Key Insights

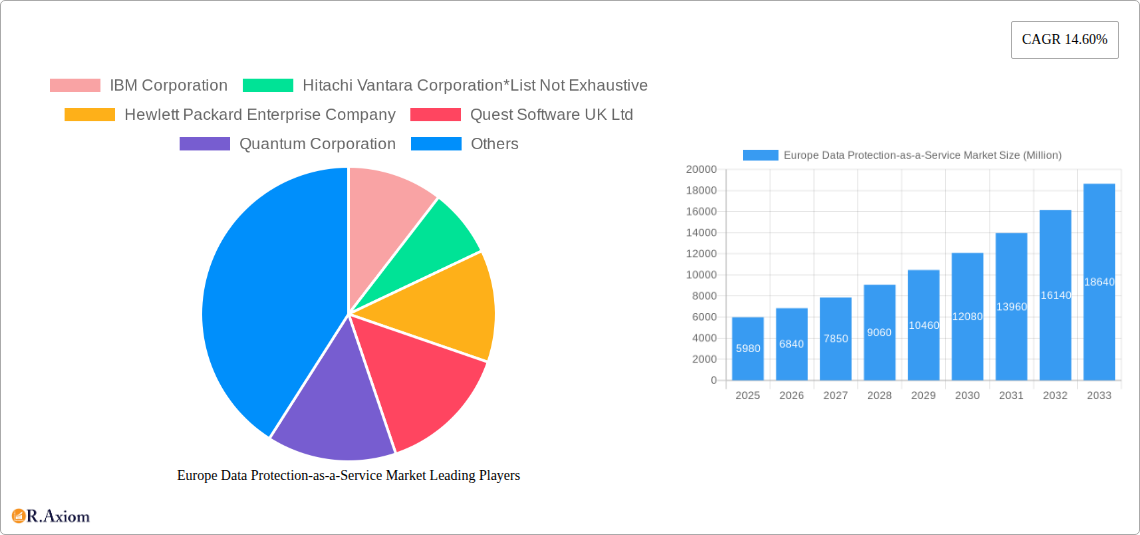

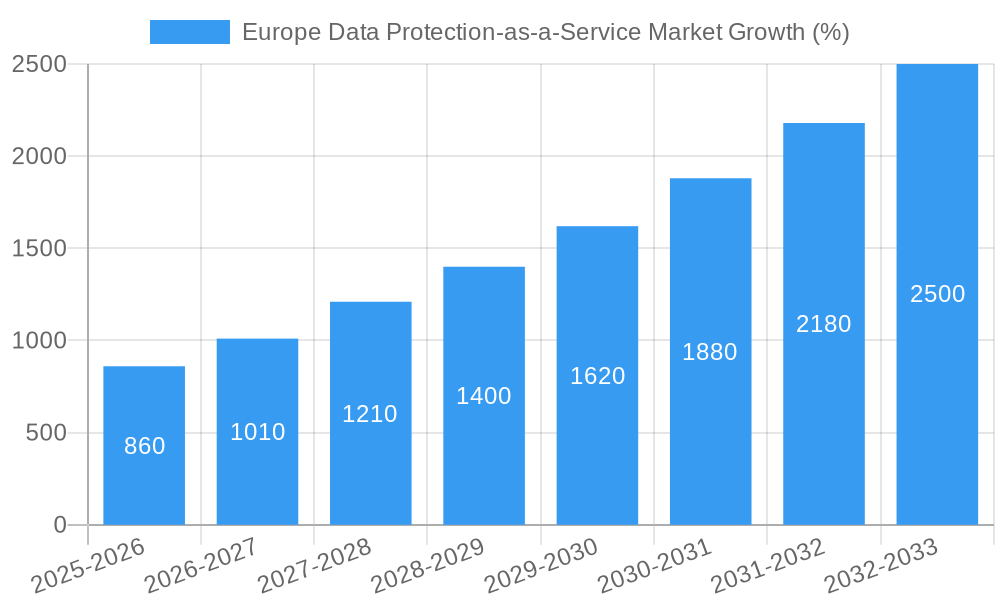

The European Data Protection-as-a-Service (DPaaS) market is experiencing robust growth, projected to reach a substantial size driven by increasing data volumes, stringent data privacy regulations (like GDPR), and the rising adoption of cloud computing across various sectors. The market's Compound Annual Growth Rate (CAGR) of 14.60% from 2019-2024 indicates a significant upward trajectory. This growth is fueled by several key drivers. Firstly, the increasing prevalence of cyber threats and data breaches necessitates robust data protection solutions, with DPaaS offering scalable and cost-effective alternatives to on-premise solutions. Secondly, the rising adoption of cloud-based services across industries like BFSI, healthcare, and government, which handle sensitive data, is significantly boosting demand for DPaaS offerings like Backup-as-a-Service (BaaS) and Disaster Recovery-as-a-Service (DRaaS). Finally, the flexibility and scalability offered by DPaaS, particularly through public and hybrid cloud deployments, are proving attractive to businesses of all sizes. While challenges like data security concerns and integration complexities exist, the overall market outlook remains positive.

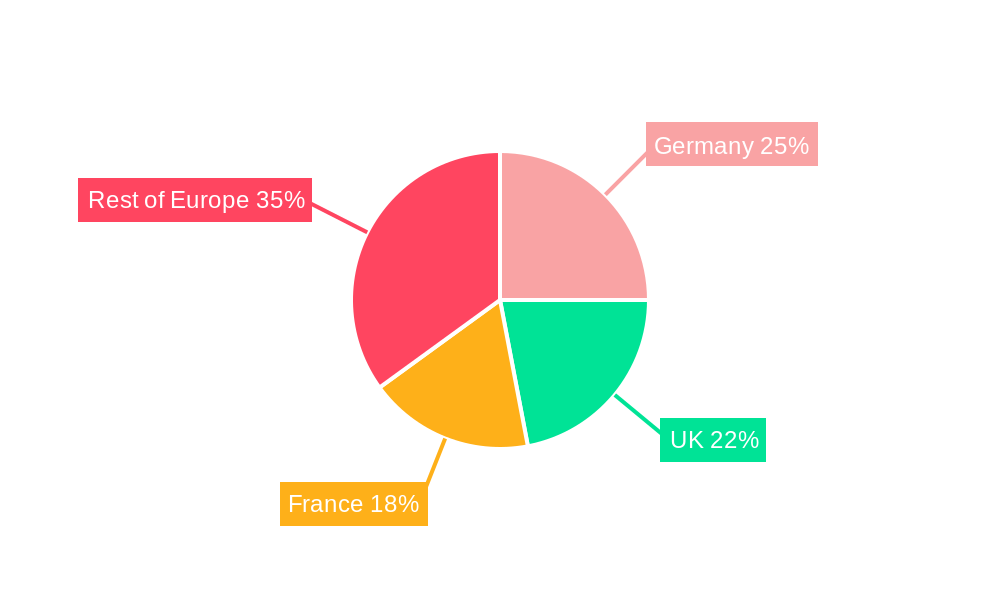

The market segmentation reveals a strong preference for cloud-based deployment models, particularly public cloud, reflecting the agility and scalability they offer. Among end-user industries, BFSI and healthcare sectors lead in DPaaS adoption due to their stringent data compliance needs. Geographically, Germany, France, and the United Kingdom represent the largest markets within Europe, driven by strong technological infrastructure and high digitalization rates. The competitive landscape is dynamic, with both established players like IBM, HPE, and Veritas, and cloud giants like AWS and Azure actively vying for market share. The future growth of the European DPaaS market will likely be influenced by advancements in artificial intelligence (AI) and machine learning (ML) for enhanced data protection, as well as the growing adoption of edge computing, demanding sophisticated and geographically dispersed data protection strategies. Continued regulatory pressure and increasing awareness of data security vulnerabilities will further propel market expansion throughout the forecast period (2025-2033).

This comprehensive report provides a detailed analysis of the Europe Data Protection-as-a-Service (DPaaS) market, covering the period 2019-2033. It offers actionable insights for stakeholders, including vendors, investors, and regulatory bodies, by examining market trends, competitive dynamics, and growth opportunities across various segments and countries. The report leverages extensive data analysis and incorporates recent industry developments to provide a forward-looking perspective on the future of the European DPaaS landscape. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Europe Data Protection-as-a-Service Market Concentration & Innovation

The Europe DPaaS market exhibits a moderately concentrated landscape, with key players such as IBM Corporation, Hitachi Vantara Corporation, Hewlett Packard Enterprise Company, Quest Software UK Ltd, Quantum Corporation, Veritas Technologies UK Ltd, Amazon Web Services Inc, Oracle Corporation, VMware Inc, Cisco Inc, Commvault Systems Inc, and Dell Technologies holding significant market share. However, the market also features numerous smaller niche players and startups, indicating a dynamic competitive environment. Precise market share figures for individual players are not publicly available and require further in-depth research.

Innovation is a primary driver in this market, fueled by evolving data privacy regulations (like GDPR), increasing cyber threats, and the growing adoption of cloud computing. Key innovations include advancements in data encryption, data loss prevention (DLP) technologies, and automated data security solutions. The rising adoption of AI and machine learning is also playing a crucial role in improving the efficiency and effectiveness of DPaaS solutions. Mergers and acquisitions (M&A) activity within the sector is relatively frequent, with deal values varying considerably depending on the size and strategic importance of the acquired company. For example, while exact figures are unavailable for specific M&A deals in this space within the defined period, the trend suggests strategic acquisitions to expand product portfolios and geographic reach. Regulatory frameworks like GDPR significantly influence market dynamics by requiring organizations to implement robust data protection measures, thereby driving demand for DPaaS solutions. Product substitutes include on-premise data protection solutions, but the shift towards cloud-based solutions continues to gain momentum due to scalability, cost-effectiveness, and ease of management. End-user trends indicate a preference for integrated DPaaS solutions that offer comprehensive data protection capabilities, enhanced automation, and seamless integration with existing IT infrastructures.

Europe Data Protection-as-a-Service Market Industry Trends & Insights

The Europe DPaaS market is experiencing substantial growth driven by several factors. The increasing volume and sensitivity of data handled by organizations across various sectors is a key driver, necessitating robust data protection strategies. The rising prevalence of cyberattacks and data breaches fuels demand for sophisticated DPaaS solutions that can effectively mitigate risks. The widespread adoption of cloud computing necessitates robust data protection mechanisms within cloud environments, leading to increased demand for cloud-based DPaaS offerings. Technological disruptions, such as the emergence of AI-powered security solutions and advancements in encryption techniques, are transforming the market, enabling more effective and efficient data protection. Consumer preferences are shifting towards solutions that prioritize data privacy, compliance, and ease of use. Competitive dynamics are characterized by intense competition among established players and emerging startups, leading to continuous innovation and price optimization. The market penetration of DPaaS is growing steadily, with a significant increase in adoption across various sectors. The market is expected to reach xx Million by 2025 and xx Million by 2033, showcasing a healthy CAGR of xx%.

Dominant Markets & Segments in Europe Data Protection-as-a-Service Market

Leading Region: Western Europe, specifically the UK, Germany, and France, are leading the DPaaS market due to strong regulatory frameworks, advanced IT infrastructure, and a high concentration of businesses.

Dominant Country: The United Kingdom currently holds a leading position due to its early adoption of cloud technologies and stringent data protection regulations.

Dominant Service Segment: Backup-as-a-Service (BaaS) is currently the dominant segment due to its widespread adoption and relatively lower cost of implementation.

Dominant Deployment Segment: Public cloud deployments are gaining significant traction due to their scalability, cost-effectiveness, and ease of access.

Dominant End-user Industry: The BFSI (Banking, Financial Services, and Insurance) sector is currently the leading adopter of DPaaS solutions due to stringent regulatory requirements and the high sensitivity of financial data.

Key Drivers (per segment):

- UK: Strong regulatory environment (GDPR), mature IT infrastructure, and high concentration of financial institutions.

- Germany: Focus on data privacy, robust IT sector, and growing digitalization across industries.

- France: Increasing government initiatives to promote cybersecurity, growing adoption of cloud computing, and significant presence of multinational corporations.

- Rest of Europe: Variable growth rates depending on individual country regulations and economic development.

The dominance of specific segments is expected to shift over time with the increasing adoption of more sophisticated DPaaS offerings and technological advancements.

Europe Data Protection-as-a-Service Market Product Developments

Recent product innovations include AI-powered data loss prevention tools, enhanced encryption algorithms, and automated compliance solutions. These developments are improving data protection efficacy, reducing operational costs, and enabling seamless integration with existing IT infrastructures. The market favors solutions that offer a balance of security, ease of use, and cost-effectiveness. The competitive advantage lies in offering comprehensive solutions tailored to specific customer needs, including integrated data protection, automated compliance, and robust security monitoring.

Report Scope & Segmentation Analysis

This report segments the Europe DPaaS market by service (Storage-as-a-Service, Backup-as-a-Service, Disaster Recovery-as-a-Service), deployment (Public Cloud, Private Cloud, Hybrid Cloud), end-user industry (BFSI, Healthcare, Government and Defense, IT and Telecom, Other End-user Industries), and country (United Kingdom, Germany, France, Rest of Europe). Each segment’s growth projection, market size, and competitive dynamics are analyzed to provide a holistic view of the market. Growth projections vary across segments depending on factors like regulatory changes, technological advancements, and industry-specific needs. For example, the Healthcare sector is expected to experience faster growth due to increasing regulatory compliance needs and the sensitive nature of patient data.

Key Drivers of Europe Data Protection-as-a-Service Market Growth

Several factors fuel the growth of the Europe DPaaS market. Stringent data privacy regulations, like GDPR, necessitate robust data protection measures. The increasing frequency and sophistication of cyberattacks are driving demand for enhanced security solutions. The widespread adoption of cloud computing increases reliance on cloud-based DPaaS solutions for security and compliance. Technological advancements, such as AI-powered security tools, are improving the effectiveness of data protection measures. Lastly, the rising awareness of data security among organizations further fuels market expansion.

Challenges in the Europe Data Protection-as-a-Service Market Sector

The Europe DPaaS market faces challenges including the complexity of implementing and managing data protection solutions, the high cost of implementation, and the need for specialized expertise. Data breaches and security vulnerabilities can significantly impact the market, eroding consumer trust. Competition among established and emerging players can lead to price wars and margin pressures. The constantly evolving regulatory landscape creates compliance complexities and continuous adaptation needs for providers and users.

Emerging Opportunities in Europe Data Protection-as-a-Service Market

Emerging opportunities include the growing adoption of AI-powered security solutions, the expansion of DPaaS solutions into new industries, and the increasing demand for integrated security platforms. The development of solutions tailored to specific industry needs and regulatory requirements offers significant potential. The exploration of novel security technologies, like blockchain, can lead to innovative data protection mechanisms. The expansion into emerging European markets presents significant growth opportunities.

Leading Players in the Europe Data Protection-as-a-Service Market Market

- IBM Corporation

- Hitachi Vantara Corporation

- Hewlett Packard Enterprise Company

- Quest Software UK Ltd

- Quantum Corporation

- Veritas Technologies UK Ltd

- Amazon Web Services Inc

- Oracle Corporation

- VMware Inc

- Cisco Inc

- Commvault Systems Inc

- Dell Technologies

Key Developments in Europe Data Protection-as-a-Service Market Industry

- June 2023: Oracle's EU Sovereign Cloud launch provides enhanced data privacy and sovereignty for EU entities, addressing evolving regulatory landscapes.

- July 2023: Thales' CipherTrust Data Security Platform, offered via a SaaS model, simplifies data security operations and offers integration with various vendors and cloud platforms.

Strategic Outlook for Europe Data Protection-as-a-Service Market Market

The Europe DPaaS market is poised for continued growth, driven by increasing data volumes, stringent regulations, and evolving cyber threats. Strategic opportunities lie in developing AI-powered solutions, expanding into new market segments, and focusing on integrated security platforms. The market's future growth will be shaped by the ability of DPaaS providers to innovate and adapt to the changing regulatory and technological landscape.

Europe Data Protection-as-a-Service Market Segmentation

-

1. Service

- 1.1. Storage-as-a-Service

- 1.2. Backup-as-a-Service

- 1.3. Disaster Recovery-as-a-Service

-

2. Deployment

- 2.1. Public Cloud

- 2.2. Private Cloud

- 2.3. Hybrid Cloud

-

3. End-user Industry

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. Government and Defense

- 3.4. IT and Telecom

- 3.5. Other End-user Industries

Europe Data Protection-as-a-Service Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Data Protection-as-a-Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Focus on Third-party Risk Management; Stringent Regulations

- 3.2.2 such as GDPR Prompting the Adoption of Data Protection Solutions; Increasing Awareness among EU Institutions

- 3.3. Market Restrains

- 3.3.1. Increasing Hidden Costs of Cloud-based Storage

- 3.4. Market Trends

- 3.4.1. BFSI Industry is Expected to Grow at a Significant Rate Throughout the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Data Protection-as-a-Service Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage-as-a-Service

- 5.1.2. Backup-as-a-Service

- 5.1.3. Disaster Recovery-as-a-Service

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Public Cloud

- 5.2.2. Private Cloud

- 5.2.3. Hybrid Cloud

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. Government and Defense

- 5.3.4. IT and Telecom

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Germany Europe Data Protection-as-a-Service Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Data Protection-as-a-Service Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Data Protection-as-a-Service Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Data Protection-as-a-Service Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Data Protection-as-a-Service Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Data Protection-as-a-Service Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Data Protection-as-a-Service Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 IBM Corporation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hitachi Vantara Corporation*List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Hewlett Packard Enterprise Company

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Quest Software UK Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Quantum Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Veritas Technologies UK Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Amazon Web Services Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Oracle Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 VMware Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Cisco Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Commvault Systems Inc

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Dell Technologies

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 IBM Corporation

List of Figures

- Figure 1: Europe Data Protection-as-a-Service Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Data Protection-as-a-Service Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Data Protection-as-a-Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Data Protection-as-a-Service Market Revenue Million Forecast, by Service 2019 & 2032

- Table 3: Europe Data Protection-as-a-Service Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 4: Europe Data Protection-as-a-Service Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Europe Data Protection-as-a-Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Data Protection-as-a-Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Data Protection-as-a-Service Market Revenue Million Forecast, by Service 2019 & 2032

- Table 15: Europe Data Protection-as-a-Service Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 16: Europe Data Protection-as-a-Service Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Europe Data Protection-as-a-Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark Europe Data Protection-as-a-Service Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Data Protection-as-a-Service Market?

The projected CAGR is approximately 14.60%.

2. Which companies are prominent players in the Europe Data Protection-as-a-Service Market?

Key companies in the market include IBM Corporation, Hitachi Vantara Corporation*List Not Exhaustive, Hewlett Packard Enterprise Company, Quest Software UK Ltd, Quantum Corporation, Veritas Technologies UK Ltd, Amazon Web Services Inc, Oracle Corporation, VMware Inc, Cisco Inc, Commvault Systems Inc, Dell Technologies.

3. What are the main segments of the Europe Data Protection-as-a-Service Market?

The market segments include Service, Deployment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Third-party Risk Management; Stringent Regulations. such as GDPR Prompting the Adoption of Data Protection Solutions; Increasing Awareness among EU Institutions.

6. What are the notable trends driving market growth?

BFSI Industry is Expected to Grow at a Significant Rate Throughout the Forecast Period.

7. Are there any restraints impacting market growth?

Increasing Hidden Costs of Cloud-based Storage.

8. Can you provide examples of recent developments in the market?

July 2023 - Thales, a France-based IT company, introduced the CipherTrust Data Security Platform to the market, and the company currently offers it through a cloud-based subscription-as-a-service model. According to Thales, the platform simplifies data security operations for organizations by utilizing data security and lifecycle management tools to help them defend against external cyber threats and other security risks. Additionally, the platform gives users access to a partner ecosystem for integrations with security vendors, enterprise storage, servers, databases, applications, and clouds.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Data Protection-as-a-Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Data Protection-as-a-Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Data Protection-as-a-Service Market?

To stay informed about further developments, trends, and reports in the Europe Data Protection-as-a-Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence