Key Insights

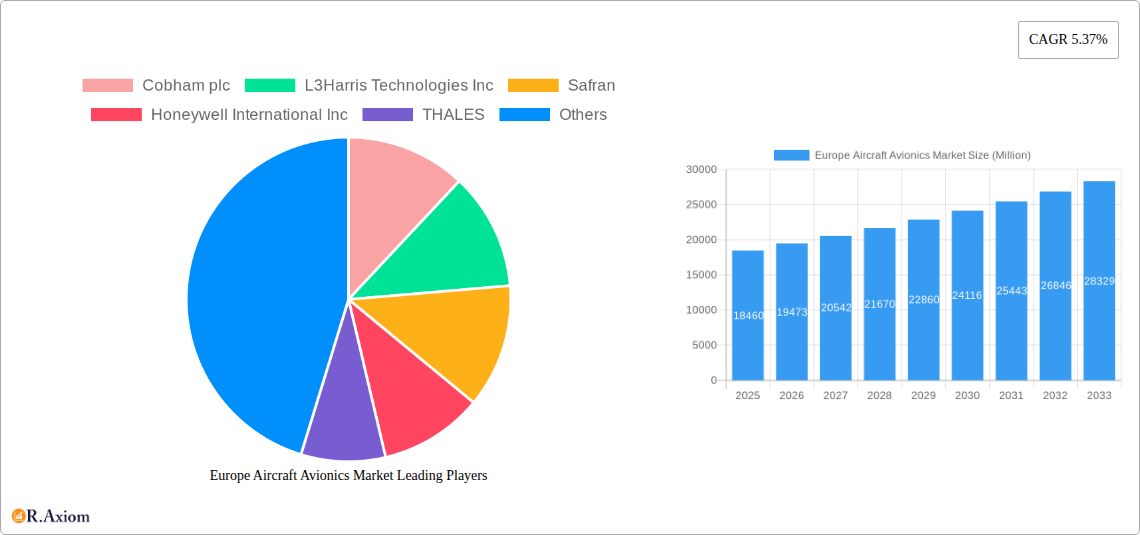

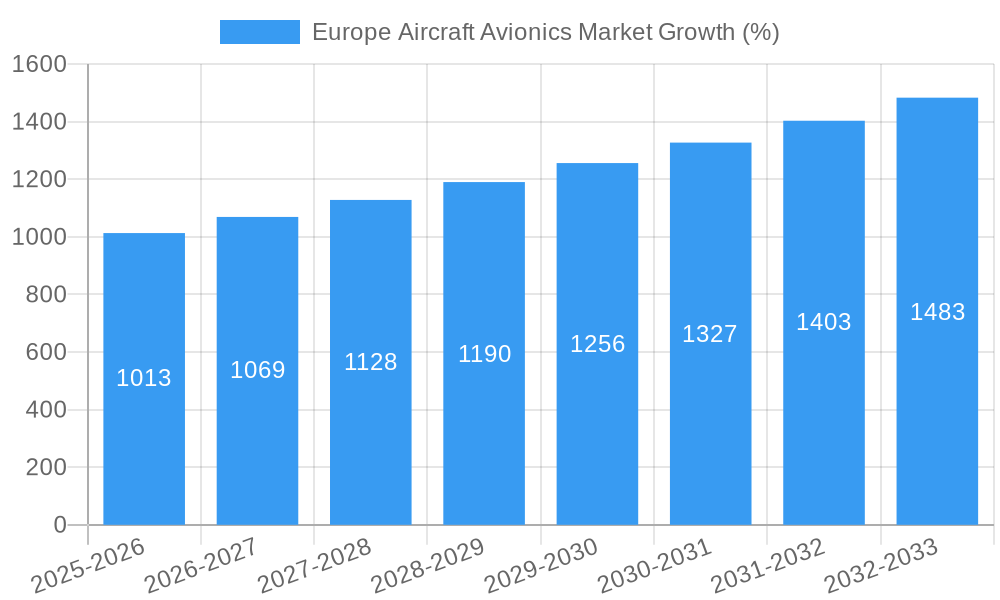

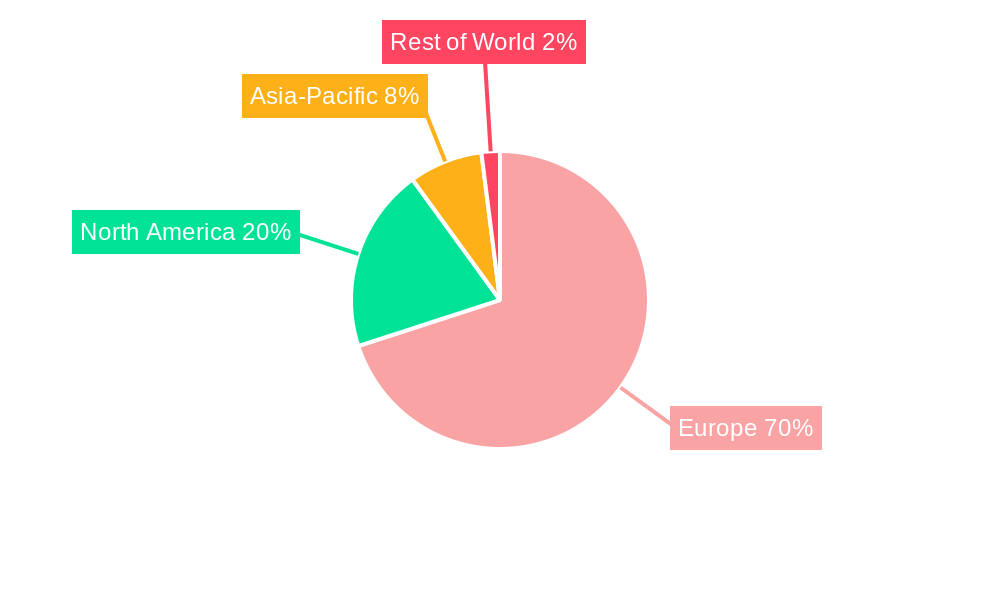

The European aircraft avionics market, valued at approximately €18.46 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 5.37% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing demand for advanced aircraft technologies, particularly in commercial aviation, is pushing adoption of sophisticated avionics systems for enhanced safety, efficiency, and passenger experience. This includes the integration of advanced navigation systems, flight management systems, and communication technologies. Secondly, the ongoing modernization and upgrade of existing aircraft fleets within Europe, alongside new aircraft orders, contribute significantly to market growth. Furthermore, stringent regulatory requirements for safety and operational efficiency are incentivizing airlines and defense organizations to invest in cutting-edge avionics solutions. Finally, technological advancements, such as the development of lighter, more powerful, and energy-efficient avionics components, are further boosting market appeal. The segment breakdown shows a significant contribution from commercial aircraft, followed by military and general aviation. Leading players like Cobham, L3Harris, Safran, Honeywell, Thales, and others are heavily invested in R&D and strategic partnerships to maintain their market positions. Germany, France, the UK, and Italy are major contributors to the European market due to strong aerospace manufacturing and defense industries.

The competitive landscape is characterized by both established industry giants and specialized players. Competition is fierce, driven by innovation in areas such as advanced pilot assistance systems, improved situational awareness capabilities, and increased connectivity. However, challenges remain, including the high cost of implementing new avionics technologies, the complexity of integrating new systems with existing aircraft infrastructure, and the need for skilled technical personnel. Nevertheless, the long-term outlook for the European aircraft avionics market remains positive, with continuous growth anticipated throughout the forecast period. The market will likely see increased consolidation and collaboration as companies seek to capitalize on the expanding market and enhance their competitive advantage. The focus will be on developing cost-effective, reliable, and cutting-edge solutions that meet the ever-evolving demands of the aviation industry.

Europe Aircraft Avionics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Aircraft Avionics Market, covering the period from 2019 to 2033. It offers invaluable insights for industry stakeholders, investors, and strategic decision-makers seeking to navigate this dynamic market. The report utilizes data from the base year 2025, with estimations for 2025 and forecasts extending to 2033, while also reviewing the historical period from 2019-2024. The market size is expressed in Millions.

Europe Aircraft Avionics Market Concentration & Innovation

The European aircraft avionics market exhibits a moderately concentrated landscape, with a few major players holding significant market share. Companies like Cobham plc, L3Harris Technologies Inc, Safran, Honeywell International Inc, THALES, Diehl Stiftung & Co KG, RTX Corporation, HR Smith Group of Companies, The General Electric Company, LATECOERE S A, Northrop Grumman Corporation, and Rohde & Schwarz GmbH & Co K, dominate the market. While precise market share figures for each company are proprietary data, analysis suggests a collective market share of approximately xx% for the top five players.

Innovation is a key driver, fueled by the increasing demand for advanced technologies such as AI, machine learning, and improved sensor integration in avionics systems. Stringent regulatory frameworks, particularly from the European Union Aviation Safety Agency (EASA), drive the need for continuous improvement and technological advancement to meet safety and performance standards. The emergence of lighter, more efficient materials and the integration of sophisticated software are further catalysts for innovation. Product substitutes, while limited, include the potential for improved ground-based communication and navigation systems to lessen the reliance on certain airborne avionics components. End-user trends show a growing preference for integrated solutions that offer enhanced situational awareness, improved fuel efficiency, and reduced maintenance costs. Mergers and acquisitions (M&A) activity, while not consistently high, demonstrates consolidation within the industry. Recent M&A deals, although specific values are not publicly available for all transactions, have involved estimated valuations ranging from xx Million to xx Million, reflecting a strategic focus on acquiring specialized technologies and expanding market presence.

Europe Aircraft Avionics Market Industry Trends & Insights

The Europe Aircraft Avionics market is experiencing robust growth, driven by several key factors. The increasing demand for air travel, particularly in emerging economies within Europe, is a significant growth driver. This demand necessitates more aircraft and, consequently, a higher demand for sophisticated avionics systems. Technological disruptions, such as the development of more efficient and reliable avionics components and the integration of advanced software platforms, are accelerating market growth. Consumer preference is shifting towards advanced functionalities in aircraft, such as improved safety features, enhanced in-flight entertainment, and better connectivity. These preferences propel investments in newer and better-equipped avionics.

The competitive dynamics are characterized by intense rivalry among established players and the emergence of new technology providers. Companies are focusing on developing cutting-edge products, forming strategic partnerships, and undertaking R&D to maintain their competitive edge. Market penetration of advanced avionics systems is rising, particularly in the commercial segment. The market’s CAGR (Compound Annual Growth Rate) for the forecast period (2025-2033) is projected at xx%, indicating strong growth potential. This positive outlook results from a synergistic effect of several factors, including increasing air traffic volume and the progressive integration of advanced technologies.

Dominant Markets & Segments in Europe Aircraft Avionics Market

The Military Aircraft segment currently dominates the European aircraft avionics market, owing to substantial defense budgets across various European nations and continuous upgrades to existing military fleets. The strong emphasis on national security and modernization of air forces is a primary driver.

- Key Drivers for Military Aircraft Segment:

- High defense spending by European governments.

- Modernization of existing military aircraft fleets.

- Stringent operational requirements for military aircraft avionics.

The Commercial Aircraft segment is also a significant contributor, although exhibiting slightly slower growth than military. This segment's growth is directly influenced by the performance of the overall airline industry and manufacturing production rates of commercial aircraft.

- Key Drivers for Commercial Aircraft Segment:

- Growth in passenger air traffic within and out of Europe.

- Increasing demand for technologically advanced avionics in commercial aircrafts.

- Stringent safety standards and regulations for commercial airliners.

The General Aviation Aircraft segment represents a smaller portion of the market, yet is also experiencing modest growth. This segment’s growth is propelled by factors such as increasing recreational aviation and advancements in smaller aircraft technologies.

- Key Drivers for General Aviation Aircraft Segment:

- Growing popularity of recreational flying.

- Advancements in lightweight and cost-effective avionics technology for smaller aircraft.

- Improved accessibility for pilots seeking more advanced avionics in their aircrafts.

Germany and the United Kingdom are the leading national markets within Europe, fueled by their large aerospace industries and robust defense sectors. The significant investment in aerospace technology and ongoing fleet modernization programs in these countries contributes substantially to market size and growth.

Europe Aircraft Avionics Market Product Developments

Recent product innovations focus on integrating advanced technologies like Artificial Intelligence (AI) for improved flight safety and predictive maintenance, as well as enhanced situational awareness systems. These systems offer improved fuel efficiency and reduced operational costs, improving market fit and offering a competitive advantage. The trend toward miniaturization, lightweighting, and increased computational power are key technological drivers for future avionics developments.

Report Scope & Segmentation Analysis

This report segments the Europe Aircraft Avionics Market based on Application:

Commercial Aircraft: This segment comprises avionics systems for commercial airliners, focusing on passenger safety, flight efficiency, and communication systems. Market size is projected at xx Million in 2025, with growth driven by an increasing number of commercial aircraft in operation and upgrades to existing fleets.

Military Aircraft: This segment includes avionics for military aircraft, prioritizing mission-critical systems such as navigation, targeting, and communication. The market size is estimated at xx Million in 2025, characterized by continuous modernization and upgrades of military aircraft.

General Aviation Aircraft: This segment covers avionics for smaller aircraft, focusing on user-friendly interfaces, basic navigation, and communication. The market is relatively smaller at xx Million in 2025, but is predicted to grow with ongoing advancements in cost-effective systems.

Competitive dynamics vary across the segments, with a higher level of consolidation observed in the commercial and military segments due to the higher value contracts and stringent regulatory requirements.

Key Drivers of Europe Aircraft Avionics Market Growth

The Europe Aircraft Avionics Market's growth is driven by several factors. The increasing demand for air travel contributes significantly. Technological advancements, such as AI-powered systems and improved sensor technology, enhance safety and operational efficiency, boosting demand. Moreover, stringent regulatory requirements promoting safety and improved performance necessitates the adoption of modern avionics systems, fueling market growth.

Challenges in the Europe Aircraft Avionics Market Sector

The sector faces challenges like high initial investment costs for advanced avionics systems, potentially hindering adoption. Supply chain disruptions and the availability of crucial components can cause delays and increased costs. Intense competition among established players presents an ongoing challenge for maintaining profitability and market share. Specific quantifiable impacts are difficult to assess due to the varied and dynamic nature of these issues, yet they are substantial obstacles to market growth.

Emerging Opportunities in Europe Aircraft Avionics Market

Emerging trends include the integration of Internet of Things (IoT) technologies, creating connected aircraft systems. The development of autonomous flight technologies, while still in its early stages, holds immense potential. Furthermore, the rising need for advanced cybersecurity solutions in the face of potential threats presents significant opportunities for the market.

Leading Players in the Europe Aircraft Avionics Market Market

- Cobham plc

- L3Harris Technologies Inc

- Safran

- Honeywell International Inc

- THALES

- Diehl Stiftung & Co KG

- RTX Corporation

- HR Smith Group of Companies

- The General Electric Company

- LATECOERE S A

- Northrop Grumman Corporation

- Rohde & Schwarz GmbH & Co K

Key Developments in Europe Aircraft Avionics Market Industry

March 2023: Leonardo S.p.A signed a contract with Armaereo for the development, integration, qualification, and certification of a new avionics configuration for the C-27J aircraft, including upgrades to general systems and the self-protection system, and the development of a new flight simulator. This signifies a significant investment in upgrading existing military aircraft with advanced avionics.

November 2022: BAE Systems PLC was awarded an USD 89 Million contract to service and support the Eurofighter Typhoon aircraft’s avionics for the air forces of Germany, Spain, the United Kingdom, and Italy for the next five years. This highlights the substantial ongoing maintenance and support needs for existing military aircraft avionics systems.

Strategic Outlook for Europe Aircraft Avionics Market Market

The Europe Aircraft Avionics Market is poised for continued growth, fueled by technological advancements and the persistent demand for enhanced safety and performance in both commercial and military aircraft. The integration of emerging technologies, like AI and IoT, promises to unlock further opportunities for market expansion and innovation. The focus on sustainability and increased efficiency in the aerospace industry is also a major growth driver, with avionics playing a critical role in achieving these goals.

Europe Aircraft Avionics Market Segmentation

-

1. Application

- 1.1. Commercial Aircraft

- 1.2. Military Aircraft

- 1.3. General Aviation Aircraft

Europe Aircraft Avionics Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. France

- 1.3. Germany

- 1.4. Russia

- 1.5. Rest of Europe

Europe Aircraft Avionics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.37% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Commercial Aircraft Segment is Expected Witness Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Aircraft Avionics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial Aircraft

- 5.1.2. Military Aircraft

- 5.1.3. General Aviation Aircraft

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Germany Europe Aircraft Avionics Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Aircraft Avionics Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Aircraft Avionics Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Aircraft Avionics Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Aircraft Avionics Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Aircraft Avionics Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Aircraft Avionics Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Cobham plc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 L3Harris Technologies Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Safran

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Honeywell International Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 THALES

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Diehl Stiftung & Co KG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 RTX Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 HR Smith Group of Companies

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 The General Electric Company

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 LATECOERE S A

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Northrop Grumman Corporation

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Rohde & Schwarz GmbH & Co K

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Cobham plc

List of Figures

- Figure 1: Europe Aircraft Avionics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Aircraft Avionics Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Aircraft Avionics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Aircraft Avionics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Europe Aircraft Avionics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Aircraft Avionics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Aircraft Avionics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: Europe Aircraft Avionics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Europe Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: France Europe Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Germany Europe Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Russia Europe Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Europe Europe Aircraft Avionics Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Aircraft Avionics Market?

The projected CAGR is approximately 5.37%.

2. Which companies are prominent players in the Europe Aircraft Avionics Market?

Key companies in the market include Cobham plc, L3Harris Technologies Inc, Safran, Honeywell International Inc, THALES, Diehl Stiftung & Co KG, RTX Corporation, HR Smith Group of Companies, The General Electric Company, LATECOERE S A, Northrop Grumman Corporation, Rohde & Schwarz GmbH & Co K.

3. What are the main segments of the Europe Aircraft Avionics Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.46 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Commercial Aircraft Segment is Expected Witness Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2023, Leonardo S.p.A signed a contract with Armaereo, the Italian Defense Ministry’s Air Force Armament and Airworthiness Directorate. The contract includes the development, integration qualification, and certification of a new avionics configuration for the C-27J, the upgrading of a number of general systems on the aircraft, the self-protection system, and the flight simulator.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Aircraft Avionics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Aircraft Avionics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Aircraft Avionics Market?

To stay informed about further developments, trends, and reports in the Europe Aircraft Avionics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence