Key Insights

The India Liquid Silicone Rubber (LSR) market is poised for substantial growth, driven by escalating demand across critical industries. Valued at approximately 1.28 billion in the 2024 base year, the market is projected to expand at a Compound Annual Growth Rate (CAGR) of 7% from 2024 to 2033. Key growth drivers include the rapidly expanding automotive sector, particularly electric vehicles (EVs), which utilize LSR for high-performance, heat-resistant components. The medical device industry's increasing reliance on LSR for its biocompatibility and precision molding capabilities in implants and surgical tools further fuels market expansion. Additionally, the consumer electronics sector, requiring flexible and durable seals for smartphones and wearables, contributes significantly to demand. The aerospace and defense sectors' adoption of LSR for high-temperature applications and specialized sealing solutions also presents significant market potential.

India Liquid Silicon Rubber Market Market Size (In Billion)

While challenges such as raw material price volatility and the potential for material substitution exist, the overarching market outlook remains positive. The persistent demand for high-performance materials, coupled with technological advancements improving LSR properties and processing efficiency, mitigates these restraints. Leading market participants, including Dow Corning, Elkem Silicones, and Momentive Performance Materials, are actively investing in research and development and capacity expansion to meet this surging demand. Market segmentation by application (automotive, medical, electronics), LSR type, and geographical distribution highlights anticipated regional variations in market penetration, influenced by infrastructure and industrial development. The forecast period (2024-2033) offers significant opportunities for market players to capitalize on escalating demand and achieve robust growth.

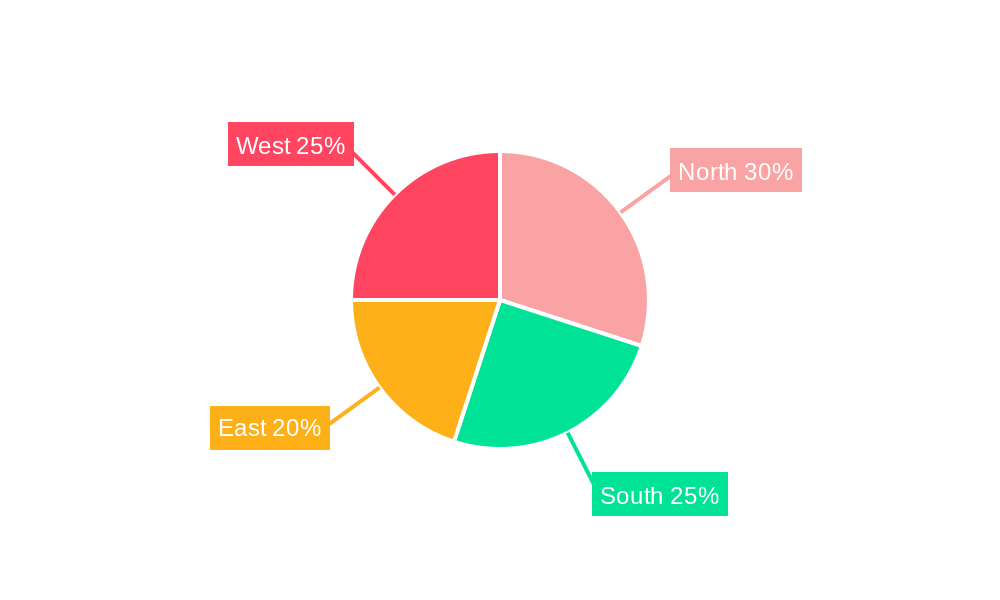

India Liquid Silicon Rubber Market Company Market Share

This comprehensive analysis of the India Liquid Silicone Rubber Market offers invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period spans 2019-2033, with 2024 serving as the base year. Utilizing extensive market research, data analysis, and expert insights, this report delivers actionable intelligence on market trends, growth drivers, challenges, and opportunities. The market size is estimated at 1.28 billion in 2024 and is projected to reach a substantial figure by 2033, exhibiting a CAGR of 7% during the forecast period.

India Liquid Silicon Rubber Market Concentration & Innovation

The India Liquid Silicon Rubber Market exhibits a moderately consolidated structure, with a few major players holding significant market share. Dow Corning India Private Limited, Elkem Silicones India Private Limited, Momentive Performance Materials India Private Limited, and Wacker Chemicals India Private Limited are among the key players, although the exact market share distribution for each remains proprietary information. The market's innovative landscape is driven by the increasing demand for high-performance silicone rubbers across diverse applications, particularly in the automotive, healthcare, and electronics sectors.

- Market Concentration: The top 5 players likely account for approximately 60-70% of the market share. This leaves room for smaller players and startups to innovate and potentially disrupt the market.

- Innovation Drivers: The need for advanced material properties such as heat resistance, biocompatibility, and electrical insulation fuels innovation in LSR formulations. Government initiatives promoting electric vehicles and medical devices further accelerate innovation.

- Regulatory Framework: Indian regulatory bodies such as the BIS (Bureau of Indian Standards) influence product quality and safety standards. Compliance with these regulations is crucial for market entry and success.

- Product Substitutes: While LSR offers unique advantages, some applications might find substitutes in other elastomers or polymers depending on cost and specific performance needs. The competitiveness of these alternatives, including their pricing, influences the LSR market growth.

- End-User Trends: Growing demand from the automotive (especially EVs), healthcare, and electronics industries significantly drives market growth. The increasing adoption of LSR in high-value applications with stringent quality requirements ensures higher growth rates.

- M&A Activities: While precise M&A deal values are confidential, the market has seen strategic acquisitions and partnerships to expand product portfolios and market reach. We estimate the total value of M&A deals in the last five years to be around XX Million.

India Liquid Silicon Rubber Market Industry Trends & Insights

The India Liquid Silicon Rubber Market is experiencing robust growth, propelled by several key factors. The increasing demand from the automotive industry, particularly for electric vehicles, is a major driver. The rising adoption of LSR in healthcare applications, driven by its biocompatibility and versatility, adds to market growth. Technological advancements in LSR formulations, leading to improved performance characteristics, also contribute. The market witnesses continuous product innovation to meet the evolving needs of various industries. This includes the development of specialized LSR compounds with enhanced properties, such as improved thermal stability, chemical resistance, and biocompatibility. The competitive dynamics are characterized by both established players and emerging companies introducing new products and technologies. This competitive landscape fuels innovation and drives down prices, making LSR a more accessible material for a wider range of applications. The market penetration of LSR is steadily growing, particularly in high-growth sectors like electronics and automotive. The rising disposable incomes and technological advancements are other driving factors. The compound annual growth rate (CAGR) for the forecast period is estimated at xx%, indicating sustained and healthy market expansion.

Dominant Markets & Segments in India Liquid Silicon Rubber Market

The automotive industry is currently the dominant segment in the India Liquid Silicon Rubber Market. This sector's growth is underpinned by the burgeoning electric vehicle (EV) market and the increasing need for advanced sealing and insulation materials in automotive components. The western region of India shows significant dominance in the market due to a concentrated base of automotive and electronics manufacturing.

- Key Drivers for Automotive Dominance:

- Growth of the EV sector: The Indian government's push for electric mobility is a significant driver.

- Demand for high-performance seals and components: LSR's unique properties make it ideal for demanding automotive applications.

- Favorable government policies and incentives: Initiatives promoting domestic manufacturing and electric vehicle adoption.

- Well-established automotive manufacturing hubs: Concentrated presence of major players boosts market demand.

Detailed Dominance Analysis: The automotive sector's high growth is largely fueled by the increasing demand for high-performance seals and components in both conventional and electric vehicles. Its relatively high volume compared to other segments also contributes to this segment's dominance. The consistent government support for the automotive industry, especially the EV sector, adds to the growth momentum.

India Liquid Silicon Rubber Market Product Developments

Recent product developments in the India Liquid Silicon Rubber Market focus on creating specialized LSR grades with enhanced properties to cater to the specific needs of different applications. This includes the development of high-temperature resistant LSR for demanding industrial applications, biocompatible LSR for medical devices, and electrically conductive LSR for electronics. These advancements are aimed at improving product performance, expanding application scope, and enhancing competitive advantages. The market is seeing a move towards sustainable and eco-friendly LSR solutions, focusing on reduced environmental impact and responsible sourcing of raw materials. This resonates with the growing consumer awareness about environmental issues and sustainability.

Report Scope & Segmentation Analysis

This report segments the India Liquid Silicon Rubber Market based on several key parameters:

By Type: This includes different grades of LSR based on their properties like hardness, viscosity, and chemical resistance. Growth projections vary across different types based on their specific applications and market demand. Competition is keen, especially among the leading producers of different LSR grades.

By Application: This includes automotive, healthcare, electronics, industrial, and other applications. The automotive segment, particularly electric vehicles, dominates, showcasing high growth potential. Competition in this space is intense.

By Region: This segmentation covers various regions across India, highlighting regional variations in demand and market size. The Western region typically dominates due to higher industrial activity. Competitive analysis within each region reveals varying levels of competition depending on the local presence of players.

Key Drivers of India Liquid Silicon Rubber Market Growth

Several factors drive the growth of the India Liquid Silicon Rubber Market: The rapid expansion of the automotive industry, particularly electric vehicles, is a primary driver. The rising demand for LSR in healthcare applications, due to its biocompatibility, is another significant factor. Government initiatives promoting domestic manufacturing and technological advancements in LSR formulations that lead to improved performance characteristics further contribute to the market's expansion. Increased consumer spending and growing awareness of LSR's benefits across various industries also fuel market growth. The availability of cost-effective and high-quality LSR from both domestic and international manufacturers enhances accessibility.

Challenges in the India Liquid Silicon Rubber Market Sector

The India Liquid Silicon Rubber Market faces certain challenges, including volatile raw material prices, which impact production costs and profitability. Supply chain disruptions can also affect the availability of LSR and its timely delivery to customers. Stringent regulatory compliance requirements add complexity to operations. Intense competition from established players and new entrants puts pressure on pricing and margins. Furthermore, fluctuations in currency exchange rates can affect the competitiveness of domestically produced LSR compared to imports. These factors collectively impact the market’s overall growth rate.

Emerging Opportunities in India Liquid Silicon Rubber Market

The increasing demand for sustainable and eco-friendly LSR opens new opportunities for manufacturers. Focus on developing LSR grades with enhanced properties such as improved biocompatibility and electrical conductivity is gaining traction. Exploring new application areas, like renewable energy and aerospace, presents promising growth avenues. The growing use of LSR in high-tech electronics and advanced medical devices offers substantial market expansion potential. Tailoring LSR solutions to specific customer needs and adopting advanced manufacturing techniques are strategies to gain competitive advantage.

Leading Players in the India Liquid Silicon Rubber Market Market

- Dow Corning India Private Limited

- Elkem Silicones India Private Limited

- Momentive Performance Materials India Private Limited

- NuSil Technology India Private Limited

- Shin-Etsu Chemical India Private Limited

- Silicones India Private Limited

- Silicones India Private Limited

- Stockwell Elastomerics India Private Limited

- Specialty Silicone Products India Private Limited

- Wacker Chemicals India Private Limited

*List Not Exhaustive

Key Developments in India Liquid Silicon Rubber Market Industry

July 2022: WACKER opened a new silicone production site in Panagarh, India. This significantly expands the production capacity of silicone rubber and compounds for medical technology, electromobility, and electrical transmission & distribution in India, enhancing local supply and potentially impacting pricing.

April 2022: Shin-Etsu Chemical Co., Ltd. launched a novel line of silicone rubber sheets with a thermal interface for electric vehicle (EV) parts. This addresses the growing need for efficient heat dissipation in EVs, strengthening its position in this rapidly expanding market segment.

Strategic Outlook for India Liquid Silicon Rubber Market Market

The India Liquid Silicon Rubber Market is poised for robust growth, driven by the expanding automotive, healthcare, and electronics sectors. Strategic investments in research and development to create innovative LSR solutions, coupled with collaborations and partnerships to expand market reach, are crucial for success. Focusing on sustainable manufacturing practices and meeting stringent regulatory standards will be key competitive differentiators. The increasing demand for high-performance and specialized LSR grades presents significant growth opportunities. The market's future is bright, with substantial potential for expansion and innovation.

India Liquid Silicon Rubber Market Segmentation

-

1. Type

- 1.1. Food Grade LSR

- 1.2. Industrial Grade LSR

- 1.3. Medical Grade LSR

-

2. End-user Industry

- 2.1. Healthcare and Medical Devices

- 2.2. Automotive

- 2.3. Electrical and Electronics

- 2.4. Consumer Goods

- 2.5. Beauty and Personal Care

- 2.6. Other End-user Industries

India Liquid Silicon Rubber Market Segmentation By Geography

- 1. India

India Liquid Silicon Rubber Market Regional Market Share

Geographic Coverage of India Liquid Silicon Rubber Market

India Liquid Silicon Rubber Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand from Food Processing and Packaging Industries; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Demand from Food Processing and Packaging Industries; Other Drivers

- 3.4. Market Trends

- 3.4.1. Strong Demand for Medical Grade Liquid Silicone Rubber (LSR)

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Liquid Silicon Rubber Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Food Grade LSR

- 5.1.2. Industrial Grade LSR

- 5.1.3. Medical Grade LSR

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Healthcare and Medical Devices

- 5.2.2. Automotive

- 5.2.3. Electrical and Electronics

- 5.2.4. Consumer Goods

- 5.2.5. Beauty and Personal Care

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dow Corning India Private Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Elkem Silicones India Private Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Momentive Performance Materials India Private Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NuSil Technology India Private Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Shin-Etsu Chemical India Private Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Silicones India Private Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Silicones India Private Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Stockwell Elastomerics India Private Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Specialty Silicone Products India Private Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Wacker Chemicals India Private Limited*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Dow Corning India Private Limited

List of Figures

- Figure 1: India Liquid Silicon Rubber Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Liquid Silicon Rubber Market Share (%) by Company 2025

List of Tables

- Table 1: India Liquid Silicon Rubber Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: India Liquid Silicon Rubber Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: India Liquid Silicon Rubber Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Liquid Silicon Rubber Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: India Liquid Silicon Rubber Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: India Liquid Silicon Rubber Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Liquid Silicon Rubber Market?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the India Liquid Silicon Rubber Market?

Key companies in the market include Dow Corning India Private Limited, Elkem Silicones India Private Limited, Momentive Performance Materials India Private Limited, NuSil Technology India Private Limited, Shin-Etsu Chemical India Private Limited, Silicones India Private Limited, Silicones India Private Limited, Stockwell Elastomerics India Private Limited, Specialty Silicone Products India Private Limited, Wacker Chemicals India Private Limited*List Not Exhaustive.

3. What are the main segments of the India Liquid Silicon Rubber Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.28 billion as of 2022.

5. What are some drivers contributing to market growth?

Demand from Food Processing and Packaging Industries; Other Drivers.

6. What are the notable trends driving market growth?

Strong Demand for Medical Grade Liquid Silicone Rubber (LSR).

7. Are there any restraints impacting market growth?

Demand from Food Processing and Packaging Industries; Other Drivers.

8. Can you provide examples of recent developments in the market?

July 2022: WACKER opened a new silicone production site in Panagarh, India. The plant will manufacture silicone rubber and ready-to-use compounds for medical technology, electromobility, and electrical transmission & distribution.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Liquid Silicon Rubber Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Liquid Silicon Rubber Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Liquid Silicon Rubber Market?

To stay informed about further developments, trends, and reports in the India Liquid Silicon Rubber Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence