Key Insights

The South America feed acidifiers market is projected for significant expansion, forecasted to reach $1.18 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 7.2% from 2024 to 2033. This growth is driven by increasing regional demand for animal protein and enhanced awareness of feed acidifiers' benefits for animal gut health, nutrient absorption, and feed efficiency. Modern animal husbandry practices and stringent food safety regulations, including reduced antibiotic use in feed, further propel market growth. Key applications span ruminants, poultry, swine, and aquaculture, each offering distinct opportunities based on regional demand and production scales.

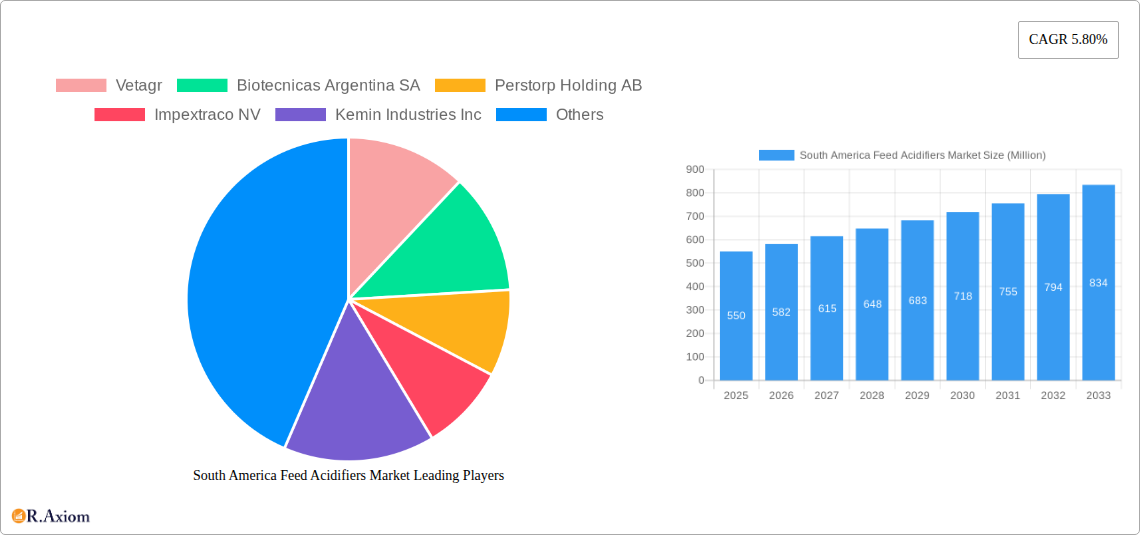

South America Feed Acidifiers Market Market Size (In Billion)

The market is characterized by innovation in product development, with a focus on organic acids such as lactic and propionic acid, favored for their efficacy and safety. Emerging trends include demand for synergistic acidifier blends and granulated or encapsulated forms for improved handling and efficacy. Potential restraints include fluctuating raw material costs and initial investment in advanced feed additive technologies. Brazil and Argentina are expected to lead the market due to substantial livestock populations and significant export contributions. Key industry players include Vetagr, Biotecnicas Argentina SA, Perstorp Holding AB, and Kemin Industries Inc., who are actively engaged in product innovation and strategic partnerships.

South America Feed Acidifiers Market Company Market Share

South America Feed Acidifiers Market: Comprehensive Analysis & Growth Projections (2024-2033)

This comprehensive report offers in-depth insights into the South America Feed Acidifiers Market for the period 2024–2033, with a base year of 2024 and a forecast period of 2024–2033. It provides critical analysis of market dynamics, growth drivers, emerging trends, and competitive landscapes. Understand the vital role of feed acidifiers in enhancing animal nutrition, promoting gut health, and improving livestock productivity within the region's expanding agricultural sector. This report is indispensable for feed manufacturers, animal nutritionists, additive suppliers, and other stakeholders seeking to leverage significant growth opportunities in the South American animal feed industry.

South America Feed Acidifiers Market Market Concentration & Innovation

The South America Feed Acidifiers Market is characterized by a moderate level of market concentration, with key players like Vetagr, Biotecnicas Argentina SA, Perstorp Holding AB, Impextraco NV, Kemin Industries Inc, Pancosma, Lignotech feed, and Cladan holding significant market share. Innovation is a critical driver, fueled by the increasing demand for antibiotic-free feed solutions and improved animal gut health. Research and development efforts are focused on developing novel organic and inorganic acid formulations that offer enhanced efficacy, better palatability, and improved shelf-life. Regulatory frameworks, while evolving, are generally supportive of feed additives that contribute to animal welfare and food safety, particularly concerning the reduction of pathogens in animal feed. Product substitutes, such as probiotics and prebiotics, exist but acidifiers offer unique benefits in terms of pH control and antimicrobial activity, particularly in feed preservation and digestive efficiency. End-user trends are strongly influenced by consumer demand for higher quality meat, milk, and egg products, which directly translates to a demand for healthier animal feed. Mergers and acquisitions (M&A) activity, while not extensive, plays a role in consolidating market presence and expanding product portfolios. For instance, strategic acquisitions aimed at integrating R&D capabilities and distribution networks are observed, with deal values ranging from tens of millions to hundreds of millions of dollars, further shaping the competitive landscape.

South America Feed Acidifiers Market Industry Trends & Insights

The South America Feed Acidifiers Market is experiencing robust growth, driven by a confluence of factors meticulously analyzed within this report. The primary growth driver is the escalating demand for enhanced animal nutrition and gut health in livestock production, particularly in the poultry, swine, and ruminant sectors. As antibiotic growth promoters face increasing scrutiny and regulatory restrictions globally, feed acidifiers have emerged as a highly effective and sustainable alternative for improving feed digestibility, nutrient absorption, and disease prevention. This shift towards antibiotic-free production methods is a significant catalyst for market expansion, as producers seek to maintain optimal animal performance and health. Technological disruptions are also playing a crucial role, with advancements in encapsulation technologies leading to the development of more stable and targeted release acidifiers. These innovations ensure that the active acid compounds reach their intended site of action in the animal's digestive tract, maximizing their efficacy. Furthermore, the growing adoption of precision farming techniques and data-driven animal husbandry is enabling a more nuanced understanding of the benefits of feed acidifiers, leading to optimized application strategies. Consumer preferences for safe, healthy, and ethically produced animal protein are indirectly fueling the demand for feed acidifiers, as they contribute to better animal welfare and reduced reliance on antibiotics. The competitive dynamics within the market are characterized by intense R&D investment, strategic partnerships, and a focus on product differentiation. Key players are investing heavily in understanding the specific needs of different animal species and regional production systems to offer tailored solutions. The market penetration of feed acidifiers is steadily increasing across South America, with an estimated Compound Annual Growth Rate (CAGR) of XX% expected during the forecast period. The market size is projected to reach USD XX Million by 2033, up from an estimated USD XX Million in 2025. This growth is further supported by favorable government policies promoting livestock productivity and food security in various South American nations. The increasing sophistication of animal feed formulations and the growing awareness of the economic benefits derived from improved animal health and growth rates are all contributing to the sustained upward trajectory of this vital market segment.

Dominant Markets & Segments in South America Feed Acidifiers Market

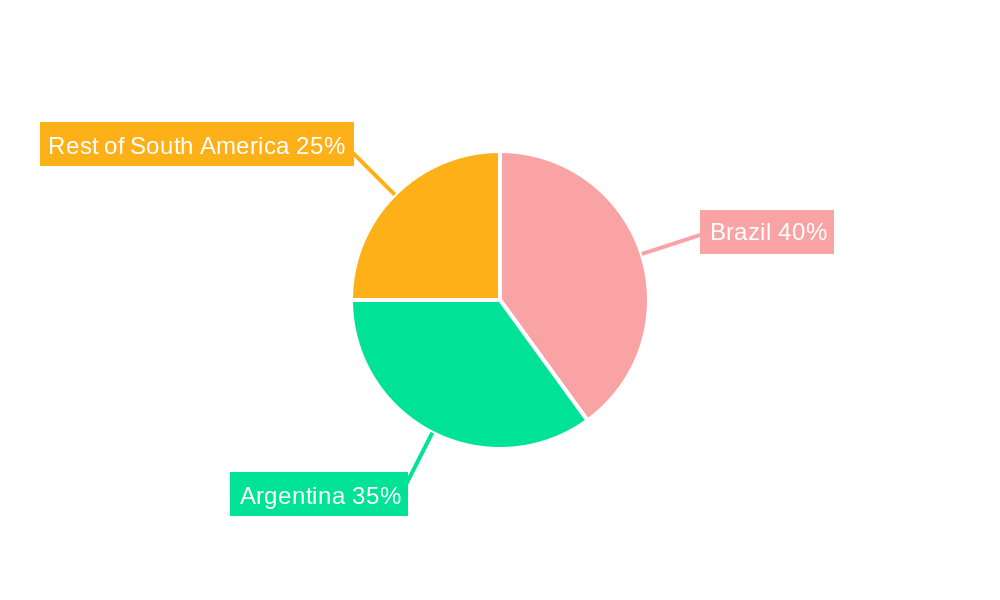

The South America Feed Acidifiers Market is a dynamic landscape with distinct regional and segment-specific dominance. Brazil stands out as the dominant geographical market, driven by its massive livestock industry, particularly in poultry and swine production. The country's strong export orientation in animal protein creates a sustained demand for high-quality feed ingredients that enhance productivity and ensure food safety. Economic policies aimed at boosting agricultural output and investments in advanced farming technologies further solidify Brazil's leading position. Argentina also represents a significant and growing market, with a robust cattle industry contributing substantially to the demand for ruminant feed acidifiers. The region's rich agricultural heritage and ongoing modernization of its livestock sector create a fertile ground for the adoption of feed acidifier solutions. The "Rest of South America," encompassing countries like Colombia, Chile, and Peru, collectively represents a substantial and expanding market, albeit with varying degrees of development in their respective livestock sectors.

Within the Type segmentation, Propionic Acid currently holds a dominant position due to its excellent mold inhibition properties, making it crucial for feed preservation, especially in humid South American climates. Its effectiveness in preventing spoilage and maintaining feed quality is a significant advantage for feed manufacturers. Lactic Acid is a rapidly growing segment, driven by its antimicrobial efficacy against common feedborne pathogens and its positive impact on gut health. Its natural origin also aligns with the increasing consumer demand for natural feed ingredients. Fumaric Acid is gaining traction for its cost-effectiveness and its role in improving feed palatability and nutrient utilization. Other Types, including formic acid and blends of organic acids, are also carving out niche markets based on specific application needs and performance benefits.

In terms of Animal Type, the Poultry segment dominates the South America Feed Acidifiers Market. The intensive nature of poultry farming, coupled with the rapid growth cycles of birds, necessitates efficient feed conversion and disease prevention, making acidifiers an indispensable additive. The Swine segment is also a major consumer, as acidifiers play a vital role in improving gut health, reducing the incidence of post-weaning diarrhea, and enhancing growth performance in pigs. The Ruminant segment, though historically less dominant for acidifiers compared to poultry and swine, is witnessing a significant upward trend. This is driven by the increasing adoption of acidifiers for managing ruminal acidosis, improving feed efficiency, and boosting milk production in dairy cattle, as well as enhancing weight gain in beef cattle. The Aquaculture segment, while smaller in comparison, presents a promising growth opportunity as aquaculture production expands across South America, requiring optimized feed solutions for fish and shrimp health.

South America Feed Acidifiers Market Product Developments

Product development in the South America Feed Acidifiers Market is centered on enhancing efficacy, improving handling, and catering to specific animal health needs. Innovations include microencapsulated acidifiers for targeted release, buffered acid blends for reduced corrosivity and improved palatability, and synergistic formulations combining acids with other functional feed additives. These advancements offer competitive advantages by providing superior antimicrobial protection, promoting gut barrier function, and optimizing nutrient absorption, ultimately leading to improved animal performance and a reduced need for antibiotics.

Report Scope & Segmentation Analysis

This report meticulously segments the South America Feed Acidifiers Market across key dimensions to provide a granular understanding of market dynamics. The Type segmentation includes Lactic Acid, Propionic Acid, Fumaric Acid, and Other Types, each analyzed for its market share, growth projections, and key applications. The Animal Type segmentation covers Ruminant, Poultry, Swine, and Aquaculture, detailing the specific demands and adoption rates within each sector. Geographically, the market is analyzed by Geography, with dedicated sections for Brazil, Argentina, and the Rest of South America, examining regional drivers, market sizes, and competitive landscapes. Growth projections for each segment are provided, offering insights into future market trends and investment opportunities.

Key Drivers of South America Feed Acidifiers Market Growth

Several key drivers are propelling the South America Feed Acidifiers Market. The increasing demand for antibiotic-free animal production, driven by consumer concerns and regulatory pressures, is a primary catalyst. Advancements in animal nutrition science have underscored the efficacy of acidifiers in improving gut health, nutrient digestibility, and feed conversion ratios, leading to enhanced livestock productivity. Furthermore, favorable government initiatives promoting food security and the growth of the livestock sector across South America are creating a conducive environment for market expansion. The rising awareness among farmers and feed manufacturers regarding the economic benefits of using acidifiers, such as reduced disease incidence and improved profitability, also contributes significantly to market growth.

Challenges in the South America Feed Acidifiers Market Sector

Despite the positive growth trajectory, the South America Feed Acidifiers Market faces certain challenges. The perceived cost of acidifiers compared to traditional feed ingredients can be a barrier for some smaller producers, particularly in price-sensitive markets. Navigating diverse and sometimes evolving regulatory landscapes across different South American countries requires significant effort and investment from market players. Supply chain disruptions and logistical complexities in a vast continent can also impact the availability and cost-effectiveness of acidifier products. Moreover, the presence of well-established and cost-effective substitutes, such as certain mineral salts and other feed additives, presents ongoing competitive pressures. Quantifiable impacts of these challenges are often seen in slower adoption rates in less developed regions and increased R&D investment in cost-reduction strategies.

Emerging Opportunities in South America Feed Acidifiers Market

The South America Feed Acidifiers Market presents a wealth of emerging opportunities. The growing adoption of organic and natural feed additives is creating a strong demand for lactic acid and other naturally derived acidifiers. The expansion of aquaculture production across the region offers a nascent but rapidly growing segment for specialized feed acidifier solutions. Furthermore, the increasing focus on precision nutrition and personalized feed formulations opens avenues for developing tailored acidifier blends for specific animal breeds, age groups, and production stages. The untapped potential in smaller South American markets, with their growing livestock sectors, represents significant expansion opportunities for innovative and cost-effective feed acidifier products.

Leading Players in the South America Feed Acidifiers Market Market

- Vetagr

- Biotecnicas Argentina SA

- Perstorp Holding AB

- Impextraco NV

- Kemin Industries Inc

- Pancosma

- Lignotech feed

- Cladan

Key Developments in South America Feed Acidifiers Market Industry

- 2023/10: Launch of a new buffered propionic acid blend for enhanced mold inhibition and animal safety by a leading global feed additive manufacturer.

- 2022/05: Biotecnicas Argentina SA expands its product portfolio with novel organic acid combinations targeting gut health in swine.

- 2021/11: Kemin Industries Inc. invests in expanding its research and development facilities in Brazil to cater to the growing South American market.

- 2020/07: Perstorp Holding AB strengthens its distribution network in Colombia to improve market reach for its feed acidifier range.

Strategic Outlook for South America Feed Acidifiers Market Market

The strategic outlook for the South America Feed Acidifiers Market is overwhelmingly positive, characterized by sustained growth and increasing adoption. The continued global push for antibiotic-free animal production will remain a primary growth catalyst, driving demand for effective alternatives like acidifiers. Investments in research and development focused on enhancing product efficacy, palatability, and environmental sustainability will be crucial for market players to maintain a competitive edge. Expansion into emerging markets within South America and the development of customized solutions for specific regional needs and animal species will unlock significant new revenue streams. Strategic partnerships and potential M&A activities will likely shape the competitive landscape further, enabling companies to consolidate market share and leverage synergistic benefits. The market is poised for significant expansion, driven by the fundamental need for improved animal health, productivity, and food safety across the continent.

South America Feed Acidifiers Market Segmentation

-

1. Type

- 1.1. Lactic Acid

- 1.2. Propionic Acid

- 1.3. Fumaric Acid

- 1.4. Other Types

-

2. Animal Type

- 2.1. Ruminant

- 2.2. Poultry

- 2.3. Swine

- 2.4. Aquaculture

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Feed Acidifiers Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Feed Acidifiers Market Regional Market Share

Geographic Coverage of South America Feed Acidifiers Market

South America Feed Acidifiers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Fish Meal and Fish Oil Production; Demand for Quality Animal Feed

- 3.3. Market Restrains

- 3.3.1. High Prices of Fish Meal and Fish Oil Products; Threat to Fish Reserves

- 3.4. Market Trends

- 3.4.1. Increasing Animal Production Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Feed Acidifiers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Lactic Acid

- 5.1.2. Propionic Acid

- 5.1.3. Fumaric Acid

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Ruminant

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Aquaculture

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Feed Acidifiers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Lactic Acid

- 6.1.2. Propionic Acid

- 6.1.3. Fumaric Acid

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Ruminant

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Aquaculture

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Feed Acidifiers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Lactic Acid

- 7.1.2. Propionic Acid

- 7.1.3. Fumaric Acid

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Ruminant

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Aquaculture

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of South America South America Feed Acidifiers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Lactic Acid

- 8.1.2. Propionic Acid

- 8.1.3. Fumaric Acid

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Ruminant

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Aquaculture

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Vetagr

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Biotecnicas Argentina SA

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Perstorp Holding AB

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Impextraco NV

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Kemin Industries Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 pancosma

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Lignotech feed

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Cladan

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Vetagr

List of Figures

- Figure 1: South America Feed Acidifiers Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Feed Acidifiers Market Share (%) by Company 2025

List of Tables

- Table 1: South America Feed Acidifiers Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: South America Feed Acidifiers Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 3: South America Feed Acidifiers Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: South America Feed Acidifiers Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: South America Feed Acidifiers Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: South America Feed Acidifiers Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 7: South America Feed Acidifiers Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: South America Feed Acidifiers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: South America Feed Acidifiers Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: South America Feed Acidifiers Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 11: South America Feed Acidifiers Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: South America Feed Acidifiers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: South America Feed Acidifiers Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: South America Feed Acidifiers Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 15: South America Feed Acidifiers Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: South America Feed Acidifiers Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Feed Acidifiers Market?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the South America Feed Acidifiers Market?

Key companies in the market include Vetagr, Biotecnicas Argentina SA, Perstorp Holding AB, Impextraco NV, Kemin Industries Inc, pancosma, Lignotech feed, Cladan.

3. What are the main segments of the South America Feed Acidifiers Market?

The market segments include Type, Animal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.18 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Fish Meal and Fish Oil Production; Demand for Quality Animal Feed.

6. What are the notable trends driving market growth?

Increasing Animal Production Drives the Market.

7. Are there any restraints impacting market growth?

High Prices of Fish Meal and Fish Oil Products; Threat to Fish Reserves.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Feed Acidifiers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Feed Acidifiers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Feed Acidifiers Market?

To stay informed about further developments, trends, and reports in the South America Feed Acidifiers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence