Key Insights

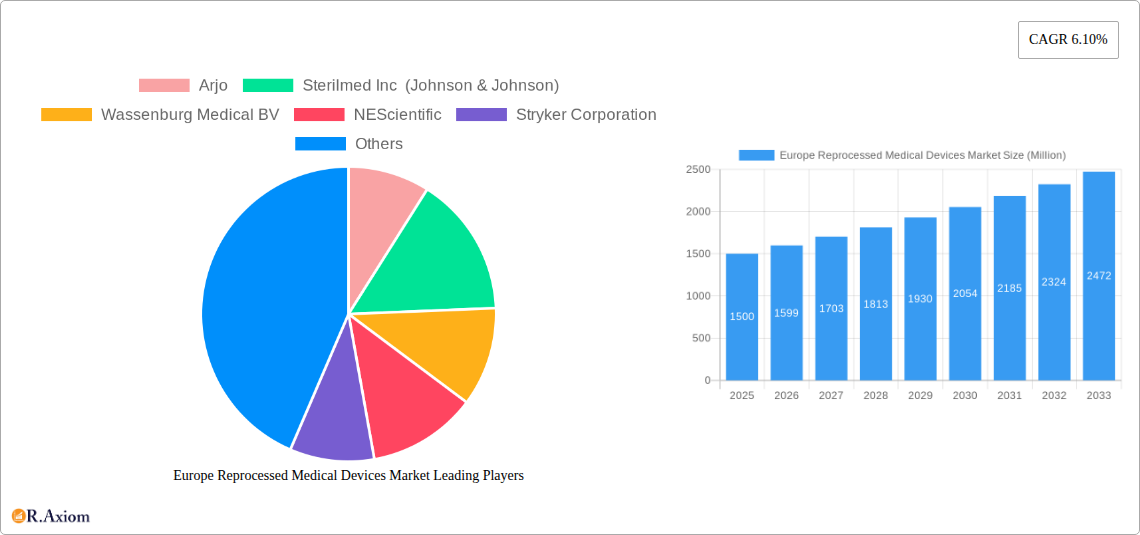

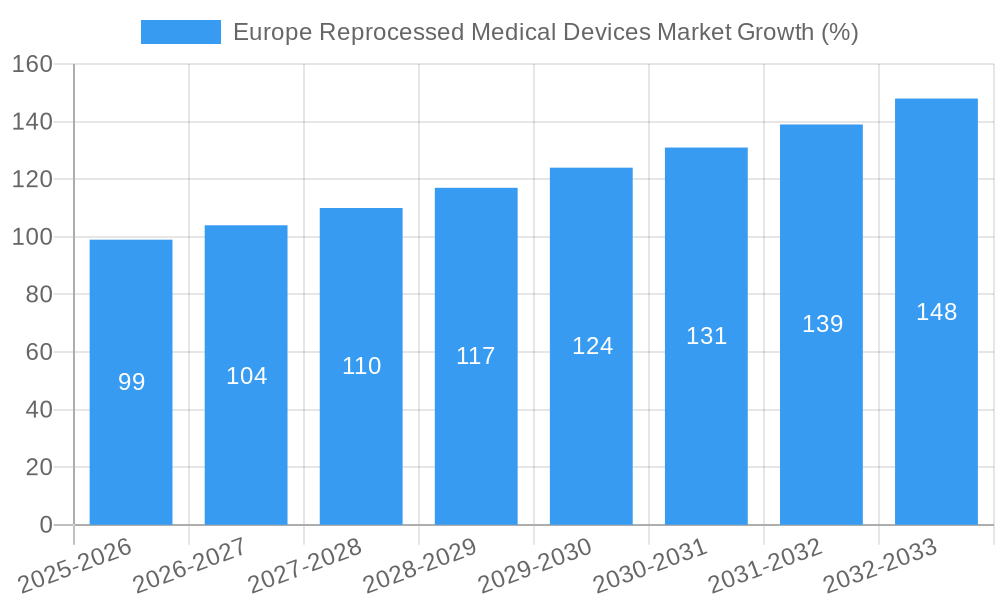

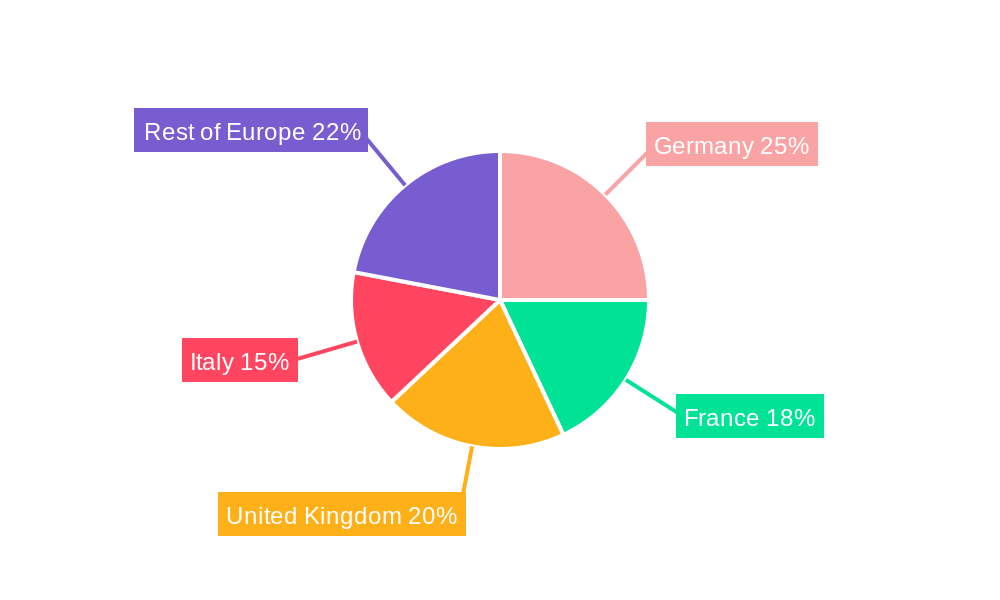

The European reprocessed medical devices market is experiencing robust growth, driven by increasing healthcare costs, stringent regulations promoting sustainability, and a rising demand for cost-effective medical solutions. The market's Compound Annual Growth Rate (CAGR) of 6.10% from 2019-2024 suggests a significant expansion, projected to continue through 2033. This growth is fueled by several key factors. Firstly, the increasing adoption of reprocessing techniques aligns with the broader trend towards sustainability and resource efficiency within the healthcare sector. Secondly, the market is segmented into Class I, II, and III devices, reflecting varying levels of complexity and regulatory requirements. Class II and III devices, while representing a smaller share initially, are expected to show higher growth rates due to technological advancements improving reprocessing capabilities. Finally, the presence of established players like Arjo, Sterilmed Inc (Johnson & Johnson), and Stryker Corporation alongside smaller, specialized companies indicates a competitive landscape conducive to innovation and further market expansion. The market is geographically concentrated, with Germany, France, the United Kingdom, and Italy being key contributors to overall revenue.

Further analysis reveals that the market's growth is strategically influenced by technological advancements in sterilization and reprocessing techniques. These improvements ensure the safety and efficacy of reprocessed devices, addressing key concerns surrounding their use. However, challenges remain, including stringent regulatory compliance and potential public perception issues surrounding the use of reprocessed medical devices. Overcoming these obstacles through clear communication and the demonstration of high safety standards will be crucial for sustaining the market's trajectory. Looking ahead, the market's success hinges on continued technological innovation, effective regulatory compliance, and proactive public education campaigns that emphasize the safety and cost-effectiveness of reprocessed medical devices. The ongoing demand for affordable healthcare solutions, particularly in the face of aging populations and increasing healthcare burdens across Europe, provides a strong foundation for continued market expansion.

This comprehensive report provides a detailed analysis of the Europe Reprocessed Medical Devices market, offering invaluable insights for stakeholders across the industry. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report utilizes rigorous research methodologies to provide actionable intelligence. The report covers market size, segmentation, growth drivers, challenges, opportunities, and competitive landscape, equipping businesses with the knowledge necessary to navigate this dynamic market.

Europe Reprocessed Medical Devices Market Concentration & Innovation

The European reprocessed medical devices market exhibits a moderately concentrated structure, with a handful of major players holding significant market share. While exact market share figures for individual companies are proprietary data within the full report, Arjo, Sterilmed Inc (Johnson & Johnson), Stryker Corporation, Cardinal Health (Sustainable Technologies), and STERIS are recognized as key players. These companies compete primarily on product quality, regulatory compliance, and efficiency of reprocessing services. Recent years have seen an increase in M&A activity, with deal values fluctuating depending on the size and strategic fit of acquired companies – the full report details the specifics of these transactions. The market is driven by innovation in reprocessing technologies, focusing on enhancing sterility assurance, extending device lifespan and optimizing cost-effectiveness. Regulatory frameworks, including those concerning medical device safety and environmental considerations, significantly impact market dynamics. The report provides a comprehensive overview of regulations across different European nations. Product substitutes, such as single-use devices, pose a significant competitive challenge; however, the growing awareness of environmental sustainability and cost benefits of reprocessing is countering this trend. End-user preferences, including hospitals, clinics, and ambulatory surgical centers, are also influencing market demand, favoring efficient and reliable reprocessing solutions.

Europe Reprocessed Medical Devices Market Industry Trends & Insights

The European reprocessed medical devices market is experiencing significant growth, driven by several key factors. The increasing adoption of cost-effective healthcare solutions is a primary driver, as reprocessing offers a more economical alternative to purchasing new devices. Rising demand for medical devices across Europe, coupled with the growing awareness of environmental sustainability, fuels market expansion. Technological advancements in reprocessing technologies are also enhancing the safety and efficiency of the process, boosting confidence among healthcare providers. Technological disruptions, including the adoption of automation and advanced sterilization techniques, continue to shape the market landscape. Consumer preferences are shifting towards high-quality, reliable, and environmentally friendly reprocessing services. The competitive dynamics are characterized by both cooperation and competition, with players pursuing strategic partnerships and investing in research and development to maintain market leadership. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%, significantly higher than the historical CAGR of xx% (2019-2024). Market penetration remains relatively high in established markets, although expansion into new segments and regions contributes significantly to overall growth.

Dominant Markets & Segments in Europe Reprocessed Medical Devices Market

Germany is the leading market for reprocessed medical devices in Europe, driven by strong healthcare infrastructure, high medical device adoption, and a supportive regulatory environment. Other major markets include the United Kingdom, France, and Italy.

Key Drivers for Germany's Dominance:

- Well-established healthcare infrastructure

- High density of hospitals and clinics

- Progressive regulatory policies fostering innovation

- Strong investment in healthcare technology

Within device types, Class II devices currently hold the largest market share, although the full report provides a breakdown of market size for each category. Class I devices show steady growth, while Class III devices, due to their complexity and regulatory scrutiny, have a comparatively smaller but rapidly expanding share of the market. The precise market size for each category within the report uses data from 2019-2024 and provides forecasts for 2025-2033.

Europe Reprocessed Medical Devices Market Product Developments

Recent product innovations center on enhancing sterilization techniques and improving the overall efficiency of reprocessing. Advanced automation, improved monitoring systems, and the development of specialized cleaning and sterilization solutions are key technological trends. These innovations aim to improve device longevity, reduce the risk of infection, and streamline the reprocessing workflow, thereby enhancing the market fit and competitive advantages of leading companies.

Report Scope & Segmentation Analysis

This report segments the Europe Reprocessed Medical Devices market primarily by device type:

Class I Devices: This segment represents the largest share of the market, driven by high demand and relatively simpler reprocessing requirements. Growth projections suggest continued expansion in this sector. Competitive dynamics are relatively less intense compared to other segments.

Class II Devices: This segment comprises a considerable portion of the market, offering significant growth potential. The increasing use of technologically advanced Class II devices boosts this segment's expansion. Competitive rivalry is high in this category.

Class III Devices: This segment represents the smallest share, although it has the highest growth potential due to the rising demand for sophisticated medical devices. Strict regulatory requirements and complex reprocessing protocols contribute to a more concentrated competitive landscape. The report includes detailed analysis of these segments' market sizes and growth projections, including the forecast for the coming years.

Key Drivers of Europe Reprocessed Medical Devices Market Growth

The market's growth is primarily driven by:

- Cost Savings: Reprocessing significantly reduces healthcare expenditure compared to purchasing new devices.

- Environmental Sustainability: The eco-friendly nature of reprocessing aligns with growing environmental awareness.

- Technological Advancements: Continuous improvements in reprocessing techniques boost efficiency and safety.

- Favorable Regulatory Environment: Supportive regulations in several European countries facilitate market growth, although this varies significantly between countries.

Challenges in the Europe Reprocessed Medical Devices Market Sector

Challenges include:

- Strict Regulatory Compliance: Maintaining stringent quality and safety standards adds complexity and cost to the process.

- Supply Chain Disruptions: Difficulties in sourcing parts and materials can impact the availability of reprocessed devices.

- Intense Competition: The market is becoming increasingly competitive with many established players and new entrants. This competition is reflected in pricing pressures and the necessity for companies to constantly innovate.

Emerging Opportunities in Europe Reprocessed Medical Devices Market

Opportunities arise from:

- Expansion into New Markets: Untapped potential exists in certain European regions with growing healthcare infrastructure.

- Technological Innovation: Further advancements in sterilization and automation can create new market niches.

- Focus on Sustainability: Enhanced sustainability initiatives can appeal to environmentally conscious healthcare providers.

Leading Players in the Europe Reprocessed Medical Devices Market Market

- Arjo

- Sterilmed Inc (Johnson & Johnson)

- Wassenburg Medical BV

- NEScientific

- Stryker Corporation

- MATACHANA

- Cardinal Health (Sustainable Technologies)

- Medline Industries Inc

- Vanguard

- STERIS

Key Developments in Europe Reprocessed Medical Devices Market Industry

- May 2022: The President of Poland signed the Act on Medical Devices, allowing reprocessing of single-use medical devices, opening up new market opportunities.

- June 2022: The Medicines and Healthcare products Regulatory Agency of the United Kingdom advised against reprocessing single-use medical devices, creating uncertainty and potentially impacting market growth in the UK.

Strategic Outlook for Europe Reprocessed Medical Devices Market Market

The future of the European reprocessed medical devices market appears promising, fueled by continued cost pressures within healthcare systems, a growing emphasis on environmental responsibility, and ongoing technological advancements that enhance the safety and efficiency of reprocessing. The market is expected to witness consistent growth, with opportunities for companies that embrace innovation, regulatory compliance, and sustainable practices. The potential for market expansion into new segments and geographic areas further strengthens the positive outlook.

Europe Reprocessed Medical Devices Market Segmentation

-

1. Device Type

-

1.1. Class I Devices

- 1.1.1. Laparoscopic Graspers

- 1.1.2. Scalpels

- 1.1.3. Tourniquet Cuffs

- 1.1.4. Other Class I Devices

-

1.2. Class II Devices

- 1.2.1. Pulse Oximeter Sensors

- 1.2.2. Sequential Compression Sleeves

- 1.2.3. Catheters and Guidewires

- 1.2.4. Other Class II Devices

-

1.1. Class I Devices

Europe Reprocessed Medical Devices Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Europe Reprocessed Medical Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cost Savings Through Reprocessing Single-use Devices; Regulatory Pressure to Reduce Volume of Medical Waste

- 3.3. Market Restrains

- 3.3.1. Potential of Material Alteration and Cross Infection with Reprocessed Device; Preconceived Notions Regarding the Quality of Reprocessed Single-use Medical Devices (SUDs)

- 3.4. Market Trends

- 3.4.1. Scalpels Segment is Poised to Register Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Reprocessed Medical Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Class I Devices

- 5.1.1.1. Laparoscopic Graspers

- 5.1.1.2. Scalpels

- 5.1.1.3. Tourniquet Cuffs

- 5.1.1.4. Other Class I Devices

- 5.1.2. Class II Devices

- 5.1.2.1. Pulse Oximeter Sensors

- 5.1.2.2. Sequential Compression Sleeves

- 5.1.2.3. Catheters and Guidewires

- 5.1.2.4. Other Class II Devices

- 5.1.1. Class I Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.2.2. United Kingdom

- 5.2.3. France

- 5.2.4. Italy

- 5.2.5. Spain

- 5.2.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Germany Europe Reprocessed Medical Devices Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 6.1.1. Class I Devices

- 6.1.1.1. Laparoscopic Graspers

- 6.1.1.2. Scalpels

- 6.1.1.3. Tourniquet Cuffs

- 6.1.1.4. Other Class I Devices

- 6.1.2. Class II Devices

- 6.1.2.1. Pulse Oximeter Sensors

- 6.1.2.2. Sequential Compression Sleeves

- 6.1.2.3. Catheters and Guidewires

- 6.1.2.4. Other Class II Devices

- 6.1.1. Class I Devices

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 7. United Kingdom Europe Reprocessed Medical Devices Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 7.1.1. Class I Devices

- 7.1.1.1. Laparoscopic Graspers

- 7.1.1.2. Scalpels

- 7.1.1.3. Tourniquet Cuffs

- 7.1.1.4. Other Class I Devices

- 7.1.2. Class II Devices

- 7.1.2.1. Pulse Oximeter Sensors

- 7.1.2.2. Sequential Compression Sleeves

- 7.1.2.3. Catheters and Guidewires

- 7.1.2.4. Other Class II Devices

- 7.1.1. Class I Devices

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 8. France Europe Reprocessed Medical Devices Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 8.1.1. Class I Devices

- 8.1.1.1. Laparoscopic Graspers

- 8.1.1.2. Scalpels

- 8.1.1.3. Tourniquet Cuffs

- 8.1.1.4. Other Class I Devices

- 8.1.2. Class II Devices

- 8.1.2.1. Pulse Oximeter Sensors

- 8.1.2.2. Sequential Compression Sleeves

- 8.1.2.3. Catheters and Guidewires

- 8.1.2.4. Other Class II Devices

- 8.1.1. Class I Devices

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 9. Italy Europe Reprocessed Medical Devices Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 9.1.1. Class I Devices

- 9.1.1.1. Laparoscopic Graspers

- 9.1.1.2. Scalpels

- 9.1.1.3. Tourniquet Cuffs

- 9.1.1.4. Other Class I Devices

- 9.1.2. Class II Devices

- 9.1.2.1. Pulse Oximeter Sensors

- 9.1.2.2. Sequential Compression Sleeves

- 9.1.2.3. Catheters and Guidewires

- 9.1.2.4. Other Class II Devices

- 9.1.1. Class I Devices

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 10. Spain Europe Reprocessed Medical Devices Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 10.1.1. Class I Devices

- 10.1.1.1. Laparoscopic Graspers

- 10.1.1.2. Scalpels

- 10.1.1.3. Tourniquet Cuffs

- 10.1.1.4. Other Class I Devices

- 10.1.2. Class II Devices

- 10.1.2.1. Pulse Oximeter Sensors

- 10.1.2.2. Sequential Compression Sleeves

- 10.1.2.3. Catheters and Guidewires

- 10.1.2.4. Other Class II Devices

- 10.1.1. Class I Devices

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 11. Rest of Europe Europe Reprocessed Medical Devices Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Device Type

- 11.1.1. Class I Devices

- 11.1.1.1. Laparoscopic Graspers

- 11.1.1.2. Scalpels

- 11.1.1.3. Tourniquet Cuffs

- 11.1.1.4. Other Class I Devices

- 11.1.2. Class II Devices

- 11.1.2.1. Pulse Oximeter Sensors

- 11.1.2.2. Sequential Compression Sleeves

- 11.1.2.3. Catheters and Guidewires

- 11.1.2.4. Other Class II Devices

- 11.1.1. Class I Devices

- 11.1. Market Analysis, Insights and Forecast - by Device Type

- 12. Europe Europe Reprocessed Medical Devices Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1. undefined

- 13. Germany Europe Reprocessed Medical Devices Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1. undefined

- 14. France Europe Reprocessed Medical Devices Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1. undefined

- 15. Italy Europe Reprocessed Medical Devices Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1. undefined

- 16. United Kingdom Europe Reprocessed Medical Devices Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1. undefined

- 17. Netherlands Europe Reprocessed Medical Devices Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1. undefined

- 18. Sweden Europe Reprocessed Medical Devices Market Analysis, Insights and Forecast, 2019-2031

- 18.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 18.1.1. undefined

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Arjo

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Sterilmed Inc (Johnson & Johnson)

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Wassenburg Medical BV

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 NEScientific

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Stryker Corporation

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 MATACHANA

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Cardinal Health (Sustainable Technologies)

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Medline Industries Inc

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Vanguard

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 STERIS

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.1 Arjo

List of Figures

- Figure 1: Europe Reprocessed Medical Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Reprocessed Medical Devices Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Reprocessed Medical Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Reprocessed Medical Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Europe Reprocessed Medical Devices Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 4: Europe Reprocessed Medical Devices Market Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 5: Europe Reprocessed Medical Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Reprocessed Medical Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Europe Reprocessed Medical Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Europe Reprocessed Medical Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: Europe Reprocessed Medical Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Europe Reprocessed Medical Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Europe Reprocessed Medical Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Europe Reprocessed Medical Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Europe Reprocessed Medical Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Europe Reprocessed Medical Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Europe Reprocessed Medical Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Reprocessed Medical Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: Europe Reprocessed Medical Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Europe Reprocessed Medical Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Europe Reprocessed Medical Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Europe Reprocessed Medical Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: Europe Reprocessed Medical Devices Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 22: Europe Reprocessed Medical Devices Market Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 23: Europe Reprocessed Medical Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Europe Reprocessed Medical Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 25: Europe Reprocessed Medical Devices Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 26: Europe Reprocessed Medical Devices Market Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 27: Europe Reprocessed Medical Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Europe Reprocessed Medical Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 29: Europe Reprocessed Medical Devices Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 30: Europe Reprocessed Medical Devices Market Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 31: Europe Reprocessed Medical Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Europe Reprocessed Medical Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 33: Europe Reprocessed Medical Devices Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 34: Europe Reprocessed Medical Devices Market Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 35: Europe Reprocessed Medical Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Europe Reprocessed Medical Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 37: Europe Reprocessed Medical Devices Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 38: Europe Reprocessed Medical Devices Market Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 39: Europe Reprocessed Medical Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Europe Reprocessed Medical Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 41: Europe Reprocessed Medical Devices Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 42: Europe Reprocessed Medical Devices Market Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 43: Europe Reprocessed Medical Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Europe Reprocessed Medical Devices Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Reprocessed Medical Devices Market?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the Europe Reprocessed Medical Devices Market?

Key companies in the market include Arjo, Sterilmed Inc (Johnson & Johnson), Wassenburg Medical BV, NEScientific, Stryker Corporation, MATACHANA, Cardinal Health (Sustainable Technologies), Medline Industries Inc, Vanguard, STERIS.

3. What are the main segments of the Europe Reprocessed Medical Devices Market?

The market segments include Device Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Cost Savings Through Reprocessing Single-use Devices; Regulatory Pressure to Reduce Volume of Medical Waste.

6. What are the notable trends driving market growth?

Scalpels Segment is Poised to Register Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Potential of Material Alteration and Cross Infection with Reprocessed Device; Preconceived Notions Regarding the Quality of Reprocessed Single-use Medical Devices (SUDs).

8. Can you provide examples of recent developments in the market?

June 2022: The Medicines and Healthcare products Regulatory Agency of the United Kingdom advised against the reprocessing of single-use medical devices in its guidance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Reprocessed Medical Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Reprocessed Medical Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Reprocessed Medical Devices Market?

To stay informed about further developments, trends, and reports in the Europe Reprocessed Medical Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence