Key Insights

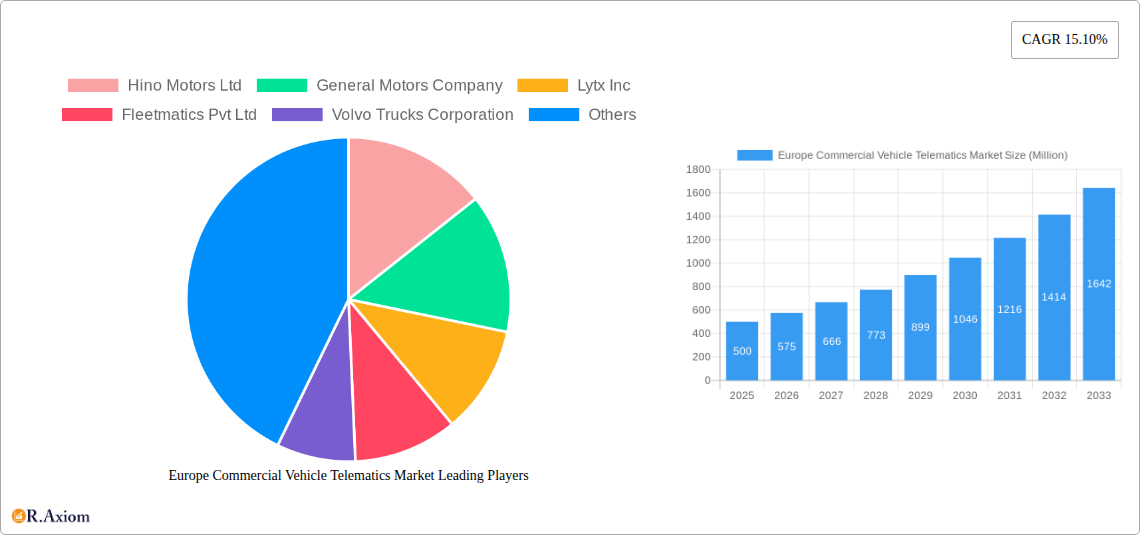

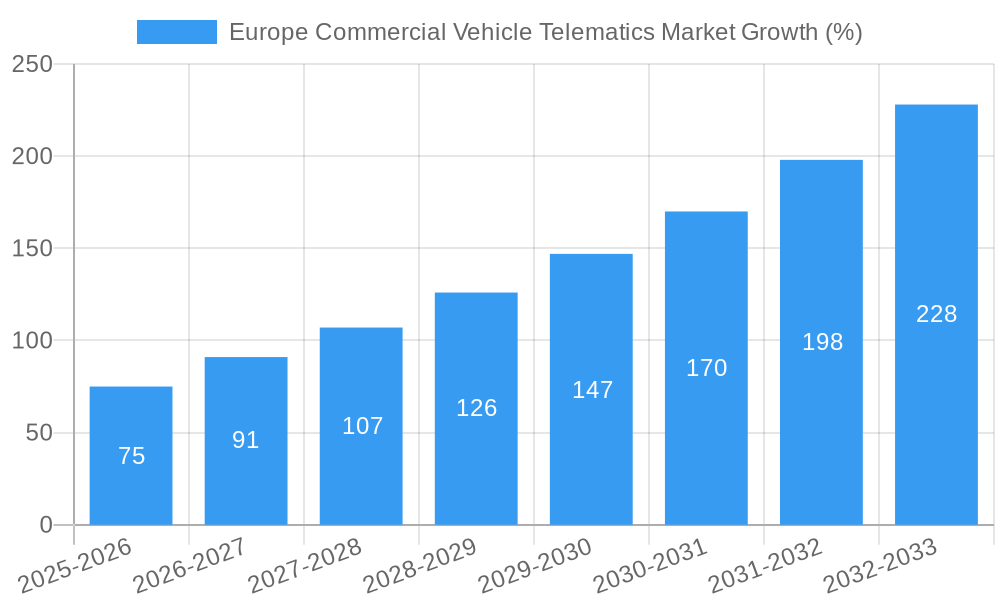

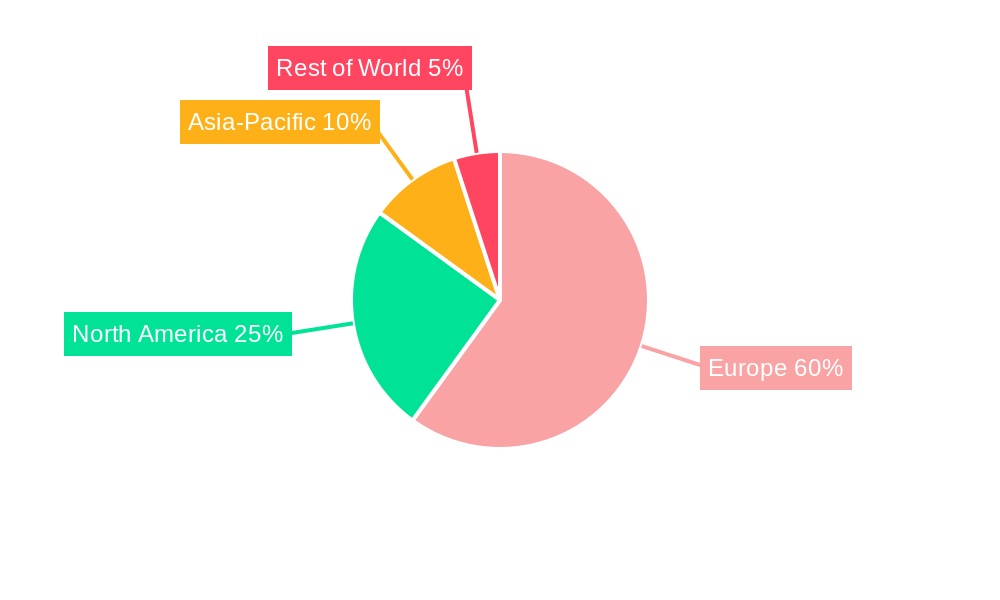

The European Commercial Vehicle Telematics market is experiencing robust growth, driven by increasing regulatory mandates for safety and efficiency, the burgeoning adoption of connected vehicle technologies, and the demand for optimized fleet management. The market, valued at approximately €[Estimate based on market size XX and currency conversion, e.g., €500 million] in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 15.10% from 2025 to 2033. This expansion is fueled by the rising integration of telematics systems in new commercial vehicles across various sectors, including logistics, transportation, and construction. Furthermore, the aftermarket segment is witnessing significant growth as fleet operators seek to upgrade their existing vehicles with advanced telematics solutions to enhance operational efficiency, reduce fuel consumption, and improve driver safety. Key players like Hino Motors, General Motors, and Volvo Trucks are actively contributing to this market expansion through continuous product innovation and strategic partnerships. The significant presence of automotive OEMs and aftermarket providers ensures diverse solutions are available, catering to the diverse needs of the European commercial vehicle landscape. The expansion is further bolstered by the increasing adoption of data analytics and AI to extract actionable insights from telematics data, enabling proactive maintenance, route optimization, and improved driver behavior. Germany, France, and the United Kingdom are expected to remain dominant markets within Europe, due to their large commercial vehicle fleets and advanced infrastructure.

The market segmentation reveals a strong preference for solutions-based telematics, indicating a demand for comprehensive platforms offering integrated functionalities. However, the "Others: Services" segment also holds significant growth potential as businesses increasingly prioritize outsourced fleet management and data analytics services. While challenges such as high initial investment costs and concerns about data security may act as restraints, the long-term benefits of improved efficiency, safety, and compliance significantly outweigh these concerns, solidifying the continued growth trajectory of the European Commercial Vehicle Telematics market. The forecast period (2025-2033) holds promising prospects for continued expansion, driven by technological advancements, increasing digitalization within the commercial vehicle sector, and the ongoing focus on sustainable transportation solutions.

This comprehensive report provides an in-depth analysis of the Europe Commercial Vehicle Telematics Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The analysis encompasses market size, segmentation, growth drivers, challenges, and key players, equipping readers with actionable intelligence to navigate this dynamic market. Key segments analyzed include solutions, services, OEMs, and aftermarket providers. The report leverages extensive data and expert analysis to present a clear and concise overview of this evolving landscape.

Europe Commercial Vehicle Telematics Market Concentration & Innovation

This section analyzes the competitive landscape of the European commercial vehicle telematics market, examining market concentration, innovation drivers, regulatory influences, and market dynamics. The market is characterized by a mix of large established players and innovative smaller companies. While precise market share data for individual companies requires specific paid access to the full report, we can analyze the competitive dynamics. The market is likely moderately concentrated, with several major players commanding significant shares, however this is subject to change with mergers and acquisitions.

Market Concentration: The market shows a trend toward consolidation, with larger players increasingly acquiring smaller companies to expand their market reach and product offerings. The exact market share for each player is unavailable without accessing the full report.

Innovation Drivers: The push for improved fuel efficiency, stricter emission regulations, and the increasing adoption of connected vehicle technologies are driving innovation in the sector. The development of advanced analytics, AI-powered solutions, and integration with other fleet management systems are key trends.

Regulatory Frameworks: EU regulations regarding data privacy (GDPR) and road safety standards significantly influence the market's trajectory. Compliance is a major cost factor and necessitates investment in robust data security infrastructure.

Product Substitutes: While few direct substitutes exist, competing technologies may include simpler, less integrated fleet management systems. The cost-benefit analysis for clients will depend on the specific needs and existing infrastructure.

End-User Trends: The increasing demand for real-time data, remote diagnostics, and predictive maintenance drives end-user preference for sophisticated telematics solutions. The focus is shifting towards total cost of ownership and long-term efficiency gains.

M&A Activities: Recent years have witnessed significant merger and acquisition (M&A) activity in the European commercial vehicle telematics market. The value of these deals varies greatly depending on the size and scope of the acquired company. xx Million in M&A deals are predicted over the study period.

Europe Commercial Vehicle Telematics Market Industry Trends & Insights

The European commercial vehicle telematics market is experiencing robust growth, driven by several key factors. The increasing adoption of telematics solutions by fleet operators seeking to enhance operational efficiency, reduce fuel consumption, and improve safety is a primary driver. The integration of telematics with other technologies, such as IoT and AI, further amplifies growth. The market's Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033), exceeding xx Million in market value by 2033. This growth is influenced by the growing awareness of the benefits of telematics among businesses of all sizes. Technological disruptions like the rise of 5G and the increasing sophistication of data analytics tools are fueling innovation and creating new opportunities within the sector. Consumer preferences are moving towards integrated, user-friendly platforms capable of providing actionable insights in real-time. Competitive dynamics are characterized by both collaboration and competition, with strategic alliances and product differentiation playing key roles. The market penetration rate, currently at approximately xx%, is expected to reach xx% by 2033.

Dominant Markets & Segments in Europe Commercial Vehicle Telematics Market

While the full report provides a granular analysis of market segments, some preliminary observations can be made. The German market is likely to remain a dominant force, driven by its large automotive industry and robust logistics infrastructure. Within segments:

By Type: The 'Solutions' segment (hardware and software solutions) likely holds the largest market share, followed by 'Services' (installation, maintenance, support). The precise values will be provided in the detailed report.

By Provider Type: Both OEM (Original Equipment Manufacturer) and Aftermarket providers contribute significantly to the market, with their relative shares influenced by factors such as vehicle production volumes and aftermarket demand. The distribution may shift slightly during the forecast period with increase in adoption of retrofitted aftermarket solutions.

Key Drivers of Regional Dominance:

Economic Policies: Government incentives and regulations related to fuel efficiency and transportation sustainability play a crucial role in shaping market demand within specific regions.

Infrastructure: Availability of robust telecommunications infrastructure (especially 5G) is essential for the effective implementation of telematics solutions.

Europe Commercial Vehicle Telematics Market Product Developments

Recent product innovations focus on enhanced data analytics, AI-powered predictive maintenance, and integration with broader fleet management ecosystems. These new applications improve operational efficiency and fuel economy, offering compelling competitive advantages. The incorporation of driver behavior monitoring systems and advanced driver-assistance systems (ADAS) enhances safety and reduces risk.

Report Scope & Segmentation Analysis

The report segments the Europe Commercial Vehicle Telematics Market based on:

By Type: Solutions (hardware, software, and data analytics platforms) and Services (installation, maintenance, and support services). The Solutions segment is expected to demonstrate substantial growth due to technological advancements and the increasing demand for advanced telematics functionalities. Services will see growth linked to the support and maintenance of increasingly complex systems.

By Provider Type: OEM (Original Equipment Manufacturer) and Aftermarket providers. Both segments are expected to grow but the Aftermarket segment may witness accelerated growth as the number of vehicles already in use increases.

Each segment’s growth projections and market sizes are detailed in the complete report. The competitive dynamics are analyzed for each, revealing market share distribution and competitive strategies.

Key Drivers of Europe Commercial Vehicle Telematics Market Growth

Several key factors contribute to the market's growth. Technological advancements in telematics technology, offering enhanced features and functionalities, are a major driver. Stringent government regulations aimed at improving road safety and reducing emissions incentivize the adoption of telematics solutions. Economic benefits such as reduced fuel consumption, improved operational efficiency, and optimized fleet management further drive market growth. The growing need to improve driver safety and reduce fuel costs for larger businesses also contributes.

Challenges in the Europe Commercial Vehicle Telematics Market Sector

Despite its growth potential, the market faces some challenges. High initial investment costs for implementing telematics systems can pose a barrier for smaller businesses. Concerns related to data privacy and security necessitate robust data protection measures, adding to operational costs. The competitive landscape, with established players and emerging companies vying for market share, presents additional challenges. Supply chain disruptions may negatively impact availability and cost of components. The market may also experience varying adoption rates across different countries due to diverse regulatory environments.

Emerging Opportunities in Europe Commercial Vehicle Telematics Market

Emerging opportunities arise from the increasing integration of telematics with other technologies like AI, IoT, and 5G. The development of predictive maintenance capabilities offers significant potential for cost reduction and improved efficiency. Expanding market penetration in smaller fleets and specialized sectors provides significant growth opportunities. The growing focus on sustainability and the increasing adoption of electric vehicles further contribute to emerging opportunities within the sector.

Leading Players in the Europe Commercial Vehicle Telematics Market Market

- Hino Motors Ltd

- General Motors Company (General Motors)

- Lytx Inc (Lytx)

- Fleetmatics Pvt Ltd

- Volvo Trucks Corporation (Volvo Trucks)

- Navistar International Corporation (Navistar)

- PTC Inc (PTC)

- Tata motors Ltd

- Trimble Inc (Trimble)

- Ford Motor Company (Ford Motor Company)

Key Developments in Europe Commercial Vehicle Telematics Industry

June 2021: Masternaut launched MoveElectric, a solution supporting fleet transitions to EVs. This reflects the market’s growing focus on electric vehicle integration.

May 2021: Alphabet Italia partnered with Octo Telematics for a car sanitation system (Alphabet CleanAir), highlighting the increasing importance of hygiene and safety features in fleet management.

February 2021: ABAX and Linkway partnered to improve data sharing among carriers and principals, enhancing the functionality and efficiency of existing telematics solutions. This partnership illustrates collaborative efforts to enhance telematics capabilities.

Strategic Outlook for Europe Commercial Vehicle Telematics Market Market

The future of the European commercial vehicle telematics market appears bright. Continued technological advancements, expanding connectivity, and increasing regulatory pressure will fuel further growth. The integration of telematics with other emerging technologies, particularly in areas like autonomous driving and predictive maintenance, offers significant potential for innovation and market expansion. The market's long-term outlook is positive, with sustained growth driven by these factors. Companies with innovative solutions and a focus on providing comprehensive services will be best positioned for success.

Europe Commercial Vehicle Telematics Market Segmentation

-

1. Type

-

1.1. Solutions

- 1.1.1. Fleet Tracking & Monitoring

- 1.1.2. Driver Management

- 1.1.3. Insurance Telematics

- 1.1.4. Safety & Compliance

- 1.1.5. V2X solutions

- 1.1.6. Others

- 1.2. Services

-

1.1. Solutions

-

2. Provider Type

- 2.1. OEM

- 2.2. Aftermarket

-

3. Geography

- 3.1. Germany

- 3.2. France

- 3.3. United Kingdom

- 3.4. Italy

- 3.5. Spain

- 3.6. Others

Europe Commercial Vehicle Telematics Market Segmentation By Geography

- 1. Germany

- 2. France

- 3. United Kingdom

- 4. Italy

- 5. Spain

- 6. Others

Europe Commercial Vehicle Telematics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for the Connected Trucks; Reduction of Fuel Costs with Real Time and Historical data

- 3.3. Market Restrains

- 3.3.1. Security and Privacy Concerns Due To Communication Technology

- 3.4. Market Trends

- 3.4.1. Growing Demand For The Connected Trucks

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Commercial Vehicle Telematics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Solutions

- 5.1.1.1. Fleet Tracking & Monitoring

- 5.1.1.2. Driver Management

- 5.1.1.3. Insurance Telematics

- 5.1.1.4. Safety & Compliance

- 5.1.1.5. V2X solutions

- 5.1.1.6. Others

- 5.1.2. Services

- 5.1.1. Solutions

- 5.2. Market Analysis, Insights and Forecast - by Provider Type

- 5.2.1. OEM

- 5.2.2. Aftermarket

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Germany

- 5.3.2. France

- 5.3.3. United Kingdom

- 5.3.4. Italy

- 5.3.5. Spain

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. France

- 5.4.3. United Kingdom

- 5.4.4. Italy

- 5.4.5. Spain

- 5.4.6. Others

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Commercial Vehicle Telematics Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Solutions

- 6.1.1.1. Fleet Tracking & Monitoring

- 6.1.1.2. Driver Management

- 6.1.1.3. Insurance Telematics

- 6.1.1.4. Safety & Compliance

- 6.1.1.5. V2X solutions

- 6.1.1.6. Others

- 6.1.2. Services

- 6.1.1. Solutions

- 6.2. Market Analysis, Insights and Forecast - by Provider Type

- 6.2.1. OEM

- 6.2.2. Aftermarket

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Germany

- 6.3.2. France

- 6.3.3. United Kingdom

- 6.3.4. Italy

- 6.3.5. Spain

- 6.3.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. France Europe Commercial Vehicle Telematics Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Solutions

- 7.1.1.1. Fleet Tracking & Monitoring

- 7.1.1.2. Driver Management

- 7.1.1.3. Insurance Telematics

- 7.1.1.4. Safety & Compliance

- 7.1.1.5. V2X solutions

- 7.1.1.6. Others

- 7.1.2. Services

- 7.1.1. Solutions

- 7.2. Market Analysis, Insights and Forecast - by Provider Type

- 7.2.1. OEM

- 7.2.2. Aftermarket

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Germany

- 7.3.2. France

- 7.3.3. United Kingdom

- 7.3.4. Italy

- 7.3.5. Spain

- 7.3.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. United Kingdom Europe Commercial Vehicle Telematics Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Solutions

- 8.1.1.1. Fleet Tracking & Monitoring

- 8.1.1.2. Driver Management

- 8.1.1.3. Insurance Telematics

- 8.1.1.4. Safety & Compliance

- 8.1.1.5. V2X solutions

- 8.1.1.6. Others

- 8.1.2. Services

- 8.1.1. Solutions

- 8.2. Market Analysis, Insights and Forecast - by Provider Type

- 8.2.1. OEM

- 8.2.2. Aftermarket

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Germany

- 8.3.2. France

- 8.3.3. United Kingdom

- 8.3.4. Italy

- 8.3.5. Spain

- 8.3.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Italy Europe Commercial Vehicle Telematics Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Solutions

- 9.1.1.1. Fleet Tracking & Monitoring

- 9.1.1.2. Driver Management

- 9.1.1.3. Insurance Telematics

- 9.1.1.4. Safety & Compliance

- 9.1.1.5. V2X solutions

- 9.1.1.6. Others

- 9.1.2. Services

- 9.1.1. Solutions

- 9.2. Market Analysis, Insights and Forecast - by Provider Type

- 9.2.1. OEM

- 9.2.2. Aftermarket

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Germany

- 9.3.2. France

- 9.3.3. United Kingdom

- 9.3.4. Italy

- 9.3.5. Spain

- 9.3.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Spain Europe Commercial Vehicle Telematics Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Solutions

- 10.1.1.1. Fleet Tracking & Monitoring

- 10.1.1.2. Driver Management

- 10.1.1.3. Insurance Telematics

- 10.1.1.4. Safety & Compliance

- 10.1.1.5. V2X solutions

- 10.1.1.6. Others

- 10.1.2. Services

- 10.1.1. Solutions

- 10.2. Market Analysis, Insights and Forecast - by Provider Type

- 10.2.1. OEM

- 10.2.2. Aftermarket

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Germany

- 10.3.2. France

- 10.3.3. United Kingdom

- 10.3.4. Italy

- 10.3.5. Spain

- 10.3.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Others Europe Commercial Vehicle Telematics Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Solutions

- 11.1.1.1. Fleet Tracking & Monitoring

- 11.1.1.2. Driver Management

- 11.1.1.3. Insurance Telematics

- 11.1.1.4. Safety & Compliance

- 11.1.1.5. V2X solutions

- 11.1.1.6. Others

- 11.1.2. Services

- 11.1.1. Solutions

- 11.2. Market Analysis, Insights and Forecast - by Provider Type

- 11.2.1. OEM

- 11.2.2. Aftermarket

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Germany

- 11.3.2. France

- 11.3.3. United Kingdom

- 11.3.4. Italy

- 11.3.5. Spain

- 11.3.6. Others

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Germany Europe Commercial Vehicle Telematics Market Analysis, Insights and Forecast, 2019-2031

- 13. France Europe Commercial Vehicle Telematics Market Analysis, Insights and Forecast, 2019-2031

- 14. Italy Europe Commercial Vehicle Telematics Market Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Europe Commercial Vehicle Telematics Market Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Europe Commercial Vehicle Telematics Market Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Europe Commercial Vehicle Telematics Market Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Europe Commercial Vehicle Telematics Market Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Hino Motors Ltd

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 General Motors Company

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Lytx Inc

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Fleetmatics Pvt Ltd

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Volvo Trucks Corporation

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Navistar International Corporation

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 PTC Inc

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Tata motors Ltd*List Not Exhaustive

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Trimble Inc

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Ford Motor Company

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.1 Hino Motors Ltd

List of Figures

- Figure 1: Europe Commercial Vehicle Telematics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Commercial Vehicle Telematics Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Provider Type 2019 & 2032

- Table 4: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Commercial Vehicle Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Commercial Vehicle Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Commercial Vehicle Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Commercial Vehicle Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Commercial Vehicle Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Commercial Vehicle Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Commercial Vehicle Telematics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Provider Type 2019 & 2032

- Table 16: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Provider Type 2019 & 2032

- Table 20: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Provider Type 2019 & 2032

- Table 24: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Provider Type 2019 & 2032

- Table 28: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 31: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Provider Type 2019 & 2032

- Table 32: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 35: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Provider Type 2019 & 2032

- Table 36: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 37: Europe Commercial Vehicle Telematics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Commercial Vehicle Telematics Market?

The projected CAGR is approximately 15.10%.

2. Which companies are prominent players in the Europe Commercial Vehicle Telematics Market?

Key companies in the market include Hino Motors Ltd, General Motors Company, Lytx Inc, Fleetmatics Pvt Ltd, Volvo Trucks Corporation, Navistar International Corporation, PTC Inc, Tata motors Ltd*List Not Exhaustive, Trimble Inc, Ford Motor Company.

3. What are the main segments of the Europe Commercial Vehicle Telematics Market?

The market segments include Type, Provider Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for the Connected Trucks; Reduction of Fuel Costs with Real Time and Historical data.

6. What are the notable trends driving market growth?

Growing Demand For The Connected Trucks.

7. Are there any restraints impacting market growth?

Security and Privacy Concerns Due To Communication Technology.

8. Can you provide examples of recent developments in the market?

June 2021 - Telematics and fleet management services provider Masternaut has launched its new MoveElectric solution, which aims to support the management of company fleets as they transition from internal combustion engines (ICE) to electric vehicles (EVs).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Commercial Vehicle Telematics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Commercial Vehicle Telematics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Commercial Vehicle Telematics Market?

To stay informed about further developments, trends, and reports in the Europe Commercial Vehicle Telematics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence