Key Insights

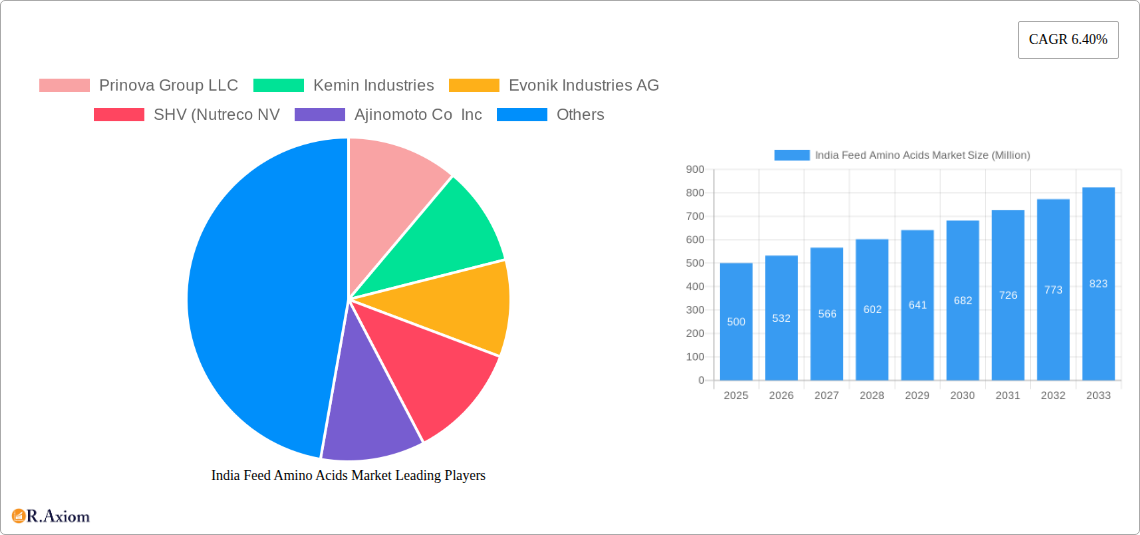

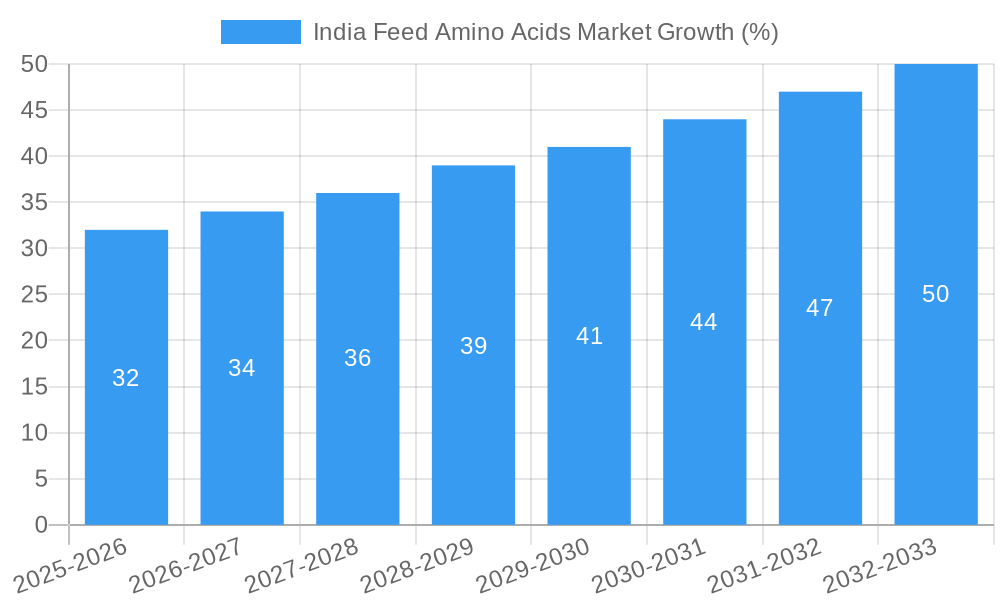

The India Feed Amino Acids market is experiencing robust growth, driven by the expanding livestock and aquaculture sectors. A burgeoning population and rising protein consumption are fueling demand for animal-based products, consequently increasing the need for feed amino acids to enhance animal nutrition and productivity. The market's Compound Annual Growth Rate (CAGR) of 6.40% from 2019 to 2024 indicates a consistent upward trajectory. This growth is further propelled by advancements in feed formulation technologies, leading to more efficient and cost-effective utilization of amino acids. Key segments within the market include lysine, methionine, and threonine, which dominate due to their essential roles in animal growth and development. The swine and aquaculture segments are particularly strong drivers, showcasing significant potential for future expansion given India's growing demand for pork and seafood. While regulatory changes and potential fluctuations in raw material prices pose challenges, the overall market outlook remains positive, projecting continued expansion throughout the forecast period (2025-2033). The presence of several established international and domestic players further strengthens the market's competitiveness and ensures a diverse range of products and services.

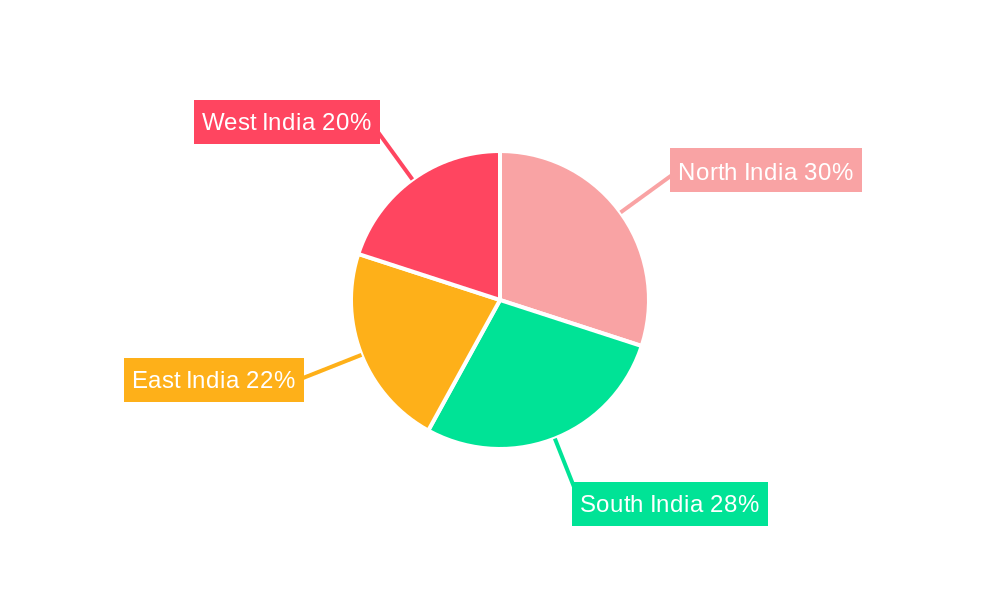

Further growth will likely be fueled by increased government initiatives promoting sustainable livestock farming and aquaculture practices, as well as growing adoption of advanced feed technologies. Regional variations exist, with potential for accelerated growth in regions like South India and North India, which possess higher livestock populations and agricultural activity. The market's competitive landscape is characterized by a mix of both international giants like Evonik Industries and Ajinomoto, and domestic players, leading to both intense competition and diverse product offerings. The continued focus on improving feed efficiency and animal health, coupled with increasing awareness of the benefits of amino acid supplementation, will further stimulate market growth in the coming years. While challenges such as price volatility and supply chain disruptions persist, the underlying market fundamentals remain strong, suggesting continued expansion.

India Feed Amino Acids Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the India Feed Amino Acids market, covering the period 2019-2033. It offers actionable insights for industry stakeholders, including manufacturers, distributors, investors, and researchers. The report leverages robust data and expert analysis to forecast market trends, identify growth opportunities, and assess competitive dynamics within this rapidly evolving sector. The Base Year is 2025, and the Estimated and Forecast Periods are 2025-2033 and 2019-2024 respectively. The market size is presented in Million USD.

India Feed Amino Acids Market Market Concentration & Innovation

The India Feed Amino Acids market exhibits a moderately concentrated landscape, with a few dominant players holding significant market share. Prinova Group LLC, Kemin Industries, Evonik Industries AG, and SHV (Nutreco NV) are key players, each contributing significantly to the overall market volume. Precise market share data for each company requires further detailed analysis and will be presented within the full report. However, preliminary estimations show that the top five players collectively command approximately xx% of the market.

Innovation in the sector is driven by several factors, including:

- Technological advancements: Improved fermentation technologies, enhanced amino acid production processes, and the development of customized amino acid blends are enhancing product efficacy and reducing costs.

- Stringent regulatory frameworks: Government regulations pertaining to feed quality and animal health are pushing manufacturers towards developing innovative solutions that meet stricter standards.

- Growing demand for sustainable feed solutions: Increasing awareness of environmental sustainability is driving demand for eco-friendly amino acid production methods and formulations.

- Product Substitutes: While few direct substitutes exist for essential amino acids, alternative protein sources and feed formulations pose some indirect competitive pressure.

Mergers and acquisitions (M&A) activity has also shaped the market landscape, impacting market share distribution and innovation. The report will detail specific M&A deals, including their value and impact on market dynamics. For example, Evonik's partnership with BASF for Opteinics™ exemplifies the trend towards technologically advanced solutions in the feed industry. Overall, strategic partnerships and acquisitions are likely to remain significant drivers of market consolidation and technological advancements.

India Feed Amino Acids Market Industry Trends & Insights

The India Feed Amino Acids market is witnessing robust growth, primarily driven by the expanding livestock and aquaculture sectors. The rising demand for animal protein in a rapidly growing population and increasing disposable incomes are major contributing factors. The historical period (2019-2024) saw a CAGR of xx%, and the forecast period (2025-2033) is projected to witness a CAGR of xx%. Market penetration is increasing, especially in regions with high livestock density and developing aquaculture industries.

Technological disruptions, particularly in precision feeding and data analytics, are enhancing feed efficiency and optimizing amino acid supplementation. Consumer preferences are shifting towards healthier and more sustainable animal products, influencing the demand for high-quality feed additives with improved bioavailability and reduced environmental impact. Competitive dynamics are characterized by intense competition amongst global and domestic players, resulting in product innovation, price optimization, and strategic partnerships. This competitive landscape fosters continuous improvement in product quality, efficiency, and sustainability within the market.

Dominant Markets & Segments in India Feed Amino Acids Market

Within the India Feed Amino Acids market, the swine segment currently holds the largest market share, driven by the significant growth in the swine farming sector. This is followed closely by the poultry and aquaculture segments, which are also experiencing rapid expansion.

Key Drivers for Dominant Segments:

- Swine: Increasing pork consumption, government support for the swine industry, and improved farming practices.

- Poultry: Growing demand for poultry products due to affordability and convenience, leading to increased feed demand.

- Aquaculture: Rising seafood consumption and government initiatives promoting aquaculture development.

Sub-additive dominance: Lysine and Methionine are currently the largest sub-segments of the market, primarily due to their essential roles in animal nutrition and the availability of efficient production processes. Other amino acids are showing strong growth potential due to increasing awareness of their nutritional benefits and the development of specialized formulations for specific animal species.

Regional dominance will be analyzed within the full report and will include a breakdown based on state-level analysis to identify key growth regions. The report will further consider the role of economic policies, infrastructure improvements, and other regional factors in driving specific market segments’ growth.

India Feed Amino Acids Market Product Developments

Recent product innovations include the development of customized amino acid blends tailored to specific animal species and dietary needs. Technological advancements in fermentation and bioprocessing technologies have improved the efficiency and sustainability of amino acid production. These advancements result in superior bioavailability, reduced environmental impact, and increased cost-effectiveness. The focus on enhanced palatability and improved nutrient absorption further adds to the competitiveness of these products within the market.

Report Scope & Segmentation Analysis

This report segments the India Feed Amino Acids market based on sub-additives (Lysine, Methionine, Threonine, Tryptophan, and Other Amino Acids) and animal species (Aquaculture, Swine, Other Ruminants, and Other Animals). Each segment's growth projections, market size, and competitive dynamics will be thoroughly analyzed in the full report. The report will detail the growth trajectory of each sub-additive category, analyzing factors like price fluctuations, demand patterns, and competitive activity influencing their individual market shares. Similarly, the report will comprehensively analyze the growth trajectories and market sizes for each animal segment based on factors such as consumption trends, breeding patterns, and other relevant factors.

Key Drivers of India Feed Amino Acids Market Growth

Several factors contribute to the growth of the India Feed Amino Acids market:

- Expanding livestock and aquaculture sectors: India's burgeoning population and rising per capita income fuel increasing demand for animal protein.

- Government initiatives: Government policies supporting the agricultural and livestock sectors create a favorable environment for market expansion.

- Technological advancements: Innovations in feed formulation and production technologies enhance the efficiency and sustainability of the industry.

Challenges in the India Feed Amino Acids Market Sector

The India Feed Amino Acids market faces several challenges:

- Price volatility of raw materials: Fluctuations in the prices of raw materials impact the overall cost and profitability of amino acid production.

- Supply chain disruptions: Inefficient logistics and infrastructure can hinder the timely supply of amino acids to end-users.

- Intense competition: The presence of numerous domestic and international players creates a highly competitive market environment.

Emerging Opportunities in India Feed Amino Acids Market

The India Feed Amino Acids market presents several opportunities:

- Growing demand for functional feed additives: The demand for feed additives with specific functionalities (e.g., improved immunity, enhanced digestibility) is creating new market opportunities.

- Increasing adoption of precision feeding techniques: Data-driven approaches to feed management are improving efficiency and reducing feed costs.

- Expansion of the aquaculture sector: The rising popularity of aquaculture creates significant growth potential for feed amino acids specifically formulated for aquatic animals.

Leading Players in the India Feed Amino Acids Market Market

- Prinova Group LLC

- Kemin Industries

- Evonik Industries AG

- SHV (Nutreco NV)

- Ajinomoto Co Inc

- Archer Daniel Midland Co

- Lonza Group Ltd

- Alltech Inc

- IFF (Danisco Animal Nutrition)

- Adisseo

Key Developments in India Feed Amino Acids Market Industry

- October 2022: Evonik and BASF's partnership granted Evonik non-exclusive licensing rights to Opteinics™, a digital solution improving animal feed efficiency and reducing environmental impact.

- December 2021: Nutreco partnered with Stellapps to reach three Million smallholder farmers, expanding market access for feed products and additives.

- February 2021: IFF's merger with DuPont's Nutrition & Biosciences created a leading ingredient and solutions provider, potentially impacting the amino acid market through enhanced product offerings and distribution networks.

Strategic Outlook for India Feed Amino Acids Market Market

The India Feed Amino Acids market is poised for significant growth, driven by the country's expanding livestock and aquaculture industries, rising demand for animal protein, and technological advancements. Strategic investments in R&D, focusing on sustainable and efficient production methods, and strengthening distribution networks will be crucial for success. The focus on customized amino acid solutions addressing specific animal needs and the adoption of precision feeding techniques will further enhance market growth prospects.

India Feed Amino Acids Market Segmentation

-

1. Sub Additive

- 1.1. Lysine

- 1.2. Methionine

- 1.3. Threonine

- 1.4. Tryptophan

- 1.5. Other Amino Acids

-

2. Animal

-

2.1. Aquaculture

-

2.1.1. By Sub Animal

- 2.1.1.1. Fish

- 2.1.1.2. Shrimp

- 2.1.1.3. Other Aquaculture Species

-

2.1.1. By Sub Animal

-

2.2. Poultry

- 2.2.1. Broiler

- 2.2.2. Layer

- 2.2.3. Other Poultry Birds

-

2.3. Ruminants

- 2.3.1. Dairy Cattle

- 2.3.2. Other Ruminants

- 2.4. Swine

- 2.5. Other Animals

-

2.1. Aquaculture

India Feed Amino Acids Market Segmentation By Geography

- 1. India

India Feed Amino Acids Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products

- 3.3. Market Restrains

- 3.3.1. Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Feed Amino Acids Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sub Additive

- 5.1.1. Lysine

- 5.1.2. Methionine

- 5.1.3. Threonine

- 5.1.4. Tryptophan

- 5.1.5. Other Amino Acids

- 5.2. Market Analysis, Insights and Forecast - by Animal

- 5.2.1. Aquaculture

- 5.2.1.1. By Sub Animal

- 5.2.1.1.1. Fish

- 5.2.1.1.2. Shrimp

- 5.2.1.1.3. Other Aquaculture Species

- 5.2.1.1. By Sub Animal

- 5.2.2. Poultry

- 5.2.2.1. Broiler

- 5.2.2.2. Layer

- 5.2.2.3. Other Poultry Birds

- 5.2.3. Ruminants

- 5.2.3.1. Dairy Cattle

- 5.2.3.2. Other Ruminants

- 5.2.4. Swine

- 5.2.5. Other Animals

- 5.2.1. Aquaculture

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Sub Additive

- 6. North India India Feed Amino Acids Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Feed Amino Acids Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Feed Amino Acids Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Feed Amino Acids Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Prinova Group LLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Kemin Industries

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Evonik Industries AG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 SHV (Nutreco NV

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Ajinomoto Co Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Archer Daniel Midland Co

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Lonza Group Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Alltech Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 IFF(Danisco Animal Nutrition)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Adisseo

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Prinova Group LLC

List of Figures

- Figure 1: India Feed Amino Acids Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Feed Amino Acids Market Share (%) by Company 2024

List of Tables

- Table 1: India Feed Amino Acids Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Feed Amino Acids Market Revenue Million Forecast, by Sub Additive 2019 & 2032

- Table 3: India Feed Amino Acids Market Revenue Million Forecast, by Animal 2019 & 2032

- Table 4: India Feed Amino Acids Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Feed Amino Acids Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Feed Amino Acids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Feed Amino Acids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Feed Amino Acids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Feed Amino Acids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Feed Amino Acids Market Revenue Million Forecast, by Sub Additive 2019 & 2032

- Table 11: India Feed Amino Acids Market Revenue Million Forecast, by Animal 2019 & 2032

- Table 12: India Feed Amino Acids Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Feed Amino Acids Market?

The projected CAGR is approximately 6.40%.

2. Which companies are prominent players in the India Feed Amino Acids Market?

Key companies in the market include Prinova Group LLC, Kemin Industries, Evonik Industries AG, SHV (Nutreco NV, Ajinomoto Co Inc, Archer Daniel Midland Co, Lonza Group Ltd, Alltech Inc, IFF(Danisco Animal Nutrition), Adisseo.

3. What are the main segments of the India Feed Amino Acids Market?

The market segments include Sub Additive, Animal.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet.

8. Can you provide examples of recent developments in the market?

October 2022: The partnership between Evonik and BASF allowed Evonik certain non-exclusive licensing rights to OpteinicsTM, a digital solution to improve comprehension and reduce the environmental impact of the animal protein and feed industries.December 2021: Nutreco partnered with the tech start-up Stellapps. This will give accessibility for the company to sell feed products, premixes, and feed additives to three million smallholder farmers using Stellapps’ technology.February 2021: IFF collaborated with DuPont’s Nutrition & Biosciences and continues to operate under IFF. The deal values the combined company at USD 45.4 billion on an enterprise value basis. The definitive agreement for the merger will create leading ingredients and solutions for customers worldwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Feed Amino Acids Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Feed Amino Acids Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Feed Amino Acids Market?

To stay informed about further developments, trends, and reports in the India Feed Amino Acids Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence