Key Insights

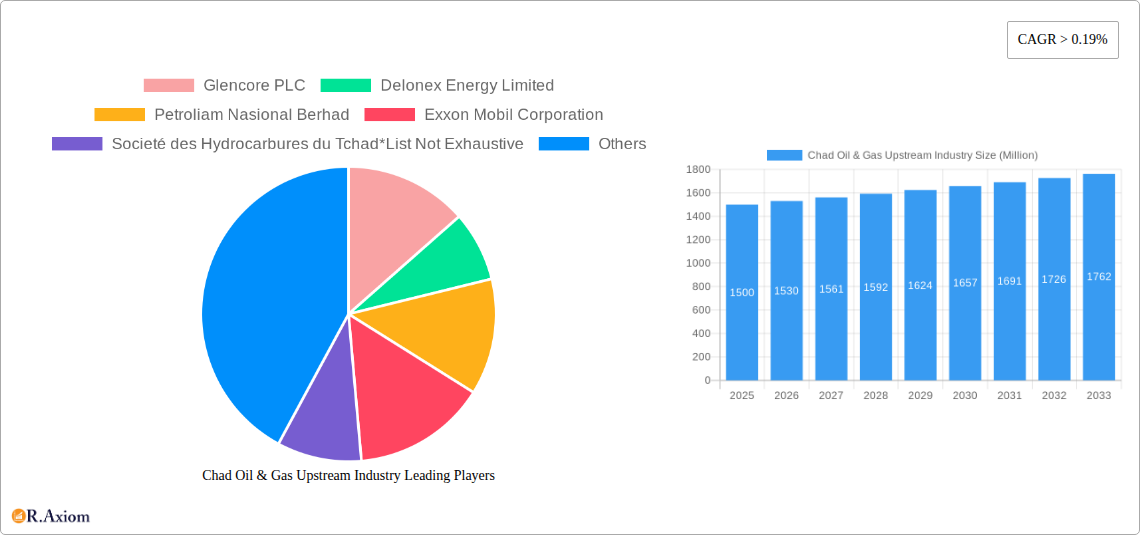

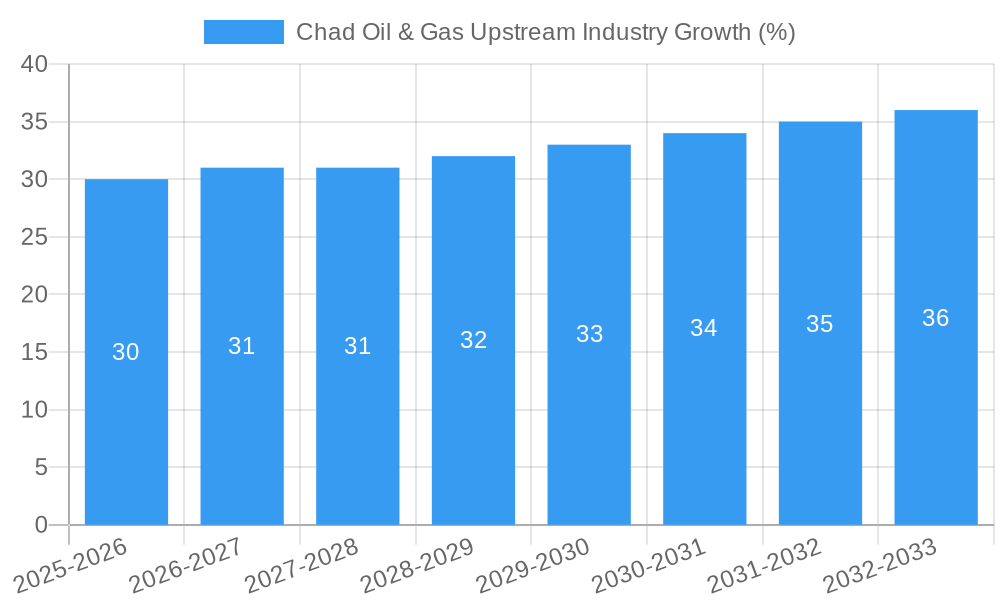

The Chad Oil & Gas Upstream industry, while relatively small compared to global giants, presents a unique investment landscape with significant growth potential. The market's Compound Annual Growth Rate (CAGR) exceeding 0.19 suggests a positive trajectory, albeit potentially modest compared to more dynamic regions. Driving this growth are several factors, including increasing global energy demand (although the pace of this demand is subject to fluctuations in the global economy and the adoption of renewables), the ongoing exploration efforts by international and national oil companies, and potential for new discoveries within the country's largely unexplored basins. However, challenges remain, such as the inherent political and economic instability within Chad, the volatility of global oil prices, and the limitations imposed by a relatively underdeveloped infrastructure. These restraints can significantly affect investment decisions and project timelines. The segmentation of the market likely involves various operational phases (exploration, development, production), each presenting differing levels of risk and return. Major players like Glencore PLC, Delonex Energy Limited, and ExxonMobil, along with national oil company Société des Hydrocarbures du Tchad, actively participate, indicating a mix of international and domestic involvement. Given the limited data provided, a thorough risk assessment is crucial for potential investors, focusing on both geological uncertainties and macroeconomic risks specific to the region.

Further analysis suggests that despite the modest CAGR, the market is projected to experience consistent, albeit gradual, growth throughout the forecast period (2025-2033). This growth can be attributed to continued exploration efforts aiming to capitalize on existing reserves and discover new ones. Strategic partnerships between international companies and the Chadian government are likely to play a key role in shaping this development. However, sustainable growth requires addressing the constraints mentioned earlier, focusing on infrastructure development, regulatory reforms, and addressing the environmental and social impacts of oil and gas extraction. The industry's trajectory in the next decade will be determined by the interplay between these driving forces and the prevailing economic and political climate. Continued monitoring of geopolitical stability and oil prices will be crucial for accurately forecasting future market size and performance.

Chad Oil & Gas Upstream Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Chad Oil & Gas Upstream Industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, growth drivers, challenges, and emerging opportunities. Leveraging rigorous research and data analysis, this report delivers actionable intelligence to navigate the complexities of this dynamic sector.

Chad Oil & Gas Upstream Industry Market Concentration & Innovation

This section analyzes the competitive landscape of Chad's oil and gas upstream sector, examining market concentration, innovation drivers, regulatory frameworks, and M&A activity. The report incorporates data from the historical period (2019-2024), the base year (2025), and projects the market's trajectory to 2033.

Market Concentration: The report assesses the market share held by key players like Glencore PLC, Delonex Energy Limited, Petroliam Nasional Berhad, Exxon Mobil Corporation, and Société des Hydrocarbures du Tchad, providing a detailed understanding of the industry's structure and competitive intensity. Market share data for 2025 will be presented, along with an analysis of potential shifts in concentration during the forecast period (2025-2033). The report will quantify the Herfindahl-Hirschman Index (HHI) for the base year and forecast years.

Innovation Drivers: The report identifies key technological advancements and their impact on upstream operations, including enhanced oil recovery techniques, digitalization, and automation. It also examines the role of government policies and incentives in fostering innovation.

Regulatory Framework: A detailed analysis of Chad's regulatory environment, including licensing processes, environmental regulations, and fiscal terms, is provided, highlighting their influence on industry development and investment decisions.

Product Substitutes: The report assesses potential substitutes for traditional oil and gas resources, considering the impact of renewable energy sources and alternative fuels on market demand.

End-User Trends: Analysis of end-user demand for oil and gas products in Chad and regional markets is provided, considering factors such as industrial growth, population increase and energy consumption patterns.

M&A Activity: The report documents significant mergers and acquisitions (M&A) transactions in the Chad oil and gas upstream industry during the study period, analyzing their motivations and impact on market dynamics. Estimated M&A deal values in Millions for 2025 will be incorporated.

Chad Oil & Gas Upstream Industry Industry Trends & Insights

This section delves into the key trends shaping the Chad oil and gas upstream industry. It offers a detailed examination of market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The compound annual growth rate (CAGR) for the forecast period (2025-2033) and the market penetration rate for key technologies will be presented. Specific factors influencing growth will be analyzed, such as global energy demand, geopolitical events, and the transition to cleaner energy sources. The competitive dynamics will be examined based on factors like exploration success rates, production costs, and technological capabilities. Specific examples of technological disruptions, like the adoption of artificial intelligence and machine learning, and their impact on upstream operations will be given.

Dominant Markets & Segments in Chad Oil & Gas Upstream Industry

This section pinpoints the leading regions, countries, or segments within the Chad oil and gas upstream market. A comprehensive analysis of dominance will be provided, identifying the key factors contributing to the leadership of specific areas.

- Key Drivers of Dominance: This section utilizes bullet points to highlight the key factors driving the dominance of particular segments or regions, such as:

- Favorable geological conditions

- Existing infrastructure

- Government policies and incentives

- Access to capital and investment

- Skilled workforce availability

The analysis will extend to explain these drivers in detail through paragraphs, providing comprehensive insights into the reasons behind market leadership.

Chad Oil & Gas Upstream Industry Product Developments

This section summarizes recent product innovations, applications, and competitive advantages in the Chad oil and gas upstream industry. It will focus on technological trends and market fit, highlighting the impact of advancements such as improved drilling techniques, enhanced recovery methods, and the application of advanced analytics. Examples of successful product launches and their market reception will be included.

Report Scope & Segmentation Analysis

This section details the market segmentation used in the report. This will include a breakdown by region, type of hydrocarbon (e.g., oil, natural gas), and exploration stage (e.g., exploration, development, production). Each segment will have a paragraph explaining its growth projections, market size in Millions for 2025 and competitive dynamics.

Key Drivers of Chad Oil & Gas Upstream Industry Growth

This section outlines the key factors driving the growth of the Chad oil and gas upstream industry. This includes technological advancements leading to increased efficiency and recovery rates, economic factors such as rising global energy demand, and favorable government policies supporting exploration and production activities. Specific examples of each factor will be provided.

Challenges in the Chad Oil & Gas Upstream Industry Sector

This section identifies and analyzes the significant challenges impacting the Chad oil and gas upstream industry. This may include regulatory hurdles impacting investment decisions, supply chain disruptions affecting operations, and intensifying competition among industry players. Quantifiable impacts, where possible, will be included, such as the estimated financial impact of specific regulatory hurdles in Millions.

Emerging Opportunities in Chad Oil & Gas Upstream Industry

This section highlights promising opportunities emerging within the Chad oil and gas upstream industry. This includes the potential for new exploration areas, the adoption of innovative technologies leading to increased efficiency and reduced environmental impact, and changes in consumer preferences opening new market niches.

Leading Players in the Chad Oil & Gas Upstream Industry Market

- Glencore PLC

- Delonex Energy Limited

- Petroliam Nasional Berhad

- Exxon Mobil Corporation

- Société des Hydrocarbures du Tchad

Key Developments in Chad Oil & Gas Upstream Industry Industry

This section will list key developments, including mergers, acquisitions, and new project announcements, with year/month specifics and an explanation of their impact on market dynamics. Examples include: xx Million investment in new exploration project (MM/YY), acquisition of Company X by Company Y (MM/YY).

Strategic Outlook for Chad Oil & Gas Upstream Industry Market

This section summarizes the key growth catalysts and future market potential, emphasizing the opportunities for growth and expansion in the Chad oil and gas upstream industry. The long-term outlook will be discussed, considering factors like technological innovation, government policies, and global energy demand. The analysis will cover predicted market size and value in Millions for 2033.

Chad Oil & Gas Upstream Industry Segmentation

-

1. Resource Type

- 1.1. Oil

- 1.2. Natural Gas

Chad Oil & Gas Upstream Industry Segmentation By Geography

- 1. Chad

Chad Oil & Gas Upstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 0.19% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Oil to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Chad Oil & Gas Upstream Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Resource Type

- 5.1.1. Oil

- 5.1.2. Natural Gas

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Chad

- 5.1. Market Analysis, Insights and Forecast - by Resource Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Glencore PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Delonex Energy Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Petroliam Nasional Berhad

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Exxon Mobil Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Societé des Hydrocarbures du Tchad*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Glencore PLC

List of Figures

- Figure 1: Chad Oil & Gas Upstream Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Chad Oil & Gas Upstream Industry Share (%) by Company 2024

List of Tables

- Table 1: Chad Oil & Gas Upstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Chad Oil & Gas Upstream Industry Revenue Million Forecast, by Resource Type 2019 & 2032

- Table 3: Chad Oil & Gas Upstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Chad Oil & Gas Upstream Industry Revenue Million Forecast, by Resource Type 2019 & 2032

- Table 5: Chad Oil & Gas Upstream Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chad Oil & Gas Upstream Industry?

The projected CAGR is approximately > 0.19%.

2. Which companies are prominent players in the Chad Oil & Gas Upstream Industry?

Key companies in the market include Glencore PLC, Delonex Energy Limited, Petroliam Nasional Berhad, Exxon Mobil Corporation, Societé des Hydrocarbures du Tchad*List Not Exhaustive.

3. What are the main segments of the Chad Oil & Gas Upstream Industry?

The market segments include Resource Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Oil to Dominate the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chad Oil & Gas Upstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chad Oil & Gas Upstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chad Oil & Gas Upstream Industry?

To stay informed about further developments, trends, and reports in the Chad Oil & Gas Upstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence