Key Insights

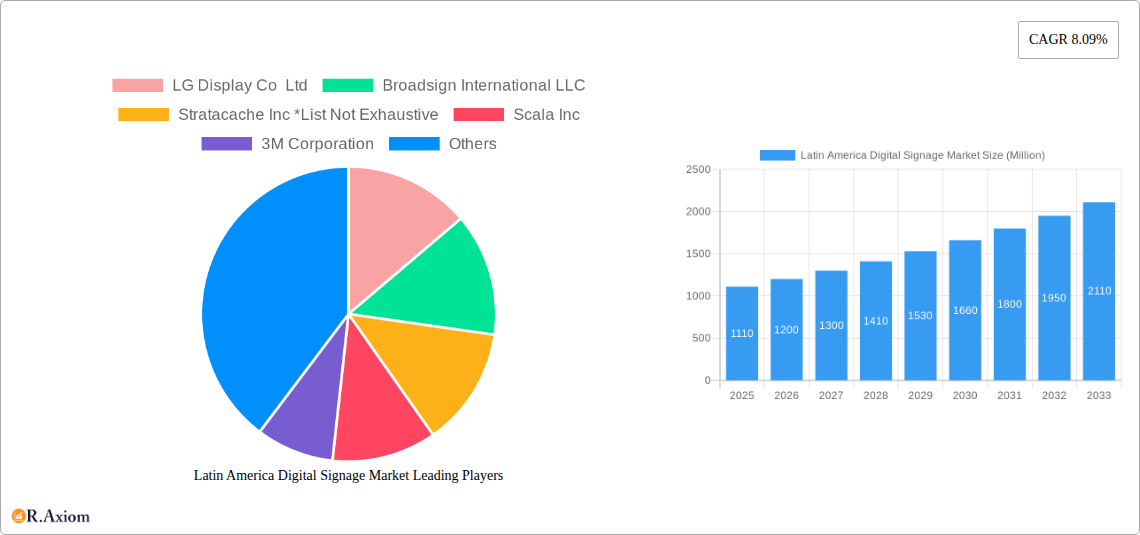

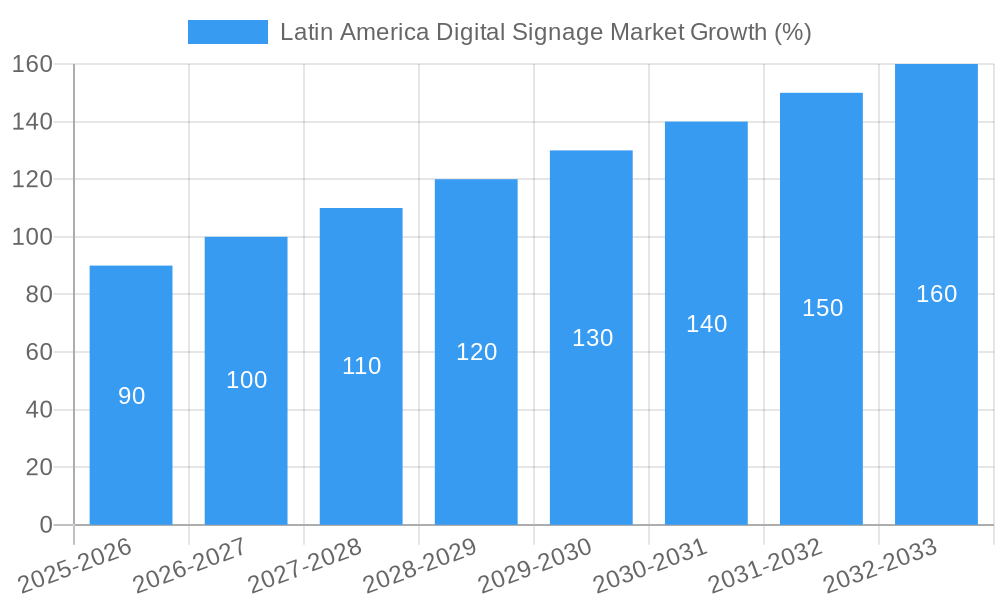

The Latin American digital signage market is experiencing robust growth, projected to reach $1.11 billion in 2025 and maintain a compound annual growth rate (CAGR) of 8.09% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing adoption of digital signage across diverse sectors like retail, hospitality, and transportation is driving demand. Retailers are leveraging digital signage for dynamic promotions and enhanced customer engagement, while hospitality venues utilize it for wayfinding and menu displays. Furthermore, the growing urbanization and rising disposable incomes across Latin America are contributing to increased advertising spend, further boosting market growth. Technological advancements, such as the introduction of high-resolution displays, interactive screens, and sophisticated content management systems, are also making digital signage more attractive and cost-effective. The market is further segmented by hardware, software, and services, with hardware currently dominating the market share.

However, market growth is not without challenges. The initial investment costs associated with implementing digital signage solutions can be a barrier for smaller businesses. Furthermore, ensuring consistent and reliable internet connectivity across various regions within Latin America, particularly in less developed areas, presents an obstacle to widespread adoption. Despite these restraints, the long-term prospects for the Latin American digital signage market remain positive, driven by continuous technological innovation, increasing digitalization across industries, and a growing preference for engaging and interactive customer experiences. Brazil, Mexico, and Argentina are currently leading the regional market, but other countries within Latin America are expected to witness significant growth in the coming years as digital transformation accelerates. Key players like LG Display, Samsung, and Broadsign are strategically positioning themselves to capitalize on this burgeoning market opportunity.

Latin America Digital Signage Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Latin America digital signage market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to capitalize on its growth potential. Covering the period from 2019 to 2033, with a focus on 2025, this report delivers a granular understanding of market dynamics, key players, and future trends. The study period is 2019-2033, the base year is 2025, the estimated year is 2025 and the forecast period is 2025-2033. The historical period covered is 2019-2024.

Latin America Digital Signage Market Market Concentration & Innovation

This section analyzes the competitive landscape of the Latin American digital signage market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities. The market is characterized by a moderately concentrated structure with a few major players holding significant market share. However, the presence of numerous smaller players also contributes to a dynamic market.

- Market Concentration: The top five players account for approximately xx% of the market share in 2025. This concentration is expected to remain relatively stable throughout the forecast period, with potential shifts driven by M&A activity and product innovation.

- Innovation Drivers: Technological advancements, such as the development of higher-resolution displays, improved software capabilities, and the rise of interactive digital signage, are major innovation drivers. Growing demand for immersive customer experiences also fuels innovation.

- Regulatory Framework: Government regulations regarding advertising, data privacy, and accessibility play a role in shaping the market. Variations in regulations across different Latin American countries create unique challenges and opportunities.

- Product Substitutes: Traditional advertising methods and static signage represent the primary substitutes for digital signage. However, the increasing cost-effectiveness and engaging nature of digital signage are gradually reducing the appeal of these alternatives.

- End-User Trends: The increasing adoption of digital signage across various end-user industries, driven by the need for improved customer engagement and operational efficiency, is a key trend.

- M&A Activities: The market has witnessed a moderate level of M&A activity in recent years, primarily driven by the consolidation efforts of large players. The total value of M&A deals in the Latin American digital signage market between 2019 and 2024 was approximately $xx Million.

Latin America Digital Signage Market Industry Trends & Insights

This section delves into the key trends shaping the Latin America digital signage market. The market is experiencing robust growth, fueled by factors such as rising disposable incomes, increasing urbanization, and the expanding adoption of digital technologies across various sectors. Market penetration is expected to reach xx% by 2033, with a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033). The growing adoption of interactive displays and the increased demand for data-driven marketing solutions are also contributing to the market's growth. Competitive dynamics are intensified by the entry of new players and the strategic initiatives of existing companies to enhance their market presence and expand their product portfolios. The increasing demand for dynamic content management systems and cloud-based solutions further enhances market growth. Consumer preferences are shifting towards engaging and interactive digital signage experiences, leading to the increased demand for innovative solutions.

Dominant Markets & Segments in Latin America Digital Signage Market

This section identifies the leading regions, countries, and segments within the Latin America digital signage market.

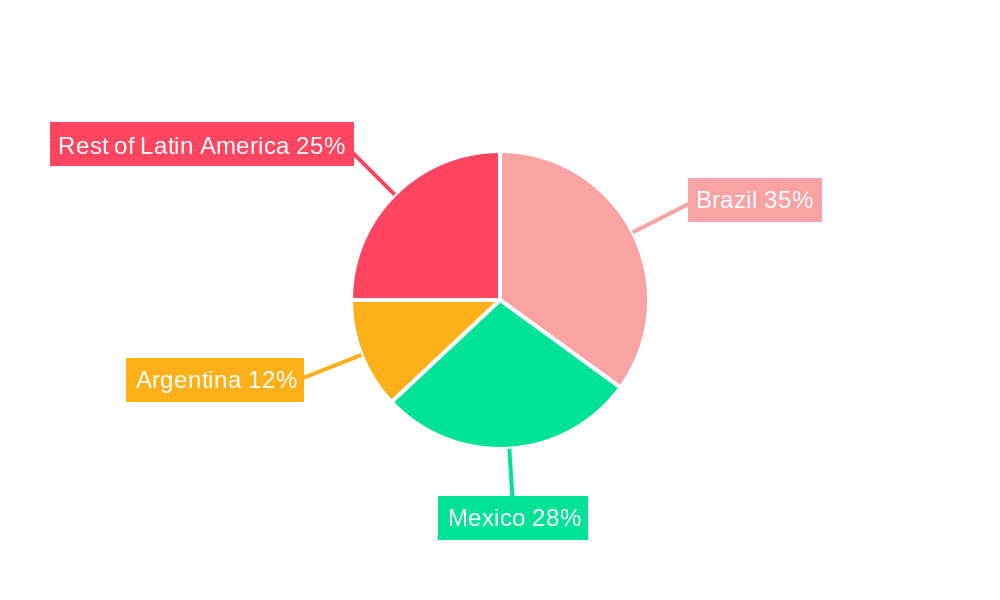

By Country:

- Brazil: Brazil holds the largest market share in Latin America due to its large population, expanding economy, and growing adoption of digital technologies in retail and other sectors. Key drivers include rising disposable incomes, a large retail sector, and government initiatives to modernize infrastructure.

- Mexico: Mexico represents the second-largest market, driven by similar factors to Brazil, including robust economic growth and increased investment in infrastructure and digital technologies.

- Argentina: Argentina is experiencing a relatively slower but steady growth in the digital signage market due to its economic fluctuations.

- Rest of Latin America: The remaining Latin American countries contribute to a substantial market segment, with varied growth rates depending on individual economic conditions and infrastructure development.

By Type:

- Hardware: The hardware segment dominates the market, comprising digital displays, media players, and other peripheral devices.

- Software: The software segment is experiencing significant growth, driven by the increasing demand for advanced content management systems and analytics tools.

- Services: Services such as installation, maintenance, and content creation are also integral to the market's growth.

By End-user Industry:

- Retail: The retail sector is the largest end-user segment, due to the widespread adoption of digital signage for in-store advertising, promotional campaigns, and wayfinding.

- Transportation: The transportation sector, including airports, bus stations, and train stations, is witnessing increased deployment of digital signage for information dissemination and advertising.

- Hospitality: Hotels, restaurants, and other hospitality venues are increasingly using digital signage to enhance customer experience and brand promotion.

- Corporate: Corporations utilize digital signage for internal communications, wayfinding, and brand building within their offices.

- Government: Government entities use digital signage for public information dissemination and emergency alerts.

Latin America Digital Signage Market Product Developments

Recent product innovations focus on enhancing display quality, interactivity, and data analytics capabilities. High-resolution displays with improved brightness and contrast are becoming increasingly prevalent. The integration of smart features, including AI-powered content management and analytics, is driving the development of more sophisticated digital signage solutions tailored to specific customer needs. These innovations cater to the growing demand for engaging, interactive, and data-driven digital signage experiences.

Report Scope & Segmentation Analysis

This report segments the Latin American digital signage market by type (hardware, software, services), end-user industry (retail, transportation, hospitality, corporate, government, others), and country (Brazil, Mexico, Argentina, Rest of Latin America). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. Growth projections vary across segments based on individual market drivers and trends. The hardware segment is expected to maintain its dominant position, while the software and services segments are projected to exhibit faster growth rates.

Key Drivers of Latin America Digital Signage Market Growth

The Latin America digital signage market growth is driven by several key factors: Firstly, the rapid urbanization and expansion of the retail sector are creating significant demand for digital signage solutions. Secondly, the increasing adoption of digital technologies across various industries is accelerating the market's growth. Thirdly, government initiatives aimed at improving infrastructure and promoting digitalization are further fueling the market's expansion. Finally, technological advancements, leading to better displays and software, are enhancing the capabilities of digital signage.

Challenges in the Latin America Digital Signage Market Sector

Challenges facing the market include the economic instability in some countries, impacting investment and market growth. Additionally, the high initial investment costs associated with digital signage implementation can be a barrier for smaller businesses. The reliance on stable power supplies and internet connectivity can be problematic in certain areas. Finally, competition amongst established and emerging players is intense.

Emerging Opportunities in Latin America Digital Signage Market

Emerging opportunities lie in the expansion of interactive digital signage, with features like touch screens and augmented reality. The integration of data analytics to track performance and customer behavior offers significant growth potential. Growth is also driven by the expanding usage of outdoor digital signage, and the increasing adoption of programmatic advertising for digital signage campaigns.

Leading Players in the Latin America Digital Signage Market Market

- LG Display Co Ltd

- Broadsign International LLC

- Stratacache Inc

- Scala Inc

- 3M Corporation

- Samsung Electronics Co Ltd

- Cisco Systems Inc

- Sharp Corporation

- Omnivex Corporation

- Panasonic Corporation

- Sony Corporation

Key Developments in Latin America Digital Signage Market Industry

- January 2023: Panasonic Corporation released its next-generation PT-REQ12 Series and PT-REZ12 Series 1-Chip DLP laser projectors, enhancing immersive entertainment experiences.

- January 2023: Broadsign International LLC launched its next-generation OOH platform, improving operational efficiency and audience targeting for OOH media owners.

Strategic Outlook for Latin America Digital Signage Market Market

The Latin American digital signage market holds significant growth potential in the coming years, driven by sustained technological advancements, rising demand for interactive and data-driven solutions, and favorable government policies. Expanding into new markets within Latin America and focusing on innovative products will be crucial for companies to thrive. The increased focus on customer engagement and improved operational efficiencies in various industries will further drive the market's expansion.

Latin America Digital Signage Market Segmentation

-

1. Type

-

1.1. Hardware

- 1.1.1. LCD/LED Display

- 1.1.2. OLED Display

- 1.1.3. Media Players

- 1.1.4. Projector/Projection Screens

- 1.1.5. Other Hardware

- 1.2. Software

- 1.3. Services

-

1.1. Hardware

-

2. End-user Industry

- 2.1. Retail

- 2.2. Transportation

- 2.3. Hospitality

- 2.4. Corporate

- 2.5. Government

- 2.6. Other End-user Industries

Latin America Digital Signage Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Digital Signage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.09% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Gradual Increasing Pace of Digitization

- 3.3. Market Restrains

- 3.3.1. Shorter Operating Range of WiGig Products

- 3.4. Market Trends

- 3.4.1. Increasing Digitization to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Digital Signage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.1.1. LCD/LED Display

- 5.1.1.2. OLED Display

- 5.1.1.3. Media Players

- 5.1.1.4. Projector/Projection Screens

- 5.1.1.5. Other Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Retail

- 5.2.2. Transportation

- 5.2.3. Hospitality

- 5.2.4. Corporate

- 5.2.5. Government

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil Latin America Digital Signage Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Digital Signage Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Digital Signage Market Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Digital Signage Market Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Digital Signage Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Digital Signage Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 LG Display Co Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Broadsign International LLC

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Stratacache Inc *List Not Exhaustive

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Scala Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 3M Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Samsung Electronics Co Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Cisco Systems Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Sharp Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Omnivex Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Panasonic Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Sony Corporation

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 LG Display Co Ltd

List of Figures

- Figure 1: Latin America Digital Signage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Digital Signage Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Digital Signage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Digital Signage Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Latin America Digital Signage Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Latin America Digital Signage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Latin America Digital Signage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Latin America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina Latin America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Latin America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Peru Latin America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Chile Latin America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Latin America Latin America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Latin America Digital Signage Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Latin America Digital Signage Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 14: Latin America Digital Signage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Latin America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Latin America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Chile Latin America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Colombia Latin America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Mexico Latin America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Peru Latin America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Venezuela Latin America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Ecuador Latin America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Bolivia Latin America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Paraguay Latin America Digital Signage Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Digital Signage Market?

The projected CAGR is approximately 8.09%.

2. Which companies are prominent players in the Latin America Digital Signage Market?

Key companies in the market include LG Display Co Ltd, Broadsign International LLC, Stratacache Inc *List Not Exhaustive, Scala Inc, 3M Corporation, Samsung Electronics Co Ltd, Cisco Systems Inc, Sharp Corporation, Omnivex Corporation, Panasonic Corporation, Sony Corporation.

3. What are the main segments of the Latin America Digital Signage Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Gradual Increasing Pace of Digitization.

6. What are the notable trends driving market growth?

Increasing Digitization to Drive the Market.

7. Are there any restraints impacting market growth?

Shorter Operating Range of WiGig Products.

8. Can you provide examples of recent developments in the market?

Jan 2023 - Panasonic Corporation released its next-generation PT-REQ12 Series and PT-REZ12 Series 1-Chip DLP laser projectors to deliver never-before-seen experiences with up to 12,000 lm brightness, 4K3 resolution, and 240 Hz4 projection capability. This launch is during a time when the experience economy is rebounding, and the demand for immersive entertainment is on the rise.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Digital Signage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Digital Signage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Digital Signage Market?

To stay informed about further developments, trends, and reports in the Latin America Digital Signage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence