Key Insights

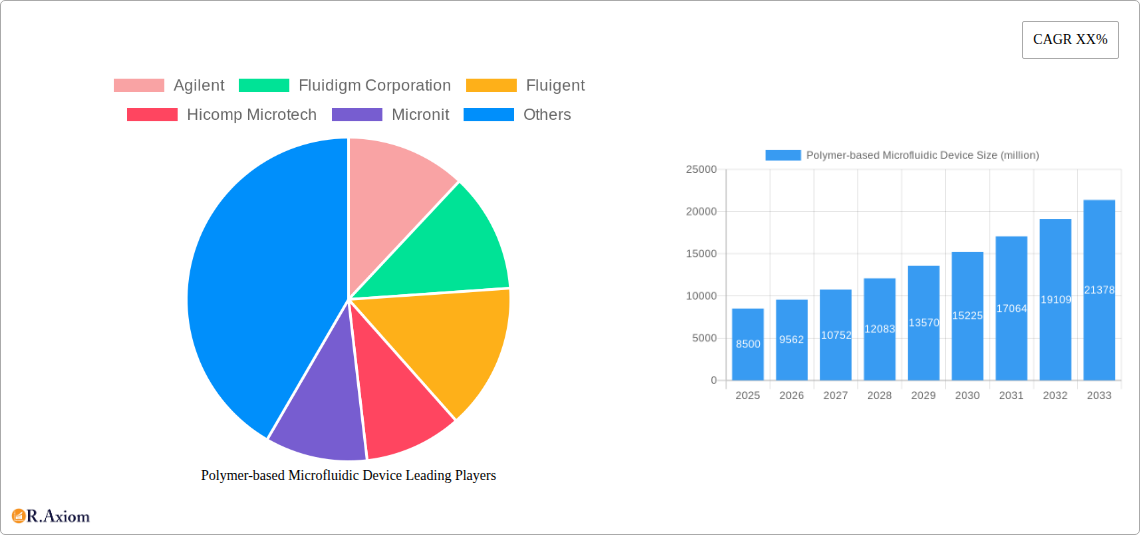

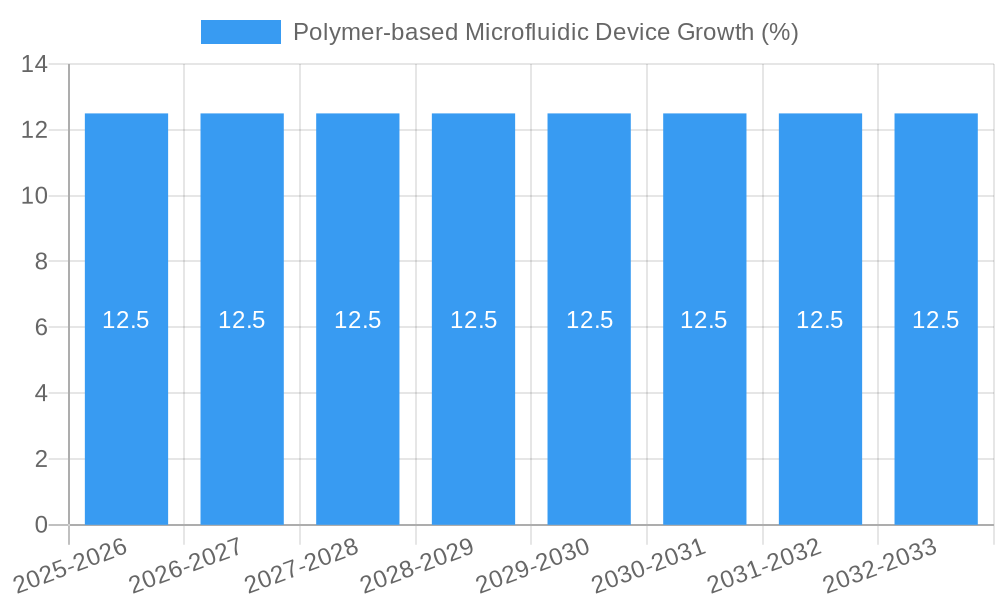

The global Polymer-based Microfluidic Device market is poised for substantial growth, projected to reach approximately USD 8.5 billion by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period of 2025-2033. This expansion is primarily driven by the escalating demand for advanced diagnostic tools, particularly in the pharmaceutical and in vitro diagnostics (IVD) sectors. The inherent advantages of polymer-based microfluidic devices, such as their cost-effectiveness, ease of manufacturing, and biocompatibility, are fueling their adoption over traditional microfluidic materials. Applications in drug discovery, personalized medicine, and point-of-care diagnostics are continuously evolving, creating significant opportunities for market players. The market's growth trajectory is further bolstered by ongoing research and development in material science, leading to the innovation of novel polymer formulations with enhanced performance characteristics.

Several key trends are shaping the Polymer-based Microfluidic Device market landscape. The increasing prevalence of chronic diseases and the growing need for rapid and accurate disease detection are paramount drivers. Furthermore, the shift towards personalized healthcare, which necessitates smaller sample volumes and faster turnaround times, aligns perfectly with the capabilities of microfluidic technology. Advancements in material science, particularly in the development of Polydimethylsiloxane (PDMS) and Cyclic Olefin Copolymer (COC), are enhancing device functionality and opening new avenues for application. While the market presents immense opportunities, certain restraints, such as the initial high cost of R&D for novel applications and stringent regulatory approvals for medical devices, could pose challenges. However, the continuous innovation in manufacturing techniques and the expanding application base in non-medical fields like environmental monitoring and food safety are expected to mitigate these challenges and sustain robust market growth.

Here is a comprehensive, SEO-optimized report description for the Polymer-based Microfluidic Device market, designed for immediate use without modification.

Polymer-based Microfluidic Device Market Concentration & Innovation

The polymer-based microfluidic device market exhibits a moderate level of concentration, with a significant presence of both established players and emerging innovators. Key companies like Agilent, Fluidigm Corporation, Fluigent, Hicomp Microtech, Micronit, MicroLIQUID, Dolomite, Illumina, MiNAN Technologies, Enplas, and IMT AG are actively shaping the competitive landscape through continuous product development and strategic collaborations. Innovation is primarily driven by the increasing demand for miniaturized, cost-effective, and high-throughput analytical platforms across various sectors. The integration of advanced polymer materials with microfabrication techniques allows for the creation of complex fluidic networks with precise control over micro-scale phenomena. Regulatory frameworks, particularly in the pharmaceutical and in vitro diagnostics (IVD) segments, are evolving to accommodate the unique characteristics of microfluidic devices, fostering standardization and market acceptance. While direct product substitutes are limited due to the inherent advantages of microfluidics, advancements in alternative technologies such as nanotechnology and lab-on-a-chip systems present potential competitive pressures. End-user trends reveal a strong preference for devices that offer reduced sample volumes, faster assay times, and improved analytical sensitivity, particularly for personalized medicine and point-of-care diagnostics. Merger and acquisition (M&A) activities are expected to accelerate as larger companies seek to acquire specialized expertise and intellectual property, with an estimated aggregate deal value of over $500 million during the forecast period.

Polymer-based Microfluidic Device Industry Trends & Insights

The polymer-based microfluidic device industry is poised for substantial growth, driven by a confluence of technological advancements, increasing application breadth, and a growing understanding of their economic and clinical benefits. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 12.5% from 2025 to 2033, reaching an estimated market size of over $15,000 million by the end of the forecast period. This growth is fundamentally fueled by the escalating need for miniaturized, highly sensitive, and cost-effective solutions in critical sectors like pharmaceutical research, drug discovery, and in vitro diagnostics. The inherent advantages of polymer-based microfluidics, including their low manufacturing cost, biocompatibility, ease of disposability, and scalability, make them an attractive alternative to traditional laboratory equipment. Technological disruptions are continuously emerging, with advancements in material science leading to the development of novel polymers with enhanced optical clarity, chemical resistance, and surface properties tailored for specific biological and chemical applications. Furthermore, the integration of microfluidics with automation, AI, and advanced sensor technologies is revolutionizing analytical capabilities, enabling complex assays to be performed with minimal human intervention. Consumer preferences are increasingly leaning towards personalized medicine and point-of-care diagnostics, areas where polymer microfluidic devices excel due to their portability and potential for rapid, on-site testing. The competitive dynamics within the industry are characterized by intense innovation, strategic partnerships between material suppliers, device manufacturers, and end-users, and a growing emphasis on integrated platforms that offer comprehensive analytical solutions. Market penetration is expected to deepen significantly as regulatory approvals become more streamlined and as awareness of the benefits of microfluidics gains wider traction across research institutions and healthcare providers. The ability to perform complex multi-step assays on a single chip, reduce reagent consumption by over 90%, and achieve higher throughput than conventional methods are key factors driving adoption and market expansion. The shift towards precision medicine and the need for rapid diagnostics in response to emerging health threats further underscore the critical role of these devices.

Dominant Markets & Segments in Polymer-based Microfluidic Device

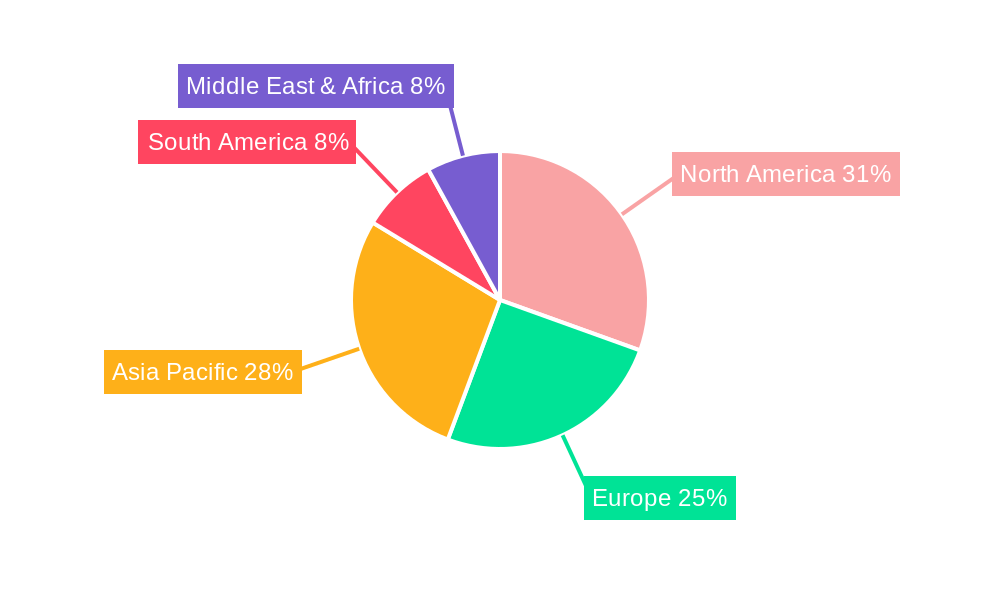

The polymer-based microfluidic device market is characterized by significant dominance within specific regions and application segments. North America, particularly the United States, currently holds the largest market share, estimated at over 35%, driven by robust government funding for life sciences research, a high prevalence of chronic diseases necessitating advanced diagnostics, and a well-established ecosystem of pharmaceutical and biotechnology companies. Asia-Pacific, with its rapidly growing economies and increasing investments in healthcare infrastructure, is emerging as a key growth region, projected to witness a CAGR of approximately 14% during the forecast period.

Leading Application Segments:

Pharmaceutical: This segment is a primary revenue driver, accounting for an estimated 45% of the total market. Key drivers include:

- Drug Discovery and Development: Miniaturized platforms enable high-throughput screening of drug candidates, reducing costs and accelerating timelines.

- Pharmacokinetic and Pharmacodynamic Studies: Precise control of fluid flow allows for accurate modeling of drug absorption, distribution, metabolism, and excretion.

- Biologics Manufacturing: Microfluidic devices are being explored for cell culture and bioprocess monitoring, enhancing efficiency and product quality.

- Personalized Medicine: Facilitates the development of tailored drug regimens based on individual patient genetics and disease profiles.

In Vitro Diagnostics (IVD): This segment represents approximately 40% of the market and is experiencing rapid expansion. Key drivers include:

- Point-of-Care Testing (POCT): Development of portable, disposable devices for rapid diagnosis of infectious diseases, cardiac markers, and glucose monitoring.

- Molecular Diagnostics: Integration with PCR and other nucleic acid amplification techniques for pathogen detection and genetic analysis.

- Biomarker Discovery and Validation: High-sensitivity assays for early disease detection and patient stratification.

- Companion Diagnostics: Development of tests that guide therapeutic decisions in conjunction with specific drug treatments.

Other: This segment, encompassing environmental monitoring, food safety, and academic research, accounts for the remaining 15% but shows considerable growth potential.

Dominant Polymer Types:

- Polydimethylsiloxane (PDMS): This elastomeric polymer is highly favored for its biocompatibility, optical transparency, and ease of prototyping through soft lithography. It dominates many early-stage research applications and is estimated to hold over 30% of the market share for polymer types.

- Polystyrene (PS) and Polycarbonate (PC): These thermoplastic polymers are widely used for mass-produced, disposable microfluidic devices due to their low cost, rigidity, and compatibility with injection molding. They collectively account for approximately 40% of the market share.

- Polymethyl Methacrylate (PMMA): Known for its excellent optical properties and chemical resistance, PMMA is increasingly used in applications requiring precise optical detection and integration with imaging systems. It holds an estimated 15% market share.

- Cyclic Olefin Copolymer (COC): This advanced polymer offers exceptional optical clarity, low autofluorescence, and good chemical resistance, making it suitable for demanding diagnostic and imaging applications. Its market share is growing, currently estimated at 10%.

- Polyvinyl Chloride (PVC): While less common for high-precision applications, PVC finds use in specific disposable devices due to its low cost and flexibility, holding a smaller but stable market share.

The dominance of these segments and materials is underpinned by economic policies that favor R&D investment, the development of specialized microfabrication infrastructure, and the increasing demand for accessible and precise analytical tools across global healthcare and research landscapes.

Polymer-based Microfluidic Device Product Developments

Product developments in the polymer-based microfluidic device market are focused on enhancing functionality, improving integration, and reducing costs. Innovations include the development of novel polymer blends with tailored surface chemistries for specific cell cultures and diagnostic assays. Integration of advanced sensor technologies directly into polymer chips is enabling real-time data acquisition and improved analytical precision. The trend towards disposable, single-use devices is also driving the development of low-cost manufacturing techniques like injection molding and hot embossing, making sophisticated microfluidic capabilities accessible to a wider range of users. These advancements are crucial for the expansion of point-of-care diagnostics and personalized medicine, offering significant competitive advantages through miniaturization, automation, and improved assay performance.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the polymer-based microfluidic device market, segmenting it across key applications and material types. The market is segmented into Application: Pharmaceutical, In Vitro Diagnostics, and Other. The Pharmaceutical segment, estimated at over $6,000 million in 2025, is driven by drug discovery and development needs. The In Vitro Diagnostics segment, valued at over $5,500 million in 2025, is fueled by the demand for point-of-care testing and molecular diagnostics. The Other segment, including environmental and food safety applications, is projected to grow at a CAGR of 10.8% to reach over $2,500 million by 2033.

Further segmentation is based on Types of polymers: Polystyrene (PS), Polycarbonate (PC), Polyvinyl Chloride (PVC), Polymethyl Methacrylate (PMMA), Polydimethylsiloxane (PDMS), and Cyclic Olefin Copolymer (COC). PDMS, favored for research, holds a significant market share, while PS and PC dominate high-volume disposable applications. PMMA and COC are gaining traction in optical and advanced diagnostic applications. The market dynamics are influenced by material cost, performance characteristics, and manufacturing feasibility for each polymer type, with overall growth projected to exceed 12% CAGR.

Key Drivers of Polymer-based Microfluidic Device Growth

Several key factors are propelling the growth of the polymer-based microfluidic device market. Technologically, the continuous advancement in microfabrication techniques, coupled with the development of novel polymer materials exhibiting superior properties like biocompatibility, optical clarity, and chemical inertness, is a significant driver. Economically, the inherent cost-effectiveness of polymer microfluidics, stemming from large-scale manufacturing processes like injection molding, makes them highly attractive compared to traditional laboratory equipment, enabling higher throughput and reduced reagent consumption. Regulatory landscapes are also becoming more conducive, with increasing approvals for microfluidic-based diagnostic tests and a growing recognition of their role in personalized medicine and point-of-care diagnostics. The demand for miniaturized, portable, and automated analytical systems in both research and clinical settings is further accelerating adoption.

Challenges in the Polymer-based Microfluidic Device Sector

Despite significant growth, the polymer-based microfluidic device sector faces several challenges. Regulatory hurdles, particularly for novel applications or devices with complex integrated functionalities, can lead to extended approval timelines and increased development costs. Supply chain complexities for specialized polymer materials and microfabrication components can impact manufacturing scalability and lead times. Intense competition from both established players and emerging startups necessitates continuous innovation and cost optimization, potentially squeezing profit margins. Furthermore, the perceived complexity of microfluidic systems by some end-users can create a barrier to adoption, requiring extensive user training and support. Ensuring consistent quality and performance across large-scale production runs of disposable devices also presents a manufacturing challenge.

Emerging Opportunities in Polymer-based Microfluidic Device

Emerging opportunities in the polymer-based microfluidic device market are abundant, driven by unmet clinical needs and technological frontiers. The burgeoning field of single-cell analysis presents a significant avenue for growth, leveraging microfluidics for high-throughput isolation, manipulation, and analysis of individual cells. The advancement of organ-on-a-chip technologies, utilizing polymer microfluidic platforms to mimic human organ functions, offers revolutionary potential for drug screening and disease modeling, bypassing traditional animal testing. The expansion of point-of-care diagnostics into resource-limited settings, enabled by low-cost, portable polymer microfluidic devices, is another major opportunity. Furthermore, the integration of advanced sensing modalities, such as electrochemical and optical sensors, directly onto polymer chips is creating new possibilities for multiplexed and highly sensitive diagnostic assays.

Leading Players in the Polymer-based Microfluidic Device Market

- Agilent

- Fluidigm Corporation

- Fluigent

- Hicomp Microtech

- Micronit

- MicroLIQUID

- Dolomite

- Illumina

- MiNAN Technologies

- Enplas

- IMT AG

Key Developments in Polymer-based Microfluidic Device Industry

- 2023: Launch of novel PDMS-based microfluidic chips for advanced cell culture applications by IMT AG, enhancing cell-material interactions and mimicking in-vivo environments.

- 2023: Agilent introduces a new generation of microfluidic consumables for gene sequencing, offering increased throughput and improved data accuracy.

- 2022: Dolomite secures significant funding for the development of high-throughput microfluidic platforms for drug discovery, focusing on droplet-based applications.

- 2022: Fluigent announces strategic partnerships to accelerate the adoption of their microfluidic flow control solutions in the pharmaceutical industry.

- 2021: Micronit expands its manufacturing capabilities for injection-molded polymer microfluidic devices, focusing on cost-effective solutions for IVD applications.

- 2020: Illumina enhances its microfluidic cartridge technology for next-generation sequencing, improving sample preparation efficiency.

- 2019: Fluidigm Corporation announces advancements in its microfluidic chip technology, enabling single-cell gene expression analysis with greater precision.

Strategic Outlook for Polymer-based Microfluidic Device Market

The strategic outlook for the polymer-based microfluidic device market remains exceptionally positive, driven by an ongoing surge in demand for miniaturized, cost-effective, and high-performance analytical solutions. Key growth catalysts include the relentless pursuit of personalized medicine, requiring advanced diagnostic and therapeutic tools, and the increasing need for rapid, on-site disease detection at the point of care. The continuous innovation in polymer materials and microfabrication techniques will further unlock new applications and enhance existing ones. Strategic collaborations between device manufacturers, material suppliers, and end-users will be crucial for accelerating product development and market penetration. The global push for more efficient drug discovery and development processes, coupled with growing investments in healthcare infrastructure across emerging economies, will provide sustained momentum. Companies that can effectively leverage these trends by offering integrated solutions, focusing on user-friendliness, and navigating regulatory pathways efficiently are poised for significant success.

Polymer-based Microfluidic Device Segmentation

-

1. Application

- 1.1. Pharmaceutical

- 1.2. In Vitro Diagnostics

- 1.3. Other

-

2. Types

- 2.1. Polystyrene (PS)

- 2.2. Polycarbonate (PC)

- 2.3. Polyvinyl Chloride (PVC)

- 2.4. Polymethyl Methacrylate (PMMA)

- 2.5. Polydimethylsiloxane (PDMS)

- 2.6. Cyclic Olefin Copolymer (COC)

Polymer-based Microfluidic Device Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Polymer-based Microfluidic Device REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Polymer-based Microfluidic Device Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Pharmaceutical

- 5.1.2. In Vitro Diagnostics

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Polystyrene (PS)

- 5.2.2. Polycarbonate (PC)

- 5.2.3. Polyvinyl Chloride (PVC)

- 5.2.4. Polymethyl Methacrylate (PMMA)

- 5.2.5. Polydimethylsiloxane (PDMS)

- 5.2.6. Cyclic Olefin Copolymer (COC)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Polymer-based Microfluidic Device Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Pharmaceutical

- 6.1.2. In Vitro Diagnostics

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Polystyrene (PS)

- 6.2.2. Polycarbonate (PC)

- 6.2.3. Polyvinyl Chloride (PVC)

- 6.2.4. Polymethyl Methacrylate (PMMA)

- 6.2.5. Polydimethylsiloxane (PDMS)

- 6.2.6. Cyclic Olefin Copolymer (COC)

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Polymer-based Microfluidic Device Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Pharmaceutical

- 7.1.2. In Vitro Diagnostics

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Polystyrene (PS)

- 7.2.2. Polycarbonate (PC)

- 7.2.3. Polyvinyl Chloride (PVC)

- 7.2.4. Polymethyl Methacrylate (PMMA)

- 7.2.5. Polydimethylsiloxane (PDMS)

- 7.2.6. Cyclic Olefin Copolymer (COC)

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Polymer-based Microfluidic Device Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Pharmaceutical

- 8.1.2. In Vitro Diagnostics

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Polystyrene (PS)

- 8.2.2. Polycarbonate (PC)

- 8.2.3. Polyvinyl Chloride (PVC)

- 8.2.4. Polymethyl Methacrylate (PMMA)

- 8.2.5. Polydimethylsiloxane (PDMS)

- 8.2.6. Cyclic Olefin Copolymer (COC)

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Polymer-based Microfluidic Device Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Pharmaceutical

- 9.1.2. In Vitro Diagnostics

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Polystyrene (PS)

- 9.2.2. Polycarbonate (PC)

- 9.2.3. Polyvinyl Chloride (PVC)

- 9.2.4. Polymethyl Methacrylate (PMMA)

- 9.2.5. Polydimethylsiloxane (PDMS)

- 9.2.6. Cyclic Olefin Copolymer (COC)

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Polymer-based Microfluidic Device Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Pharmaceutical

- 10.1.2. In Vitro Diagnostics

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Polystyrene (PS)

- 10.2.2. Polycarbonate (PC)

- 10.2.3. Polyvinyl Chloride (PVC)

- 10.2.4. Polymethyl Methacrylate (PMMA)

- 10.2.5. Polydimethylsiloxane (PDMS)

- 10.2.6. Cyclic Olefin Copolymer (COC)

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Agilent

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Fluidigm Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fluigent

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hicomp Microtech

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Micronit

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MicroLIQUID

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dolomite

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Illumina

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MiNAN Technologies

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Enplas

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 IMT AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Agilent

List of Figures

- Figure 1: Global Polymer-based Microfluidic Device Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Polymer-based Microfluidic Device Revenue (million), by Application 2024 & 2032

- Figure 3: North America Polymer-based Microfluidic Device Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Polymer-based Microfluidic Device Revenue (million), by Types 2024 & 2032

- Figure 5: North America Polymer-based Microfluidic Device Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Polymer-based Microfluidic Device Revenue (million), by Country 2024 & 2032

- Figure 7: North America Polymer-based Microfluidic Device Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Polymer-based Microfluidic Device Revenue (million), by Application 2024 & 2032

- Figure 9: South America Polymer-based Microfluidic Device Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Polymer-based Microfluidic Device Revenue (million), by Types 2024 & 2032

- Figure 11: South America Polymer-based Microfluidic Device Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Polymer-based Microfluidic Device Revenue (million), by Country 2024 & 2032

- Figure 13: South America Polymer-based Microfluidic Device Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Polymer-based Microfluidic Device Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Polymer-based Microfluidic Device Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Polymer-based Microfluidic Device Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Polymer-based Microfluidic Device Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Polymer-based Microfluidic Device Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Polymer-based Microfluidic Device Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Polymer-based Microfluidic Device Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Polymer-based Microfluidic Device Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Polymer-based Microfluidic Device Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Polymer-based Microfluidic Device Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Polymer-based Microfluidic Device Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Polymer-based Microfluidic Device Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Polymer-based Microfluidic Device Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Polymer-based Microfluidic Device Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Polymer-based Microfluidic Device Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Polymer-based Microfluidic Device Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Polymer-based Microfluidic Device Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Polymer-based Microfluidic Device Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Polymer-based Microfluidic Device Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Polymer-based Microfluidic Device Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Polymer-based Microfluidic Device Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Polymer-based Microfluidic Device Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Polymer-based Microfluidic Device Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Polymer-based Microfluidic Device Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Polymer-based Microfluidic Device Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Polymer-based Microfluidic Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Polymer-based Microfluidic Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Polymer-based Microfluidic Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Polymer-based Microfluidic Device Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Polymer-based Microfluidic Device Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Polymer-based Microfluidic Device Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Polymer-based Microfluidic Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Polymer-based Microfluidic Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Polymer-based Microfluidic Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Polymer-based Microfluidic Device Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Polymer-based Microfluidic Device Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Polymer-based Microfluidic Device Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Polymer-based Microfluidic Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Polymer-based Microfluidic Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Polymer-based Microfluidic Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Polymer-based Microfluidic Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Polymer-based Microfluidic Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Polymer-based Microfluidic Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Polymer-based Microfluidic Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Polymer-based Microfluidic Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Polymer-based Microfluidic Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Polymer-based Microfluidic Device Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Polymer-based Microfluidic Device Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Polymer-based Microfluidic Device Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Polymer-based Microfluidic Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Polymer-based Microfluidic Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Polymer-based Microfluidic Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Polymer-based Microfluidic Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Polymer-based Microfluidic Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Polymer-based Microfluidic Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Polymer-based Microfluidic Device Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Polymer-based Microfluidic Device Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Polymer-based Microfluidic Device Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Polymer-based Microfluidic Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Polymer-based Microfluidic Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Polymer-based Microfluidic Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Polymer-based Microfluidic Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Polymer-based Microfluidic Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Polymer-based Microfluidic Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Polymer-based Microfluidic Device Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Polymer-based Microfluidic Device?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Polymer-based Microfluidic Device?

Key companies in the market include Agilent, Fluidigm Corporation, Fluigent, Hicomp Microtech, Micronit, MicroLIQUID, Dolomite, Illumina, MiNAN Technologies, Enplas, IMT AG.

3. What are the main segments of the Polymer-based Microfluidic Device?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Polymer-based Microfluidic Device," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Polymer-based Microfluidic Device report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Polymer-based Microfluidic Device?

To stay informed about further developments, trends, and reports in the Polymer-based Microfluidic Device, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence