Key Insights

The European payment processors market is experiencing robust growth, projected to reach a substantial value by 2033. A compound annual growth rate (CAGR) of 15.83% from 2025 to 2033 indicates a significant expansion driven by several key factors. The increasing adoption of e-commerce and digital payment solutions across various sectors, including retail, entertainment, and healthcare, fuels this growth. Furthermore, the rising preference for contactless payments and mobile wallets is transforming the landscape, boosting the demand for efficient and secure payment processing systems. Government initiatives promoting digitalization and financial inclusion across European nations also contribute to market expansion. While the market faces challenges such as regulatory complexities and the potential for security breaches, these are being offset by the ongoing innovation in payment technologies and the emergence of new players offering innovative solutions, including solutions supporting open banking and improved cross-border transactions.

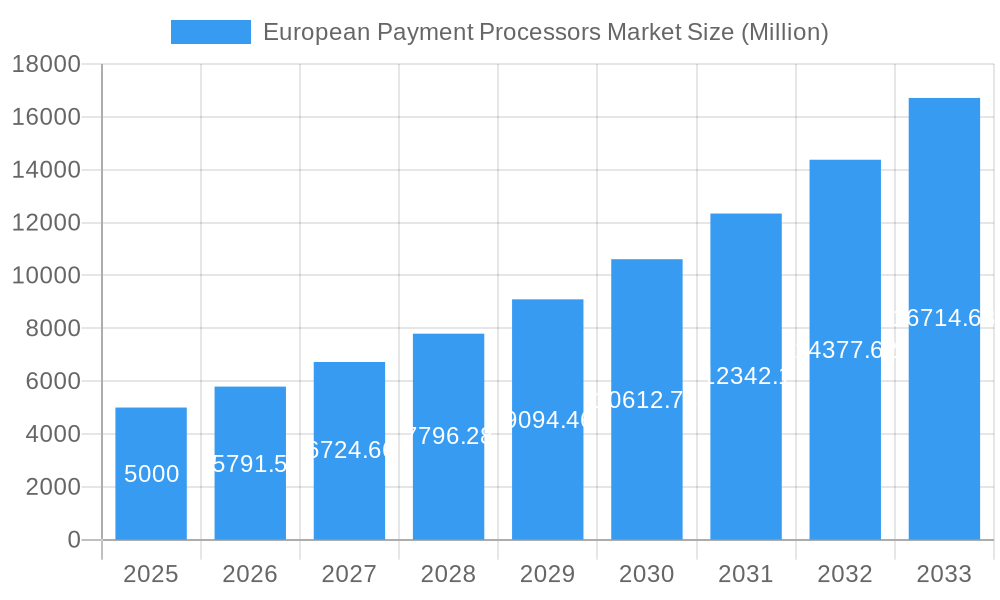

European Payment Processors Market Market Size (In Billion)

The market segmentation reveals interesting dynamics. While point-of-sale (POS) systems remain dominant, online sales are rapidly gaining traction, reflecting the shift towards digital commerce. Regionally, Germany, France, and the UK are major contributors to the market size, yet smaller nations within the Nordics and Benelux are exhibiting higher growth rates, presenting lucrative opportunities. The competitive landscape is characterized by both established players like Visa, Mastercard, and PayPal, alongside innovative fintech companies like Klarna and smaller regional players. This competitive pressure drives innovation and further enhances the overall market expansion. The market’s future depends on sustained technological advancements, regulatory adaptations, and the evolving preferences of consumers towards seamless and secure payment experiences.

European Payment Processors Market Company Market Share

This comprehensive report provides an in-depth analysis of the European Payment Processors Market, covering the period from 2019 to 2033. It delves into market dynamics, competitive landscapes, technological advancements, and future growth projections, offering valuable insights for industry stakeholders, investors, and businesses operating within this dynamic sector. The report utilizes data from 2019-2024 as the historical period, 2025 as the base and estimated year, and 2025-2033 as the forecast period. The market size is expressed in Millions throughout the report.

European Payment Processors Market Concentration & Innovation

The European payment processing market exhibits a moderately concentrated landscape, dominated by established players like Visa Inc, Mastercard, and PayPal Holdings Inc, alongside a growing number of specialized regional providers such as Giropay, iDEAL, and Bancontact. These companies hold significant market share, estimated at xx% collectively in 2025, primarily due to established brand recognition, extensive network infrastructure, and robust security systems. However, the market is witnessing increasing competition from FinTech startups and innovative payment solutions.

Market innovation is driven by several factors:

- Technological advancements: The rise of mobile payments, digital wallets, and open banking APIs are reshaping the industry.

- Regulatory frameworks: PSD2 (Payment Services Directive 2) and other regulations are fostering competition and driving innovation in payment solutions.

- Product substitutes: The emergence of cryptocurrency and alternative payment methods presents both challenges and opportunities.

- End-user trends: The increasing preference for contactless payments and online transactions is significantly impacting market growth.

- M&A activities: Consolidation and strategic partnerships are playing a significant role in market reshaping. In 2024, M&A deal values in the sector totaled approximately xx Million, indicating a robust level of activity.

European Payment Processors Market Industry Trends & Insights

The European Payment Processors Market is experiencing robust growth, driven by increasing digitalization, e-commerce expansion, and the rising adoption of contactless payment methods. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. Market penetration of digital payment solutions is steadily increasing, driven by factors such as improved smartphone penetration, enhanced internet connectivity, and growing consumer trust in online payment platforms. Technological disruptions, such as the adoption of blockchain technology and AI-powered fraud detection systems, are further enhancing the efficiency and security of payment systems. Consumer preferences are shifting towards faster, more convenient, and secure payment options, influencing the development and adoption of innovative solutions. Competitive dynamics are marked by both intense competition among established players and the emergence of new entrants leveraging innovative technologies and business models.

Dominant Markets & Segments in European Payment Processors Market

Dominant Regions/Countries: The United Kingdom, Germany, and France represent the largest markets within Europe, accounting for a significant portion of the overall market size. This dominance is driven by a number of factors:

- United Kingdom: High levels of digital adoption, strong e-commerce infrastructure, and a large consumer base contribute to its leading position.

- Germany: A strong economy and robust financial infrastructure support the high usage of digital payment systems.

- France: Similar to the UK and Germany, a mature e-commerce ecosystem fuels substantial market growth.

Dominant Payment Modes: Point-of-Sale (POS) payments remain a dominant segment, although online sales are rapidly gaining traction, projected to have a higher CAGR (xx%) compared to POS payments during the forecast period.

Dominant End-User Industries: The Retail sector constitutes a substantial portion of the market, driven by the high volume of transactions. However, significant growth is anticipated in the Entertainment, Healthcare, and Hospitality sectors as digitalization gains momentum across industries.

European Payment Processors Market Product Developments

Recent product innovations focus on enhancing security, convenience, and speed of transactions. This includes the development of advanced fraud detection systems, biometric authentication, and real-time payment processing solutions. Key technological trends shaping product development include the integration of AI, blockchain, and cloud computing to offer improved scalability, security, and personalization. The market fit of these innovations is strong, driven by increasing demand for seamless, secure, and efficient payment experiences. The launch of the Thames Technology Fusion Card, a dual-interface metal card, exemplifies the focus on enhanced features and materials.

Report Scope & Segmentation Analysis

By Country: The report segments the market across the United Kingdom, Germany, France, Spain, Italy, Nordics, and Rest of Europe, providing detailed analysis of market size, growth projections, and competitive dynamics within each region.

By Mode of Payment: The market is segmented into Point of Sale (POS) and Online Sale, analyzing the growth trajectories, technological trends, and market share of each payment method.

By End-user Industry: The report analyzes the market across Retail, Entertainment, Healthcare, Hospitality, and Other End-user Industries, outlining growth projections and competitive dynamics within each segment.

Key Drivers of European Payment Processors Market Growth

Several factors drive the growth of the European Payment Processors Market:

- Increased digitalization: The widespread adoption of smartphones and internet access fuels the preference for digital payments.

- E-commerce expansion: The rapid growth of online businesses significantly increases the demand for secure and efficient online payment solutions.

- Government initiatives: Regulatory frameworks such as PSD2 are fostering innovation and competition within the industry.

- Technological advancements: Innovations in payment technologies lead to more efficient, secure, and user-friendly payment solutions.

Challenges in the European Payment Processors Market Sector

The market faces several challenges:

- Regulatory hurdles: Compliance with evolving regulations and data protection laws can be complex and costly.

- Security concerns: The risk of fraud and data breaches poses a significant challenge for payment processors.

- Competition: The market is characterized by intense competition among established players and new entrants. This leads to price wars and pressure on profit margins.

Emerging Opportunities in European Payment Processors Market

Several emerging opportunities exist:

- Open banking: The integration of open banking APIs enables the development of innovative payment solutions and enhanced customer experiences.

- Blockchain technology: Blockchain can improve the security and transparency of payment transactions.

- Expansion into underserved markets: Reaching out to unbanked or underbanked populations presents significant growth potential.

Leading Players in the European Payment Processors Market Market

- Visa Inc

- Giropay

- Mastercard

- PayPal Holdings Inc

- SEPA Direct Debit

- Bancontact

- Melio Payments

- Multibanco

- Klarna

- iDEAL

Key Developments in European Payment Processors Market Industry

- May 2022: The European Union's antitrust regulator accused Apple of restricting rivals' access to its payment technology. This decision forces Apple to modify its business practices and exposes it to substantial fines, potentially fostering greater competition in the mobile payment sector.

- May 2022: Thames Technology launched the Fusion Card, Europe's first dual-interface metal card, signifying advancements in card technology and potentially influencing consumer preferences.

- May 2022: PingPong Payments partnered with BNP Paribas to expand its services to Europe's direct-to-consumer (D2C) market, illustrating increased cross-border collaboration and growth in the D2C segment.

- May 2022: Paysafe expanded its partnership with Visa to integrate Visa Direct, enhancing real-time payment processing capabilities for various online businesses, highlighting the trend towards faster transaction speeds.

Strategic Outlook for European Payment Processors Market Market

The European Payment Processors Market is poised for sustained growth, driven by the ongoing digital transformation across various sectors. The convergence of technologies like AI, blockchain, and open banking presents substantial opportunities for innovation and market expansion. Strategic partnerships and M&A activities will continue to shape the competitive landscape, while a focus on enhanced security and user experience will remain paramount for success. The market's future hinges on adapting to evolving consumer preferences and regulatory frameworks, creating a dynamic and competitive environment that fosters innovation and growth.

European Payment Processors Market Segmentation

-

1. Mode of Payment

-

1.1. Point of Sale

- 1.1.1. Card Pay

- 1.1.2. Digital Wallet (includes Mobile Wallets)

- 1.1.3. Cash

- 1.1.4. Others

-

1.2. Online Sale

- 1.2.1. Others (

-

1.1. Point of Sale

-

2. End-user Industry

- 2.1. Retail

- 2.2. Entertainment

- 2.3. Healthcare

- 2.4. Hospitality

- 2.5. Other End-user Industries

European Payment Processors Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

European Payment Processors Market Regional Market Share

Geographic Coverage of European Payment Processors Market

European Payment Processors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increased digitalisation and decreased cash usage and Real-Time Payments; The digital economy's expansion and changing consumer behaviour; Regulation

- 3.2.2 specifically PSD2 and Open Banking

- 3.3. Market Restrains

- 3.3.1. High Costs Associated With Testing Equipment

- 3.4. Market Trends

- 3.4.1. Increasing use of Digital wallets while shopping online

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Payment Processors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 5.1.1. Point of Sale

- 5.1.1.1. Card Pay

- 5.1.1.2. Digital Wallet (includes Mobile Wallets)

- 5.1.1.3. Cash

- 5.1.1.4. Others

- 5.1.2. Online Sale

- 5.1.2.1. Others (

- 5.1.1. Point of Sale

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Retail

- 5.2.2. Entertainment

- 5.2.3. Healthcare

- 5.2.4. Hospitality

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Visa Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Giropay

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mastercard

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PayPal Holdings Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SEPA Direct Debit

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bancontact

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Melio Payments

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Multibanco

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Klarna*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 iDEAL

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Visa Inc

List of Figures

- Figure 1: European Payment Processors Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: European Payment Processors Market Share (%) by Company 2025

List of Tables

- Table 1: European Payment Processors Market Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 2: European Payment Processors Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: European Payment Processors Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: European Payment Processors Market Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 5: European Payment Processors Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: European Payment Processors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom European Payment Processors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Germany European Payment Processors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France European Payment Processors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Italy European Payment Processors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain European Payment Processors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands European Payment Processors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Belgium European Payment Processors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Sweden European Payment Processors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Norway European Payment Processors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Poland European Payment Processors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Denmark European Payment Processors Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Payment Processors Market?

The projected CAGR is approximately 15.83%.

2. Which companies are prominent players in the European Payment Processors Market?

Key companies in the market include Visa Inc, Giropay, Mastercard, PayPal Holdings Inc, SEPA Direct Debit, Bancontact, Melio Payments, Multibanco, Klarna*List Not Exhaustive, iDEAL.

3. What are the main segments of the European Payment Processors Market?

The market segments include Mode of Payment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased digitalisation and decreased cash usage and Real-Time Payments; The digital economy's expansion and changing consumer behaviour; Regulation. specifically PSD2 and Open Banking.

6. What are the notable trends driving market growth?

Increasing use of Digital wallets while shopping online.

7. Are there any restraints impacting market growth?

High Costs Associated With Testing Equipment.

8. Can you provide examples of recent developments in the market?

May 2022- The European Union's antitrust regulator has accused Apple of restricting rivals' access to its payment technology, forcing the company to change its business practices and expose it to a massive fine.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Payment Processors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Payment Processors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Payment Processors Market?

To stay informed about further developments, trends, and reports in the European Payment Processors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence