Key Insights

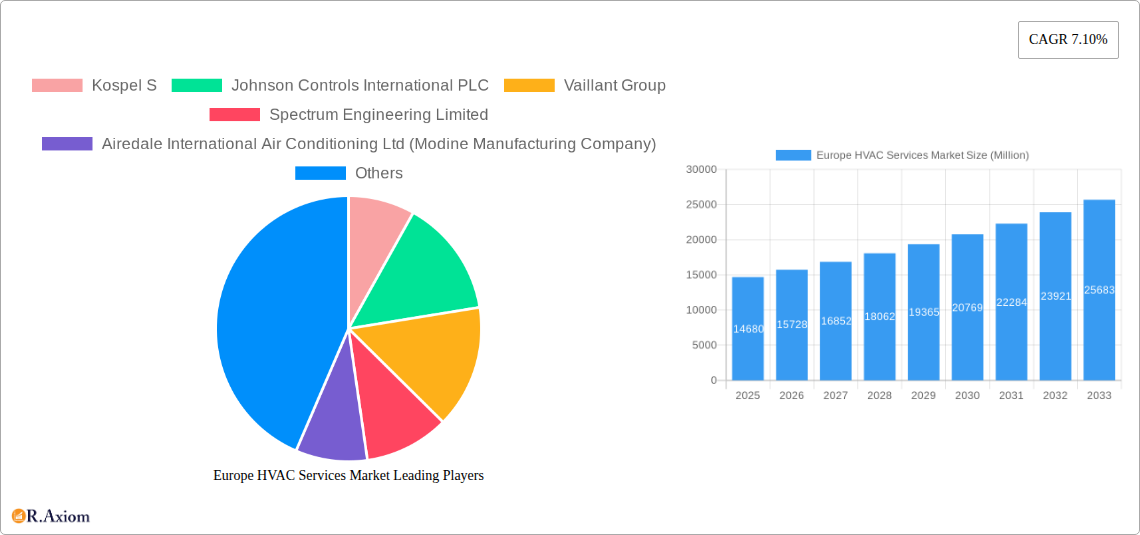

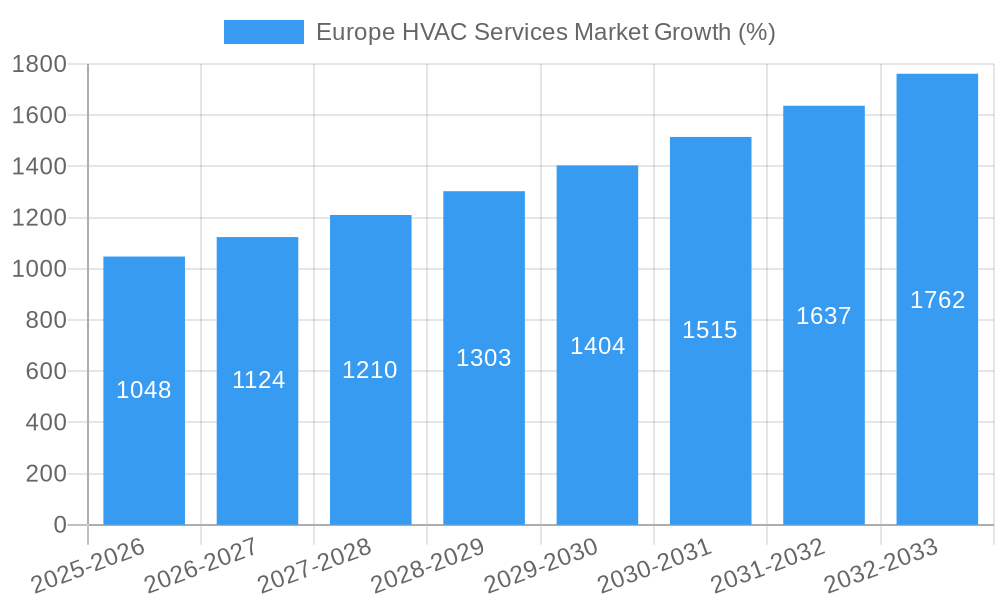

The European HVAC services market, valued at €14.68 billion in 2025, is projected to experience robust growth, driven by several key factors. Increasing concerns about energy efficiency and sustainability are prompting building owners and occupants to invest in improved HVAC systems and regular maintenance. Stringent environmental regulations across Europe, aimed at reducing carbon emissions, are further incentivizing the adoption of energy-efficient HVAC technologies and services. The growth is also fueled by a rising demand for smart building technologies that optimize energy consumption and enhance indoor environmental quality. This demand is particularly strong in the residential sector, as homeowners prioritize comfort and energy savings. Furthermore, the increasing prevalence of older buildings in many European cities necessitates significant retrofitting projects, contributing to market expansion. Growth in commercial and industrial sectors is also expected, driven by the need for reliable and efficient HVAC systems to maintain productivity and operational efficiency.

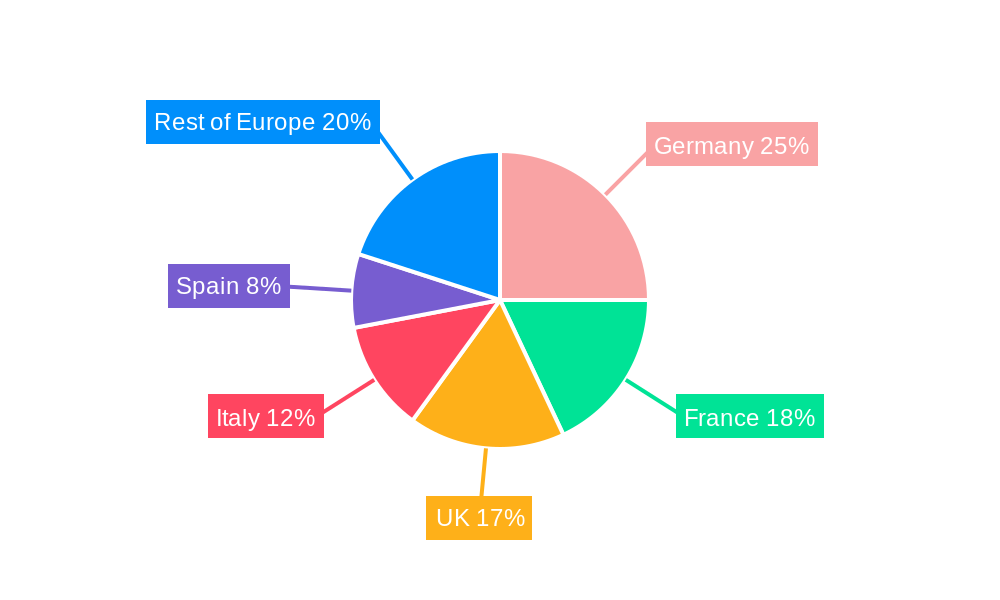

The market segmentation reveals significant opportunities across different service types, implementation types, and end-user industries. Maintenance and repair services account for a substantial portion of the market, underscoring the importance of regular upkeep for optimal system performance and longevity. New construction projects offer significant potential for HVAC system installations, while the retrofitting sector presents a substantial market for upgrades and replacements in existing buildings. The non-residential segment, encompassing commercial and industrial buildings, is expected to witness strong growth due to the focus on operational efficiency and employee comfort. Germany, France, and the United Kingdom are currently leading the market, but other countries, like Spain and the Nordic nations, are expected to show accelerated growth driven by investments in sustainable building practices and rising disposable incomes. Competition among established players like Johnson Controls, Vaillant, and Daikin, alongside regional and specialized service providers, is intense, fostering innovation and driving down costs for consumers. The forecast period of 2025-2033 anticipates a continuation of this upward trajectory, propelled by the factors mentioned above. A conservative estimate, considering the 7.10% CAGR, suggests a market size exceeding €25 billion by 2033.

Europe HVAC Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe HVAC services market, offering actionable insights for industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market dynamics, competitive landscapes, and future growth projections. The report segments the market by country, service type, implementation type, and end-user industry, providing granular data for strategic decision-making.

Europe HVAC Services Market Concentration & Innovation

The European HVAC services market exhibits a moderately concentrated structure, with several large multinational players alongside numerous smaller, regional companies. Market share is dynamic, influenced by M&A activity and technological advancements. The top five players account for approximately xx% of the market, with Johnson Controls International PLC, Vaillant Group, and Carrier Corporation among the leading firms. Innovation is a key driver, fueled by stringent environmental regulations (like the EU's Energy Efficiency Directive) pushing for energy-efficient solutions. The rising adoption of smart technologies, such as IoT-enabled HVAC systems and building automation, is also impacting the market.

- Market Concentration: Top 5 players hold xx% market share (2025).

- M&A Activity: Significant M&A deals, with a total estimated value of xx Million in 2024, signaling consolidation. Examples include Apleona's acquisition of Air for All.

- Regulatory Framework: Stringent environmental regulations drive demand for energy-efficient solutions.

- Product Substitutes: Growing competition from alternative heating and cooling technologies (e.g., geothermal).

- End-User Trends: Increasing preference for smart and energy-efficient HVAC systems.

Europe HVAC Services Market Industry Trends & Insights

The European HVAC services market is experiencing robust growth, driven by factors such as rising urbanization, increasing disposable incomes, and the growing need for comfortable and energy-efficient buildings. The market is projected to achieve a CAGR of xx% during the forecast period (2025-2033). Technological advancements, particularly in smart HVAC systems and renewable energy integration, are significantly impacting market dynamics. Consumer preferences are shifting towards sustainable and eco-friendly options, influencing product development and market segmentation. The competitive landscape is characterized by intense rivalry, with companies focusing on innovation, strategic partnerships, and expansion strategies to maintain their market share. Market penetration of smart HVAC systems is currently estimated at xx%, with growth potential significantly increasing.

Dominant Markets & Segments in Europe HVAC Services Market

The United Kingdom, Germany, and France represent the largest national markets within the European HVAC services sector, driven by robust construction activity, aging building stock requiring renovation, and favorable government policies supporting energy efficiency. Maintenance and repair services constitute a significant portion of the market, followed by installation services. Retrofit buildings present a substantial market opportunity due to the large existing building stock requiring upgrades. Non-residential segments, including commercial and industrial buildings, dominate in terms of market share due to the high HVAC requirements in these sectors.

- Key Drivers for Dominant Markets:

- UK: Strong construction activity and government initiatives.

- Germany: Large industrial base and high adoption of energy-efficient technologies.

- France: Significant investment in building renovation and infrastructure development.

- Dominant Segments:

- By Type of Service: Maintenance and repair holds the largest share.

- By Implementation Type: Retrofit buildings provide significant growth potential.

- By End-user Industry: Non-residential sector dominates market share.

Europe HVAC Services Market Product Developments

Recent innovations focus on energy efficiency, smart technology integration, and environmentally friendly refrigerants. Companies are developing HVAC systems with improved energy performance, remote monitoring capabilities, and seamless integration with building management systems. These advancements improve operational efficiency, reduce energy consumption, and enhance occupant comfort, resulting in greater market appeal. The focus on sustainability aligns with growing consumer and regulatory demand for eco-conscious solutions.

Report Scope & Segmentation Analysis

This report segments the European HVAC services market by:

- Country: United Kingdom, Germany, France, Italy, Spain, Denmark, Norway, Sweden, Finland, Iceland. Each country's market size and growth projections are detailed.

- Type of Service: Maintenance and Repair, Installation. Growth rates and competitive landscapes are analyzed for each service type.

- Implementation Type: New Construction, Retrofit Buildings. Market size and growth projections are presented separately for new construction and retrofit projects.

- End-user Industry: Residential, Non-residential. Market share and growth forecasts are provided for each end-user segment.

Each segment’s analysis includes market size, growth projections, and competitive dynamics.

Key Drivers of Europe HVAC Services Market Growth

Key growth drivers include:

- Stringent environmental regulations: Promoting energy-efficient HVAC systems.

- Rising urbanization and construction activity: Increasing demand for new HVAC installations.

- Growing focus on energy efficiency: Driving demand for upgrades and retrofits.

- Technological advancements: Enabling smarter and more efficient HVAC solutions.

Challenges in the Europe HVAC Services Market Sector

The market faces challenges such as:

- Supply chain disruptions: Impacting the availability and cost of components.

- High initial investment costs for energy-efficient systems: A barrier for some consumers.

- Skilled labor shortages: Limiting the capacity of installation and maintenance services.

- Economic fluctuations: Affecting construction activity and consumer spending.

Emerging Opportunities in Europe HVAC Services Market

Emerging opportunities include:

- Growing demand for smart HVAC systems: Offering energy optimization and remote management.

- Expansion into renewable energy integration: Linking HVAC systems with solar and geothermal energy.

- Focus on sustainable and eco-friendly solutions: Meeting increasing environmental concerns.

- Development of specialized services: For cleanroom facilities, healthcare, etc.

Leading Players in the Europe HVAC Services Market Market

- Johnson Controls International PLC

- Vaillant Group

- Carrier Corporation (United Technologies)

- Kospel S

- Spectrum Engineering Limited

- Airedale International Air Conditioning Ltd (Modine Manufacturing Company)

- Crystal Air Holdings Limited

- Pentair Inc

- Air Conditioning Solutions Inc

- Ingersoll Rand PLC

- BDR Thermea Group

- IAC Vestcold AS

- Klima Venta

- Aggreko PLC

- Envirotec Limited

- AAF International (Daikin Industries Ltd)

- Aermec SpA (Giordano Riello International Group SpA)

- Daikin Applied Americas Inc

Key Developments in Europe HVAC Services Market Industry

- April 2024: Panasonic Corporation launched new environmentally friendly HVAC solutions, leveraging innovative technologies and partnerships to meet the growing demand for energy-efficient solutions.

- January 2024: Apleona acquired Air for All, expanding its technical systems range and presence in southwest Germany.

Strategic Outlook for Europe HVAC Services Market Market

The European HVAC services market holds significant growth potential, driven by technological innovation, environmental regulations, and increasing consumer demand for energy-efficient and sustainable solutions. Companies focused on strategic partnerships, innovation in smart technologies, and expansion into niche markets are poised to benefit significantly from this growth. The market is expected to continue its upward trajectory, driven by long-term trends in urbanization, infrastructure development, and the increasing awareness of the importance of energy efficiency and sustainable practices.

Europe HVAC Services Market Segmentation

-

1. Type of Service

- 1.1. Maintenance and Repair

- 1.2. Installation

-

2. Implementation Type

- 2.1. New Construction

- 2.2. Retrofit Buildings

-

3. End-user Industry

- 3.1. Non-residential

Europe HVAC Services Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe HVAC Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Construction Activity; Growing Demand for Replacement and Retrofit Services

- 3.3. Market Restrains

- 3.3.1. Data privacy and security concerns; High installation and maintenance costs

- 3.4. Market Trends

- 3.4.1. The Residential Segment Holds Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe HVAC Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Service

- 5.1.1. Maintenance and Repair

- 5.1.2. Installation

- 5.2. Market Analysis, Insights and Forecast - by Implementation Type

- 5.2.1. New Construction

- 5.2.2. Retrofit Buildings

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Non-residential

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type of Service

- 6. Germany Europe HVAC Services Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe HVAC Services Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe HVAC Services Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe HVAC Services Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe HVAC Services Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe HVAC Services Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe HVAC Services Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Kospel S

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Johnson Controls International PLC

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Vaillant Group

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Spectrum Engineering Limited

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Airedale International Air Conditioning Ltd (Modine Manufacturing Company)

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Carrier Corporation (United Technologies)

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Crystal Air Holdings Limited

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Pentair Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Air Conditioning Solutions Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Ingersoll Rand PLC

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 BDR Thermea Group

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 IAC Vestcold AS

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Klima Venta

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Aggreko PLC

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Envirotec Limited

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 AAF International (Daikin Industries Ltd)

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 Aermec SpA (Giordano Riello International Group SpA)

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.18 Daikin Applied Americas Inc

- 13.2.18.1. Overview

- 13.2.18.2. Products

- 13.2.18.3. SWOT Analysis

- 13.2.18.4. Recent Developments

- 13.2.18.5. Financials (Based on Availability)

- 13.2.1 Kospel S

List of Figures

- Figure 1: Europe HVAC Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe HVAC Services Market Share (%) by Company 2024

List of Tables

- Table 1: Europe HVAC Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe HVAC Services Market Revenue Million Forecast, by Type of Service 2019 & 2032

- Table 3: Europe HVAC Services Market Revenue Million Forecast, by Implementation Type 2019 & 2032

- Table 4: Europe HVAC Services Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Europe HVAC Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe HVAC Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe HVAC Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe HVAC Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe HVAC Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe HVAC Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe HVAC Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe HVAC Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe HVAC Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe HVAC Services Market Revenue Million Forecast, by Type of Service 2019 & 2032

- Table 15: Europe HVAC Services Market Revenue Million Forecast, by Implementation Type 2019 & 2032

- Table 16: Europe HVAC Services Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Europe HVAC Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe HVAC Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Europe HVAC Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe HVAC Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe HVAC Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe HVAC Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe HVAC Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe HVAC Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe HVAC Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway Europe HVAC Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland Europe HVAC Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark Europe HVAC Services Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe HVAC Services Market?

The projected CAGR is approximately 7.10%.

2. Which companies are prominent players in the Europe HVAC Services Market?

Key companies in the market include Kospel S, Johnson Controls International PLC, Vaillant Group, Spectrum Engineering Limited, Airedale International Air Conditioning Ltd (Modine Manufacturing Company), Carrier Corporation (United Technologies), Crystal Air Holdings Limited, Pentair Inc, Air Conditioning Solutions Inc, Ingersoll Rand PLC, BDR Thermea Group, IAC Vestcold AS, Klima Venta, Aggreko PLC, Envirotec Limited, AAF International (Daikin Industries Ltd), Aermec SpA (Giordano Riello International Group SpA), Daikin Applied Americas Inc.

3. What are the main segments of the Europe HVAC Services Market?

The market segments include Type of Service, Implementation Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.68 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Construction Activity; Growing Demand for Replacement and Retrofit Services.

6. What are the notable trends driving market growth?

The Residential Segment Holds Significant Market Share.

7. Are there any restraints impacting market growth?

Data privacy and security concerns; High installation and maintenance costs.

8. Can you provide examples of recent developments in the market?

April 2024: Panasonic Corporation announced the launch of new environmentally friendly HVAC solutions in Europe. In addition, the company leverages innovative technologies and partnerships to meet the growing need for energy-efficient heating, ventilation, and air conditioning HVAC solutions in Europe. The European HVAC division ensures a healthy, sustainable environment, well-being, and comfort.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe HVAC Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe HVAC Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe HVAC Services Market?

To stay informed about further developments, trends, and reports in the Europe HVAC Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence