Key Insights

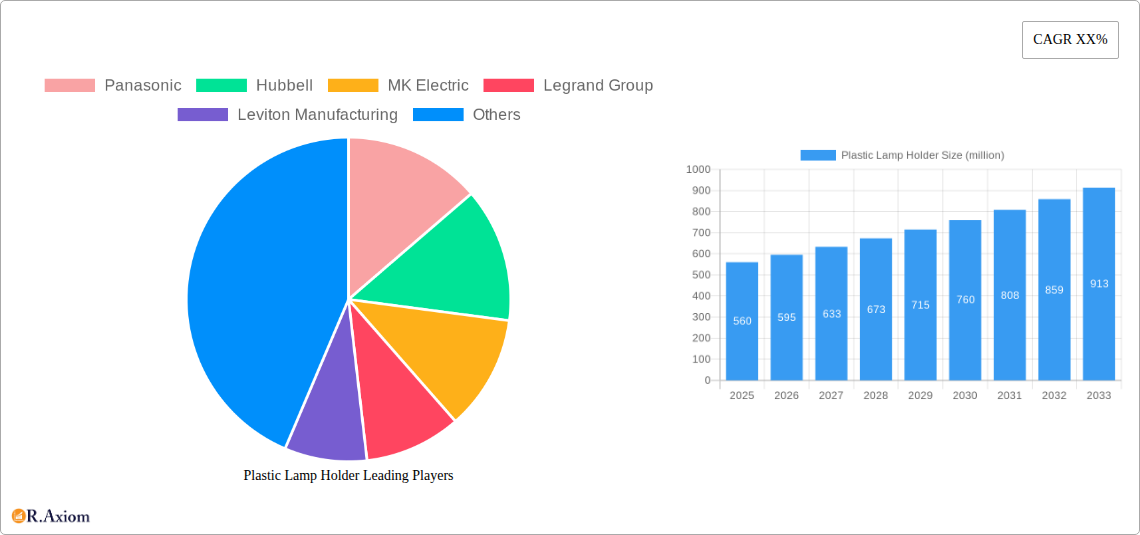

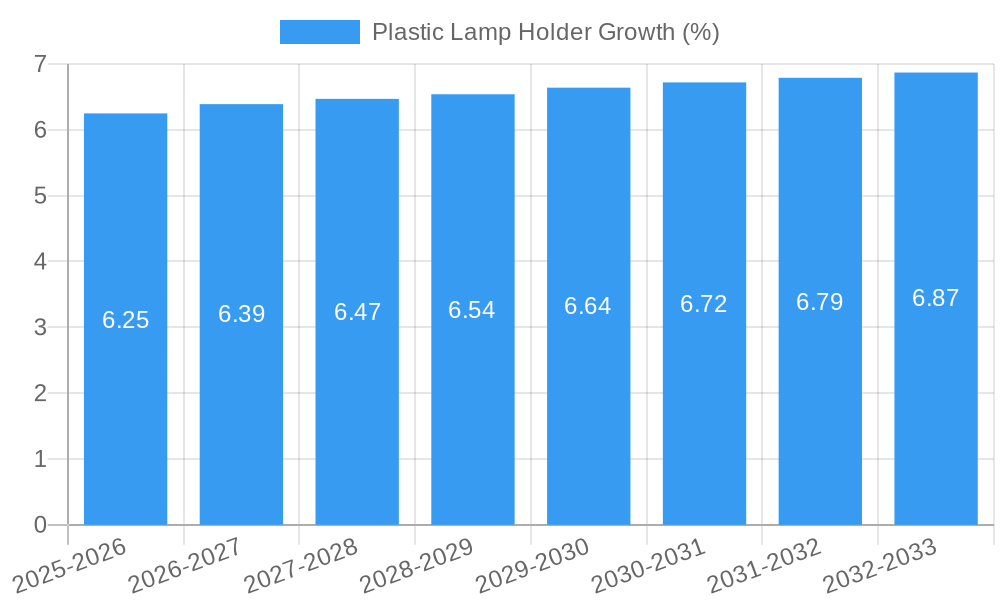

The global Plastic Lamp Holder market is poised for robust expansion, projected to reach a significant market size with a healthy Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025-2033. This impressive growth is primarily fueled by the burgeoning construction and renovation sectors worldwide, coupled with the increasing demand for energy-efficient lighting solutions. Plastic lamp holders, offering advantages such as cost-effectiveness, durability, and ease of installation, are becoming indispensable components in residential, commercial, and industrial lighting applications. The market's trajectory is further bolstered by the growing adoption of LED technology, which necessitates specialized holders designed for their unique thermal and electrical requirements. Furthermore, the continuous innovation in product design, incorporating enhanced safety features and aesthetic appeal, is expanding their applicability and market reach, contributing to substantial market value.

The market dynamics are characterized by a diverse range of applications and types, catering to varied consumer needs. The Living Room and Bedroom segments are expected to dominate, driven by ongoing interior design trends and the replacement of older lighting fixtures. The Corridor segment also presents significant opportunities due to its widespread use in both residential and commercial buildings. In terms of types, E27 holders are anticipated to maintain their leading position due to their compatibility with a wide array of bulbs. However, the growing popularity of compact fluorescent lamps (CFLs) and certain types of LEDs is expected to drive demand for E14 and other specialized holder types. Key players like Panasonic, Legrand Group, and Schneider Electric are actively investing in research and development to introduce advanced, sustainable, and aesthetically pleasing plastic lamp holders, further stimulating market growth and value within the global plastic lamp holder landscape.

Here's an SEO-optimized, detailed report description for the Plastic Lamp Holder market, incorporating high-traffic keywords and adhering to your specified structure and requirements.

Plastic Lamp Holder Market Concentration & Innovation

The Plastic Lamp Holder market, with an estimated market size of $4,000 million in the base year of 2025, exhibits a moderate to high concentration driven by innovation in materials science and manufacturing processes. Key players like Panasonic, Hubbell, MK Electric, Legrand Group, Leviton Manufacturing, Osram Sylvania, Schneider Electric, Simon, ABB, and others are actively investing in research and development to introduce enhanced durability, flame retardancy, and energy-efficient plastic lamp holders. Regulatory frameworks, particularly concerning electrical safety standards and environmental compliance, are significant drivers influencing product development and market entry strategies. The market's innovation landscape is shaped by evolving end-user trends, such as the increasing demand for smart lighting solutions and aesthetically pleasing designs in residential and commercial spaces. Product substitutes, while present in niche applications, generally fail to match the cost-effectiveness and versatility of plastic lamp holders. Mergers and acquisitions (M&A) activities, with an estimated aggregate value of $500 million in the historical period of 2019–2024, have played a crucial role in market consolidation and the expansion of key players' portfolios. The study projects continued M&A activity, potentially valued at $700 million during the forecast period of 2025–2033, as companies seek to bolster their market share and technological capabilities.

Plastic Lamp Holder Industry Trends & Insights

The global plastic lamp holder market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 7.5% from 2025 to 2033, with an estimated market size of $7,000 million by 2033. This significant expansion is propelled by a confluence of factors, including the ever-increasing demand for lighting solutions across residential, commercial, and industrial sectors. Technological advancements are revolutionizing the industry, with a particular emphasis on the integration of advanced polymers that offer superior heat resistance, electrical insulation, and fire safety. The proliferation of energy-efficient lighting technologies, such as LED bulbs, directly fuels the demand for specialized plastic lamp holders designed to accommodate these newer bulb types and optimize heat dissipation. Consumer preferences are evolving, with a growing emphasis on sustainable materials, smart home integration, and customizable lighting aesthetics. The market penetration of plastic lamp holders is already substantial, exceeding 85% in most key applications due to their inherent advantages in terms of cost-effectiveness, ease of manufacturing, and design flexibility. Competitive dynamics are characterized by intense price competition and a constant drive for product differentiation. Key players are focusing on developing innovative designs that cater to specific applications, such as living rooms, bedrooms, and corridors, while also addressing niche requirements in other sectors. The shift towards smart lighting systems, which often integrate control modules and sensors, is creating new opportunities for plastic lamp holder manufacturers to embed advanced functionalities within their products. Furthermore, the growing adoption of modular electrical systems and the increasing construction of new residential and commercial spaces globally are acting as powerful market growth drivers. The transition towards eco-friendly materials and manufacturing processes is also becoming a significant trend, influencing product development and corporate sustainability strategies.

Dominant Markets & Segments in Plastic Lamp Holder

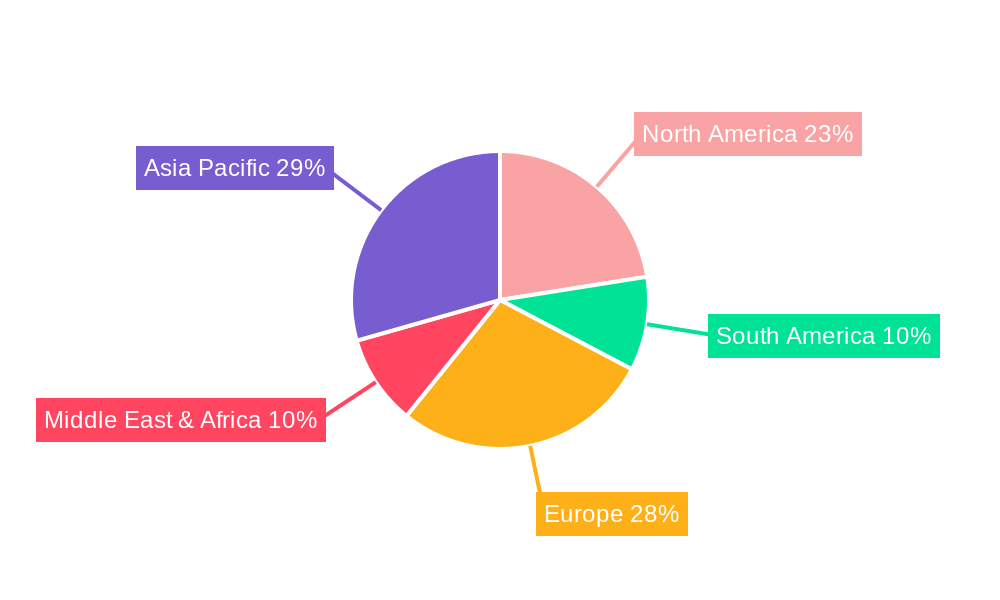

The plastic lamp holder market demonstrates distinct regional and segmental dominance, shaped by economic policies, infrastructure development, and evolving consumer demands. Asia Pacific emerges as the dominant region, accounting for an estimated 40% of the global market share in 2025, driven by rapid urbanization, burgeoning construction activities, and a growing middle-class population with increasing disposable income. Countries like China and India are particularly significant, with their extensive manufacturing capabilities and vast domestic markets for lighting fixtures.

Within the Application segment, the Living Room application commands the largest market share, estimated at 35% in 2025. This dominance is attributed to the high volume of decorative lighting and the increasing trend of incorporating smart home features in residential spaces. The Bedroom application follows closely, representing approximately 25% of the market, driven by the need for ambient and task lighting. The Corridor segment, though smaller at around 15%, is crucial for safety and architectural lighting, experiencing steady growth due to infrastructure upgrades and commercial building developments. The Others segment, encompassing industrial, hospitality, and outdoor applications, represents the remaining 25%, showcasing significant potential for specialized product development.

In terms of Types, the E27 socket type remains the most prevalent, holding an estimated 50% market share in 2025, owing to its widespread use in traditional and energy-efficient lighting solutions globally. The E14 type, commonly found in smaller decorative luminaires, captures approximately 30% of the market. The Other types, including specialized sockets for newer LED technologies and industrial applications, account for the remaining 20%, with this segment expected to witness higher growth rates as technology evolves.

Key drivers for dominance in these markets include supportive government policies promoting energy efficiency and electrical safety standards, substantial investments in infrastructure projects, and the increasing adoption of modern building designs. The economic policies in emerging economies, focused on industrialization and housing development, directly translate into higher demand for plastic lamp holders. Furthermore, the accessibility and affordability of plastic lamp holders make them the preferred choice for a wide range of end-users, further solidifying their market leadership.

Plastic Lamp Holder Product Developments

Plastic lamp holder product developments are primarily focused on enhancing safety, functionality, and aesthetic appeal. Innovations include the integration of advanced flame-retardant materials that meet stringent international safety standards, ensuring greater user protection. Manufacturers are also developing compact and modular designs that simplify installation and accommodate the evolving form factors of LED lighting. Smart functionalities, such as built-in dimming capabilities and compatibility with smart home ecosystems, are emerging as key competitive advantages, offering users greater control and convenience. The development of aesthetically pleasing finishes and customizable designs caters to the growing demand for decorative lighting solutions across residential and commercial interiors.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global plastic lamp holder market, segmented by Application and Type. The Application segmentation includes: Living Room, Bedroom, Corridor, and Others (encompassing industrial, hospitality, and outdoor uses). The Type segmentation focuses on: E14, E27, and Other (specialized and emerging socket types). The report projects the Living Room segment to reach an estimated $2,500 million by 2033, driven by smart home adoption. The E27 type is expected to maintain its leadership, with a projected market size of $3,500 million by 2033, due to its widespread legacy and continued adoption in energy-efficient lighting. The Other types segment is anticipated to experience the highest growth rate, reflecting technological advancements and the introduction of new lighting technologies.

Key Drivers of Plastic Lamp Holder Growth

The growth of the plastic lamp holder market is propelled by several key drivers. The ubiquitous expansion of the construction industry, both residential and commercial, directly translates to increased demand for lighting fixtures. A significant driver is the global shift towards energy-efficient lighting solutions, particularly LED technology, which necessitates specialized and cost-effective lamp holders. Favorable government regulations promoting electrical safety standards and energy conservation further bolster market growth. Economic development and rising disposable incomes in emerging economies are leading to increased adoption of modern lighting solutions in households and infrastructure projects. Technological advancements in polymer science are enabling the production of more durable, heat-resistant, and aesthetically versatile plastic lamp holders, catering to diverse end-user needs.

Challenges in the Plastic Lamp Holder Sector

Despite robust growth prospects, the plastic lamp holder sector faces several challenges. Stringent and evolving electrical safety regulations across different regions can necessitate costly product re-engineering and certification processes. Fluctuations in raw material prices, particularly for polymers, can impact manufacturing costs and profit margins. Intense competition from established players and emerging manufacturers leads to price pressures and demands continuous innovation to maintain market share. The increasing adoption of integrated lighting systems and smart fixtures may pose a long-term challenge as they potentially reduce the demand for standalone lamp holders in some applications. Supply chain disruptions, geopolitical uncertainties, and trade policies can also impact the availability and cost of essential components.

Emerging Opportunities in Plastic Lamp Holder

The plastic lamp holder market presents several emerging opportunities. The rapid growth of the smart home market is creating demand for plastic lamp holders with integrated smart functionalities, such as Wi-Fi connectivity, Bluetooth, and sensor capabilities. The increasing focus on sustainable and eco-friendly products is driving the demand for lamp holders made from recycled or biodegradable plastics, offering a niche but growing market segment. The expansion of renewable energy solutions, such as solar-powered lighting systems, opens avenues for specialized plastic lamp holders designed for off-grid applications. Furthermore, the continuous evolution of lighting technologies, including advancements in OLED and other emerging light sources, will require innovative lamp holder designs.

Leading Players in the Plastic Lamp Holder Market

- Panasonic

- Hubbell

- MK Electric

- Legrand Group

- Leviton Manufacturing

- Osram Sylvania

- Schneider Electric

- Simon

- ABB

Key Developments in Plastic Lamp Holder Industry

- 2023/08: Panasonic launches a new range of flame-retardant E27 plastic lamp holders meeting enhanced safety standards.

- 2023/05: Hubbell introduces smart-enabled E14 plastic lamp holders for residential lighting applications.

- 2022/11: MK Electric announces a partnership with a material science company to develop eco-friendly plastic lamp holders.

- 2022/07: Legrand Group acquires a smaller competitor, expanding its product portfolio in specialized lamp holders.

- 2021/12: Leviton Manufacturing enhances its product line with modular plastic lamp holders for easier installation.

- 2021/06: Osram Sylvania invests in R&D for advanced heat-dissipating plastic lamp holders for high-power LEDs.

- 2020/10: Schneider Electric focuses on developing smart home integrated lamp holders.

- 2020/03: Simon introduces a new line of designer plastic lamp holders for the hospitality sector.

- 2019/09: ABB expands its offerings with universal plastic lamp holders for industrial applications.

Strategic Outlook for Plastic Lamp Holder Market

The strategic outlook for the plastic lamp holder market remains highly positive, driven by continued global urbanization, construction growth, and the relentless shift towards energy-efficient and smart lighting solutions. Key growth catalysts include an increased focus on product innovation, particularly in integrating smart technologies and sustainable materials. Manufacturers are advised to invest in research and development to stay ahead of evolving regulatory landscapes and consumer preferences. Expanding market reach into emerging economies and focusing on value-added products that offer enhanced safety, functionality, and aesthetics will be crucial for long-term success. Strategic collaborations and potential M&A activities will further shape the competitive landscape, enabling companies to consolidate market positions and broaden their technological capabilities.

Plastic Lamp Holder Segmentation

-

1. Application

- 1.1. Living Room

- 1.2. Bedroom

- 1.3. Corridor

- 1.4. Others

-

2. Types

- 2.1. E14

- 2.2. E27

- 2.3. Other

Plastic Lamp Holder Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Plastic Lamp Holder REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Plastic Lamp Holder Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Living Room

- 5.1.2. Bedroom

- 5.1.3. Corridor

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. E14

- 5.2.2. E27

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Plastic Lamp Holder Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Living Room

- 6.1.2. Bedroom

- 6.1.3. Corridor

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. E14

- 6.2.2. E27

- 6.2.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Plastic Lamp Holder Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Living Room

- 7.1.2. Bedroom

- 7.1.3. Corridor

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. E14

- 7.2.2. E27

- 7.2.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Plastic Lamp Holder Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Living Room

- 8.1.2. Bedroom

- 8.1.3. Corridor

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. E14

- 8.2.2. E27

- 8.2.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Plastic Lamp Holder Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Living Room

- 9.1.2. Bedroom

- 9.1.3. Corridor

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. E14

- 9.2.2. E27

- 9.2.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Plastic Lamp Holder Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Living Room

- 10.1.2. Bedroom

- 10.1.3. Corridor

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. E14

- 10.2.2. E27

- 10.2.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Panasonic

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hubbell

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MK Electric

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Legrand Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Leviton Manufacturing

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Osram Sylvania

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Schneider Electric

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Simon

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ABB

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Panasonic

List of Figures

- Figure 1: Global Plastic Lamp Holder Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Plastic Lamp Holder Revenue (million), by Application 2024 & 2032

- Figure 3: North America Plastic Lamp Holder Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Plastic Lamp Holder Revenue (million), by Types 2024 & 2032

- Figure 5: North America Plastic Lamp Holder Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Plastic Lamp Holder Revenue (million), by Country 2024 & 2032

- Figure 7: North America Plastic Lamp Holder Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Plastic Lamp Holder Revenue (million), by Application 2024 & 2032

- Figure 9: South America Plastic Lamp Holder Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Plastic Lamp Holder Revenue (million), by Types 2024 & 2032

- Figure 11: South America Plastic Lamp Holder Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Plastic Lamp Holder Revenue (million), by Country 2024 & 2032

- Figure 13: South America Plastic Lamp Holder Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Plastic Lamp Holder Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Plastic Lamp Holder Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Plastic Lamp Holder Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Plastic Lamp Holder Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Plastic Lamp Holder Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Plastic Lamp Holder Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Plastic Lamp Holder Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Plastic Lamp Holder Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Plastic Lamp Holder Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Plastic Lamp Holder Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Plastic Lamp Holder Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Plastic Lamp Holder Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Plastic Lamp Holder Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Plastic Lamp Holder Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Plastic Lamp Holder Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Plastic Lamp Holder Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Plastic Lamp Holder Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Plastic Lamp Holder Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Plastic Lamp Holder Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Plastic Lamp Holder Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Plastic Lamp Holder Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Plastic Lamp Holder Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Plastic Lamp Holder Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Plastic Lamp Holder Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Plastic Lamp Holder Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Plastic Lamp Holder Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Plastic Lamp Holder Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Plastic Lamp Holder Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Plastic Lamp Holder Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Plastic Lamp Holder Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Plastic Lamp Holder Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Plastic Lamp Holder Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Plastic Lamp Holder Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Plastic Lamp Holder Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Plastic Lamp Holder Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Plastic Lamp Holder Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Plastic Lamp Holder Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Plastic Lamp Holder Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Plastic Lamp Holder Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Plastic Lamp Holder Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Plastic Lamp Holder Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Plastic Lamp Holder Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Plastic Lamp Holder Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Plastic Lamp Holder Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Plastic Lamp Holder Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Plastic Lamp Holder Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Plastic Lamp Holder Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Plastic Lamp Holder Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Plastic Lamp Holder Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Plastic Lamp Holder Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Plastic Lamp Holder Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Plastic Lamp Holder Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Plastic Lamp Holder Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Plastic Lamp Holder Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Plastic Lamp Holder Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Plastic Lamp Holder Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Plastic Lamp Holder Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Plastic Lamp Holder Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Plastic Lamp Holder Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Plastic Lamp Holder Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Plastic Lamp Holder Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Plastic Lamp Holder Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Plastic Lamp Holder Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Plastic Lamp Holder Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Plastic Lamp Holder Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Plastic Lamp Holder?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Plastic Lamp Holder?

Key companies in the market include Panasonic, Hubbell, MK Electric, Legrand Group, Leviton Manufacturing, Osram Sylvania, Schneider Electric, Simon, ABB.

3. What are the main segments of the Plastic Lamp Holder?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Plastic Lamp Holder," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Plastic Lamp Holder report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Plastic Lamp Holder?

To stay informed about further developments, trends, and reports in the Plastic Lamp Holder, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence