Key Insights

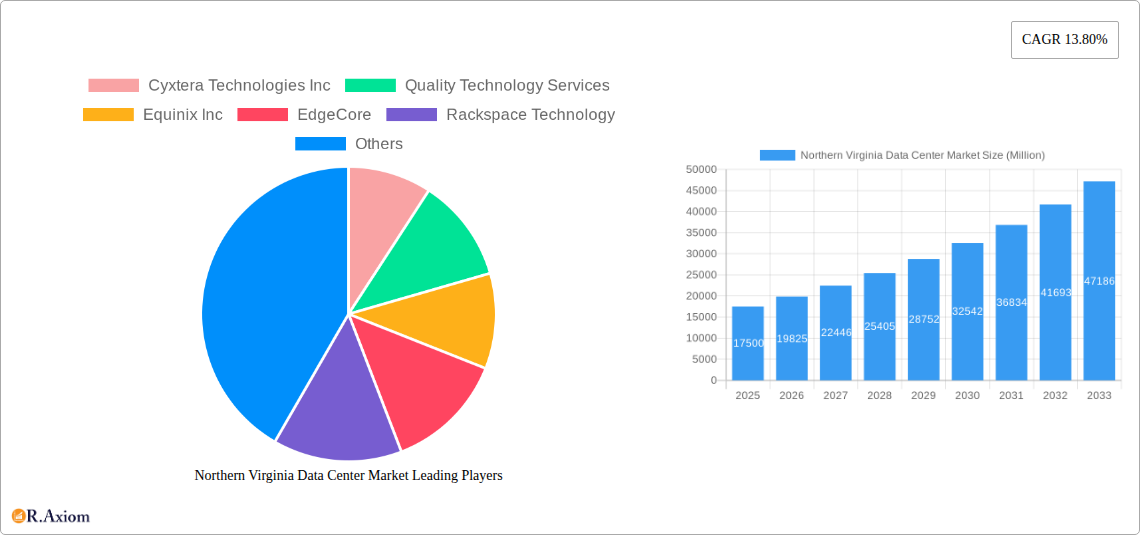

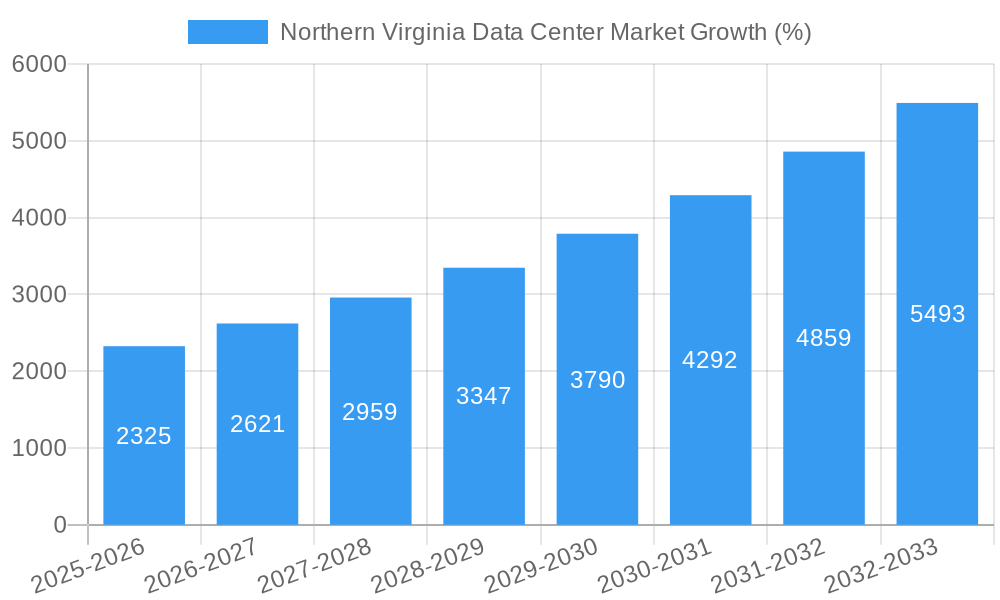

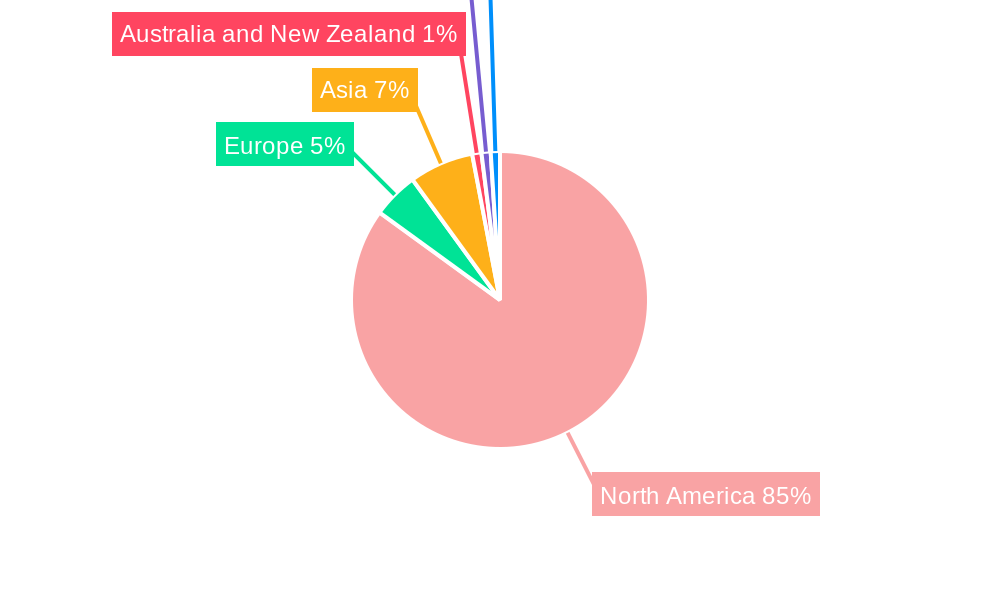

The Northern Virginia data center market is experiencing robust growth, driven by the region's strategic location, robust infrastructure, and concentration of major technology companies and government agencies. This area serves as a critical hub for internet connectivity, cloud computing, and data storage, fueling significant demand for data center space. The market's high concentration of hyperscale providers, coupled with substantial investment in network infrastructure and renewable energy sources, further solidifies its position as a global leader. While the exact market size for Northern Virginia in 2025 is unavailable, considering a global CAGR of 13.80% and the region's outsized contribution to the overall data center market, a reasonable estimate for the 2025 market value would be in the range of $15-20 billion, given the existing global market size (XX Million) and the strong growth trajectory observed in previous years. This substantial value is expected to grow at a similar rate to the global average in the coming years, potentially exceeding $30 billion by 2033. Major growth drivers include the increasing adoption of cloud computing, the expanding presence of hyperscale data centers, and the growing demand for edge computing solutions. However, challenges remain, including limited land availability, increasing energy costs, and the need to address environmental concerns related to energy consumption and waste heat management. The market segmentation reflects this complexity, with diverse sizes of data centers, various tier levels indicating resilience and redundancy, and different models of utilization and colocation to cater to diverse customer needs.

The competitive landscape is highly concentrated, with major players such as Equinix, Digital Realty, and Vantage Data Centers holding significant market share. However, smaller regional players and new entrants also contribute to the dynamism of the market. The diverse end-user segments, including cloud & IT, telecom, and government, reflect the broad applications of data centers. Regional variations within the Northern Virginia market are expected, with some areas experiencing faster growth than others due to factors such as proximity to key infrastructure, availability of skilled labor, and zoning regulations. Ongoing investment in infrastructure, including fiber optic networks and renewable energy projects, will further drive growth and attract new investment in the coming years. The region's strong regulatory environment and supportive government policies are also contributing factors to its continued success.

Northern Virginia Data Center Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Northern Virginia data center market, covering market size, segmentation, key players, and future growth projections from 2019 to 2033. The report leverages extensive primary and secondary research to offer actionable insights for industry stakeholders, investors, and strategists. With a base year of 2025 and a forecast period spanning 2025-2033, this report offers a thorough understanding of the current market landscape and future trends. Key segments analyzed include DC size (Small, Medium, Large, Massive, Mega), Tier type (Tier 1, Tier 2, Tier 3), absorption (Utilized, Non-Utilized), colocation type (Retail, Wholesale, Hyperscale), and end-user sectors (Cloud & IT, Telecom, Media & Entertainment, Government, BFSI, Manufacturing, E-Commerce, Other). Leading players like Equinix Inc, Digital Realty Trust Inc, and others are profiled, highlighting their strategies and market share. Recent developments, including significant acquisitions and planned expansions, are meticulously documented.

Northern Virginia Data Center Market Market Concentration & Innovation

The Northern Virginia data center market exhibits high concentration, with a few major players controlling a significant portion of the market share. Equinix Inc, Digital Realty Trust Inc, and others hold leading positions, driven by their extensive infrastructure, strategic acquisitions, and strong client relationships. Market share analysis reveals that the top five players account for approximately xx% of the total market revenue in 2025, while the remaining xx% is shared among numerous smaller players. Innovation is driven by the increasing demand for higher bandwidth, lower latency, and enhanced security features. This has led to significant investments in advanced technologies, such as AI-powered management systems and sustainable energy solutions. Regulatory frameworks, while generally supportive of data center development, are constantly evolving to address issues related to energy consumption, environmental impact, and data privacy. Product substitutes are limited, although cloud computing presents a partial alternative for some applications. Mergers and acquisitions (M&A) are frequent, with deals valued at xx Million annually in recent years, reflecting the consolidation and expansion strategies of major players. Key M&A activities include GI Partners' acquisition of a 98-acre Ashburn campus in April 2023. End-user trends indicate a shift towards hyperscale colocation facilities and cloud-based solutions, increasing demand for high-capacity data centers.

Northern Virginia Data Center Market Industry Trends & Insights

The Northern Virginia data center market is experiencing robust growth, driven by several factors. The region's strong digital infrastructure, favorable regulatory environment, and proximity to major technology hubs fuel its appeal. Technological disruptions, such as the rise of 5G and the increasing adoption of AI and machine learning, are driving demand for advanced data center facilities. Consumer preference for cloud-based services and streaming media further expands market demand. Competitive dynamics are intense, with major players focusing on capacity expansion, service differentiation, and strategic partnerships. The Compound Annual Growth Rate (CAGR) for the market is estimated at xx% during the forecast period (2025-2033), indicating sustained growth. Market penetration by hyperscale providers is expected to reach xx% by 2033, significantly impacting the retail and wholesale segments. The increasing adoption of green technologies and sustainability initiatives also reflects a significant trend within the industry, affecting both consumer and provider perspectives. Increased government regulation to enhance cyber-security is another contributing factor that will affect growth.

Dominant Markets & Segments in Northern Virginia Data Center Market

- Leading Region: Northern Virginia remains the dominant market due to its superior infrastructure, connectivity, and access to skilled labor.

- Dominant DC Size: The large and mega segments are expected to dominate due to the growing demand from hyperscale cloud providers.

- Tier Type: Tier III and Tier IV data centers are prevalent, reflecting the high demand for reliability and uptime.

- Absorption: The utilized segment is clearly dominant, reflecting the high occupancy rates within established data centers.

- Colocation Type: The hyperscale colocation type is expected to be the fastest-growing segment, driven by large cloud providers.

- End-User: Cloud & IT, and Telecom sectors are the primary drivers of demand.

The dominance of Northern Virginia stems from several key drivers:

- Robust Infrastructure: Excellent fiber connectivity, power infrastructure, and abundant land resources.

- Favorable Regulatory Environment: Supportive policies towards data center development.

- Skilled Workforce: Access to a large pool of skilled IT professionals.

- Strategic Location: Proximity to major technology hubs and significant internet exchange points (IXPs).

Northern Virginia Data Center Market Product Developments

Recent product innovations in the Northern Virginia data center market include advanced cooling technologies (liquid cooling, AI-powered thermal management), increased power density solutions, and enhanced security measures (biometric access control, advanced intrusion detection). These innovations offer improved efficiency, reliability, and security, aligning with the evolving needs of end-users. The market is witnessing a strong shift towards modular data center designs for faster deployment and scalability.

Report Scope & Segmentation Analysis

This report segments the Northern Virginia data center market based on DC size (small, medium, large, massive, mega), tier type (Tier 1, Tier 2, Tier 3), absorption (utilized, non-utilized), colocation type (retail, wholesale, hyperscale), and end-user (cloud & IT, telecom, media & entertainment, government, BFSI, manufacturing, e-commerce, other). Growth projections vary across segments; hyperscale colocation is projected to exhibit the highest growth, while the retail segment is predicted to show moderate growth. Market sizes are estimated based on revenue and capacity, and competitive dynamics are assessed based on market share, strategic initiatives, and technological capabilities of key players.

Key Drivers of Northern Virginia Data Center Market Growth

Several factors fuel the growth of the Northern Virginia data center market. Technological advancements, particularly in cloud computing, AI, and 5G, drive the demand for high-capacity data centers. Favorable government policies and incentives encourage investments in infrastructure development. The region's strategic location, strong connectivity, and access to skilled talent further attract significant investments in data centers.

Challenges in the Northern Virginia Data Center Market Sector

The Northern Virginia data center market faces challenges, including rising energy costs, land scarcity, and increasing competition. Regulatory hurdles related to environmental impact and infrastructure development can also pose delays and added costs. Supply chain disruptions can impact project timelines and budgets. The intense competition among established and emerging players necessitates continuous innovation and strategic partnerships.

Emerging Opportunities in Northern Virginia Data Center Market

Emerging opportunities include the increasing demand for edge data centers, the growth of AI and IoT applications, and the expanding adoption of sustainable energy solutions. The market is witnessing a rising demand for customized colocation solutions that cater to specific client needs. Investment in advanced cooling technologies and energy-efficient designs offer significant growth potential.

Leading Players in the Northern Virginia Data Center Market Market

- Cyxtera Technologies Inc

- Quality Technology Services

- Equinix Inc

- EdgeCore

- Rackspace Technology

- PhoenixNAP

- Iron Mountain

- 365 data centers

- DataBank

- Evocative

- CyrusOne

- EdgeConneX Inc

- Flexential

- Cogent

- Cologix

- Evoque

- Vantage Data Center

- CoreSite

- H5 Data centers

- Digital Realty Trust Inc

- Stack Infrastructure

- NTT Ltd

Key Developments in Northern Virginia Data Center Market Industry

- May 2023: Culpeper County approves rezoning for over 4 Million square feet of new data center construction. This signals significant expansion outside of the traditional Ashburn area.

- April 2023: GI Partners acquires a fully leased 9 MW data center campus in Ashburn, reflecting strong investor confidence in the market.

Strategic Outlook for Northern Virginia Data Center Market Market

The Northern Virginia data center market is poised for continued growth, driven by robust demand from hyperscale providers, cloud service providers, and other major technology companies. The ongoing investments in infrastructure, coupled with supportive government policies, will further solidify the region's position as a global data center hub. The focus on sustainability and energy efficiency will continue to drive innovation within the market. Expansion into surrounding areas, such as Culpeper, indicates further market diversification and growth potential.

Northern Virginia Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. End User

- 3.1.2.1. Cloud & IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media & Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-Commerce

- 3.1.2.8. Other End User

-

3.1.1. Colocation Type

- 3.2. Non-Utilized

-

3.1. Utilized

Northern Virginia Data Center Market Segmentation By Geography

- 1. Virginia

Northern Virginia Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's

- 3.3. Market Restrains

- 3.3.1. Dependence on Regulatory Landscape & Stringent Security Requirements

- 3.4. Market Trends

- 3.4.1. Tier 4 is Expected to Hold Significant Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Northern Virginia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. End User

- 5.3.1.2.1. Cloud & IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media & Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-Commerce

- 5.3.1.2.8. Other End User

- 5.3.1.1. Colocation Type

- 5.3.2. Non-Utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Virginia

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 6. North America Northern Virginia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe Northern Virginia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Northern Virginia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Australia and New Zealand Northern Virginia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Latin America Northern Virginia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Middle East and Africa Northern Virginia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Cyxtera Technologies Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Quality Technology Services

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Equinix Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 EdgeCore

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Rackspace Technology

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 PhoenixNAP

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Iron Mountain

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 365 data centers

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 DataBank

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Evocative

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 CyrusOne

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 EdgeConneX Inc

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Flexential

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Cogent

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Cologix

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 Evoque

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.17 Vantage Data Center

- 12.2.17.1. Overview

- 12.2.17.2. Products

- 12.2.17.3. SWOT Analysis

- 12.2.17.4. Recent Developments

- 12.2.17.5. Financials (Based on Availability)

- 12.2.18 CoreSite

- 12.2.18.1. Overview

- 12.2.18.2. Products

- 12.2.18.3. SWOT Analysis

- 12.2.18.4. Recent Developments

- 12.2.18.5. Financials (Based on Availability)

- 12.2.19 H5 Data centers

- 12.2.19.1. Overview

- 12.2.19.2. Products

- 12.2.19.3. SWOT Analysis

- 12.2.19.4. Recent Developments

- 12.2.19.5. Financials (Based on Availability)

- 12.2.20 Digital Realty Trust Inc

- 12.2.20.1. Overview

- 12.2.20.2. Products

- 12.2.20.3. SWOT Analysis

- 12.2.20.4. Recent Developments

- 12.2.20.5. Financials (Based on Availability)

- 12.2.21 Stack Infrastructure

- 12.2.21.1. Overview

- 12.2.21.2. Products

- 12.2.21.3. SWOT Analysis

- 12.2.21.4. Recent Developments

- 12.2.21.5. Financials (Based on Availability)

- 12.2.22 NTT Ltd

- 12.2.22.1. Overview

- 12.2.22.2. Products

- 12.2.22.3. SWOT Analysis

- 12.2.22.4. Recent Developments

- 12.2.22.5. Financials (Based on Availability)

- 12.2.1 Cyxtera Technologies Inc

List of Figures

- Figure 1: Northern Virginia Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Northern Virginia Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Northern Virginia Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Northern Virginia Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 3: Northern Virginia Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 4: Northern Virginia Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 5: Northern Virginia Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Northern Virginia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Northern Virginia Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Northern Virginia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Northern Virginia Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Northern Virginia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Northern Virginia Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Northern Virginia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Northern Virginia Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Northern Virginia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Northern Virginia Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Northern Virginia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Northern Virginia Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Northern Virginia Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 19: Northern Virginia Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 20: Northern Virginia Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 21: Northern Virginia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Northern Virginia Data Center Market?

The projected CAGR is approximately 13.80%.

2. Which companies are prominent players in the Northern Virginia Data Center Market?

Key companies in the market include Cyxtera Technologies Inc, Quality Technology Services, Equinix Inc, EdgeCore, Rackspace Technology, PhoenixNAP, Iron Mountain, 365 data centers, DataBank, Evocative, CyrusOne, EdgeConneX Inc , Flexential, Cogent, Cologix, Evoque, Vantage Data Center, CoreSite, H5 Data centers, Digital Realty Trust Inc, Stack Infrastructure, NTT Ltd.

3. What are the main segments of the Northern Virginia Data Center Market?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's.

6. What are the notable trends driving market growth?

Tier 4 is Expected to Hold Significant Share of the Market.

7. Are there any restraints impacting market growth?

Dependence on Regulatory Landscape & Stringent Security Requirements.

8. Can you provide examples of recent developments in the market?

May 2023: Culpeper County, Virginia, may soon see the building of more than four million square feet of data centers. The Culpeper Town and County Councils have received rezoning proposals allowing the construction of about 17 structures on two campuses on the town's border alongside McDevitt Drive. According to the Culpeper Star-Exponent, the Culpeper County Planning Commission voted 7-1 last week to approve an application to rezone approximately 34.4 acres from RA (Rural Areas) to LI (Light Industrial) over Route 799 (McDevitt Drive) and Route 699 (East Chandler Street) in the StevensburgMagisterial area.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Northern Virginia Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Northern Virginia Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Northern Virginia Data Center Market?

To stay informed about further developments, trends, and reports in the Northern Virginia Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence