Key Insights

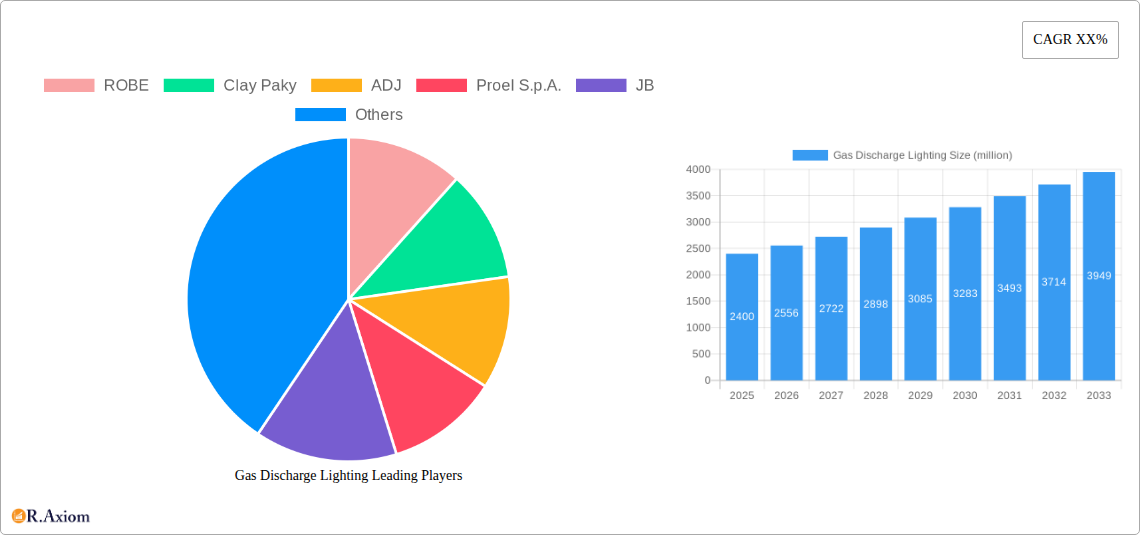

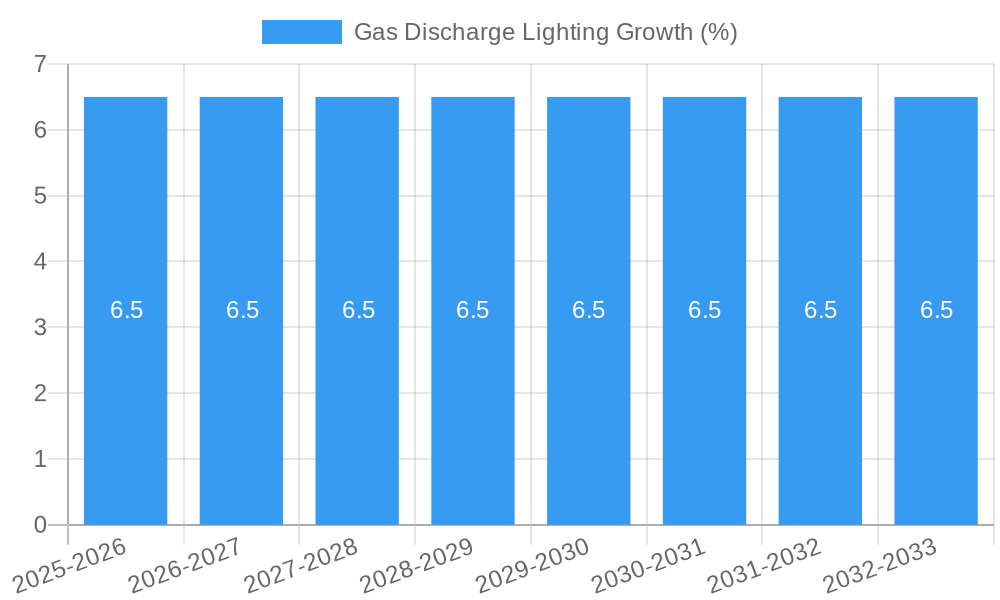

The global Gas Discharge Lighting market is projected for substantial growth, estimated at USD 2,400 million in 2025 and anticipated to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.5% through 2033. This robust expansion is fueled by the inherent advantages of gas discharge lamps, including their high luminous efficacy, extended lifespan, and superior color rendering capabilities, making them indispensable in professional entertainment settings. The market is primarily driven by the burgeoning entertainment and events industry, encompassing vibrant concert venues, dynamic KTV establishments, and lively bars, all of which rely heavily on sophisticated lighting solutions to enhance audience experience. As these sectors continue to flourish globally, the demand for high-performance and energy-efficient lighting systems, such as those offered by gas discharge lamps, is expected to surge. Furthermore, ongoing technological advancements in lamp design and ballast systems are contributing to improved performance and energy efficiency, further bolstering market adoption.

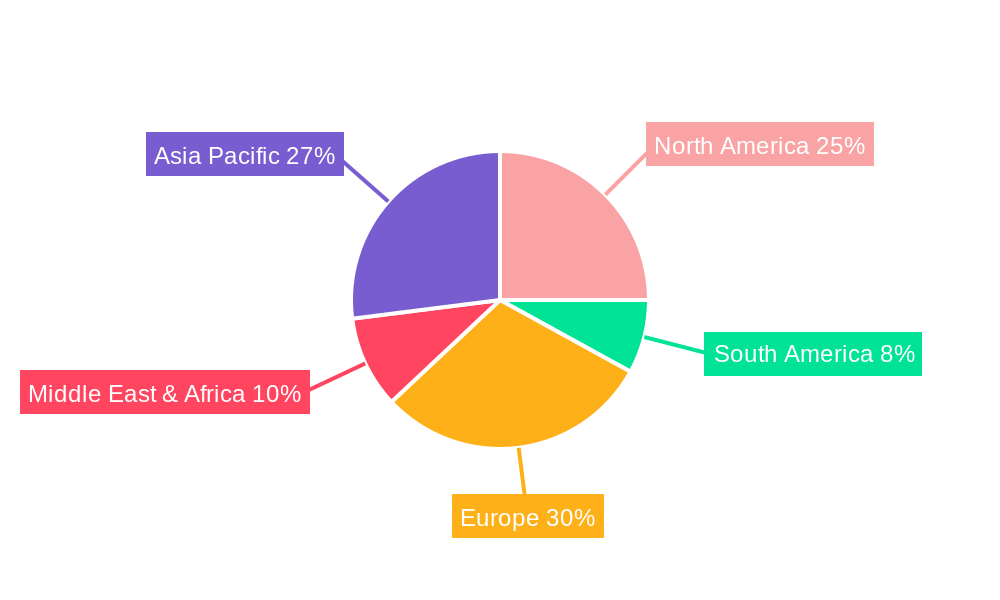

The market segmentation by type reveals a dynamic landscape, with Super High Pressure Gas Discharge Lamps leading in demand due to their exceptional brightness and focused beam capabilities, crucial for stage lighting and large-scale productions. Low Pressure Gas Discharge Lamps and High Pressure Discharge Lamps also hold significant market share, catering to diverse needs within the entertainment sector. Geographically, Asia Pacific, led by China and India, is emerging as a pivotal growth engine, driven by rapid industrialization, a burgeoning middle class, and a booming live entertainment scene. North America and Europe remain mature yet strong markets, with continuous demand for upgrades and premium lighting solutions. Restraints, such as the increasing adoption of LED lighting in certain applications due to its energy efficiency and versatility, present a challenge. However, the unique performance characteristics of gas discharge lamps, particularly in professional entertainment, ensure their continued relevance and a positive market trajectory for the foreseeable future, with companies like ROBE, Clay Paky, and ADJ at the forefront of innovation.

Gas Discharge Lighting Market Concentration & Innovation

The global Gas Discharge Lighting market is characterized by a moderate level of concentration, with a significant presence of established players alongside emerging innovators. Key industry developments driving this landscape include substantial investments in research and development aimed at enhancing energy efficiency, color rendering index (CRI), and lifespan of gas discharge lamps. Regulatory frameworks, such as those promoting energy-saving technologies and phasing out less efficient lighting solutions, are indirectly influencing the market by creating demand for advanced gas discharge lighting. Product substitutes, primarily LED lighting, pose a considerable competitive threat, pushing manufacturers to differentiate through performance and specialized applications. End-user trends reveal a growing demand for high-quality, dynamic lighting solutions in entertainment venues and architectural projects. Mergers and acquisitions (M&A) activities, while not exceptionally high, are strategically driven, often involving smaller, innovative firms being acquired by larger entities to gain access to new technologies or market segments. For instance, M&A deal values in the broader lighting industry have reached hundreds of millions, indicating potential consolidation opportunities in specialized niches within gas discharge lighting.

Gas Discharge Lighting Industry Trends & Insights

The global Gas Discharge Lighting market is poised for significant evolution, driven by a confluence of technological advancements, shifting consumer preferences, and the persistent demand for high-performance lighting solutions. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 4.5% during the forecast period of 2025–2033. This growth is underpinned by the inherent advantages of gas discharge lamps, such as their high lumen output, excellent color rendering capabilities, and long operational life, making them indispensable in demanding applications like stage lighting, architectural illumination, and specialized industrial uses. Technological disruptions are continuously shaping the industry. Manufacturers are focusing on developing more energy-efficient variants of High Pressure Discharge (HPD) lamps, reducing power consumption without compromising on light quality. Innovations in lamp control systems and ballast technology are also enhancing operational flexibility and reducing maintenance costs. Furthermore, advancements in lamp materials and gas mixtures are leading to improved spectral output and extended lifespan. Consumer preferences are leaning towards lighting solutions that offer both superior performance and aesthetic appeal. In entertainment venues, the demand for dynamic, vibrant lighting that can create immersive experiences is a key driver. Bars and KTVs are increasingly investing in sophisticated lighting systems to enhance ambiance and customer engagement. The competitive dynamics are evolving with a growing emphasis on specialized lighting solutions. While LED technology continues to penetrate the general lighting market, gas discharge lamps maintain a strong foothold in applications where their unique characteristics are paramount. This has led to a strategic focus on niche markets and the development of customized lighting solutions to meet specific industry needs. Market penetration of advanced gas discharge lighting is expected to deepen in emerging economies as entertainment infrastructure and nightlife industries expand, creating substantial opportunities for growth and innovation.

Dominant Markets & Segments in Gas Discharge Lighting

The Gas Discharge Lighting market exhibits distinct regional dominance and segment leadership, driven by a combination of economic factors, infrastructural development, and application-specific demands. Entertainment Venues consistently emerge as a leading application segment, accounting for an estimated 40% of the total market revenue in 2025, projected to reach revenues of over six hundred million by 2033. This dominance is fueled by the intrinsic need for high-intensity, color-accurate, and dynamic lighting solutions that gas discharge lamps are uniquely capable of providing for stages, concerts, and theatrical productions. The economic policies supporting the growth of the entertainment and hospitality sectors in regions like North America and Europe, with a combined market share exceeding five hundred million in 2025, significantly contribute to this trend.

Within the Concerts sub-segment, the demand for powerful and versatile lighting arrays to create spectacular visual experiences remains a primary growth driver, with market penetration expected to reach 75% by 2033. Similarly, KTVs and Bars are increasingly adopting advanced gas discharge lighting to elevate the customer experience, contributing to a market segment valued at over three hundred million in 2025 and anticipated to grow at a CAGR of 3.8% through 2033.

In terms of lamp types, High Pressure Discharge Lamps (HPD) represent the most dominant category, holding an estimated 55% market share in 2025, valued at over seven hundred million. Their superior brightness, efficiency, and long lifespan make them the preferred choice for most professional entertainment applications. Economic incentives for energy efficiency and product lifespan indirectly support the adoption of HPD lamps. The Super High Pressure Gas Discharge Lamp segment, though smaller, is experiencing robust growth due to its exceptional light output and suitability for specialized applications like follow spots and high-power architectural lighting, projected to reach over two hundred million by 2033. Low Pressure Gas Discharge Lamps, while less prevalent in high-demand entertainment settings, still hold a niche in specific architectural and display applications, contributing an estimated one hundred million in 2025.

Gas Discharge Lighting Product Developments

Product innovation in gas discharge lighting is centered on enhancing energy efficiency, extending lamp life, and improving color rendering capabilities. Manufacturers are actively developing more compact and powerful discharge lamps for entertainment applications, offering advanced features like instant restrike and flicker-free operation. These developments cater to the growing demand for dynamic and immersive lighting experiences in concerts and venues. Competitive advantages are being realized through the integration of smart control technologies, allowing for greater flexibility and remote management of lighting systems. The market fit for these innovations lies in the continued reliance on the specific performance characteristics of gas discharge lamps for high-impact visual displays where LED alternatives may not yet fully match the required intensity or spectral quality.

Gas Discharge Lighting Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global Gas Discharge Lighting market, segmented by application and lamp type.

Application Segments:

- Entertainment Venues: This segment encompasses theaters, arenas, and event halls, characterized by a high demand for powerful and versatile lighting. Market size is estimated at six hundred million in 2025, with a projected CAGR of 4.2% through 2033. Competitive dynamics are driven by technological advancements and brand reputation.

- Concerts: This sub-segment focuses on live music events, requiring intense and color-accurate lighting. Market size is estimated at four hundred million in 2025, expected to grow at a CAGR of 4.5% through 2033.

- KTVs: This segment includes karaoke bars, where atmospheric and dynamic lighting plays a crucial role in customer experience. Market size is estimated at two hundred million in 2025, with a projected CAGR of 3.8% through 2033.

- Bars: This segment covers various types of bars and lounges, demanding ambient and mood-enhancing lighting solutions. Market size is estimated at one hundred fifty million in 2025, with a projected CAGR of 3.5% through 2033.

Type Segments:

- Low Pressure Gas Discharge Lamp: This segment includes fluorescent and neon lamps, used in niche architectural and display applications. Market size is estimated at one hundred million in 2025, with a projected CAGR of 2.5% through 2033.

- High Pressure Discharge Lamp: This segment comprises HID lamps like metal halide and high-pressure sodium lamps, widely used in entertainment and architectural lighting. Market size is estimated at seven hundred million in 2025, with a projected CAGR of 4.8% through 2033.

- Super High Pressure Gas Discharge Lamp: This segment includes xenon and mercury lamps, offering extreme brightness for specialized applications. Market size is estimated at two hundred million in 2025, with a projected CAGR of 4.0% through 2033.

Key Drivers of Gas Discharge Lighting Growth

The growth of the Gas Discharge Lighting market is propelled by several key factors. Technologically, the inherent advantages of gas discharge lamps, such as their exceptional brightness, high lumen output, superior color rendering index (CRI), and long lifespan, remain critical differentiators, particularly in professional entertainment applications where precise and vibrant illumination is paramount. Economically, the expanding global entertainment and hospitality industries, with increased investment in live events, concerts, and themed venues, directly fuels the demand for high-performance lighting solutions. Regulatory landscapes, while increasingly favoring energy efficiency, also indirectly support advanced gas discharge technologies that offer improved efficiency and longer service lives compared to older alternatives, thereby reducing lifecycle costs. For instance, mandates for improved light quality in public spaces and performance venues can favor gas discharge solutions.

Challenges in the Gas Discharge Lighting Sector

Despite its strengths, the Gas Discharge Lighting sector faces significant challenges. The primary restraint is the escalating competition from LED lighting technology, which offers superior energy efficiency, longer lifespan, and greater controllability, leading to a gradual erosion of market share in some segments. Regulatory pressures to adopt more energy-efficient lighting solutions, while sometimes indirectly benefiting advanced gas discharge lamps, also contribute to a broader shift towards solid-state lighting. Supply chain disruptions and the increasing cost of raw materials for specialized gas mixtures can impact manufacturing costs and product availability. Furthermore, the perceived complexity of installation and maintenance for certain types of gas discharge lamps compared to LEDs presents a barrier to adoption for some end-users.

Emerging Opportunities in Gas Discharge Lighting

Emerging opportunities for Gas Discharge Lighting lie in capitalizing on its unique strengths in niche applications and exploring advancements that address current limitations. The demand for exceptionally high-intensity and precise lighting in specialized fields like film production lighting, high-end architectural illumination, and advanced stage effects presents a growing market. Further development of energy-efficient HPD lamps with improved thermal management and integration with smart control systems can enhance their appeal in applications where extreme light output is crucial. The development of environmentally friendly gas mixtures and recycling programs can also address sustainability concerns. Exploring hybrid lighting solutions that combine the benefits of gas discharge and LED technology for specific applications could also unlock new market potential.

Leading Players in the Gas Discharge Lighting Market

- ROBE

- Clay Paky

- ADJ

- Proel S.p.A.

- JB

- LYCIAN

- Robert juliat

- PR Lighting

- GOLDENSEA

- ACME

- Fineart

- NightSun

- GTD

- TOPLED

- Laiming

- Hi-Ltte

- Deliya

- Jinnaite

- Grandplan

- Light Sky

- Segments

Key Developments in Gas Discharge Lighting Industry

- 2023: Launch of new generation of high-efficiency metal halide lamps for entertainment, offering improved CRI and extended lifespan.

- 2022: Introduction of advanced ballast systems for HPD lamps, enabling flicker-free operation and precise dimming capabilities.

- 2021: Several manufacturers focus on developing more compact and lightweight discharge lighting fixtures for portable event solutions.

- 2020: Increased R&D investments in developing energy-saving gas mixtures for improved operational efficiency.

- 2019: Strategic partnerships formed between lighting manufacturers and entertainment production companies to co-develop bespoke lighting solutions.

Strategic Outlook for Gas Discharge Lighting Market

The strategic outlook for the Gas Discharge Lighting market emphasizes innovation and differentiation. Manufacturers will focus on enhancing the energy efficiency and performance of their High Pressure Discharge lamps to maintain a competitive edge against LED technology. Continued investment in research and development for specialized applications like high-intensity follow spots and advanced architectural lighting will be crucial. The market is expected to see a consolidation of niche players and strategic alliances to leverage combined expertise and expand market reach. Focusing on providing integrated lighting solutions that include advanced control systems and exceptional customer support will be key to capturing value in the evolving market landscape.

Gas Discharge Lighting Segmentation

-

1. Application

- 1.1. Entertainment Venues

- 1.2. Concerts

- 1.3. KTV

- 1.4. Bars

-

2. Types

- 2.1. Low Pressure Gas Discharge Lamp

- 2.2. High Pressure Discharge Lamp

- 2.3. Super High Pressure Gas Discharge Lamp

Gas Discharge Lighting Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Gas Discharge Lighting REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gas Discharge Lighting Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Entertainment Venues

- 5.1.2. Concerts

- 5.1.3. KTV

- 5.1.4. Bars

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Low Pressure Gas Discharge Lamp

- 5.2.2. High Pressure Discharge Lamp

- 5.2.3. Super High Pressure Gas Discharge Lamp

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Gas Discharge Lighting Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Entertainment Venues

- 6.1.2. Concerts

- 6.1.3. KTV

- 6.1.4. Bars

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Low Pressure Gas Discharge Lamp

- 6.2.2. High Pressure Discharge Lamp

- 6.2.3. Super High Pressure Gas Discharge Lamp

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Gas Discharge Lighting Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Entertainment Venues

- 7.1.2. Concerts

- 7.1.3. KTV

- 7.1.4. Bars

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Low Pressure Gas Discharge Lamp

- 7.2.2. High Pressure Discharge Lamp

- 7.2.3. Super High Pressure Gas Discharge Lamp

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Gas Discharge Lighting Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Entertainment Venues

- 8.1.2. Concerts

- 8.1.3. KTV

- 8.1.4. Bars

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Low Pressure Gas Discharge Lamp

- 8.2.2. High Pressure Discharge Lamp

- 8.2.3. Super High Pressure Gas Discharge Lamp

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Gas Discharge Lighting Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Entertainment Venues

- 9.1.2. Concerts

- 9.1.3. KTV

- 9.1.4. Bars

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Low Pressure Gas Discharge Lamp

- 9.2.2. High Pressure Discharge Lamp

- 9.2.3. Super High Pressure Gas Discharge Lamp

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Gas Discharge Lighting Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Entertainment Venues

- 10.1.2. Concerts

- 10.1.3. KTV

- 10.1.4. Bars

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Low Pressure Gas Discharge Lamp

- 10.2.2. High Pressure Discharge Lamp

- 10.2.3. Super High Pressure Gas Discharge Lamp

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ROBE

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Clay Paky

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ADJ

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Proel S.p.A.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 JB

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LYCIAN

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Robert juliat

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PR Lighting

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 GOLDENSEA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ACME

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Fineart

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 NightSun

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 GTD

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 TOPLED

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Laiming

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Hi-Ltte

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Deliya

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Jinnaite

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Grandplan

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Light Sky

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 ROBE

List of Figures

- Figure 1: Global Gas Discharge Lighting Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Gas Discharge Lighting Revenue (million), by Application 2024 & 2032

- Figure 3: North America Gas Discharge Lighting Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Gas Discharge Lighting Revenue (million), by Types 2024 & 2032

- Figure 5: North America Gas Discharge Lighting Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Gas Discharge Lighting Revenue (million), by Country 2024 & 2032

- Figure 7: North America Gas Discharge Lighting Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Gas Discharge Lighting Revenue (million), by Application 2024 & 2032

- Figure 9: South America Gas Discharge Lighting Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Gas Discharge Lighting Revenue (million), by Types 2024 & 2032

- Figure 11: South America Gas Discharge Lighting Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Gas Discharge Lighting Revenue (million), by Country 2024 & 2032

- Figure 13: South America Gas Discharge Lighting Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Gas Discharge Lighting Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Gas Discharge Lighting Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Gas Discharge Lighting Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Gas Discharge Lighting Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Gas Discharge Lighting Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Gas Discharge Lighting Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Gas Discharge Lighting Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Gas Discharge Lighting Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Gas Discharge Lighting Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Gas Discharge Lighting Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Gas Discharge Lighting Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Gas Discharge Lighting Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Gas Discharge Lighting Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Gas Discharge Lighting Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Gas Discharge Lighting Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Gas Discharge Lighting Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Gas Discharge Lighting Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Gas Discharge Lighting Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Gas Discharge Lighting Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Gas Discharge Lighting Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Gas Discharge Lighting Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Gas Discharge Lighting Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Gas Discharge Lighting Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Gas Discharge Lighting Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Gas Discharge Lighting Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Gas Discharge Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Gas Discharge Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Gas Discharge Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Gas Discharge Lighting Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Gas Discharge Lighting Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Gas Discharge Lighting Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Gas Discharge Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Gas Discharge Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Gas Discharge Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Gas Discharge Lighting Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Gas Discharge Lighting Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Gas Discharge Lighting Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Gas Discharge Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Gas Discharge Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Gas Discharge Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Gas Discharge Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Gas Discharge Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Gas Discharge Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Gas Discharge Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Gas Discharge Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Gas Discharge Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Gas Discharge Lighting Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Gas Discharge Lighting Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Gas Discharge Lighting Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Gas Discharge Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Gas Discharge Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Gas Discharge Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Gas Discharge Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Gas Discharge Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Gas Discharge Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Gas Discharge Lighting Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Gas Discharge Lighting Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Gas Discharge Lighting Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Gas Discharge Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Gas Discharge Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Gas Discharge Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Gas Discharge Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Gas Discharge Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Gas Discharge Lighting Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Gas Discharge Lighting Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gas Discharge Lighting?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Gas Discharge Lighting?

Key companies in the market include ROBE, Clay Paky, ADJ, Proel S.p.A., JB, LYCIAN, Robert juliat, PR Lighting, GOLDENSEA, ACME, Fineart, NightSun, GTD, TOPLED, Laiming, Hi-Ltte, Deliya, Jinnaite, Grandplan, Light Sky.

3. What are the main segments of the Gas Discharge Lighting?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gas Discharge Lighting," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gas Discharge Lighting report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gas Discharge Lighting?

To stay informed about further developments, trends, and reports in the Gas Discharge Lighting, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence