Key Insights

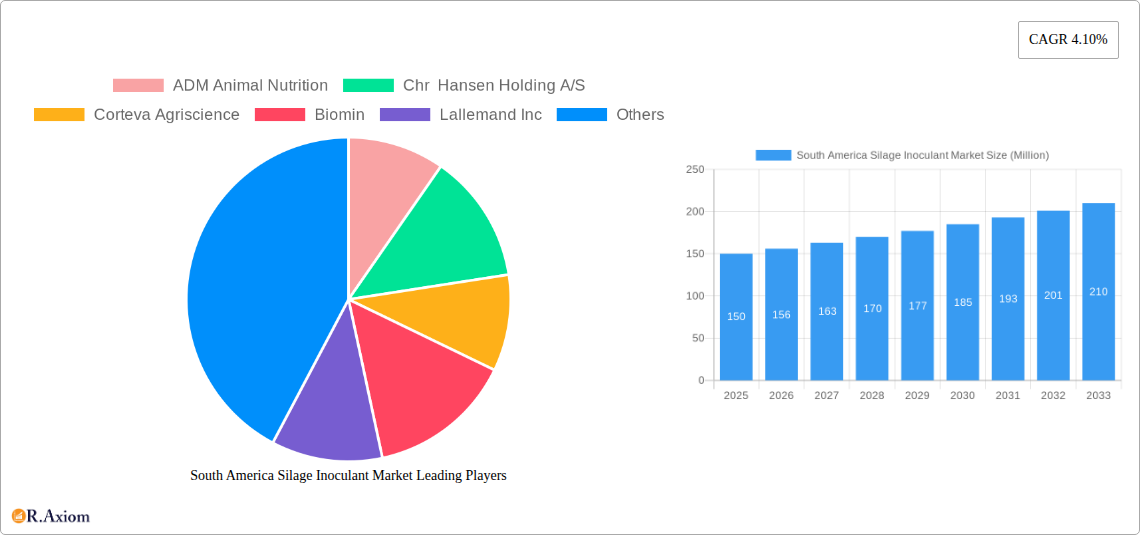

The South American silage inoculant market is poised for significant expansion, projected to reach a substantial market size of approximately $150 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 4.10% through 2033. This growth is primarily fueled by the escalating demand for high-quality animal feed, driven by the burgeoning livestock industry across the continent, particularly in Brazil and Argentina. Farmers are increasingly recognizing the crucial role of silage inoculants in enhancing forage preservation, improving nutritional value, and reducing spoilage, thereby contributing to improved animal health and productivity. The market's expansion is further supported by growing awareness of sustainable agricultural practices and the need to maximize nutrient utilization from harvested crops. Investments in research and development by leading companies are introducing innovative inoculant formulations tailored to specific crop types and regional conditions, further stimulating market adoption.

South America Silage Inoculant Market Market Size (In Million)

The market is segmented across various bacterial types and crop applications, with Homolactic bacteria, including Lactobacillus plantarum and Pediococcus pentosaceus, currently dominating due to their proven efficacy in producing lactic acid for rapid and effective fermentation. Applications in cereal crops like corn and barley, and pulse crops such as peas and clover, represent key areas of consumption. Brazil stands out as the largest regional market, followed by Argentina, owing to their extensive agricultural landscapes and significant livestock populations. However, emerging opportunities in "Rest of South America" are being tapped by new entrants. While the market exhibits strong growth potential, certain restraints, such as the initial cost of inoculants for smaller farms and the need for greater farmer education on optimal application techniques, need to be addressed to unlock the full market potential and ensure widespread adoption of these critical feed preservation solutions.

South America Silage Inoculant Market Company Market Share

This in-depth report provides a granular analysis of the South America silage inoculant market, forecasting growth from 2025 to 2033, with a base year of 2025 and historical data spanning 2019–2024. The market for silage inoculants in South America is experiencing robust expansion, driven by the increasing demand for high-quality animal feed, enhanced livestock productivity, and the growing adoption of advanced agricultural practices across the continent. This report delves into market dynamics, key trends, dominant segments, and strategic opportunities, offering actionable insights for stakeholders including animal nutrition companies, feed manufacturers, agricultural cooperatives, researchers, and investors.

South America Silage Inoculant Market Market Concentration & Innovation

The South America silage inoculant market exhibits moderate to high concentration, with a few key players holding significant market shares. Major companies like ADM Animal Nutrition, Chr Hansen Holding A/S, Corteva Agriscience, Biomin, Lallemand Inc, Micron Bio-Systems, Pearce Group of Companies, and Nutrec are actively involved in research and development, driving innovation in this sector. Innovation is primarily focused on developing novel microbial strains that enhance silage fermentation efficiency, improve nutrient availability, reduce spoilage, and boost overall feed palatability and digestibility. Regulatory frameworks, while evolving, generally support the adoption of safe and effective silage inoculants that contribute to animal health and farm profitability. Product substitutes, such as chemical additives and ensiling aids, exist but often lack the biological advantages and long-term sustainability benefits offered by microbial inoculants. End-user trends indicate a growing preference for science-backed solutions that optimize feed conversion ratios and reduce methane emissions from livestock. Mergers and acquisitions (M&A) activities are likely to shape the market landscape further, with potential consolidation to gain market access and technological expertise. Anticipated M&A deal values are estimated to be in the range of xx Million.

South America Silage Inoculant Market Industry Trends & Insights

The South America silage inoculant market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. This robust expansion is underpinned by several interconnected industry trends. A primary growth driver is the escalating demand for enhanced livestock productivity and improved animal health across South America. As the global population continues to rise, so does the need for protein sources, making efficient livestock farming crucial. Silage inoculants play a pivotal role in this by optimizing the nutritional value and preservation of forages, leading to better feed conversion ratios and reduced wastage. Technological disruptions, particularly in the field of microbial genomics and fermentation technology, are enabling the development of more potent and targeted silage inoculant strains. These advancements allow for tailor-made solutions addressing specific forage types and environmental conditions prevalent in South America.

Consumer preferences are also indirectly influencing the market. There is a growing awareness among consumers about sustainable agriculture and animal welfare, which translates into demand for animal products produced through efficient and environmentally responsible practices. High-quality silage, facilitated by inoculants, contributes to reduced greenhouse gas emissions from livestock and improved animal well-being. Furthermore, economic factors, such as government initiatives promoting agricultural modernization and increased investment in the livestock sector, are significantly boosting market penetration. For instance, Brazil and Argentina, being major agricultural powerhouses, are experiencing increased adoption of these advanced feed preservation techniques. The competitive dynamics are characterized by intense R&D efforts, strategic partnerships, and market expansion strategies by leading players. The market penetration of silage inoculants, currently estimated at around 35%, is expected to rise significantly as more farmers recognize the economic and operational benefits. The total market size is projected to reach xx Million by 2033.

Dominant Markets & Segments in South America Silage Inoculant Market

The South America silage inoculant market is characterized by distinct regional dominance and segment preferences, driven by agricultural practices, crop cultivation, and livestock farming characteristics.

Geographical Dominance:

- Brazil: Currently holds the largest market share, estimated at around 45% of the total South American market. This dominance is attributed to its vast agricultural land, extensive cattle ranching industry, and significant production of cereal crops like corn, which are primary feed sources. Government support for agricultural innovation and a growing awareness of feed efficiency among Brazilian farmers further bolster its leading position.

- Argentina: Ranks as the second-largest market, accounting for approximately 30% of the total market. Argentina's strong tradition in beef and dairy production, coupled with its substantial cultivation of corn and grains, makes it a key consumer of silage inoculants. Investments in modern farming techniques and a focus on export markets for meat and dairy products drive demand.

- Rest of South America: This segment, encompassing countries like Colombia, Chile, and Uruguay, represents the remaining 25% of the market. While smaller individually, these regions are showing promising growth, driven by expanding livestock sectors and increasing adoption of improved forage management practices.

Segment Dominance:

- Type: Homolactic Bacteria: This segment is the most dominant, holding an estimated 60% market share.

- Lactobacillus plantarum: Remains a workhorse, widely used for its effectiveness in lactic acid production, leading to rapid pH drop and efficient silage preservation. Its versatility across various forage types contributes to its widespread adoption.

- Pediococcus pentosaceus: Frequently used in blends, offering complementary benefits to Lactobacillus plantarum by further enhancing fermentation and reducing spoilage organisms.

- Enterococcus faecium: Known for its ability to improve aerobic stability and reduce heat damage in silage.

- Others (Homolactic Bacteria): Includes various other strains contributing to specific fermentation profiles.

- Application: Cereal Crops: This segment is the largest, accounting for approximately 70% of the market.

- Corn: The most significant application within cereal crops, given its high yield and energy content, making it a staple for silage across South America. The demand for high-quality corn silage for cattle feed is a primary market driver.

- Barley, Oats, Wheat, Sorghum: These grains are also crucial for silage production, particularly in regions with different climatic conditions or specific nutritional requirements for livestock. Their cultivation for silage purposes directly fuels the demand for corresponding inoculants.

- Application: Pulse Crops: This segment holds about 20% of the market.

- Alfalfa: A key forage legume in South America, valued for its protein content and ability to fix nitrogen. Its ensiling benefits from specific inoculant applications to optimize fermentation and nutrient retention.

- Peas, Clover: Other pulse crops increasingly utilized for silage, contributing to a more diverse and nutritious feed base.

- Application: Others Crops: This segment represents about 10% of the market.

- Grasses: Various types of grasses are ensiled, especially in extensive grazing systems, requiring inoculants for efficient preservation and nutritional enhancement.

- Canola: Increasingly being ensiled for its nutritional value, creating niche demand for specialized inoculants.

South America Silage Inoculant Market Product Developments

Product development in the South America silage inoculant market is focused on enhancing microbial efficacy and broadening application spectrums. Innovations include the development of multi-strain inoculants designed for specific forage types and climatic conditions, offering superior fermentation control and aerobic stability. Companies are investing in research to identify and isolate novel bacterial strains that improve nutrient digestibility, reduce dry matter losses, and inhibit the growth of spoilage organisms like yeasts and molds. These advancements lead to inoculants that contribute to more palatable and digestible silage, ultimately boosting animal performance and farm profitability. Competitive advantages are being built on science-backed formulations, robust field trial data, and tailored solutions that address the unique challenges faced by South American livestock producers.

Report Scope & Segmentation Analysis

This report meticulously analyzes the South America silage inoculant market, segmented by Type, Application, and Geography.

- Type Segmentation: The market is segmented into Homolactic Bacteria (including Lactobacillus plantarum, Pediococcus pentosaceus, Enterococcus faecium, and Others) and Heterolactic Bacteria (Lactobacillus buchneri, Lactobacillus brevis, Propionibacteria freundenreichii). Homolactic bacteria are expected to dominate due to their established efficacy in lactic acid production, contributing to rapid pH drop and silage preservation. Heterolactic bacteria are gaining traction for their role in improving aerobic stability.

- Application Segmentation: Key applications include Cereal Crops (Corn, Barley, Oats, Wheat, Sorghum), Pulse Crops (Peas, Clover, Alfalfa, Others), and Others Crops (Grasses, Canola). Cereal crops, particularly corn, are anticipated to lead the market due to their widespread use in silage production. Pulse crops and other miscellaneous crops represent growing segments driven by diversification in feed strategies.

- Geographical Segmentation: The analysis covers Brazil, Argentina, and the Rest of South America. Brazil is projected to maintain its leadership position owing to its extensive agricultural and livestock sectors. Argentina follows closely, with the Rest of South America presenting significant growth potential. Market sizes and growth projections for each segment are detailed within the report.

Key Drivers of South America Silage Inoculant Market Growth

The growth of the South America silage inoculant market is propelled by several key factors. Firstly, the escalating demand for high-quality animal feed to support the expanding livestock industry, driven by increasing global protein consumption, is paramount. Secondly, technological advancements in microbial science are leading to the development of more effective and targeted inoculant formulations that enhance silage preservation and nutritional value. Economic policies promoting agricultural modernization and investment in the livestock sector across countries like Brazil and Argentina provide a supportive environment. Furthermore, increasing farmer awareness of the economic benefits, including reduced feed spoilage, improved animal health, and enhanced productivity, is a significant driver.

Challenges in the South America Silage Inoculant Market Sector

Despite its growth potential, the South America silage inoculant market faces several challenges. Regulatory hurdles related to the registration and approval of new microbial products can slow down market entry and adoption. Supply chain complexities, particularly in vast and diverse geographies, can impact product availability and logistics. Intense competition from existing and new market players, coupled with potential price sensitivity among some farmer segments, can exert pressure on profit margins. Educating farmers about the correct application and benefits of silage inoculants remains a continuous challenge, requiring sustained outreach and technical support.

Emerging Opportunities in South America Silage Inoculant Market

The South America silage inoculant market presents several emerging opportunities. The increasing focus on sustainable agriculture and reducing the environmental footprint of livestock farming creates a demand for inoculants that improve feed efficiency and potentially reduce methane emissions. The growing middle class in many South American countries is driving increased consumption of meat and dairy products, further boosting the demand for efficient livestock production. Opportunities also lie in developing specialized inoculants for niche crops and specific livestock breeds. Furthermore, partnerships with local agricultural institutions and extension services can facilitate wider market penetration and farmer education.

Leading Players in the South America Silage Inoculant Market Market

- ADM Animal Nutrition

- Chr Hansen Holding A/S

- Corteva Agriscience

- Biomin

- Lallemand Inc

- Micron Bio-Systems

- Pearce Group of Companies

- Nutrec

Key Developments in South America Silage Inoculant Market Industry

- 2023/2024: Increased investment in R&D for novel bacterial strains with enhanced aerobic stability and resistance to spoilage organisms.

- 2022/2023: Expansion of product portfolios by major players to include inoculants specifically formulated for regional forage types in Brazil and Argentina.

- 2021/2022: Strategic partnerships formed between inoculant manufacturers and feed companies to promote integrated feed solutions.

- 2020/2021: Growing emphasis on product development for pulse crops and alternative forages due to diversification in livestock diets.

- 2019/2020: Introduction of enhanced application technologies and farmer education programs by leading companies to improve product adoption rates.

Strategic Outlook for South America Silage Inoculant Market Market

The strategic outlook for the South America silage inoculant market remains highly positive. Continued investment in research and development will be crucial for introducing next-generation inoculants with superior performance characteristics and addressing emerging challenges like climate change impacts on forage quality. Expanding market penetration through targeted marketing campaigns and robust farmer education initiatives will drive growth. Strategic collaborations with agricultural cooperatives, governmental bodies, and research institutions will foster market acceptance and facilitate wider adoption of best practices in silage management. The focus on sustainability and enhancing livestock productivity will continue to be the primary growth catalysts, ensuring sustained demand for effective silage inoculants across the continent.

South America Silage Inoculant Market Segmentation

-

1. Type

-

1.1. Homolactic Bacteria

- 1.1.1. Lactobacillus plantarum

- 1.1.2. Pediococcus pentosaceus

- 1.1.3. Enterococcus faecium

- 1.1.4. Others

-

1.2. Heterolactic Bacteria

- 1.2.1. Lactobacillus buchneri

- 1.2.2. Lactobacillus brevis

- 1.2.3. Propionibacteria freundenreichii

-

1.1. Homolactic Bacteria

-

2. Application

-

2.1. Cereal Crops

- 2.1.1. Corn

- 2.1.2. Barley

- 2.1.3. Oats

- 2.1.4. Wheat

- 2.1.5. Sorghum

-

2.2. Pulse Crops

- 2.2.1. Peas

- 2.2.2. Clover

- 2.2.3. Alfalfa

- 2.2.4. Others

-

2.3. Others Crops

- 2.3.1. Grasses

- 2.3.2. Canola

-

2.1. Cereal Crops

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Silage Inoculant Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Silage Inoculant Market Regional Market Share

Geographic Coverage of South America Silage Inoculant Market

South America Silage Inoculant Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growing Demand for Livestock Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Silage Inoculant Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Homolactic Bacteria

- 5.1.1.1. Lactobacillus plantarum

- 5.1.1.2. Pediococcus pentosaceus

- 5.1.1.3. Enterococcus faecium

- 5.1.1.4. Others

- 5.1.2. Heterolactic Bacteria

- 5.1.2.1. Lactobacillus buchneri

- 5.1.2.2. Lactobacillus brevis

- 5.1.2.3. Propionibacteria freundenreichii

- 5.1.1. Homolactic Bacteria

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cereal Crops

- 5.2.1.1. Corn

- 5.2.1.2. Barley

- 5.2.1.3. Oats

- 5.2.1.4. Wheat

- 5.2.1.5. Sorghum

- 5.2.2. Pulse Crops

- 5.2.2.1. Peas

- 5.2.2.2. Clover

- 5.2.2.3. Alfalfa

- 5.2.2.4. Others

- 5.2.3. Others Crops

- 5.2.3.1. Grasses

- 5.2.3.2. Canola

- 5.2.1. Cereal Crops

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Silage Inoculant Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Homolactic Bacteria

- 6.1.1.1. Lactobacillus plantarum

- 6.1.1.2. Pediococcus pentosaceus

- 6.1.1.3. Enterococcus faecium

- 6.1.1.4. Others

- 6.1.2. Heterolactic Bacteria

- 6.1.2.1. Lactobacillus buchneri

- 6.1.2.2. Lactobacillus brevis

- 6.1.2.3. Propionibacteria freundenreichii

- 6.1.1. Homolactic Bacteria

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Cereal Crops

- 6.2.1.1. Corn

- 6.2.1.2. Barley

- 6.2.1.3. Oats

- 6.2.1.4. Wheat

- 6.2.1.5. Sorghum

- 6.2.2. Pulse Crops

- 6.2.2.1. Peas

- 6.2.2.2. Clover

- 6.2.2.3. Alfalfa

- 6.2.2.4. Others

- 6.2.3. Others Crops

- 6.2.3.1. Grasses

- 6.2.3.2. Canola

- 6.2.1. Cereal Crops

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Silage Inoculant Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Homolactic Bacteria

- 7.1.1.1. Lactobacillus plantarum

- 7.1.1.2. Pediococcus pentosaceus

- 7.1.1.3. Enterococcus faecium

- 7.1.1.4. Others

- 7.1.2. Heterolactic Bacteria

- 7.1.2.1. Lactobacillus buchneri

- 7.1.2.2. Lactobacillus brevis

- 7.1.2.3. Propionibacteria freundenreichii

- 7.1.1. Homolactic Bacteria

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Cereal Crops

- 7.2.1.1. Corn

- 7.2.1.2. Barley

- 7.2.1.3. Oats

- 7.2.1.4. Wheat

- 7.2.1.5. Sorghum

- 7.2.2. Pulse Crops

- 7.2.2.1. Peas

- 7.2.2.2. Clover

- 7.2.2.3. Alfalfa

- 7.2.2.4. Others

- 7.2.3. Others Crops

- 7.2.3.1. Grasses

- 7.2.3.2. Canola

- 7.2.1. Cereal Crops

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of South America South America Silage Inoculant Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Homolactic Bacteria

- 8.1.1.1. Lactobacillus plantarum

- 8.1.1.2. Pediococcus pentosaceus

- 8.1.1.3. Enterococcus faecium

- 8.1.1.4. Others

- 8.1.2. Heterolactic Bacteria

- 8.1.2.1. Lactobacillus buchneri

- 8.1.2.2. Lactobacillus brevis

- 8.1.2.3. Propionibacteria freundenreichii

- 8.1.1. Homolactic Bacteria

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Cereal Crops

- 8.2.1.1. Corn

- 8.2.1.2. Barley

- 8.2.1.3. Oats

- 8.2.1.4. Wheat

- 8.2.1.5. Sorghum

- 8.2.2. Pulse Crops

- 8.2.2.1. Peas

- 8.2.2.2. Clover

- 8.2.2.3. Alfalfa

- 8.2.2.4. Others

- 8.2.3. Others Crops

- 8.2.3.1. Grasses

- 8.2.3.2. Canola

- 8.2.1. Cereal Crops

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 ADM Animal Nutrition

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Chr Hansen Holding A/S

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Corteva Agriscience

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Biomin

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Lallemand Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Micron Bio-Systems

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Pearce Group of Companies

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Nutrec

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 ADM Animal Nutrition

List of Figures

- Figure 1: South America Silage Inoculant Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Silage Inoculant Market Share (%) by Company 2025

List of Tables

- Table 1: South America Silage Inoculant Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: South America Silage Inoculant Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: South America Silage Inoculant Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: South America Silage Inoculant Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: South America Silage Inoculant Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: South America Silage Inoculant Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: South America Silage Inoculant Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: South America Silage Inoculant Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: South America Silage Inoculant Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: South America Silage Inoculant Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: South America Silage Inoculant Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: South America Silage Inoculant Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: South America Silage Inoculant Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: South America Silage Inoculant Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: South America Silage Inoculant Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: South America Silage Inoculant Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Silage Inoculant Market?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the South America Silage Inoculant Market?

Key companies in the market include ADM Animal Nutrition, Chr Hansen Holding A/S, Corteva Agriscience, Biomin, Lallemand Inc, Micron Bio-Systems, Pearce Group of Companies, Nutrec.

3. What are the main segments of the South America Silage Inoculant Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growing Demand for Livestock Products.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Silage Inoculant Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Silage Inoculant Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Silage Inoculant Market?

To stay informed about further developments, trends, and reports in the South America Silage Inoculant Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence