Key Insights

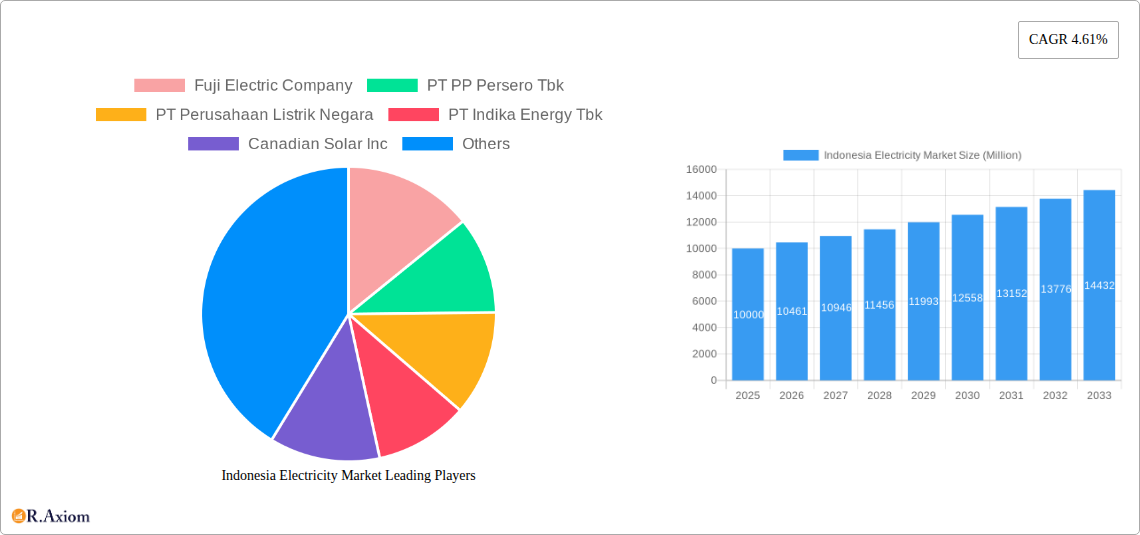

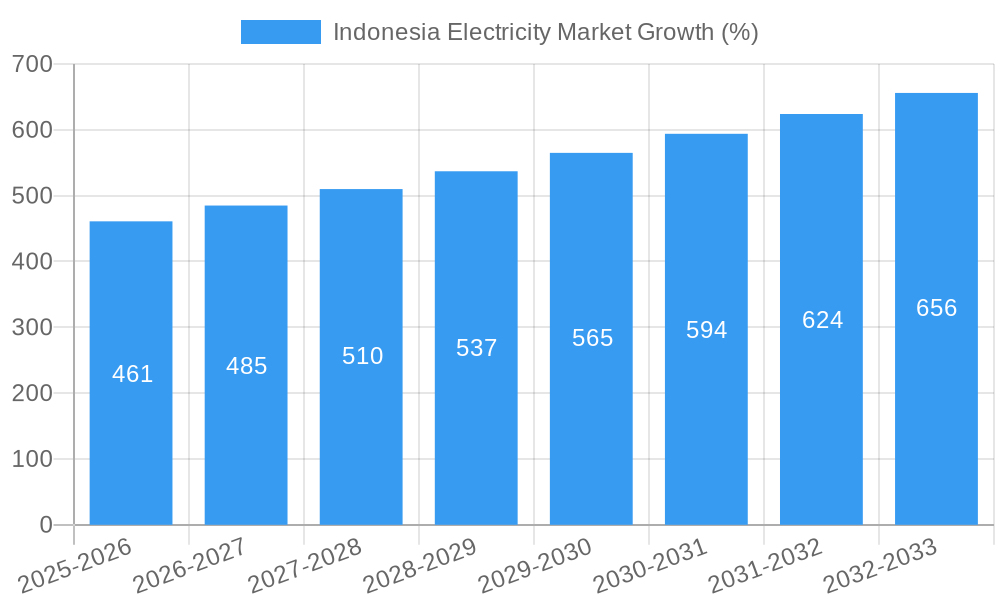

The Indonesian electricity market, valued at approximately $XX million in 2025 (assuming a logical extrapolation from the provided CAGR and study period), is projected to experience robust growth at a Compound Annual Growth Rate (CAGR) of 4.61% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, Indonesia's rapidly developing economy necessitates a continuous increase in electricity consumption across residential, commercial, and industrial sectors. Secondly, the government's strong commitment to infrastructure development, including significant investments in renewable energy sources, is a major catalyst. The rising adoption of renewable energy technologies, particularly solar and geothermal, driven by both environmental concerns and energy security considerations, is reshaping the energy landscape. However, challenges remain. Constraints include the need for upgrading aging infrastructure, ensuring grid stability to accommodate intermittent renewable energy sources, and managing the country's reliance on fossil fuels, particularly coal, which contributes significantly to greenhouse gas emissions. The market segmentation reveals a diverse mix of power generation sources, with oil and natural gas, coal, hydroelectricity, and renewables all playing important roles. Key players like PT Perusahaan Listrik Negara (PLN), a state-owned electricity company, and several private players, including those specializing in renewable energy, are actively shaping the market's future.

The Indonesian electricity market's growth trajectory over the forecast period (2025-2033) presents significant opportunities for both domestic and international investors. The ongoing shift towards renewable energy presents considerable potential, necessitating strategic partnerships and technological advancements to overcome challenges related to grid integration and energy storage. Furthermore, the market's size and growth rate indicate significant investment potential in infrastructure development, particularly the expansion of transmission and distribution networks. Competition among established players and emerging renewable energy companies is likely to intensify, leading to innovation in technology and pricing strategies. Effective regulatory frameworks and government policies will be crucial in ensuring a sustainable and efficient electricity market that balances economic growth with environmental sustainability goals.

Indonesia Electricity Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Indonesian electricity market, covering the period from 2019 to 2033, with a focus on market dynamics, key players, and future growth potential. The report leverages extensive data and insightful analysis to offer actionable intelligence for industry stakeholders, investors, and policymakers. The base year for this report is 2025, with estimations for 2025 and forecasts extending to 2033.

Indonesia Electricity Market Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities within the Indonesian electricity market. The Indonesian electricity market is characterized by a mix of state-owned and private players, leading to a moderately concentrated market. PT Perusahaan Listrik Negara (PLN) holds a significant market share, particularly in power generation and distribution. However, the increasing participation of private companies, particularly in renewable energy projects, is driving competition and innovation.

Market Concentration: PLN holds approximately xx% market share in power generation, while other major players such as PT Indika Energy Tbk and PT Pertamina Geothermal Energy control smaller, but significant, portions. The market share for renewable energy providers is growing rapidly.

Innovation Drivers: The government's push for renewable energy integration, coupled with decreasing technology costs, is a major driver of innovation. The adoption of smart grid technologies and energy storage solutions is also gaining momentum.

Regulatory Framework: The Indonesian government's regulatory framework aims to support market liberalization and attract foreign investment. However, bureaucratic processes can sometimes pose challenges.

Product Substitutes: The increasing affordability of renewable energy sources presents a significant substitute for traditional fossil fuel-based power generation.

End-User Trends: Increasing industrialization and rising energy consumption are driving demand for electricity across various sectors.

M&A Activities: The Indonesian electricity market has witnessed several significant M&A activities in recent years, with deal values totaling approximately xx Million USD. These transactions reflect the strategic consolidation within the sector. For example, [insert specific examples of recent M&A activity, if available, with deal values]

Indonesia Electricity Market Industry Trends & Insights

This section explores the key trends and insights shaping the Indonesian electricity market. The market exhibits robust growth driven by factors such as increasing urbanization, industrialization, and a rising middle class. The compound annual growth rate (CAGR) for the period 2025-2033 is projected to be xx%, significantly influenced by government initiatives promoting renewable energy sources and energy efficiency programs. Market penetration of renewable energy is expected to increase from xx% in 2025 to xx% by 2033. Technological disruptions like the adoption of smart grids and the rise of distributed generation are also reshaping the competitive landscape.

Dominant Markets & Segments in Indonesia Electricity Market

This section identifies the leading segments within the Indonesian electricity market, focusing on power generation sources: oil and natural gas, coal, hydroelectricity, and renewables.

Coal: Historically dominant, coal remains a significant contributor to power generation due to its abundance and established infrastructure. However, its share is projected to decline due to environmental concerns and government policies promoting renewable sources.

Oil and Natural Gas: While playing a role, its share in the power generation mix is relatively smaller compared to coal and is expected to decline steadily.

Hydroelectricity: Hydropower enjoys a considerable presence due to Indonesia's abundant water resources. Further development and expansion of hydroelectric projects are anticipated.

Renewables: This sector is experiencing exponential growth fueled by government incentives, decreasing technology costs, and a growing awareness of environmental sustainability. Solar, wind, and geothermal are the leading renewable energy sources. Key drivers for renewables include:

- Supportive government policies and subsidies.

- Decreasing technology costs, making renewable energy more competitive.

- Increased private sector investments and international partnerships.

- Growing public awareness and demand for cleaner energy.

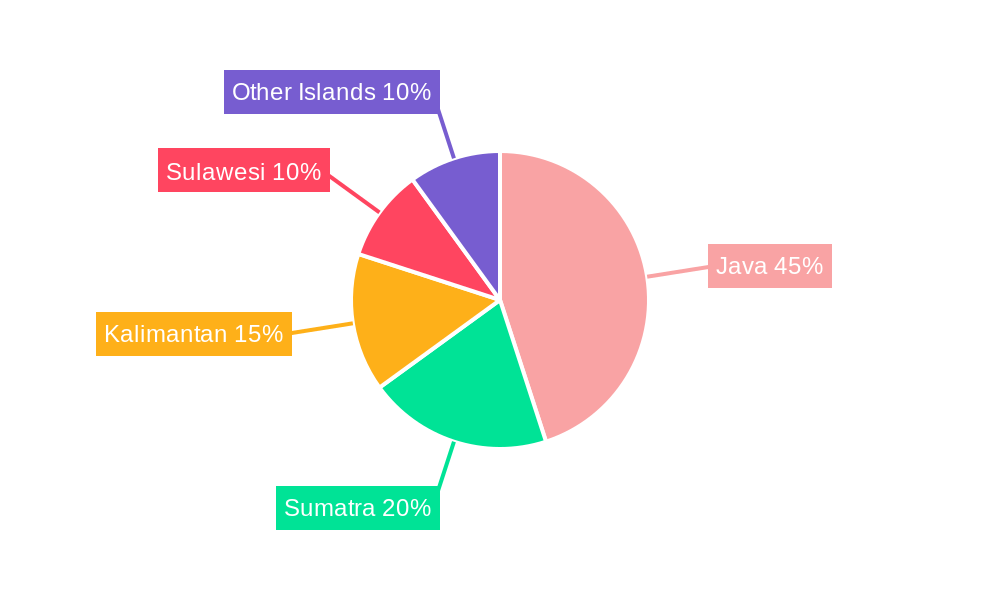

The dominance of specific segments varies across regions. Java, due to its high population density and industrial activity, consumes the largest share of electricity.

Indonesia Electricity Market Product Developments

Significant product innovations are evident across the market, with a strong emphasis on enhancing efficiency and integrating renewable energy sources. This includes advancements in solar PV technology, battery storage solutions, and smart grid management systems. The competitive advantage lies in offering cost-effective, reliable, and environmentally sustainable solutions tailored to the specific needs of the Indonesian market. For example, the emergence of floating solar PV projects represents a significant advancement in harnessing renewable energy in water-rich areas.

Report Scope & Segmentation Analysis

This report segments the Indonesian electricity market based on power generation sources: Oil and Natural Gas, Coal, Hydroelectricity, and Renewables. Each segment is analyzed based on market size, growth projections, and competitive dynamics. Detailed market sizes and growth projections for each segment are provided within the full report (values in Millions). For example, the renewable energy segment is projected to experience the highest growth rate due to government support and technological advancements.

Key Drivers of Indonesia Electricity Market Growth

The Indonesian electricity market's growth is primarily fueled by robust economic expansion, increasing urbanization and industrialization, and a growing energy demand across all sectors. Government support for renewable energy adoption, improving infrastructure, and investments in smart grid technologies are additional key contributors to market expansion.

Challenges in the Indonesia Electricity Market Sector

Challenges include managing the transition from fossil fuels to renewable energy sources, addressing grid infrastructure limitations, and ensuring energy security amidst fluctuating global energy prices. Furthermore, regulatory hurdles and supply chain issues can hinder market development. These challenges are quantified within the report by presenting projected impacts on market growth and investment.

Emerging Opportunities in Indonesia Electricity Market

Significant opportunities exist in expanding renewable energy capacity, investing in smart grid technologies, and developing energy storage solutions. Moreover, the growing demand for electricity in remote areas and the development of off-grid solutions represent lucrative market prospects.

Leading Players in the Indonesia Electricity Market Market

- Fuji Electric Company

- PT PP Persero Tbk

- PT Perusahaan Listrik Negara

- PT Indika Energy Tbk

- Canadian Solar Inc

- BCPG Public Company Limited

- PT Pertamina Geothermal Energy

- Harbin Power Engineering

- Sindicatum Renewable Energy Company Pte Ltd

- Mitsubishi Power Ltd

Key Developments in Indonesia Electricity Market Industry

March 2023: Mitsubishi Heavy Industries, Ltd. and PT. PLN Nusantara Power signed an agreement for three technical studies on co-firing less carbon-intensive fuels in Nusantara Power plants. This signifies a move towards cleaner energy sources.

November 2022: ACWA Power secured a contract from PLN to develop two floating solar PV projects (Saguling and Singkarak), totaling 110 MWac and representing a USD 105 Million investment. This highlights growing interest in renewable energy solutions.

Strategic Outlook for Indonesia Electricity Market Market

The Indonesian electricity market presents significant growth potential driven by increasing energy demand, supportive government policies, and technological advancements in renewable energy. Strategic investments in renewable energy infrastructure, grid modernization, and energy storage are crucial for sustainable growth and meeting the country's long-term energy needs. The market is expected to continue expanding at a robust pace throughout the forecast period, with considerable opportunities for both domestic and international players.

Indonesia Electricity Market Segmentation

-

1. Power Generation Source

- 1.1. Oil and Natural Gas

- 1.2. Coal

- 1.3. Hydroelectricity

- 1.4. Renewables

- 2. Power Transmission and Distribution

Indonesia Electricity Market Segmentation By Geography

- 1. Indonesia

Indonesia Electricity Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.61% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation Cost as Compared to Rooftop PV Systems

- 3.4. Market Trends

- 3.4.1. Coal-based Power Generation to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Electricity Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 5.1.1. Oil and Natural Gas

- 5.1.2. Coal

- 5.1.3. Hydroelectricity

- 5.1.4. Renewables

- 5.2. Market Analysis, Insights and Forecast - by Power Transmission and Distribution

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Fuji Electric Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PT PP Persero Tbk

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Perusahaan Listrik Negara

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Indika Energy Tbk

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Canadian Solar Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BCPG Public Company Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Pertamina Geothermal Energy

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Harbin Power Engineering

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sindicatum Renewable Energy Company Pte Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mitsubishi Power Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Fuji Electric Company

List of Figures

- Figure 1: Indonesia Electricity Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Electricity Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Electricity Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Electricity Market Volume gigawatt Forecast, by Region 2019 & 2032

- Table 3: Indonesia Electricity Market Revenue Million Forecast, by Power Generation Source 2019 & 2032

- Table 4: Indonesia Electricity Market Volume gigawatt Forecast, by Power Generation Source 2019 & 2032

- Table 5: Indonesia Electricity Market Revenue Million Forecast, by Power Transmission and Distribution 2019 & 2032

- Table 6: Indonesia Electricity Market Volume gigawatt Forecast, by Power Transmission and Distribution 2019 & 2032

- Table 7: Indonesia Electricity Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Indonesia Electricity Market Volume gigawatt Forecast, by Region 2019 & 2032

- Table 9: Indonesia Electricity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Indonesia Electricity Market Volume gigawatt Forecast, by Country 2019 & 2032

- Table 11: Indonesia Electricity Market Revenue Million Forecast, by Power Generation Source 2019 & 2032

- Table 12: Indonesia Electricity Market Volume gigawatt Forecast, by Power Generation Source 2019 & 2032

- Table 13: Indonesia Electricity Market Revenue Million Forecast, by Power Transmission and Distribution 2019 & 2032

- Table 14: Indonesia Electricity Market Volume gigawatt Forecast, by Power Transmission and Distribution 2019 & 2032

- Table 15: Indonesia Electricity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Indonesia Electricity Market Volume gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Electricity Market?

The projected CAGR is approximately 4.61%.

2. Which companies are prominent players in the Indonesia Electricity Market?

Key companies in the market include Fuji Electric Company, PT PP Persero Tbk, PT Perusahaan Listrik Negara, PT Indika Energy Tbk, Canadian Solar Inc, BCPG Public Company Limited, PT Pertamina Geothermal Energy, Harbin Power Engineering, Sindicatum Renewable Energy Company Pte Ltd, Mitsubishi Power Ltd.

3. What are the main segments of the Indonesia Electricity Market?

The market segments include Power Generation Source, Power Transmission and Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment.

6. What are the notable trends driving market growth?

Coal-based Power Generation to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Installation Cost as Compared to Rooftop PV Systems.

8. Can you provide examples of recent developments in the market?

March 2023: Mitsubishi Heavy Industries, Ltd. and PT. PLN Nusantara Power, a sub-holding of Indonesia's state-owned electricity provider PT. PLN (Persero) (PLN) signed an agreement to start off three technical studies related to co-firing of less carbon-intensive fuels at power plants owned and operated by Nusantara Power.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Electricity Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Electricity Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Electricity Market?

To stay informed about further developments, trends, and reports in the Indonesia Electricity Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence