Key Insights

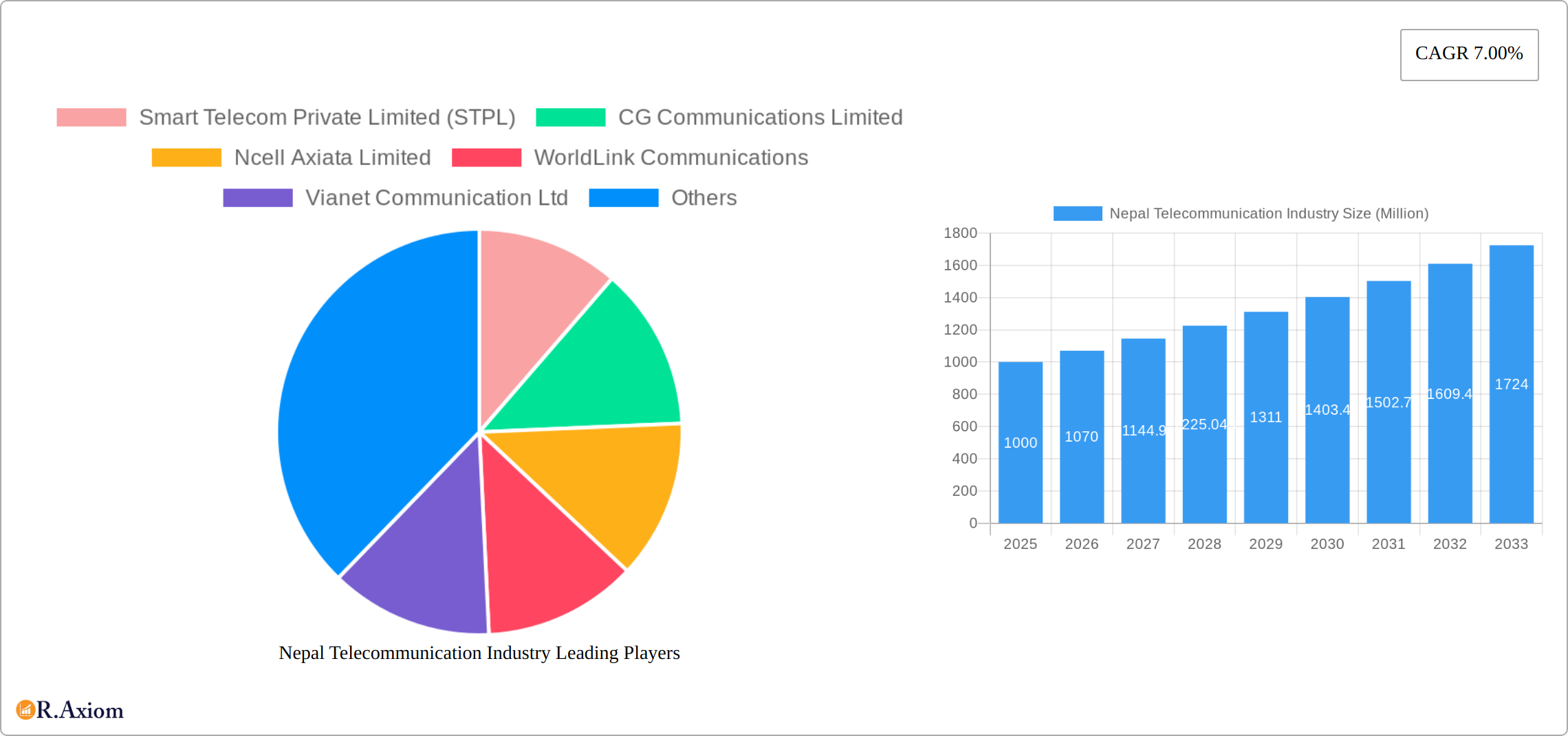

The Nepal telecommunication industry, valued at approximately $XX million in 2025, is experiencing robust growth, projected at a 7% CAGR through 2033. This expansion is fueled by increasing smartphone penetration, rising data consumption driven by the popularity of OTT platforms and social media, and government initiatives promoting digital inclusion. Key growth drivers include the expanding coverage of 4G and the gradual rollout of 5G networks, offering faster speeds and improved connectivity. The market is segmented into Voice, Wireless Data & Messaging (including internet and handset data packages with bundled discounts), and OTT & PayTV services. While precise revenue per user (ARPU) data for each segment isn't available, a reasonable estimate based on regional comparisons and industry trends suggests ARPU is likely higher for data and OTT services compared to traditional voice services. Competitive pressures from established players like Ncell Axiata Limited, Nepal Doorsanchar Company Limited (NDCL), and newer entrants like Smart Telecom Private Limited (STPL) and WorldLink Communications are driving innovation and improving service offerings. However, challenges remain, including infrastructure limitations in remote areas, affordability concerns for a significant portion of the population, and the need for consistent regulatory framework to foster healthy competition.

The forecast period (2025-2033) anticipates continued growth, albeit potentially at a slightly moderated rate as the market matures. The penetration of data services, particularly mobile data, will remain a key driver of revenue growth, further bolstered by the increasing adoption of smartphones and affordable data packages. However, the industry will need to address the challenges of network congestion in urban areas and expanding high-speed internet access across rural regions to sustain this growth trajectory. The competitive landscape is expected to remain dynamic, with existing players focusing on network upgrades and service diversification, and potential new entrants aiming to capture market share. This will likely result in ongoing price competition and innovative service offerings to attract and retain customers.

Nepal Telecommunication Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Nepal telecommunication industry, covering market trends, competitive landscape, and future growth prospects from 2019 to 2033. The study period covers the historical period (2019-2024), with 2025 as the base and estimated year, and forecasts extending to 2033. The report uses Million (M) as the unit for all monetary values.

Nepal Telecommunication Industry Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities within the Nepal telecommunication industry. The industry exhibits moderate concentration, with Ncell Axiata Limited and Nepal Telecom holding significant market share, but a competitive landscape exists with multiple players vying for consumer attention.

- Market Concentration: Ncell Axiata Limited and Nepal Doorsanchar Company Limited (NDCL) dominate the market, holding an estimated xx% and xx% market share respectively in 2024. Other players like WorldLink Communications and Vianet Communication Ltd hold a significant but smaller share. The Herfindahl-Hirschman Index (HHI) is estimated to be xx, indicating a moderately concentrated market.

- Innovation Drivers: Increasing demand for high-speed data, the proliferation of smartphones, and government initiatives promoting digitalization are key drivers of innovation. The introduction of 5G technology and the expansion of fiber-optic networks are major factors influencing this sector.

- Regulatory Framework: The Nepal Telecommunication Authority (NTA) plays a crucial role in regulating the industry, impacting market entry, pricing, and service quality. Regulatory changes and their implications on market dynamics are analyzed extensively in this report.

- Product Substitutes: Over-the-top (OTT) communication services and VoIP services pose a competitive threat to traditional voice and messaging services. The report assesses the extent of this impact.

- End-User Trends: Rising mobile penetration, increasing internet usage, and demand for affordable data packages have shaped consumer trends. The report explores these trends to forecast future demands.

- M&A Activities: The report details completed and potential M&A activities in the industry, including deal values (estimated at xx M for the period 2019-2024). The impact of these activities on market share and competitive dynamics is analyzed.

Nepal Telecommunication Industry Industry Trends & Insights

This section delves into the key trends and insights shaping the Nepal telecommunication market. The industry has experienced significant growth, driven by increasing mobile and internet penetration, along with government initiatives promoting digital inclusion. Technological disruptions, such as the introduction of 5G technology and fiber-optic networks, are transforming the industry landscape. Consumer preferences are shifting toward higher data speeds, more affordable packages, and diverse content offerings.

The Compound Annual Growth Rate (CAGR) for the overall telecommunication services market is estimated at xx% during 2020-2027. Mobile penetration is over xx%, with internet penetration at approximately xx%. The competitive dynamics are characterized by intense competition among major players focusing on pricing, network coverage, and service offerings. The report explores these and other details at length.

Dominant Markets & Segments in Nepal Telecommunication Industry

This section identifies the leading market segments in the Nepal telecommunication industry. While precise figures are not always available, estimates based on industry reports and analyses have been used where necessary.

- Dominant Segment: Wireless Data and Messaging Services are the dominant segment, driven by rising smartphone usage and increasing demand for internet access.

- Key Drivers:

- Economic Policies: Government initiatives to promote digital literacy and expand internet access have fueled market growth.

- Infrastructure Development: Investment in telecom infrastructure, including fiber-optic networks and cell towers, plays a significant role.

- Technological Advancements: The introduction of 4G and the upcoming rollout of 5G technology further propel market growth.

- Detailed Dominance Analysis: The dominance of wireless data services is primarily due to the affordability of mobile data packages and the widespread availability of smartphones. Voice services maintain a significant presence, but their growth is slowing compared to data services. The OTT and Pay TV segments are emerging, though currently smaller than wireless data services. The report provides a detailed analysis of each segment's market size and growth projections, along with revenue per user estimates.

Nepal Telecommunication Industry Product Developments

The Nepal telecommunication industry is witnessing significant product innovations, driven by technological advancements and evolving consumer preferences. Companies are focusing on developing and offering affordable data packages, enhanced network coverage, and innovative services. For instance, the introduction of 4G LTE technology and the upcoming launch of 5G networks are improving data speeds and network capacity, enhancing the consumer experience. Furthermore, there's a growing trend toward bundled services, combining voice, data, and other value-added services into attractive packages. These developments have significantly enhanced the industry’s competitiveness, driving market growth.

Report Scope & Segmentation Analysis

This report segments the Nepal telecommunication market based on services offered:

Voice Services: This segment comprises traditional voice calls over fixed and mobile networks. The market size is estimated at xx M in 2024, with a projected CAGR of xx% during 2025-2033. Competition is intense, with pricing pressure impacting profitability.

Wireless Data and Messaging Services: This is the largest and fastest-growing segment, encompassing mobile data, SMS, and MMS. The market size is estimated at xx M in 2024, with a projected CAGR of xx% during 2025-2033. This segment is characterized by intense competition, particularly in the provision of affordable data packages.

OTT and Pay TV Services: This emerging segment is gaining traction, with market size estimated at xx M in 2024 and a projected CAGR of xx% during 2025-2033. This growth is driven by increased internet penetration and changing consumer viewing habits.

Key Drivers of Nepal Telecommunication Industry Growth

The growth of the Nepal telecommunication industry is propelled by several factors: increasing smartphone penetration, rising internet adoption, government support for digitalization, investments in network infrastructure (including fiber-optic expansion), and the introduction of advanced technologies like 4G and upcoming 5G networks. These factors, coupled with the demand for affordable data packages, create a favorable environment for continued growth.

Challenges in the Nepal Telecommunication Industry Sector

The Nepal telecommunication industry faces challenges such as limited infrastructure in remote areas, the need for significant investments in network expansion, and competition from new OTT and VoIP players impacting revenues. The regulatory environment and associated costs also pose hurdles for market players. Furthermore, ensuring cybersecurity and data privacy in a rapidly evolving digital landscape remains a significant challenge.

Emerging Opportunities in Nepal Telecommunication Industry

The industry presents several opportunities, including the expansion of 4G/5G networks into underserved areas, the growth of the IoT (Internet of Things) market, the increasing demand for cloud-based services, and the expansion of digital financial services. Moreover, the emergence of new services like 5G-based applications and the growth of the digital content market offer further expansion avenues.

Leading Players in the Nepal Telecommunication Industry Market

- Ncell Axiata Limited

- CG Communications Limited

- Nepal Doorsanchar Company Limited (NDCL)

- WorldLink Communications

- Vianet Communication Ltd

- Smart Telecom Private Limited (STPL)

- Subisu Cablenet Pvt Ltd

Key Developments in Nepal Telecommunication Industry Industry

- October 2022: Ncell launched a "Home and Away Data Pack" offering 60GB (30GB home, 30GB away) for Rs. 599 during Dashain, Tihar, and Chhath festivals, boosting data consumption during the holiday season.

- November 2022: CGNET introduced FTTH (Fiber to the Home) internet service at a competitive price, increasing bandwidth accessibility, particularly beneficial for World Cup viewing.

Strategic Outlook for Nepal Telecommunication Industry Market

The Nepal telecommunication industry is poised for sustained growth driven by ongoing infrastructure development, increasing smartphone penetration, and the continued rollout of 4G and 5G technologies. Expanding broadband access to underserved regions presents significant opportunities. Furthermore, exploring new revenue streams through IoT services and focusing on digital financial inclusion can unlock further growth potential for market players.

Nepal Telecommunication Industry Segmentation

-

1. Segmenta

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

Nepal Telecommunication Industry Segmentation By Geography

- 1. Nepal

Nepal Telecommunication Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Increase in Mobile Connection; Government-Sponsored Reforms

- 3.3. Market Restrains

- 3.3.1. High Cost and Competition from Flexible Plastic Technologies

- 3.4. Market Trends

- 3.4.1. Growing Internet Penetration in Nepal

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nepal Telecommunication Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Segmenta

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Nepal

- 5.1. Market Analysis, Insights and Forecast - by Segmenta

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Smart Telecom Private Limited (STPL)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CG Communications Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ncell Axiata Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 WorldLink Communications

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Vianet Communication Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nepal Doorsanchar Company Limited (NDCL)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Subisu Cablenet Pvt Ltd*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Smart Telecom Private Limited (STPL)

List of Figures

- Figure 1: Nepal Telecommunication Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Nepal Telecommunication Industry Share (%) by Company 2024

List of Tables

- Table 1: Nepal Telecommunication Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Nepal Telecommunication Industry Revenue Million Forecast, by Segmenta 2019 & 2032

- Table 3: Nepal Telecommunication Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Nepal Telecommunication Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Nepal Telecommunication Industry Revenue Million Forecast, by Segmenta 2019 & 2032

- Table 6: Nepal Telecommunication Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nepal Telecommunication Industry?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Nepal Telecommunication Industry?

Key companies in the market include Smart Telecom Private Limited (STPL), CG Communications Limited, Ncell Axiata Limited, WorldLink Communications, Vianet Communication Ltd, Nepal Doorsanchar Company Limited (NDCL), Subisu Cablenet Pvt Ltd*List Not Exhaustive.

3. What are the main segments of the Nepal Telecommunication Industry?

The market segments include Segmenta.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Robust Increase in Mobile Connection; Government-Sponsored Reforms.

6. What are the notable trends driving market growth?

Growing Internet Penetration in Nepal.

7. Are there any restraints impacting market growth?

High Cost and Competition from Flexible Plastic Technologies.

8. Can you provide examples of recent developments in the market?

October 2022: Ncell introduced a new "Home and Away Data Pack." On Dashain, Tihar, and Chhath, Ncell Axiata Limited introduced this festive offer, allowing consumers to connect with loved ones, send holiday greetings, and experience excitement. Customers who purchase this deal receive a total of 60GB, a combination of 30GB of home data and 30GB of away data, for just Rs. 599, taxes included.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nepal Telecommunication Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nepal Telecommunication Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nepal Telecommunication Industry?

To stay informed about further developments, trends, and reports in the Nepal Telecommunication Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence