Key Insights

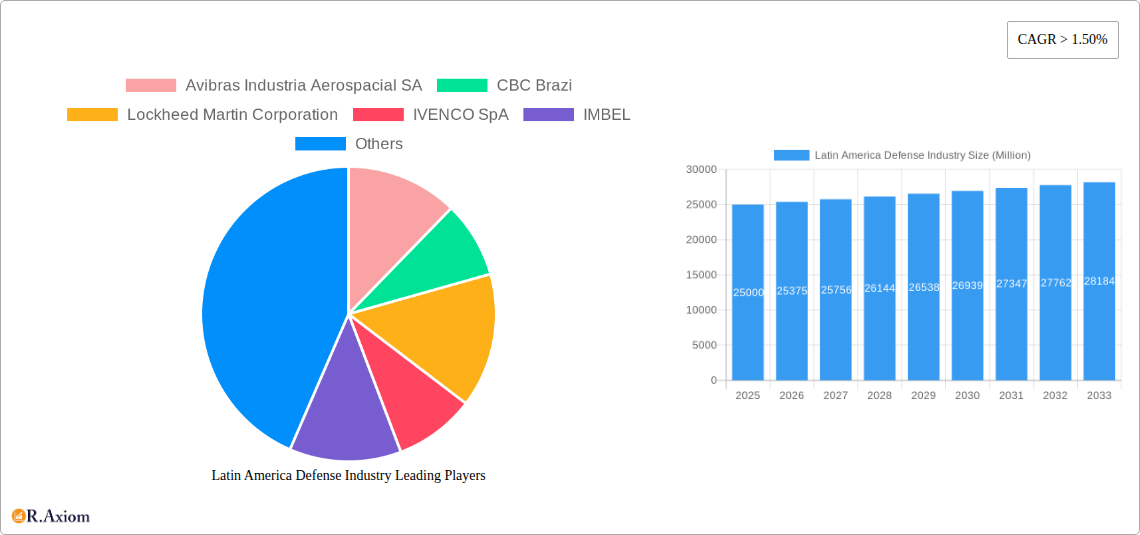

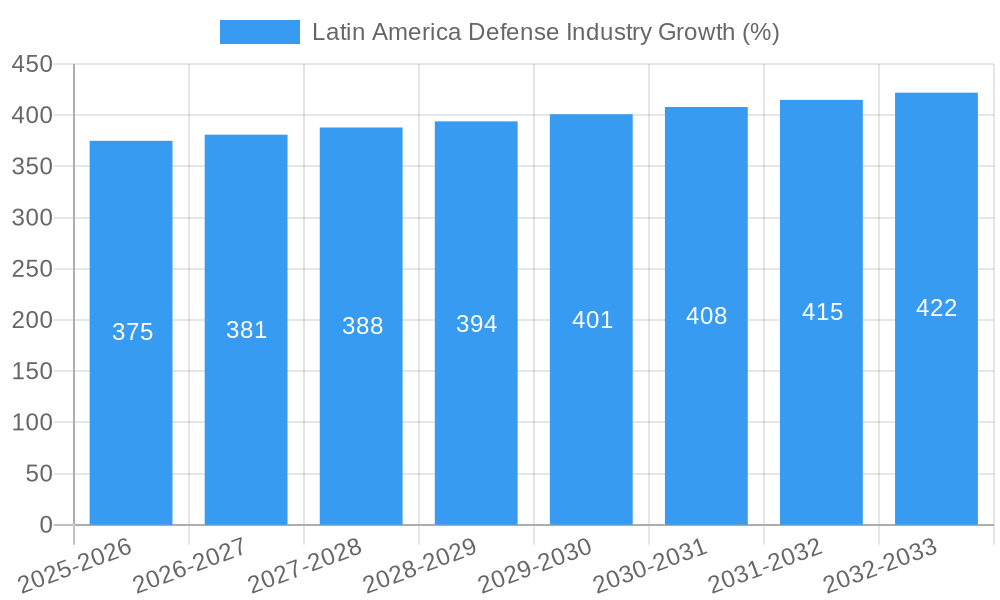

The Latin American defense industry, valued at approximately $XX million in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 1.50% through 2033. This expansion is fueled by several key factors. Increased regional instability and cross-border tensions are driving demand for advanced weaponry, communication systems, and personnel protection equipment. Furthermore, modernization efforts by several Latin American nations, aimed at upgrading aging defense infrastructure and enhancing operational capabilities, are significantly contributing to market growth. Government investments in defense budgets across the region, particularly in Brazil, Mexico, and Argentina, are also instrumental in fueling this upward trajectory. The market is segmented into procurement (personnel training and protection, communication systems, weapons and ammunition, and vehicles) and maintenance, repair, and overhaul (MRO) services across the same categories. Key players such as Avibras, Embraer, Lockheed Martin, and Thales are actively shaping the competitive landscape through strategic partnerships, technological advancements, and expansion into new markets within the region.

However, economic fluctuations within certain Latin American countries and budgetary constraints in others pose potential restraints to market growth. Furthermore, the industry faces challenges related to technological dependence on external suppliers, requiring strategic diversification and fostering of domestic defense capabilities. Despite these hurdles, the long-term outlook for the Latin American defense industry remains positive, propelled by continued government investment, rising geopolitical concerns, and the ongoing need to modernize defense systems. The increasing focus on cybersecurity and intelligence gathering within the defense sector also presents lucrative opportunities for companies offering specialized solutions. The market's performance in the coming years will largely depend on the continued political stability and economic growth across the region, alongside the successful implementation of modernization initiatives.

Latin America Defense Industry: 2019-2033 Market Analysis & Forecast Report

This comprehensive report provides an in-depth analysis of the Latin America defense industry, encompassing market size, growth drivers, key players, and future trends from 2019 to 2033. The report leverages extensive primary and secondary research to deliver actionable insights for industry stakeholders, including manufacturers, suppliers, government agencies, and investors. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. Total market value projections are provided in Millions.

Latin America Defense Industry Market Concentration & Innovation

The Latin American defense industry exhibits a moderately concentrated market structure, with a few dominant players and several regional specialists. Market share data reveals that the top five companies hold approximately xx% of the overall market in 2025, indicating some level of consolidation. However, regional variations exist, with certain countries demonstrating higher levels of fragmentation. Innovation is driven by the need to modernize armed forces, counter emerging threats, and leverage technological advancements. Regulatory frameworks vary significantly across the region, impacting procurement processes and technology adoption. Product substitution is limited due to the specialized nature of defense equipment, although pressure exists to incorporate cost-effective solutions. End-user trends are shifting toward greater emphasis on cybersecurity, asymmetric warfare capabilities, and advanced surveillance systems.

- Market Share: Top 5 players hold approximately xx% in 2025.

- M&A Activity: The total value of M&A deals within the Latin American defense sector from 2019 to 2024 was approximately $xx Million. This is expected to increase to $xx Million from 2025 to 2033.

Latin America Defense Industry Industry Trends & Insights

The Latin American defense industry is experiencing robust growth, driven by increased defense budgets, geopolitical instability, and the modernization of armed forces across the region. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Technological disruptions, including the adoption of AI, unmanned systems, and cyber warfare capabilities, are reshaping the industry landscape. Consumer preferences are shifting towards more sophisticated, versatile, and cost-effective defense solutions. Intense competition among both domestic and international players is driving innovation and efficiency gains. Market penetration of advanced technologies remains relatively low compared to developed nations, but it is expected to increase significantly over the forecast period. This expansion is projected to be driven by increasing government investment in defense modernization initiatives and a growing focus on enhancing national security capabilities.

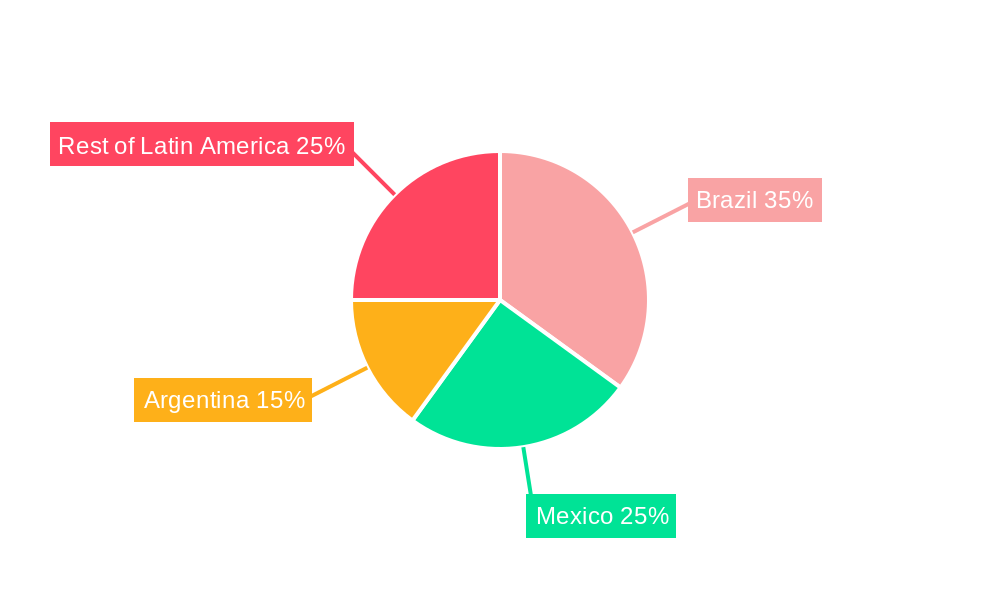

Dominant Markets & Segments in Latin America Defense Industry

Brazil consistently emerges as the dominant market in the Latin American defense sector, due to its substantial defense budget, active domestic industry, and regional influence. Within the procurement segment, Weapons and Ammunition holds the largest market share, primarily driven by regional security concerns and the need for modernization of existing arsenals. The MRO (Maintenance, Repair, and Overhaul) segment exhibits significant growth potential, particularly for communication systems and vehicles, due to the aging nature of existing defense equipment and the increasing demand for sustained operational capabilities.

- Key Drivers for Brazil's Dominance: Large defense budget, active domestic industry, regional influence, and investment in modernization programs.

- Key Drivers for Weapons and Ammunition Segment: Regional security concerns, modernization needs, and ongoing conflicts.

- Key Drivers for MRO Segment: Aging equipment, operational needs, and cost optimization efforts.

Latin America Defense Industry Product Developments

Recent product innovations focus on enhancing situational awareness, improving operational efficiency, and bolstering cybersecurity capabilities. This includes the development of advanced communication systems, unmanned aerial vehicles (UAVs), and integrated surveillance platforms. These innovations aim to address the evolving threat landscape and provide armed forces with a technological edge. Key competitive advantages lie in adapting technologies to the specific operational needs of Latin American countries, particularly considering geographical factors and budgetary constraints.

Report Scope & Segmentation Analysis

This report segments the Latin American defense industry by procurement and MRO categories, further subdivided into Personnel Training and Protection, Communication Systems, Weapons and Ammunition, and Vehicles.

Procurement: Each procurement segment shows strong growth, with Weapons and Ammunition having the largest market share. Competition is characterized by both domestic and international players vying for contracts.

MRO: The MRO segment experiences healthy growth, driven by the need to maintain aging equipment. Competition is focused on service capabilities, cost-efficiency, and technological expertise.

Key Drivers of Latin America Defense Industry Growth

Growth in the Latin American defense industry is fueled by several factors: increasing defense budgets across several nations aimed at modernizing armed forces, rising geopolitical tensions and internal security concerns necessitate investments in advanced defense technologies, and the growing adoption of technologically advanced solutions for improved defense capabilities. Furthermore, government initiatives promoting domestic defense industries play a role.

Challenges in the Latin America Defense Industry Sector

The Latin American defense industry faces challenges such as budgetary constraints in some countries which limit modernization efforts, supply chain complexities and disruptions create logistical hurdles, and intense competition from both domestic and international players limits profitability. Additionally, regulatory inconsistencies across the region can complicate procurement processes.

Emerging Opportunities in Latin America Defense Industry

Opportunities arise from the increasing demand for cybersecurity solutions, a growing need for advanced surveillance systems, and the potential for expansion into niche markets focused on specific regional requirements. The adoption of new technologies like AI and UAVs also presents lucrative opportunities for innovative companies.

Leading Players in the Latin America Defense Industry Market

- Avibras Industria Aerospacial SA

- CBC Brazi

- Lockheed Martin Corporation

- IVENCO SpA

- IMBEL

- FAMAE

- Thales Group

- Embraer SA

- INDUMIL

- Northrop Grumman Corporation

- Saab AB

- The Boeing Company

Key Developments in Latin America Defense Industry Industry

- 2023: Brazil launches a new national defense modernization program.

- 2022: Mexico signs a major contract for new communication systems.

- 2021: A significant merger occurs between two regional defense companies.

Strategic Outlook for Latin America Defense Industry Market

The Latin American defense industry presents a significant growth opportunity over the next decade. Continued modernization efforts, evolving security threats, and technological advancements will drive market expansion. Companies focusing on innovation, regional adaptation, and cost-effective solutions will be best positioned to succeed. The market's trajectory indicates strong prospects for growth and investment, particularly in advanced technologies and integrated defense systems.

Latin America Defense Industry Segmentation

-

1. Procurement

- 1.1. Personnel Training and Protection

- 1.2. Communication Systems

- 1.3. Weapons and Ammunition

-

1.4. Vehicles

- 1.4.1. Land-based Vehicles

- 1.4.2. Sea-based Vehicles

- 1.4.3. Air-based Vehicles

-

2. MRO

- 2.1. Communication Systems

- 2.2. Weapons and Ammunition

- 2.3. Vehicles

-

3. Geography

- 3.1. Brazil

- 3.2. Colombia

- 3.3. Mexico

- 3.4. Chile

- 3.5. Rest of Latin America

Latin America Defense Industry Segmentation By Geography

- 1. Brazil

- 2. Colombia

- 3. Mexico

- 4. Chile

- 5. Rest of Latin America

Latin America Defense Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Vehicles Segment to Experience the Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Defense Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Procurement

- 5.1.1. Personnel Training and Protection

- 5.1.2. Communication Systems

- 5.1.3. Weapons and Ammunition

- 5.1.4. Vehicles

- 5.1.4.1. Land-based Vehicles

- 5.1.4.2. Sea-based Vehicles

- 5.1.4.3. Air-based Vehicles

- 5.2. Market Analysis, Insights and Forecast - by MRO

- 5.2.1. Communication Systems

- 5.2.2. Weapons and Ammunition

- 5.2.3. Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Colombia

- 5.3.3. Mexico

- 5.3.4. Chile

- 5.3.5. Rest of Latin America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Colombia

- 5.4.3. Mexico

- 5.4.4. Chile

- 5.4.5. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Procurement

- 6. Brazil Latin America Defense Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Procurement

- 6.1.1. Personnel Training and Protection

- 6.1.2. Communication Systems

- 6.1.3. Weapons and Ammunition

- 6.1.4. Vehicles

- 6.1.4.1. Land-based Vehicles

- 6.1.4.2. Sea-based Vehicles

- 6.1.4.3. Air-based Vehicles

- 6.2. Market Analysis, Insights and Forecast - by MRO

- 6.2.1. Communication Systems

- 6.2.2. Weapons and Ammunition

- 6.2.3. Vehicles

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Colombia

- 6.3.3. Mexico

- 6.3.4. Chile

- 6.3.5. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Procurement

- 7. Colombia Latin America Defense Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Procurement

- 7.1.1. Personnel Training and Protection

- 7.1.2. Communication Systems

- 7.1.3. Weapons and Ammunition

- 7.1.4. Vehicles

- 7.1.4.1. Land-based Vehicles

- 7.1.4.2. Sea-based Vehicles

- 7.1.4.3. Air-based Vehicles

- 7.2. Market Analysis, Insights and Forecast - by MRO

- 7.2.1. Communication Systems

- 7.2.2. Weapons and Ammunition

- 7.2.3. Vehicles

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Colombia

- 7.3.3. Mexico

- 7.3.4. Chile

- 7.3.5. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Procurement

- 8. Mexico Latin America Defense Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Procurement

- 8.1.1. Personnel Training and Protection

- 8.1.2. Communication Systems

- 8.1.3. Weapons and Ammunition

- 8.1.4. Vehicles

- 8.1.4.1. Land-based Vehicles

- 8.1.4.2. Sea-based Vehicles

- 8.1.4.3. Air-based Vehicles

- 8.2. Market Analysis, Insights and Forecast - by MRO

- 8.2.1. Communication Systems

- 8.2.2. Weapons and Ammunition

- 8.2.3. Vehicles

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Colombia

- 8.3.3. Mexico

- 8.3.4. Chile

- 8.3.5. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Procurement

- 9. Chile Latin America Defense Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Procurement

- 9.1.1. Personnel Training and Protection

- 9.1.2. Communication Systems

- 9.1.3. Weapons and Ammunition

- 9.1.4. Vehicles

- 9.1.4.1. Land-based Vehicles

- 9.1.4.2. Sea-based Vehicles

- 9.1.4.3. Air-based Vehicles

- 9.2. Market Analysis, Insights and Forecast - by MRO

- 9.2.1. Communication Systems

- 9.2.2. Weapons and Ammunition

- 9.2.3. Vehicles

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Brazil

- 9.3.2. Colombia

- 9.3.3. Mexico

- 9.3.4. Chile

- 9.3.5. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Procurement

- 10. Rest of Latin America Latin America Defense Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Procurement

- 10.1.1. Personnel Training and Protection

- 10.1.2. Communication Systems

- 10.1.3. Weapons and Ammunition

- 10.1.4. Vehicles

- 10.1.4.1. Land-based Vehicles

- 10.1.4.2. Sea-based Vehicles

- 10.1.4.3. Air-based Vehicles

- 10.2. Market Analysis, Insights and Forecast - by MRO

- 10.2.1. Communication Systems

- 10.2.2. Weapons and Ammunition

- 10.2.3. Vehicles

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Brazil

- 10.3.2. Colombia

- 10.3.3. Mexico

- 10.3.4. Chile

- 10.3.5. Rest of Latin America

- 10.1. Market Analysis, Insights and Forecast - by Procurement

- 11. Brazil Latin America Defense Industry Analysis, Insights and Forecast, 2019-2031

- 12. Argentina Latin America Defense Industry Analysis, Insights and Forecast, 2019-2031

- 13. Mexico Latin America Defense Industry Analysis, Insights and Forecast, 2019-2031

- 14. Peru Latin America Defense Industry Analysis, Insights and Forecast, 2019-2031

- 15. Chile Latin America Defense Industry Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Latin America Latin America Defense Industry Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Avibras Industria Aerospacial SA

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 CBC Brazi

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Lockheed Martin Corporation

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 IVENCO SpA

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 IMBEL

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 FAMAE

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Thales Group

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Embraer SA

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 INDUMIL

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Northrop Grumman Corporation

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Saab AB

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 The Boeing Company

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.1 Avibras Industria Aerospacial SA

List of Figures

- Figure 1: Latin America Defense Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Defense Industry Share (%) by Company 2024

List of Tables

- Table 1: Latin America Defense Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Defense Industry Revenue Million Forecast, by Procurement 2019 & 2032

- Table 3: Latin America Defense Industry Revenue Million Forecast, by MRO 2019 & 2032

- Table 4: Latin America Defense Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Latin America Defense Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Latin America Defense Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil Latin America Defense Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina Latin America Defense Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Latin America Defense Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Peru Latin America Defense Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Chile Latin America Defense Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Latin America Latin America Defense Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Latin America Defense Industry Revenue Million Forecast, by Procurement 2019 & 2032

- Table 14: Latin America Defense Industry Revenue Million Forecast, by MRO 2019 & 2032

- Table 15: Latin America Defense Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: Latin America Defense Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Latin America Defense Industry Revenue Million Forecast, by Procurement 2019 & 2032

- Table 18: Latin America Defense Industry Revenue Million Forecast, by MRO 2019 & 2032

- Table 19: Latin America Defense Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Latin America Defense Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Latin America Defense Industry Revenue Million Forecast, by Procurement 2019 & 2032

- Table 22: Latin America Defense Industry Revenue Million Forecast, by MRO 2019 & 2032

- Table 23: Latin America Defense Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Latin America Defense Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Latin America Defense Industry Revenue Million Forecast, by Procurement 2019 & 2032

- Table 26: Latin America Defense Industry Revenue Million Forecast, by MRO 2019 & 2032

- Table 27: Latin America Defense Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Latin America Defense Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Latin America Defense Industry Revenue Million Forecast, by Procurement 2019 & 2032

- Table 30: Latin America Defense Industry Revenue Million Forecast, by MRO 2019 & 2032

- Table 31: Latin America Defense Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: Latin America Defense Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Defense Industry?

The projected CAGR is approximately > 1.50%.

2. Which companies are prominent players in the Latin America Defense Industry?

Key companies in the market include Avibras Industria Aerospacial SA, CBC Brazi, Lockheed Martin Corporation, IVENCO SpA, IMBEL, FAMAE, Thales Group, Embraer SA, INDUMIL, Northrop Grumman Corporation, Saab AB, The Boeing Company.

3. What are the main segments of the Latin America Defense Industry?

The market segments include Procurement, MRO, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Vehicles Segment to Experience the Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Defense Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Defense Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Defense Industry?

To stay informed about further developments, trends, and reports in the Latin America Defense Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence