Key Insights

The European blister packaging market is poised for significant expansion, fueled by robust demand from the pharmaceutical and consumer goods sectors. Projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5%, the market is valued at $28.16 billion in the base year 2024 and is forecast to continue its upward trajectory through 2033. Key growth drivers include the increasing necessity for tamper-evident pharmaceutical packaging, the rising consumer preference for convenient, single-dose packaging in confectionery and personal care, and substantial investments in advanced thermoforming and cold forming technologies. Germany, France, and the United Kingdom are leading national markets, supported by established manufacturing infrastructure and strong consumer spending. Challenges, however, include volatile raw material costs, particularly for plastics, and environmental concerns surrounding plastic waste. The market is segmented by end-user industry (consumer goods, pharmaceuticals, industrial), country, packaging process (thermoforming, cold forming), and material type, with plastic films currently leading but sustainable alternatives gaining momentum. Industry leaders such as Constantia Flexibles, Honeywell International, and Amcor PLC are driving innovation and strategic collaborations. The market's future is increasingly shaped by the demand for sustainable and eco-friendly packaging solutions, including biodegradable materials and enhanced recycling initiatives. Growth is expected to be most pronounced in the pharmaceutical sector, where blister packaging's security and protective qualities align with stringent regulatory requirements.

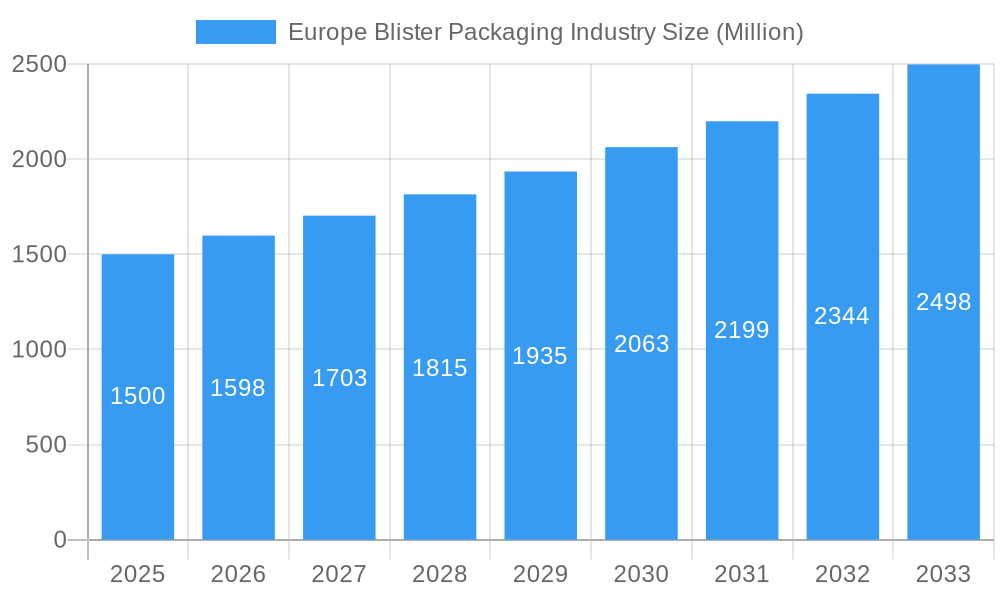

Europe Blister Packaging Industry Market Size (In Billion)

The forecast period (2025-2033) offers substantial growth opportunities driven by the continuous emphasis on product protection, tamper evidence, and convenience. Market players will gain a competitive edge by embracing advanced technologies and prioritizing environmentally responsible materials. While plastic films currently hold a dominant position, the escalating demand for sustainable alternatives like paperboard and other innovative materials presents significant future potential. Regional growth will vary, with the most dynamic expansion anticipated in countries with developed healthcare systems and thriving consumer goods markets. Strategic adaptation to meet evolving consumer and regulatory demands, focusing on sustainability, efficiency, and cost-effectiveness, will be crucial for market participants.

Europe Blister Packaging Industry Company Market Share

Europe Blister Packaging Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe blister packaging industry, covering market size, growth drivers, challenges, and future opportunities. With a focus on actionable insights and detailed segmentation, this report is an essential resource for industry stakeholders, investors, and strategic planners. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024.

Europe Blister Packaging Industry Market Concentration & Innovation

The European blister packaging market exhibits a moderately concentrated landscape, with a few major players holding significant market share. Leading companies like Amcor PLC, Constantia Flexibles GmbH, and Klöckner Pentaplast Group dominate the market, although the exact market share for each company requires further research. The industry is characterized by continuous innovation, driven by the need for enhanced product protection, improved sustainability, and increasing demand for specialized packaging solutions across various end-user sectors. Regulatory frameworks, including those related to material safety and environmental regulations, significantly impact industry practices. The emergence of sustainable and eco-friendly packaging materials, such as recycled plastics and biodegradable alternatives, presents both opportunities and challenges. Product substitution is a factor, with companies constantly exploring new materials and designs to improve performance and meet specific end-user requirements. Mergers and acquisitions (M&A) activity is also significant, with deal values reaching xx Million in recent years, primarily driven by efforts to expand market reach, enhance product portfolios, and gain access to new technologies. Overall, the industry is dynamic and competitive, with ongoing innovation shaping its future trajectory.

- Market Leaders: Amcor PLC, Constantia Flexibles GmbH, Klöckner Pentaplast Group (market share data unavailable, requires further research)

- Innovation Drivers: Sustainability, enhanced product protection, specialized packaging solutions

- M&A Activity: xx Million in recent years (exact value requires further research)

Europe Blister Packaging Industry Industry Trends & Insights

The European blister packaging market is experiencing robust growth, driven by factors such as the increasing demand for pharmaceutical and consumer goods, alongside advancements in packaging technology. The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), expanding from xx Million in 2025 to xx Million by 2033. Technological disruptions, such as the adoption of automation and smart packaging solutions, are transforming industry operations, improving efficiency, and enhancing product traceability. Consumer preferences for convenience, aesthetics, and sustainable packaging solutions are also influencing product development. Competitive dynamics are intense, with companies constantly striving to differentiate their offerings through innovation, cost optimization, and superior customer service. Market penetration of new materials and processes is ongoing, with xx% market penetration expected for biodegradable blister packaging by 2033 (prediction).

Dominant Markets & Segments in Europe Blister Packaging Industry

The pharmaceutical sector dominates the European blister packaging market, accounting for the largest share due to the stringent requirements for drug protection and safety. Germany and the United Kingdom are leading national markets within Europe, driven by robust healthcare infrastructure and high pharmaceutical consumption. Thermoforming is the most widely used process, offering high production efficiency. Plastic films remain the dominant material, due to their cost-effectiveness and versatility.

By End-User Industry: Pharmaceutical (dominant), Consumer Goods, Industrial, Other End-user Industries.

By Country: Germany and United Kingdom (dominant), France, CIS countries, Rest of Europe.

By Process: Thermoforming (dominant), Coldforming.

By Material: Plastic Films (dominant), Paper and Paperboard, Aluminum, Other Materials.

Key Drivers (Germany and UK): Strong pharmaceutical industries, advanced healthcare infrastructure, favorable economic policies.

Europe Blister Packaging Industry Product Developments

Recent product innovations focus on enhanced barrier properties, improved sustainability, and specialized functionalities. Companies are introducing materials and designs to enhance product protection while reducing environmental impact. For example, the introduction of heat-seal coatings and innovative lidding solutions that withstand heat sterilization showcases the industry’s focus on meeting stringent requirements for specific applications such as medical devices and pharmaceuticals. These developments improve product shelf life, ensure sterility, and enhance patient convenience.

Report Scope & Segmentation Analysis

This report provides a granular segmentation of the European blister packaging market across various parameters:

- By End-User Industry: Detailed analysis of market size, growth projections, and competitive dynamics for each segment (Pharmaceutical, Consumer Goods, Industrial, Other).

- By Country: In-depth assessment of market characteristics and growth potential in major European countries (Germany, UK, France, CIS countries, and Rest of Europe).

- By Process: Examination of market shares and growth trends for different manufacturing processes (Thermoforming, Coldforming).

- By Material: Analysis of market size and projections for various packaging materials (Plastic Films, Paper and Paperboard, Aluminum, Other Materials).

Key Drivers of Europe Blister Packaging Industry Growth

Several factors drive the growth of the European blister packaging market: the rising demand for pharmaceuticals and consumer goods, advancements in packaging technology (e.g., sustainable materials, automated production), stringent regulatory requirements for product safety and traceability, and increasing focus on consumer convenience. Economic growth in several European countries also contributes to the market's expansion.

Challenges in the Europe Blister Packaging Industry Sector

The European blister packaging industry faces challenges such as fluctuating raw material prices, stringent environmental regulations that necessitate adopting sustainable packaging solutions, intense competition from both domestic and international players, and supply chain disruptions impacting production and distribution. These factors exert pressure on profit margins and operational efficiency, requiring companies to adopt innovative strategies to overcome them.

Emerging Opportunities in Europe Blister Packaging Industry

Emerging opportunities include growing demand for sustainable packaging solutions, the increasing adoption of smart packaging technologies (e.g., RFID and sensors), expanding applications in healthcare and consumer electronics, and exploration of new materials such as biodegradable polymers and innovative designs to improve product protection and aesthetics. The industry can capitalize on these trends to drive future growth.

Leading Players in the Europe Blister Packaging Industry Market

- Constantia Flexibles GmbH

- Honeywell International Inc

- Tekni-Plex Inc

- Klöckner Pentaplast Group

- Sonoco Products Company

- The Dow Chemical Company

- Westrock Company

- Amcor PLC

- E I Du Pont De Nemours and Company

Key Developments in Europe Blister Packaging Industry Industry

- June 2021: Amcor introduced a heat seal coating for medical-grade DuPont and paper packaging applications, enhancing performance in healthcare.

- August 2021: Amcor launched a heat-sterilization-resistant lidding solution for combination healthcare products, improving machinability and patient convenience.

Strategic Outlook for Europe Blister Packaging Industry Market

The future of the European blister packaging market appears promising, with continued growth driven by technological advancements, increasing demand for specialized packaging solutions across various sectors, and a growing emphasis on sustainability. Companies that invest in innovation, adopt sustainable practices, and effectively manage supply chain complexities are well-positioned to capitalize on emerging opportunities and achieve significant growth in the coming years.

Europe Blister Packaging Industry Segmentation

-

1. Process

- 1.1. Thermoforming

- 1.2. Coldforming

-

2. Material

- 2.1. Plastic Films

- 2.2. Paper and Paperboard

- 2.3. Aluminum

- 2.4. Other Materials

-

3. End-User Industry

- 3.1. Consumer Goods

- 3.2. Pharmaceutical

- 3.3. Industrial

- 3.4. Other End-user Industries

Europe Blister Packaging Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Blister Packaging Industry Regional Market Share

Geographic Coverage of Europe Blister Packaging Industry

Europe Blister Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing geriatric population and prevalence of diseases; Product innovations such as downsizing coupled with relatively low costs

- 3.3. Market Restrains

- 3.3.1. Advent of New Printing Technologies

- 3.4. Market Trends

- 3.4.1. Pharmaceutical is Expected to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Blister Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process

- 5.1.1. Thermoforming

- 5.1.2. Coldforming

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Plastic Films

- 5.2.2. Paper and Paperboard

- 5.2.3. Aluminum

- 5.2.4. Other Materials

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Consumer Goods

- 5.3.2. Pharmaceutical

- 5.3.3. Industrial

- 5.3.4. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Process

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Constantia Flexibles GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tekni-Plex Inc *List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Klockner Pentaplast Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sonoco Products Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Dow Chemical Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Westrock Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amcor PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 E I Du Pont De Nemours and Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Constantia Flexibles GmbH

List of Figures

- Figure 1: Europe Blister Packaging Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Blister Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Blister Packaging Industry Revenue billion Forecast, by Process 2020 & 2033

- Table 2: Europe Blister Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 3: Europe Blister Packaging Industry Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 4: Europe Blister Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Blister Packaging Industry Revenue billion Forecast, by Process 2020 & 2033

- Table 6: Europe Blister Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 7: Europe Blister Packaging Industry Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 8: Europe Blister Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Blister Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Blister Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe Blister Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Blister Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Blister Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Blister Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Blister Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Blister Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Blister Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Blister Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Blister Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Blister Packaging Industry?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Europe Blister Packaging Industry?

Key companies in the market include Constantia Flexibles GmbH, Honeywell International Inc, Tekni-Plex Inc *List Not Exhaustive, Klockner Pentaplast Group, Sonoco Products Company, The Dow Chemical Company, Westrock Company, Amcor PLC, E I Du Pont De Nemours and Company.

3. What are the main segments of the Europe Blister Packaging Industry?

The market segments include Process, Material, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 28.16 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing geriatric population and prevalence of diseases; Product innovations such as downsizing coupled with relatively low costs.

6. What are the notable trends driving market growth?

Pharmaceutical is Expected to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

Advent of New Printing Technologies.

8. Can you provide examples of recent developments in the market?

August 2021 - Amcor introduced a product based on patented inert film development and laminate design, which provides a lidding solution that can withstand heat sterilization, the process of preserving and sterilizing items, while also preventing drug uptake into the packaging. The packaging solution is designed ideally for combination healthcare products, such as devices with an Active Pharmaceutical Ingredient (API) that forms the basis of medicine. It ensures machinability, integrity after sterilization, as well as a convenient peel opening for patients.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Blister Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Blister Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Blister Packaging Industry?

To stay informed about further developments, trends, and reports in the Europe Blister Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence