Key Insights

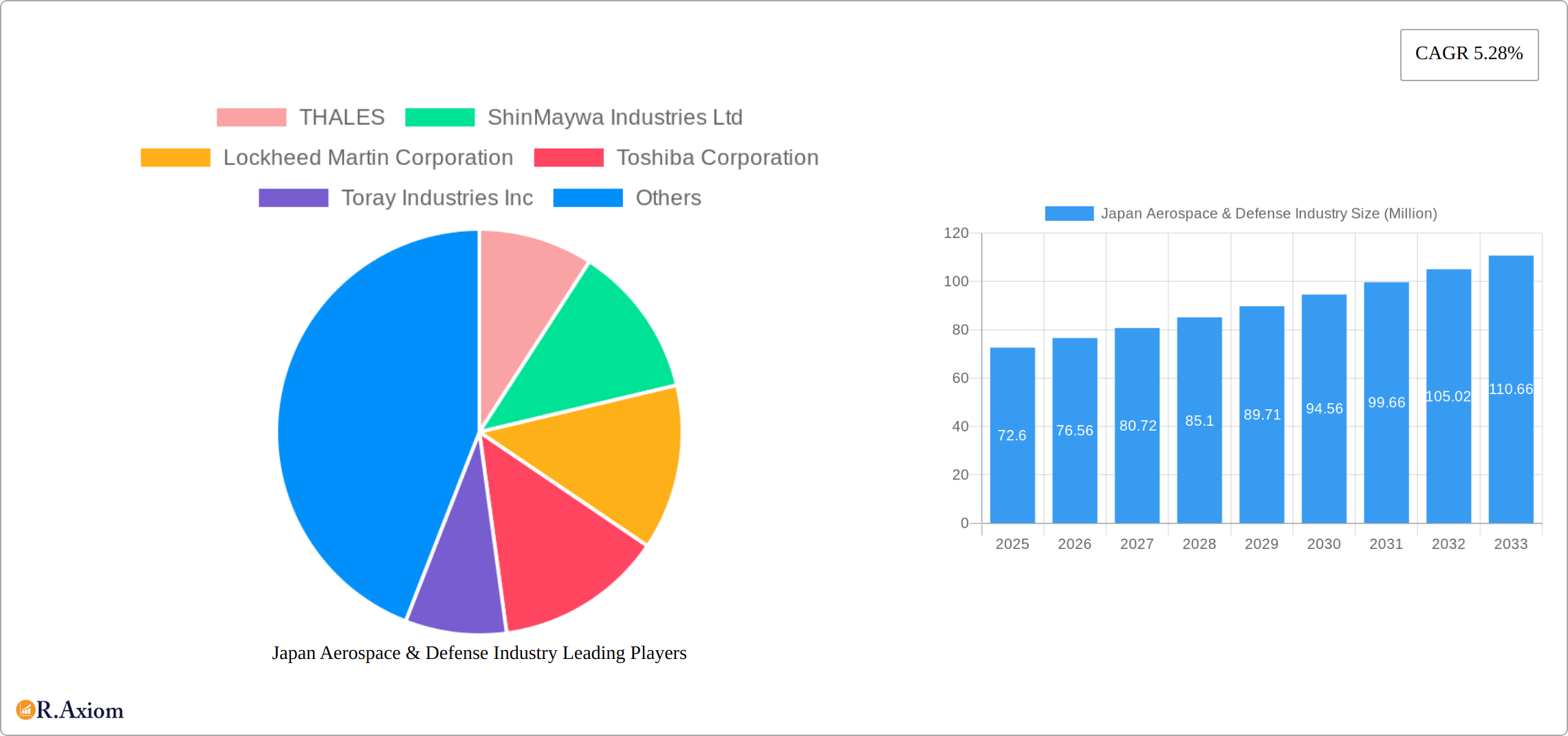

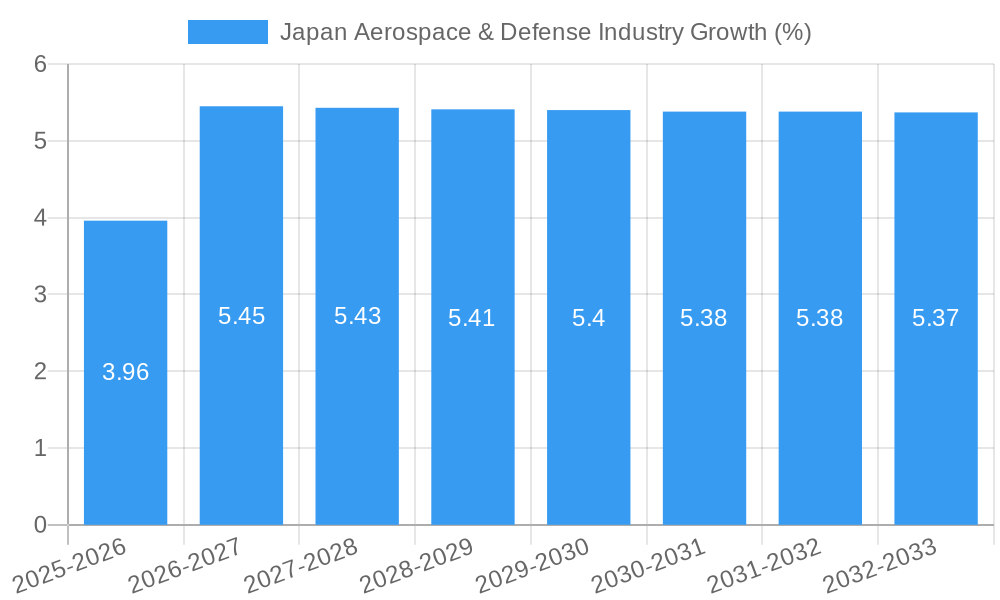

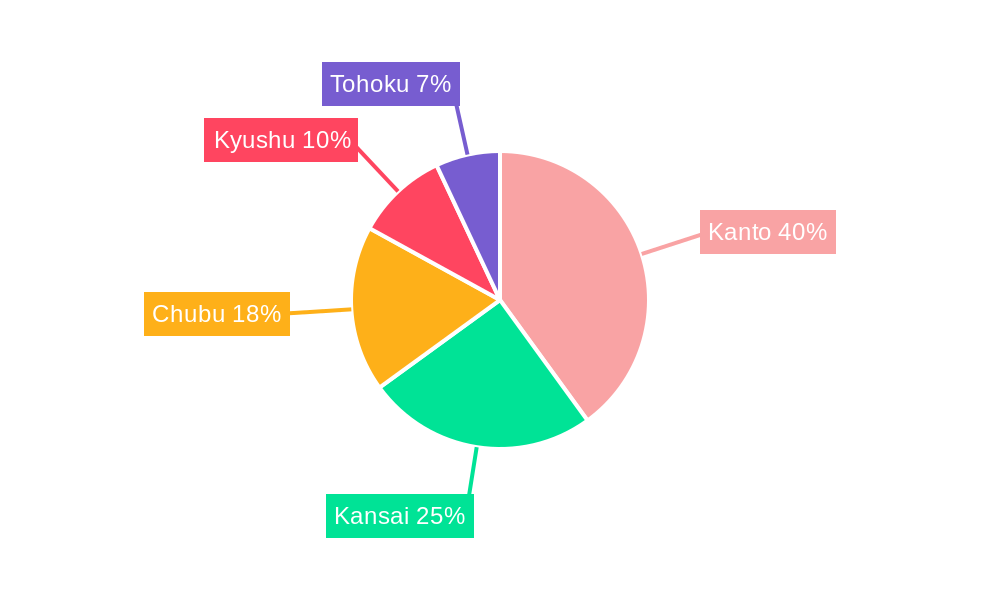

The Japan Aerospace & Defense industry, valued at $72.60 million in 2025, is poised for steady growth, projected to expand at a compound annual growth rate (CAGR) of 5.28% from 2025 to 2033. This growth is fueled by increasing government spending on defense modernization, particularly in response to regional geopolitical uncertainties and technological advancements driving demand for advanced aerospace and defense systems. Significant drivers include the development of next-generation fighter jets, unmanned aerial vehicles (UAVs), and missile defense systems. Furthermore, a robust domestic manufacturing base, coupled with a strong emphasis on technological innovation within companies like Mitsubishi Heavy Industries, Kawasaki Heavy Industries, and others, contributes significantly to the sector's expansion. The industry’s segmentation across aerospace and defense sectors, manufacturing, maintenance, repair, and overhaul (MRO) services, and terrestrial, aerial, and naval platforms reflects a diversified market with opportunities across various applications. The concentration of industry activity across regions like Kanto, Kansai, and Chubu further highlights the geographically clustered nature of this important sector within Japan.

However, challenges remain. While government investment is a key driver, budgetary constraints and global economic fluctuations could impact future growth trajectories. Competition from international players and the need for continuous technological upgrades to maintain a competitive edge also present significant hurdles. Despite these challenges, the Japanese Aerospace & Defense industry is anticipated to experience considerable expansion over the forecast period, driven by its strong technological foundation, skilled workforce, and increasing strategic importance in the broader geopolitical landscape. The continued focus on R&D and strategic partnerships will be vital for sustaining this growth and navigating the competitive landscape effectively.

Japan Aerospace & Defense Industry: Market Analysis & Forecast Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Japan Aerospace & Defense Industry, covering market size, growth drivers, challenges, opportunities, and key players. The report leverages extensive primary and secondary research, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, while the historical period analyzed is 2019-2024.

Japan Aerospace & Defense Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the Japanese aerospace and defense industry, examining market concentration, innovation drivers, regulatory influences, and market dynamics. The analysis incorporates market share data for key players, and assesses the impact of mergers and acquisitions (M&A) activities on market structure. The total market value in 2025 is estimated at xx Million.

Market Concentration: The Japanese aerospace and defense market demonstrates a moderate level of concentration, with a few large players holding significant market share. Mitsubishi Heavy Industries Ltd and Kawasaki Heavy Industries Ltd are major players, but the market also supports numerous specialized SMEs. Precise market share data for each company is proprietary and unavailable for public disclosure. However, we estimate that the top 5 players hold approximately 60% of the overall market share in 2025.

Innovation Drivers: Government funding for R&D, a focus on advanced technologies (e.g., unmanned aerial vehicles, hypersonic weapons), and increasing defense spending are key innovation drivers. The pressure to maintain technological parity with global competitors also fuels innovation.

Regulatory Framework: Stringent regulations governing defense procurement and export controls significantly influence industry dynamics. The Japanese government's policies regarding technology transfer and foreign investment play a crucial role.

Product Substitutes: The availability of substitutes is limited due to the specialized nature of aerospace and defense products. However, advancements in commercial technologies can indirectly create substitutes or enhance competition in certain areas.

M&A Activities: M&A activity in the Japanese aerospace and defense sector has been relatively moderate in recent years, with deal values averaging around xx Million annually. However, a potential increase is anticipated in the forecast period driven by industry consolidation and technological advancements. Consolidation efforts mostly focus on gaining access to technologies or expanding into new markets.

Japan Aerospace & Defense Industry Industry Trends & Insights

This section delves into the key trends shaping the Japanese aerospace and defense market, focusing on growth drivers, technological disruptions, and evolving consumer preferences (in the context of government procurements). The CAGR for the forecast period (2025-2033) is projected at xx%, driven primarily by increased defense budgets and modernization initiatives. Market penetration of advanced technologies is gradually increasing, though adoption remains somewhat cautious due to cost and integration challenges.

The market is experiencing significant technological disruptions, with the integration of AI, autonomous systems, and big data analytics transforming aerospace and defense capabilities. The consumer (government) preference is clearly shifting towards advanced technologies which offer enhanced operational capabilities and cost-effectiveness. Competitive dynamics are marked by both domestic and international players vying for market share. This competitive landscape fuels innovation and drives down prices.

Dominant Markets & Segments in Japan Aerospace & Defense Industry

This section identifies the dominant segments within the Japanese aerospace and defense industry, highlighting key drivers for their dominance and providing a detailed analysis of market dynamics.

Dominant Sector: The Defense sector holds the largest market share, driven by increased government spending on military modernization and national security concerns.

Dominant Service Type: Manufacturing accounts for the largest share due to high domestic production, but MRO (Maintenance, Repair, and Overhaul) is a rapidly growing segment as aging fleets require extensive maintenance.

Dominant Platform: Aerial platforms (aircraft, UAVs) constitute the largest segment, followed by naval platforms. Terrestrial platforms also play a significant role, although growth is projected to be more moderate in comparison.

Key Drivers for Dominance:

- Increased Defense Budgets: Significant government investment in defense modernization is the primary growth driver.

- Technological Advancements: The adoption of cutting-edge technologies is enhancing capabilities and driving market growth.

- Geopolitical Instability: Regional security concerns are increasing demand for advanced defense systems.

- Government Support: Strong government support in R&D and export promotion is fostering industry growth.

Japan Aerospace & Defense Industry Product Developments

Recent product innovations reflect a strong focus on unmanned systems, advanced materials, and improved sensor technologies. These developments enhance operational capabilities, providing a significant competitive advantage. The market sees a growing demand for more autonomous and intelligent systems, integrating AI and machine learning for enhanced situational awareness and decision-making. This trend is reflected across aerial, naval, and terrestrial platforms.

Report Scope & Segmentation Analysis

The report comprehensively segments the Japanese aerospace and defense market across three key dimensions: Sector (Aerospace, Defense), Service Type (Manufacturing, MRO), and Platform (Terrestrial, Aerial, Naval). Each segment is further analyzed considering growth projections, market size, and competitive dynamics. The Aerospace sector is expected to witness robust growth, particularly in the commercial aviation segment. The Manufacturing segment continues to dominate, with a significant share of total market value. Aerial platforms represent the largest segment by value, driven by increasing demand for advanced fighter aircraft and unmanned aerial vehicles.

Key Drivers of Japan Aerospace & Defense Industry Growth

Several key factors contribute to the growth of the Japanese aerospace and defense industry. Increased government spending on defense modernization, driven by evolving geopolitical dynamics and technological advancements, is paramount. Government policies promoting technological innovation and domestic manufacturing also play a crucial role. The growing need for enhanced national security and the modernization of aging military fleets are further propelling market expansion.

Challenges in the Japan Aerospace & Defense Industry Sector

The industry faces challenges, including stringent regulatory frameworks that can hinder innovation and limit international collaboration. Supply chain disruptions and dependence on foreign technologies pose additional concerns. Competition from international players and the high cost of research and development are also significant hurdles. The impact of these constraints translates to project delays and higher production costs. These costs are partially offset by government subsidies, but still put pressure on profit margins.

Emerging Opportunities in Japan Aerospace & Defense Industry

Emerging opportunities include the growing demand for advanced unmanned systems, the development of new materials and technologies, and expanding export opportunities. The increasing integration of AI and machine learning across platforms offers considerable potential. Furthermore, the expanding market for space-based systems presents new avenues for growth and innovation.

Leading Players in the Japan Aerospace & Defense Industry Market

- THALES

- ShinMaywa Industries Ltd

- Lockheed Martin Corporation

- Toshiba Corporation

- Toray Industries Inc

- Japan Steel Works Ltd

- RTX Corporation

- Komatsu Ltd

- BAE Systems plc

- Kawasaki Heavy Industries Ltd

- Northrop Grumman Corporation

- The Boeing Company

- Mitsubishi Heavy Industries Ltd

Key Developments in Japan Aerospace & Defense Industry Industry

- January 2023: Mitsubishi Heavy Industries secures a major contract for the development of a new generation of fighter jets.

- March 2022: Kawasaki Heavy Industries announces a partnership with a foreign firm to develop advanced UAV technology.

- June 2021: The Japanese government approves increased defense spending, boosting investment in the sector.

- Further developments require specific data to be added.

Strategic Outlook for Japan Aerospace & Defense Industry Market

The Japanese aerospace and defense industry is poised for continued growth driven by modernization efforts, technological advancements, and geopolitical factors. The focus on next-generation technologies, increased government investment, and strategic partnerships will be key to unlocking future market potential. The industry needs to address the challenges of maintaining technological edge while managing costs and ensuring supply chain resilience. A strategic focus on innovation, collaboration, and export diversification will ensure a strong outlook for the sector.

Japan Aerospace & Defense Industry Segmentation

-

1. Sector

- 1.1. Aerospace

- 1.2. Defense

-

2. Service Type

- 2.1. Manufacturing

- 2.2. MRO

-

3. Platform

- 3.1. Terrestrial

- 3.2. Aerial

- 3.3. Naval

Japan Aerospace & Defense Industry Segmentation By Geography

- 1. Japan

Japan Aerospace & Defense Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.28% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Manufacturing Segment Accounted for a Major Share in 2023

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Aerospace & Defense Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Aerospace

- 5.1.2. Defense

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Manufacturing

- 5.2.2. MRO

- 5.3. Market Analysis, Insights and Forecast - by Platform

- 5.3.1. Terrestrial

- 5.3.2. Aerial

- 5.3.3. Naval

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Kanto Japan Aerospace & Defense Industry Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan Aerospace & Defense Industry Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan Aerospace & Defense Industry Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan Aerospace & Defense Industry Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan Aerospace & Defense Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 THALES

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ShinMaywa Industries Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lockheed Martin Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Toshiba Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Toray Industries Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Japan Steel Works Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 RTX Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Komatsu Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BAE Systems plc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kawasaki Heavy Industries Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Northrop Grumman Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 The Boeing Company

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Mitsubishi Heavy Industries Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 THALES

List of Figures

- Figure 1: Japan Aerospace & Defense Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Aerospace & Defense Industry Share (%) by Company 2024

List of Tables

- Table 1: Japan Aerospace & Defense Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Aerospace & Defense Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Japan Aerospace & Defense Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 4: Japan Aerospace & Defense Industry Revenue Million Forecast, by Platform 2019 & 2032

- Table 5: Japan Aerospace & Defense Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Japan Aerospace & Defense Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Kanto Japan Aerospace & Defense Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Kansai Japan Aerospace & Defense Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Chubu Japan Aerospace & Defense Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kyushu Japan Aerospace & Defense Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Tohoku Japan Aerospace & Defense Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Japan Aerospace & Defense Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 13: Japan Aerospace & Defense Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 14: Japan Aerospace & Defense Industry Revenue Million Forecast, by Platform 2019 & 2032

- Table 15: Japan Aerospace & Defense Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Aerospace & Defense Industry?

The projected CAGR is approximately 5.28%.

2. Which companies are prominent players in the Japan Aerospace & Defense Industry?

Key companies in the market include THALES, ShinMaywa Industries Ltd, Lockheed Martin Corporation, Toshiba Corporation, Toray Industries Inc, Japan Steel Works Ltd, RTX Corporation, Komatsu Ltd, BAE Systems plc, Kawasaki Heavy Industries Ltd, Northrop Grumman Corporation, The Boeing Company, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Japan Aerospace & Defense Industry?

The market segments include Sector, Service Type, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 72.60 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Manufacturing Segment Accounted for a Major Share in 2023.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Aerospace & Defense Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Aerospace & Defense Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Aerospace & Defense Industry?

To stay informed about further developments, trends, and reports in the Japan Aerospace & Defense Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence