Key Insights

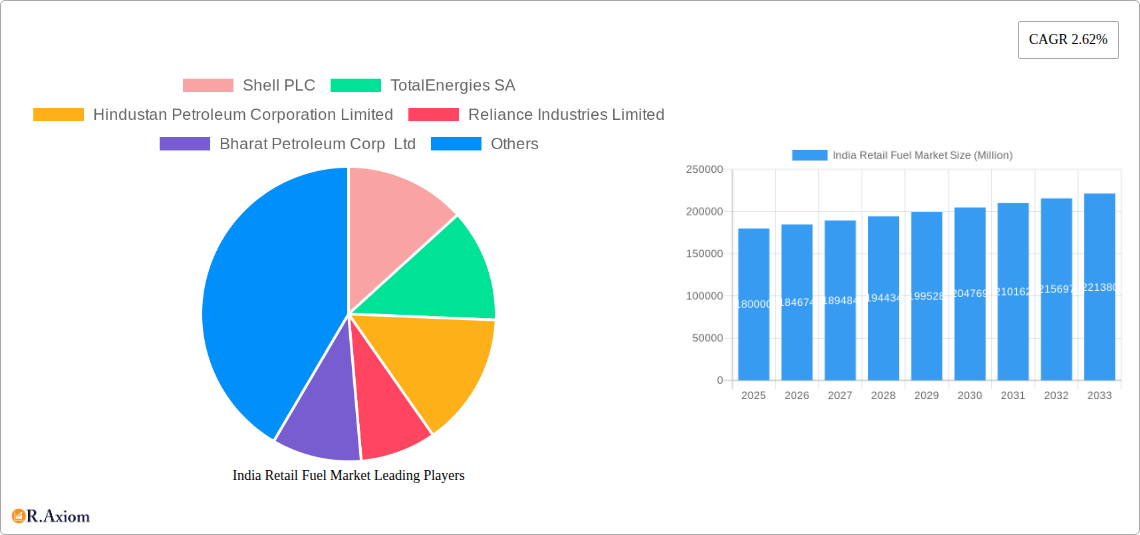

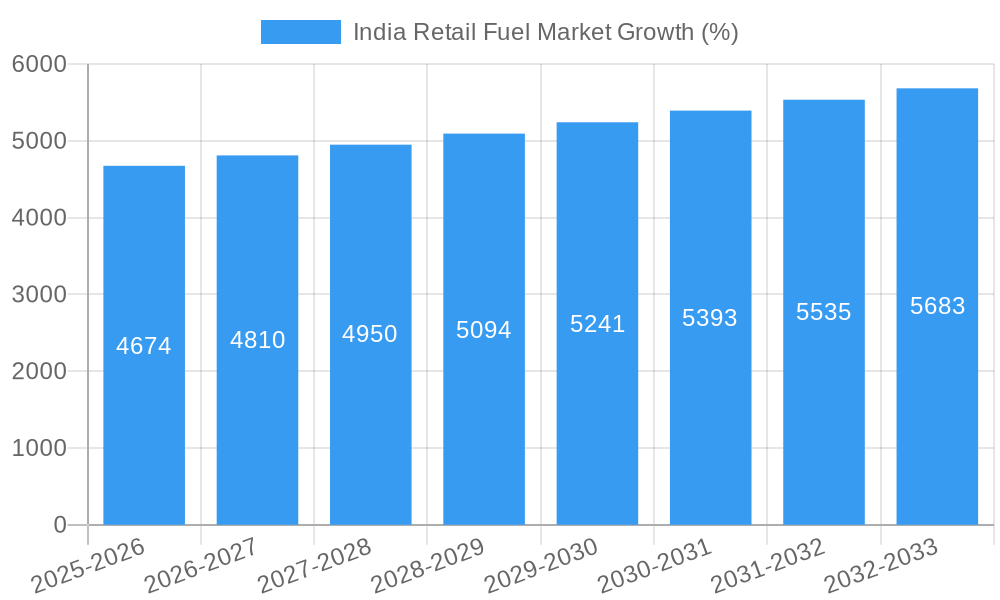

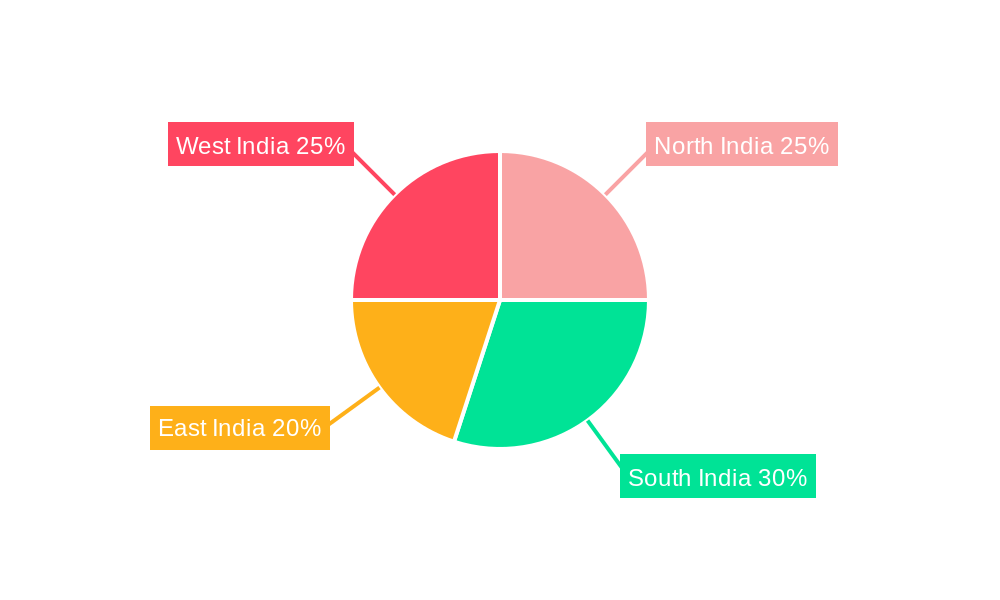

The India retail fuel market, valued at approximately ₹15 trillion (USD 180 billion) in 2025, is projected to experience robust growth, driven by rising vehicle ownership, increasing urbanization, and a burgeoning middle class with higher disposable incomes. The market's Compound Annual Growth Rate (CAGR) of 2.62% from 2025 to 2033 indicates a steady expansion, although this growth may be influenced by fluctuating global crude oil prices and government policies aimed at promoting cleaner energy sources like electric vehicles. Significant regional variations are expected, with South and West India potentially outpacing other regions due to higher economic activity and vehicle density. The dominance of Public Sector Undertakings (PSUs) like Indian Oil Corporation, Bharat Petroleum, and Hindustan Petroleum is anticipated to continue, although private players like Reliance Industries and Nayara Energy are expected to gain market share through aggressive expansion and strategic partnerships. The increasing adoption of digital payment methods and loyalty programs further shapes the market landscape.

Competition within the market is fierce, with major players continuously investing in infrastructure development, enhancing customer service, and exploring new technologies to improve efficiency and expand their retail networks. Growth will also be influenced by factors such as government regulations related to fuel quality and emissions standards, and evolving consumer preferences towards fuel-efficient vehicles. The increasing focus on sustainable practices within the industry presents both challenges and opportunities for market players, requiring strategic adaptation to environmental concerns and the shift towards alternative fuel sources. This dynamic interplay of economic growth, regulatory changes, and technological advancements will define the trajectory of the India retail fuel market over the forecast period.

This comprehensive report provides an in-depth analysis of the India Retail Fuel Market, covering the period 2019-2033. It offers actionable insights into market dynamics, competitive landscape, and future growth opportunities, making it an essential resource for industry stakeholders, investors, and strategic decision-makers. The report leverages extensive primary and secondary research to present a detailed overview of market size, segmentation, trends, and key players. With a base year of 2025 and a forecast period spanning 2025-2033, this report is meticulously crafted to provide a clear understanding of the current market scenario and its future trajectory.

India Retail Fuel Market Concentration & Innovation

This section analyzes the competitive intensity and innovation within the India Retail Fuel Market. The market is characterized by a mix of public sector undertakings (PSUs) and private players, leading to a dynamic competitive landscape. Key metrics like market share and merger & acquisition (M&A) activity are examined to determine market concentration. The report also explores the influence of regulatory frameworks, the emergence of substitute fuels (e.g., ethanol blends), shifting end-user preferences, and the role of technological innovations in driving market evolution.

Market Share Analysis: The report details the market share held by major players like Indian Oil Corporation Ltd, Bharat Petroleum Corp Ltd, Hindustan Petroleum Corporation Limited, Reliance Industries Limited, Nayara Energy Limited, Shell PLC, and TotalEnergies SA. XX% of the market is controlled by Public Sector Undertakings (PSUs), while XX% is held by private companies.

M&A Activities: The report examines recent mergers and acquisitions within the industry, analyzing their impact on market concentration and competitive dynamics. While precise deal values are not publicly available for all transactions, the report provides an estimate of the total M&A deal value in the sector at approximately XX Million during the historical period.

Innovation Drivers: The push for cleaner fuels, driven by government regulations and environmental concerns, is a major innovation driver. The adoption of advanced technologies in fuel delivery and retail operations is also reshaping the market.

Regulatory Framework: The report analyzes the impact of government policies, including those related to fuel pricing, environmental regulations, and ethanol blending mandates.

Product Substitutes: The growing adoption of electric vehicles and alternative fuels poses a threat, forcing incumbents to innovate and diversify their offerings.

End-User Trends: The report analyzes trends in consumption patterns across public and private sectors, highlighting the impact of economic growth and urbanization on fuel demand.

India Retail Fuel Market Industry Trends & Insights

This section delves into the key trends shaping the India Retail Fuel Market. It examines market growth drivers, including rising vehicle ownership, industrialization, and economic expansion. Technological advancements, such as digitalization of retail operations and the adoption of biofuels, are also analyzed. The evolving consumer preferences, influenced by price sensitivity and environmental consciousness, are discussed in detail. The competitive dynamics, characterized by intense price competition and strategic alliances, are explored.

The market is projected to register a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). Market penetration of E20 fuel is expected to reach XX% by 2033, driven by government initiatives. The report further examines the impact of geopolitical factors and global energy prices on the market. The section also details the shift in consumer preferences towards more environment-friendly fuel options and the resultant impact on market demand.

Dominant Markets & Segments in India Retail Fuel Market

This section identifies the leading regions, countries, and segments within the India Retail Fuel Market. The analysis considers both ownership type (Public Sector Undertakings and Private Owned) and end-user (Public Sector and Private Sector).

Dominant Segment: Public Sector Undertakings (Ownership)

Key Drivers: Strong government support, established infrastructure, and extensive distribution networks give PSUs a significant advantage. Government policies favoring ethanol blending significantly boost this sector.

Dominance Analysis: PSUs, with their established market presence and access to resources, command a larger share of the retail fuel market. This dominance is reinforced by government policies and initiatives.

Dominant Segment: Public Sector (End-User)

Key Drivers: Large-scale government projects, defense, and public transportation contribute significantly to fuel demand in the public sector.

Dominance Analysis: Consistent demand from government entities, coupled with subsidized fuel prices for certain segments, solidifies the public sector's dominant position.

Regional Dominance: The report will identify the regions with the highest fuel consumption, based on economic activity, population density, and industrial development. Details of this analysis will be included in the complete report.

India Retail Fuel Market Product Developments

Recent innovations in the retail fuel market include the introduction of E20 fuel (a blend of 20% ethanol and 80% gasoline) as part of the government's push for cleaner fuels. This offers a competitive advantage to companies that adopt this technology early, leading to cost savings and reduced environmental impact. Technological advancements in fuel dispensing systems and digital payment integration are also enhancing customer experience and operational efficiency. The adoption of SD-WAN technology by companies like Indian Oil Corporation is further enhancing the efficiency of their operations.

Report Scope & Segmentation Analysis

This report segments the India Retail Fuel Market based on ownership (Public Sector Undertakings and Private Owned) and end-user (Public Sector and Private Sector).

Ownership: The Public Sector Undertakings segment holds a larger market share due to government support and infrastructure. The Private Owned segment is expected to show faster growth driven by increased investments and expansion.

End-User: The Public Sector segment is a significant consumer of retail fuels due to government projects and operations. The Private Sector segment is driven by personal vehicle use and industrial demands. Growth projections and market sizes will vary across these segments and be further detailed within the full report.

Key Drivers of India Retail Fuel Market Growth

Several factors contribute to the growth of the India Retail Fuel Market. These include rising vehicle ownership fueled by increasing disposable incomes and expanding road infrastructure. Government policies promoting ethanol blending and infrastructure development further stimulate growth. The industrial sector's robust growth is another significant driver. Finally, increasing tourism and transportation also adds to the demand.

Challenges in the India Retail Fuel Market Sector

Challenges include fluctuating global crude oil prices impacting fuel costs and margins. Stringent environmental regulations necessitate investment in cleaner fuel technologies. Intense competition from both established and emerging players also presents a challenge. Supply chain disruptions and the need for continuous infrastructure upgrades add to the complexity of the market.

Emerging Opportunities in India Retail Fuel Market

Opportunities lie in expanding fuel retail networks, particularly in underserved areas. The increasing adoption of electric vehicles creates a need for charging infrastructure and related services. The push for biofuels presents opportunities for companies that can invest in and capitalize on this transition. Finally, innovations in fuel delivery and digital solutions create opportunities for improved efficiency and customer experience.

Leading Players in the India Retail Fuel Market Market

- Shell PLC

- TotalEnergies SA

- Hindustan Petroleum Corporation Limited

- Reliance Industries Limited

- Bharat Petroleum Corp Ltd

- Nayara Energy Limited

- Indian Oil Corporation Ltd

Key Developments in India Retail Fuel Market Industry

- February 2023: The Government of India launched E20 fuel across 11 states and union territories, aiming for 20% ethanol blending by 2025 to reduce emissions.

- February 2023: Jio-bp started selling E20 gasoline at select locations.

- December 2022: Indian Oil Corporation (IOCL) partnered with Reliance Jio to connect 7,200 IOC sites using SD-WAN.

Strategic Outlook for India Retail Fuel Market Market

The India Retail Fuel Market is poised for sustained growth, driven by continued economic expansion, rising vehicle ownership, and government initiatives promoting cleaner fuels. Investment in infrastructure, technological advancements, and the ongoing transition to cleaner energy sources will shape the future of the market. The strategic adoption of biofuels and diversification into related services will offer significant growth opportunities.

India Retail Fuel Market Segmentation

-

1. Ownership

- 1.1. Public Sector Undertakings

- 1.2. Private Owned

-

2. End User

- 2.1. Public Sector

- 2.2. Private Sector

India Retail Fuel Market Segmentation By Geography

- 1. India

India Retail Fuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.62% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Vehicle Ownership4.; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. 4.; Volatile Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. The Public Sector Undertakings Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Retail Fuel Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 5.1.1. Public Sector Undertakings

- 5.1.2. Private Owned

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Public Sector

- 5.2.2. Private Sector

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 6. North India India Retail Fuel Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Retail Fuel Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Retail Fuel Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Retail Fuel Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Shell PLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 TotalEnergies SA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Hindustan Petroleum Corporation Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Reliance Industries Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Bharat Petroleum Corp Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Nayara Energy Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Indian Oil Corporation Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Shell PLC

List of Figures

- Figure 1: India Retail Fuel Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Retail Fuel Market Share (%) by Company 2024

List of Tables

- Table 1: India Retail Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Retail Fuel Market Volume Metric Tonns Forecast, by Region 2019 & 2032

- Table 3: India Retail Fuel Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 4: India Retail Fuel Market Volume Metric Tonns Forecast, by Ownership 2019 & 2032

- Table 5: India Retail Fuel Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: India Retail Fuel Market Volume Metric Tonns Forecast, by End User 2019 & 2032

- Table 7: India Retail Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Retail Fuel Market Volume Metric Tonns Forecast, by Region 2019 & 2032

- Table 9: India Retail Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: India Retail Fuel Market Volume Metric Tonns Forecast, by Country 2019 & 2032

- Table 11: North India India Retail Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North India India Retail Fuel Market Volume (Metric Tonns) Forecast, by Application 2019 & 2032

- Table 13: South India India Retail Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South India India Retail Fuel Market Volume (Metric Tonns) Forecast, by Application 2019 & 2032

- Table 15: East India India Retail Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: East India India Retail Fuel Market Volume (Metric Tonns) Forecast, by Application 2019 & 2032

- Table 17: West India India Retail Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: West India India Retail Fuel Market Volume (Metric Tonns) Forecast, by Application 2019 & 2032

- Table 19: India Retail Fuel Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 20: India Retail Fuel Market Volume Metric Tonns Forecast, by Ownership 2019 & 2032

- Table 21: India Retail Fuel Market Revenue Million Forecast, by End User 2019 & 2032

- Table 22: India Retail Fuel Market Volume Metric Tonns Forecast, by End User 2019 & 2032

- Table 23: India Retail Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: India Retail Fuel Market Volume Metric Tonns Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Retail Fuel Market?

The projected CAGR is approximately 2.62%.

2. Which companies are prominent players in the India Retail Fuel Market?

Key companies in the market include Shell PLC, TotalEnergies SA, Hindustan Petroleum Corporation Limited, Reliance Industries Limited, Bharat Petroleum Corp Ltd, Nayara Energy Limited, Indian Oil Corporation Ltd.

3. What are the main segments of the India Retail Fuel Market?

The market segments include Ownership, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Vehicle Ownership4.; Government Initiatives.

6. What are the notable trends driving market growth?

The Public Sector Undertakings Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Volatile Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

February 2023: The Government of India announced the launch of E20 fuel across 11 states and union territories at 84 retail outlets in India. The Indian government aims to achieve 20% blending of ethanol with petrol by 2025 in the country. The step was taken to control the environmental emission from conventional fuels and progress towards a greener fuel economy. Oil marketing companies (OMC), including HPCL, have set up plants to accomplish the goal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Metric Tonns.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Retail Fuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Retail Fuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Retail Fuel Market?

To stay informed about further developments, trends, and reports in the India Retail Fuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence