Key Insights

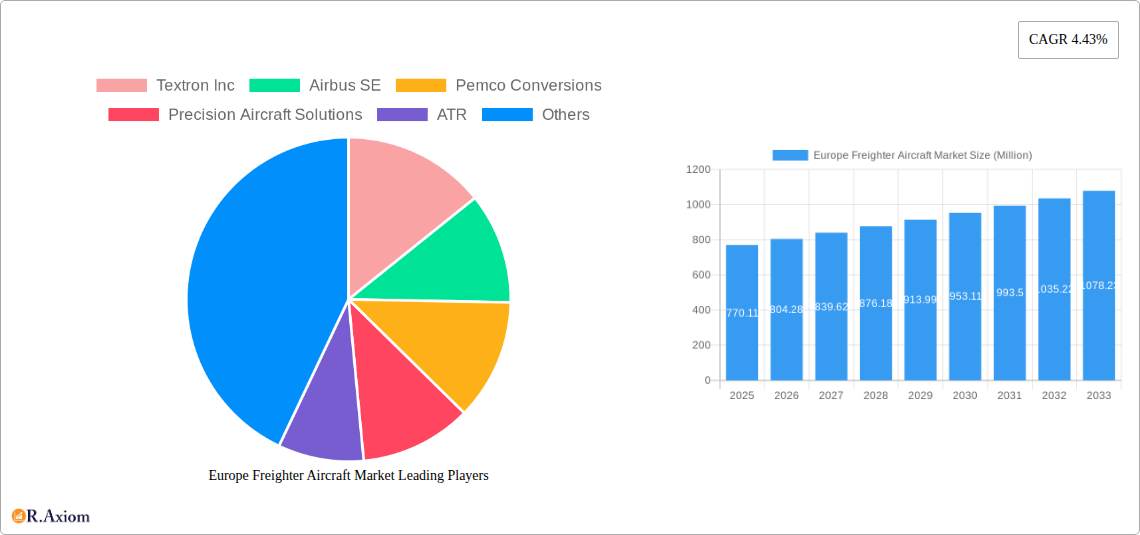

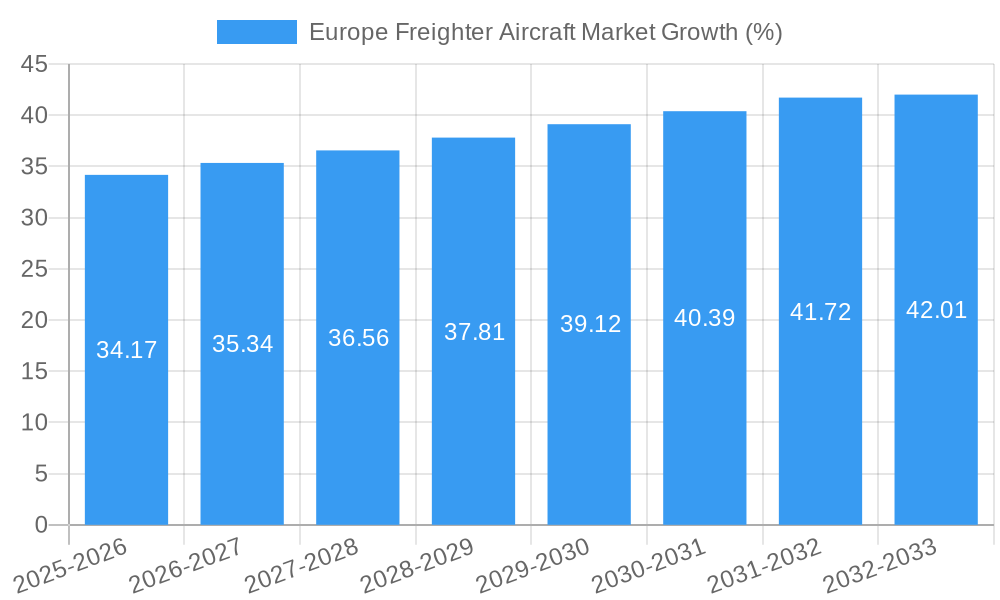

The European freighter aircraft market, valued at €770.11 million in 2025, is projected to experience robust growth, driven by the burgeoning e-commerce sector and the increasing demand for efficient air freight solutions across the continent. The market's Compound Annual Growth Rate (CAGR) of 4.43% from 2025 to 2033 signifies a steady expansion, fueled by factors such as rising cross-border trade, advancements in aircraft technology (particularly in fuel efficiency and payload capacity), and the expansion of air cargo hubs in key European nations like Germany, France, and the United Kingdom. The segment dominated by turbofan aircraft is expected to witness significant growth due to their superior range and payload capabilities, making them ideal for long-haul freight operations. However, the market also faces challenges, including fluctuating fuel prices, stringent environmental regulations, and potential disruptions caused by geopolitical instability. Competition among major players such as Airbus SE, Boeing, and Textron Inc., along with specialized conversion companies like Pemco Conversions, is expected to intensify, leading to innovation in aircraft design and operational efficiency. The increasing adoption of dedicated cargo aircraft over converted passenger aircraft reflects a growing emphasis on optimized performance and cost-effectiveness for air freight operators.

The growth within the European market will likely be uneven across the various segments. Germany, France, and the UK will continue to be the leading markets due to their established air cargo infrastructure and robust economies. However, growth in other European countries, including smaller nations with developing logistical networks, should contribute significantly to the overall market expansion. The market's future hinges on adapting to evolving customer demands, technological advancements, and maintaining operational resilience in the face of potential external shocks. Continued investment in sustainable aviation fuels and noise reduction technologies will also be critical for long-term market sustainability and regulatory compliance.

Europe Freighter Aircraft Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Europe Freighter Aircraft Market, encompassing market size, segmentation, growth drivers, challenges, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. This report is invaluable for industry stakeholders, investors, and strategic decision-makers seeking actionable insights into this dynamic market.

Europe Freighter Aircraft Market Market Concentration & Innovation

The European freighter aircraft market exhibits a moderately concentrated structure, with a few major players holding significant market share. The Boeing Company, Airbus SE, and Textron Inc. are key players, commanding a combined xx% market share in 2025 (estimated). However, smaller players like Pemco Conversions, Precision Aircraft Solutions, ATR, Singapore Technologies Engineering Ltd, and Aeronautical Engineers Inc. contribute significantly to market innovation through specialized conversions and niche offerings.

Market innovation is driven by technological advancements in engine technology (e.g., fuel efficiency improvements in turbofan and turboprop engines), aircraft design (e.g., enhanced payload capacity and range), and operational efficiency (e.g., advanced flight management systems). Stringent regulatory frameworks, particularly concerning emissions and safety standards, also push innovation. Product substitutes, such as maritime and rail freight, exert competitive pressure, forcing continuous improvement. End-user trends towards e-commerce and faster delivery times fuel demand for efficient freighter aircraft. M&A activity within the sector has been moderate, with deal values averaging xx Million in the past five years. These activities have primarily focused on expanding service networks and technological capabilities.

- Key Metrics:

- 2025 Estimated Market Share of Top 3 Players: xx%

- Average M&A Deal Value (2019-2024): xx Million

- Number of significant M&A deals (2019-2024): xx

Europe Freighter Aircraft Market Industry Trends & Insights

The European freighter aircraft market is experiencing robust growth, driven by the burgeoning e-commerce sector, expansion of global trade, and increasing demand for efficient air cargo solutions. The market's Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). This growth is further fueled by technological advancements in aircraft design, engine technology, and operational efficiency. The market penetration of advanced technologies like improved fuel-efficient engines and advanced flight management systems is steadily increasing, which contributes to operational cost reductions and enhanced efficiency. Technological disruptions, such as the development of electric and hybrid-electric freighter aircraft, are emerging as potential game-changers in the long term. Consumer preferences for faster and more reliable delivery services are positively impacting demand. However, competitive dynamics remain intense, as existing players strive to maintain market share while new entrants emerge, creating a highly competitive landscape.

Dominant Markets & Segments in Europe Freighter Aircraft Market

The dominant segment within the Europe Freighter Aircraft Market is the Turbofan Aircraft segment, accounting for approximately xx% of the market in 2025 (estimated). This segment's dominance is attributable to its higher payload capacity and extended range, catering to long-haul freight operations.

- Key Drivers of Turbofan Aircraft Segment Dominance:

- Higher payload capacity

- Extended range suitable for long-haul routes

- Technological advancements leading to fuel efficiency

- Strong demand from major e-commerce companies

The Dedicated Cargo Aircraft type holds a significant market share compared to derivative aircraft, reflecting the growing preference for specialized aircraft optimized for cargo operations. Germany and the UK emerge as leading countries within the European market, driven by strong economic activity and well-established logistics infrastructure.

- Key Drivers of Germany and UK Market Dominance:

- Strong economic activity and robust logistics networks

- High volume of international trade and e-commerce activities

- Favorable regulatory environment for air freight operations.

Europe Freighter Aircraft Market Product Developments

Recent product innovations in the European freighter aircraft market focus on enhancing fuel efficiency, payload capacity, and operational flexibility. Manufacturers are incorporating advanced materials, aerodynamic designs, and improved engine technologies to reduce fuel consumption and emissions. New applications are emerging in the express delivery sector and specialized cargo transportation (e.g., pharmaceuticals, perishables). These improvements provide competitive advantages by reducing operational costs and improving reliability, making them attractive to air freight operators.

Report Scope & Segmentation Analysis

This report segments the Europe Freighter Aircraft Market based on aircraft type (Dedicated Cargo Aircraft, Derivative of Non-Cargo Aircraft) and engine type (Turboprop Aircraft, Turbofan Aircraft).

Aircraft Type: Dedicated Cargo Aircraft is projected to show a higher growth rate compared to derivative aircraft, driven by increasing demand for purpose-built solutions.

Engine Type: The Turbofan Aircraft segment dominates due to its superior range and payload capacity, but turboprop aircraft will maintain a niche market in regional and shorter-haul operations.

Key Drivers of Europe Freighter Aircraft Market Growth

Several factors contribute to the growth of the Europe Freighter Aircraft Market:

- E-commerce boom: Increased online shopping drives demand for rapid and efficient freight transportation.

- Globalization and international trade: Growing global trade necessitates efficient air cargo solutions.

- Technological advancements: Improved fuel efficiency, payload capacity, and operational technology enhance profitability.

- Favorable government policies: Supportive regulations and infrastructure development facilitate market expansion.

Challenges in the Europe Freighter Aircraft Market Sector

The European freighter aircraft market faces several challenges:

- High acquisition and operational costs: The cost of purchasing and operating freighter aircraft can be prohibitive for smaller operators.

- Stringent regulatory compliance: Meeting environmental and safety regulations imposes significant costs and complexities.

- Supply chain disruptions: Global supply chain issues can impact the availability of parts and maintenance services.

- Intense competition: The market is highly competitive, with established players and new entrants vying for market share.

Emerging Opportunities in Europe Freighter Aircraft Market

The European freighter aircraft market presents several emerging opportunities:

- Growth in e-commerce and express delivery: The continued expansion of e-commerce creates substantial demand for air freight services.

- Development of sustainable aviation fuels (SAFs): The adoption of SAFs can reduce the environmental impact of air freight operations.

- Advancements in automation and digital technologies: Automation and data analytics can enhance operational efficiency and reduce costs.

- Expansion into emerging markets: Growth in developing economies in Eastern Europe can drive further demand.

Leading Players in the Europe Freighter Aircraft Market Market

- Textron Inc

- Airbus SE

- Pemco Conversions

- Precision Aircraft Solutions

- ATR

- Singapore Technologies Engineering Ltd

- Aeronautical Engineers Inc

- The Boeing Company

Key Developments in Europe Freighter Aircraft Market Industry

- April 2023: Air France-KLM and CMA CGM Group launched a long-term strategic air cargo partnership, combining their networks and capacity for ten years. This significantly impacts market consolidation and service offerings.

- July 2023: One Air commenced operations in the UK with a Boeing B747 freighter, becoming the sole UK airline operating this aircraft type. This indicates a potential shift in market dynamics within the UK air freight sector.

Strategic Outlook for Europe Freighter Aircraft Market Market

The future of the Europe Freighter Aircraft Market is promising, driven by sustained growth in e-commerce, global trade, and technological advancements. Continued innovation in fuel-efficient engines and aircraft design will be key to ensuring the long-term sustainability and competitiveness of the sector. The emergence of new players and strategic partnerships will further shape the market landscape, creating both opportunities and challenges for existing players. The focus on sustainability and reducing environmental impact will play an increasingly important role in shaping the future of the market.

Europe Freighter Aircraft Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Freighter Aircraft Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Freighter Aircraft Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.43% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Derivative of Non-Cargo Aircraft Segment is Anticipated to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Freighter Aircraft Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Germany Europe Freighter Aircraft Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Freighter Aircraft Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Freighter Aircraft Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Freighter Aircraft Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Freighter Aircraft Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Freighter Aircraft Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Freighter Aircraft Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Textron Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Airbus SE

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Pemco Conversions

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Precision Aircraft Solutions

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 ATR

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Singapore Technologies Engineering Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Aeronautical Engineers Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 The Boeing Company

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Textron Inc

List of Figures

- Figure 1: Europe Freighter Aircraft Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Freighter Aircraft Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Freighter Aircraft Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Freighter Aircraft Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Europe Freighter Aircraft Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Europe Freighter Aircraft Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Europe Freighter Aircraft Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Europe Freighter Aircraft Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Europe Freighter Aircraft Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Freighter Aircraft Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Italy Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Netherlands Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sweden Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Europe Freighter Aircraft Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 17: Europe Freighter Aircraft Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 18: Europe Freighter Aircraft Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Europe Freighter Aircraft Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 20: Europe Freighter Aircraft Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 21: Europe Freighter Aircraft Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United Kingdom Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Germany Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Italy Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Spain Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Netherlands Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Belgium Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Sweden Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Norway Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Poland Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Denmark Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Freighter Aircraft Market?

The projected CAGR is approximately 4.43%.

2. Which companies are prominent players in the Europe Freighter Aircraft Market?

Key companies in the market include Textron Inc, Airbus SE, Pemco Conversions, Precision Aircraft Solutions, ATR, Singapore Technologies Engineering Ltd, Aeronautical Engineers Inc, The Boeing Company.

3. What are the main segments of the Europe Freighter Aircraft Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 770.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Derivative of Non-Cargo Aircraft Segment is Anticipated to Dominate the Market.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

April 2023: Air France-KLM and the CMA CGM Group announced the launch of the long-term strategic air cargo partnership they made public in May 2022. The initial duration of this partnership is ten years, and Air France-KLM MartinairCargo and CMA CGM Air Cargo will combine their complementary cargo networks, full freighter capacity, and other dedicated services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Freighter Aircraft Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Freighter Aircraft Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Freighter Aircraft Market?

To stay informed about further developments, trends, and reports in the Europe Freighter Aircraft Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence