Key Insights

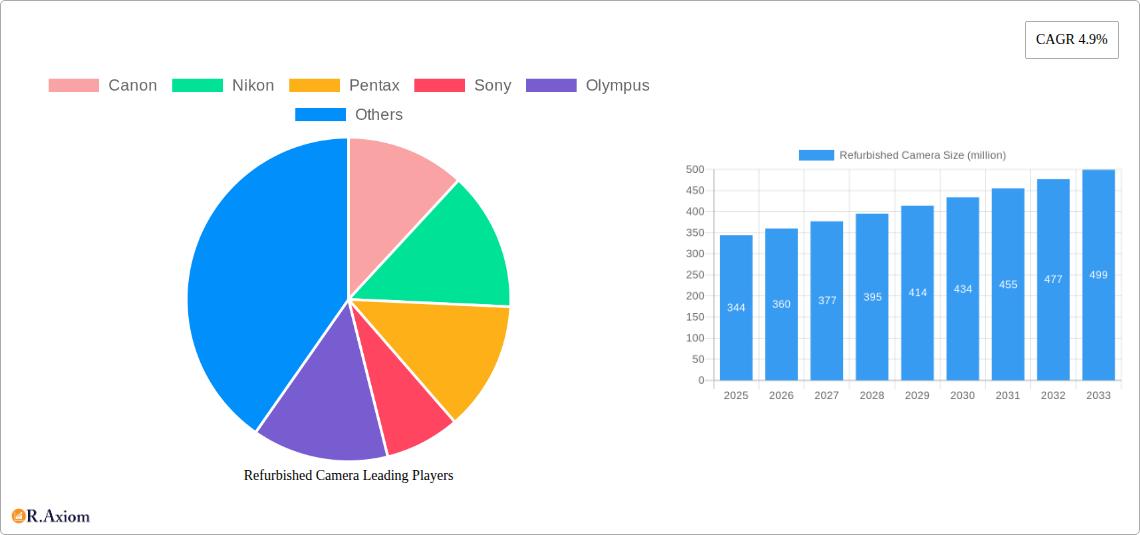

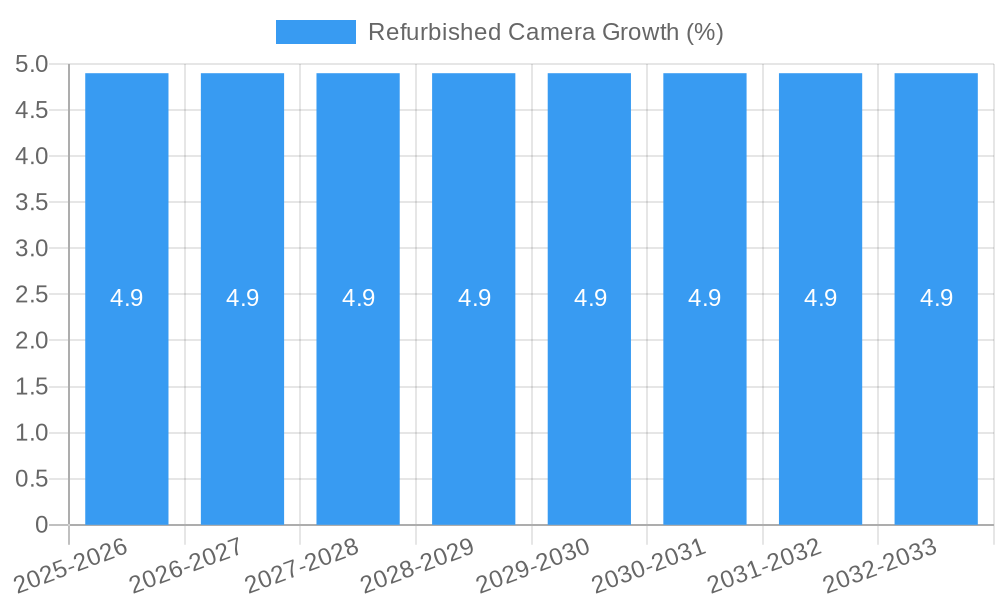

The global refurbished camera market is poised for substantial growth, projected to reach an estimated $344 million by 2025, demonstrating a healthy Compound Annual Growth Rate (CAGR) of 4.9% throughout the forecast period of 2025-2033. This expansion is fueled by a confluence of evolving consumer preferences and technological advancements within the photography industry. A significant driver for this market is the increasing consumer demand for cost-effective yet high-quality photographic equipment, particularly among budget-conscious individuals and aspiring photographers. The growing awareness and adoption of sustainable consumption patterns also play a crucial role, with consumers actively seeking pre-owned products to reduce electronic waste and embrace environmentally responsible purchasing. The market segments are broadly categorized by application into Home Use and Commercial Use, with Digital Cameras dominating the types, although Film Cameras are experiencing a niche resurgence among enthusiasts and for specific creative projects.

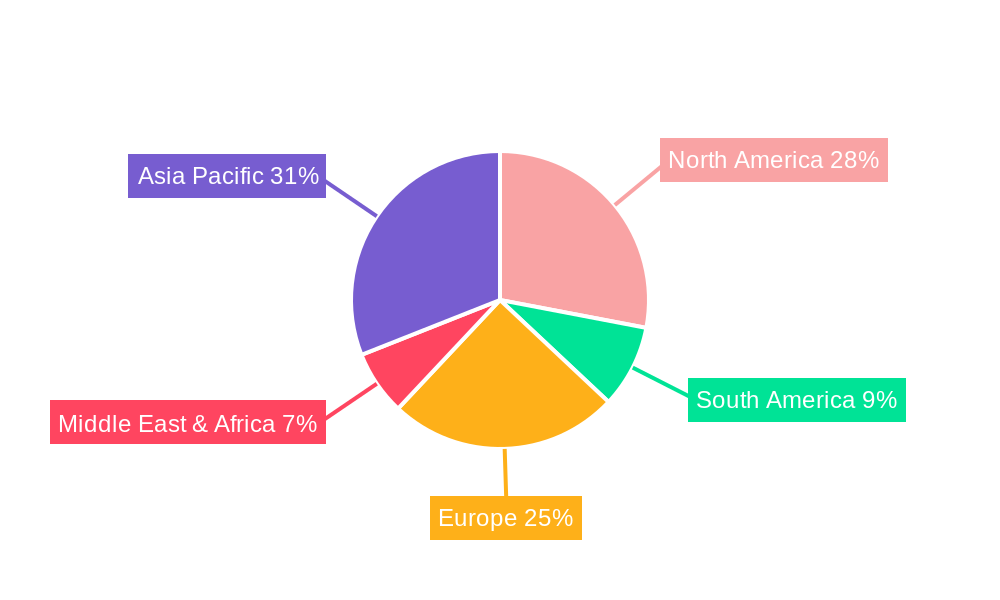

Further bolstering the refurbished camera market are key trends such as the rise of online marketplaces dedicated to pre-owned electronics, which offer greater accessibility and trust for consumers. Brands like Canon, Nikon, Sony, and Fujifilm, all major players in the new camera market, are increasingly participating in or supporting refurbished programs, lending credibility and quality assurance to these offerings. While the market enjoys robust growth, certain restraints like varying warranty policies and potential concerns over product longevity in some lower-tier refurbished options need to be addressed by industry stakeholders. Geographically, Asia Pacific is expected to lead market expansion due to its large population, increasing disposable income, and a burgeoning interest in photography, particularly in countries like China and India. North America and Europe also represent significant markets, driven by established photography communities and a strong consumer base for used goods.

This comprehensive report provides an in-depth analysis of the global refurbished camera market, offering invaluable insights into market concentration, key trends, dominant segments, product developments, and future strategic outlook. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report leverages historical data from 2019-2024 to present accurate market estimations and projections. It is designed to empower industry stakeholders, including manufacturers, suppliers, investors, and end-users, with actionable intelligence to navigate this dynamic and growing sector. Our analysis covers a wide array of camera types, including digital cameras and film cameras, catering to both home use and commercial use applications. The report meticulously examines the market's competitive landscape, highlighting innovation drivers, regulatory frameworks, and emerging opportunities.

Refurbished Camera Market Concentration & Innovation

The global refurbished camera market exhibits a moderate level of concentration, with a few key players holding substantial market share, estimated at approximately 65% in the base year of 2025. Innovation is a critical driver, fueled by the continuous release of new camera models that create a steady supply of pre-owned equipment. Key innovation drivers include advancements in sensor technology, AI-powered features, and enhanced video capabilities in new digital cameras, which directly impact the availability and desirability of their refurbished counterparts. Regulatory frameworks are largely favorable, focusing on consumer protection and quality standards for refurbished electronics, ensuring trust and market growth. Product substitutes, such as smartphones with advanced camera functionalities, pose a competitive challenge, yet the superior image quality and control offered by dedicated cameras, especially for professional and enthusiast use, maintain a strong market presence. End-user trends indicate a growing preference for sustainable and cost-effective solutions, bolstering the demand for refurbished cameras. Mergers and acquisitions (M&A) activities, while not as prevalent as in other electronics sectors, are present, with estimated deal values in the range of tens of millions to hundreds of millions of dollars, indicating strategic consolidation and expansion by larger entities.

Refurbished Camera Industry Trends & Insights

The refurbished camera industry is poised for robust growth, driven by a confluence of economic, technological, and societal factors. The estimated Compound Annual Growth Rate (CAGR) for the forecast period 2025–2033 is projected to be approximately 12.5%, reflecting strong market penetration and increasing consumer adoption. A primary growth driver is the escalating affordability of high-quality imaging equipment. As new camera technologies emerge, particularly in the digital camera segment, a significant volume of nearly new and gently used professional and consumer-grade cameras enter the secondary market. This creates a substantial opportunity for budget-conscious consumers, aspiring photographers, and small businesses to acquire premium gear at a fraction of the original cost. Technological disruptions, such as the rapid evolution of mirrorless camera technology and the increasing integration of AI in imaging, indirectly fuel the refurbished market by accelerating the upgrade cycle for new camera models. Consumer preferences are shifting towards sustainability and conscious consumption. The refurbished camera market aligns perfectly with these values, offering an eco-friendly alternative to purchasing new devices, thereby reducing electronic waste. Market penetration is expected to reach an estimated 30% of the total camera market by 2033, up from an estimated 18% in 2024. Competitive dynamics are characterized by a mix of dedicated online refurbished retailers, manufacturer-certified pre-owned programs, and peer-to-peer marketplaces. Companies are increasingly investing in robust quality control processes and offering extended warranties to build consumer confidence. The demand for specific types of refurbished cameras, such as those used in commercial applications like event photography, real estate videography, and content creation, is also a significant contributor to market expansion. The resurgence of interest in film photography is also creating a niche but growing segment within the refurbished market.

Dominant Markets & Segments in Refurbished Camera

The refurbished camera market exhibits distinct regional and segment dominance. North America, particularly the United States, is a leading region, accounting for an estimated 35% of the global market share in 2025. This dominance is attributable to a strong consumer culture of upgrading technology, a well-established e-commerce infrastructure, and a high disposable income that supports the purchase of both new and refurbished camera equipment. Within North America, the United States is the top country, with an estimated market share of 70% of the regional market.

Application: Home Use

- Dominance: Home use represents a significant segment, driven by hobbyists, families, and content creators on a budget. The availability of high-quality refurbished DSLRs and mirrorless cameras at accessible price points makes them attractive for personal photography and videography.

- Key Drivers:

- Increased interest in photography and videography as hobbies.

- Growing popularity of social media content creation.

- Economic stimulus and desire for cost-effective solutions.

- Availability of refurbished models from popular brands like Canon and Nikon.

Application: Commercial Use

- Dominance: Commercial use, encompassing professional photography, videography, journalism, and small businesses, is a rapidly expanding segment. The need for reliable, high-performance equipment at lower operational costs makes refurbished professional-grade cameras highly sought after.

- Key Drivers:

- Demand from freelance photographers and videographers.

- Requirement for specialized equipment for events, weddings, and corporate media.

- Cost savings for startups and small businesses in content production.

- The availability of robust, industry-standard refurbished cameras from manufacturers like Sony and Fujifilm.

Types: Digital Camera

- Dominance: Digital cameras overwhelmingly dominate the refurbished market, mirroring the broader camera industry's shift towards digital technology. This includes DSLRs, mirrorless cameras, and compact digital cameras.

- Key Drivers:

- Ubiquity of digital camera technology.

- Rapid obsolescence of new models, leading to a large supply of used digital cameras.

- Continuous advancements in digital sensor and processing technology.

- Versatility and ease of use compared to film cameras.

Types: Film Camera

- Dominance: While a niche segment, refurbished film cameras are experiencing a resurgence in popularity. This segment is driven by artistic photographers, collectors, and those seeking a unique aesthetic and a more deliberate photographic process.

- Key Drivers:

- Nostalgia and retro appeal.

- Unique tonal qualities and aesthetic of film photography.

- Growing interest in the tangible nature of analog photography.

- Availability of classic and collectible film camera models.

Refurbished Camera Product Developments

Product developments in the refurbished camera market are intrinsically linked to innovations in new camera technology. As manufacturers like Canon, Nikon, Sony, and Fujifilm release advanced digital cameras with cutting-edge features such as improved autofocus, higher resolution sensors, and superior video capabilities, older models become prime candidates for refurbishment. This cycle ensures a continuous supply of high-quality, pre-owned equipment. Competitive advantages for refurbished cameras lie in their significantly reduced price point while still offering excellent performance and functionality, often with warranties that rival those of new products. The market sees the introduction of refurbished professional-grade mirrorless cameras and DSLRs, as well as compact digital cameras suitable for everyday use. The application of these products spans amateur photography, professional content creation, and even specialized commercial uses, making them a versatile and attractive option for a broad consumer base.

Report Scope & Segmentation Analysis

This report encompasses a detailed segmentation of the refurbished camera market. The primary segmentation is based on Application, which includes Home Use and Commercial Use. The Home Use segment, projected to grow at a CAGR of 11.8%, caters to individuals and families pursuing photography as a hobby, creating social media content, or documenting personal milestones. This segment is characterized by demand for user-friendly, versatile, and affordable cameras. The Commercial Use segment, anticipated to grow at a CAGR of 13.2%, focuses on professional photographers, videographers, content creators, and businesses requiring reliable imaging solutions for their operations. This segment demands higher performance, durability, and specialized features. The second major segmentation is by Types, comprising Digital Camera and Film Camera. The Digital Camera segment is the largest and fastest-growing, with an estimated market size of several hundred million dollars in 2025, driven by the widespread adoption and continuous innovation in digital imaging. The Film Camera segment, though smaller with an estimated market size in the tens of millions of dollars in 2025, is experiencing a steady niche growth due to its artistic appeal and collectible value.

Key Drivers of Refurbished Camera Growth

The growth of the refurbished camera market is propelled by several interconnected factors. Economically, the increasing price of new camera equipment makes refurbished options a highly attractive and cost-effective alternative for consumers and businesses alike. Technologically, the rapid pace of innovation in digital cameras leads to a frequent upgrade cycle, creating a consistent supply of high-quality, pre-owned devices. Regulatory frameworks supporting consumer protection and warranties for refurbished goods build trust and encourage purchases. Furthermore, a growing consumer awareness and preference for sustainable and environmentally friendly consumption patterns directly benefit the refurbished sector by promoting reuse and reducing electronic waste. The demand for specific applications, such as content creation and vlogging, further amplifies the need for accessible, high-quality camera equipment.

Challenges in the Refurbished Camera Sector

Despite its strong growth trajectory, the refurbished camera sector faces several challenges. One significant barrier is the perception of quality and reliability among some consumers who may be hesitant to purchase pre-owned electronics. While most refurbished products undergo rigorous testing and certification, overcoming this perception requires consistent efforts in quality assurance and marketing. Supply chain issues, particularly in sourcing sufficient volumes of popular camera models for refurbishment, can also pose a restraint. Intense competition from both new camera sales and other refurbished electronics markets can put pressure on pricing and margins. Furthermore, the limited lifespan of certain electronic components can lead to ongoing maintenance costs, impacting profitability. The estimated impact of these challenges can translate to a potential reduction in market growth by approximately 1-2% annually if not effectively managed.

Emerging Opportunities in Refurbished Camera

Several emerging opportunities are poised to shape the future of the refurbished camera market. The growing demand for specialized videography equipment, including professional camcorders and cinema cameras, presents a significant opportunity for refurbished sales. The increasing adoption of virtual and augmented reality technologies may also create a secondary market for cameras used in content creation for these platforms. Geographically, emerging markets in Asia and South America, with their rapidly growing middle classes and increasing access to technology, represent untapped potential for refurbished camera sales. Moreover, the development of advanced diagnostic and repair technologies can further enhance the quality and longevity of refurbished cameras, building greater consumer confidence. The rise of subscription-based models for photography equipment could also integrate refurbished options, expanding accessibility.

Leading Players in the Refurbished Camera Market

- Canon

- Nikon

- Pentax

- Sony

- Olympus

- Fujifilm

- GoPro

- Leica

Key Developments in Refurbished Camera Industry

- 2023 January: Increased focus on certified pre-owned programs by major camera manufacturers, enhancing consumer trust and product quality assurance.

- 2023 May: Growth in online marketplaces specializing in refurbished camera gear, offering a wider selection and competitive pricing.

- 2024 February: Introduction of extended warranty options for refurbished digital cameras, mirroring new product offerings.

- 2024 July: Resurgence of interest in vintage film cameras driving demand for high-quality refurbished models among enthusiasts and artists.

- 2025 March: Significant increase in trade-in values for new camera purchases, contributing to the influx of used cameras for refurbishment.

Strategic Outlook for Refurbished Camera Market

The strategic outlook for the refurbished camera market remains highly optimistic. The sustained demand for high-quality imaging solutions, coupled with increasing consumer awareness of sustainability and cost-effectiveness, will continue to drive market growth. Key growth catalysts include further investments in quality control and refurbishment processes by leading manufacturers and third-party vendors, the expansion of online sales channels, and targeted marketing campaigns that emphasize the value proposition of refurbished cameras. The integration of advanced technologies in new camera models will ensure a consistent supply of desirable used equipment, while the growing interest in niche segments like film photography and professional videography will open up new avenues for expansion. The market is projected to see continued innovation in service offerings, such as enhanced warranties and flexible financing options, further solidifying its position as a vital and growing segment of the global camera industry.

Refurbished Camera Segmentation

-

1. Application

- 1.1. Home Use

- 1.2. Commercial Use

-

2. Types

- 2.1. Digital Camera

- 2.2. Film Camera

Refurbished Camera Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Refurbished Camera REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.9% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Refurbished Camera Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Home Use

- 5.1.2. Commercial Use

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Digital Camera

- 5.2.2. Film Camera

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Refurbished Camera Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Home Use

- 6.1.2. Commercial Use

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Digital Camera

- 6.2.2. Film Camera

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Refurbished Camera Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Home Use

- 7.1.2. Commercial Use

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Digital Camera

- 7.2.2. Film Camera

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Refurbished Camera Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Home Use

- 8.1.2. Commercial Use

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Digital Camera

- 8.2.2. Film Camera

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Refurbished Camera Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Home Use

- 9.1.2. Commercial Use

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Digital Camera

- 9.2.2. Film Camera

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Refurbished Camera Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Home Use

- 10.1.2. Commercial Use

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Digital Camera

- 10.2.2. Film Camera

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Canon

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nikon

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Pentax

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sony

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Olympus

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fujifilm

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GoPro

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Leica

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Canon

List of Figures

- Figure 1: Global Refurbished Camera Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Refurbished Camera Revenue (million), by Application 2024 & 2032

- Figure 3: North America Refurbished Camera Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Refurbished Camera Revenue (million), by Types 2024 & 2032

- Figure 5: North America Refurbished Camera Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Refurbished Camera Revenue (million), by Country 2024 & 2032

- Figure 7: North America Refurbished Camera Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Refurbished Camera Revenue (million), by Application 2024 & 2032

- Figure 9: South America Refurbished Camera Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Refurbished Camera Revenue (million), by Types 2024 & 2032

- Figure 11: South America Refurbished Camera Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Refurbished Camera Revenue (million), by Country 2024 & 2032

- Figure 13: South America Refurbished Camera Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Refurbished Camera Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Refurbished Camera Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Refurbished Camera Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Refurbished Camera Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Refurbished Camera Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Refurbished Camera Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Refurbished Camera Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Refurbished Camera Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Refurbished Camera Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Refurbished Camera Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Refurbished Camera Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Refurbished Camera Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Refurbished Camera Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Refurbished Camera Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Refurbished Camera Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Refurbished Camera Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Refurbished Camera Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Refurbished Camera Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Refurbished Camera Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Refurbished Camera Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Refurbished Camera Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Refurbished Camera Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Refurbished Camera Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Refurbished Camera Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Refurbished Camera Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Refurbished Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Refurbished Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Refurbished Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Refurbished Camera Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Refurbished Camera Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Refurbished Camera Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Refurbished Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Refurbished Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Refurbished Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Refurbished Camera Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Refurbished Camera Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Refurbished Camera Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Refurbished Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Refurbished Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Refurbished Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Refurbished Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Refurbished Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Refurbished Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Refurbished Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Refurbished Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Refurbished Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Refurbished Camera Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Refurbished Camera Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Refurbished Camera Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Refurbished Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Refurbished Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Refurbished Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Refurbished Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Refurbished Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Refurbished Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Refurbished Camera Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Refurbished Camera Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Refurbished Camera Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Refurbished Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Refurbished Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Refurbished Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Refurbished Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Refurbished Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Refurbished Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Refurbished Camera Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Refurbished Camera?

The projected CAGR is approximately 4.9%.

2. Which companies are prominent players in the Refurbished Camera?

Key companies in the market include Canon, Nikon, Pentax, Sony, Olympus, Fujifilm, GoPro, Leica.

3. What are the main segments of the Refurbished Camera?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 344 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Refurbished Camera," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Refurbished Camera report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Refurbished Camera?

To stay informed about further developments, trends, and reports in the Refurbished Camera, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence