in pipeline infrastructure, automation, and digitalization are key drivers of innovation. The push for enhanced efficiency and safety is also stimulating innovation within the sector.

- Regulatory Frameworks: Government regulations regarding pipeline safety, environmental protection, and pricing policies significantly influence market dynamics. The report provides a thorough assessment of these regulatory impacts.

- Product Substitutes: Limited direct substitutes exist for traditional pipeline transportation, though alternative modes such as trucking or rail may compete under specific circumstances.

- End-User Trends: The increasing demand for oil and gas in Central Asia fuels growth in the midstream sector. Shifting energy demands and environmental concerns, however, create long-term challenges.

- M&A Activities: The report includes a detailed overview of mergers and acquisitions (M&A) activities in the sector, quantifying deal values where available. For example, xx Million in M&A deals were recorded in the historical period.

Central Asia Oil & Gas Midstream Market Industry Trends & Insights

This section delves into the prevailing trends and insights shaping the Central Asia oil and gas midstream market. The market is experiencing substantial growth driven by increased production and consumption of oil and gas in the region. Significant investments in infrastructure upgrades and expansions contribute to this positive trajectory.

The compound annual growth rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Market penetration of advanced technologies such as pipeline monitoring systems is also increasing, contributing to efficiency improvements. Competitive dynamics are largely influenced by the strategic moves of major national oil companies and the involvement of multinational corporations. The industry is also undergoing transformation in response to evolving geopolitical factors and an increased emphasis on environmental sustainability.

Dominant Markets & Segments in Central Asia Oil & Gas Midstream Market

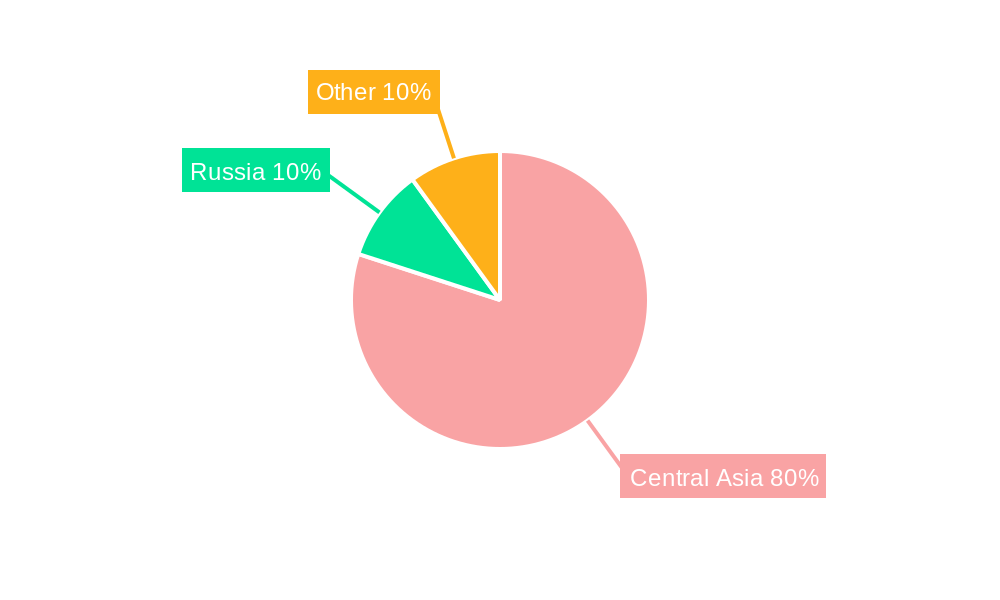

This section identifies the dominant regions, countries, and segments within the Central Asia oil and gas midstream market, specifically focusing on Transportation and Storage & Terminals.

Dominant Segment: Transportation

- Key Drivers: The extensive pipeline network connecting various oil and gas fields to processing facilities and export terminals is crucial to the sector. The transportation segment's dominance is driven by the efficient, high-capacity nature of pipelines and the high volume of oil and gas transported.

- Kazakhstan: Kazakhstan's extensive oil and gas reserves and well-established pipeline infrastructure make it a dominant player. The ongoing development of new pipelines and expansion projects fuel this dominance.

- Other Regions/Countries: While Kazakhstan's influence is prominent, the report will provide a detailed analysis of the role of other countries, such as Turkmenistan and Uzbekistan, including their contribution to the overall market.

Storage & Terminals Segment

The Storage & Terminals segment experiences steady growth driven by the need for efficient storage of oil and gas before transportation and processing. This section provides a breakdown of storage capacity, terminal locations, and their contribution to the overall market size.

Central Asia Oil & Gas Midstream Market Product Developments

Technological advancements are driving product innovation in the Central Asia oil and gas midstream sector. This involves the implementation of sophisticated pipeline monitoring systems, automation technology for enhanced operational efficiency, and the use of advanced materials to enhance pipeline longevity and durability. These improvements directly translate to improved safety standards and reduced operational costs. The integration of digital technologies and data analytics provides valuable insights for optimizing operations and investment planning.

Report Scope & Segmentation Analysis

This report segments the Central Asia oil and gas midstream market primarily by sector: Transportation and Storage & Terminals.

Transportation Segment: This segment encompasses all aspects of oil and gas transportation via pipelines, including the construction, operation, and maintenance of these infrastructure assets. Market size estimations for this segment, along with growth projections and analysis of the competitive dynamics, are included in the full report.

Storage & Terminals Segment: This segment focuses on the storage facilities and terminals used for the temporary storage of oil and gas before further processing or transportation. Similar market size estimations, growth projections, and competitive dynamics analysis will be detailed in the full report.

Key Drivers of Central Asia Oil & Gas Midstream Market Growth

Several factors drive the growth of the Central Asia oil and gas midstream market. These include the steady increase in oil and gas production across the region, fueled by rising global demand, the substantial investments in upgrading and expanding pipeline infrastructure, and the development of new transportation routes. Furthermore, technological advancements contribute significantly to improving efficiency and operational safety, ultimately enhancing the attractiveness of this market.

Challenges in the Central Asia Oil & Gas Midstream Market Sector

Despite the significant growth potential, certain challenges impede the development of the Central Asia oil and gas midstream market. These include navigating complex regulatory environments, geopolitical uncertainties impacting project development, and managing the risks associated with aging infrastructure. Additionally, ensuring environmental sustainability in operations and securing sufficient funding for infrastructure upgrades continue to pose challenges. The report quantifies these challenges, including potential financial impact (xx Million) for specific constraints.

Emerging Opportunities in Central Asia Oil and Gas Midstream Market

The Central Asia oil and gas midstream market presents several promising opportunities. These include the development of new pipeline infrastructure to facilitate increased production and export capabilities, expansion of storage capacity to accommodate growing volumes, and the integration of advanced technologies to enhance operational efficiency and environmental sustainability. Exploring new markets and partnerships, along with embracing innovative technologies, can significantly contribute to unlocking further opportunities for growth.

Leading Players in the Central Asia Oil & Gas Midstream Market Market

- KazTransOil JSC

- Shell PLC

- Intergas Central Asia JSC

- National Company JSC (KazMunayGas)

- Chevron Corporation

- National Company QazaqGaz JSC

- Caspian Pipeline Consortium

Key Developments in Central Asia Oil & Gas Midstream Market Industry

- August 2022: Kazakhstan explored using Azerbaijan's oil pipeline as an alternative to Russian routes, signifying a shift in geopolitical reliance and market dynamics.

- August 2022: KazMunayGas (KMG) and SOCAR initiated discussions on trans-Caspian infrastructure development, reflecting a strategic move towards regional cooperation and diversification of transportation routes.

- September 2021: The agreement between SOCAR and Vitol Group to transport Turkmen oil via the BTC pipeline highlights the increasing role of regional partnerships in facilitating oil transportation. This also demonstrates the significance of the BTC pipeline as a crucial transportation route.

Strategic Outlook for Central Asia Oil & Gas Midstream Market Market

The Central Asia oil and gas midstream market holds significant potential for future growth, driven by consistent demand for oil and gas in the region, planned expansions of pipeline infrastructure, and technological advancements promoting operational efficiency. Strategic partnerships, investments in sustainable technologies, and effective regulatory frameworks will be critical in unlocking this potential and ensuring the long-term viability of the sector. The market is projected to reach xx Million by 2033.

Central Asia Oil and Gas Midstream Market Segmentation

-

1. Sector

- 1.1. Transportation

- 1.2. Storage and Terminals

-

2. Geography

- 2.1. Kazakhstan

- 2.2. Tajikistan

- 2.3. Turkmenistan

- 2.4. Rest of Central Asia

Central Asia Oil and Gas Midstream Market Segmentation By Geography

- 1. Kazakhstan

- 2. Tajikistan

- 3. Turkmenistan

- 4. Rest of Central Asia

Central Asia Oil and Gas Midstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand from Industrial Applications4.; Growing Infrastructure Across the World

- 3.3. Market Restrains

- 3.3.1. 4.; A Rise In Concerns Related To Carbon Emissions And A Shift Towards Electric Vehicles And Renewable Sources Of Energy

- 3.4. Market Trends

- 3.4.1. Transportation Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Central Asia Oil and Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Transportation

- 5.1.2. Storage and Terminals

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Kazakhstan

- 5.2.2. Tajikistan

- 5.2.3. Turkmenistan

- 5.2.4. Rest of Central Asia

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Kazakhstan

- 5.3.2. Tajikistan

- 5.3.3. Turkmenistan

- 5.3.4. Rest of Central Asia

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Kazakhstan Central Asia Oil and Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Transportation

- 6.1.2. Storage and Terminals

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Kazakhstan

- 6.2.2. Tajikistan

- 6.2.3. Turkmenistan

- 6.2.4. Rest of Central Asia

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. Tajikistan Central Asia Oil and Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Transportation

- 7.1.2. Storage and Terminals

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Kazakhstan

- 7.2.2. Tajikistan

- 7.2.3. Turkmenistan

- 7.2.4. Rest of Central Asia

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Turkmenistan Central Asia Oil and Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Transportation

- 8.1.2. Storage and Terminals

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Kazakhstan

- 8.2.2. Tajikistan

- 8.2.3. Turkmenistan

- 8.2.4. Rest of Central Asia

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Rest of Central Asia Central Asia Oil and Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Transportation

- 9.1.2. Storage and Terminals

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Kazakhstan

- 9.2.2. Tajikistan

- 9.2.3. Turkmenistan

- 9.2.4. Rest of Central Asia

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. China Central Asia Oil and Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 11. Japan Central Asia Oil and Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 12. India Central Asia Oil and Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 13. South Korea Central Asia Oil and Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 14. Taiwan Central Asia Oil and Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 15. Australia Central Asia Oil and Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Asia-Pacific Central Asia Oil and Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 KazTransOil JSC

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Shell PLC

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Intergas Central Asia JSC

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 National Company JSC (KazMunayGas)

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Chevron Corporation

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 National Company QazaqGaz JSC

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Caspian Pipeline Consortium*List Not Exhaustive

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.1 KazTransOil JSC

List of Figures

- Figure 1: Central Asia Oil and Gas Midstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Central Asia Oil and Gas Midstream Market Share (%) by Company 2024

List of Tables

- Table 1: Central Asia Oil and Gas Midstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Central Asia Oil and Gas Midstream Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Central Asia Oil and Gas Midstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Central Asia Oil and Gas Midstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Central Asia Oil and Gas Midstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Central Asia Oil and Gas Midstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Central Asia Oil and Gas Midstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Central Asia Oil and Gas Midstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Central Asia Oil and Gas Midstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Central Asia Oil and Gas Midstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Central Asia Oil and Gas Midstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Central Asia Oil and Gas Midstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Central Asia Oil and Gas Midstream Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 14: Central Asia Oil and Gas Midstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Central Asia Oil and Gas Midstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Central Asia Oil and Gas Midstream Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 17: Central Asia Oil and Gas Midstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Central Asia Oil and Gas Midstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Central Asia Oil and Gas Midstream Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 20: Central Asia Oil and Gas Midstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Central Asia Oil and Gas Midstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Central Asia Oil and Gas Midstream Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 23: Central Asia Oil and Gas Midstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Central Asia Oil and Gas Midstream Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Central Asia Oil and Gas Midstream Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Central Asia Oil and Gas Midstream Market?

Key companies in the market include KazTransOil JSC, Shell PLC, Intergas Central Asia JSC, National Company JSC (KazMunayGas), Chevron Corporation, National Company QazaqGaz JSC, Caspian Pipeline Consortium*List Not Exhaustive.

3. What are the main segments of the Central Asia Oil and Gas Midstream Market?

The market segments include Sector, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand from Industrial Applications4.; Growing Infrastructure Across the World.

6. What are the notable trends driving market growth?

Transportation Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; A Rise In Concerns Related To Carbon Emissions And A Shift Towards Electric Vehicles And Renewable Sources Of Energy.

8. Can you provide examples of recent developments in the market?

August 2022: Kazakhstan aimed to sell some of its crude oil through Azerbaijan's most extensive oil pipeline. Kazakhstan is seeking alternatives to a route Russia has threatened to shut.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Central Asia Oil and Gas Midstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Central Asia Oil and Gas Midstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Central Asia Oil and Gas Midstream Market?

To stay informed about further developments, trends, and reports in the Central Asia Oil and Gas Midstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence