Key Insights

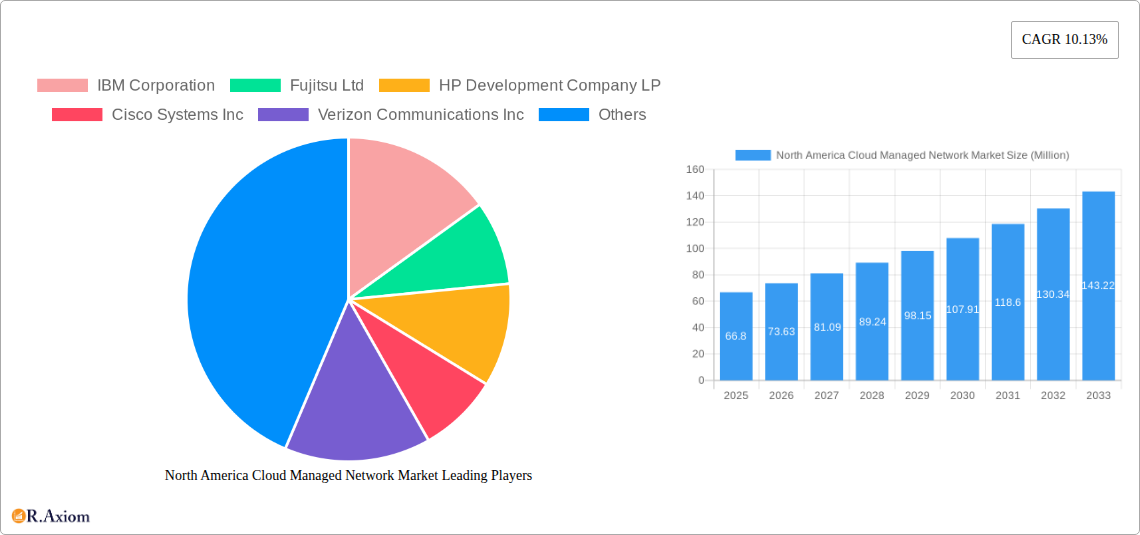

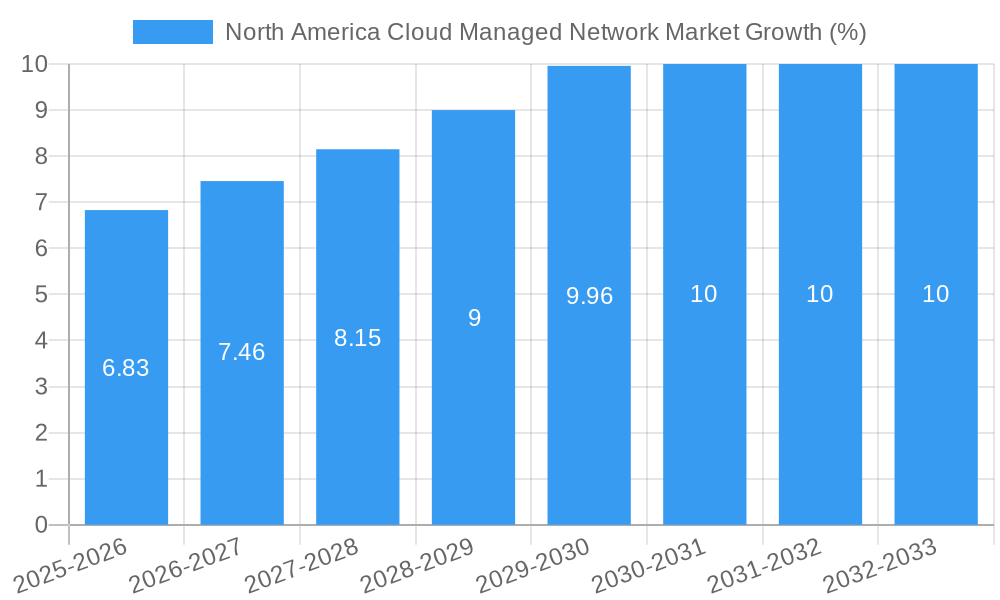

The North America cloud managed network market, valued at $66.80 million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.13% from 2025 to 2033. This expansion is driven by several key factors. Increasing adoption of cloud-based solutions by enterprises of all sizes – from small to large – is a primary driver. Businesses are increasingly seeking to improve operational efficiency, enhance security, and reduce IT infrastructure costs, all of which are facilitated by cloud managed network services. The BFSI (Banking, Financial Services, and Insurance), IT and Telecom, and Healthcare sectors are leading adopters, driven by stringent regulatory compliance requirements and the need for robust and scalable network solutions. Furthermore, the shift towards hybrid and multi-cloud environments is fueling demand, as businesses require seamless connectivity and management across various cloud platforms. The prevalence of on-premise solutions is gradually diminishing, with cloud deployment gaining significant traction due to its flexibility and scalability advantages. The managed services segment, encompassing managed data centers, security, communications, networks, infrastructure, and mobility, are witnessing significant growth, reflecting the rising preference for outsourcing IT management tasks to specialized providers.

The market's growth trajectory is further bolstered by technological advancements, such as Software-Defined Networking (SDN) and Network Function Virtualization (NFV), which are enhancing network agility and automation. However, challenges remain. Security concerns surrounding cloud-based networks and the potential for data breaches represent a significant restraint. Furthermore, the complexity of migrating existing on-premise networks to the cloud, along with the need for skilled professionals to manage these systems, can hinder adoption. Despite these challenges, the market's positive outlook remains strong, fueled by continued technological innovation and increasing enterprise demand for efficient and secure network solutions. The United States, being a technologically advanced nation with a high concentration of major players, forms a significant portion of this market, with Canada contributing substantially to North America's overall growth. Future projections indicate sustained expansion driven by ongoing digital transformation initiatives and the increasing adoption of cloud-based managed network services across various industry verticals.

North America Cloud Managed Network Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America cloud managed network market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, growth drivers, competitive landscape, and future opportunities, empowering businesses to make informed strategic decisions. The report incorporates extensive data analysis, detailed segmentations, and key industry developments to present a holistic view of this rapidly evolving market. The base year for this report is 2025, with estimations for 2025 and forecasts extending to 2033. The historical period covered is 2019-2024. The market size is expressed in Millions.

North America Cloud Managed Network Market Market Concentration & Innovation

This section analyzes the level of market concentration, identifying key players and their market share. Innovation drivers, including technological advancements and evolving customer needs, are examined. The regulatory landscape impacting the market, including relevant laws and compliance requirements, is assessed. The report also explores substitute products and their potential impact on market growth. Furthermore, the impact of end-user trends on market demand is detailed, alongside an analysis of mergers and acquisitions (M&A) activities within the industry, including deal values and their influence on market dynamics.

The market is moderately concentrated, with the top 5 players holding an estimated xx% market share in 2025. Significant M&A activity has been observed, with deal values totaling approximately xx Million in the past three years, indicating consolidation within the industry. Key innovation drivers include the rising adoption of SD-WAN, 5G connectivity, and AI-powered network management solutions. Regulatory frameworks like data privacy regulations and cybersecurity standards significantly impact market strategies.

- Market Share: Top 5 players: xx% (2025)

- M&A Activity: Total deal value (2022-2024): xx Million

- Innovation Drivers: SD-WAN, 5G, AI-powered network management

- Regulatory Impact: Data privacy, cybersecurity standards

North America Cloud Managed Network Market Industry Trends & Insights

This section delves into the key industry trends and insights shaping the North America cloud managed network market. It explores the factors driving market growth, examining technological advancements and their impact on market dynamics. Consumer preferences and evolving business needs are analyzed to understand market demand. The competitive landscape is assessed to identify major players and their strategies. The analysis includes quantification through metrics such as Compound Annual Growth Rate (CAGR) and market penetration rates.

The North America cloud managed network market is experiencing robust growth, driven by the increasing adoption of cloud-based services, the expansion of 5G networks, and the rising demand for secure and scalable network solutions across various industries. The market is projected to witness a CAGR of xx% during the forecast period (2025-2033). The increasing penetration of cloud computing in enterprises is a key driver, with a market penetration rate of xx% in 2025, expected to reach xx% by 2033. The shift towards digital transformation and remote work models further fuels demand for reliable and secure managed network services. Competitive dynamics are characterized by intense rivalry among established players and emerging technology providers.

Dominant Markets & Segments in North America Cloud Managed Network Market

This section identifies the dominant segments within the North America cloud managed network market, based on end-user vertical, country, deployment type, service type, and enterprise size. Key drivers for the dominance of specific segments are highlighted using bullet points, while in-depth dominance analysis uses paragraphs to explain the reasons behind the leading positions.

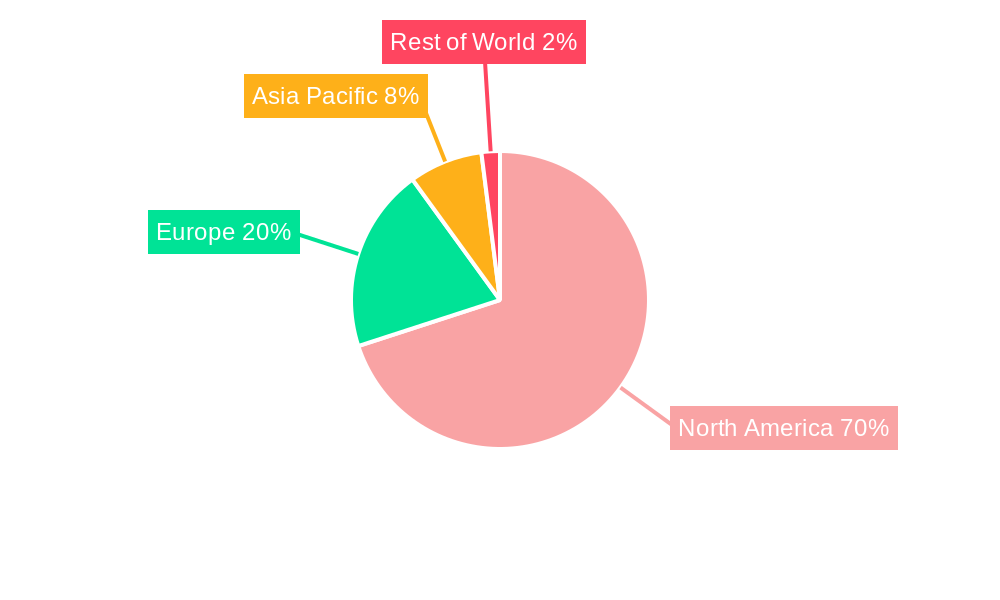

By Country: The United States dominates the market due to its advanced technological infrastructure and high adoption of cloud-based solutions. Canada follows as a significant contributor, driven by increasing digitalization initiatives.

By End-user Vertical: The BFSI (Banking, Financial Services, and Insurance) sector exhibits the highest demand, owing to its stringent security requirements and need for high availability. The IT and Telecom sector is also a significant contributor due to its inherent reliance on robust network infrastructure.

By Deployment: The cloud deployment segment is rapidly expanding, fueled by its scalability, cost-effectiveness, and enhanced security features.

By Type: Managed network services constitute the largest segment due to the widespread need for comprehensive network management solutions.

By Enterprise Size: Large enterprises dominate the market due to their greater resources and higher demand for sophisticated network solutions.

North America Cloud Managed Network Market Product Developments

This section provides a concise overview of recent product innovations, their applications, and their competitive advantages. Key technological trends and their market fit are highlighted.

Recent product innovations focus on enhanced security features, improved scalability, and integration with emerging technologies like AI and machine learning. The market is witnessing the introduction of AI-driven network optimization tools, which improve efficiency and reduce operational costs. These innovations cater to the increasing demand for robust, secure, and cost-effective managed network solutions, strengthening the competitive edge of leading providers.

Report Scope & Segmentation Analysis

This section details the market segmentation across all categories: end-user vertical, country, deployment, type, and enterprise size. Growth projections, market sizes, and competitive dynamics are presented for each segment.

The report comprehensively analyzes the North America cloud managed network market across various segments, offering detailed insights into market size, growth projections, and competitive dynamics for each. For example, the BFSI segment is projected to witness significant growth due to increasing digitalization initiatives. The United States accounts for the largest market share, driven by strong technological infrastructure and high cloud adoption. The cloud deployment model displays rapid expansion due to its flexibility and scalability. The managed network segment is the largest by type. Lastly, large enterprises exhibit the highest demand.

Key Drivers of North America Cloud Managed Network Market Growth

This section outlines the key factors driving the growth of the North America cloud managed network market.

Several factors contribute to the market's growth. The increasing adoption of cloud-based technologies, driven by cost savings, enhanced scalability, and improved security, is a major driver. The proliferation of 5G networks is further fueling demand for high-bandwidth connectivity solutions. Government initiatives supporting digital transformation and the growing need for remote work capabilities also significantly contribute to market expansion.

Challenges in the North America Cloud Managed Network Market Sector

This section discusses the challenges and restraints faced by the North America cloud managed network market.

The market faces challenges like stringent regulatory compliance requirements, escalating cybersecurity threats, and intense competition among providers. Supply chain disruptions can impact the availability of components, leading to cost increases and delays in project implementation. These factors collectively impact profitability and market growth.

Emerging Opportunities in North America Cloud Managed Network Market

This section highlights emerging trends and opportunities in the North America cloud managed network market.

Emerging opportunities lie in the expanding adoption of SD-WAN, increased integration of AI and ML in network management, and the growth of edge computing. The increasing demand for secure and reliable network solutions in sectors like healthcare and manufacturing presents significant growth potential. New market entrants with innovative solutions can capitalize on these opportunities.

Leading Players in the North America Cloud Managed Network Market Market

- IBM Corporation

- Fujitsu Ltd

- HP Development Company LP

- Cisco Systems Inc

- Verizon Communications Inc

- Microsoft Corporation

- Dell Technologies Inc

- Rackspace Inc

- AT&T Inc

- Citrix Systems Inc

Key Developments in North America Cloud Managed Network Market Industry

December 2021: Verizon Business enhanced its Network as a Service (NaaS) strategy by adding Cisco-managed SD-WAN services with 4G/5G connectivity options. This move expands Verizon's NaaS capabilities, enabling enterprises to leverage advanced technology and remain agile.

February 2022: Verizon Business integrated VMware into its Managed WAN Service's global managed SD-WAN service portfolio. This integration enhances the flexibility and scalability of Verizon's SD-WAN offerings, improving customer experiences.

Strategic Outlook for North America Cloud Managed Network Market Market

The North America cloud managed network market is poised for continued growth, driven by technological advancements, increasing digitalization, and the rising demand for secure and reliable network solutions. The adoption of innovative technologies such as AI and ML will further enhance network efficiency and security, creating new opportunities for market players. The market presents strong prospects for companies that can offer comprehensive, scalable, and secure solutions tailored to the evolving needs of businesses across diverse industries.

North America Cloud Managed Network Market Segmentation

-

1. Deployment

- 1.1. On-premise

- 1.2. Cloud

-

2. Type

- 2.1. Managed Data Center

- 2.2. Managed Security

- 2.3. Managed Communications

- 2.4. Managed Network

- 2.5. Managed Infrastructure

- 2.6. Managed Mobility

-

3. Enterprise Size

- 3.1. Small Enterprises

- 3.2. Medium Enterprises

- 3.3. Large Enterprises

-

4. End-user Vertical

- 4.1. BFSI

- 4.2. IT and Telecom

- 4.3. Healthcare

- 4.4. Entertainment and Media

- 4.5. Retail

- 4.6. Manufacturing

- 4.7. Government

- 4.8. Other End-user Verticals

North America Cloud Managed Network Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Cloud Managed Network Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.13% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Shift to Hybrid IT; Improved Cost and Operational Efficiency

- 3.3. Market Restrains

- 3.3.1. Higher Initial Investments

- 3.4. Market Trends

- 3.4.1. IT and Telecom Sector Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Cloud Managed Network Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-premise

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Managed Data Center

- 5.2.2. Managed Security

- 5.2.3. Managed Communications

- 5.2.4. Managed Network

- 5.2.5. Managed Infrastructure

- 5.2.6. Managed Mobility

- 5.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 5.3.1. Small Enterprises

- 5.3.2. Medium Enterprises

- 5.3.3. Large Enterprises

- 5.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.4.1. BFSI

- 5.4.2. IT and Telecom

- 5.4.3. Healthcare

- 5.4.4. Entertainment and Media

- 5.4.5. Retail

- 5.4.6. Manufacturing

- 5.4.7. Government

- 5.4.8. Other End-user Verticals

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. United States North America Cloud Managed Network Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Cloud Managed Network Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Cloud Managed Network Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Cloud Managed Network Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 IBM Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Fujitsu Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 HP Development Company LP

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Cisco Systems Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Verizon Communications Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Microsoft Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Dell Technologies Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Rackspace Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 AT&T Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Citrix Systems Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 IBM Corporation

List of Figures

- Figure 1: North America Cloud Managed Network Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Cloud Managed Network Market Share (%) by Company 2024

List of Tables

- Table 1: North America Cloud Managed Network Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Cloud Managed Network Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 3: North America Cloud Managed Network Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: North America Cloud Managed Network Market Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 5: North America Cloud Managed Network Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 6: North America Cloud Managed Network Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: North America Cloud Managed Network Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States North America Cloud Managed Network Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada North America Cloud Managed Network Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico North America Cloud Managed Network Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of North America North America Cloud Managed Network Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North America Cloud Managed Network Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 13: North America Cloud Managed Network Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: North America Cloud Managed Network Market Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 15: North America Cloud Managed Network Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 16: North America Cloud Managed Network Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United States North America Cloud Managed Network Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada North America Cloud Managed Network Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Mexico North America Cloud Managed Network Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Cloud Managed Network Market?

The projected CAGR is approximately 10.13%.

2. Which companies are prominent players in the North America Cloud Managed Network Market?

Key companies in the market include IBM Corporation, Fujitsu Ltd, HP Development Company LP, Cisco Systems Inc, Verizon Communications Inc, Microsoft Corporation, Dell Technologies Inc, Rackspace Inc , AT&T Inc, Citrix Systems Inc.

3. What are the main segments of the North America Cloud Managed Network Market?

The market segments include Deployment, Type, Enterprise Size, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 66.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Shift to Hybrid IT; Improved Cost and Operational Efficiency.

6. What are the notable trends driving market growth?

IT and Telecom Sector Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Higher Initial Investments.

8. Can you provide examples of recent developments in the market?

February 2022 - Verizon Business announced the inclusion of VMware to Verizon's Managed WAN Service's global managed Software-Defined Wide Area Network (SD-WAN) service portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Cloud Managed Network Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Cloud Managed Network Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Cloud Managed Network Market?

To stay informed about further developments, trends, and reports in the North America Cloud Managed Network Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence