Key Insights

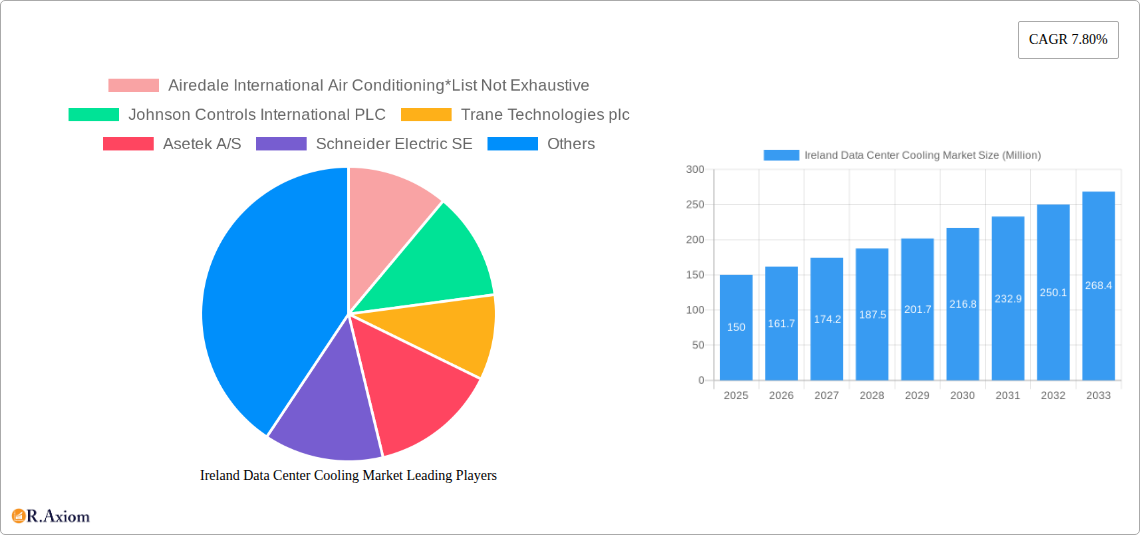

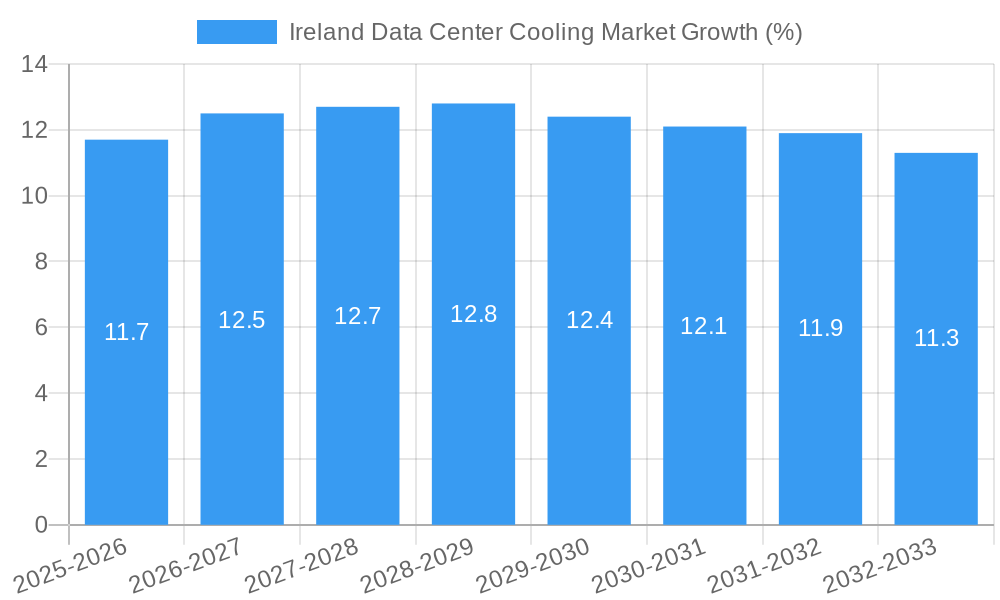

The Ireland data center cooling market is experiencing robust growth, driven by the increasing adoption of cloud computing, big data analytics, and the expansion of digital infrastructure within the country. The market's Compound Annual Growth Rate (CAGR) of 7.80% from 2019 to 2024 indicates a significant upward trajectory. Key drivers include the rising demand for high-performance computing, stringent regulations regarding data center energy efficiency, and the growing need for reliable and resilient cooling solutions to prevent costly downtime. The market is segmented by end-user (IT & Telecommunication, BFSI, Government, Media & Entertainment, and Others) and cooling technology (Air-based, Liquid-based, and Evaporative). While the IT & Telecommunication sector currently dominates, growth is anticipated across all segments fueled by increasing digitalization across various sectors. The competitive landscape features both global giants like Johnson Controls, Trane Technologies, and Schneider Electric, alongside specialized providers like Asetek and Iceotope, suggesting a market with diverse technological offerings catering to specific needs. The presence of established players alongside innovative technology providers points toward a dynamic market responding to evolving cooling requirements and sustainability concerns.

Based on the 7.80% CAGR from 2019-2024 and considering typical market maturation, we can project continued, albeit potentially slightly moderated, growth into the forecast period. While a precise market size for 2025 is unavailable, a reasonable estimation would place it within a range reflecting the projected CAGR continuation. The continued growth is further supported by the ongoing expansion of data centers in Ireland, driven by both domestic demand and the country's strategic position within the European digital landscape. This necessitates robust and adaptable cooling solutions, further driving market expansion. The adoption of more efficient and sustainable cooling technologies like liquid-based and evaporative cooling is expected to gain traction, spurred by environmental concerns and cost optimization strategies. The government's focus on digital infrastructure development will likely act as a catalyst, creating further opportunities for market growth.

Ireland Data Center Cooling Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Ireland Data Center Cooling market, offering invaluable insights for stakeholders, investors, and industry professionals. The study covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. We delve into market dynamics, segment performance, key players, and future growth opportunities, presenting data in Million for all values.

Ireland Data Center Cooling Market Market Concentration & Innovation

The Ireland Data Center Cooling market exhibits a moderately concentrated landscape, with several multinational corporations holding significant market share. Key players such as Johnson Controls International PLC, Trane Technologies plc, and Schneider Electric SE compete intensely, driving innovation in cooling technologies. Market share analysis reveals that the top 5 players collectively account for approximately xx% of the total market revenue in 2025. The market is characterized by a dynamic interplay of established players and emerging innovators focusing on energy efficiency and sustainability.

- Market Concentration: Top 5 players hold xx% market share (2025).

- Innovation Drivers: Stringent energy regulations, growing demand for high-density computing, and the increasing adoption of sustainable practices are driving innovation.

- Regulatory Frameworks: EU environmental regulations and data center energy efficiency standards significantly influence market dynamics.

- Product Substitutes: While traditional air-based cooling remains dominant, liquid-based and evaporative cooling solutions are gaining traction due to their enhanced energy efficiency.

- End-User Trends: The IT & Telecommunication sector leads the demand, followed by the BFSI and Government sectors.

- M&A Activities: Recent years have witnessed several strategic mergers and acquisitions, with deal values totaling approximately xx Million in the past five years, reflecting the consolidation trend within the sector. These activities aim to expand product portfolios, enhance technological capabilities, and achieve greater market penetration.

Ireland Data Center Cooling Market Industry Trends & Insights

The Ireland Data Center Cooling market is experiencing robust growth, driven by factors such as the expanding IT infrastructure, increasing data center deployments, and the escalating demand for energy-efficient cooling solutions. The market is projected to register a CAGR of xx% during the forecast period (2025-2033), reaching a market value of xx Million by 2033. Technological advancements, including liquid cooling and AI-powered cooling management systems, are significantly influencing market dynamics.

The rising adoption of cloud computing and edge computing is further fueling demand. Market penetration of liquid-based cooling systems is expected to increase from xx% in 2025 to xx% by 2033. Competitive dynamics are shaped by the ongoing innovation in cooling technologies, partnerships, and strategic investments. Consumer preferences are shifting towards sustainable and energy-efficient cooling solutions, leading to increased demand for eco-friendly products.

Dominant Markets & Segments in Ireland Data Center Cooling Market

The IT & Telecommunication sector dominates the end-user segment, accounting for the largest market share, driven by the increasing demand for data storage and processing capabilities. Within cooling technologies, air-based cooling currently holds the largest market share, but liquid-based cooling is experiencing the fastest growth rate due to its higher efficiency and capacity to handle high-density computing environments.

- Dominant End-User Segment: IT & Telecommunication

- Key Drivers: Rapid growth of cloud computing, increasing data traffic, and rising demand for digital services.

- Dominant Cooling Technology: Air-based Cooling

- Key Drivers: Established technology, relatively lower initial investment costs, and wide availability.

- Fastest Growing Segment: Liquid-based Cooling

- Key Drivers: Superior energy efficiency, ability to handle high-density server deployments, and suitability for future technological advancements.

Ireland Data Center Cooling Market Product Developments

Recent product innovations focus on enhancing energy efficiency, reducing carbon footprint, and improving cooling capacity. Manufacturers are introducing advanced liquid cooling systems, AI-powered thermal management solutions, and modular designs to cater to diverse data center needs. These developments aim to address the growing demand for sustainable and highly efficient cooling solutions in data centers of all sizes. The market is seeing a trend towards integrated solutions that combine cooling with power management and other critical data center infrastructure components.

Report Scope & Segmentation Analysis

This report segments the Ireland Data Center Cooling market by end-user (IT & Telecommunication, BFSI, Government, Media & Entertainment, Other End-Users) and cooling technology (Air-based Cooling, Liquid-based Cooling, Evaporative Cooling). Each segment's growth trajectory, market size, and competitive landscape are analyzed thoroughly. The IT & Telecommunication segment exhibits the highest growth potential, while liquid-based cooling technology is anticipated to witness the fastest expansion due to its energy-efficiency advantages and suitability for high-density environments. The market size for each segment is projected to expand significantly during the forecast period (2025-2033).

Key Drivers of Ireland Data Center Cooling Market Growth

Several key factors are driving the growth of the Ireland Data Center Cooling market. These include:

- Growing Data Center Infrastructure: The increasing demand for data storage and processing is leading to a surge in data center construction and expansion.

- Technological Advancements: Innovations in cooling technologies, such as liquid cooling and AI-powered thermal management, are enhancing efficiency and capacity.

- Government Initiatives: Regulatory support for renewable energy and energy efficiency standards is creating incentives for sustainable cooling solutions.

Challenges in the Ireland Data Center Cooling Market Sector

Despite the positive growth outlook, the Ireland Data Center Cooling market faces certain challenges:

- High Initial Investment Costs: Implementing advanced cooling technologies like liquid cooling can require significant upfront investments.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of components.

- Intense Competition: The market is characterized by intense competition among established players and new entrants, putting pressure on pricing and margins.

Emerging Opportunities in Ireland Data Center Cooling Market

The Ireland Data Center Cooling market presents several exciting opportunities:

- Growth in Edge Computing: The rising popularity of edge computing necessitates efficient cooling solutions for distributed data centers.

- Demand for Sustainable Cooling: Increasing environmental concerns are driving demand for eco-friendly cooling technologies.

- Integration with AI & IoT: The integration of AI and IoT in cooling systems offers potential for enhanced efficiency and predictive maintenance.

Leading Players in the Ireland Data Center Cooling Market Market

- Airedale International Air Conditioning

- Johnson Controls International PLC

- Trane Technologies plc

- Asetek A/S

- Schneider Electric SE

- Mitsubishi Electric Hydronics & IT Cooling Systems S p A

- Iceotope Technologies Limited

- Fujitsu General Limited

- Stulz GmbH

- Vertiv Group Corp

- Rittal GMBH & Co KG

Key Developments in Ireland Data Center Cooling Market Industry

- July 2022: Iceotope Technologies collaborated with Intel and HPE to reduce energy consumption in edge data centers by 30%, showcasing advancements in precision cooling technology.

- July 2022: nVent Electric plc invested in Iceotope Technologies, signifying a strengthening partnership to deliver modularized liquid cooling solutions for data centers and edge computing.

Strategic Outlook for Ireland Data Center Cooling Market Market

The Ireland Data Center Cooling market is poised for continued growth, driven by ongoing digital transformation, the increasing adoption of advanced cooling technologies, and the growing emphasis on sustainability. The market will see increased competition, further innovation in energy-efficient solutions, and expansion into new segments like edge computing. The focus will be on providing integrated and optimized cooling solutions to support the evolving needs of the data center industry.

Ireland Data Center Cooling Market Segmentation

-

1. Cooling Technology

-

1.1. Air-based Cooling

- 1.1.1. Chiller and Economizer

- 1.1.2. CRAH

- 1.1.3. Cooling

- 1.1.4. Other Air-based Cooling Technologies

-

1.2. Liquid-based Cooling

- 1.2.1. Immersion Cooling

- 1.2.2. Direct-to-chip Cooling

- 1.2.3. Rear-door Heat Exchanger

-

1.1. Air-based Cooling

-

2. Type

- 2.1. Hyperscaler (Owned and Leased)

- 2.2. Enterprise (On-premise)

- 2.3. Colocation

-

3. End-user Industry

- 3.1. IT and Telecom

- 3.2. Retail and Consumer Goods

- 3.3. Healthcare

- 3.4. Media and Entertainment

- 3.5. Federal and Institutional Agencies

- 3.6. Other End-user Industries

Ireland Data Center Cooling Market Segmentation By Geography

- 1. Ireland

Ireland Data Center Cooling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Rack Power Density; Increasing Trend of High-Performance Computing across Europe

- 3.3. Market Restrains

- 3.3.1. The High Costs Associated with Cooling Infrastructure.; Cooling machines in many data centers are not equipped for the changing climate.

- 3.4. Market Trends

- 3.4.1. IT & Telecommunication Segment holds the major share.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Ireland Data Center Cooling Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cooling Technology

- 5.1.1. Air-based Cooling

- 5.1.1.1. Chiller and Economizer

- 5.1.1.2. CRAH

- 5.1.1.3. Cooling

- 5.1.1.4. Other Air-based Cooling Technologies

- 5.1.2. Liquid-based Cooling

- 5.1.2.1. Immersion Cooling

- 5.1.2.2. Direct-to-chip Cooling

- 5.1.2.3. Rear-door Heat Exchanger

- 5.1.1. Air-based Cooling

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Hyperscaler (Owned and Leased)

- 5.2.2. Enterprise (On-premise)

- 5.2.3. Colocation

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. IT and Telecom

- 5.3.2. Retail and Consumer Goods

- 5.3.3. Healthcare

- 5.3.4. Media and Entertainment

- 5.3.5. Federal and Institutional Agencies

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Ireland

- 5.1. Market Analysis, Insights and Forecast - by Cooling Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Airedale International Air Conditioning*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Johnson Controls International PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Trane Technologies plc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Asetek A/S

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Schneider Electric SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mitsubishi Electric Hydronics & IT Cooling Systems S p A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Iceotope Technologies Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Fujitsu General Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Stulz GmbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vertiv Group Corp

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Rittal GMBH & Co KG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Airedale International Air Conditioning*List Not Exhaustive

List of Figures

- Figure 1: Ireland Data Center Cooling Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Ireland Data Center Cooling Market Share (%) by Company 2024

List of Tables

- Table 1: Ireland Data Center Cooling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Ireland Data Center Cooling Market Revenue Million Forecast, by Cooling Technology 2019 & 2032

- Table 3: Ireland Data Center Cooling Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Ireland Data Center Cooling Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Ireland Data Center Cooling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Ireland Data Center Cooling Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Ireland Data Center Cooling Market Revenue Million Forecast, by Cooling Technology 2019 & 2032

- Table 8: Ireland Data Center Cooling Market Revenue Million Forecast, by Type 2019 & 2032

- Table 9: Ireland Data Center Cooling Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 10: Ireland Data Center Cooling Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ireland Data Center Cooling Market?

The projected CAGR is approximately 7.80%.

2. Which companies are prominent players in the Ireland Data Center Cooling Market?

Key companies in the market include Airedale International Air Conditioning*List Not Exhaustive, Johnson Controls International PLC, Trane Technologies plc, Asetek A/S, Schneider Electric SE, Mitsubishi Electric Hydronics & IT Cooling Systems S p A, Iceotope Technologies Limited, Fujitsu General Limited, Stulz GmbH, Vertiv Group Corp, Rittal GMBH & Co KG.

3. What are the main segments of the Ireland Data Center Cooling Market?

The market segments include Cooling Technology, Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Rack Power Density; Increasing Trend of High-Performance Computing across Europe.

6. What are the notable trends driving market growth?

IT & Telecommunication Segment holds the major share..

7. Are there any restraints impacting market growth?

The High Costs Associated with Cooling Infrastructure.; Cooling machines in many data centers are not equipped for the changing climate..

8. Can you provide examples of recent developments in the market?

July 2022: Iceotope Technologies, a leading provider of IT cooling solutions, collaborated with Intel and Hewlett Packard Enterprise (HPE) to significantly reduce energy consumption in edge data centers by 30%. The joint initiative is aimed at advancing their shared commitment to achieving net-zero sustainability goals by integrating Iceotope's precision cooling technology into edge data centers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ireland Data Center Cooling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ireland Data Center Cooling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ireland Data Center Cooling Market?

To stay informed about further developments, trends, and reports in the Ireland Data Center Cooling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence