Key Insights

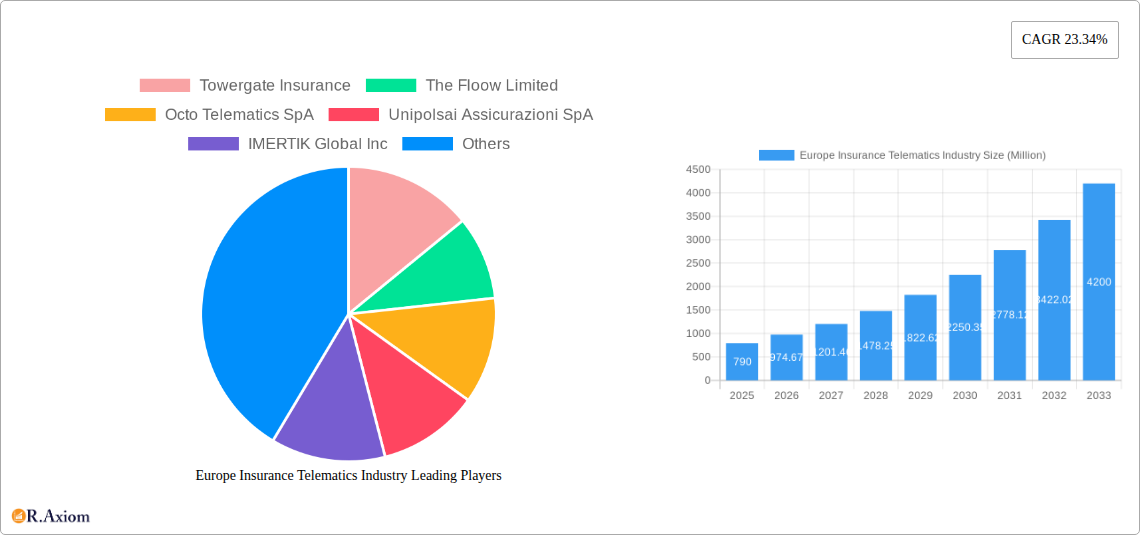

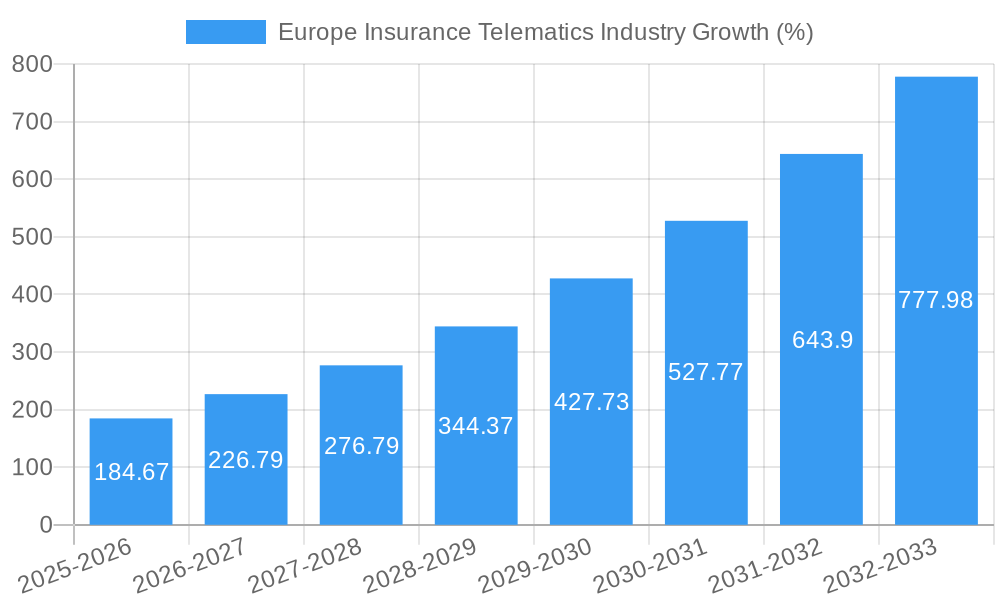

The European insurance telematics market is experiencing robust growth, projected to reach €0.79 billion in 2025 and exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 23.34% from 2025 to 2033. This expansion is driven by several key factors. Increasing adoption of connected car technologies provides a wealth of data enabling insurers to offer usage-based insurance (UBI) programs, which reward safer driving habits with lower premiums. Furthermore, stringent government regulations promoting road safety and the rising demand for personalized insurance solutions are accelerating market penetration. The market is segmented by insurance type (Pay-As-You-Drive, Pay-How-You-Drive, Manage-How-You-Drive) and geography (Italy, United Kingdom, Germany, and the Rest of Europe), reflecting varying levels of technological adoption and regulatory frameworks across the region. Germany, the UK, and Italy are currently leading the market, driven by high vehicle ownership and a relatively advanced insurance landscape. Competitive dynamics are characterized by a mix of established insurance providers like AXA and UnipolSai, alongside specialized telematics companies such as Octo Telematics and The Floow, and technology providers like Vodafone Automotive and LexisNexis Risk Solutions. The market's growth trajectory is further strengthened by ongoing technological advancements, including the integration of advanced driver-assistance systems (ADAS) and the development of sophisticated data analytics capabilities for risk assessment.

The continued expansion of the European insurance telematics market relies on several key considerations. Successful market penetration depends on addressing consumer concerns regarding data privacy and security. Building trust and transparency through robust data protection measures will be crucial. Furthermore, overcoming technological barriers, ensuring seamless integration with existing insurance systems, and addressing the potential for increased insurance fraud are vital for sustained growth. The competitive landscape necessitates strategic partnerships between insurers, telematics providers, and technology companies to develop innovative and cost-effective solutions. Expansion into new market segments, such as commercial fleets and motorcycle insurance, presents significant opportunities for growth. Finally, proactive adaptation to evolving regulatory environments will be essential to maintain market momentum. The market's continued success hinges on the effective management of these factors.

Europe Insurance Telematics Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe insurance telematics industry, covering market size, growth drivers, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report offers actionable insights for industry stakeholders, including insurers, telematics providers, and technology companies. With a focus on key segments (Pay-As-You-Drive, Pay-How-You-Drive, Manage-How-You-Drive) and major European markets (Italy, United Kingdom, Germany, and Rest of Europe), this report is an invaluable resource for strategic decision-making. The report projects a market valued at xx Million in 2025, expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Europe Insurance Telematics Industry Market Concentration & Innovation

The Europe insurance telematics market exhibits a moderately concentrated landscape, with several key players commanding significant market share. However, the industry is experiencing increasing competition from both established players and new entrants. Innovation is a key driver, fueled by advancements in IoT, AI, and data analytics. Regulatory frameworks, particularly around data privacy and security, play a crucial role in shaping market dynamics. Product substitutes, such as traditional insurance models, continue to exist, but the adoption of telematics is steadily increasing. End-user trends favor personalized insurance solutions, pushing demand for more sophisticated telematics offerings. M&A activities have been notable, with deal values totaling xx Million in the historical period (2019-2024).

- Key Players and Market Share: While precise market share figures are proprietary, Towergate Insurance, The Floow Limited, Octo Telematics SpA, Unipolsai Assicurazioni SpA, IMERTIK Global Inc, AXA S A, Drive Quant, Viasat Group, LexisNexis Risks Solutions, and Vodafone Automotive SpA are major contributors.

- M&A Activity: Significant M&A activity occurred between 2019 and 2024, primarily driven by consolidation efforts and the acquisition of specialized technologies. Deal values varied, with some exceeding xx Million.

- Innovation Drivers: Advancements in AI-powered risk assessment, IoT device miniaturization and affordability, and enhanced data analytics capabilities are driving innovation.

- Regulatory Landscape: GDPR and other data privacy regulations are shaping product development and data handling practices within the industry.

Europe Insurance Telematics Industry Industry Trends & Insights

The Europe insurance telematics market is experiencing robust growth, driven by several key factors. The increasing adoption of connected cars and the rising demand for usage-based insurance (UBI) are significant contributors to market expansion. Technological advancements, particularly in the field of AI and machine learning, are enabling more accurate risk assessments and personalized pricing models. Consumer preferences are shifting towards value-based insurance solutions, where premiums are directly linked to driving behavior. Competitive dynamics are characterized by both intense competition and strategic alliances, as companies seek to consolidate their market positions. The market is projected to grow at a CAGR of xx% from 2025 to 2033, with market penetration expected to reach xx% by 2033. This growth is fueled by increased smartphone penetration, improving data infrastructure, and the rising awareness of the benefits of telematics among both insurers and consumers.

Dominant Markets & Segments in Europe Insurance Telematics Industry

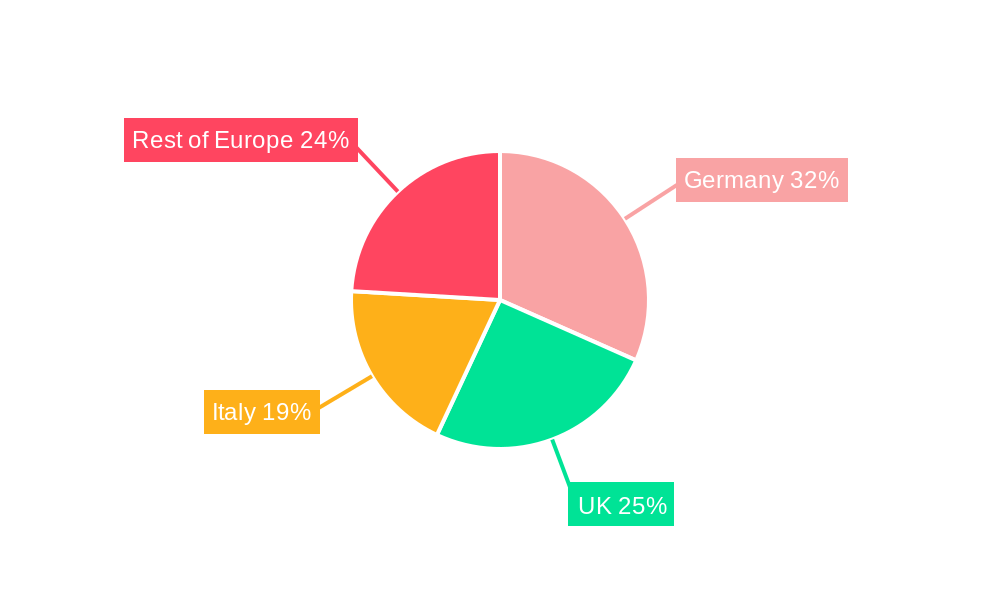

The United Kingdom currently holds the largest market share in the European insurance telematics industry, followed by Germany and Italy. The "Pay-As-You-Drive" segment is the most dominant type, driven by its simplicity and affordability.

- United Kingdom: High adoption rates of connected cars, strong regulatory support, and a mature insurance market contribute to the UK's dominance.

- Germany: A large automotive industry and a focus on technological innovation drive growth in Germany.

- Italy: Increasing adoption of UBI programs and a growing awareness of the benefits of telematics are fueling market expansion.

- Rest of Europe: Significant growth potential exists in the "Rest of Europe" segment, fueled by increasing smartphone penetration and the expansion of telematics offerings.

- Pay-As-You-Drive: Simple pricing model and ease of implementation drive this segment's high market share.

- Pay-How-You-Drive: More complex pricing models reflecting diverse driving behaviors are gaining traction.

- Manage-How-You-Drive: Focus on driver behavior modification and safety enhancement drives the growth of this segment, albeit slower than Pay-As-You-Drive.

Europe Insurance Telematics Industry Product Developments

Recent product innovations focus on improving data accuracy, enhancing user experience, and integrating with other vehicle systems. The use of AI and machine learning in risk assessment is becoming increasingly prevalent. Integration with wearable technology and smartphone apps is expanding the capabilities of telematics systems, providing more comprehensive data insights. These developments are creating more personalized and competitive offerings that better meet consumer demands for value-based insurance.

Report Scope & Segmentation Analysis

This report segments the European insurance telematics market by type (Pay-As-You-Drive, Pay-How-You-Drive, Manage-How-You-Drive) and by country (Italy, United Kingdom, Germany, Rest of Europe). Each segment offers unique growth projections, market sizes, and competitive dynamics. The Pay-As-You-Drive segment is characterized by high growth due to its straightforward nature. The Pay-How-You-Drive segment displays steady expansion as it offers a more nuanced pricing structure. The Manage-How-You-Drive sector shows promising future prospects, yet growth is somewhat limited by its focus on behavior modification. Regionally, the UK demonstrates the highest market size and growth, though significant potential exists across other European countries.

Key Drivers of Europe Insurance Telematics Industry Growth

Several factors are driving the growth of the European insurance telematics market. Technological advancements, particularly in IoT and AI, are enabling more sophisticated and accurate risk assessment. Favorable regulatory environments in several European countries encourage the adoption of telematics. The increasing adoption of connected cars provides the necessary data infrastructure for telematics solutions. Consumer demand for personalized and value-based insurance is a key market driver, pushing the development of innovative telematics products. Economic factors such as increasing insurance costs also push adoption.

Challenges in the Europe Insurance Telematics Industry Sector

Despite significant growth potential, the industry faces challenges. Data privacy concerns are paramount, necessitating stringent data security measures. The high initial investment costs associated with telematics implementation can be a barrier for smaller insurance companies. Competition is intense, requiring companies to continuously innovate and differentiate their offerings. Interoperability issues between different telematics systems also pose a challenge to standardization. The xx Million investment in data security measures in 2024 highlights the significance of this challenge.

Emerging Opportunities in Europe Insurance Telematics Industry

Several emerging opportunities exist in the European insurance telematics market. The integration of telematics with other automotive technologies, such as ADAS, creates new opportunities for data-driven services. The expansion of telematics into new markets, such as commercial fleets, presents further growth potential. The development of advanced analytics capabilities allows for more accurate risk prediction and personalized insurance offerings. The growth of the sharing economy also creates opportunities for telematics-based insurance solutions for shared vehicles.

Leading Players in the Europe Insurance Telematics Industry Market

- Towergate Insurance

- The Floow Limited

- Octo Telematics SpA

- Unipolsai Assicurazioni SpA

- IMERTIK Global Inc

- AXA S A

- Drive Quant

- Viasat Group

- LexisNexis Risks Solutions

- Vodafone Automotive SpA

Key Developments in Europe Insurance Telematics Industry Industry

- February 2023: Octo Telematics partners with Ford Motor Company to expand its data streaming partnership into Europe, strengthening its position in fleet telematics and smart mobility solutions. This partnership significantly expands Octo Telematics' reach and strengthens its position in the European market.

Strategic Outlook for Europe Insurance Telematics Industry Market

The future of the European insurance telematics market is bright. Continued technological advancements, coupled with increasing consumer demand for personalized insurance solutions, will drive further growth. The market will see increased consolidation, with larger players acquiring smaller companies to expand their product portfolios and market share. The focus will remain on data security, user experience improvements, and the development of innovative applications that leverage the power of telematics data to provide enhanced value to both insurers and consumers. The potential for expansion into new segments and geographic markets remains considerable.

Europe Insurance Telematics Industry Segmentation

-

1. Type

- 1.1. Pay-As-You-Drive

- 1.2. Pay-How-You-Drive

- 1.3. Manage-How-You-Drive

-

2. BY COUNTRY

- 2.1. Italy

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. Rest of the Europe

Europe Insurance Telematics Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Insurance Telematics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 23.34% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Usage-based Insurance by Insurance Companies

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Workforce and Low Capital Investment

- 3.4. Market Trends

- 3.4.1. Adoption of Usage-based Insurance by Insurance Companies will Drive The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Insurance Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Pay-As-You-Drive

- 5.1.2. Pay-How-You-Drive

- 5.1.3. Manage-How-You-Drive

- 5.2. Market Analysis, Insights and Forecast - by BY COUNTRY

- 5.2.1. Italy

- 5.2.2. United Kingdom

- 5.2.3. Germany

- 5.2.4. Rest of the Europe

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Insurance Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Insurance Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Insurance Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Insurance Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Insurance Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Insurance Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Insurance Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Towergate Insurance

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 The Floow Limited

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Octo Telematics SpA

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Unipolsai Assicurazioni SpA

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 IMERTIK Global Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 *List Not Exhaustive*List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 AXA S A

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Drive Quant

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Viasat Group

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 LexisNexis Risks Solutions

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Vodafone Automotive SpA

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Towergate Insurance

List of Figures

- Figure 1: Europe Insurance Telematics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Insurance Telematics Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Insurance Telematics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Insurance Telematics Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Insurance Telematics Industry Revenue Million Forecast, by BY COUNTRY 2019 & 2032

- Table 4: Europe Insurance Telematics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Insurance Telematics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Insurance Telematics Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Europe Insurance Telematics Industry Revenue Million Forecast, by BY COUNTRY 2019 & 2032

- Table 15: Europe Insurance Telematics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Insurance Telematics Industry?

The projected CAGR is approximately 23.34%.

2. Which companies are prominent players in the Europe Insurance Telematics Industry?

Key companies in the market include Towergate Insurance, The Floow Limited, Octo Telematics SpA, Unipolsai Assicurazioni SpA, IMERTIK Global Inc, *List Not Exhaustive*List Not Exhaustive, AXA S A, Drive Quant, Viasat Group, LexisNexis Risks Solutions, Vodafone Automotive SpA.

3. What are the main segments of the Europe Insurance Telematics Industry?

The market segments include Type, BY COUNTRY.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Usage-based Insurance by Insurance Companies.

6. What are the notable trends driving market growth?

Adoption of Usage-based Insurance by Insurance Companies will Drive The Market.

7. Are there any restraints impacting market growth?

Shortage of Skilled Workforce and Low Capital Investment.

8. Can you provide examples of recent developments in the market?

February 2023 -OCTO Telematics, a provider of telematics and data analytics for the insurance sector, has partnered with Ford Motor Company to extend its data streaming partnership into Europe. The company has positioned itself as one of the leading companies offering Fleet Telematics and Smart Mobility solutions. The company is on a mission to leverage its advanced analytics and set of IoT Big Data to generate actionable analytics, giving life to a new era of Smart Telematics.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Insurance Telematics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Insurance Telematics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Insurance Telematics Industry?

To stay informed about further developments, trends, and reports in the Europe Insurance Telematics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence