Key Insights

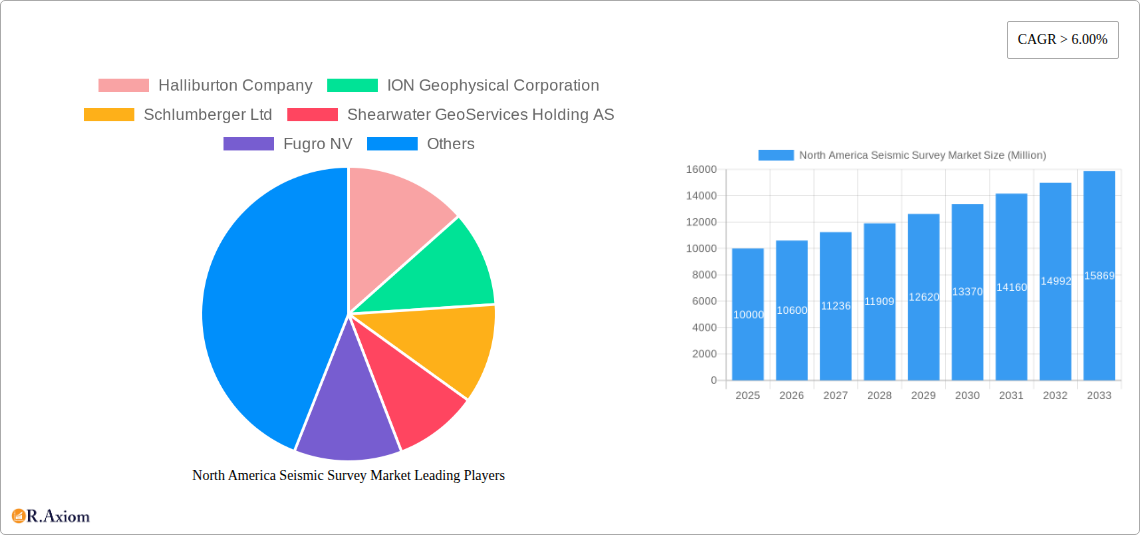

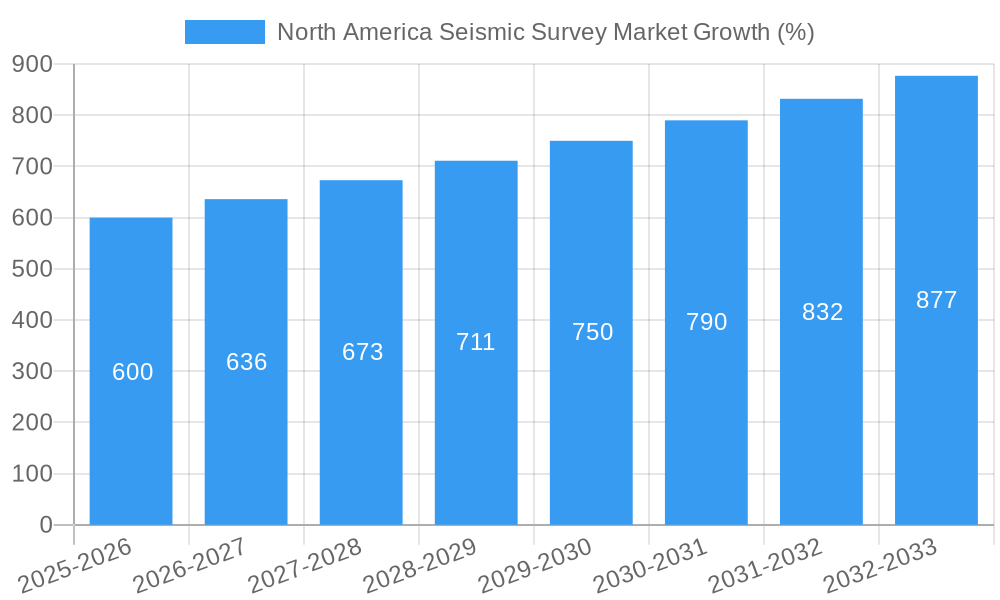

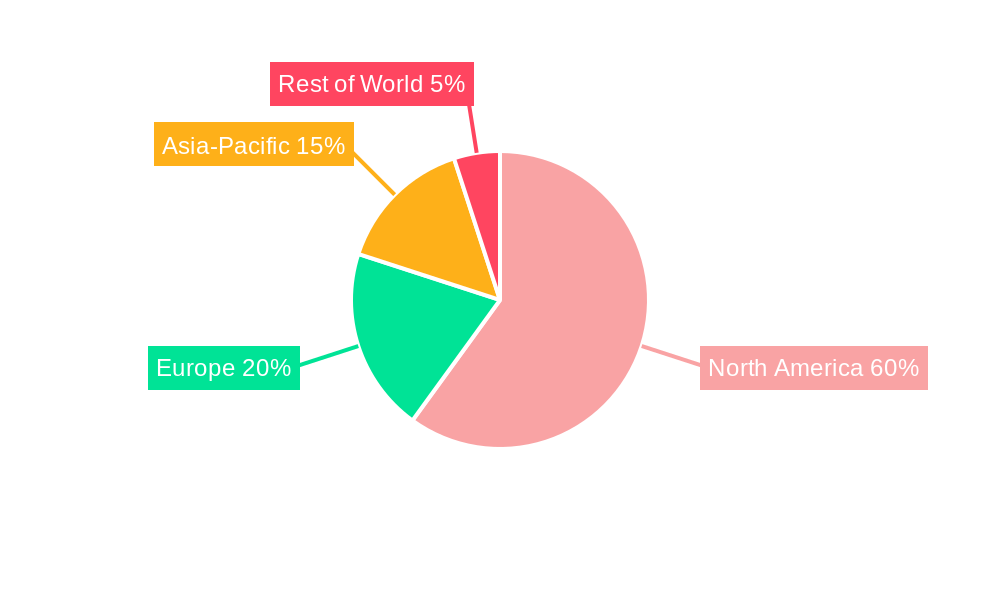

The North America seismic survey market is experiencing robust growth, driven by increasing exploration and production activities in the oil and gas sector, coupled with the rising demand for advanced subsurface imaging technologies. The market's compound annual growth rate (CAGR) exceeding 6% signifies a consistent upward trajectory, projected to continue through 2033. This growth is fueled by several key factors. Firstly, the ongoing exploration for new reserves, especially in unconventional resources like shale gas and tight oil, necessitates detailed subsurface imaging to optimize drilling strategies and minimize risks. Secondly, technological advancements in seismic acquisition and processing techniques, such as 3D and 4D seismic surveys, provide higher-resolution images, leading to improved reservoir characterization and enhanced production efficiency. This has increased the market demand for sophisticated and cost-effective services from major players in the industry. Finally, government initiatives promoting energy independence and supporting exploration activities in North America further contribute to market expansion.

However, the market also faces certain constraints. Fluctuations in oil and gas prices directly impact exploration budgets, potentially slowing down investment in seismic surveys during periods of low prices. Furthermore, environmental regulations and concerns regarding the environmental impact of seismic surveys can pose challenges, particularly in sensitive ecological regions. Nevertheless, the overall positive outlook for the North American energy sector, coupled with continuous technological advancements, makes the seismic survey market a promising investment area. Major players like Halliburton, Schlumberger, and ION Geophysical are strategically positioned to benefit from this growth, continually improving their technology and expanding their service offerings to meet evolving industry demands. The market segmentation likely includes various service types (e.g., land, marine, and 3D/4D surveys) and end-users (e.g., oil and gas exploration companies and government agencies). Considering the provided CAGR and market dynamics, a reasonable estimate for the 2025 market size could be around $10 billion, growing to approximately $15 billion by 2033, although further detailed data would be needed for precision.

This in-depth report provides a comprehensive analysis of the North America seismic survey market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's dynamics, growth drivers, challenges, and future potential. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

North America Seismic Survey Market Concentration & Innovation

This section analyzes the competitive landscape of the North America seismic survey market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities. The market is characterized by a moderately concentrated structure, with key players such as Halliburton Company, ION Geophysical Corporation, Schlumberger Ltd, Shearwater GeoServices Holding AS, Fugro NV, SAExploration Holdings Inc, and CGG SA holding significant market share. However, the presence of several smaller players indicates a degree of competition.

- Market Share: The top 5 players account for approximately xx% of the market share in 2025. Precise figures require further analysis of confidential company data.

- Innovation Drivers: Technological advancements in seismic data acquisition and processing, including the adoption of advanced sensors and AI-powered interpretation software, are key innovation drivers.

- Regulatory Frameworks: Stringent environmental regulations and safety standards influence market operations and investment decisions.

- Product Substitutes: While seismic surveys remain the dominant technology for subsurface imaging, alternative technologies like electromagnetic surveys present a degree of substitution.

- End-User Trends: Increasing exploration activities in unconventional resources (shale gas, tight oil) and offshore areas are driving demand for seismic surveys.

- M&A Activities: The past five years have witnessed several M&A activities within the industry, with deal values totaling approximately xx Million. These activities have mainly focused on consolidating market share and acquiring specialized technologies.

North America Seismic Survey Market Industry Trends & Insights

The North America seismic survey market is experiencing robust growth fueled by several factors. The exploration and production of oil and gas, particularly in unconventional resources, is the main driver of market expansion. Technological advancements in seismic data acquisition and processing are improving data quality and reducing acquisition time, leading to cost efficiencies. This, coupled with an increased focus on data analytics and interpretation, is transforming the industry’s ability to identify and extract resources more efficiently. However, volatile oil and gas prices, and the increased focus on renewable energy sources pose challenges to market growth.

The market's competitive dynamics are characterized by intense rivalry among established players, each striving to improve its service offerings, expand geographically, and develop strategic partnerships. This rivalry drives innovation and compels companies to constantly enhance their technologies and service capabilities to stay ahead of the curve. The market penetration of advanced seismic technologies, such as 3D and 4D seismic imaging, is steadily increasing, driven by their superior ability to provide detailed subsurface images.

Dominant Markets & Segments in North America Seismic Survey Market

The Gulf of Mexico and the Western Canadian Sedimentary Basin are the most dominant regions within the North America seismic survey market. These regions exhibit high exploration and production activity, supported by robust infrastructure and favorable regulatory environments.

- Gulf of Mexico: High oil and gas reserves, established infrastructure, and supportive government policies contribute to its dominance.

- Western Canadian Sedimentary Basin: Significant shale gas and oil sands reserves drive considerable demand for seismic surveys.

- Other Regions: The eastern US and parts of Alaska also show growth potential but lag behind the dominant regions due to factors like geological complexities and operational challenges.

Segment Dominance: The offshore segment holds a larger market share compared to the onshore segment due to the significant exploration activity in offshore areas. However, the onshore segment is growing at a faster rate, fueled by unconventional resource exploration.

North America Seismic Survey Market Product Developments

Recent years have seen significant advancements in seismic survey technologies. High-density 3D and 4D seismic acquisition methods are gaining traction, providing more detailed subsurface images and enhancing reservoir characterization. This is coupled with the increasing adoption of AI and machine learning in seismic data processing and interpretation, improving efficiency and accuracy. The focus is on providing comprehensive and high-quality data at reduced costs, which enables clients to make well-informed decisions regarding resource exploration and extraction.

Report Scope & Segmentation Analysis

This report segments the North America seismic survey market based on several key parameters:

- By Type: 2D, 3D, and 4D seismic surveys; each with its own unique application and cost profile. 3D and 4D surveys are exhibiting faster growth due to their superior image quality.

- By Application: Oil and gas exploration, geothermal energy exploration, and geological research; the oil and gas sector dominates this market.

- By Geography: The report provides detailed market size and growth projections for key regions including the Gulf of Mexico, Western Canadian Sedimentary Basin, and other regions.

Key Drivers of North America Seismic Survey Market Growth

The North America seismic survey market's growth is driven by several factors:

- Increased Exploration and Production: Rising global energy demand and the need to explore unconventional resources are primary drivers.

- Technological Advancements: Improved data acquisition and processing techniques are increasing efficiency and accuracy.

- Government Initiatives: Policies promoting energy exploration and production fuel demand for seismic surveys.

Challenges in the North America Seismic Survey Market Sector

Several challenges hinder market growth:

- Fluctuating Oil and Gas Prices: Oil price volatility directly impacts investment in exploration activities and seismic surveys.

- Environmental Regulations: Stringent environmental regulations increase operational costs and complexity.

- Competition: Intense competition among seismic service providers puts pressure on pricing and profit margins.

Emerging Opportunities in North America Seismic Survey Market

Emerging opportunities include:

- Growth of Unconventional Resources: Continued exploration of shale gas and tight oil presents significant opportunities.

- Technological Advancements: The adoption of AI and automation in data processing offers new avenues for efficiency gains.

- Offshore Exploration: Exploration in deepwater and ultra-deepwater areas is creating new demands for advanced seismic techniques.

Leading Players in the North America Seismic Survey Market Market

- Halliburton Company

- ION Geophysical Corporation

- Schlumberger Ltd

- Shearwater GeoServices Holding AS

- Fugro NV

- SAExploration Holdings Inc

- CGG SA

- List Not Exhaustive

Key Developments in North America Seismic Survey Market Industry

- 2022, December: Equinor proposed the Bay du Nord offshore oil project (USD 12 Billion) located 500 km off the coast of Newfoundland and Labrador, Canada. This project is expected to significantly boost demand for seismic survey services in the region.

Strategic Outlook for North America Seismic Survey Market Market

The North America seismic survey market is poised for sustained growth driven by ongoing exploration activities, technological advancements, and supportive government policies. The focus on efficiency, cost reduction, and improved data quality will shape the market's future trajectory. The increasing demand for 3D and 4D seismic surveys, coupled with the adoption of AI-powered solutions, is expected to further drive market expansion in the coming years. Strategic partnerships, technological innovation, and expansion into new geographical areas will be crucial for companies seeking to thrive in this dynamic market.

North America Seismic Survey Market Segmentation

-

1. Service

- 1.1. Data Acquisition

- 1.2. Data Processing and Interpretation

-

2. Location of Deployment

- 2.1. Onshore

- 2.2. Offshore

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Seismic Survey Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Seismic Survey Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Offshore Oil and Gas Activity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global North America Seismic Survey Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Data Acquisition

- 5.1.2. Data Processing and Interpretation

- 5.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.2.1. Onshore

- 5.2.2. Offshore

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. United States North America Seismic Survey Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Data Acquisition

- 6.1.2. Data Processing and Interpretation

- 6.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.2.1. Onshore

- 6.2.2. Offshore

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Canada North America Seismic Survey Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Data Acquisition

- 7.1.2. Data Processing and Interpretation

- 7.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.2.1. Onshore

- 7.2.2. Offshore

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Mexico North America Seismic Survey Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Data Acquisition

- 8.1.2. Data Processing and Interpretation

- 8.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.2.1. Onshore

- 8.2.2. Offshore

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Halliburton Company

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 ION Geophysical Corporation

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Schlumberger Ltd

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Shearwater GeoServices Holding AS

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Fugro NV

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 SAExploration Holdings Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 CGG SA

*List Not Exhaustive

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.1 Halliburton Company

List of Figures

- Figure 1: Global North America Seismic Survey Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United States North America Seismic Survey Market Revenue (Million), by Service 2024 & 2032

- Figure 3: United States North America Seismic Survey Market Revenue Share (%), by Service 2024 & 2032

- Figure 4: United States North America Seismic Survey Market Revenue (Million), by Location of Deployment 2024 & 2032

- Figure 5: United States North America Seismic Survey Market Revenue Share (%), by Location of Deployment 2024 & 2032

- Figure 6: United States North America Seismic Survey Market Revenue (Million), by Geography 2024 & 2032

- Figure 7: United States North America Seismic Survey Market Revenue Share (%), by Geography 2024 & 2032

- Figure 8: United States North America Seismic Survey Market Revenue (Million), by Country 2024 & 2032

- Figure 9: United States North America Seismic Survey Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Canada North America Seismic Survey Market Revenue (Million), by Service 2024 & 2032

- Figure 11: Canada North America Seismic Survey Market Revenue Share (%), by Service 2024 & 2032

- Figure 12: Canada North America Seismic Survey Market Revenue (Million), by Location of Deployment 2024 & 2032

- Figure 13: Canada North America Seismic Survey Market Revenue Share (%), by Location of Deployment 2024 & 2032

- Figure 14: Canada North America Seismic Survey Market Revenue (Million), by Geography 2024 & 2032

- Figure 15: Canada North America Seismic Survey Market Revenue Share (%), by Geography 2024 & 2032

- Figure 16: Canada North America Seismic Survey Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Canada North America Seismic Survey Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Mexico North America Seismic Survey Market Revenue (Million), by Service 2024 & 2032

- Figure 19: Mexico North America Seismic Survey Market Revenue Share (%), by Service 2024 & 2032

- Figure 20: Mexico North America Seismic Survey Market Revenue (Million), by Location of Deployment 2024 & 2032

- Figure 21: Mexico North America Seismic Survey Market Revenue Share (%), by Location of Deployment 2024 & 2032

- Figure 22: Mexico North America Seismic Survey Market Revenue (Million), by Geography 2024 & 2032

- Figure 23: Mexico North America Seismic Survey Market Revenue Share (%), by Geography 2024 & 2032

- Figure 24: Mexico North America Seismic Survey Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Mexico North America Seismic Survey Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global North America Seismic Survey Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global North America Seismic Survey Market Revenue Million Forecast, by Service 2019 & 2032

- Table 3: Global North America Seismic Survey Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 4: Global North America Seismic Survey Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Global North America Seismic Survey Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global North America Seismic Survey Market Revenue Million Forecast, by Service 2019 & 2032

- Table 7: Global North America Seismic Survey Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 8: Global North America Seismic Survey Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 9: Global North America Seismic Survey Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global North America Seismic Survey Market Revenue Million Forecast, by Service 2019 & 2032

- Table 11: Global North America Seismic Survey Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 12: Global North America Seismic Survey Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: Global North America Seismic Survey Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global North America Seismic Survey Market Revenue Million Forecast, by Service 2019 & 2032

- Table 15: Global North America Seismic Survey Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 16: Global North America Seismic Survey Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Global North America Seismic Survey Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Seismic Survey Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the North America Seismic Survey Market?

Key companies in the market include Halliburton Company, ION Geophysical Corporation, Schlumberger Ltd, Shearwater GeoServices Holding AS, Fugro NV, SAExploration Holdings Inc, CGG SA *List Not Exhaustive.

3. What are the main segments of the North America Seismic Survey Market?

The market segments include Service, Location of Deployment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Offshore Oil and Gas Activity.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In 2022, Equinor proposed Bay du Nord offshore oil project which has an estimated cost of USD 12 billion located in the 500 km of the coast of Canada's Newfoundland and Labrador province.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Seismic Survey Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Seismic Survey Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Seismic Survey Market?

To stay informed about further developments, trends, and reports in the North America Seismic Survey Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence