Key Insights

The South America Pet Treats Market is projected for significant expansion, expected to reach a market size of $1.71 billion by 2025, with a compound annual growth rate (CAGR) of 5.82% from 2025 to 2033. This growth is primarily driven by the increasing humanization of pets across the region, where owners increasingly consider pets as family members and invest in their health and happiness. Demand for premium and specialized treats, including dental and freeze-dried options, is rising due to a greater focus on pet nutrition and well-being. Factors such as increasing disposable incomes, enhanced awareness of high-quality pet food benefits, innovative product development, and the expansion of e-commerce channels contribute to market dynamics. Key product segments like crunchy and dental treats are gaining traction, reflecting consumer preferences for pet oral health and enjoyable treat experiences.

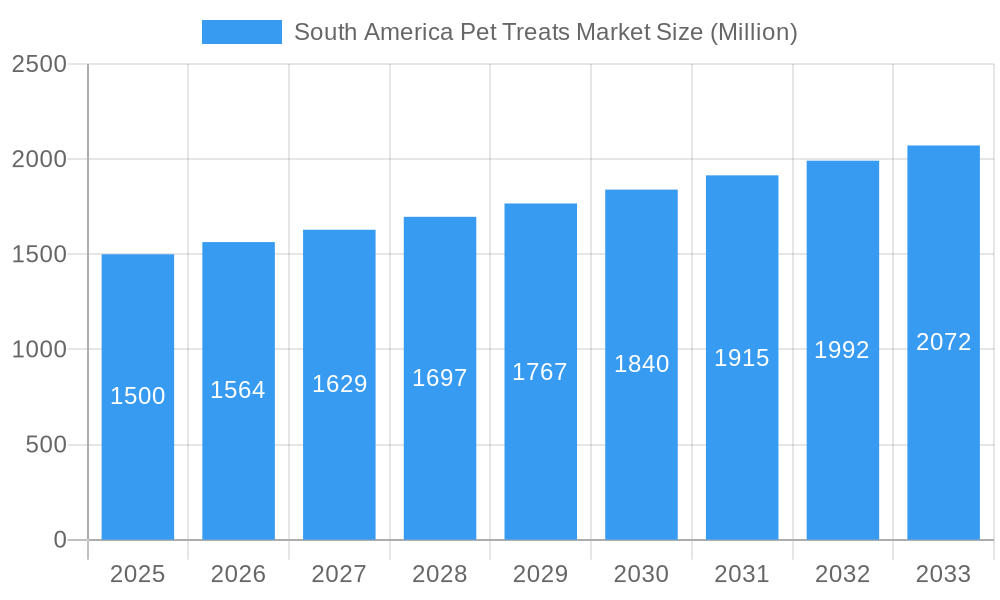

South America Pet Treats Market Market Size (In Billion)

The competitive environment in the South America Pet Treats Market features both established multinational corporations and agile regional players. Key companies are focusing on product innovation, strategic alliances, and robust marketing initiatives to capture market share. While global brands like Mars Incorporated, Nestlé (Purina), and General Mills Inc. are expanding their offerings and distribution, local players such as PremieRpet and INABA-PETFOOD Co Ltd are effectively addressing specific regional needs and preferences. Market challenges include potential economic instability in some South American economies and consumer price sensitivity towards non-essential pet products. Nevertheless, sustained growth in pet ownership and a continuous demand for premium, health-focused treats indicate a dynamic and promising market outlook. Canine and feline segments will continue to be the primary focus for product development and marketing strategies.

South America Pet Treats Market Company Market Share

This report offers a comprehensive analysis of the South America Pet Treats Market, providing essential insights for industry participants. Covering the study period from 2019 to 2033, with a base year of 2025, and a forecast period of 2025–2033, this research details historical trends from 2019–2024.

South America Pet Treats Market Market Concentration & Innovation

The South America Pet Treats Market is characterized by a dynamic mix of established global players and increasingly influential regional brands, indicating a moderate to high concentration in specific segments. Innovation serves as a critical differentiator, driven by a growing pet humanization trend and rising disposable incomes across key South American nations. Regulatory frameworks, while evolving, generally support product safety and ingredient transparency, influencing ingredient sourcing and formulation. Product substitutes, primarily in the form of homemade pet treats and bulk kibble, represent a minor challenge, especially in lower-income demographics. End-user trends highlight a strong demand for natural, organic, and functional pet treats that cater to specific health needs, such as dental care, joint support, and allergy management. Merger and Acquisition (M&A) activities are expected to rise as larger companies seek to expand their market reach and acquire innovative technologies or specialized product lines. For instance, Clearlake Capital Group L P's acquisition of Wellness Pet Company Inc. demonstrates a significant investment in the premium pet food and treats sector. While specific market share data for individual companies is proprietary, key players like Mars Incorporated and Nestle (Purina) hold substantial influence, estimated to be over 30% of the consolidated market in certain premium segments. M&A deal values in the broader pet care industry have reached hundreds of millions, signaling investor confidence in this growing sector.

- Innovation Drivers: Premiumization, demand for natural/organic ingredients, functional benefits, and ingredient transparency.

- Regulatory Frameworks: Focus on pet food safety, labeling requirements, and ingredient standards.

- Product Substitutes: Homemade treats, bulk kibble.

- End-User Trends: Pet humanization, health-conscious pet ownership, demand for sustainable sourcing.

- M&A Activity: Strategic acquisitions to gain market share, access new technologies, and expand product portfolios.

South America Pet Treats Market Industry Trends & Insights

The South America Pet Treats Market is poised for robust growth, driven by a confluence of powerful industry trends. The escalating pet humanization phenomenon, where pets are increasingly viewed as integral family members, fuels demand for high-quality, specialized treats that mirror human food trends. This translates into a growing preference for natural, organic, and grain-free formulations, with manufacturers investing heavily in research and development to meet these evolving consumer expectations. Technological advancements in pet food processing, such as freeze-drying and advanced extrusion techniques, enable the creation of innovative textures and preservation methods, enhancing product appeal and nutritional value. The burgeoning e-commerce sector has democratized access to pet treats, allowing consumers across the region to explore a wider array of brands and products, thereby boosting market penetration and sales volumes. Furthermore, increasing disposable incomes and a rising middle class in countries like Brazil, Argentina, and Colombia are directly contributing to higher spending on premium pet products, including treats. The market is also witnessing a significant shift towards functional treats that offer specific health benefits, such as improved dental hygiene, stress reduction, and enhanced joint mobility. This trend is supported by extensive research into pet nutrition and well-being. The CAGR for the South America Pet Treats Market is projected to be between 7.5% and 9.0% during the forecast period, reflecting sustained consumer spending and market expansion. Market penetration is expected to reach over 65% in urban areas by 2033. The competitive landscape is intensifying, with both global giants and agile local players vying for market share. Companies are strategically investing in marketing campaigns that emphasize the health and wellness benefits of their products, as well as sustainable sourcing practices. The online channel is expected to witness the fastest growth, driven by convenience and a wide product selection, estimated to capture over 30% of the market by the end of the forecast period.

Dominant Markets & Segments in South America Pet Treats Market

The South America Pet Treats Market exhibits significant regional dominance and segment-specific growth patterns, primarily driven by economic development, pet ownership demographics, and evolving consumer preferences. Dogs represent the largest pet segment, accounting for an estimated 70% of the total pet treats market share. This dominance is attributed to higher dog ownership rates across the continent and a more established culture of treating dogs with specialized products. Brazil stands out as the leading market within South America, contributing approximately 35% to the overall market revenue. Its large population, growing middle class, and increasing pet humanization trends make it a pivotal growth engine. Within the product segmentation, Crunchy Treats hold a substantial market share due to their affordability, versatility, and long shelf life, making them accessible to a broader consumer base. However, Soft & Chewy Treats are experiencing rapid growth, driven by consumer demand for more palatable and easily digestible options, particularly for older dogs and cats. The Online Channel is rapidly emerging as a dominant distribution force, projected to capture over 30% of the market by 2033. This surge is fueled by the convenience it offers, especially in large, urbanized countries like Brazil and Argentina, where consumers seek efficient shopping solutions.

- Dominant Pet Segment: Dogs (estimated 70% market share).

- Key Drivers: Higher ownership rates, established treating culture, wide product variety catering to different breeds and sizes.

- Leading Market: Brazil (estimated 35% market share).

- Key Drivers: Large population, increasing disposable income, strong pet humanization trends, significant pet care expenditure.

- Dominant Sub Product: Crunchy Treats.

- Key Drivers: Affordability, long shelf life, wide availability, established consumer familiarity.

- Fastest Growing Sub Product: Soft & Chewy Treats.

- Key Drivers: Palatability, digestibility, appeal for specific pet needs (e.g., senior pets, training treats).

- Dominant Distribution Channel: Online Channel.

- Key Drivers: Convenience, wide product selection, competitive pricing, direct-to-consumer models, increasing internet penetration.

- Emerging Distribution Channels: Specialty Stores and Supermarkets/Hypermarkets continue to hold significant share, driven by the desire for in-person shopping and impulse purchases.

South America Pet Treats Market Product Developments

Product innovation in the South America Pet Treats Market is increasingly focused on health, natural ingredients, and unique functionalities. Manufacturers are developing Dental Treats with advanced formulations to combat plaque and tartar, contributing to overall pet oral hygiene. The demand for Freeze-dried and Jerky Treats is soaring, as these methods preserve natural flavors and nutrients, appealing to pet owners seeking minimally processed options. Companies are also introducing Other Treats that incorporate functional ingredients like probiotics for gut health, omega fatty acids for skin and coat, and calming agents for anxiety. These advancements offer competitive advantages by catering to specific consumer needs and premiumizing the treat category.

Report Scope & Segmentation Analysis

This report offers a comprehensive segmentation of the South America Pet Treats Market. The Sub Product segmentation includes Crunchy Treats, Dental Treats, Freeze-dried and Jerky Treats, Soft & Chewy Treats, and Other Treats. The Pets segmentation covers Cats, Dogs, and Other Pets. The Distribution Channel segmentation analyzes Convenience Stores, Online Channel, Specialty Stores, Supermarkets/Hypermarkets, and Other Channels. Each segment is analyzed for its market size, growth projections, and competitive dynamics throughout the forecast period. The Online Channel is projected to experience the highest CAGR, driven by convenience and accessibility, with an estimated market size of over USD 500 Million by 2033. Dogs will continue to dominate the Pets segment, with significant growth expected in the Cats segment as well.

Key Drivers of South America Pet Treats Market Growth

The South America Pet Treats Market growth is propelled by several key drivers. The escalating trend of pet humanization is transforming pets into family members, leading to increased spending on premium and specialized treats. A growing middle class and rising disposable incomes, particularly in countries like Brazil and Argentina, empower consumers to allocate more resources to pet care. The e-commerce boom provides unprecedented access to a diverse range of products and brands, facilitating market expansion. Furthermore, heightened consumer awareness regarding pet health and nutrition is driving demand for functional treats with specific health benefits, such as dental care and joint support. Technological advancements in food processing are enabling the development of higher-quality, more appealing, and nutritionally superior treats.

Challenges in the South America Pet Treats Market Sector

Despite its promising growth trajectory, the South America Pet Treats Market faces several challenges. Economic volatility and currency fluctuations in some South American countries can impact consumer purchasing power and import costs. Regulatory complexities and varying standards across different nations can pose hurdles for market entry and product standardization. Supply chain disruptions, exacerbated by logistical challenges in remote areas and geopolitical factors, can affect product availability and lead times. Intense price competition, especially from unbranded or lower-cost alternatives, can pressure profit margins for premium product manufacturers. Furthermore, the limited awareness and adoption of premium pet treats in certain rural or lower-income regions present a barrier to widespread market penetration.

Emerging Opportunities in South America Pet Treats Market

Emerging opportunities in the South America Pet Treats Market are ripe for exploitation. The growing demand for sustainable and ethically sourced ingredients presents a significant avenue for brands focusing on eco-friendly practices. The rise of personalized pet nutrition and customized treat options catering to specific dietary needs and breed predispositions offers a niche growth area. The increasing adoption of smart pet feeders and treat dispensers creates opportunities for innovative, connected treat products. Expansion into underserved markets within South America that are witnessing a rise in pet ownership and disposable income offers untapped potential. Furthermore, partnerships with veterinarians and pet wellness influencers can enhance brand credibility and drive product adoption.

Leading Players in the South America Pet Treats Market Market

- ADM

- Clearlake Capital Group L P (Wellness Pet Company Inc)

- General Mills Inc

- INABA-PETFOOD Co Ltd

- PremieRpet

- Mars Incorporated

- Nestle (Purina)

- Empresas Carozzi SA

- Colgate-Palmolive Company (Hill's Pet Nutrition Inc)

- Virbac

Key Developments in South America Pet Treats Market Industry

- May 2023: Nestle Purina launched new cat treats under the Friskies "Friskies Playfuls - treats" brand. These treats are round in shape and are available in chicken and liver and salmon and shrimp flavors for adult cats.

- March 2023: PremieRpet launched a line of superpremium, "Protein-packed" meal toppers/treats for dogs and cats under the brand Natoo. These are produced at PremieRpet's facility in Brazil.

- January 2023: Mars Incorporated partnered with the Broad Institute to create an open-access database of dog and cat genomes to advance preventive pet care. It is aimed at developing more effective precision medicines and diets that lead to scientific breakthroughs for the future of pet health.

Strategic Outlook for South America Pet Treats Market Market

The strategic outlook for the South America Pet Treats Market remains highly optimistic, driven by sustained pet humanization trends and increasing disposable incomes. Companies that focus on product innovation, particularly in the realms of natural, functional, and sustainable treats, are best positioned for growth. Expanding distribution networks, with a strong emphasis on the burgeoning online channel and strategic partnerships with specialty retailers, will be crucial for market penetration. Leveraging technological advancements in product development and marketing will enhance brand appeal and customer engagement. Furthermore, understanding and adapting to diverse regional consumer preferences and economic conditions within South America will enable companies to capture significant market share and achieve long-term success.

South America Pet Treats Market Segmentation

-

1. Sub Product

- 1.1. Crunchy Treats

- 1.2. Dental Treats

- 1.3. Freeze-dried and Jerky Treats

- 1.4. Soft & Chewy Treats

- 1.5. Other Treats

-

2. Pets

- 2.1. Cats

- 2.2. Dogs

- 2.3. Other Pets

-

3. Distribution Channel

- 3.1. Convenience Stores

- 3.2. Online Channel

- 3.3. Specialty Stores

- 3.4. Supermarkets/Hypermarkets

- 3.5. Other Channels

South America Pet Treats Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Pet Treats Market Regional Market Share

Geographic Coverage of South America Pet Treats Market

South America Pet Treats Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Pet Treats Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sub Product

- 5.1.1. Crunchy Treats

- 5.1.2. Dental Treats

- 5.1.3. Freeze-dried and Jerky Treats

- 5.1.4. Soft & Chewy Treats

- 5.1.5. Other Treats

- 5.2. Market Analysis, Insights and Forecast - by Pets

- 5.2.1. Cats

- 5.2.2. Dogs

- 5.2.3. Other Pets

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Convenience Stores

- 5.3.2. Online Channel

- 5.3.3. Specialty Stores

- 5.3.4. Supermarkets/Hypermarkets

- 5.3.5. Other Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Sub Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ADM

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Clearlake Capital Group L P (Wellness Pet Company Inc )

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 General Mills Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 INABA-PETFOOD Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PremieRpet

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mars Incorporated

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nestle (Purina)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Empresas Carozzi SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Colgate-Palmolive Company (Hill's Pet Nutrition Inc )

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Virba

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ADM

List of Figures

- Figure 1: South America Pet Treats Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Pet Treats Market Share (%) by Company 2025

List of Tables

- Table 1: South America Pet Treats Market Revenue billion Forecast, by Sub Product 2020 & 2033

- Table 2: South America Pet Treats Market Revenue billion Forecast, by Pets 2020 & 2033

- Table 3: South America Pet Treats Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: South America Pet Treats Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: South America Pet Treats Market Revenue billion Forecast, by Sub Product 2020 & 2033

- Table 6: South America Pet Treats Market Revenue billion Forecast, by Pets 2020 & 2033

- Table 7: South America Pet Treats Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: South America Pet Treats Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Brazil South America Pet Treats Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Argentina South America Pet Treats Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Chile South America Pet Treats Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Colombia South America Pet Treats Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Peru South America Pet Treats Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Venezuela South America Pet Treats Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Ecuador South America Pet Treats Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Bolivia South America Pet Treats Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Paraguay South America Pet Treats Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Uruguay South America Pet Treats Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Pet Treats Market?

The projected CAGR is approximately 5.82%.

2. Which companies are prominent players in the South America Pet Treats Market?

Key companies in the market include ADM, Clearlake Capital Group L P (Wellness Pet Company Inc ), General Mills Inc, INABA-PETFOOD Co Ltd, PremieRpet, Mars Incorporated, Nestle (Purina), Empresas Carozzi SA, Colgate-Palmolive Company (Hill's Pet Nutrition Inc ), Virba.

3. What are the main segments of the South America Pet Treats Market?

The market segments include Sub Product, Pets, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.71 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

May 2023: Nestle Purina launched new cat treats under the Friskies "Friskies Playfuls - treats" brand. These treats are round in shape and are available in chicken and liver and salmon and shrimp flavors for adult cats.March 2023: PremieRpet launched a line of superpremium, "Protein-packed" meal toppers/treats for dogs and cats under the brand Natoo. These are produced at PremieRpet's facility in Brazil.January 2023: Mars Incorporated partnered with the Broad Institute to create an open-access database of dog and cat genomes to advance preventive pet care. It is aimed at developing more effective precision medicines and diets that lead to scientific breakthroughs for the future of pet health.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Pet Treats Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Pet Treats Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Pet Treats Market?

To stay informed about further developments, trends, and reports in the South America Pet Treats Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence