Key Insights

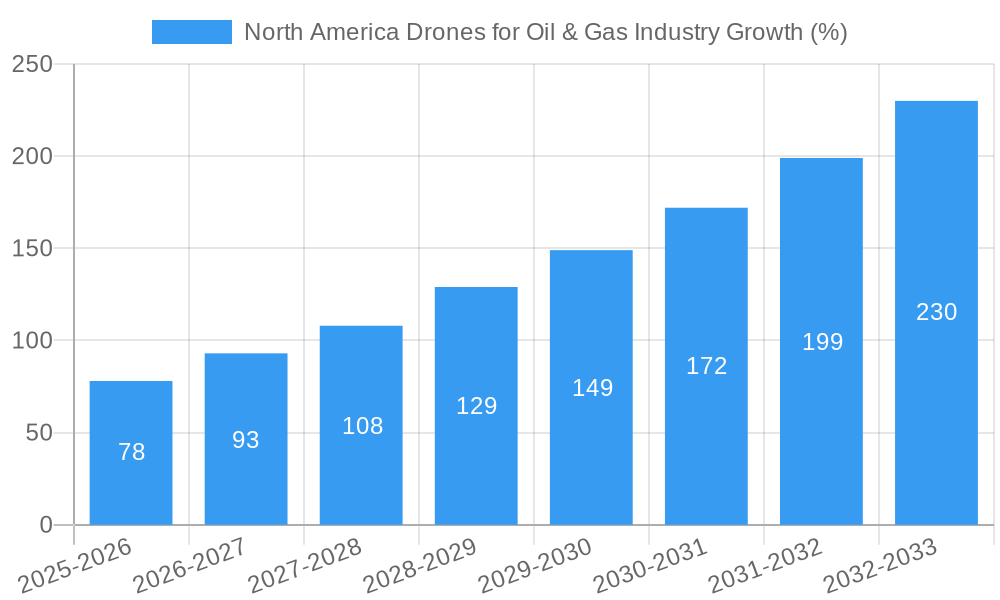

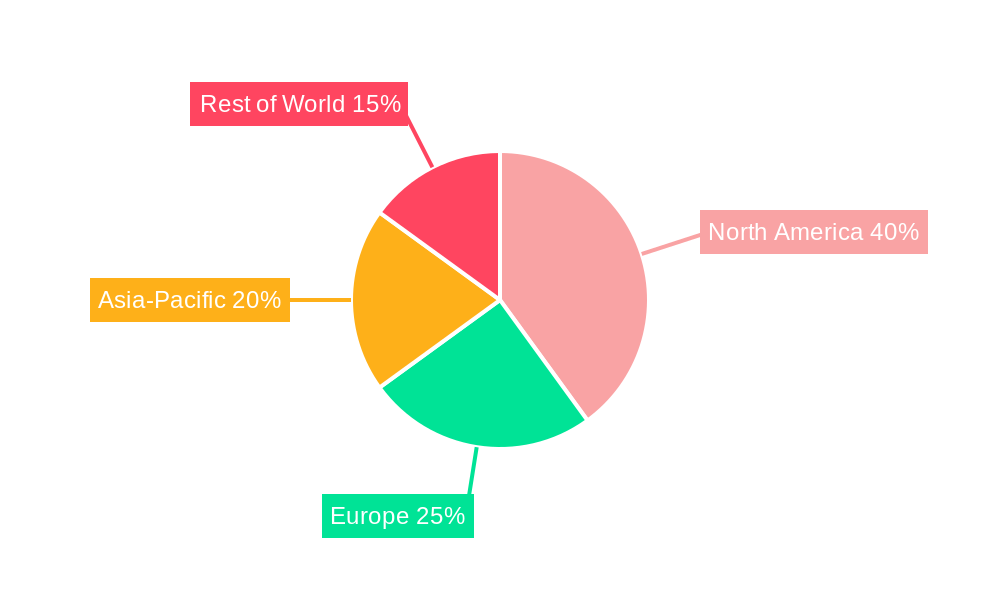

The North American drone market for the oil and gas industry is experiencing robust growth, driven by increasing demand for efficient and cost-effective solutions for pipeline inspection, asset mapping, and surveillance. The market, currently valued at approximately $500 million in 2025 (estimated based on a global market size projection and North America's significant share of the oil & gas sector), is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 15.70% from 2025 to 2033. This expansion is fueled by several key factors: the need for enhanced safety measures, the rising complexity of oil and gas infrastructure, and the increasing adoption of advanced technologies like AI and machine learning for data analysis. Fixed-wing drones are currently dominant due to their longer flight times and wider coverage, but multi-rotor drones are gaining traction for their maneuverability in challenging terrains. Companies like PrecisionHawk, Sky Futures, and Cyberhawk Innovations are leading the charge, deploying innovative drone solutions tailored to specific oil and gas applications. Regulatory approvals and evolving safety standards are key considerations impacting market dynamics.

Despite the positive growth trajectory, certain restraints exist. High initial investment costs for drone acquisition and specialized software can be a barrier to entry for smaller operators. Concerns related to data security and privacy, along with potential regulatory hurdles in specific jurisdictions, may also pose challenges. However, ongoing technological advancements, cost reductions in drone technology, and increasing awareness of the benefits of drone-based solutions are expected to mitigate these constraints. The segmentation of the market by application (pipeline inspection, asset mapping, and surveillance) and drone type (fixed-wing, multi-rotor, and hybrid) provides opportunities for specialized service providers catering to niche requirements within the industry. North America, with its mature oil and gas sector and supportive regulatory environment, is expected to remain a leading market in this space for the foreseeable future.

North America Drones for Oil & Gas Industry: A Comprehensive Market Analysis (2019-2033)

This detailed report provides a comprehensive analysis of the North America drones for oil and gas industry, offering actionable insights for industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a robust understanding of the market’s historical performance, current status, and future trajectory. The report covers key segments including pipeline inspection, asset mapping, and surveillance, analyzing the deployment of fixed-wing, multi-rotor, and hybrid drones. Market sizing is provided in Millions of USD.

North America Drones for Oil & Gas Industry Market Concentration & Innovation

This section analyzes the level of market concentration, examining the market share held by key players such as PrecisionHawk, Sky Futures, SkyX, Viper Drones, Cyberhawk Innovations Limited, Terra Drones (and others). We assess innovation drivers, including advancements in sensor technology and AI-powered data analytics, influencing the growth of this sector. The report also details the regulatory landscape impacting drone operations in the oil and gas sector across North America, exploring the influence of evolving safety standards and airspace regulations. Further analysis explores the presence and impact of substitute technologies and the evolving end-user preferences driving market dynamics. Finally, this section provides an overview of recent mergers and acquisitions (M&A) activity within the industry, including deal values (xx Million USD) and their impact on market consolidation.

- Market share analysis of leading players.

- Detailed overview of M&A activity and deal values (xx Million USD).

- Assessment of regulatory frameworks and their impact.

- Analysis of substitute technologies and their market penetration.

North America Drones for Oil & Gas Industry Industry Trends & Insights

This section dives deep into the key trends and insights shaping the North American drones for oil and gas market. We explore the market growth drivers, focusing on factors such as increasing demand for efficient inspection and monitoring solutions, the adoption of advanced analytics for data-driven decision-making, and the growing need for enhanced safety protocols within oil and gas operations. Technological disruptions, including the integration of AI and machine learning capabilities within drone systems and the development of more resilient and autonomous drone platforms, are also scrutinized. The competitive landscape is examined, focusing on the strategies employed by leading players and the overall market dynamics which are analyzed by providing the Compound Annual Growth Rate (CAGR) and market penetration metrics for the forecast period.

Dominant Markets & Segments in North America Drones for Oil & Gas Industry

This section identifies the dominant regions, countries, and market segments within the North American drone market for the oil and gas industry. A detailed analysis is presented for each segment (Pipeline Inspection, Asset Mapping, Surveillance; Fixed-Wing Drones, Multi-Rotor Drones, Hybrid Drones), highlighting the leading segments and their key growth drivers.

- Pipeline Inspection: The key drivers for this segment include the increasing length of pipelines, the need for regular inspection to avoid costly leaks, and technological advancements in high-resolution cameras and data analytics. The US is currently the dominant market in this area.

- Asset Mapping: This segment is experiencing rapid growth, driven by the need for accurate and up-to-date asset mapping for efficient operations and risk mitigation. Canada is a strong market, particularly in remote areas.

- Surveillance: The increasing focus on security and safety within the oil and gas industry is driving the demand for drone-based surveillance solutions. Both the US and Canada show strong growth in this segment.

- Fixed-Wing Drones: The efficiency in covering large areas makes fixed-wing drones highly suitable for applications like pipeline inspection and wide-area surveillance.

- Multi-Rotor Drones: Their maneuverability and ability to hover make them ideal for detailed inspections of specific assets and infrastructure.

- Hybrid Drones: Offering a blend of the benefits of both fixed-wing and multi-rotor drones, hybrid systems provide versatility across various applications.

Detailed analysis of each segment's dominance, including economic policies and infrastructure contributions, is provided within the report.

North America Drones for Oil & Gas Industry Product Developments

This section summarizes recent product innovations in the North America drone market for oil and gas. It highlights the key advancements in sensor technology, payload capacity, flight autonomy, and data analytics capabilities. The competitive advantages offered by these new products, their applications, and their market fit are discussed, focusing on technological trends and overall market acceptance.

Report Scope & Segmentation Analysis

This report segments the North American drones for oil and gas market based on application (Pipeline Inspection, Asset Mapping, Surveillance) and drone type (Fixed-Wing Drones, Multi-Rotor Drones, Hybrid Drones). For each segment, the report provides detailed analysis including growth projections (xx Million USD), current market size (xx Million USD), and competitive landscape insights. The impact of emerging technologies and regulatory changes on these segments are also thoroughly reviewed.

Key Drivers of North America Drones for Oil & Gas Industry Growth

Several factors are driving the growth of the North American drone market for oil and gas. These include the increasing demand for cost-effective and efficient inspection and maintenance solutions, stringent safety regulations promoting drone adoption for safer operations, and the advancements in drone technology leading to greater accuracy and capabilities. Government initiatives promoting the use of drones in the oil and gas industry also contribute significantly to market growth.

Challenges in the North America Drones for Oil & Gas Industry Sector

Despite the growth opportunities, the North American drone market for oil and gas faces several challenges. These include regulatory hurdles related to drone operations in restricted airspace, concerns regarding data security and privacy, and the high initial investment costs associated with drone technology. Supply chain disruptions, particularly the availability of key components, also pose significant risks to market growth, potentially impacting overall production and availability. The impact of these challenges on the market is quantified within the report.

Emerging Opportunities in North America Drones for Oil & Gas Industry

The North American drone market for oil and gas presents several emerging opportunities. These include the integration of advanced analytics, AI, and machine learning capabilities to enhance data processing and decision-making, the increasing adoption of autonomous drones for complex inspections, and the growth of drone-as-a-service (DaaS) models. The expansion into new applications, such as environmental monitoring and leak detection, also represents substantial opportunities for growth.

Leading Players in the North America Drones for Oil & Gas Industry Market

- PrecisionHawk

- Sky Futures

- SkyX

- Viper Drones

- Cyberhawk Innovations Limited

- Terra Drones

Key Developments in North America Drones for Oil & Gas Industry Industry

- January 2021: X-Terra Resources Inc. contracts with Vision 4K for a drone magnetic survey covering 82 km (2.1 square kilometers) in New Brunswick, aiming to identify drill targets. This highlights the growing use of drones in exploration activities.

Strategic Outlook for North America Drones for Oil & Gas Industry Market

The North American drone market for oil and gas exhibits significant growth potential. Driven by technological advancements, stringent safety regulations, and the rising demand for efficient operational solutions, the market is poised for sustained expansion. The increasing adoption of autonomous drone systems, enhanced data analytics capabilities, and the development of specialized drone platforms for specific oil and gas applications will be key catalysts for future growth. The market’s long-term outlook remains positive, with substantial opportunities for industry players to capitalize on the growing demand for drone-based solutions within the oil and gas sector.

North America Drones for Oil & Gas Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Drones for Oil & Gas Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Drones for Oil & Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 15.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources

- 3.3. Market Restrains

- 3.3.1. 4.; The Recycling Rate of Waste in Germany

- 3.4. Market Trends

- 3.4.1. Integration of Artificial Intelligence (AI) with Drones to Fuel the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Drones for Oil & Gas Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. United States North America Drones for Oil & Gas Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Drones for Oil & Gas Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Drones for Oil & Gas Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Drones for Oil & Gas Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 PrecisionHawk

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sky futures

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 SkyX

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Viper Drones

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Cyberhawk Innovations Limited*List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Terra Drones

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 PrecisionHawk

List of Figures

- Figure 1: North America Drones for Oil & Gas Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Drones for Oil & Gas Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Drones for Oil & Gas Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Drones for Oil & Gas Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 3: North America Drones for Oil & Gas Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: North America Drones for Oil & Gas Industry Volume K Units Forecast, by Production Analysis 2019 & 2032

- Table 5: North America Drones for Oil & Gas Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: North America Drones for Oil & Gas Industry Volume K Units Forecast, by Consumption Analysis 2019 & 2032

- Table 7: North America Drones for Oil & Gas Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: North America Drones for Oil & Gas Industry Volume K Units Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: North America Drones for Oil & Gas Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: North America Drones for Oil & Gas Industry Volume K Units Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: North America Drones for Oil & Gas Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: North America Drones for Oil & Gas Industry Volume K Units Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: North America Drones for Oil & Gas Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 14: North America Drones for Oil & Gas Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 15: North America Drones for Oil & Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: North America Drones for Oil & Gas Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 17: United States North America Drones for Oil & Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United States North America Drones for Oil & Gas Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: Canada North America Drones for Oil & Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Canada North America Drones for Oil & Gas Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 21: Mexico North America Drones for Oil & Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mexico North America Drones for Oil & Gas Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 23: Rest of North America North America Drones for Oil & Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of North America North America Drones for Oil & Gas Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 25: North America Drones for Oil & Gas Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 26: North America Drones for Oil & Gas Industry Volume K Units Forecast, by Production Analysis 2019 & 2032

- Table 27: North America Drones for Oil & Gas Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 28: North America Drones for Oil & Gas Industry Volume K Units Forecast, by Consumption Analysis 2019 & 2032

- Table 29: North America Drones for Oil & Gas Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 30: North America Drones for Oil & Gas Industry Volume K Units Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 31: North America Drones for Oil & Gas Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 32: North America Drones for Oil & Gas Industry Volume K Units Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 33: North America Drones for Oil & Gas Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 34: North America Drones for Oil & Gas Industry Volume K Units Forecast, by Price Trend Analysis 2019 & 2032

- Table 35: North America Drones for Oil & Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Drones for Oil & Gas Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 37: United States North America Drones for Oil & Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: United States North America Drones for Oil & Gas Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 39: Canada North America Drones for Oil & Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Canada North America Drones for Oil & Gas Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 41: Mexico North America Drones for Oil & Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Mexico North America Drones for Oil & Gas Industry Volume (K Units) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Drones for Oil & Gas Industry?

The projected CAGR is approximately > 15.70%.

2. Which companies are prominent players in the North America Drones for Oil & Gas Industry?

Key companies in the market include PrecisionHawk, Sky futures, SkyX, Viper Drones, Cyberhawk Innovations Limited*List Not Exhaustive, Terra Drones.

3. What are the main segments of the North America Drones for Oil & Gas Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources.

6. What are the notable trends driving market growth?

Integration of Artificial Intelligence (AI) with Drones to Fuel the Market.

7. Are there any restraints impacting market growth?

4.; The Recycling Rate of Waste in Germany.

8. Can you provide examples of recent developments in the market?

In January 2021, X-Terra Resources Inc. contracted with Vision 4K to perform a detailed drone magnetic survey on the Northwest property located in New Brunswick. Vision 4K is most likely to conduct a survey on 82 km covering an area of about 2.1 square kilometers. This survey aims to identify the drill targets by applying a detailed overprint of subtle structures at Rim.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Drones for Oil & Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Drones for Oil & Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Drones for Oil & Gas Industry?

To stay informed about further developments, trends, and reports in the North America Drones for Oil & Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence