Key Insights

The North America Feed Phytogenics Market is projected to expand significantly, with an estimated market size of 734.1 million and a Compound Annual Growth Rate (CAGR) of 5.41% from the base year 2025 through 2033. This growth is propelled by the escalating demand for animal protein, increased consumer focus on meat product safety and quality, and a robust industry commitment to reducing antibiotic reliance in animal feed. Phytogenic feed additives, derived from plant sources, offer a natural and effective alternative to synthetic growth promoters and antibiotics, addressing concerns surrounding antimicrobial resistance and promoting animal welfare. The market is segmented by product type, with Essential Oils and Oleoresins expected to gain substantial traction due to their potent bioactive compounds and ease of integration into animal diets. Key application areas include Poultry and Swine, with Ruminant and Aquaculture also anticipated to be significant growth segments, as phytogenics are increasingly adopted to enhance gut health, improve feed efficiency, and bolster immune responses in these animals.

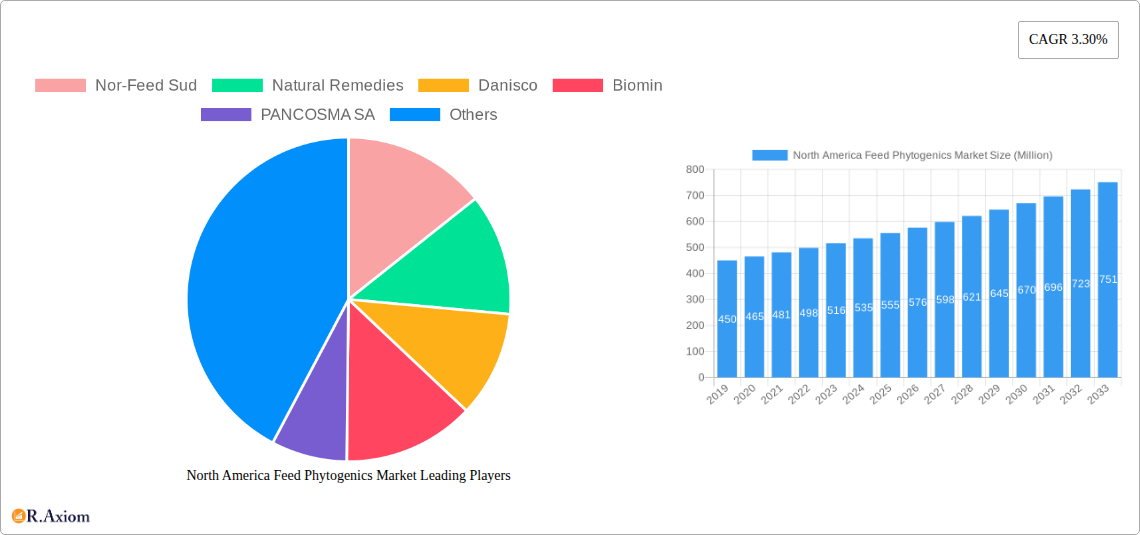

North America Feed Phytogenics Market Market Size (In Million)

Market expansion is further supported by trends such as the growing adoption of novel and synergistic phytogenic blends, continuous innovation in extraction and formulation technologies for enhanced efficacy and stability, and increasing regulatory support for natural feed additives. Potential challenges include variability in raw plant material quality and efficacy, the need for more extensive scientific validation and standardization of phytogenic products, and potentially higher initial costs compared to conventional additives. Despite these hurdles, leading companies are actively investing in research and development and strategic collaborations to broaden their product portfolios and geographic presence. The North American market, comprising the United States, Mexico, and Canada, presents substantial opportunities for expansion, driven by advanced animal husbandry practices and a proactive approach to sustainable feed solutions.

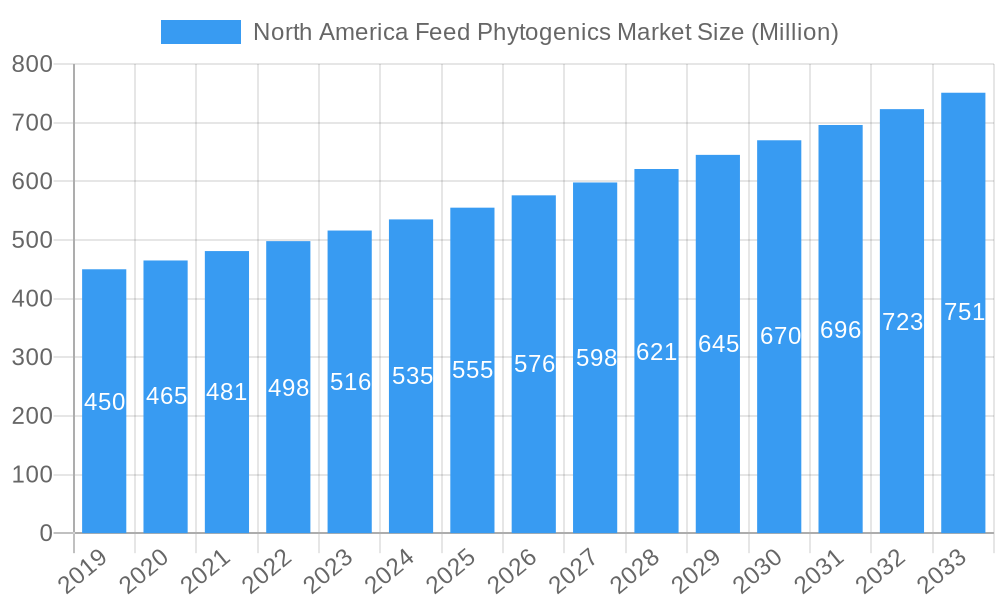

North America Feed Phytogenics Market Company Market Share

This comprehensive market research report provides an in-depth analysis of the North America Feed Phytogenics Market, detailing its current status, historical performance, and future forecasts. We examine market concentration, innovation drivers, industry trends, dominant segments, product developments, key growth factors, challenges, and emerging opportunities, offering actionable insights for stakeholders. The study encompasses the period from 2019 to 2033, with 2025 serving as the base year, and is meticulously structured to deliver a holistic understanding of market dynamics for informed strategic decision-making.

North America Feed Phytogenics Market Market Concentration & Innovation

The North America Feed Phytogenics Market exhibits moderate market concentration, with a mix of established global players and emerging regional specialists. Innovation is a key differentiator, driven by increasing demand for natural and sustainable animal feed additives. Companies are heavily investing in research and development to enhance the efficacy and broaden the application of phytogenic compounds, focusing on areas like improved gut health, antioxidant properties, and antimicrobial benefits. Regulatory frameworks, particularly in the United States and Canada, are evolving to support the adoption of natural feed ingredients, albeit with varying approval processes. Product substitutes, primarily synthetic additives, continue to pose a competitive challenge, although consumer and producer preference is shifting towards natural alternatives. End-user trends highlight a growing emphasis on animal welfare, food safety, and reducing antibiotic use in livestock production, directly fueling the demand for phytogenic feed solutions. Mergers and acquisitions (M&A) activities are expected to increase as larger companies seek to acquire innovative technologies and expand their market reach. For instance, hypothetical M&A deals in the range of $50 Million to $200 Million are anticipated for key acquisitions.

- Innovation Drivers: Enhanced animal health and performance, antibiotic reduction initiatives, consumer demand for natural and sustainable products, improved feed conversion ratios, and a focus on animal welfare.

- Regulatory Frameworks: Growing acceptance of GRAS (Generally Recognized As Safe) status for natural ingredients, supportive policies for antibiotic-free production in countries like the US and Canada.

- Product Substitutes: Synthetic antioxidants, antibiotics, and other growth promoters, although their market share is gradually declining.

- End-User Trends: Increased demand for traceable and sustainably sourced animal products, focus on gut microbiome health in animals, and a preference for non-GMO ingredients.

- M&A Activities: Strategic acquisitions to gain access to novel phytogenic formulations, expand product portfolios, and strengthen market presence.

North America Feed Phytogenics Market Industry Trends & Insights

The North America Feed Phytogenics Market is poised for robust growth, driven by a confluence of escalating demand for natural animal feed solutions and a conscious shift away from antibiotic growth promoters. The estimated market size for 2025 is expected to reach approximately $1,200 Million, with a projected Compound Annual Growth Rate (CAGR) of 8.5% from 2025 to 2033. This growth is underpinned by a growing awareness among livestock producers regarding the multifaceted benefits of phytogenic feed additives. These benefits extend beyond mere growth promotion, encompassing significant improvements in animal gut health, immune function, and overall well-being, leading to enhanced feed efficiency and reduced mortality rates. Technological disruptions are playing a pivotal role, with advancements in extraction and formulation techniques leading to more potent and bioavailable phytogenic compounds. This allows for precise dosing and targeted delivery, maximizing their efficacy in various animal species. Consumer preferences are increasingly influencing the agricultural sector, with a heightened demand for antibiotic-free meat, dairy, and egg products. This trend directly translates into a greater need for effective alternatives to antibiotics, positioning phytogenics as a prime solution. Competitive dynamics are intensifying, characterized by product differentiation, strategic partnerships, and a focus on providing customized solutions to meet the specific needs of different livestock segments. The market penetration of phytogenics is steadily increasing across all major animal categories, including poultry, swine, and ruminants, with significant potential also seen in aquaculture. The industry is also witnessing a trend towards the development of synergistic blends of different phytogenic ingredients to achieve a broader spectrum of benefits, further enhancing their market appeal and effectiveness. The market is dynamic, with ongoing research exploring novel plant-based compounds and their applications in animal nutrition, contributing to a sustained upward trajectory.

Dominant Markets & Segments in North America Feed Phytogenics Market

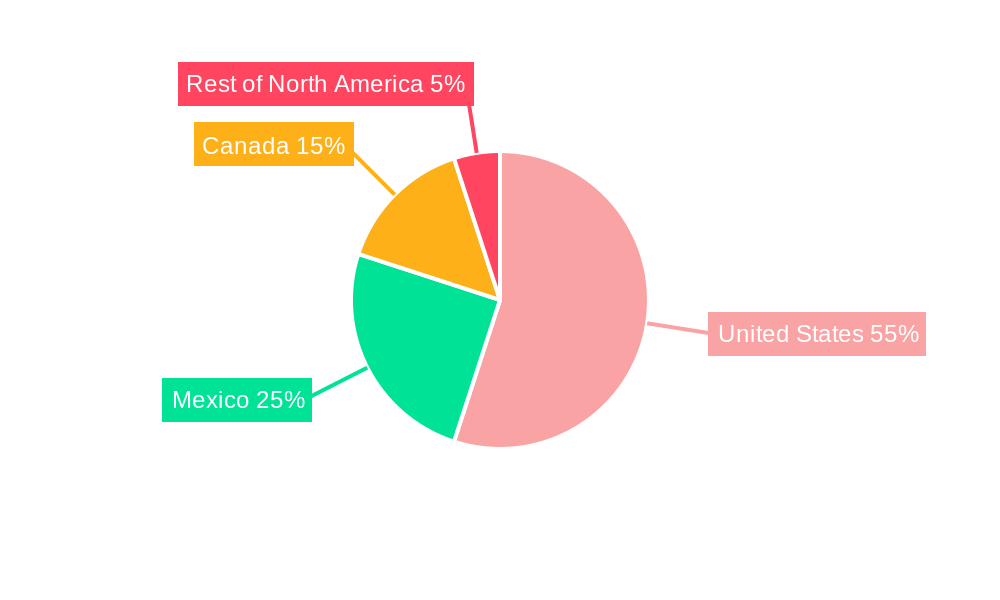

The North America Feed Phytogenics Market is significantly influenced by its dominant geographical regions and key application segments, reflecting diverse livestock production practices and evolving consumer demands. The United States stands as the largest and most influential market within North America, driven by its vast livestock industry, advanced agricultural technology, and strong emphasis on sustainable farming practices. Its substantial market share is attributed to factors such as robust economic policies supporting agricultural innovation, well-established infrastructure for feed production and distribution, and a proactive approach to animal welfare and food safety regulations that encourage the adoption of natural feed additives.

Among the Type segments, Herbs and Essential Oils collectively represent the largest share of the market. This dominance is due to their established efficacy in improving gut health, acting as natural antioxidants, and possessing antimicrobial properties, which are crucial for reducing reliance on antibiotics.

In terms of Application, Poultry and Swine segments are the primary revenue generators. The high density of production in these sectors, coupled with the critical need for efficient feed conversion and disease prevention, makes them ideal candidates for phytogenic solutions. Poultry producers, in particular, have been early adopters, seeking natural alternatives to enhance growth and gut integrity. Swine producers are increasingly leveraging phytogenics to manage gut health challenges and improve performance in a post-antibiotic era.

The Mexico market is a rapidly growing segment, driven by an expanding livestock population and increasing adoption of modern farming techniques. Economic growth and a rising demand for animal protein contribute to its increasing significance. Canada also represents a substantial market, characterized by a strong focus on animal welfare and a supportive regulatory environment for natural feed ingredients. The "Rest of North America" segment, while smaller, encompasses emerging markets with potential for future growth, influenced by regional agricultural policies and the increasing global trend towards natural feed additives. The overall dominance is a result of these interconnected geographical and application-specific factors, highlighting the market's responsiveness to both production demands and ethical consumer considerations.

Dominant Geography:

- United States: Largest market share due to extensive livestock industry, advanced technology, and supportive regulations.

- Key Drivers: High animal protein consumption, significant investment in R&D for animal nutrition, strong consumer demand for antibiotic-free products.

- Mexico: Rapidly growing market driven by expanding livestock population and adoption of modern farming.

- Key Drivers: Increasing demand for animal protein, growing export markets for livestock products, improving agricultural infrastructure.

- Canada: Significant market with a focus on animal welfare and natural ingredient acceptance.

- Key Drivers: Government initiatives promoting sustainable agriculture, strong consumer preference for ethically produced food, established feed industry.

- United States: Largest market share due to extensive livestock industry, advanced technology, and supportive regulations.

Dominant Segments:

- Type:

- Herbs: Widely used for their diverse therapeutic properties, including antimicrobial and anti-inflammatory effects.

- Key Drivers: Cost-effectiveness, broad spectrum of benefits, traditional use in animal husbandry.

- Essential Oils: Potent sources of bioactive compounds known for their antimicrobial and antioxidant capabilities.

- Key Drivers: High concentration of active ingredients, proven efficacy in improving gut health, natural alternative to synthetic additives.

- Herbs: Widely used for their diverse therapeutic properties, including antimicrobial and anti-inflammatory effects.

- Application:

- Poultry: High adoption due to its impact on growth performance, gut integrity, and disease resistance.

- Key Drivers: Intensive production systems, susceptibility to gut-related issues, demand for antibiotic-free poultry meat.

- Swine: Growing demand for gut health management and performance enhancement in the absence of antibiotics.

- Key Drivers: Management of post-weaning diarrhea, improving feed conversion ratio, reducing reliance on in-feed antibiotics.

- Poultry: High adoption due to its impact on growth performance, gut integrity, and disease resistance.

- Type:

North America Feed Phytogenics Market Product Developments

Product developments in the North America Feed Phytogenics Market are largely focused on enhancing the efficacy, palatability, and ease of application of plant-derived feed additives. Companies are investing in advanced extraction technologies to isolate and concentrate key bioactive compounds, such as carvacrol, thymol, and capsaicin, for greater potency. Formulations are evolving to include microencapsulation and other controlled-release technologies, ensuring optimal delivery and stability within the animal's digestive tract. Competitive advantages are being gained through the development of synergistic blends that target multiple physiological pathways, offering broader benefits for animal health and performance. Innovations are also centered on tailoring specific phytogenic solutions for different animal species and life stages, addressing unique nutritional and health challenges.

Report Scope & Segmentation Analysis

This report meticulously analyzes the North America Feed Phytogenics Market across key segmentation criteria. The Type segmentation includes Herbs, Species, Essential Oils, Oleoresins, and Others, each representing distinct sources and applications of plant-based feed additives, with projected market growth expected to be highest in Essential Oils due to their concentrated bioactivity. The Application segmentation covers Ruminant, Poultry, Swine, Aquaculture, and Others, with Poultry and Swine currently dominating due to intensive farming practices and a push for antibiotic reduction, though Aquaculture shows strong future potential. Geographically, the market is segmented into the United States, Mexico, and Canada, with the United States holding the largest market share but Mexico and Canada exhibiting robust growth rates. The report provides detailed insights into the market size and competitive dynamics within each of these segments, offering growth projections for the forecast period of 2025–2033.

Key Drivers of North America Feed Phytogenics Market Growth

The North America Feed Phytogenics Market is propelled by several critical drivers. Foremost among these is the escalating global demand for antibiotic-free animal products, directly increasing the need for viable alternatives like phytogenics. Technological advancements in extraction and formulation are enhancing the efficacy and bioavailability of these natural compounds, making them more attractive to producers. Growing consumer awareness regarding animal welfare and sustainable farming practices also plays a significant role, encouraging the adoption of environmentally friendly feed solutions. Furthermore, supportive regulatory policies in some North American countries are easing the market entry and acceptance of phytogenic feed additives. The inherent benefits of phytogenics, such as improved gut health, enhanced immune function, and better feed conversion ratios, provide a strong economic incentive for their integration into animal diets.

Challenges in the North America Feed Phytogenics Market Sector

Despite its promising growth trajectory, the North America Feed Phytogenics Market faces several challenges. Regulatory hurdles and varying approval processes across different regions can create complexities for market entry and product standardization. The cost-effectiveness of phytogenic additives compared to synthetic alternatives can sometimes be a barrier, particularly for smaller producers. Ensuring consistent quality and efficacy of plant-derived ingredients can also be challenging due to variations in sourcing and processing. Intense competition from established synthetic additives, which often have a longer track record and wider market penetration, continues to exert pressure. Supply chain complexities and the potential for price volatility of raw botanical materials can also impact market stability.

Emerging Opportunities in North America Feed Phytogenics Market

Emerging opportunities in the North America Feed Phytogenics Market are abundant and diverse. The expanding aquaculture sector presents a significant untapped market for phytogenic solutions, as producers seek ways to improve fish health and growth sustainably. There is also growing interest in developing functional phytogenic blends tailored for specific animal health concerns, such as stress reduction or improved reproductive performance. The increasing consumer demand for transparency and traceability in the food chain is creating opportunities for phytogenic products that are perceived as natural and ethically sourced. Furthermore, ongoing research into novel plant species and their bioactive compounds promises to unlock new applications and enhance the efficacy of existing products, driving innovation and market expansion.

Leading Players in the North America Feed Phytogenics Market Market

- Nor-Feed Sud

- Natural Remedies

- Danisco

- Biomin

- PANCOSMA SA

- Delacon Biotechnik

- Bayir extract Pvt Ltd

- Phytosynthse

- Dostofarm

- Igusol

- Phytobiotics

- A&A Pharmachem Inc

- Kemin

Key Developments in North America Feed Phytogenics Market Industry

- 2023: Launch of a new range of synergistic essential oil blends for poultry, focusing on improved gut health and antibiotic reduction.

- 2022: Strategic partnership formed to develop novel extraction techniques for enhanced bioavailability of oregano-based phytogenics.

- 2021: Acquisition of a specialized phytogenic ingredient supplier to expand product portfolio and market reach in the US.

- 2020: Introduction of a new oleoresin-based additive for swine, demonstrating significant improvements in feed conversion ratio.

- 2019: Expansion of R&D facilities dedicated to exploring new plant sources for antimicrobial and antioxidant compounds in animal feed.

Strategic Outlook for North America Feed Phytogenics Market Market

The strategic outlook for the North America Feed Phytogenics Market remains exceptionally positive. The continued global push towards antibiotic reduction in animal agriculture, coupled with growing consumer demand for natural and sustainable food production, will be the primary catalysts for market expansion. Investments in research and development aimed at enhancing the efficacy, specificity, and cost-effectiveness of phytogenic solutions will be crucial for capturing market share. Strategic collaborations between ingredient manufacturers, feed producers, and animal health companies will foster innovation and facilitate wider adoption. Emerging applications in aquaculture and for addressing specific animal health challenges present significant growth avenues. The market is expected to evolve towards more sophisticated, science-backed phytogenic formulations that offer demonstrable improvements in animal performance, health, and welfare, solidifying their position as a cornerstone of modern animal nutrition.

North America Feed Phytogenics Market Segmentation

-

1. Type

- 1.1. Herbs

- 1.2. Species

- 1.3. Essential Oils

- 1.4. Oleoresins

- 1.5. Others

-

2. Application

- 2.1. Ruminant

- 2.2. Poultry

- 2.3. Swine

- 2.4. Aquaculture

- 2.5. Others

-

3. Geography

- 3.1. United States

- 3.2. Mexico

- 3.3. Canada

- 3.4. Rest of North America

North America Feed Phytogenics Market Segmentation By Geography

- 1. United States

- 2. Mexico

- 3. Canada

- 4. Rest of North America

North America Feed Phytogenics Market Regional Market Share

Geographic Coverage of North America Feed Phytogenics Market

North America Feed Phytogenics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increase in Industrialized Livestock Production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Feed Phytogenics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Herbs

- 5.1.2. Species

- 5.1.3. Essential Oils

- 5.1.4. Oleoresins

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Ruminant

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Aquaculture

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Mexico

- 5.3.3. Canada

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Mexico

- 5.4.3. Canada

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Feed Phytogenics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Herbs

- 6.1.2. Species

- 6.1.3. Essential Oils

- 6.1.4. Oleoresins

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Ruminant

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Aquaculture

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Mexico

- 6.3.3. Canada

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Mexico North America Feed Phytogenics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Herbs

- 7.1.2. Species

- 7.1.3. Essential Oils

- 7.1.4. Oleoresins

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Ruminant

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Aquaculture

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Mexico

- 7.3.3. Canada

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Canada North America Feed Phytogenics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Herbs

- 8.1.2. Species

- 8.1.3. Essential Oils

- 8.1.4. Oleoresins

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Ruminant

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Aquaculture

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Mexico

- 8.3.3. Canada

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Feed Phytogenics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Herbs

- 9.1.2. Species

- 9.1.3. Essential Oils

- 9.1.4. Oleoresins

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Ruminant

- 9.2.2. Poultry

- 9.2.3. Swine

- 9.2.4. Aquaculture

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Mexico

- 9.3.3. Canada

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Nor-Feed Sud

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Natural Remedies

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Danisco

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Biomin

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 PANCOSMA SA

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Delacon Biotechnik

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Bayir extract Pvt Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Phytosynthse

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Dostofarm

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Igusol

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Phytobiotics

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 A&A Pharmachem Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Kemin

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Nor-Feed Sud

List of Figures

- Figure 1: North America Feed Phytogenics Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Feed Phytogenics Market Share (%) by Company 2025

List of Tables

- Table 1: North America Feed Phytogenics Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: North America Feed Phytogenics Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: North America Feed Phytogenics Market Revenue million Forecast, by Geography 2020 & 2033

- Table 4: North America Feed Phytogenics Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: North America Feed Phytogenics Market Revenue million Forecast, by Type 2020 & 2033

- Table 6: North America Feed Phytogenics Market Revenue million Forecast, by Application 2020 & 2033

- Table 7: North America Feed Phytogenics Market Revenue million Forecast, by Geography 2020 & 2033

- Table 8: North America Feed Phytogenics Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: North America Feed Phytogenics Market Revenue million Forecast, by Type 2020 & 2033

- Table 10: North America Feed Phytogenics Market Revenue million Forecast, by Application 2020 & 2033

- Table 11: North America Feed Phytogenics Market Revenue million Forecast, by Geography 2020 & 2033

- Table 12: North America Feed Phytogenics Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: North America Feed Phytogenics Market Revenue million Forecast, by Type 2020 & 2033

- Table 14: North America Feed Phytogenics Market Revenue million Forecast, by Application 2020 & 2033

- Table 15: North America Feed Phytogenics Market Revenue million Forecast, by Geography 2020 & 2033

- Table 16: North America Feed Phytogenics Market Revenue million Forecast, by Country 2020 & 2033

- Table 17: North America Feed Phytogenics Market Revenue million Forecast, by Type 2020 & 2033

- Table 18: North America Feed Phytogenics Market Revenue million Forecast, by Application 2020 & 2033

- Table 19: North America Feed Phytogenics Market Revenue million Forecast, by Geography 2020 & 2033

- Table 20: North America Feed Phytogenics Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Feed Phytogenics Market?

The projected CAGR is approximately 5.41%.

2. Which companies are prominent players in the North America Feed Phytogenics Market?

Key companies in the market include Nor-Feed Sud, Natural Remedies, Danisco, Biomin, PANCOSMA SA, Delacon Biotechnik, Bayir extract Pvt Ltd, Phytosynthse, Dostofarm, Igusol, Phytobiotics, A&A Pharmachem Inc, Kemin.

3. What are the main segments of the North America Feed Phytogenics Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 734.1 million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increase in Industrialized Livestock Production.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Feed Phytogenics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Feed Phytogenics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Feed Phytogenics Market?

To stay informed about further developments, trends, and reports in the North America Feed Phytogenics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence