Key Insights

The Italian luxury goods market is projected to experience substantial growth, driven by a CAGR of 3.18% from 2024 to 2033. The current market size is valued at 5.82 billion. Key growth catalysts include the enduring allure of Italian craftsmanship and heritage brands, a burgeoning global affluent class, and strategic investments in e-commerce and personalized customer experiences. The market is segmented by product type (apparel, footwear, accessories, jewelry, watches) and distribution channels (brand stores, multi-brand retailers, online platforms). Digital commerce is significantly influencing sales growth, reflecting a broader industry trend. Leading entities such as LVMH, Kering, and Prada are leveraging brand equity and innovative strategies for market leadership, though economic volatility and evolving consumer preferences present challenges. Sustained success hinges on maintaining brand exclusivity while adapting to dynamic consumer demands.

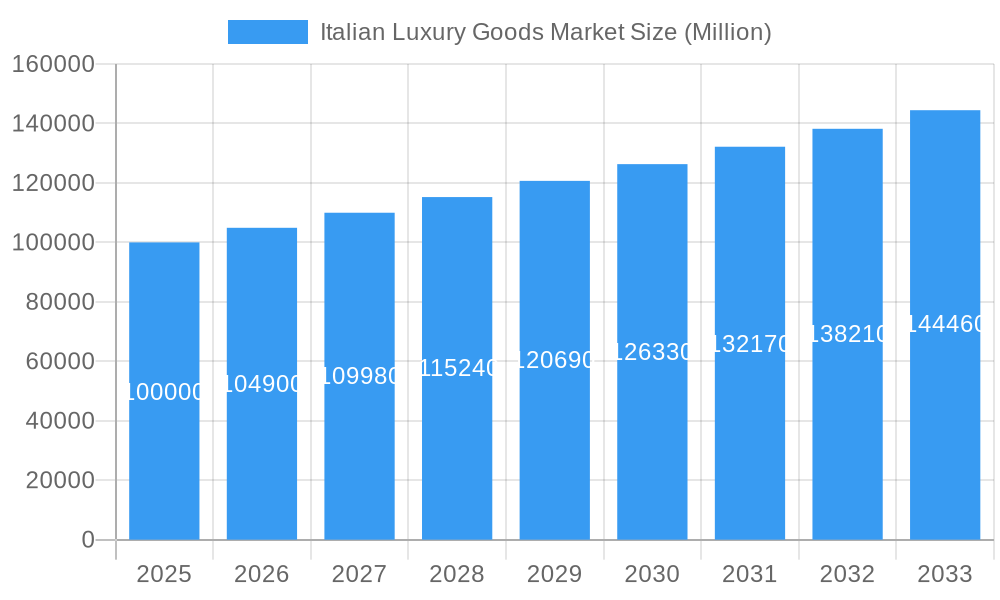

Italian Luxury Goods Market Market Size (In Billion)

Balancing tradition and innovation is central to the Italian luxury goods market's success. Brands are integrating sustainable practices and technology to enhance customer engagement, maintaining the high standards of craftsmanship that define Italian luxury. Intense competition exists among established and emerging players. Geographical concentration of production and consumption in Italy creates unique opportunities and necessitates strategic collaborations and efficient supply chain management. Fluctuations in the Euro and global economic conditions directly influence market trajectory. Accurate forecasting demands careful analysis of macroeconomic factors and consumer behavior. Future success will depend on product excellence, effective marketing, and robust strategies for long-term sustainability and resilience against market disruptions. The forecast period offers significant growth potential, requiring strategic foresight and adaptability in the evolving luxury landscape.

Italian Luxury Goods Market Company Market Share

Italian Luxury Goods Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Italian luxury goods market, covering market size, segmentation, key players, growth drivers, and future trends. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period extends from 2025 to 2033, encompassing historical data from 2019 to 2024. This report is crucial for industry stakeholders, investors, and businesses seeking to understand and capitalize on the opportunities within this dynamic market. The report uses Million (M) as the unit for all values.

Italian Luxury Goods Market Concentration & Innovation

The Italian luxury goods market exhibits a concentrated structure, with a few dominant players holding significant market share. LVMH Moët Hennessy Louis Vuitton, Kering, and Prada S p A are among the leading companies, collectively commanding xx% of the market in 2024. However, mid-sized companies like MAX MARA SRL and emerging brands are actively challenging the established order, driving innovation and competition. The market's innovative spirit is fueled by several factors:

- Technological advancements: Integration of digital technologies in design, production, and marketing is transforming the industry, driving efficiency and personalized experiences.

- Sustainable practices: Growing consumer demand for ethically and sustainably sourced products is pushing luxury brands to adopt eco-friendly materials and manufacturing processes, exemplified by Prada's NFT initiative.

- Product diversification: Brands are expanding their product portfolios beyond traditional categories to cater to diverse customer preferences.

- Regulatory landscape: The Italian government's policies regarding luxury goods production, intellectual property protection, and tourism impact market dynamics.

- M&A activity: Consolidation through mergers and acquisitions is expected to continue, resulting in further market concentration. While precise M&A deal values are not publicly available for all transactions, recent deals have ranged from xxM to xxM, indicating significant investment.

Substitute products from other countries and brands challenge the market, along with shifts in end-user trends towards experiences rather than solely material goods.

Italian Luxury Goods Market Industry Trends & Insights

The Italian luxury goods market is projected to experience robust growth throughout the forecast period (2025-2033), driven by several key factors. The Compound Annual Growth Rate (CAGR) is estimated to be xx% during this period, exceeding the global average CAGR for luxury goods. The luxury market has seen strong consumer spending fueled by a combination of factors including:

- Resurgence of tourism: The return of international tourists to Italy, particularly from Asia and the Americas, has significantly boosted sales of luxury goods.

- High-net-worth individual growth: The increasing number of high-net-worth individuals (HNWIs) in key markets contributes to elevated demand.

- E-commerce expansion: The increasing adoption of e-commerce by luxury brands has widened their reach, improving market penetration.

- Brand loyalty & heritage: Italian luxury brands enjoy strong global recognition and a rich heritage which command premium pricing and sustained demand.

- Shifting consumer preferences: Consumers are demonstrating increased interest in experiential luxury and personalized products.

- Competitive dynamics: Intense competition amongst both established and emerging players are driving innovation and improved product quality, though some smaller brands are struggling with profit margins.

Dominant Markets & Segments in Italian Luxury Goods Market

Within the Italian luxury goods market, several segments and distribution channels stand out:

- By Type: The clothing and apparel segment holds the largest market share, followed closely by bags and footwear. Watches and jewelry also represent significant portions of the market, all indicating high consumer demand for Italian craftsmanship.

- By Distribution Channel: Single-brand stores maintain a dominant market position, leveraging brand experience and exclusivity. Online stores, however, are exhibiting rapid growth, gaining market share among younger and tech-savvy consumers.

Key Drivers of Segment Dominance:

- Economic factors: Italy's strong luxury goods manufacturing sector benefits from government incentives, supportive infrastructure, and skilled labor.

- Tourism and retail experience: The availability of high-quality retail experiences tailored to luxury shopping directly impacts demand.

- Brand reputation: The reputation of Italian luxury brands is a key driver, fueling demand amongst consumers worldwide.

Italian Luxury Goods Market Product Developments

Recent years have witnessed significant product innovation in the Italian luxury goods market. Brands are increasingly adopting sustainable materials and production methods, responding to growing consumer consciousness and regulations. Technological advancements, such as 3D printing and personalized customization options, are also impacting product development. The integration of digital technologies in design and production enhances efficiency and allows for more efficient customization based on consumer feedback. This focus on sustainable luxury and technological integration aligns with shifting consumer preferences and creates a stronger market fit.

Report Scope & Segmentation Analysis

This report segments the Italian luxury goods market by type (Clothing and Apparel, Footwear, Bags, Jewelry, Watches, Other Accessories) and distribution channel (Single-brand Stores, Multi-brand Stores, Online Stores, Other Distribution Channels). Each segment's growth projection, market size (in Million), and competitive dynamics are thoroughly analyzed, providing comprehensive market insight. Market sizes for each segment vary significantly and detailed analysis is offered in the full report.

Key Drivers of Italian Luxury Goods Market Growth

Several key factors fuel the growth of the Italian luxury goods market. These include:

- Rising disposable incomes: Increased purchasing power, particularly among HNWIs, directly drives demand.

- Tourism and Travel: The increasing number of tourists visiting Italy contributes to substantial growth of the industry.

- Government support: Italian government initiatives to support the luxury industry play a crucial role in its growth and expansion.

- Brand recognition: The global recognition of Italian luxury brands contributes positively to sustained market demand.

Challenges in the Italian Luxury Goods Market Sector

Despite strong growth potential, the Italian luxury goods market faces certain challenges:

- Economic fluctuations: Global economic downturns can impact consumer spending on luxury goods, which have a higher degree of discretionary purchases.

- Counterfeit goods: The proliferation of counterfeit luxury goods undermines brand value and profitability.

- Supply chain disruptions: Global supply chain issues can hinder production and distribution.

- Competition: Intense competition from other luxury brands worldwide requires continual innovation and adaptation.

Emerging Opportunities in Italian Luxury Goods Market

The Italian luxury goods market presents several promising opportunities:

- Experiential luxury: Focus on delivering unique customer experiences enhances brand loyalty and drives sales.

- Personalization: Offering customized products to individual preferences caters to growing consumer demands.

- Sustainable luxury: Promoting eco-friendly products is crucial for attracting environmentally conscious consumers.

- Expansion into new markets: Exploring untapped markets in emerging economies offers high growth potential.

Leading Players in the Italian Luxury Goods Market Market

- The Estee Lauder Companies Inc. (https://www.elcompanies.com/)

- KERING (https://www.kering.com/)

- Prada S p A (https://www.prada.com/)

- Ralph Lauren Corporation (https://www.ralphlauren.com/)

- MAX MARA SRL

- PVH Corp (https://www.pvh.com/)

- TAG Heuer International SA (https://www.tagheuer.com/)

- L'OREAL (https://www.loreal.com/)

- LVMH Moët Hennessy Louis Vuitton (https://www.lvmh.com/)

Key Developments in Italian Luxury Goods Market Industry

- July 2022: Prada SA launched its second Timecapsule NFT collection, showcasing its commitment to digital innovation and sustainability.

- May 2022: Fendi invested in a new shoe factory, indicating expansion plans and a focus on domestic manufacturing.

- February 2022: Hublot opened its fourth Italian store in Milan, highlighting the brand's commitment to the Italian market.

Strategic Outlook for Italian Luxury Goods Market Market

The Italian luxury goods market is poised for sustained growth, driven by strong brand equity, increasing consumer spending, and innovative product development. The strategic focus should be on enhancing customer experiences, embracing sustainability, and leveraging digital technologies to reach a wider global audience. The market presents significant opportunities for existing players and new entrants willing to adapt and innovate.

Italian Luxury Goods Market Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Jewelry

- 1.5. Watches

- 1.6. Other Accessories

-

2. Distibution Channel

- 2.1. Single-brand Stores

- 2.2. Multi-brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

Italian Luxury Goods Market Segmentation By Geography

- 1. Italia

Italian Luxury Goods Market Regional Market Share

Geographic Coverage of Italian Luxury Goods Market

Italian Luxury Goods Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Internet Usage and Effortless Shopping Experience; Growing Consumer Inclination Towards Appearance and Latest Fashion

- 3.3. Market Restrains

- 3.3.1. Robust Offline Retail Channel Penetration

- 3.4. Market Trends

- 3.4.1. Exponentially Growing market of Luxury Leather Goods

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italian Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Jewelry

- 5.1.5. Watches

- 5.1.6. Other Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Single-brand Stores

- 5.2.2. Multi-brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Estee Lauder Companies Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 KERING

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Prada S p A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ralph Lauren Corporation*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MAX MARA SRL

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PVH Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TAG Heuer International SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ralph Lauren Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 L'OREAL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LVMH Moët Hennessy Louis Vuitton

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 The Estee Lauder Companies Inc

List of Figures

- Figure 1: Italian Luxury Goods Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italian Luxury Goods Market Share (%) by Company 2025

List of Tables

- Table 1: Italian Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Italian Luxury Goods Market Volume K Units Forecast, by Type 2020 & 2033

- Table 3: Italian Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 4: Italian Luxury Goods Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 5: Italian Luxury Goods Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Italian Luxury Goods Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Italian Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Italian Luxury Goods Market Volume K Units Forecast, by Type 2020 & 2033

- Table 9: Italian Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 10: Italian Luxury Goods Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 11: Italian Luxury Goods Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Italian Luxury Goods Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italian Luxury Goods Market?

The projected CAGR is approximately 3.18%.

2. Which companies are prominent players in the Italian Luxury Goods Market?

Key companies in the market include The Estee Lauder Companies Inc, KERING, Prada S p A, Ralph Lauren Corporation*List Not Exhaustive, MAX MARA SRL, PVH Corp, TAG Heuer International SA, Ralph Lauren Corporation, L'OREAL, LVMH Moët Hennessy Louis Vuitton.

3. What are the main segments of the Italian Luxury Goods Market?

The market segments include Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.82 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Internet Usage and Effortless Shopping Experience; Growing Consumer Inclination Towards Appearance and Latest Fashion.

6. What are the notable trends driving market growth?

Exponentially Growing market of Luxury Leather Goods.

7. Are there any restraints impacting market growth?

Robust Offline Retail Channel Penetration.

8. Can you provide examples of recent developments in the market?

In July 2022, Prada SA unveiled its second Timecapsule NFT collection, a shirt made from upcycled fabric from the Prada archives. The shirt features a 'Jacquard Animalier' silk brocade and lurex fabric in addition to a Jacquard Thrush (flower), which is silk sourced from an early 20th-century French archive.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italian Luxury Goods Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italian Luxury Goods Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italian Luxury Goods Market?

To stay informed about further developments, trends, and reports in the Italian Luxury Goods Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence