Key Insights

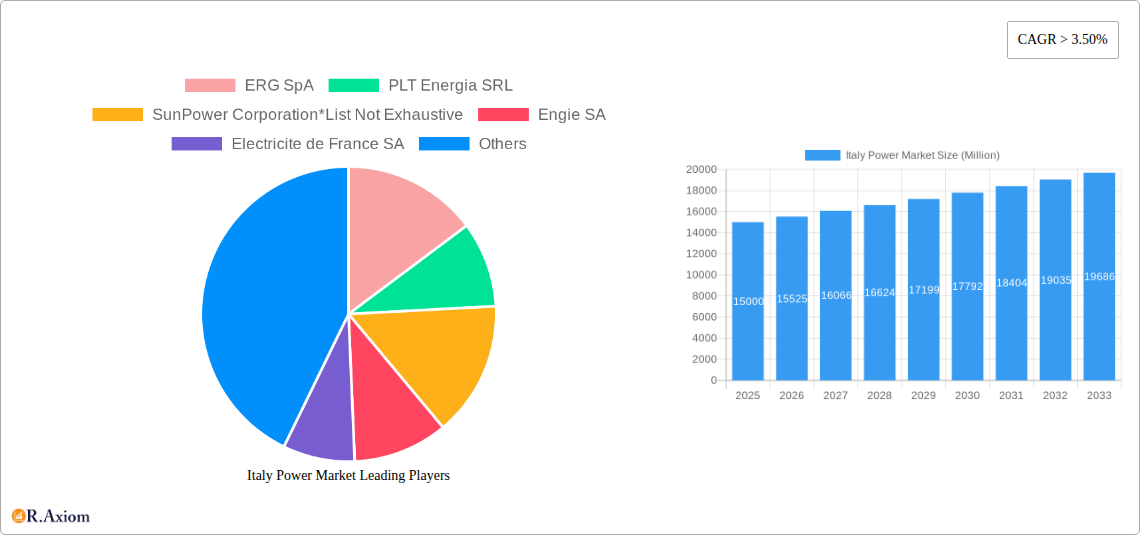

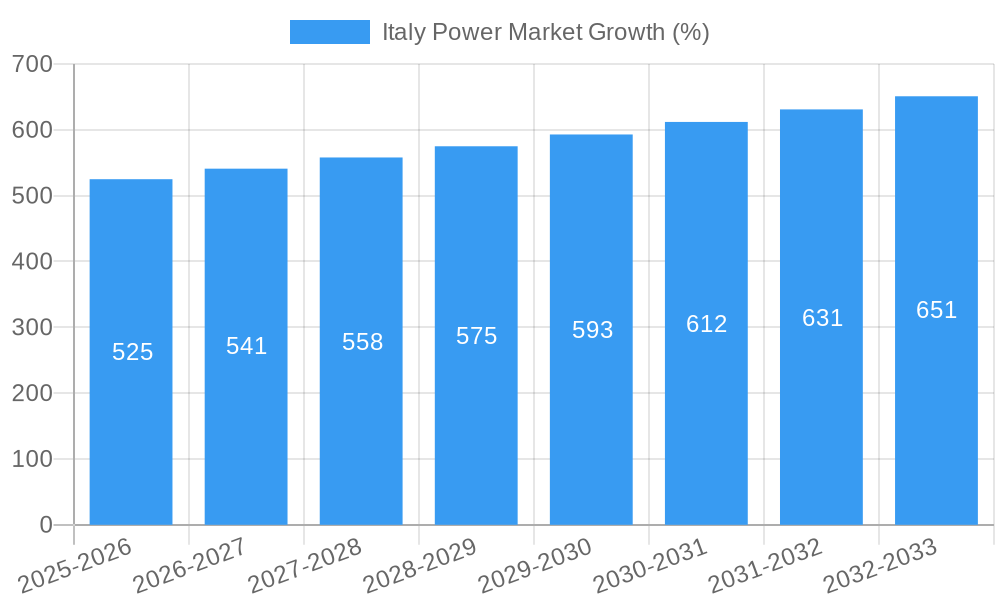

The Italian power market, valued at approximately €[Estimate based on market size XX and value unit Million; let's assume €15 Billion in 2025 for example purposes], is experiencing robust growth, projected to maintain a CAGR exceeding 3.50% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing demand for electricity driven by economic growth and population increase necessitates significant investments in power generation capacity. Furthermore, Italy's commitment to renewable energy targets under the EU's Green Deal is accelerating the adoption of solar, wind, and other sustainable power sources. This transition is reshaping the market landscape, with non-hydro renewable power experiencing the most rapid growth. While hydroelectric power remains a significant contributor, its share is gradually decreasing as the country diversifies its energy portfolio. However, the market faces challenges, including the intermittent nature of renewable energy sources requiring grid modernization and energy storage solutions, and regulatory hurdles associated with permitting and grid connection for new projects. The aging infrastructure of thermal power plants also presents a significant challenge demanding substantial investment in upgrades or replacements.

Leading players like Enel SpA, ERG SpA, and Siemens Gamesa Renewable Energy SA are actively shaping this evolving market, investing in new capacities and technologies. Competition is intense, with both domestic and international companies vying for market share. The segmentation of the market across thermal, non-hydro renewables, and hydroelectric power provides various avenues for growth and investment. The regional focus on Italy offers a detailed analysis of a crucial European energy market. The forecast period (2025-2033) offers valuable insights into the long-term trajectory of the Italian power sector, facilitating informed decision-making for investors, policymakers, and industry participants. Careful consideration of market restraints and the continuous evolution of technological advancements will be critical for sustainable growth within the sector.

Italy Power Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Italy power market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a focus on market dynamics, technological advancements, and competitive landscapes, this report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033. The report utilizes data from the historical period (2019-2024) to establish a robust foundation for future projections. The total market size is estimated to reach xx Million by 2025.

Italy Power Market Market Concentration & Innovation

This section analyzes the level of market concentration in Italy's power sector, examining the market share of key players and the impact of mergers and acquisitions (M&A) activity. The report also explores innovation drivers, regulatory frameworks, and the influence of substitute products on market dynamics. End-user trends and their implications are also carefully considered.

- Market Concentration: The Italian power market exhibits a moderate level of concentration, with a few dominant players holding significant market share. Further analysis reveals that the combined market share of the top five players stands at approximately xx%.

- Innovation Drivers: The push for renewable energy integration, coupled with stringent environmental regulations, is a major driver of innovation. Significant investments in R&D are driving advancements in renewable energy technologies, such as solar and wind power.

- Regulatory Frameworks: The Italian government's regulatory policies significantly shape the market, impacting investment decisions and technological adoption. These policies aim to promote energy security and a transition toward renewable sources.

- Product Substitutes: The increasing competitiveness of renewable energy sources presents a significant challenge to traditional thermal power generation, impacting the market share of existing players.

- End-User Trends: The increasing demand for reliable and sustainable energy sources from residential, commercial, and industrial sectors is driving market growth and influencing investment strategies.

- M&A Activities: The Italian power market has seen considerable M&A activity in recent years, with deal values totaling approximately xx Million in the last five years. These transactions reflect consolidation trends and strategic acquisitions aimed at expanding market reach and enhancing technological capabilities.

Italy Power Market Industry Trends & Insights

This section delves into the key trends shaping the Italian power market, focusing on market growth drivers, technological disruptions, evolving consumer preferences, and competitive dynamics. The Compound Annual Growth Rate (CAGR) and market penetration rates of various segments are also analyzed. This section provides a detailed overview of the factors that contribute to the overall growth of the Italian power sector, along with projections for the future. The market is expected to witness a CAGR of xx% during the forecast period, driven primarily by the increasing demand for electricity, government initiatives to support renewable energy sources, and ongoing investments in grid modernization. Further, the increasing market penetration of renewable energy technologies, particularly solar and wind, is driving a major shift in the energy mix. The growing awareness of environmental concerns and government regulations favouring cleaner energy sources significantly influence consumer preferences and fuel market transformations.

Dominant Markets & Segments in Italy Power Market

This section identifies the leading segments within the Italian power market, focusing on power generation from Thermal Power, Non-hydro Renewable Power, and Hydroelectric sources. The analysis includes regional variations and highlights key drivers of dominance in each segment.

- Thermal Power: This segment remains dominant, particularly in meeting baseload demand, although its share is gradually declining due to increased penetration of renewables.

- Key Drivers: Existing infrastructure, established supply chains, and the availability of natural gas.

- Non-hydro Renewable Power: This segment is experiencing the fastest growth, driven primarily by solar and wind power.

- Key Drivers: Government incentives, falling technology costs, and increasing environmental awareness. The Southern regions of Italy show stronger growth than Northern regions due to increased solar irradiation and available land space.

- Hydroelectric Power: Hydroelectric power contributes a significant but relatively stable share to Italy's energy mix.

- Key Drivers: Existing infrastructure, reliable power generation, and a relatively consistent water resource availability.

The overall dominance analysis indicates that Non-hydro Renewable Power is projected to witness the highest growth and gradually increase its market share, driven by policy support, technological advancements and cost reductions.

Italy Power Market Product Developments

Recent years have witnessed significant product innovation in the Italian power market, focusing primarily on enhancing the efficiency and sustainability of power generation and distribution. Advancements in renewable energy technologies, including solar PV, wind turbines, and energy storage systems, are transforming the energy landscape. These innovations are designed to improve efficiency, reduce costs, and enhance integration with the existing grid infrastructure. The focus is on smart grid technologies, enabling better grid management, improved efficiency, and reduced transmission losses. The market is also witnessing the emergence of hybrid power plants integrating renewable energy sources with conventional thermal power, improving reliability and diversification.

Report Scope & Segmentation Analysis

This report segments the Italy power market based on power generation sources: Thermal Power, Non-hydro Renewable Power, and Hydroelectric. Each segment is analyzed based on growth projections, market size, and competitive dynamics.

- Thermal Power: This segment is expected to maintain a substantial market size, but witness a decrease in its growth rate, primarily due to environmental concerns and the growing penetration of renewable energy sources.

- Non-hydro Renewable Power: This segment exhibits the highest growth potential, driven by government support for renewable energy and decreasing technology costs. This segment is further divided into solar, wind, and other renewable sources.

- Hydroelectric Power: While already established, this segment will demonstrate stable growth, primarily due to existing infrastructure and limited potential for substantial expansion.

Each segment’s analysis includes detailed market sizing, forecasts, and competitive landscape information.

Key Drivers of Italy Power Market Growth

Several key factors are driving the growth of the Italy power market:

- Increasing electricity demand driven by economic growth and population increase.

- Government policies and incentives aimed at promoting renewable energy adoption.

- Technological advancements leading to reduced costs and improved efficiency of renewable energy technologies.

- Investments in grid modernization to accommodate the integration of renewable energy sources.

Challenges in the Italy Power Market Sector

The Italian power market faces several challenges:

- Regulatory uncertainties and evolving policies can impact investment decisions and project timelines. The complexity and frequent changes in regulations contribute to a level of uncertainty that can hinder investment decisions and slow down market expansion.

- Supply chain disruptions can affect the availability and cost of equipment, particularly for renewable energy projects.

- Intense competition among existing players and new entrants is increasing pressure on profit margins. This is especially true in the renewable energy sector, where several players compete for projects and market share.

Emerging Opportunities in Italy Power Market

The Italian power market presents several emerging opportunities:

- Increased demand for energy storage solutions to manage the intermittency of renewable energy sources.

- Growing adoption of smart grid technologies to improve grid efficiency and integration of renewable energy.

- Expansion of opportunities in the energy efficiency sector, supporting energy conservation efforts.

Leading Players in the Italy Power Market Market

- ERG SpA

- PLT Energia SRL

- SunPower Corporation

- Engie SA

- Electricite de France SA

- Enel SpA

- Siemens Gamesa Renewable Energy SA

- Vestas Wind Systems AS

- Intergen SpA

- Terna SpA

- Sonnedix Power Holdings Limited

Key Developments in Italy Power Market Industry

- January 2022: Wärtsilä to supply gas engines for a 110 MW flexible power plant in Cassano d'Adda. This development highlights the continued relevance of flexible gas-fired power plants for grid stability and peak demand management.

- April 2021: RWE commissions Alcamo II onshore wind farm in Sicily, its first global collaboration with Goldwind. This underscores the increasing importance of international collaboration and the expansion of renewable energy capacity in Italy.

- July 2021: Terna pledges EUR 18.1 billion (USD 21 Billion) investment in Italy's power grid over 10 years. This significant investment underlines the commitment towards grid modernization and adapting to the growing renewable energy capacity.

Strategic Outlook for Italy Power Market Market

The Italian power market is poised for significant growth, driven by the increasing demand for electricity, the government's commitment to renewable energy, and the ongoing investments in grid modernization. Opportunities exist in renewable energy technologies, energy storage, smart grid solutions, and energy efficiency services. The market will continue to evolve with increased competition and the continued integration of renewable energy. These factors create a dynamic and exciting environment for innovation and growth.

Italy Power Market Segmentation

-

1. Power Generation from Sources

- 1.1. Thermal Power

- 1.2. Non-hydro Renewable Power

- 1.3. Hydroelectric

- 2. Power Transmission and Distribution (T&D)

Italy Power Market Segmentation By Geography

- 1. Italy

Italy Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Power Demand due to the Growing Population4.; Upcoming Power Generation Projects

- 3.3. Market Restrains

- 3.3.1. The New Government's Intentions to Reduce Private Investments

- 3.4. Market Trends

- 3.4.1. Non-hydro Renewable Power to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Power Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Generation from Sources

- 5.1.1. Thermal Power

- 5.1.2. Non-hydro Renewable Power

- 5.1.3. Hydroelectric

- 5.2. Market Analysis, Insights and Forecast - by Power Transmission and Distribution (T&D)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Power Generation from Sources

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 ERG SpA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PLT Energia SRL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SunPower Corporation*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Engie SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Electricite de France SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Enel SpA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Siemens Gamesa Renewable Energy SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vestas Wind Systems AS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Intergen SpA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Terna SpA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sonnedix Power Holdings Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 ERG SpA

List of Figures

- Figure 1: Italy Power Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Italy Power Market Share (%) by Company 2024

List of Tables

- Table 1: Italy Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Italy Power Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Italy Power Market Revenue Million Forecast, by Power Generation from Sources 2019 & 2032

- Table 4: Italy Power Market Volume Gigawatt Forecast, by Power Generation from Sources 2019 & 2032

- Table 5: Italy Power Market Revenue Million Forecast, by Power Transmission and Distribution (T&D) 2019 & 2032

- Table 6: Italy Power Market Volume Gigawatt Forecast, by Power Transmission and Distribution (T&D) 2019 & 2032

- Table 7: Italy Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Italy Power Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 9: Italy Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Italy Power Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 11: Italy Power Market Revenue Million Forecast, by Power Generation from Sources 2019 & 2032

- Table 12: Italy Power Market Volume Gigawatt Forecast, by Power Generation from Sources 2019 & 2032

- Table 13: Italy Power Market Revenue Million Forecast, by Power Transmission and Distribution (T&D) 2019 & 2032

- Table 14: Italy Power Market Volume Gigawatt Forecast, by Power Transmission and Distribution (T&D) 2019 & 2032

- Table 15: Italy Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Italy Power Market Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Power Market?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the Italy Power Market?

Key companies in the market include ERG SpA, PLT Energia SRL, SunPower Corporation*List Not Exhaustive, Engie SA, Electricite de France SA, Enel SpA, Siemens Gamesa Renewable Energy SA, Vestas Wind Systems AS, Intergen SpA, Terna SpA, Sonnedix Power Holdings Limited.

3. What are the main segments of the Italy Power Market?

The market segments include Power Generation from Sources, Power Transmission and Distribution (T&D).

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

High Power Demand due to the Growing Population4.; Upcoming Power Generation Projects.

6. What are the notable trends driving market growth?

Non-hydro Renewable Power to Witness Significant Growth.

7. Are there any restraints impacting market growth?

The New Government's Intentions to Reduce Private Investments.

8. Can you provide examples of recent developments in the market?

In January 2022, Wartsila will supply six 50SG gas engines for a natural gas-fueled 110 MW flexible power plant in Cassano d'Adda Town, Italy. The delivery of the equipment is scheduled for autumn 2022, and the plant is expected to become operational in 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Power Market?

To stay informed about further developments, trends, and reports in the Italy Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence