Key Insights

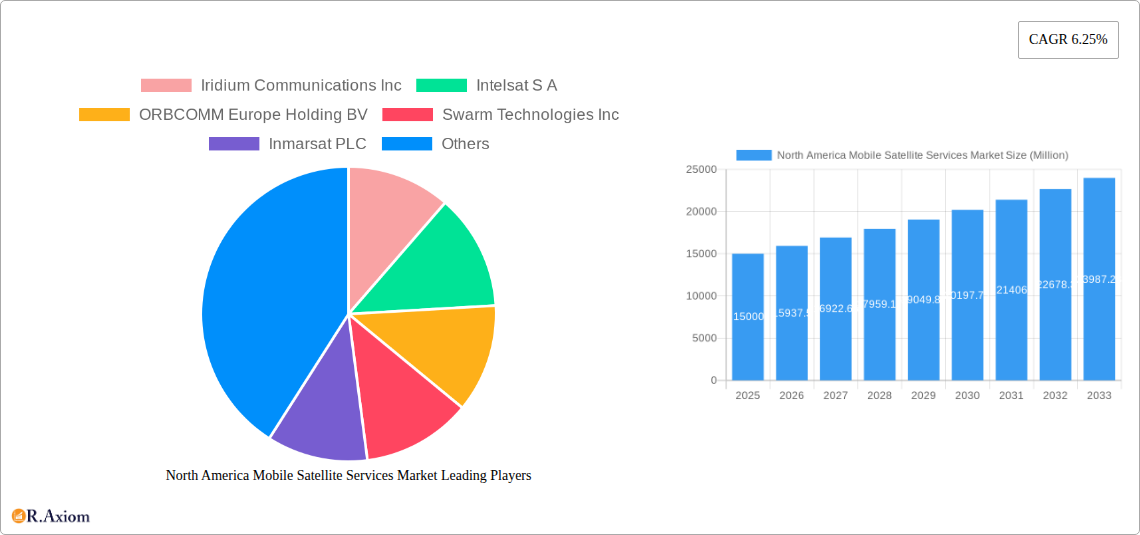

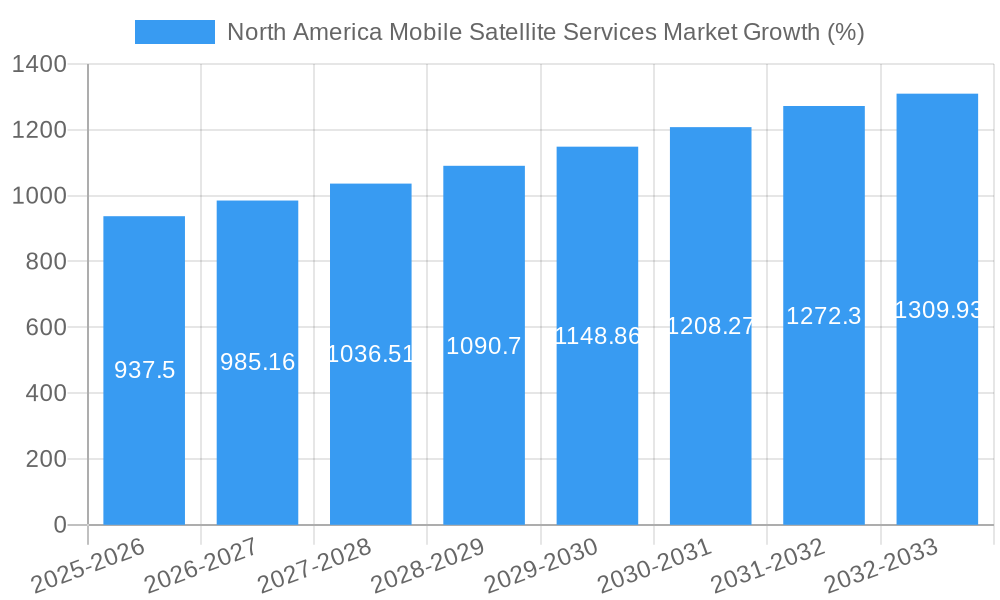

The North American Mobile Satellite Services market, currently experiencing robust growth, is projected to expand significantly over the forecast period (2025-2033). A compound annual growth rate (CAGR) of 6.25% indicates a substantial increase in market value, driven primarily by escalating demand across key sectors. The maritime industry, a significant contributor, relies heavily on reliable satellite communication for navigation, safety, and operational efficiency. Similarly, the burgeoning enterprise sector is increasingly adopting mobile satellite services for remote workforce connectivity and business continuity in areas with limited terrestrial infrastructure. Government agencies also contribute substantially, utilizing these services for national security, disaster response, and environmental monitoring. Technological advancements, such as the deployment of Low Earth Orbit (LEO) satellite constellations offering enhanced coverage and lower latency, are further fueling market expansion. Competition among major players like Iridium Communications, Inmarsat, and Viasat is fostering innovation and driving down costs, making these services more accessible to a wider range of users. While regulatory hurdles and potential interference from other communication technologies pose some constraints, the overall market outlook remains positive, indicating a sustained period of growth.

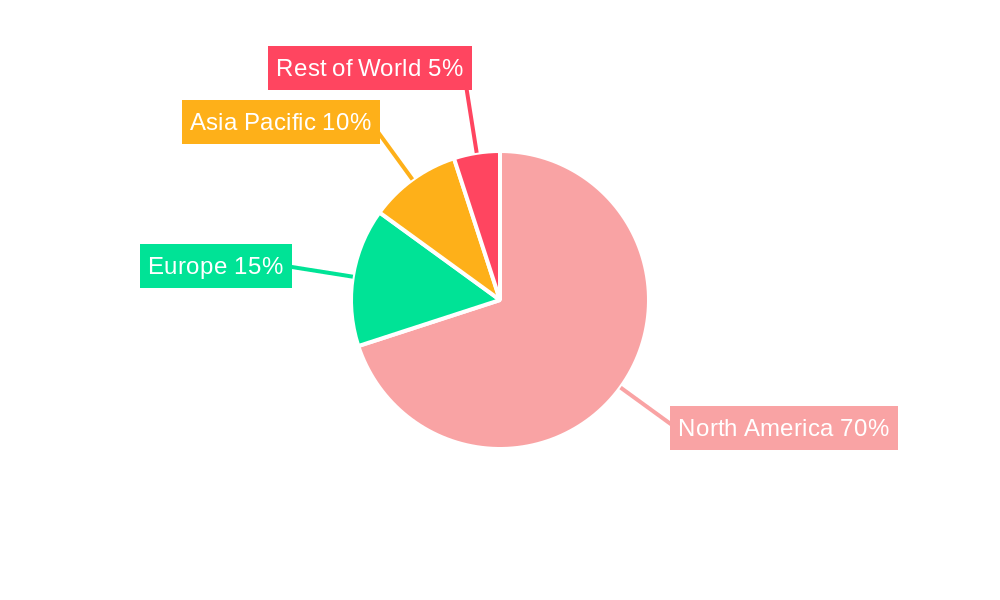

Growth within the North American region is particularly strong, fueled by robust investments in infrastructure and the increasing adoption of IoT (Internet of Things) applications. The United States, being the largest market within North America, is expected to continue dominating the region due to its advanced technological infrastructure and the high concentration of key players. Canada and Mexico, although smaller markets, are also witnessing significant growth driven by increasing demand from the maritime and aviation sectors. Segmentation by satellite type (LEO, MEO, GEO) reveals a shift towards LEO constellations due to their advantages in latency and coverage. The data segment is anticipated to show accelerated growth compared to the voice segment, reflecting the growing reliance on data-intensive applications like remote sensing, telematics, and machine-to-machine communication. Furthermore, strategic partnerships and mergers and acquisitions amongst key market players are shaping the competitive landscape and stimulating innovation within the North American Mobile Satellite Services market.

This comprehensive report provides an in-depth analysis of the North America Mobile Satellite Services market, covering the period from 2019 to 2033. The study includes detailed segmentation by satellite type (LEO, MEO, GEO), service (voice, data), end-user industry (maritime, enterprise, aviation, government), and country (U.S., Canada). With a base year of 2025 and an estimated year of 2025, this report offers valuable insights for industry stakeholders, investors, and businesses seeking to understand the market's growth trajectory and opportunities. The market size is projected to reach xx Million by 2033.

North America Mobile Satellite Services Market Concentration & Innovation

The North American mobile satellite services market exhibits a moderately concentrated landscape, with key players such as Iridium Communications Inc, Intelsat S A, Inmarsat PLC, and Viasat Inc holding significant market share. However, the emergence of smaller, innovative companies like Swarm Technologies Inc and the expansion of existing players into new service offerings are leading to increased competition. Market share dynamics are influenced by technological advancements, regulatory approvals, and strategic partnerships. The total market value in 2024 was estimated at xx Million. M&A activity has been moderate, with deal values ranging from xx Million to xx Million in recent years, primarily focused on enhancing technological capabilities and expanding service reach.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated to be xx, suggesting a moderately concentrated market.

- Innovation Drivers: The demand for reliable communication in remote areas, advancements in satellite technology (e.g., LEO constellations), and the increasing adoption of IoT devices are driving innovation.

- Regulatory Frameworks: Government regulations concerning spectrum allocation and licensing play a crucial role in market development.

- Product Substitutes: While terrestrial networks are primary substitutes, mobile satellite services offer unique advantages in areas with limited or no terrestrial coverage.

- End-User Trends: The growing adoption of M2M communication and demand for reliable connectivity in various sectors like aviation and maritime fuel market expansion.

- M&A Activities: Consolidation and strategic partnerships are expected to continue shaping the market landscape.

North America Mobile Satellite Services Market Industry Trends & Insights

The North American mobile satellite services market is experiencing significant growth, driven by increasing demand for reliable connectivity in remote and underserved areas. The market is witnessing a CAGR of xx% during the forecast period (2025-2033). Technological advancements such as the deployment of low Earth orbit (LEO) satellite constellations are revolutionizing the industry, offering improved latency and higher bandwidth compared to traditional GEO satellites. Consumer preferences are shifting towards more integrated and user-friendly satellite communication solutions. The competitive landscape is becoming more dynamic with the entry of new players and strategic alliances. Market penetration is gradually increasing across various end-user segments, especially in the maritime and aviation sectors.

Dominant Markets & Segments in North America Mobile Satellite Services Market

The U.S. dominates the North American mobile satellite services market, accounting for a larger market share than Canada. This is mainly attributable to the greater size of its economy, advanced infrastructure, and a wider range of applications across diverse sectors.

- By Satellite Type: The LEO segment is projected to witness the highest growth due to advancements in technology and its ability to provide improved connectivity.

- By Service: The data segment holds a significant market share, driven by the increasing adoption of IoT applications and the demand for broadband services in remote areas.

- By End-user Industry: The maritime and aviation industries are key drivers of market growth, fueled by stringent safety regulations and the need for reliable communication.

- By Country: The United States accounts for a significantly larger market share compared to Canada.

- Key Drivers for the U.S.: Strong economic growth, robust infrastructure development, and increasing adoption of satellite-based solutions in various sectors are driving the U.S. market.

- Key Drivers for Canada: Government initiatives promoting rural connectivity and growing demand from the energy and mining sectors are boosting the Canadian market.

North America Mobile Satellite Services Market Product Developments

Recent product developments focus on enhancing data speeds, reducing latency, and improving the overall user experience. New satellite constellations are being deployed, utilizing advanced technologies to deliver improved coverage and performance. Smaller, more affordable satellite terminals are being introduced, expanding market access for smaller businesses and individual users. The integration of mobile satellite services with other communication technologies is also gaining momentum.

Report Scope & Segmentation Analysis

This report segments the North American mobile satellite services market across various parameters:

- By Satellite Type: LEO, MEO, GEO; each segment's growth is analyzed considering technological advancements and market demand.

- By Service: Voice, Data; the data segment is expected to have the highest growth due to the rise of IoT.

- By End-user Industry: Maritime, Enterprise, Aviation, Government; each segment's market size and growth are assessed based on application-specific needs.

- By Country: U.S., Canada; the report provides a detailed analysis of market conditions and growth potential in each country.

Key Drivers of North America Mobile Satellite Services Market Growth

The North American mobile satellite services market growth is fueled by several key factors:

- Technological advancements: The development of LEO constellations offering higher bandwidth and lower latency.

- Increasing demand for connectivity in remote areas: Satellite services provide critical communication links where terrestrial networks are unavailable.

- Growth of IoT applications: The need for reliable connectivity for remote devices in various industries.

- Government initiatives: Funding and regulatory support for expanding satellite communication infrastructure.

Challenges in the North America Mobile Satellite Services Market Sector

The market faces several challenges:

- High initial investment costs: Deploying satellite constellations and infrastructure requires substantial capital investment.

- Regulatory hurdles: Obtaining licenses and complying with spectrum allocation regulations can be complex.

- Competitive pressures: Intense competition among existing and emerging players can impact profitability.

- Limited coverage in certain areas: Satellite communication may not provide ubiquitous coverage.

Emerging Opportunities in North America Mobile Satellite Services Market

Several opportunities are emerging:

- Expansion into new markets: Growth in emerging sectors like agriculture and smart cities.

- Integration with 5G networks: Hybrid satellite-terrestrial networks offer improved coverage and capacity.

- Development of advanced satellite terminals: Smaller, more affordable, and energy-efficient terminals are expanding market reach.

Leading Players in the North America Mobile Satellite Services Market Market

- Iridium Communications Inc

- Intelsat S A

- ORBCOMM Europe Holding BV

- Swarm Technologies Inc

- Inmarsat PLC

- Viasat Inc

- Thales Group

- Globalstar Inc

- Telesat

- TerreStar Solutions Inc

Key Developments in North America Mobile Satellite Services Market Industry

- February 2022: Lynk Global, Inc. signed multiple commercial contracts with Mobile Network Operators (MNOs) in the Pacific and Caribbean.

- January 2022: Telesat announced a strategic partnership with Canada's ENCQOR 5G to advance 5G connectivity.

Strategic Outlook for North America Mobile Satellite Services Market Market

The North American mobile satellite services market is poised for robust growth, driven by continuous technological advancements, increasing demand for reliable connectivity in underserved areas, and the expansion of IoT applications. Strategic partnerships, investments in new technologies, and focus on providing user-friendly and affordable solutions will be crucial for success in this dynamic market. The market's potential for future growth is substantial, offering attractive opportunities for existing and new market entrants alike.

North America Mobile Satellite Services Market Segmentation

-

1. Satellite Type

- 1.1. Low Earth Orbit (LEO)

- 1.2. Medium Earth Orbit (MEO)

- 1.3. Geostationary Earth Orbit (GEO)

-

2. Service

- 2.1. Voice

- 2.2. Data

-

3. End-user Industry

- 3.1. Maritime

- 3.2. Enterprise

- 3.3. Aviation

- 3.4. Government

North America Mobile Satellite Services Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Mobile Satellite Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.25% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Integration Demands for Satellite and Terrestrial Mobile Technology5.1.2 5G mobile networks with next-generation satellite capabilities is likely to propel the market growth

- 3.3. Market Restrains

- 3.3.1. Lack of Interoperability between MSS Systems; Increasing Regulations on the Use of Satellite Technology

- 3.4. Market Trends

- 3.4.1. Increasing Government Investments

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Mobile Satellite Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Satellite Type

- 5.1.1. Low Earth Orbit (LEO)

- 5.1.2. Medium Earth Orbit (MEO)

- 5.1.3. Geostationary Earth Orbit (GEO)

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Voice

- 5.2.2. Data

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Maritime

- 5.3.2. Enterprise

- 5.3.3. Aviation

- 5.3.4. Government

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Satellite Type

- 6. United States North America Mobile Satellite Services Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Mobile Satellite Services Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Mobile Satellite Services Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Mobile Satellite Services Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Iridium Communications Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Intelsat S A

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 ORBCOMM Europe Holding BV

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Swarm Technologies Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Inmarsat PLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Viasat Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Thales Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Globalstar Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Telesat

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 TerreStar Solutions Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Iridium Communications Inc

List of Figures

- Figure 1: North America Mobile Satellite Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Mobile Satellite Services Market Share (%) by Company 2024

List of Tables

- Table 1: North America Mobile Satellite Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Mobile Satellite Services Market Revenue Million Forecast, by Satellite Type 2019 & 2032

- Table 3: North America Mobile Satellite Services Market Revenue Million Forecast, by Service 2019 & 2032

- Table 4: North America Mobile Satellite Services Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: North America Mobile Satellite Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Mobile Satellite Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Mobile Satellite Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Mobile Satellite Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Mobile Satellite Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Mobile Satellite Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Mobile Satellite Services Market Revenue Million Forecast, by Satellite Type 2019 & 2032

- Table 12: North America Mobile Satellite Services Market Revenue Million Forecast, by Service 2019 & 2032

- Table 13: North America Mobile Satellite Services Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 14: North America Mobile Satellite Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Mobile Satellite Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Mobile Satellite Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Mobile Satellite Services Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Mobile Satellite Services Market?

The projected CAGR is approximately 6.25%.

2. Which companies are prominent players in the North America Mobile Satellite Services Market?

Key companies in the market include Iridium Communications Inc, Intelsat S A, ORBCOMM Europe Holding BV, Swarm Technologies Inc, Inmarsat PLC, Viasat Inc, Thales Group, Globalstar Inc, Telesat, TerreStar Solutions Inc.

3. What are the main segments of the North America Mobile Satellite Services Market?

The market segments include Satellite Type, Service, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Integration Demands for Satellite and Terrestrial Mobile Technology5.1.2 5G mobile networks with next-generation satellite capabilities is likely to propel the market growth.

6. What are the notable trends driving market growth?

Increasing Government Investments.

7. Are there any restraints impacting market growth?

Lack of Interoperability between MSS Systems; Increasing Regulations on the Use of Satellite Technology.

8. Can you provide examples of recent developments in the market?

In February 2022, Lynk Global, Inc. satellite-direct-to-phone telecoms company announced that it had signed multiple commercial contracts with Mobile Network Operators (MNOs) covering seven island nations in the Pacific and Caribbean, including Telikom PNG in Papua New Guinea (PNG) and bmobile in the Solomon Islands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Mobile Satellite Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Mobile Satellite Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Mobile Satellite Services Market?

To stay informed about further developments, trends, and reports in the North America Mobile Satellite Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence