Key Insights

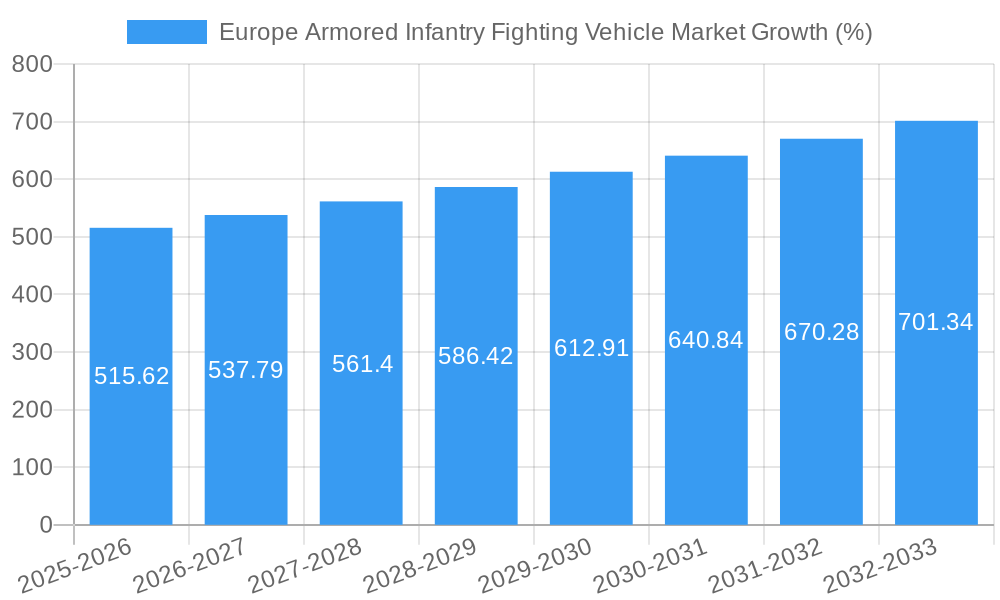

The European Armored Infantry Fighting Vehicle (IFV) market, valued at €9.01 billion in 2025, is projected to experience robust growth, driven by escalating geopolitical tensions and the need for modernized defense capabilities across the region. A Compound Annual Growth Rate (CAGR) of 5.62% is anticipated from 2025 to 2033, indicating a significant market expansion. Key market drivers include increasing defense budgets among major European nations like Germany, the UK, and France, coupled with ongoing modernization programs aimed at replacing aging IFV fleets. Furthermore, the rising demand for advanced technological features, such as enhanced situational awareness systems, improved survivability armor, and advanced weaponry integration, fuels market growth. The market is segmented by vehicle type (APC, IFV, MBT, and others) and by country, with Germany, the UK, France, and Russia representing major contributors to the market's value. The competitive landscape is dominated by prominent players including Oshkosh Corporation, Iveco Defence Vehicles, General Dynamics, BAE Systems, Rheinmetall, ARQUUS, KNDS, Patria, and Supacat, each vying for market share through technological innovation and strategic partnerships. The market's growth is expected to be influenced by factors such as evolving defense procurement strategies, collaborative defense initiatives within the European Union, and the ongoing development of next-generation IFVs. Continued technological advancements, focusing on lighter weight, increased mobility, and improved lethality, will shape the market's future trajectory.

The Rest of Europe segment, encompassing smaller but strategically important nations, is projected to exhibit notable growth, driven by increased investments in defense modernization and border security. The competitive landscape reflects a blend of established defense contractors with extensive experience in IFV production and newer entrants bringing disruptive technologies to the market. Strategic partnerships and collaborations, often spanning national borders, are increasingly common, aiming to reduce development costs and facilitate technology sharing. Regulatory changes concerning defense procurement and export controls will also play a significant role in shaping market dynamics. Understanding the technological advancements, geopolitical factors, and competitive dynamics is critical for successful participation in this growing market.

Europe Armored Infantry Fighting Vehicle Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Europe Armored Infantry Fighting Vehicle (AIFV) market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. The report leverages extensive primary and secondary research to deliver actionable intelligence on market size, segmentation, growth drivers, challenges, and competitive landscape.

Europe Armored Infantry Fighting Vehicle Market Concentration & Innovation

The European AIFV market exhibits a moderately concentrated landscape, with a few dominant players holding significant market share. Key players like BAE Systems, Rheinmetall AG, and General Dynamics Corporation account for approximately xx% of the total market revenue in 2025. The market's competitive intensity is fueled by continuous product innovation, driven by the need for advanced technologies such as enhanced armor protection, improved firepower, and advanced sensor systems. Regulatory frameworks, particularly concerning export controls and defense procurement policies, significantly influence market dynamics. The emergence of alternative defense solutions, including unmanned ground vehicles (UGVs) and drones, presents a potential substitute threat. End-user trends, primarily driven by evolving military strategies and geopolitical uncertainties, dictate demand fluctuations. Mergers and acquisitions (M&A) activity within the sector remains moderate, with recent deals valued at approximately xx Million, signaling consolidation and strategic expansion efforts. For instance, the acquisition of xx by xx in [Year] impacted market share distribution and technological capabilities. The market share of the top 5 players is projected to be xx% by 2033.

Europe Armored Infantry Fighting Vehicle Market Industry Trends & Insights

The European AIFV market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily fueled by increasing defense budgets across several European nations, driven by geopolitical instability and the need for modernized military equipment. Technological advancements, such as the integration of AI, autonomous systems, and improved communication networks, are significantly transforming the industry. Consumer preferences are shifting towards lighter, more agile, and technologically advanced AIFVs, capable of operating in diverse terrains and environments. Competitive dynamics are shaped by intense R&D efforts, strategic partnerships, and the continuous pursuit of technological superiority. Market penetration of advanced AIFV models is expected to increase from xx% in 2025 to xx% by 2033, driven by adoption of upgraded technologies. The market penetration of APC vehicles is higher currently and projected to be xx% by 2033, while IFV penetration is expected to increase gradually to reach xx%.

Dominant Markets & Segments in Europe Armored Infantry Fighting Vehicle Market

Germany, the United Kingdom, and France collectively represent the most significant markets within Europe for AIFVs.

- Key Drivers in Germany: Strong defense spending, focus on technological advancements, and a robust domestic defense industry.

- Key Drivers in the United Kingdom: Modernization of military assets, participation in international peacekeeping operations, and a well-established defense procurement process.

- Key Drivers in France: Significant investments in defense capabilities, strategic partnerships, and a commitment to technological innovation.

These countries’ dominance stems from their substantial defense budgets, strategic geopolitical positioning, and established defense industrial bases. The Infantry Fighting Vehicle (IFV) segment currently holds the largest market share, driven by its versatile capabilities and tactical significance. However, the Armored Personnel Carrier (APC) segment is projected to experience significant growth due to its cost-effectiveness and suitability for diverse operations. Other types, including specialized AIFVs, are expected to witness niche growth driven by specific operational requirements. Russia and Spain also contribute significantly to the market, although at a comparatively smaller scale than the aforementioned leading nations. The Rest of Europe represents a considerable market with a diverse range of defense needs and spending capabilities.

Europe Armored Infantry Fighting Vehicle Market Product Developments

Recent innovations in the AIFV sector focus on enhancing protection, mobility, and firepower. Lightweight materials, advanced armor systems, improved suspension technologies, and the integration of sophisticated sensor suites are key areas of development. These advancements aim to improve survivability, operational effectiveness, and battlefield situational awareness. The increasing integration of unmanned systems and AI-powered functionalities is further augmenting the capabilities of modern AIFVs. The market is witnessing a surge in the development of hybrid and electric-powered AIFVs, focusing on reducing fuel consumption and operational costs while improving stealth capabilities.

Report Scope & Segmentation Analysis

This report segments the European AIFV market by Type (Armored Personnel Carrier (APC), Infantry Fighting Vehicle (IFV), Main Battle Tank (MBT), Other Types) and Country (Germany, United Kingdom, France, Russia, Spain, Rest of Europe). Each segment is analyzed in detail, considering its market size, growth projections, competitive dynamics, and key driving factors. For example, the IFV segment is expected to exhibit strong growth due to its tactical advantages. The APC segment offers a cost-effective option with steady demand. The MBT segment is less significant in this specific report, but its inclusion provides a holistic view of the broader armored vehicle market. Regional variations in defense spending and operational requirements influence the segment-specific market dynamics and growth trajectory.

Key Drivers of Europe Armored Infantry Fighting Vehicle Market Growth

The European AIFV market growth is propelled by several factors: escalating geopolitical tensions leading to increased defense spending, advancements in AIFV technology enhancing operational capabilities, and modernization initiatives by European armed forces seeking improved equipment. Further, evolving military doctrines and strategic priorities are influencing the demand for more versatile and technologically advanced vehicles.

Challenges in the Europe Armored Infantry Fighting Vehicle Market Sector

The European AIFV market faces challenges such as stringent regulatory frameworks governing defense procurement, fluctuations in global economic conditions affecting defense budgets, and intense competition from established players and emerging market entrants. Supply chain disruptions and the rising cost of raw materials and advanced technologies represent additional hurdles. These factors can result in delayed project timelines, increased costs, and potential market share erosion.

Emerging Opportunities in Europe Armored Infantry Fighting Vehicle Market

Emerging opportunities lie in the development and adoption of autonomous and semi-autonomous AIFVs, the integration of advanced sensor and communication technologies, and the exploration of new materials and designs for improved protection and mobility. Furthermore, the market offers opportunities for collaborations between defense companies and technology providers to integrate AI and other advanced technologies. The increasing adoption of hybrid and electric powertrains will also contribute to sustainable and cost-effective AIFV operations.

Leading Players in the Europe Armored Infantry Fighting Vehicle Market Market

- Oshkosh Corporation Inc

- Iveco Defence Vehicle

- General Dynamics Corporation

- BAE Systems

- Rheinmetall AG

- ARQUUS Defense

- KNDS N V

- Patria

- Supacat Limited (SC Group)

- Military Industrial Company

Key Developments in Europe Armored Infantry Fighting Vehicle Market Industry

- [Month, Year]: BAE Systems unveils its latest IFV model featuring advanced armor and fire control systems.

- [Month, Year]: Rheinmetall AG announces a strategic partnership with a technology provider to integrate AI capabilities into its AIFV platforms.

- [Month, Year]: General Dynamics Corporation secures a major contract for AIFV supply to a European nation.

- [Month, Year]: Iveco Defence Vehicles introduces a new generation of APC with improved mobility and survivability features.

(Further developments can be added based on available data)

Strategic Outlook for Europe Armored Infantry Fighting Vehicle Market Market

The European AIFV market presents significant growth potential driven by technological advancements, increased defense spending, and geopolitical factors. Opportunities exist for companies to innovate, leverage partnerships, and adapt to evolving market demands. Successful players will be those who can effectively balance technological innovation, cost-effectiveness, and timely delivery to meet the evolving needs of European armed forces. Focus on sustainable and cost-effective solutions will play a crucial role in shaping future market dynamics.

Europe Armored Infantry Fighting Vehicle Market Segmentation

-

1. Type

- 1.1. Armored Personal Carrier (APC)

- 1.2. Infantry Fighting Vehicle (IFV)

- 1.3. Main Battle Tank (MBT)

- 1.4. Other Types

Europe Armored Infantry Fighting Vehicle Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Armored Infantry Fighting Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.62% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Main Battle Tank Segment is Projected to Lead the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Armored Infantry Fighting Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Armored Personal Carrier (APC)

- 5.1.2. Infantry Fighting Vehicle (IFV)

- 5.1.3. Main Battle Tank (MBT)

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Armored Infantry Fighting Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Armored Infantry Fighting Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Armored Infantry Fighting Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Armored Infantry Fighting Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Armored Infantry Fighting Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Armored Infantry Fighting Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Armored Infantry Fighting Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Oshkosh Corporation Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Iveco Defence Vehicle

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 General Dynamics Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 BAE Systems

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Rheinmetall AG

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 ARQUUS Defense

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 KNDS N V

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Patria

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Supacat Limited (SC Group)

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Military Industrial Company

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Oshkosh Corporation Inc

List of Figures

- Figure 1: Europe Armored Infantry Fighting Vehicle Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Armored Infantry Fighting Vehicle Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Armored Infantry Fighting Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Armored Infantry Fighting Vehicle Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Armored Infantry Fighting Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Armored Infantry Fighting Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Armored Infantry Fighting Vehicle Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Europe Armored Infantry Fighting Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Germany Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Spain Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Belgium Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Norway Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Poland Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Denmark Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Armored Infantry Fighting Vehicle Market?

The projected CAGR is approximately 5.62%.

2. Which companies are prominent players in the Europe Armored Infantry Fighting Vehicle Market?

Key companies in the market include Oshkosh Corporation Inc, Iveco Defence Vehicle, General Dynamics Corporation, BAE Systems, Rheinmetall AG, ARQUUS Defense, KNDS N V, Patria, Supacat Limited (SC Group), Military Industrial Company.

3. What are the main segments of the Europe Armored Infantry Fighting Vehicle Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.01 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Main Battle Tank Segment is Projected to Lead the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Armored Infantry Fighting Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Armored Infantry Fighting Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Armored Infantry Fighting Vehicle Market?

To stay informed about further developments, trends, and reports in the Europe Armored Infantry Fighting Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence