Key Insights

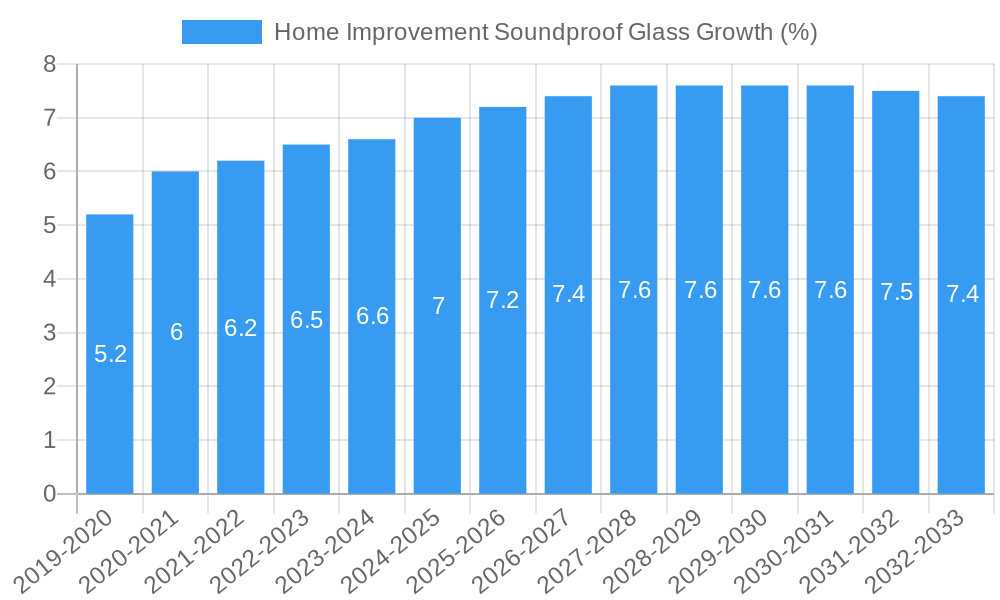

The global market for home improvement soundproof glass is experiencing robust growth, projected to reach an estimated market size of approximately $7,800 million by 2025, with a Compound Annual Growth Rate (CAGR) of around 8.5% anticipated between 2025 and 2033. This expansion is fueled by increasing consumer demand for enhanced living comfort and privacy within residential spaces. The rising awareness of noise pollution's negative impact on well-being, coupled with the growing popularity of home renovations and the desire for dedicated quiet zones for remote work, study, or relaxation, are key drivers. Furthermore, advancements in glass technology, leading to more effective and aesthetically pleasing soundproofing solutions, are contributing significantly to market adoption. The market is segmented by application, with the Household segment holding a dominant share due to these residential trends. Other applications like Hospitals, Cinemas, and Studios also represent significant, albeit smaller, markets, driven by specific acoustic requirements.

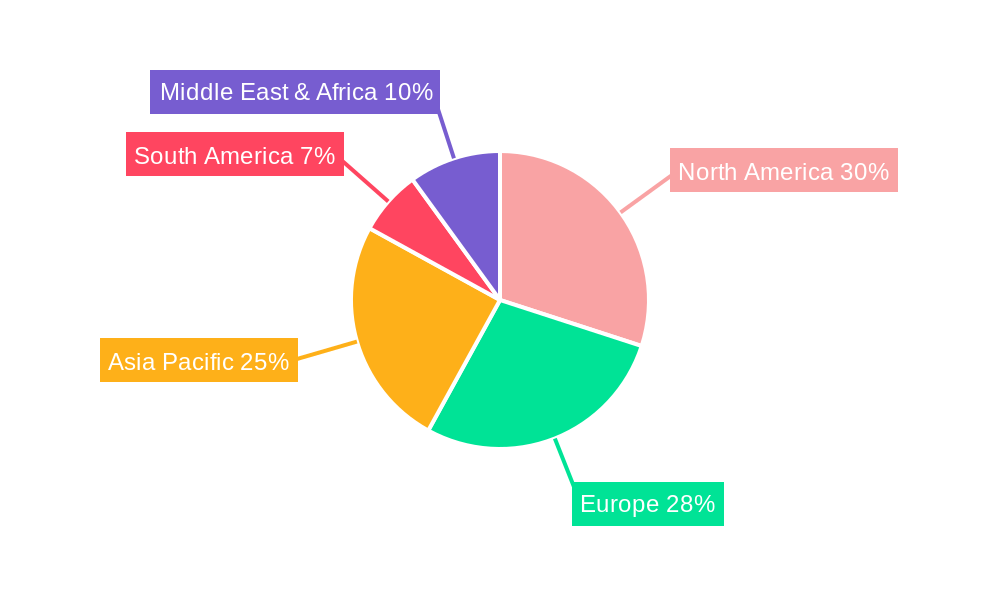

The market is characterized by several evolving trends and a few restraints. Innovations in multi-pane glazing, the incorporation of specialized acoustic interlayers, and the development of frameless or minimalist designs that don't compromise acoustic performance are prominent trends. The increasing availability of DIY-friendly soundproofing glass solutions is also broadening market accessibility. However, the primary restraint remains the higher cost associated with soundproof glass compared to standard glazing, which can deter some budget-conscious consumers. Supply chain complexities and the need for specialized installation expertise in some regions can also pose challenges. Geographically, North America and Europe are leading markets, driven by high disposable incomes and a strong emphasis on home comfort and renovation. Asia Pacific, particularly China and India, is showing rapid growth potential due to rapid urbanization and a burgeoning middle class increasingly investing in premium home features.

Home Improvement Soundproof Glass Market Concentration & Innovation

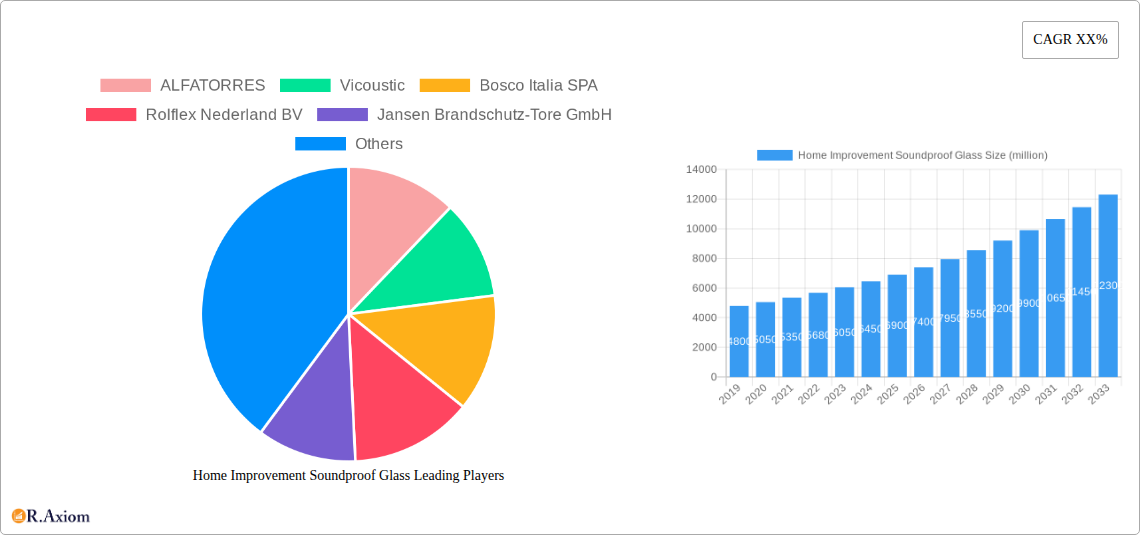

The Home Improvement Soundproof Glass market exhibits a moderate to high concentration, driven by specialized manufacturing capabilities and stringent quality certifications. Leading players like ALFATORRES, Vicoustic, and Bosco Italia SPA hold significant market share, estimated to be in the range of 15-20 million each. Innovation is a key differentiator, with a focus on developing advanced acoustic insulation technologies, improving energy efficiency in soundproof glass, and integrating smart features for enhanced user experience. Regulatory frameworks, particularly building codes and environmental standards, are increasingly shaping product development and adoption. For instance, stricter noise pollution regulations in urban areas are pushing demand for superior soundproofing solutions. Product substitutes, such as traditional insulation materials and acoustic panels, offer competition but often fall short in aesthetics and dual functionality. End-user trends are leaning towards increased awareness of the benefits of acoustic comfort in residential and commercial spaces, driving demand for soundproof glass in homes, hospitals, and studios. Mergers and Acquisitions (M&A) activity is moderate, with deal values typically ranging from 5-10 million, often aimed at consolidating market share or acquiring specialized technology. For example, the acquisition of a niche acoustic glass manufacturer by a larger building materials company in 2022, valued at approximately 7 million, demonstrates this trend.

Home Improvement Soundproof Glass Industry Trends & Insights

The Home Improvement Soundproof Glass industry is poised for robust growth, fueled by a confluence of expanding urbanization, rising disposable incomes, and a growing emphasis on well-being and productivity. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% over the forecast period of 2025–2033, with an estimated market size of over 150 million in the base year 2025. Technological advancements are at the forefront of market evolution, with innovations in laminated glass technology, advanced interlayer materials, and enhanced frame sealing techniques significantly improving sound transmission class (STC) ratings. The development of triple-pane soundproof glass with specialized gas fills and vacuum insulation is a significant technological disruption, offering unparalleled acoustic performance and energy savings. Consumer preferences are increasingly shifting towards creating quieter and more comfortable living and working environments. This is particularly evident in densely populated urban areas where noise pollution is a major concern. The demand for soundproof glass in household applications, such as home offices and bedrooms, is surging as remote work becomes more prevalent. In the commercial sector, hospitals are investing in soundproof glass to create serene patient recovery rooms, while cinemas and recording studios continue to be significant end-users demanding the highest levels of acoustic isolation. Competitive dynamics are characterized by a blend of established players and emerging innovators. Companies are investing heavily in research and development to enhance product performance, reduce manufacturing costs, and broaden their application reach. Market penetration is steadily increasing, driven by increased awareness campaigns and the availability of more aesthetically pleasing and customizable soundproof glass solutions. The integration of smart technologies, such as self-tinting or electronically controllable soundproof glass, is also emerging as a trend, catering to the demand for sophisticated building solutions. The overall industry landscape is one of dynamic innovation and expanding application horizons, driven by a fundamental human desire for peace and quiet in an increasingly noisy world.

Dominant Markets & Segments in Home Improvement Soundproof Glass

The Home Improvement Soundproof Glass market’s dominance is multifaceted, with distinct regions and applications exhibiting significant growth and consumption. North America, particularly the United States and Canada, is a leading region due to high disposable incomes, a strong focus on home improvement, and stringent building regulations promoting acoustic comfort. Economic policies supporting green building initiatives and infrastructure development further bolster market expansion in this region. Asia Pacific, driven by rapid urbanization in countries like China and India, is emerging as a high-growth market, with increasing investments in residential and commercial construction demanding superior soundproofing solutions.

Within Application segments, the Household sector is experiencing the most significant growth. The proliferation of remote work, coupled with a rising awareness of mental well-being and the need for quieter living spaces, has dramatically increased demand for soundproof glass in homes. Estimated market share for Household applications in 2025 is around 40 million. Hospital applications are also a dominant force, driven by the therapeutic benefits of reduced noise for patient recovery and staff efficiency. The development of specialized acoustic glazing for operating rooms and patient wards contributes to this segment's strength, with an estimated market share of 25 million. Cinema and Studio applications, while niche, represent a high-value segment due to the critical acoustic performance requirements for professional audio and visual experiences. These sectors are expected to maintain a steady market share of approximately 15 million each, driven by the constant need for upgrades and new construction. The Others segment, encompassing applications like hotels, educational institutions, and public transportation, also presents substantial growth potential, estimated at 20 million, as acoustic comfort becomes a standard expectation across various public and private spaces.

Analyzing Type segments, Glass Wool and Metal Material based soundproofing solutions are leading the market. Metal frames, often incorporating advanced sealing techniques and composite materials, offer durability and structural integrity, making them popular for commercial and high-performance applications. The estimated market share for Metal Material is around 45 million. Glass wool, renowned for its excellent sound absorption properties and cost-effectiveness, is widely adopted in residential and certain commercial applications, holding an estimated market share of 40 million. Wooden soundproof glass solutions, while offering aesthetic appeal, are typically found in more specialized residential and luxury applications, with an estimated market share of 20 million. The Other types segment, which includes advanced composites and emerging materials, is gaining traction due to its innovative properties and potential for enhanced performance, with an estimated market share of 15 million. The dominance of each segment is influenced by a combination of factors including cost-effectiveness, performance requirements, aesthetic preferences, and regional building practices.

Home Improvement Soundproof Glass Product Developments

Recent product developments in Home Improvement Soundproof Glass are centered on enhancing acoustic performance, energy efficiency, and aesthetic versatility. Innovations include the introduction of multi-layered laminated glass with advanced polymeric interlayers that offer superior sound damping across a wider frequency range. Companies are also focusing on the integration of thinner, yet highly effective, sound-insulating materials within glass units. Smart functionalities, such as electrochromic glass that can adjust tint for privacy and glare control while maintaining acoustic integrity, are also emerging. Competitive advantages are being derived from products offering higher Sound Transmission Class (STC) ratings, improved thermal performance, and customizability for diverse architectural designs.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Home Improvement Soundproof Glass market, segmented by Application and Type.

Under Application, the market is analyzed across:

- Household: Focusing on residential applications, driven by a need for peace and quiet in homes. Growth projections indicate a significant CAGR of 7% for this segment, with a projected market size of over 60 million by 2033.

- Hospital: Encompassing healthcare facilities where acoustic comfort is crucial for patient recovery. This segment is expected to grow at a CAGR of 6%, reaching approximately 40 million.

- Cinema: Including movie theaters and screening rooms demanding high acoustic fidelity. This segment is projected to grow at a CAGR of 5.5%, with a market size of around 25 million.

- Studio: Covering recording studios, broadcasting facilities, and sound production environments requiring extreme acoustic isolation. This segment is expected to grow at a CAGR of 6%, reaching approximately 25 million.

- Others: This broad category includes applications like hotels, schools, airports, and office buildings, showing robust growth potential driven by increasing awareness of acoustic comfort across various public spaces, with a projected CAGR of 6.2% and a market size exceeding 35 million.

Under Type, the market is segmented into:

- Metal Material: Focusing on soundproof glass solutions incorporating metal frames, known for durability and performance. This segment is projected to grow at a CAGR of 6.8%, with a market size of over 60 million.

- Wooden: Addressing soundproof glass with wooden frames, popular for aesthetic integration in specific architectural styles. This segment is expected to grow at a CAGR of 5%, reaching approximately 30 million.

- Glass Wool: Analyzing soundproof glass incorporating glass wool insulation, valued for its acoustic absorption properties and cost-effectiveness. This segment is projected to grow at a CAGR of 6.5%, with a market size of around 55 million.

- Other: Encompassing innovative composite materials and emerging technologies offering advanced soundproofing capabilities, expected to grow at a CAGR of 7.5%, with a market size exceeding 30 million.

Key Drivers of Home Improvement Soundproof Glass Growth

Several key factors are driving the growth of the Home Improvement Soundproof Glass market. Increasing urbanization and rising noise pollution levels are compelling consumers and businesses to seek effective sound insulation solutions. Growing awareness of the health and productivity benefits associated with quieter environments, particularly in residential and healthcare settings, is a significant economic driver. Technological advancements in glass manufacturing and acoustic materials, leading to more efficient and aesthetically pleasing products, are enhancing market appeal. Furthermore, stricter building codes and environmental regulations mandating noise reduction standards are creating a favorable regulatory landscape for soundproof glass adoption. The rise of remote work and the demand for dedicated home office spaces also contribute significantly to this growth.

Challenges in the Home Improvement Soundproof Glass Sector

Despite its promising growth, the Home Improvement Soundproof Glass sector faces several challenges. High initial cost of premium soundproof glass products can be a barrier for some consumers, especially in price-sensitive markets. Limited consumer awareness and understanding of the specific acoustic performance metrics (e.g., STC ratings) can hinder informed purchasing decisions. Complex installation processes and the need for specialized expertise can also lead to higher overall project costs and potential performance degradation if not executed correctly. Supply chain disruptions and the fluctuating cost of raw materials, particularly specialized interlayers and high-performance glass, can impact pricing and availability. Additionally, competition from alternative soundproofing methods that might be perceived as more cost-effective or easier to install presents an ongoing challenge.

Emerging Opportunities in Home Improvement Soundproof Glass

The Home Improvement Soundproof Glass market is ripe with emerging opportunities. The development of smart soundproof glass with integrated functionalities like dynamic tinting and self-cleaning capabilities presents a significant avenue for innovation and premium product offerings. The growing demand for sustainable and eco-friendly building materials opens opportunities for manufacturers to develop soundproof glass solutions using recycled content and energy-efficient manufacturing processes. Expansion into emerging economies with rapidly developing urban infrastructure and increasing disposable incomes offers substantial untapped market potential. Furthermore, the increasing focus on noise mitigation in public spaces such as airports, railway stations, and educational institutions creates new application frontiers. Collaboration with architects and builders to integrate soundproof glass solutions early in the design phase can also unlock significant market opportunities.

Leading Players in the Home Improvement Soundproof Glass Market

- ALFATORRES

- Vicoustic

- Bosco Italia SPA

- Rolflex Nederland BV

- Jansen Brandschutz-Tore GmbH

- Wilcox Door Service

- Vigor Doors

- Envirotech Systems

- HSE Doors

- Clark Door

- ZAKACOUSTICS

- Soundproof Interior Door

Key Developments in Home Improvement Soundproof Glass Industry

- 2023 January: Launch of a new generation of acoustic interlayer for laminated glass offering enhanced STC ratings by ZAKACOUSTICS.

- 2023 March: ALFATORRES announces strategic partnership with a major construction firm to integrate advanced soundproof glass solutions in new residential projects.

- 2023 June: Vicoustic introduces a range of customizable soundproof glass panels for studios and home theaters, emphasizing aesthetic integration.

- 2023 October: Bosco Italia SPA invests in advanced manufacturing technology to increase production capacity for high-performance acoustic glazing.

- 2024 February: Envirotech Systems expands its product line with specialized soundproof glass solutions for hospital environments, focusing on patient well-being.

- 2024 April: Rolflex Nederland BV unveils innovative frame designs that improve the overall acoustic seal and performance of soundproof windows.

- 2024 July: Wilcox Door Service reports significant growth in demand for soundproof glass doors in commercial applications.

- 2024 September: Jansen Brandschutz-Tore GmbH introduces fire-rated soundproof glass for enhanced safety and acoustic performance in commercial buildings.

- 2025 January: Vigor Doors highlights the increasing trend of integrating soundproof glass into modern architectural designs for both residential and commercial properties.

- 2025 March: Clark Door showcases their latest advancements in acoustic performance for large-scale soundproof glass installations in entertainment venues.

Strategic Outlook for Home Improvement Soundproof Glass Market

The strategic outlook for the Home Improvement Soundproof Glass market is exceptionally positive, driven by a sustained increase in demand for acoustic comfort across diverse sectors. Future growth will be catalyzed by continued innovation in material science, leading to lighter, more efficient, and cost-effective soundproofing solutions. The integration of smart technologies and a focus on sustainability will also be critical growth catalysts. As urbanization intensifies and the importance of well-being in built environments is increasingly recognized, soundproof glass is set to become a standard, rather than a luxury, feature in construction. Strategic investments in R&D, market penetration in emerging regions, and a focus on educating consumers about the long-term benefits of acoustic insulation will be key to unlocking the full market potential.

Home Improvement Soundproof Glass Segmentation

-

1. Application

- 1.1. Household

- 1.2. Hospital

- 1.3. Cinema

- 1.4. Studio

- 1.5. Others

-

2. Types

- 2.1. Metal Material

- 2.2. Wooden

- 2.3. Glass Wool

- 2.4. Other

Home Improvement Soundproof Glass Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Home Improvement Soundproof Glass REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Home Improvement Soundproof Glass Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Household

- 5.1.2. Hospital

- 5.1.3. Cinema

- 5.1.4. Studio

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Metal Material

- 5.2.2. Wooden

- 5.2.3. Glass Wool

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Home Improvement Soundproof Glass Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Household

- 6.1.2. Hospital

- 6.1.3. Cinema

- 6.1.4. Studio

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Metal Material

- 6.2.2. Wooden

- 6.2.3. Glass Wool

- 6.2.4. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Home Improvement Soundproof Glass Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Household

- 7.1.2. Hospital

- 7.1.3. Cinema

- 7.1.4. Studio

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Metal Material

- 7.2.2. Wooden

- 7.2.3. Glass Wool

- 7.2.4. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Home Improvement Soundproof Glass Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Household

- 8.1.2. Hospital

- 8.1.3. Cinema

- 8.1.4. Studio

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Metal Material

- 8.2.2. Wooden

- 8.2.3. Glass Wool

- 8.2.4. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Home Improvement Soundproof Glass Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Household

- 9.1.2. Hospital

- 9.1.3. Cinema

- 9.1.4. Studio

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Metal Material

- 9.2.2. Wooden

- 9.2.3. Glass Wool

- 9.2.4. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Home Improvement Soundproof Glass Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Household

- 10.1.2. Hospital

- 10.1.3. Cinema

- 10.1.4. Studio

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Metal Material

- 10.2.2. Wooden

- 10.2.3. Glass Wool

- 10.2.4. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ALFATORRES

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Vicoustic

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bosco Italia SPA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rolflex Nederland BV

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Jansen Brandschutz-Tore GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Wilcox Door Service

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Vigor Doors

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Envirotech Systems

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 HSE Doors

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Clark Door

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ZAKACOUSTICS

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Soundproof Interior Door

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 ALFATORRES

List of Figures

- Figure 1: Global Home Improvement Soundproof Glass Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Home Improvement Soundproof Glass Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Home Improvement Soundproof Glass Revenue (million), by Application 2024 & 2032

- Figure 4: North America Home Improvement Soundproof Glass Volume (K), by Application 2024 & 2032

- Figure 5: North America Home Improvement Soundproof Glass Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Home Improvement Soundproof Glass Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Home Improvement Soundproof Glass Revenue (million), by Types 2024 & 2032

- Figure 8: North America Home Improvement Soundproof Glass Volume (K), by Types 2024 & 2032

- Figure 9: North America Home Improvement Soundproof Glass Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Home Improvement Soundproof Glass Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Home Improvement Soundproof Glass Revenue (million), by Country 2024 & 2032

- Figure 12: North America Home Improvement Soundproof Glass Volume (K), by Country 2024 & 2032

- Figure 13: North America Home Improvement Soundproof Glass Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Home Improvement Soundproof Glass Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Home Improvement Soundproof Glass Revenue (million), by Application 2024 & 2032

- Figure 16: South America Home Improvement Soundproof Glass Volume (K), by Application 2024 & 2032

- Figure 17: South America Home Improvement Soundproof Glass Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Home Improvement Soundproof Glass Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Home Improvement Soundproof Glass Revenue (million), by Types 2024 & 2032

- Figure 20: South America Home Improvement Soundproof Glass Volume (K), by Types 2024 & 2032

- Figure 21: South America Home Improvement Soundproof Glass Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Home Improvement Soundproof Glass Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Home Improvement Soundproof Glass Revenue (million), by Country 2024 & 2032

- Figure 24: South America Home Improvement Soundproof Glass Volume (K), by Country 2024 & 2032

- Figure 25: South America Home Improvement Soundproof Glass Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Home Improvement Soundproof Glass Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Home Improvement Soundproof Glass Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Home Improvement Soundproof Glass Volume (K), by Application 2024 & 2032

- Figure 29: Europe Home Improvement Soundproof Glass Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Home Improvement Soundproof Glass Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Home Improvement Soundproof Glass Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Home Improvement Soundproof Glass Volume (K), by Types 2024 & 2032

- Figure 33: Europe Home Improvement Soundproof Glass Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Home Improvement Soundproof Glass Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Home Improvement Soundproof Glass Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Home Improvement Soundproof Glass Volume (K), by Country 2024 & 2032

- Figure 37: Europe Home Improvement Soundproof Glass Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Home Improvement Soundproof Glass Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Home Improvement Soundproof Glass Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Home Improvement Soundproof Glass Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Home Improvement Soundproof Glass Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Home Improvement Soundproof Glass Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Home Improvement Soundproof Glass Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Home Improvement Soundproof Glass Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Home Improvement Soundproof Glass Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Home Improvement Soundproof Glass Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Home Improvement Soundproof Glass Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Home Improvement Soundproof Glass Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Home Improvement Soundproof Glass Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Home Improvement Soundproof Glass Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Home Improvement Soundproof Glass Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Home Improvement Soundproof Glass Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Home Improvement Soundproof Glass Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Home Improvement Soundproof Glass Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Home Improvement Soundproof Glass Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Home Improvement Soundproof Glass Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Home Improvement Soundproof Glass Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Home Improvement Soundproof Glass Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Home Improvement Soundproof Glass Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Home Improvement Soundproof Glass Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Home Improvement Soundproof Glass Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Home Improvement Soundproof Glass Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Home Improvement Soundproof Glass Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Home Improvement Soundproof Glass Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Home Improvement Soundproof Glass Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Home Improvement Soundproof Glass Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Home Improvement Soundproof Glass Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Home Improvement Soundproof Glass Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Home Improvement Soundproof Glass Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Home Improvement Soundproof Glass Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Home Improvement Soundproof Glass Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Home Improvement Soundproof Glass Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Home Improvement Soundproof Glass Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Home Improvement Soundproof Glass Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Home Improvement Soundproof Glass Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Home Improvement Soundproof Glass Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Home Improvement Soundproof Glass Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Home Improvement Soundproof Glass Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Home Improvement Soundproof Glass Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Home Improvement Soundproof Glass Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Home Improvement Soundproof Glass Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Home Improvement Soundproof Glass Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Home Improvement Soundproof Glass Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Home Improvement Soundproof Glass Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Home Improvement Soundproof Glass Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Home Improvement Soundproof Glass Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Home Improvement Soundproof Glass Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Home Improvement Soundproof Glass Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Home Improvement Soundproof Glass Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Home Improvement Soundproof Glass Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Home Improvement Soundproof Glass Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Home Improvement Soundproof Glass Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Home Improvement Soundproof Glass Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Home Improvement Soundproof Glass Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Home Improvement Soundproof Glass Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Home Improvement Soundproof Glass Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Home Improvement Soundproof Glass Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Home Improvement Soundproof Glass Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Home Improvement Soundproof Glass Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Home Improvement Soundproof Glass Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Home Improvement Soundproof Glass Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Home Improvement Soundproof Glass Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Home Improvement Soundproof Glass Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Home Improvement Soundproof Glass Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Home Improvement Soundproof Glass Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Home Improvement Soundproof Glass Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Home Improvement Soundproof Glass Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Home Improvement Soundproof Glass Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Home Improvement Soundproof Glass Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Home Improvement Soundproof Glass Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Home Improvement Soundproof Glass Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Home Improvement Soundproof Glass Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Home Improvement Soundproof Glass Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Home Improvement Soundproof Glass Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Home Improvement Soundproof Glass Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Home Improvement Soundproof Glass Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Home Improvement Soundproof Glass Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Home Improvement Soundproof Glass Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Home Improvement Soundproof Glass Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Home Improvement Soundproof Glass Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Home Improvement Soundproof Glass Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Home Improvement Soundproof Glass Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Home Improvement Soundproof Glass Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Home Improvement Soundproof Glass Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Home Improvement Soundproof Glass Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Home Improvement Soundproof Glass Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Home Improvement Soundproof Glass Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Home Improvement Soundproof Glass Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Home Improvement Soundproof Glass Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Home Improvement Soundproof Glass Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Home Improvement Soundproof Glass Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Home Improvement Soundproof Glass Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Home Improvement Soundproof Glass Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Home Improvement Soundproof Glass Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Home Improvement Soundproof Glass Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Home Improvement Soundproof Glass Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Home Improvement Soundproof Glass Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Home Improvement Soundproof Glass Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Home Improvement Soundproof Glass Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Home Improvement Soundproof Glass Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Home Improvement Soundproof Glass Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Home Improvement Soundproof Glass Volume K Forecast, by Country 2019 & 2032

- Table 81: China Home Improvement Soundproof Glass Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Home Improvement Soundproof Glass Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Home Improvement Soundproof Glass Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Home Improvement Soundproof Glass Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Home Improvement Soundproof Glass Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Home Improvement Soundproof Glass Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Home Improvement Soundproof Glass Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Home Improvement Soundproof Glass Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Home Improvement Soundproof Glass Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Home Improvement Soundproof Glass Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Home Improvement Soundproof Glass Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Home Improvement Soundproof Glass Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Home Improvement Soundproof Glass Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Home Improvement Soundproof Glass Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Home Improvement Soundproof Glass?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Home Improvement Soundproof Glass?

Key companies in the market include ALFATORRES, Vicoustic, Bosco Italia SPA, Rolflex Nederland BV, Jansen Brandschutz-Tore GmbH, Wilcox Door Service, Vigor Doors, Envirotech Systems, HSE Doors, Clark Door, ZAKACOUSTICS, Soundproof Interior Door.

3. What are the main segments of the Home Improvement Soundproof Glass?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Home Improvement Soundproof Glass," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Home Improvement Soundproof Glass report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Home Improvement Soundproof Glass?

To stay informed about further developments, trends, and reports in the Home Improvement Soundproof Glass, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence