Key Insights

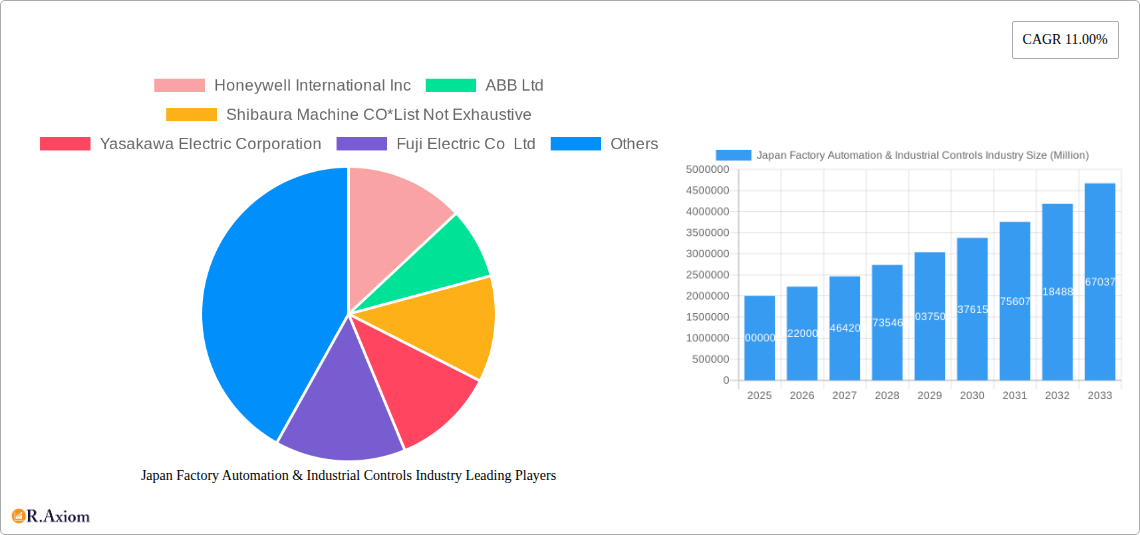

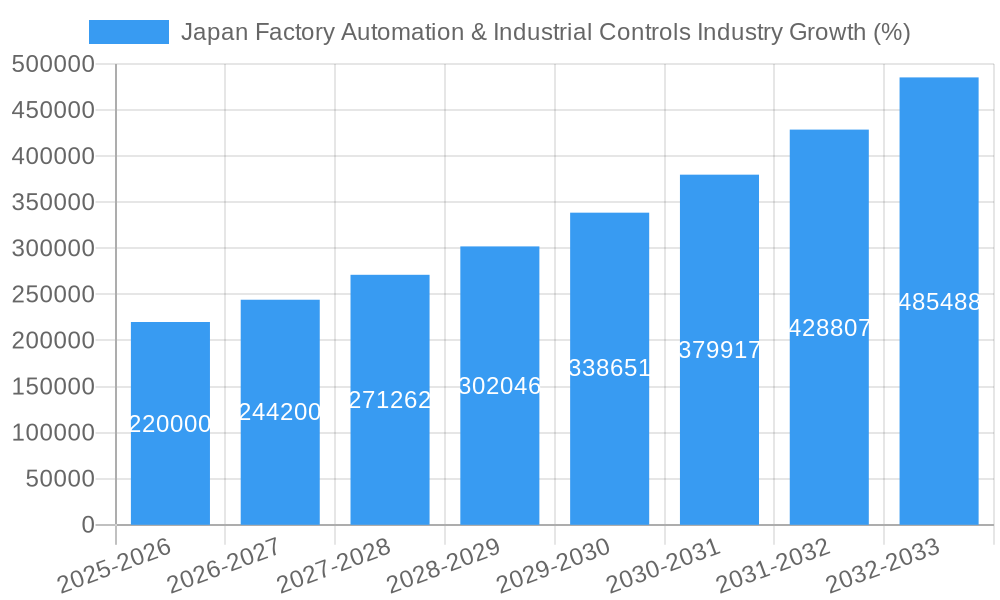

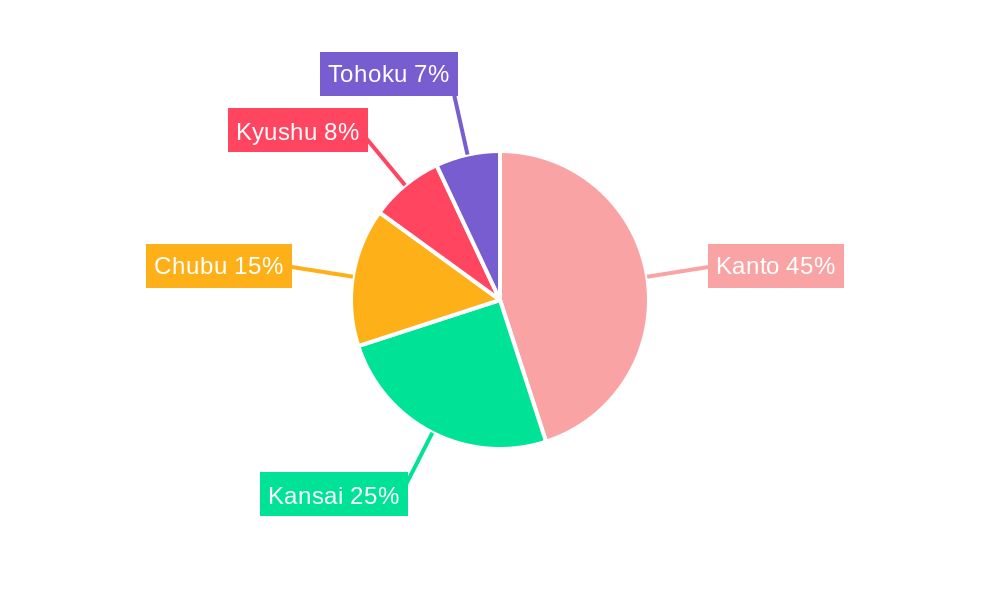

The Japan Factory Automation & Industrial Controls market is experiencing robust growth, driven by increasing automation needs across various sectors, particularly in manufacturing and logistics. The market, valued at approximately ¥2 trillion (assuming a market size "XX" of $15 Billion USD and current exchange rate) in 2025, is projected to maintain a Compound Annual Growth Rate (CAGR) of 11% through 2033. Key drivers include the government's ongoing initiatives to promote Industry 4.0 adoption, a strong focus on improving manufacturing efficiency and productivity, and the rising demand for advanced technologies like AI, machine learning, and robotics in industrial processes. The segment encompassing industrial control systems, especially field devices, holds significant market share, fueled by the upgrading of legacy systems and the adoption of more sophisticated control solutions. Growth is observed across major end-user industries, including automotive, food and beverage, and power and utilities, although the oil and gas sector remains a crucial contributor. Geographical distribution shows concentrated growth in the Kanto region, followed by Kansai and Chubu, reflecting the density of manufacturing and industrial hubs. However, restraints include the relatively high initial investment costs associated with automation upgrades, a potential shortage of skilled labor to implement and maintain these systems, and the ongoing challenges of integrating legacy systems with newer technologies.

Leading global players like Honeywell, ABB, Siemens, and Fanuc, alongside prominent Japanese companies such as Mitsubishi Electric, Yaskawa, and Omron, dominate the market landscape. Intense competition fosters innovation and pushes prices down, making automation accessible to a wider range of businesses. The market's trajectory suggests significant opportunities for both established companies and innovative startups specializing in niche areas like predictive maintenance, cybersecurity for industrial control systems, and the development of tailored automation solutions for specific industries. The ongoing trend towards digitalization and the growing importance of data analytics in manufacturing will further shape the market's future growth, driving demand for advanced control systems capable of handling complex data streams and improving operational efficiency. Expansion into less-developed regions within Japan and a focus on sustainable automation solutions are key strategic considerations for success in this dynamic market.

This comprehensive report provides an in-depth analysis of the Japan Factory Automation & Industrial Controls industry, offering valuable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market size, growth drivers, challenges, and future opportunities. The report leverages extensive primary and secondary research, incorporating data from key players like Fanuc Corporation, Omron Corporation, and Mitsubishi Electric Corporation, to provide a holistic view of this dynamic sector.

Japan Factory Automation & Industrial Controls Industry Market Concentration & Innovation

The Japanese factory automation and industrial controls market exhibits a moderately concentrated landscape, dominated by a mix of global giants and established domestic players. Key players, including Fanuc, Omron, and Mitsubishi Electric, hold significant market share, reflecting their extensive product portfolios and strong brand recognition. However, the market also features numerous smaller, specialized companies catering to niche segments. The market share of the top 5 companies in 2025 is estimated at xx%.

Innovation is a key driver, fueled by advancements in artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT). These technologies are enabling the development of sophisticated industrial control systems, smart sensors, and predictive maintenance solutions, improving efficiency and reducing operational costs. Government initiatives promoting automation and Industry 4.0 are further accelerating innovation. The regulatory framework, while generally supportive, focuses on safety and data privacy, potentially impacting the adoption of certain technologies. Product substitutes, such as manual labor or legacy systems, are gradually becoming less relevant due to rising labor costs and the increasing need for precision and efficiency. Mergers and acquisitions (M&A) activity has been moderate, with deal values totaling approximately xx Million in the past five years. Key M&A activities focused on expanding product lines and geographic reach.

- Market Concentration: Top 5 players hold xx% market share (2025 estimate).

- M&A Activity: Total deal value (2019-2024): xx Million.

- Innovation Drivers: AI, ML, IoT, government initiatives.

- Regulatory Focus: Safety, data privacy.

Japan Factory Automation & Industrial Controls Industry Industry Trends & Insights

The Japanese factory automation and industrial controls market is experiencing robust growth, driven by increasing automation needs across various industries. The compound annual growth rate (CAGR) is projected to be xx% during the forecast period (2025-2033). This growth is fueled by several factors, including the increasing demand for improved productivity, reduced labor costs, enhanced product quality, and the need for greater operational efficiency. Technological disruptions, such as the rise of AI and cloud computing, are transforming the industry, leading to the development of more intelligent and connected systems. Consumer preferences are shifting towards customized and high-quality products, which in turn necessitates advanced automation solutions. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants offering innovative products and services. Market penetration of advanced automation technologies remains relatively high in automotive and electronics manufacturing but is increasing rapidly in other sectors such as food and beverage.

Dominant Markets & Segments in Japan Factory Automation & Industrial Controls Industry

The automotive and transportation sector currently dominates the Japanese factory automation and industrial controls market. This dominance stems from the country's robust automotive industry and its focus on technological advancements in vehicle manufacturing. Other significant segments include the chemical and petrochemical industries, which are characterized by large-scale operations requiring advanced process control and automation systems.

By Type: Industrial Control Systems holds the largest market share, followed by Field Devices within Other Industrial Control Systems.

By End-user Industry:

- Automotive and Transportation: High automation levels, significant investments in robotics, and the presence of major automotive manufacturers contribute to its market dominance.

- Chemical and Petrochemical: Complex processes and stringent safety requirements drive the demand for advanced control systems.

- Power and Utilities: Investments in smart grids and renewable energy infrastructure are contributing to growth in this segment.

- Food and Beverage: Rising consumer demand for processed food and stringent hygiene standards are fostering the adoption of automated solutions.

Key Drivers:

- High labor costs in Japan.

- Government incentives for automation.

- Demand for improved product quality and efficiency.

- Technological advancements in robotics, AI, and IoT.

Japan Factory Automation & Industrial Controls Industry Product Developments

Recent product innovations focus on AI-powered solutions for predictive maintenance, improved human-machine interfaces, and enhanced cybersecurity features. These advancements aim to optimize operational efficiency, minimize downtime, and improve overall system reliability. The integration of cloud computing and IoT technologies allows for remote monitoring and control of industrial processes, enhancing operational flexibility and productivity. Companies are increasingly emphasizing modularity and customization in their offerings to better address the diverse needs of different industries.

Report Scope & Segmentation Analysis

This report segments the Japanese factory automation and industrial controls market by type (Industrial Control Systems, Other Industrial Control Systems: Field Devices) and by end-user industry (Oil and Gas, Chemical and Petrochemical, Power and Utilities, Food and Beverage, Automotive and Transportation, Other End-user Industries). Each segment is analyzed in detail, providing growth projections, market size estimates for 2025, and an overview of competitive dynamics. The report also includes a comprehensive analysis of the key players in each segment.

Key Drivers of Japan Factory Automation & Industrial Controls Industry Growth

The growth of the Japanese factory automation and industrial controls market is driven by a multitude of factors. Technological advancements, particularly in AI, robotics, and IoT, are enabling the development of highly efficient and intelligent automation systems. The government's push for Industry 4.0 and its incentives for automation further bolster market growth. Increasing labor costs and the need for enhanced productivity are also significant drivers. Strict quality and safety standards, coupled with the rising demand for customized and high-quality products, are propelling the adoption of advanced automation solutions.

Challenges in the Japan Factory Automation & Industrial Controls Industry Sector

The Japanese factory automation and industrial controls market faces several challenges. The high initial investment costs associated with implementing automation solutions can pose a barrier for smaller businesses. Supply chain disruptions and the global chip shortage have impacted the availability of crucial components, hindering the growth of the market. Intense competition among both domestic and international players requires companies to constantly innovate and adapt to remain competitive. Furthermore, maintaining cybersecurity and protecting sensitive industrial data are critical concerns for the industry. These factors may constrain the market growth by xx% over the forecast period.

Emerging Opportunities in Japan Factory Automation & Industrial Controls Industry

Emerging opportunities in the Japanese factory automation and industrial controls market include the growing adoption of collaborative robots (cobots) for improved human-robot interaction, the increased use of cloud-based industrial control systems for greater flexibility and scalability, and the expansion of automation into new sectors like healthcare and agriculture. The development and implementation of smart factories, leveraging AI-driven analytics and predictive maintenance, present significant growth potentials. The government's focus on digital transformation and infrastructure modernization further creates openings for innovation and market expansion.

Leading Players in the Japan Factory Automation & Industrial Controls Industry Market

- Honeywell International Inc

- ABB Ltd

- Shibaura Machine CO

- Yasakawa Electric Corporation

- Fuji Electric Co Ltd

- Nidec Corporation

- Mitsubishi Electric Corporation

- Siemens AG

- Schneider Electric SE

- Fanuc Corporation

- Omron Corporation

- Seiko Epson Corporation

- Rockwell Automation Inc

- Yokogawa Electric Corporation

- Emerson Electric Company

Key Developments in Japan Factory Automation & Industrial Controls Industry Industry

May 2022: Kawasaki Heavy Industries unveiled a humanoid robot, "HINOTORI," designed for medical aid and surgical support, demonstrating advancements in robotics for both industrial and non-industrial applications. This aligns with their Group Vision 2030, emphasizing robotics' role in safety and security and future mobility.

April 2022: Yaskawa Electric Corporation launched an AI-powered industrial robot capable of object recognition and precise placement, highlighting the integration of AI in enhancing automation capabilities and efficiency within the automobile and parts manufacturing sectors.

Strategic Outlook for Japan Factory Automation & Industrial Controls Industry Market

The future of the Japanese factory automation and industrial controls market appears promising. Continued technological advancements, increasing government support, and the ongoing need for improved efficiency across various industries will drive significant growth. The integration of AI, IoT, and cloud technologies will further transform the market, creating new opportunities for innovation and market expansion. The focus on sustainability and reducing environmental impact will also drive demand for energy-efficient automation solutions, offering further avenues for growth and innovation.

Japan Factory Automation & Industrial Controls Industry Segmentation

-

1. Type

-

1.1. Industrial Control Systems

- 1.1.1. Distributed Control System (DCS)

- 1.1.2. Programable Logic Controller (PLC)

- 1.1.3. Supervisory Control and Data Acquisition (SCADA)

- 1.1.4. Product Lifecycle Management (PLM)

- 1.1.5. Manufacturing Execution System (MES)

- 1.1.6. Human Machine Interface (HMI)

- 1.1.7. Other Industrial Control Systems

-

1.2. Field Devices

- 1.2.1. Machine Vision

- 1.2.2. Industrial Robotics

- 1.2.3. Sensors and Transmitters

- 1.2.4. Motors and Drives

- 1.2.5. Safety Systems

- 1.2.6. Other Field Devices

-

1.1. Industrial Control Systems

-

2. End-user Industry

- 2.1. Oil and Gas

- 2.2. Chemical and Petrochemical

- 2.3. Power and Utilities

- 2.4. Food and Beverage

- 2.5. Automotive and Transportation

- 2.6. Other End-user Industries

Japan Factory Automation & Industrial Controls Industry Segmentation By Geography

- 1. Japan

Japan Factory Automation & Industrial Controls Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Launch of Stringent Energy Conservation Standards and Drive for Local Manufacturing?

- 3.3. Market Restrains

- 3.3.1. ; Trade Tensions and Implementation Challenges

- 3.4. Market Trends

- 3.4.1. Distributed Control Systems are Expected to Witness a Significant Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Factory Automation & Industrial Controls Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Industrial Control Systems

- 5.1.1.1. Distributed Control System (DCS)

- 5.1.1.2. Programable Logic Controller (PLC)

- 5.1.1.3. Supervisory Control and Data Acquisition (SCADA)

- 5.1.1.4. Product Lifecycle Management (PLM)

- 5.1.1.5. Manufacturing Execution System (MES)

- 5.1.1.6. Human Machine Interface (HMI)

- 5.1.1.7. Other Industrial Control Systems

- 5.1.2. Field Devices

- 5.1.2.1. Machine Vision

- 5.1.2.2. Industrial Robotics

- 5.1.2.3. Sensors and Transmitters

- 5.1.2.4. Motors and Drives

- 5.1.2.5. Safety Systems

- 5.1.2.6. Other Field Devices

- 5.1.1. Industrial Control Systems

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas

- 5.2.2. Chemical and Petrochemical

- 5.2.3. Power and Utilities

- 5.2.4. Food and Beverage

- 5.2.5. Automotive and Transportation

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Kanto Japan Factory Automation & Industrial Controls Industry Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan Factory Automation & Industrial Controls Industry Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan Factory Automation & Industrial Controls Industry Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan Factory Automation & Industrial Controls Industry Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan Factory Automation & Industrial Controls Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABB Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Shibaura Machine CO*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Yasakawa Electric Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fuji Electric Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nidec Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mitsubishi Electric Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Siemens AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Schneider Electric SE

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fanuc Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Omron Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Seiko Epson Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Rockwell Automation Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Yokogawa Electric Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Emerson Electric Company

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Japan Factory Automation & Industrial Controls Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Factory Automation & Industrial Controls Industry Share (%) by Company 2024

List of Tables

- Table 1: Japan Factory Automation & Industrial Controls Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Factory Automation & Industrial Controls Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Japan Factory Automation & Industrial Controls Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Japan Factory Automation & Industrial Controls Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Japan Factory Automation & Industrial Controls Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Kanto Japan Factory Automation & Industrial Controls Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Kansai Japan Factory Automation & Industrial Controls Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Chubu Japan Factory Automation & Industrial Controls Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Kyushu Japan Factory Automation & Industrial Controls Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tohoku Japan Factory Automation & Industrial Controls Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Japan Factory Automation & Industrial Controls Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Japan Factory Automation & Industrial Controls Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 13: Japan Factory Automation & Industrial Controls Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Factory Automation & Industrial Controls Industry?

The projected CAGR is approximately 11.00%.

2. Which companies are prominent players in the Japan Factory Automation & Industrial Controls Industry?

Key companies in the market include Honeywell International Inc, ABB Ltd, Shibaura Machine CO*List Not Exhaustive, Yasakawa Electric Corporation, Fuji Electric Co Ltd, Nidec Corporation, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, Fanuc Corporation, Omron Corporation, Seiko Epson Corporation, Rockwell Automation Inc, Yokogawa Electric Corporation, Emerson Electric Company.

3. What are the main segments of the Japan Factory Automation & Industrial Controls Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Launch of Stringent Energy Conservation Standards and Drive for Local Manufacturing?.

6. What are the notable trends driving market growth?

Distributed Control Systems are Expected to Witness a Significant Market Growth.

7. Are there any restraints impacting market growth?

; Trade Tensions and Implementation Challenges.

8. Can you provide examples of recent developments in the market?

May 2022 - Kawasaki Heavy Industries developed a humanoid robot that works like humans outside factories and exhibited it in Tokyo. The company sports a Group Vision 2030, appealing for robotics technology in two areas: safety and security in remote societies and mobility in the future. In the area of the safety and security of remote society, the company exhibited the "HINOTORI," a Medic-aid or a surgical support robot.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Factory Automation & Industrial Controls Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Factory Automation & Industrial Controls Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Factory Automation & Industrial Controls Industry?

To stay informed about further developments, trends, and reports in the Japan Factory Automation & Industrial Controls Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence