Key Insights

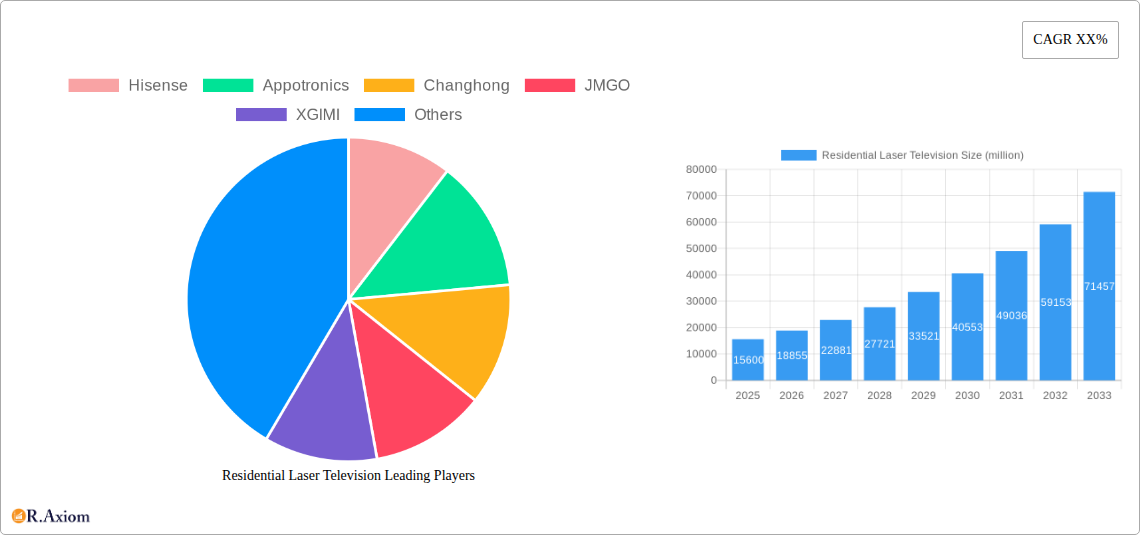

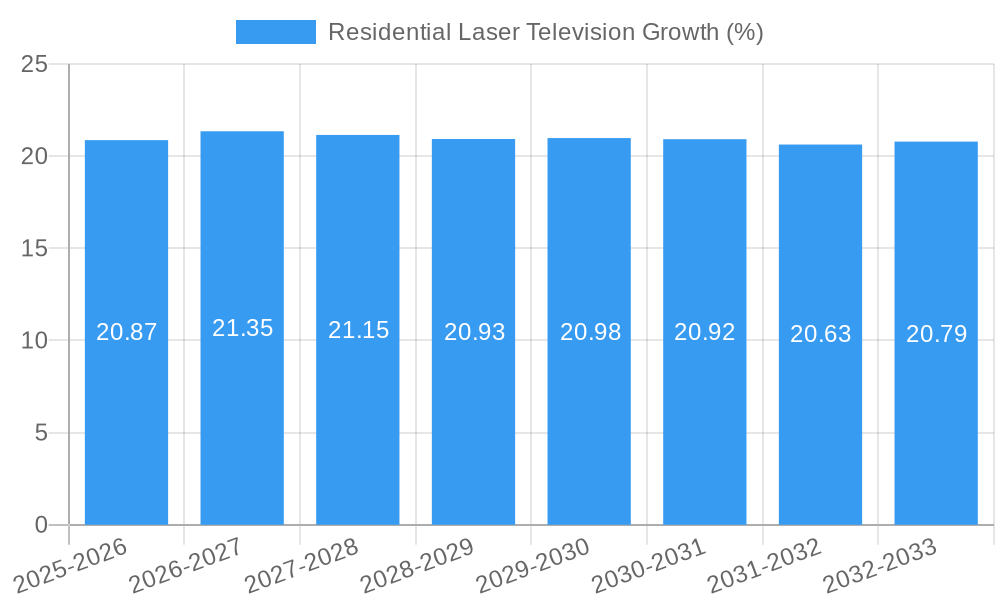

The Residential Laser Television market is poised for significant expansion, projected to reach an estimated market size of $15,600 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 22.5% during the forecast period of 2025-2033. This impressive growth is propelled by several key drivers, including the increasing consumer demand for immersive, cinema-like viewing experiences at home and the continuous technological advancements in laser projection technology. As laser TVs offer superior brightness, color accuracy, and contrast ratios compared to traditional displays, coupled with longer lifespan and lower energy consumption, they are becoming an attractive premium alternative for home entertainment systems. The market is segmented into Online Sales and Offline Sales, with Online Sales expected to gain further traction due to the convenience and wider reach offered by e-commerce platforms. In terms of types, 4K resolution is currently dominant, but the growing adoption of 8K technology will likely fuel future market dynamics.

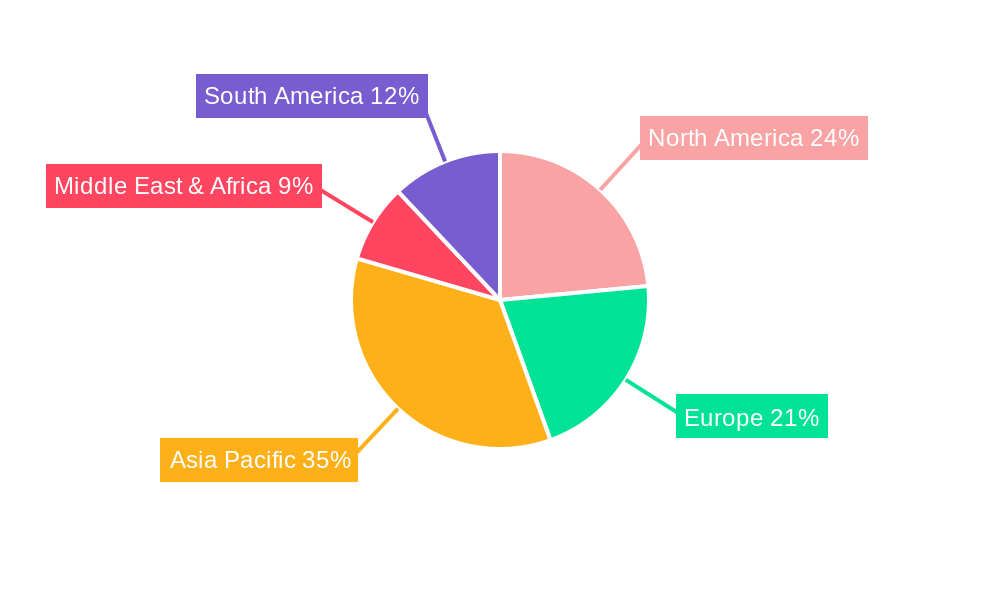

The market's growth trajectory is further supported by the increasing affordability and accessibility of laser projection technology, making it a viable option for a broader consumer base. Major players like Hisense, Appotronics, JMGO, XGIMI, Sony, LG, and Samsung are heavily investing in research and development, introducing innovative products with enhanced features and competitive pricing. The widespread availability of content in high resolutions like 4K and the growing popularity of streaming services further fuel the demand for high-performance home entertainment solutions. While the initial cost of some high-end models can be a restraining factor, the long-term benefits in terms of performance and energy efficiency are gradually shifting consumer perception. Geographically, Asia Pacific, led by China, is expected to be a dominant region due to rapid economic growth and a burgeoning middle class with a high propensity for adopting advanced consumer electronics. North America and Europe are also significant markets, driven by early adoption and a strong demand for premium home theater systems.

Here is a comprehensive, SEO-optimized report description for the Residential Laser Television market:

Residential Laser Television Market Concentration & Innovation

The global Residential Laser Television market is characterized by a moderate to high level of concentration, with a few prominent players like Hisense, Appotronics, Changhong, JMGO, and XGIMI leading the innovation charge. These companies are heavily investing in research and development, driving advancements in brightness, color accuracy, and lifespan of laser light sources. Regulatory frameworks, primarily focused on energy efficiency and laser safety standards, are gradually shaping product development and market entry strategies. Product substitutes, including traditional LED TVs and OLED displays, continue to pose a competitive challenge, although laser televisions are carving out a distinct niche with their superior brightness, immersive viewing experience, and potential for larger screen sizes at competitive price points. End-user trends indicate a growing demand for home cinema experiences, larger displays, and energy-efficient entertainment solutions. Merger and acquisition (M&A) activities, though not at a peak, are anticipated to increase as larger electronics manufacturers look to consolidate their market presence or acquire innovative laser display technologies. M&A deal values are expected to range from tens of millions to hundreds of millions of dollars as consolidation accelerates.

- Innovation Drivers: Enhanced laser phosphor technology, development of solid-state lasers for improved efficiency and longevity, AI-powered picture enhancement, and integration of smart features.

- Regulatory Frameworks: Energy Star certifications, laser safety compliance (IEC standards), and potential for future eco-labeling initiatives.

- Product Substitutes: High-end OLED TVs, premium QLED TVs, and microLED displays.

- End-User Trends: Desire for large screen sizes exceeding 100 inches, immersive gaming experiences, enhanced contrast and color fidelity, and reduced energy consumption.

- M&A Activity: Strategic acquisitions of laser component manufacturers, partnerships for technology licensing, and potential consolidation among smaller players to achieve economies of scale.

Residential Laser Television Industry Trends & Insights

The Residential Laser Television market is poised for substantial growth, driven by a confluence of technological advancements, evolving consumer preferences, and increasing market penetration. The global market is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 15% over the forecast period of 2025–2033. This robust growth is underpinned by the inherent advantages of laser display technology, including unparalleled brightness, exceptional color accuracy with wide color gamut coverage, and an extended lifespan of the light source, often exceeding 20,000 hours with minimal degradation. These factors contribute to a superior viewing experience, particularly for content viewed in well-lit rooms, a common scenario in residential settings.

Technological disruptions are a key catalyst, with ongoing innovations in laser light sources, such as advancements in blue laser diodes and the wider adoption of red-blue laser and RGB laser technologies, promising even greater color purity and brightness. The development of ultra-short-throw (UST) projectors integrated with laser technology has democratized the large-screen experience, allowing consumers to achieve expansive displays from just inches away from the screen, eliminating the need for complex installations and traditional projection setups. Furthermore, the integration of artificial intelligence (AI) for picture optimization, motion smoothing, and smart content recommendations is enhancing user engagement and satisfaction.

Consumer preferences are shifting towards immersive home entertainment solutions, with a growing desire for cinematic experiences within the comfort of their homes. Large screen sizes, once a luxury, are becoming more accessible due to competitive pricing strategies and the efficiency of laser projection. The demand for energy-efficient appliances also plays a crucial role, as laser televisions often consume less power compared to their LED counterparts for equivalent brightness levels.

The competitive landscape is intensifying, with established players like Hisense, Appotronics, Changhong, JMGO, and XGIMI, alongside traditional display manufacturers such as Sony, BenQ, LG, Samsung, Seiko Epson, Haier, Hualu, Optoma, and ViewSonic, all vying for market share. This competition fosters continuous innovation and drives down prices, further accelerating market adoption. Market penetration, currently estimated at around 5% globally in the premium TV segment, is expected to surge to over 20% by 2033 as awareness grows and affordability improves. The ability of laser televisions to offer screen sizes of 100 inches and above at price points comparable to mid-range LED TVs is a significant market disruptor. The projected market size for residential laser televisions is expected to reach over $20 billion by 2033, indicating a significant growth trajectory.

Dominant Markets & Segments in Residential Laser Television

The global Residential Laser Television market is experiencing significant growth, with Asia Pacific emerging as a dominant region, driven by strong economic policies, rapid urbanization, and a burgeoning middle class with a high propensity for adopting advanced consumer electronics. Countries like China and South Korea are at the forefront of this dominance, fueled by local manufacturing capabilities and substantial investment in research and development by key players such as Hisense, Appotronics, and Changhong. The region's advanced infrastructure also supports the efficient distribution and adoption of these cutting-edge technologies.

Within the application segment, Online Sales are rapidly gaining prominence, accounting for an estimated 60% of the total market share in the base year of 2025. This trend is propelled by the convenience of e-commerce platforms, the ability to access a wider range of products and comparative pricing, and targeted digital marketing campaigns that effectively reach tech-savvy consumers. Online channels provide a direct connection between manufacturers and end-users, facilitating faster product introductions and customer feedback loops. This segment is projected to continue its upward trajectory, reaching over 70% market share by 2033.

Conversely, Offline Sales remain a crucial channel, particularly in developing markets where physical retail experiences and in-person product demonstrations are still highly valued. Offline sales are expected to constitute approximately 40% of the market in 2025, gradually declining to around 30% by 2033 as digital adoption continues to mature. Showrooms and retail partnerships play a vital role in educating consumers about the unique benefits of laser televisions, such as the immersive viewing experience and the potential for ultra-large screen sizes.

In terms of product types, the 4K resolution segment is overwhelmingly dominant, holding an estimated 85% market share in 2025. The widespread availability of 4K content, coupled with the consumer's increasing expectation for high-definition visuals, makes 4K resolution the standard for premium home entertainment. Manufacturers are heavily focused on delivering high-quality 4K laser television experiences, characterized by excellent contrast ratios and vibrant color reproduction. This segment is expected to maintain its strong position throughout the forecast period, though advancements in 8K technology might lead to a gradual shift in the later years of the study.

The 1080P resolution segment, while still present, represents a smaller and declining portion of the market, accounting for roughly 15% in 2025. These models are typically positioned as more budget-friendly options or target niche markets where the highest resolution is not a primary concern. As the cost of 4K laser technology continues to decrease and content availability further solidifies, the market share of 1080P laser televisions is anticipated to shrink considerably, possibly reaching below 5% by 2033.

Key drivers for the dominance of 4K and online sales include:

- Technological Advancements: Continuous improvements in laser light source efficiency and imaging chips enable higher resolutions and better picture quality.

- Content Availability: A vast and growing library of 4K Ultra HD content across streaming platforms and physical media.

- Consumer Demand for Immersive Experiences: The desire for cinematic viewing at home, enhanced by large screen sizes and superior picture fidelity.

- E-commerce Infrastructure: Robust online retail networks and secure payment gateways facilitating global online transactions.

- Government Initiatives: Policies promoting digital infrastructure and e-commerce adoption in various regions.

- Economic Growth: Rising disposable incomes, especially in emerging markets, allowing consumers to invest in premium home entertainment.

Residential Laser Television Product Developments

Residential laser television products are witnessing rapid evolution, driven by a commitment to delivering unparalleled home cinema experiences. Innovations center around enhancing image quality through advanced laser light sources, including red-blue and RGB lasers, which offer superior color purity and brightness, achieving over 3,000 ANSI lumens in many models. The integration of ultra-short-throw (UST) technology has revolutionized installation flexibility, enabling massive screen sizes from mere inches away, transforming living spaces into immersive entertainment hubs. Smart features are being deeply embedded, with AI-powered picture processing, intuitive operating systems, and seamless connectivity to streaming services and gaming consoles. Competitive advantages stem from their extended lifespan, typically exceeding 20,000 hours, significantly longer than traditional lamps, and their inherent energy efficiency. Market fit is enhanced by offering larger screen sizes at increasingly competitive price points compared to equivalent LED or OLED displays.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Residential Laser Television market, segmented by Application and Type. The Application segment is bifurcated into Online Sales and Offline Sales. Online Sales, projected to hold a market size of approximately $12 billion in 2025 and grow at a CAGR of 16% to reach over $38 billion by 2033, are driven by e-commerce convenience and targeted marketing. Offline Sales, valued at approximately $8 billion in 2025, are expected to grow at a CAGR of 12% to reach over $19 billion by 2033, supported by retail presence and demonstrations.

The Type segment is divided into 4K and 1080P resolutions. The 4K segment is the dominant force, with a market size of approximately $17 billion in 2025 and a projected CAGR of 15.5% to reach over $52 billion by 2033, driven by content availability and consumer preference for high resolution. The 1080P segment, representing a smaller market share of approximately $3 billion in 2025, is forecast to grow at a modest CAGR of 8% to reach around $5 billion by 2033, catering to specific budget-conscious segments.

Key Drivers of Residential Laser Television Growth

The growth of the Residential Laser Television market is fueled by several potent drivers. Technologically, the evolution of laser light source efficiency, brightness capabilities, and lifespan continues to enhance the viewing experience, making laser TVs a compelling alternative to traditional displays. Economic factors, including increasing disposable incomes globally and the growing affordability of these advanced technologies, are expanding the consumer base. Regulatory support, such as energy efficiency standards that laser technology often surpasses, also contributes positively. Furthermore, the expanding ecosystem of 4K and HDR content across streaming services and gaming platforms directly boosts demand for high-resolution laser displays. The trend towards larger screen sizes in homes, mirroring cinema experiences, is another significant impetus.

Challenges in the Residential Laser Television Sector

Despite its promising growth, the Residential Laser Television sector faces certain challenges. High initial manufacturing costs for advanced laser components can lead to a premium price point compared to some traditional technologies, impacting mass adoption. Consumer awareness and understanding of laser TV technology are still developing, with some consumers hesitant to adopt a newer, less familiar display method. Intense competition from established LED, OLED, and emerging display technologies like microLED exerts significant pricing pressure. Supply chain complexities for specialized laser components can also pose risks, potentially leading to production delays or increased costs. Overcoming these hurdles requires continued technological innovation, effective consumer education, and strategic market positioning.

Emerging Opportunities in Residential Laser Television

Emerging opportunities in the Residential Laser Television market are diverse and promising. The expansion into emerging economies in Asia, Latin America, and Africa presents significant untapped potential as disposable incomes rise. Advancements in laser technology, such as higher energy efficiency and the development of smaller, more integrated laser modules, will further enhance product appeal and affordability. The increasing demand for immersive gaming experiences and the growing popularity of smart home integration offer avenues for new product features and bundled solutions. Furthermore, the development of eco-friendly and sustainable laser display technologies could attract environmentally conscious consumers. The potential for laser projection in ultra-large format displays for dedicated home theaters also remains a significant growth frontier.

Leading Players in the Residential Laser Television Market

- Hisense

- Appotronics

- Changhong

- JMGO

- XGIMI

- Sony

- BenQ

- LG

- Samsung

- Seiko Epson

- Haier

- Hualu

- Optoma

- ViewSonic

Key Developments in Residential Laser Television Industry

- 2023: Hisense launches its new range of 4K TriChroma Laser TVs, featuring enhanced color accuracy and brightness, expanding its global market presence.

- 2023: Appotronics showcases advancements in its blue laser technology, promising longer lifespan and greater energy efficiency for its laser display components.

- 2024 (Q1): JMGO introduces its latest ultra-short-throw laser projector with integrated smart features, targeting the premium home entertainment segment.

- 2024 (Q2): XGIMI expands its Aurora series with new 4K laser projectors, focusing on portability and user-friendly design for home and outdoor use.

- 2024 (Q3): Changhong announces strategic partnerships with content providers to offer bundled streaming services with its laser TV offerings, enhancing value proposition.

- 2024 (Q4): Seiko Epson demonstrates advancements in its laser diode technology, emphasizing improved thermal management and reduced power consumption.

- 2025 (Q1): Samsung explores integration of laser projection technology into its existing QLED and Neo QLED product lines, potentially creating hybrid display solutions.

- 2025 (Q2): Sony unveils new professional-grade laser modules for high-end home cinema installations, pushing the boundaries of resolution and color performance.

- 2025 (Q3): Optoma introduces a new line of affordable 4K laser projectors, aiming to democratize large-screen viewing for a broader consumer base.

- 2025 (Q4): ViewSonic launches a series of interactive laser projectors for educational and business applications, highlighting the versatility of laser display technology beyond entertainment.

Strategic Outlook for Residential Laser Television Market

The strategic outlook for the Residential Laser Television market is exceptionally positive, characterized by sustained innovation and expanding market reach. Growth catalysts include the continuous refinement of laser technology, leading to brighter, more color-accurate, and energy-efficient displays at increasingly competitive price points. The growing consumer appetite for immersive, large-screen home entertainment, coupled with the widespread availability of 4K content, provides a robust demand foundation. Strategic focus will likely involve expanding distribution networks, both online and offline, particularly in emerging markets, and developing tailored product offerings to meet diverse consumer needs and price sensitivities. Furthermore, partnerships with content creators and smart home ecosystem providers will be crucial for enhancing user experience and driving adoption. The market is set to capture a significant share of the premium television segment, offering a compelling blend of performance, longevity, and visual splendor.

Residential Laser Television Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Offline Sales

-

2. Types

- 2.1. 4K

- 2.2. 1080P

Residential Laser Television Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Residential Laser Television REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Residential Laser Television Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Offline Sales

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 4K

- 5.2.2. 1080P

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Residential Laser Television Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Offline Sales

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 4K

- 6.2.2. 1080P

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Residential Laser Television Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Offline Sales

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 4K

- 7.2.2. 1080P

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Residential Laser Television Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Offline Sales

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 4K

- 8.2.2. 1080P

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Residential Laser Television Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Offline Sales

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 4K

- 9.2.2. 1080P

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Residential Laser Television Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Offline Sales

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 4K

- 10.2.2. 1080P

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Hisense

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Appotronics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Changhong

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 JMGO

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 XGIMI

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sony

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BenQ

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 LG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Samsung

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Seiko Epson

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Haier

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Hualu

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Optoma

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 ViewSonic

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Hisense

List of Figures

- Figure 1: Global Residential Laser Television Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Residential Laser Television Revenue (million), by Application 2024 & 2032

- Figure 3: North America Residential Laser Television Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Residential Laser Television Revenue (million), by Types 2024 & 2032

- Figure 5: North America Residential Laser Television Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Residential Laser Television Revenue (million), by Country 2024 & 2032

- Figure 7: North America Residential Laser Television Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Residential Laser Television Revenue (million), by Application 2024 & 2032

- Figure 9: South America Residential Laser Television Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Residential Laser Television Revenue (million), by Types 2024 & 2032

- Figure 11: South America Residential Laser Television Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Residential Laser Television Revenue (million), by Country 2024 & 2032

- Figure 13: South America Residential Laser Television Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Residential Laser Television Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Residential Laser Television Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Residential Laser Television Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Residential Laser Television Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Residential Laser Television Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Residential Laser Television Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Residential Laser Television Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Residential Laser Television Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Residential Laser Television Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Residential Laser Television Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Residential Laser Television Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Residential Laser Television Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Residential Laser Television Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Residential Laser Television Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Residential Laser Television Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Residential Laser Television Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Residential Laser Television Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Residential Laser Television Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Residential Laser Television Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Residential Laser Television Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Residential Laser Television Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Residential Laser Television Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Residential Laser Television Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Residential Laser Television Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Residential Laser Television Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Residential Laser Television Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Residential Laser Television Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Residential Laser Television Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Residential Laser Television Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Residential Laser Television Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Residential Laser Television Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Residential Laser Television Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Residential Laser Television Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Residential Laser Television Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Residential Laser Television Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Residential Laser Television Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Residential Laser Television Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Residential Laser Television Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Residential Laser Television Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Residential Laser Television Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Residential Laser Television Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Residential Laser Television Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Residential Laser Television Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Residential Laser Television Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Residential Laser Television Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Residential Laser Television Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Residential Laser Television Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Residential Laser Television Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Residential Laser Television Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Residential Laser Television Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Residential Laser Television Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Residential Laser Television Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Residential Laser Television Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Residential Laser Television Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Residential Laser Television Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Residential Laser Television Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Residential Laser Television Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Residential Laser Television Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Residential Laser Television Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Residential Laser Television Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Residential Laser Television Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Residential Laser Television Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Residential Laser Television Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Residential Laser Television Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Residential Laser Television Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Residential Laser Television?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Residential Laser Television?

Key companies in the market include Hisense, Appotronics, Changhong, JMGO, XGIMI, Sony, BenQ, LG, Samsung, Seiko Epson, Haier, Hualu, Optoma, ViewSonic.

3. What are the main segments of the Residential Laser Television?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Residential Laser Television," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Residential Laser Television report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Residential Laser Television?

To stay informed about further developments, trends, and reports in the Residential Laser Television, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence