Key Insights

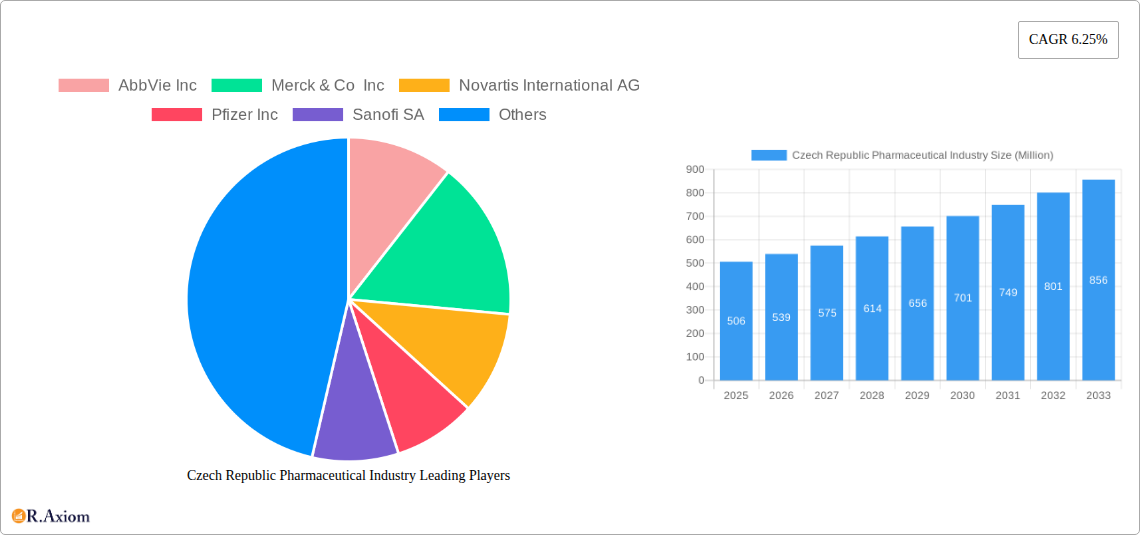

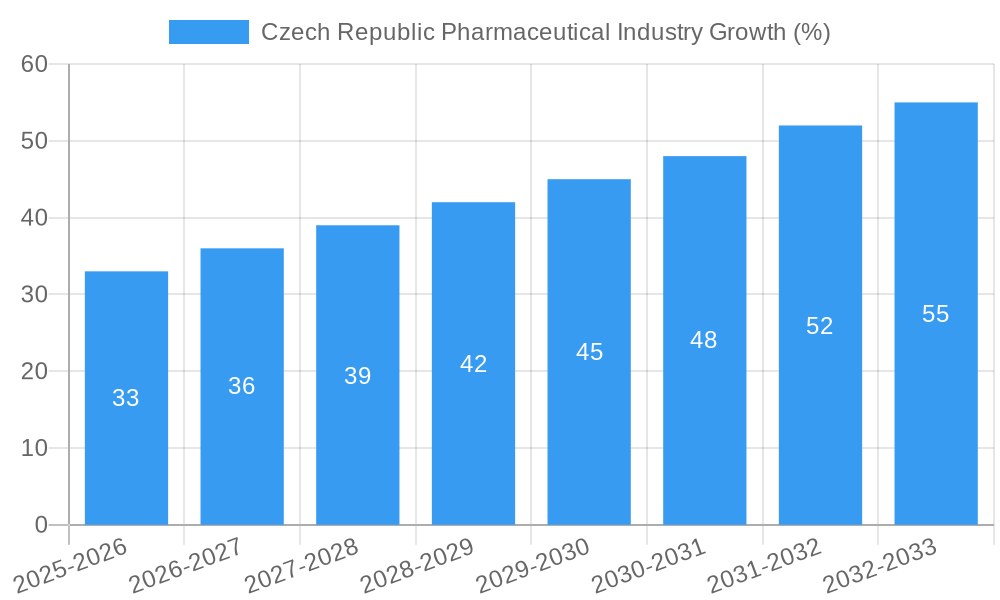

The Czech Republic's pharmaceutical market, valued at approximately €506 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.25% from 2025 to 2033. This expansion is driven by several key factors. An aging population necessitates increased demand for chronic disease medications, while rising healthcare expenditure and government initiatives promoting accessible healthcare further fuel market growth. Furthermore, the increasing prevalence of chronic illnesses like cardiovascular diseases and diabetes, coupled with a growing awareness of preventative healthcare, contributes significantly to market expansion. The market is characterized by a strong presence of multinational pharmaceutical companies, including AbbVie, Merck, Novartis, Pfizer, and Sanofi, alongside a developing domestic pharmaceutical sector. These companies are actively involved in research and development, bringing innovative treatments and technologies to the Czech market. However, price regulations and the potential for generic drug competition pose some challenges to sustained high growth.

Despite these challenges, the market's future outlook remains positive. The ongoing focus on improving healthcare infrastructure and increasing access to advanced medical treatments positions the Czech Republic for continued pharmaceutical market expansion. Specific growth areas are likely to include innovative therapies for oncology, immunology, and diabetes. The integration of digital health technologies and telehealth services will also shape the market's evolution, promoting efficiency and improving patient care. Further market segmentation based on therapeutic areas and drug classes will reveal more granular growth patterns. Competitive landscape analysis focusing on market share, R&D investment, and strategic alliances will further refine our understanding of the market dynamics in the years to come.

Czech Republic Pharmaceutical Industry: Market Analysis and Forecast 2019-2033

This comprehensive report provides a detailed analysis of the Czech Republic pharmaceutical industry, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and an estimated and forecast period of 2025-2033, this report offers a historical perspective and future projections for this dynamic market. The report leverages rigorous data analysis and expert insights to provide a 360-degree view of the market landscape, including market size, growth drivers, challenges, and opportunities. The Czech Republic's pharmaceutical sector is experiencing significant transformation, driven by technological advancements, evolving regulatory landscapes, and growing healthcare needs. This report illuminates the key factors influencing this change and offers actionable recommendations for navigating the future. The report's findings are supported by extensive research and analysis, including primary and secondary data sources. Market sizes are presented in Millions.

Czech Republic Pharmaceutical Industry Market Concentration & Innovation

The Czech Republic pharmaceutical market demonstrates a moderately concentrated landscape, with a few multinational giants holding significant market share. While precise market share data for individual companies remains proprietary, key players include AbbVie Inc, Merck & Co Inc, Novartis International AG, Pfizer Inc, Sanofi SA, F Hoffmann-La Roche AG, AstraZeneca PLC, Eli Lilly and Company, and GlaxoSmithKline PLC. However, a significant portion of the market is also occupied by smaller, locally established companies and generic drug manufacturers.

Innovation Drivers: The industry is driven by innovation in several areas, including biopharmaceuticals, personalized medicine, and digital health technologies. The establishment of research hubs like the Masaryk University biopharma hub contributes significantly to this innovation.

Regulatory Framework: The Czech Republic's regulatory framework for pharmaceuticals largely aligns with EU standards, ensuring drug safety and efficacy. This consistent regulatory environment fosters a stable investment climate.

Product Substitutes and Competition: Generic drugs represent a significant portion of the market, creating price competition and impacting the market dynamics for branded pharmaceuticals.

End-User Trends: The ageing population and the rising prevalence of chronic diseases are increasing demand for pharmaceuticals. Moreover, consumer preference towards innovative treatment options and better health outcomes is driving growth in specialized drug segments.

M&A Activities: While precise M&A deal values for the Czech Republic pharmaceutical sector aren't publicly available in detail, a few smaller acquisitions or partnerships are likely within the xx Million range annually. These activities usually center around expanding product portfolios or gaining access to new technologies.

Czech Republic Pharmaceutical Industry Industry Trends & Insights

The Czech Republic pharmaceutical market exhibits a steady growth trajectory, propelled by several key factors. The market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was approximately xx%, and a similar CAGR is projected for the forecast period (2025-2033), although this projection is subject to potential macroeconomic fluctuations and regulatory changes.

Market penetration of innovative drugs is gradually increasing, however, price controls and the prevalence of generic alternatives pose challenges. Technological disruptions, including AI-driven drug discovery and personalized medicine, are increasingly influential but adoption rates are moderate, considering budget constraints and infrastructure limitations. The consumer preference is shifting towards more accessible and affordable medications, with a concurrent increase in demand for specialized treatments for chronic diseases. Competitive dynamics are shaped by a balance between multinational pharmaceutical corporations and domestic generic manufacturers. The latter have a significant presence due to cost-effectiveness, which impacts pricing and market share among certain drug segments.

Dominant Markets & Segments in Czech Republic Pharmaceutical Industry

While regional variations exist within the Czech Republic, the pharmaceutical market demonstrates relatively uniform distribution across the country. There isn't a single dominant region. Key drivers of this market include:

- Strong Healthcare Infrastructure: The Czech Republic possesses a well-established healthcare system, providing a solid foundation for pharmaceutical distribution and consumption.

- Government Support for Healthcare: Government initiatives aimed at improving healthcare access and affordability create a supportive environment for the pharmaceutical sector.

- Strategic Location: The Czech Republic's geographical position within Central Europe facilitates efficient logistics and distribution networks, connecting it with larger European markets.

The pharmaceutical market is segmented primarily by therapeutic area (e.g., oncology, cardiovascular, central nervous system), drug type (branded vs. generic), and distribution channel (hospitals, pharmacies, etc.). Each segment exhibits different growth patterns based on specific market dynamics. The oncology segment experiences strong growth due to increasing cancer prevalence and the introduction of newer, targeted therapies, despite high pricing points.

Czech Republic Pharmaceutical Industry Product Developments

Recent years have witnessed notable product innovations in the Czech Republic pharmaceutical sector. Although specific new drug launches are typically not publicly announced in detail until broader market rollout, technological trends show increasing focus on biosimilars and specialized treatments for chronic conditions. The market fit for these products is largely driven by unmet medical needs and the alignment with the overall growth of the healthcare sector. The level of innovation is moderate, compared to larger markets in western Europe, influenced by the relatively smaller domestic R&D investment.

Report Scope & Segmentation Analysis

This report covers the entire Czech Republic pharmaceutical market, segmented by therapeutic area (oncology, cardiovascular, central nervous system, etc.), drug type (branded, generic, biosimilars), distribution channel (hospital, retail pharmacy, online pharmacy), and product type (tablets, injections, etc.). Growth projections vary by segment, with the oncology and chronic disease segments exhibiting higher growth compared to others, due to evolving disease prevalence and technological advancements in targeted therapies. Competitive dynamics are segment-specific, with varying degrees of market concentration and competition intensity.

Key Drivers of Czech Republic Pharmaceutical Industry Growth

Several factors fuel the growth of the Czech Republic's pharmaceutical industry:

- Aging Population: The increasing elderly population leads to higher demand for chronic disease medications.

- Rising Prevalence of Chronic Diseases: The growing incidence of diseases like diabetes, cardiovascular conditions, and cancer necessitates greater pharmaceutical consumption.

- Government Healthcare Spending: Government investments in healthcare infrastructure and initiatives enhance market access and affordability.

- EU Integration: Alignment with EU regulations promotes a stable and reliable market environment.

Challenges in the Czech Republic Pharmaceutical Industry Sector

The Czech Republic pharmaceutical market faces several challenges:

- Price Controls: Government regulations on drug pricing can limit profitability.

- Generic Competition: The presence of generic drug manufacturers intensifies price competition.

- Healthcare Budget Constraints: Limited healthcare budgets can impact drug access and affordability.

- Supply Chain Disruptions: Global supply chain issues can lead to drug shortages.

Emerging Opportunities in Czech Republic Pharmaceutical Industry

Despite challenges, the Czech Republic offers several promising opportunities:

- Biosimilar Development: The growing focus on biosimilars presents opportunities for cost-effective treatments.

- Digital Health Technologies: The adoption of digital health solutions can enhance patient care and market efficiency.

- Personalized Medicine: Personalized medicine approaches are expected to gain traction in the long-term.

- Expansion of R&D: Increased investment in research and development in the Czech Republic could drive innovation.

Leading Players in the Czech Republic Pharmaceutical Industry Market

- AbbVie Inc

- Merck & Co Inc

- Novartis International AG

- Pfizer Inc

- Sanofi SA

- F Hoffmann-La Roche AG

- AstraZeneca PLC

- Eli Lilly and Company

- Novartis International AG

- GlaxoSmithKline PLC

- *List Not Exhaustive

Key Developments in Czech Republic Pharmaceutical Industry Industry

October 2023: Motagon Cannabis (Motagon), a subsidiary of HEATON Group AS (Heaton), successfully imported medical cannabis flower to Prague after obtaining necessary approvals from the State Institute for Drug Control (SUKL) and the Ministry of Health. This marks a significant step in expanding access to medical cannabis in the Czech Republic.

June 2023: Masaryk University secured a building permit for a CZK 2.5 billion (USD 0.1 billion) biopharma hub. This development is poised to boost production and research capabilities, potentially accelerating the development of new and innovative medicinal products. This investment will have a long-term positive impact on the innovation capacity of the Czech Republic's pharmaceutical sector.

Strategic Outlook for Czech Republic Pharmaceutical Industry Market

The Czech Republic pharmaceutical market presents a promising outlook. Continued growth is expected, driven by factors such as the aging population, increased prevalence of chronic diseases, and government support for healthcare. Opportunities exist in specialized therapeutics, biosimilars, and digital health solutions. While challenges like price controls and generic competition remain, strategic investments in research and development, alongside the adoption of innovative technologies, will be critical for sustained success in this evolving market. The focus should be on balancing affordability and access to cutting-edge treatments to ensure the continued growth and positive impact of the industry on public health.

Czech Republic Pharmaceutical Industry Segmentation

-

1. Therapeutic Category

- 1.1. Anti-infectives

- 1.2. Cardiovascular

- 1.3. Gastrointestinal

- 1.4. Anti-diabetic

- 1.5. Respiratory

- 1.6. Dermatologicals

- 1.7. Musculoskeletal System

- 1.8. Nervous System

- 1.9. Other Therapeutic Categories

-

2. Drug Type

-

2.1. Prescription Drug

- 2.1.1. Branded Drugs

- 2.1.2. Generic Drugs

- 2.2. OTC Drugs

-

2.1. Prescription Drug

Czech Republic Pharmaceutical Industry Segmentation By Geography

- 1. Czech Republic

Czech Republic Pharmaceutical Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.25% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Healthcare Expenditure; Rising Incidence of Chronic Disease

- 3.3. Market Restrains

- 3.3.1. Rising Healthcare Expenditure; Rising Incidence of Chronic Disease

- 3.4. Market Trends

- 3.4.1. The Anti-diabetic Segment is Expected to Register Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Czech Republic Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Therapeutic Category

- 5.1.1. Anti-infectives

- 5.1.2. Cardiovascular

- 5.1.3. Gastrointestinal

- 5.1.4. Anti-diabetic

- 5.1.5. Respiratory

- 5.1.6. Dermatologicals

- 5.1.7. Musculoskeletal System

- 5.1.8. Nervous System

- 5.1.9. Other Therapeutic Categories

- 5.2. Market Analysis, Insights and Forecast - by Drug Type

- 5.2.1. Prescription Drug

- 5.2.1.1. Branded Drugs

- 5.2.1.2. Generic Drugs

- 5.2.2. OTC Drugs

- 5.2.1. Prescription Drug

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Czech Republic

- 5.1. Market Analysis, Insights and Forecast - by Therapeutic Category

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 AbbVie Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Merck & Co Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Novartis International AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Pfizer Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sanofi SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 F Hoffmann-La Roche AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AstraZeneca PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eli Lilly and Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Novartis International AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GlaxoSmithKline PLC*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 AbbVie Inc

List of Figures

- Figure 1: Czech Republic Pharmaceutical Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Czech Republic Pharmaceutical Industry Share (%) by Company 2024

List of Tables

- Table 1: Czech Republic Pharmaceutical Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Czech Republic Pharmaceutical Industry Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Czech Republic Pharmaceutical Industry Revenue Million Forecast, by Therapeutic Category 2019 & 2032

- Table 4: Czech Republic Pharmaceutical Industry Volume Billion Forecast, by Therapeutic Category 2019 & 2032

- Table 5: Czech Republic Pharmaceutical Industry Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 6: Czech Republic Pharmaceutical Industry Volume Billion Forecast, by Drug Type 2019 & 2032

- Table 7: Czech Republic Pharmaceutical Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Czech Republic Pharmaceutical Industry Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Czech Republic Pharmaceutical Industry Revenue Million Forecast, by Therapeutic Category 2019 & 2032

- Table 10: Czech Republic Pharmaceutical Industry Volume Billion Forecast, by Therapeutic Category 2019 & 2032

- Table 11: Czech Republic Pharmaceutical Industry Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 12: Czech Republic Pharmaceutical Industry Volume Billion Forecast, by Drug Type 2019 & 2032

- Table 13: Czech Republic Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Czech Republic Pharmaceutical Industry Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Czech Republic Pharmaceutical Industry?

The projected CAGR is approximately 6.25%.

2. Which companies are prominent players in the Czech Republic Pharmaceutical Industry?

Key companies in the market include AbbVie Inc, Merck & Co Inc, Novartis International AG, Pfizer Inc, Sanofi SA, F Hoffmann-La Roche AG, AstraZeneca PLC, Eli Lilly and Company, Novartis International AG, GlaxoSmithKline PLC*List Not Exhaustive.

3. What are the main segments of the Czech Republic Pharmaceutical Industry?

The market segments include Therapeutic Category, Drug Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Healthcare Expenditure; Rising Incidence of Chronic Disease.

6. What are the notable trends driving market growth?

The Anti-diabetic Segment is Expected to Register Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Rising Healthcare Expenditure; Rising Incidence of Chronic Disease.

8. Can you provide examples of recent developments in the market?

October 2023: Motagon Cannabis (Motagon), a subsidiary of HEATON Group AS (Heaton), completed its import of medical cannabis flower to Prague, Czechia, after receiving approval from Czechia’s State Institute for Drug Control (SUKL) and the Ministry of Health.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Czech Republic Pharmaceutical Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Czech Republic Pharmaceutical Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Czech Republic Pharmaceutical Industry?

To stay informed about further developments, trends, and reports in the Czech Republic Pharmaceutical Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence