Key Insights

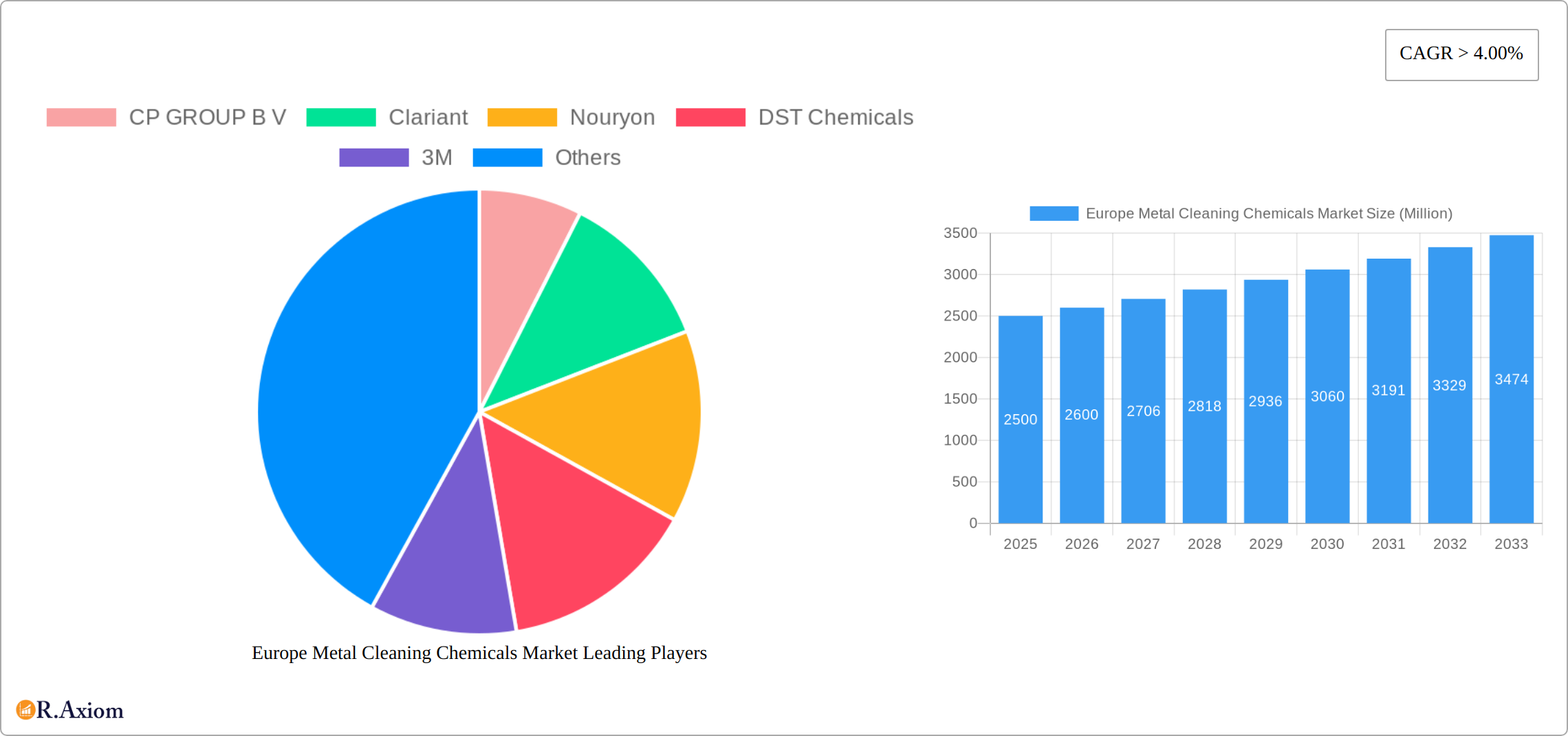

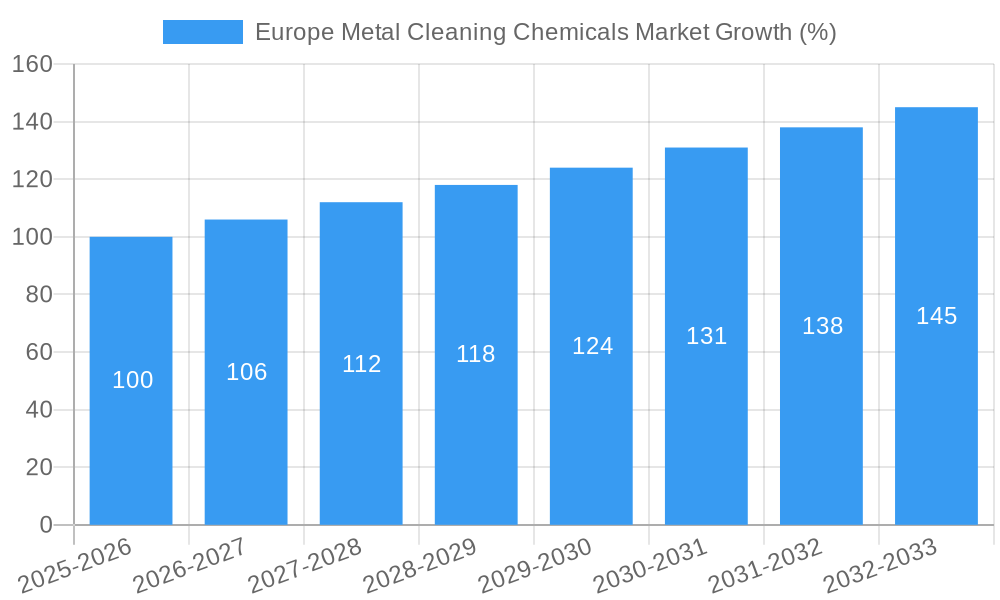

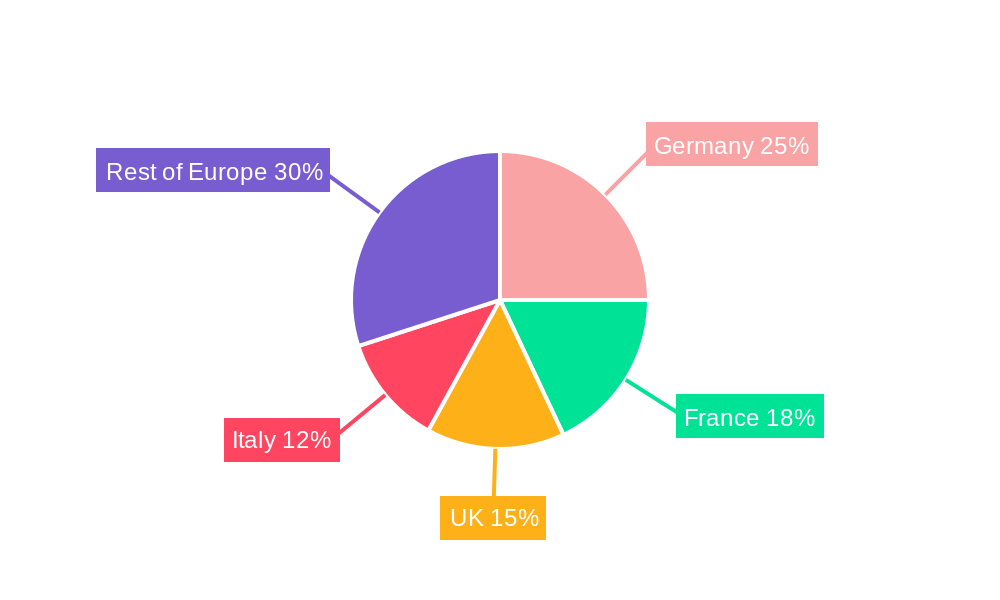

The European metal cleaning chemicals market, valued at approximately €2.5 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 4% from 2025 to 2033. This expansion is driven by several key factors. The automotive industry's increasing production, particularly electric vehicles requiring meticulous cleaning processes, fuels significant demand. Furthermore, the electronics sector's relentless pursuit of miniaturization necessitates highly effective and precise cleaning solutions, boosting market growth. Stringent environmental regulations are pushing manufacturers toward eco-friendly, water-based cleaning chemicals, while the growing adoption of advanced cleaning technologies enhances efficiency and reduces operational costs. Germany, France, and the UK represent major market segments within Europe, benefiting from established manufacturing bases and robust industrial activity. However, the market faces challenges like fluctuating raw material prices and the potential for substitution by alternative cleaning methods. The diverse range of chemical types (acidic, basic, neutral) and functional additives (surfactants, corrosion inhibitors, etc.) cater to a wide spectrum of metal cleaning needs across industries such as transportation, electronics, chemicals, pharmaceuticals, and oil & gas. The presence of major global players like BASF, Clariant, and 3M ensures a competitive landscape, constantly driving innovation and efficiency improvements.

The market segmentation reveals significant opportunities for specialized chemical suppliers. The aqueous-based segment is likely to dominate due to its environmental friendliness and cost-effectiveness. However, solvent-based solutions retain relevance in specific applications requiring superior cleaning power. The demand for corrosion inhibitors and surfactants is expected to rise alongside the increasing need for surface protection and improved cleaning performance. Regional variations exist, reflecting differences in industrial development and environmental policies across European nations. The forecast period will likely witness consolidation among market players through mergers and acquisitions, further shaping the competitive landscape and accelerating technological advancements. The continued focus on sustainable solutions and technological innovation will remain central to the market's trajectory over the next decade.

Europe Metal Cleaning Chemicals Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Metal Cleaning Chemicals market, offering valuable insights for stakeholders across the value chain. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, competitive landscapes, and future growth projections. The study period encompasses historical data (2019-2024), the base year (2025), and a detailed forecast (2025-2033).

Europe Metal Cleaning Chemicals Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory landscape, substitute products, end-user trends, and merger & acquisition (M&A) activities within the European metal cleaning chemicals market. The market exhibits a moderately concentrated structure, with several large multinational corporations holding significant market share. Key players such as Clariant, Nouryon, 3M, BASF SE, and Dow compete intensely, driving innovation and influencing market pricing. The market share of these leading players is estimated to be approximately xx%, collectively, in 2025.

Innovation is driven by the increasing demand for environmentally friendly, high-performance cleaning solutions, stricter environmental regulations (e.g., REACH), and the need for specialized cleaning agents for advanced materials used in various end-user industries. Product substitution is occurring with the introduction of bio-based and sustainable alternatives to traditional solvent-based cleaners. End-user trends show a move toward automation and improved process efficiency.

M&A activity has been significant, with notable acquisitions shaping the market landscape. For example:

- August 2022: MKS Instruments' acquisition of Atotech significantly boosted its global metal cleaning chemicals presence. The deal value was estimated at xx Million.

- September 2021: Element Solutions Inc.'s acquisition of Coventya Holding SAS expanded its reach into various end markets. The deal value was approximately xx Million.

These and other M&A activities illustrate the dynamic nature of the market and the strategies employed by major players to strengthen their market position and expand their product portfolios.

Europe Metal Cleaning Chemicals Market Industry Trends & Insights

The European metal cleaning chemicals market is experiencing substantial growth, driven by factors including the increasing demand from various end-use industries, particularly the automotive, electronics, and pharmaceutical sectors. The market is expected to register a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by rising industrialization, technological advancements in metal fabrication, and the increasing adoption of stringent quality control measures in manufacturing processes.

Technological disruptions, such as the development of advanced cleaning technologies like ultrasonic cleaning and plasma cleaning, are further stimulating market growth. Consumer preferences are shifting towards eco-friendly and sustainable solutions, creating opportunities for manufacturers offering biodegradable and less toxic cleaning chemicals. Competitive dynamics are characterized by intense competition, with companies constantly innovating to improve product performance, reduce costs, and expand their market share. Market penetration of aqueous-based cleaners is increasing due to environmental concerns, reaching an estimated xx% market share in 2025.

Dominant Markets & Segments in Europe Metal Cleaning Chemicals Market

The German market is currently the dominant market in Europe for metal cleaning chemicals, driven by strong manufacturing activity and the presence of major automotive and engineering companies. Other key markets include the UK, France, Italy, and Spain.

Key Drivers by Segment:

- Form: The aqueous segment dominates due to its cost-effectiveness and environmental benefits.

- Type: Acidic cleaners hold the largest share, driven by their effectiveness in removing various contaminants.

- Functional Additives: Surfactants are the most widely used additives, due to their superior cleaning properties.

- End-user Industries: The transportation sector (automotive, aerospace) is a major consumer, followed by the electrical and electronics industries. Growth in these sectors directly fuels the demand for metal cleaning chemicals.

The dominance of these segments is primarily attributable to:

- Strong industrial presence: Germany's well-established automotive and manufacturing industries drive high demand.

- Favorable economic policies: Government support for industrial growth fosters market expansion.

- Robust infrastructure: A well-developed infrastructure supports efficient transportation and distribution networks.

Europe Metal Cleaning Chemicals Market Product Developments

Recent product developments focus on the introduction of environmentally friendly and high-performance cleaning solutions. Manufacturers are emphasizing bio-based cleaning agents, advanced formulations with improved cleaning efficiency, and products designed to reduce environmental impact. These innovations cater to the increasing demand for sustainable and compliant products in the European market. The integration of smart technologies for optimized cleaning processes is also gaining traction.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the European metal cleaning chemicals market across several key segments:

Form: Aqueous and Solvent-based cleaners, each with distinct applications and market dynamics. The aqueous segment is projected to experience a CAGR of xx% during the forecast period, driven by growing environmental concerns.

Type: Acidic, Basic, and Neutral cleaners, categorized by their chemical properties and usage in various applications. Acidic cleaners are currently the dominant type, representing xx% of the market in 2025.

Functional Additives: Surfactants, Corrosion Inhibitors, Chelating Agents, and PH Regulators, each providing specific functionalities to enhance cleaning effectiveness.

End-user Industries: Transportation, Electrical and Electronics, Chemical and Pharmaceutical, Oil and Gas, and Other End-user Industries, each with varying cleaning requirements and market sizes. The transportation segment is the largest consumer, accounting for xx% of total demand in 2025.

Growth projections for each segment vary based on several factors including the industry’s development rate and environmental regulations. Competitive dynamics are shaped by innovation, pricing strategies, and market positioning of individual players.

Key Drivers of Europe Metal Cleaning Chemicals Market Growth

The growth of the Europe Metal Cleaning Chemicals market is primarily driven by:

- Increased industrial activity: Expansion across various end-user industries creates substantial demand for metal cleaning chemicals.

- Stringent quality standards: The requirement for precise cleaning in high-precision manufacturing boosts the market.

- Technological advancements: Innovative cleaning solutions offer greater efficiency and eco-friendliness.

- Rising environmental concerns: Demand for sustainable and biodegradable products is on the rise.

Challenges in the Europe Metal Cleaning Chemicals Market Sector

Several challenges hinder the market's growth. These include:

- Stringent environmental regulations: Compliance costs can impact profitability.

- Fluctuating raw material prices: Supply chain disruptions and price volatility pose risks.

- Intense competition: Market saturation necessitates continuous innovation and cost optimization.

- Economic downturns: Reduced industrial activity can negatively affect demand. The impact of a potential economic downturn is estimated to reduce market growth by xx% in the short term.

Emerging Opportunities in Europe Metal Cleaning Chemicals Market

Significant opportunities exist within the market, including:

- Bio-based and sustainable solutions: Growing environmental awareness promotes the adoption of eco-friendly cleaning chemicals.

- Advanced cleaning technologies: Ultrasonic and plasma cleaning technologies offer efficiency improvements.

- Expansion into niche markets: Specialized cleaning solutions for high-tech applications have a high growth potential.

- Focus on customized solutions: Tailored cleaning solutions for specific metal types and industries.

Leading Players in the Europe Metal Cleaning Chemicals Market Market

- CP GROUP B V

- Clariant

- Nouryon

- DST Chemicals

- 3M

- Hubbard-Hall

- MKS Instruments

- BASF SE

- Dow

- Eastman Chemical Company

- Elmer Wallace Ltd

- Evonik industries

- Stepan Company

- KYZEN CORPORATION

- Quaker Chemical Corporation

- BP

Key Developments in Europe Metal Cleaning Chemicals Market Industry

- September 2021: Element Solutions Inc. acquired Coventya Holding SAS, expanding its reach in the metal cleaning market.

- August 2022: MKS Instruments acquired Atotech, strengthening its position in the global metal cleaning chemicals market.

Strategic Outlook for Europe Metal Cleaning Chemicals Market Market

The European metal cleaning chemicals market is poised for significant growth, driven by expanding industrialization, stringent quality control measures, and the increasing adoption of eco-friendly solutions. Companies should focus on developing sustainable and high-performance products to capture market share. Strategic partnerships and acquisitions will play a crucial role in shaping the market landscape. The long-term outlook remains positive, with substantial growth opportunities anticipated in various end-user sectors.

Europe Metal Cleaning Chemicals Market Segmentation

-

1. Form

- 1.1. Aqueous

- 1.2. Solvent

-

2. Type

- 2.1. Acidic

- 2.2. Basic

- 2.3. Neutral

-

3. Functional Additives

- 3.1. Surfactants

- 3.2. Corrosion Inhibitors

- 3.3. Chelating Agents

- 3.4. PH Regulators

-

4. End-user Industries

- 4.1. Transportation

- 4.2. Electrical and Electronics

- 4.3. Chemical and Pharmaceutical

- 4.4. Oil and Gas

- 4.5. Other End-user Industries

Europe Metal Cleaning Chemicals Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Rest of Europe

Europe Metal Cleaning Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Concern Towards Industrial Cleaning and Maintenance; Increasing Demand for Metal Cleaners from Manufacturing Industries

- 3.3. Market Restrains

- 3.3.1. Stringent Environments Regulations

- 3.4. Market Trends

- 3.4.1. Increasing Usage in the Transportation Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Aqueous

- 5.1.2. Solvent

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Acidic

- 5.2.2. Basic

- 5.2.3. Neutral

- 5.3. Market Analysis, Insights and Forecast - by Functional Additives

- 5.3.1. Surfactants

- 5.3.2. Corrosion Inhibitors

- 5.3.3. Chelating Agents

- 5.3.4. PH Regulators

- 5.4. Market Analysis, Insights and Forecast - by End-user Industries

- 5.4.1. Transportation

- 5.4.2. Electrical and Electronics

- 5.4.3. Chemical and Pharmaceutical

- 5.4.4. Oil and Gas

- 5.4.5. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Germany

- 5.5.2. United Kingdom

- 5.5.3. France

- 5.5.4. Italy

- 5.5.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Germany Europe Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Form

- 6.1.1. Aqueous

- 6.1.2. Solvent

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Acidic

- 6.2.2. Basic

- 6.2.3. Neutral

- 6.3. Market Analysis, Insights and Forecast - by Functional Additives

- 6.3.1. Surfactants

- 6.3.2. Corrosion Inhibitors

- 6.3.3. Chelating Agents

- 6.3.4. PH Regulators

- 6.4. Market Analysis, Insights and Forecast - by End-user Industries

- 6.4.1. Transportation

- 6.4.2. Electrical and Electronics

- 6.4.3. Chemical and Pharmaceutical

- 6.4.4. Oil and Gas

- 6.4.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Form

- 7. United Kingdom Europe Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Form

- 7.1.1. Aqueous

- 7.1.2. Solvent

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Acidic

- 7.2.2. Basic

- 7.2.3. Neutral

- 7.3. Market Analysis, Insights and Forecast - by Functional Additives

- 7.3.1. Surfactants

- 7.3.2. Corrosion Inhibitors

- 7.3.3. Chelating Agents

- 7.3.4. PH Regulators

- 7.4. Market Analysis, Insights and Forecast - by End-user Industries

- 7.4.1. Transportation

- 7.4.2. Electrical and Electronics

- 7.4.3. Chemical and Pharmaceutical

- 7.4.4. Oil and Gas

- 7.4.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Form

- 8. France Europe Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Form

- 8.1.1. Aqueous

- 8.1.2. Solvent

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Acidic

- 8.2.2. Basic

- 8.2.3. Neutral

- 8.3. Market Analysis, Insights and Forecast - by Functional Additives

- 8.3.1. Surfactants

- 8.3.2. Corrosion Inhibitors

- 8.3.3. Chelating Agents

- 8.3.4. PH Regulators

- 8.4. Market Analysis, Insights and Forecast - by End-user Industries

- 8.4.1. Transportation

- 8.4.2. Electrical and Electronics

- 8.4.3. Chemical and Pharmaceutical

- 8.4.4. Oil and Gas

- 8.4.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Form

- 9. Italy Europe Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Form

- 9.1.1. Aqueous

- 9.1.2. Solvent

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Acidic

- 9.2.2. Basic

- 9.2.3. Neutral

- 9.3. Market Analysis, Insights and Forecast - by Functional Additives

- 9.3.1. Surfactants

- 9.3.2. Corrosion Inhibitors

- 9.3.3. Chelating Agents

- 9.3.4. PH Regulators

- 9.4. Market Analysis, Insights and Forecast - by End-user Industries

- 9.4.1. Transportation

- 9.4.2. Electrical and Electronics

- 9.4.3. Chemical and Pharmaceutical

- 9.4.4. Oil and Gas

- 9.4.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Form

- 10. Rest of Europe Europe Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Form

- 10.1.1. Aqueous

- 10.1.2. Solvent

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Acidic

- 10.2.2. Basic

- 10.2.3. Neutral

- 10.3. Market Analysis, Insights and Forecast - by Functional Additives

- 10.3.1. Surfactants

- 10.3.2. Corrosion Inhibitors

- 10.3.3. Chelating Agents

- 10.3.4. PH Regulators

- 10.4. Market Analysis, Insights and Forecast - by End-user Industries

- 10.4.1. Transportation

- 10.4.2. Electrical and Electronics

- 10.4.3. Chemical and Pharmaceutical

- 10.4.4. Oil and Gas

- 10.4.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Form

- 11. Germany Europe Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 12. France Europe Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 13. Italy Europe Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 14. United Kingdom Europe Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 15. Netherlands Europe Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 16. Sweden Europe Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Europe Europe Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 CP GROUP B V

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Clariant

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Nouryon

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 DST Chemicals

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 3M

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Hubbard-Hall

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 MKS Instruments

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 BASF SE

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Dow

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Eastman Chemical Company

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Elmer Wallace Ltd

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 Evonik industries

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.13 Stepan Company*List Not Exhaustive

- 18.2.13.1. Overview

- 18.2.13.2. Products

- 18.2.13.3. SWOT Analysis

- 18.2.13.4. Recent Developments

- 18.2.13.5. Financials (Based on Availability)

- 18.2.14 KYZEN CORPORATION

- 18.2.14.1. Overview

- 18.2.14.2. Products

- 18.2.14.3. SWOT Analysis

- 18.2.14.4. Recent Developments

- 18.2.14.5. Financials (Based on Availability)

- 18.2.15 Quaker Chemical Corporation

- 18.2.15.1. Overview

- 18.2.15.2. Products

- 18.2.15.3. SWOT Analysis

- 18.2.15.4. Recent Developments

- 18.2.15.5. Financials (Based on Availability)

- 18.2.16 BP

- 18.2.16.1. Overview

- 18.2.16.2. Products

- 18.2.16.3. SWOT Analysis

- 18.2.16.4. Recent Developments

- 18.2.16.5. Financials (Based on Availability)

- 18.2.1 CP GROUP B V

List of Figures

- Figure 1: Europe Metal Cleaning Chemicals Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Metal Cleaning Chemicals Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by Form 2019 & 2032

- Table 3: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by Functional Additives 2019 & 2032

- Table 5: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by End-user Industries 2019 & 2032

- Table 6: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Germany Europe Metal Cleaning Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: France Europe Metal Cleaning Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Italy Europe Metal Cleaning Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Europe Metal Cleaning Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Netherlands Europe Metal Cleaning Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Sweden Europe Metal Cleaning Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Europe Metal Cleaning Chemicals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by Form 2019 & 2032

- Table 16: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by Functional Additives 2019 & 2032

- Table 18: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by End-user Industries 2019 & 2032

- Table 19: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by Form 2019 & 2032

- Table 21: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by Functional Additives 2019 & 2032

- Table 23: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by End-user Industries 2019 & 2032

- Table 24: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by Form 2019 & 2032

- Table 26: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by Functional Additives 2019 & 2032

- Table 28: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by End-user Industries 2019 & 2032

- Table 29: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by Form 2019 & 2032

- Table 31: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by Type 2019 & 2032

- Table 32: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by Functional Additives 2019 & 2032

- Table 33: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by End-user Industries 2019 & 2032

- Table 34: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by Form 2019 & 2032

- Table 36: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by Type 2019 & 2032

- Table 37: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by Functional Additives 2019 & 2032

- Table 38: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by End-user Industries 2019 & 2032

- Table 39: Europe Metal Cleaning Chemicals Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Metal Cleaning Chemicals Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Europe Metal Cleaning Chemicals Market?

Key companies in the market include CP GROUP B V, Clariant, Nouryon, DST Chemicals, 3M, Hubbard-Hall, MKS Instruments, BASF SE, Dow, Eastman Chemical Company, Elmer Wallace Ltd, Evonik industries, Stepan Company*List Not Exhaustive, KYZEN CORPORATION, Quaker Chemical Corporation, BP.

3. What are the main segments of the Europe Metal Cleaning Chemicals Market?

The market segments include Form, Type, Functional Additives, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Concern Towards Industrial Cleaning and Maintenance; Increasing Demand for Metal Cleaners from Manufacturing Industries.

6. What are the notable trends driving market growth?

Increasing Usage in the Transportation Industry.

7. Are there any restraints impacting market growth?

Stringent Environments Regulations.

8. Can you provide examples of recent developments in the market?

August 2022: MKS Instruments completed the acquisition of Atotech, a global player in producing surface treatment and processing chemicals for various metals. The acquisition may strengthen the position of MKS Instruments in the metal cleaning market across the world, including Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Metal Cleaning Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Metal Cleaning Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Metal Cleaning Chemicals Market?

To stay informed about further developments, trends, and reports in the Europe Metal Cleaning Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence