Key Insights

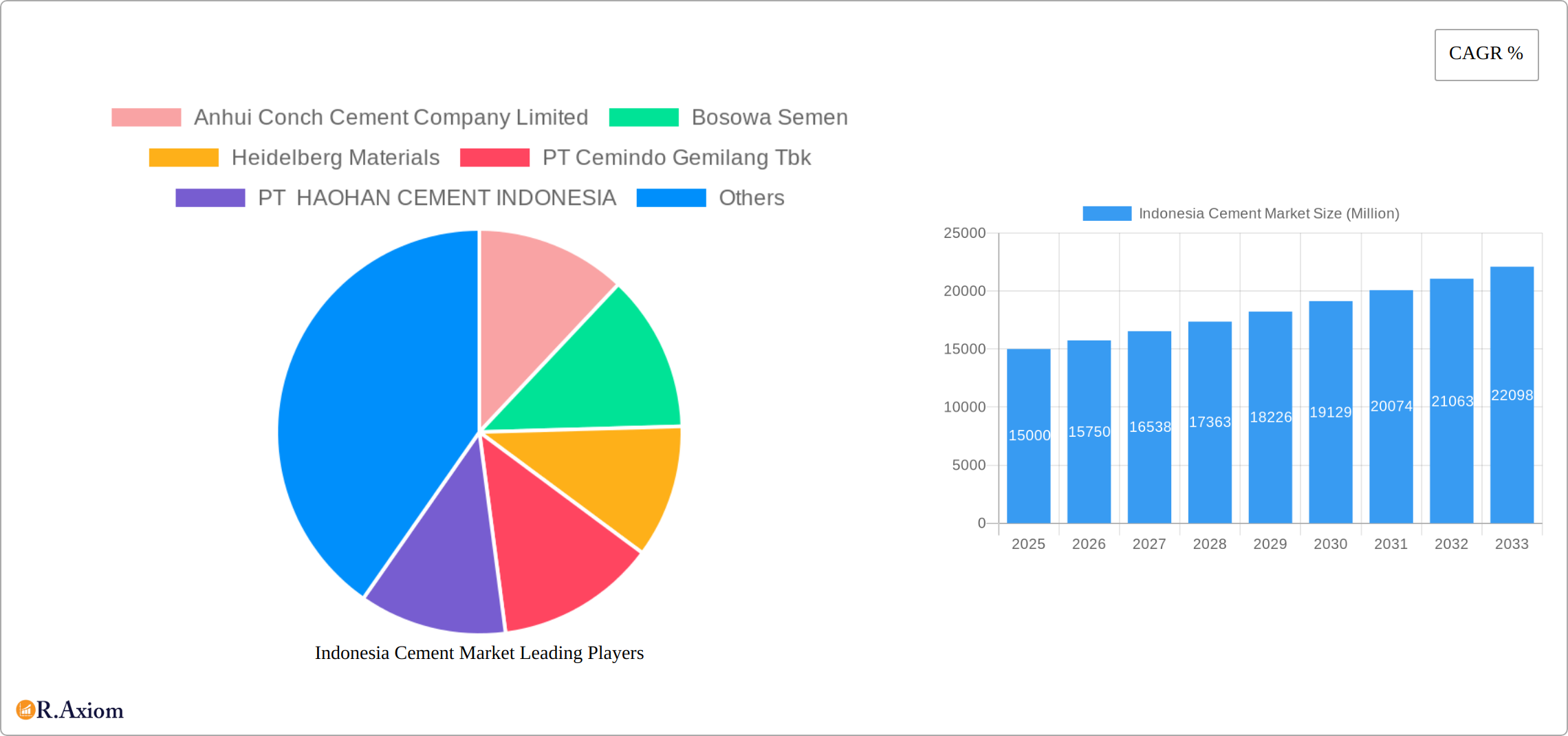

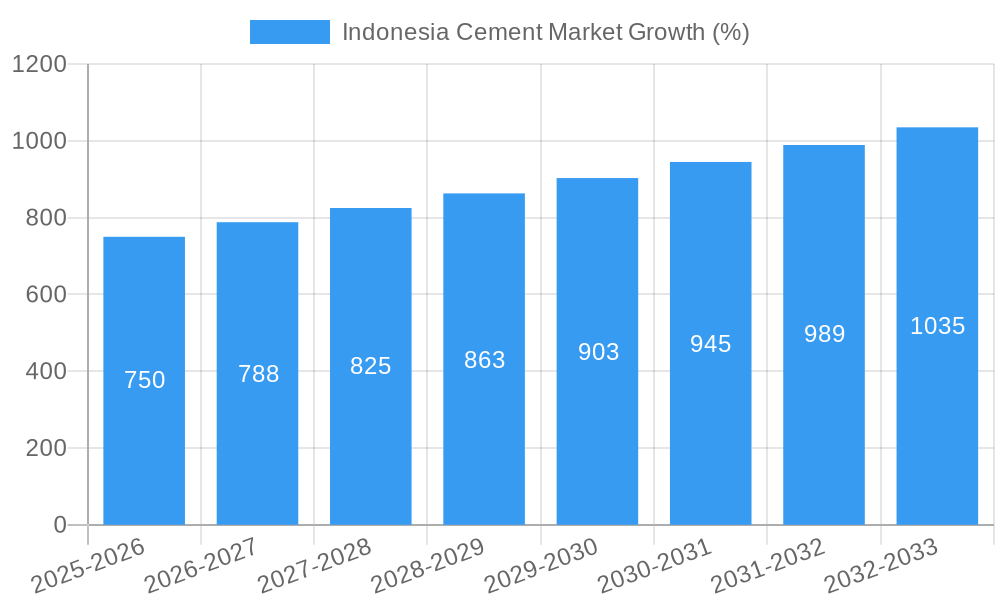

The Indonesian cement market, a significant player in Southeast Asia's construction boom, is experiencing robust growth. While precise figures for market size and CAGR are unavailable in the provided data, industry reports suggest a market valued in the billions of USD in 2025, with a Compound Annual Growth Rate (CAGR) likely exceeding 5% through 2033. This growth is fueled by several key drivers: Indonesia's substantial infrastructure development projects (including roads, bridges, and housing initiatives), rapid urbanization leading to increased cement demand in construction of residential and commercial buildings, and a growing middle class with rising disposable incomes. Furthermore, government initiatives promoting sustainable development and infrastructure modernization contribute positively to market expansion. However, challenges remain. These include fluctuating raw material prices (like clinker and gypsum), potential environmental regulations impacting production costs and methods, and competition among numerous domestic and international cement players. The market is segmented by cement type (e.g., Portland cement, blended cement) and geographic region, with various companies competing for market share. Companies like Anhui Conch Cement, Bosowa Semen, Heidelberg Materials, and several Indonesian players dominate the landscape, employing various strategies to gain a competitive edge, including investments in capacity expansion, technological advancements, and strategic partnerships.

The forecast period (2025-2033) anticipates continued expansion, although the rate of growth might moderate in later years due to potential market saturation in specific regions and the increasing adoption of alternative building materials. Nevertheless, the long-term outlook remains positive, driven by Indonesia's sustained economic growth and ongoing infrastructure development programs. Companies are expected to focus on efficiency improvements, technological innovations (like the use of alternative fuels), and sustainable practices to maintain profitability and meet evolving market demands. A key area of focus will be optimizing logistics and supply chains to mitigate the effects of fluctuating raw material costs and transportation challenges.

Indonesia Cement Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Indonesia cement market, covering market size, segmentation, key players, industry trends, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is essential for industry stakeholders, investors, and strategic decision-makers seeking to understand the dynamics and opportunities within this rapidly evolving market.

Indonesia Cement Market Concentration & Innovation

This section analyzes the competitive landscape of the Indonesian cement market, exploring market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. We delve into market share dynamics, identifying the dominant players and assessing their strategies. The analysis incorporates an assessment of the impact of mergers and acquisitions (M&A) on market consolidation and innovation.

- Market Concentration: The Indonesian cement market exhibits a moderately concentrated structure, with a few major players holding significant market share. The exact market share distribution varies across segments and regions, with larger players benefiting from economies of scale. We provide a detailed breakdown of market share by company.

- Innovation Drivers: Key innovation drivers include government regulations promoting sustainable cement production, the demand for higher-performance cement, and technological advancements in manufacturing and distribution.

- Regulatory Framework: Government policies related to infrastructure development, environmental protection, and building codes significantly impact market growth and player strategies.

- Product Substitutes: Alternative construction materials like prefabricated concrete and steel pose some competitive pressure, although cement remains the dominant material in the construction sector.

- End-User Trends: The increasing urbanization and infrastructure development in Indonesia are driving strong demand for cement across various end-user sectors, including residential, commercial, and industrial construction.

- M&A Activity: Recent years have witnessed notable M&A activity in the Indonesian cement sector, with significant deals reshaping the competitive landscape. For instance, the value of M&A transactions in the recent years totaled approximately xx Million, impacting market consolidation and influencing pricing strategies.

Indonesia Cement Market Industry Trends & Insights

This section provides a detailed analysis of market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. We analyze the Compound Annual Growth Rate (CAGR) and market penetration rates across various segments to offer insights into the evolving market landscape. The impact of economic growth, government policies, and technological advancements on market dynamics are extensively covered. We discuss the evolving consumer preferences towards sustainable and high-performance cement products. The competitive landscape, including pricing strategies, brand positioning, and distribution channels, is also analyzed.

The Indonesian cement market has experienced significant growth driven by robust infrastructure development, expanding construction activity fueled by population growth and urbanization, and government initiatives to improve housing and infrastructure. The CAGR for the historical period (2019-2024) is estimated at xx%, while the projected CAGR for the forecast period (2025-2033) is xx%. Market penetration of certain types of cement (e.g., high-strength cement, environmentally friendly cements) is also examined.

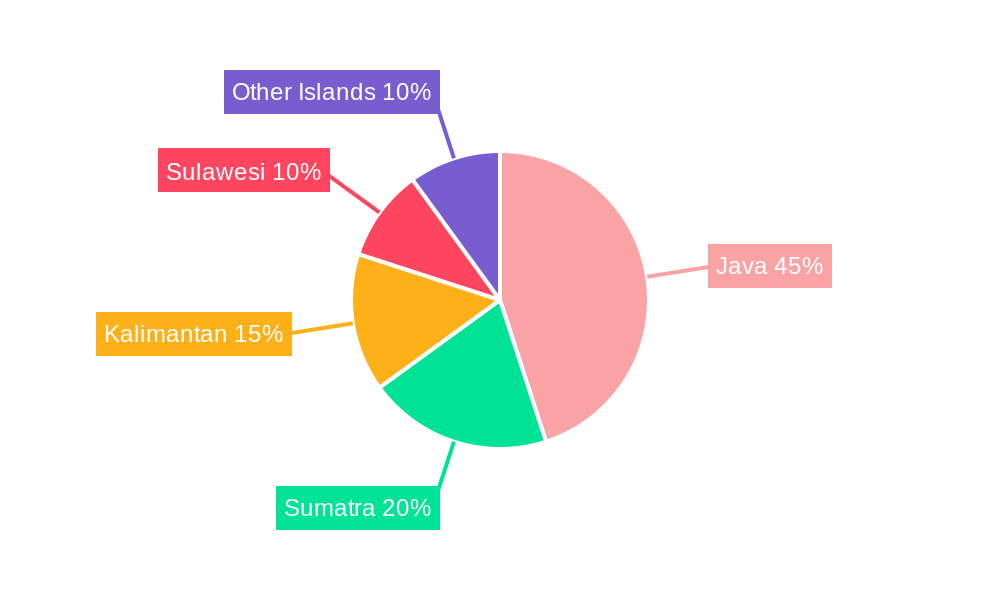

Dominant Markets & Segments in Indonesia Cement Market

This section identifies the leading regions and segments within the Indonesian cement market. Key drivers for dominance, such as economic policies, infrastructure development, and regional construction activity, are highlighted using bullet points. A comprehensive analysis of market dominance is provided using detailed paragraphs.

- Key Drivers of Dominance:

- Robust infrastructure development projects (e.g., roads, bridges, and buildings)

- Government initiatives to stimulate housing construction

- High population growth and urbanization leading to increased housing demand

- Regional disparities in economic growth and infrastructure investment.

The dominance of certain segments is explained by analyzing these drivers within their specific geographic regions. Regional variations in cement consumption patterns, due to factors like construction activity, urbanization rates, and government policies, are examined.

Indonesia Cement Market Product Developments

This section summarizes recent product innovations, applications, and competitive advantages in the Indonesian cement market. Technological trends like the development of environmentally friendly cements and high-performance variants are discussed in relation to their market fit and competitive advantage. The focus is on the increasing importance of sustainability and the adoption of new technologies to enhance product quality and efficiency.

The market has seen the introduction of new cement types that emphasize sustainability and enhanced performance characteristics, catering to the evolving needs of the construction industry and government initiatives promoting environmentally responsible practices.

Report Scope & Segmentation Analysis

This section details the market segmentation used in the report. The scope includes a granular breakdown of the market based on product type, application, and region. Growth projections and market sizes are provided for each segment, along with a competitive analysis illustrating the dominant players in each area.

By Product Type: This includes various cement types, such as ordinary Portland cement, blended cement, and specialized cement. Growth projections and market sizes vary significantly across product types, with certain blends exhibiting higher growth rates due to their enhanced performance and eco-friendly attributes. Market share of different product types is detailed.

By Application: This covers the main applications of cement, including residential construction, commercial construction, infrastructure projects, and industrial applications. The growth projections and market share within each application segment are presented, highlighting sector-specific trends and dynamics.

By Region: The report provides regional-level analysis of the Indonesian cement market, highlighting regional disparities in cement consumption and market dynamics. Growth projections for each region are presented, considering regional development patterns, infrastructure projects, and economic conditions.

Key Drivers of Indonesia Cement Market Growth

This section outlines the key growth drivers for the Indonesian cement market, focusing on technological, economic, and regulatory factors. Specific examples are provided to illustrate the impact of each driver on market growth.

The strong economic growth in Indonesia, coupled with government initiatives to improve infrastructure and housing, serves as a significant growth driver. Technological advancements leading to the production of high-performance and eco-friendly cement are increasing market penetration of these products. Furthermore, government regulations promoting sustainable construction practices and infrastructure development are driving growth.

Challenges in the Indonesia Cement Market Sector

This section discusses the key challenges facing the Indonesian cement market, including regulatory hurdles, supply chain issues, and competitive pressures. We analyze these challenges with quantifiable impacts wherever possible.

Challenges include rising raw material costs and potential supply chain disruptions, along with intense competition from both domestic and international players. Environmental regulations and concerns over carbon emissions add complexity. These challenges may restrict market growth, but innovation and strategic adaptations by players can mitigate these limitations.

Emerging Opportunities in Indonesia Cement Market

This section highlights emerging trends and opportunities in the Indonesian cement market, including new technologies, and shifting consumer preferences.

The demand for sustainable and high-performance cement presents a major opportunity. Innovations in cement production, along with advancements in related technologies, offer scope for new product development and market expansion. Focusing on sustainable development and environmentally friendly construction practices provides significant market opportunities.

Leading Players in the Indonesia Cement Market Market

- Anhui Conch Cement Company Limited

- Bosowa Semen

- Heidelberg Materials

- PT Cemindo Gemilang Tbk

- PT HAOHAN CEMENT INDONESIA

- PT Jui Shin Indonesia

- PT SEMEN JAKARTA

- PT Sinar Tambang Arthalestari

- SCG

- SI (Semen Indonesia)

Key Developments in Indonesia Cement Market Industry

June 2023: SIG's subsidiary PT Semen Baturaja Tbk announced plans to expand its cement production capacity by 3.8 Million tons per year across three factories. This expansion will significantly increase the supply of cement in the market and strengthen SIG's position.

January 2023: Heidelberg Material's subsidiary, PT Indocement Tunggal Prakarsa Tbk, launched Semen Jempolan, a new environmentally friendly cement product, aligning with the government's sustainability initiatives and potentially attracting environmentally conscious consumers.

January 2023: Semen Indonesia (SIG) acquired an 83.52% stake in Solusi Bangun Indonesia, boosting its production capacity by 14.8 Million tons/year. This acquisition strengthens SIG's market dominance and expands its operational capabilities.

Strategic Outlook for Indonesia Cement Market Market

The Indonesian cement market holds substantial future potential, driven by sustained economic growth, ongoing urbanization, and extensive infrastructure projects. Strategic investments in sustainable production technologies, coupled with innovative product development to meet the evolving needs of the construction industry, will shape future market dynamics. Players who effectively adapt to these trends are likely to experience significant growth in the coming years.

Indonesia Cement Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Product

- 2.1. Blended Cement

- 2.2. Fiber Cement

- 2.3. Ordinary Portland Cement

- 2.4. White Cement

- 2.5. Other Types

Indonesia Cement Market Segmentation By Geography

- 1. Indonesia

Indonesia Cement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of % from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Cement Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Blended Cement

- 5.2.2. Fiber Cement

- 5.2.3. Ordinary Portland Cement

- 5.2.4. White Cement

- 5.2.5. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Anhui Conch Cement Company Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bosowa Semen

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Heidelberg Materials

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Cemindo Gemilang Tbk

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PT HAOHAN CEMENT INDONESIA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Jui Shin Indonesia

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT SEMEN JAKARTA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT Sinar Tambang Arthalestari

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SCG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SI

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Anhui Conch Cement Company Limited

List of Figures

- Figure 1: Indonesia Cement Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Cement Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Cement Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Cement Market Revenue Million Forecast, by End Use Sector 2019 & 2032

- Table 3: Indonesia Cement Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Indonesia Cement Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Indonesia Cement Market Revenue Million Forecast, by End Use Sector 2019 & 2032

- Table 6: Indonesia Cement Market Revenue Million Forecast, by Product 2019 & 2032

- Table 7: Indonesia Cement Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Cement Market?

The projected CAGR is approximately N/A%.

2. Which companies are prominent players in the Indonesia Cement Market?

Key companies in the market include Anhui Conch Cement Company Limited, Bosowa Semen, Heidelberg Materials, PT Cemindo Gemilang Tbk, PT HAOHAN CEMENT INDONESIA, PT Jui Shin Indonesia, PT SEMEN JAKARTA, PT Sinar Tambang Arthalestari, SCG, SI.

3. What are the main segments of the Indonesia Cement Market?

The market segments include End Use Sector, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2023: SIG's subsidiary PT Semen Baturaja Tbk announced to expand its cement production capacity to 3.8 million tons of cement per year through three factories in Palembang and Baturaja City, Ogan Komering Ulu (OKU) Regency, South Sumatra, Panjang, Bandar Lampung in Indonesia.January 2023: Heidelburg Material's subsidiary, PT Indocement Tunggal Prakarsa Tbk, introduced a new cement product, Semen Jempolan, to support the government's environmentally friendly cement production program.January 2023: Semen Indonesia (SIG) acquired an 83.52% stake in Solusi Bangun Indonesia, which has a 14.8 Mt/yr of cement production capacity, strengthening its cement business in Indonesia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Cement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Cement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Cement Market?

To stay informed about further developments, trends, and reports in the Indonesia Cement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence