Key Insights

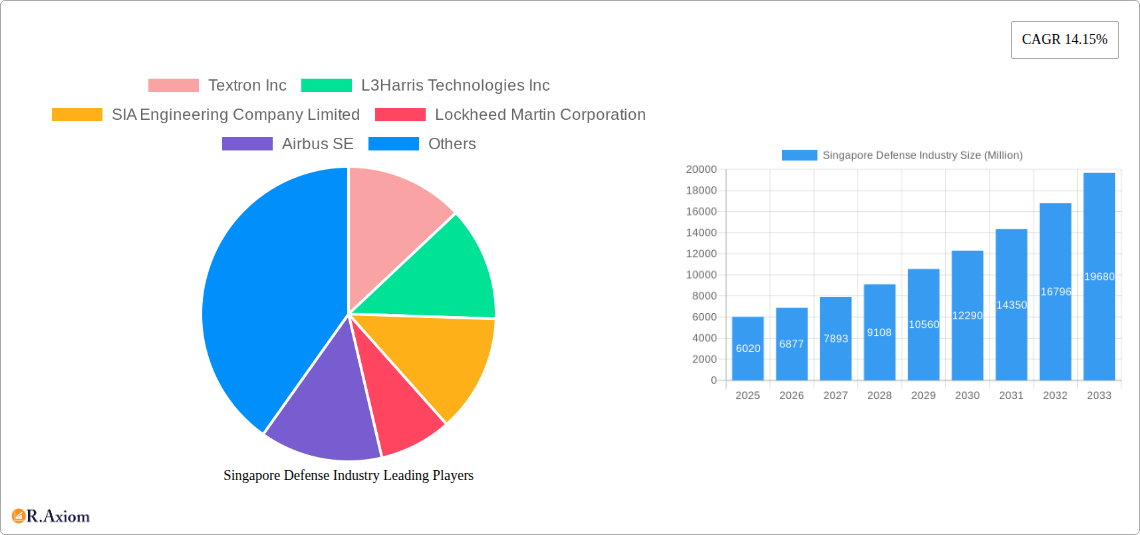

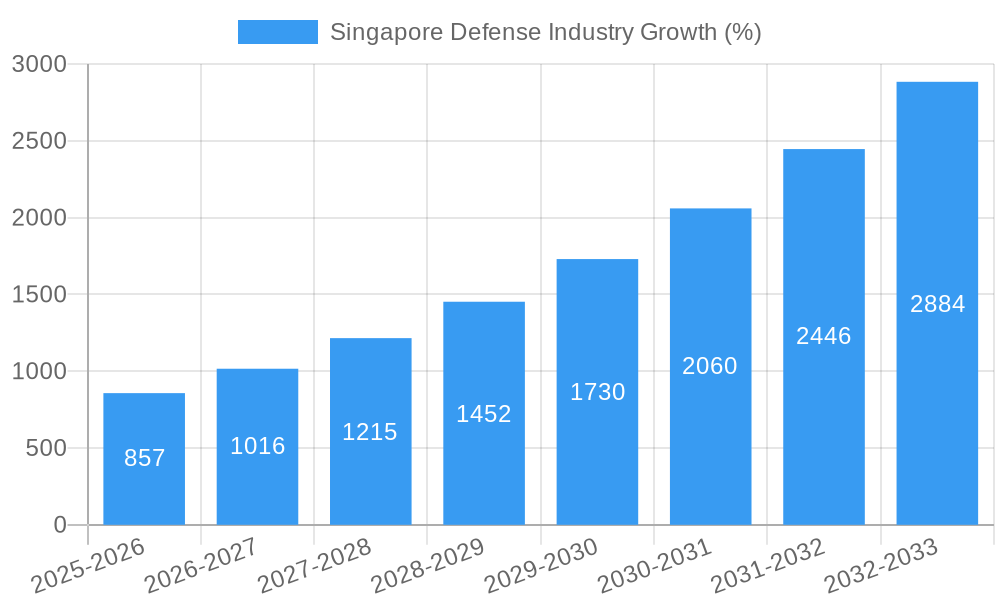

The Singapore defense industry, valued at $6.02 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 14.15% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, geopolitical instability in the Asia-Pacific region necessitates significant investments in defense capabilities to safeguard national security. Secondly, technological advancements in areas such as unmanned aerial vehicles (UAVs), cybersecurity, and artificial intelligence (AI) are driving demand for sophisticated defense systems and modernization programs. Furthermore, Singapore's strategic location and its role as a regional hub for defense activities contribute to market growth. The industry is segmented by industry type (Manufacturing, Design & Engineering, Maintenance, Repair & Overhaul) and product type (Aerospace, Defense). Key players like Textron, L3Harris, SIA Engineering, Lockheed Martin, Airbus, and others are actively involved in meeting the evolving needs of the Singaporean Armed Forces and regional partners. The manufacturing segment is expected to witness significant growth driven by the increasing demand for domestically produced equipment and components. Similarly, the maintenance, repair, and overhaul sector will benefit from the need for continued servicing of existing defense assets.

Looking ahead, the Singapore defense industry faces both opportunities and challenges. While government support and sustained investment in defense modernization will continue to drive growth, increasing competition from international defense contractors and potential economic fluctuations may present headwinds. To maintain its competitive edge, the industry will need to focus on innovation, technological upgrades, and strategic partnerships. The development and adoption of cutting-edge technologies, combined with a skilled workforce, will be crucial in ensuring the long-term success and sustainability of the Singapore defense industry. This includes adapting to shifting regional security dynamics and maintaining close collaborations with international partners.

Singapore Defense Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Singapore defense industry, offering invaluable insights for industry stakeholders, investors, and policymakers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report utilizes extensive data and expert analysis to present a clear picture of the market's current state and future trajectory. The report's value lies in its granular segmentation, precise market sizing (in Millions), and actionable predictions.

Singapore Defense Industry Market Concentration & Innovation

The Singapore defense industry exhibits a concentrated market structure, dominated by a few large multinational corporations and key domestic players. Market share data reveals that Singapore Technologies Engineering Ltd holds a significant portion, estimated at xx% in 2025, followed by The Boeing Company at xx% and Lockheed Martin Corporation at xx%. The industry is characterized by high capital expenditure requirements and advanced technological barriers to entry. Innovation is driven by the need for technologically superior defense systems and the ongoing geopolitical landscape.

Several factors influence market dynamics: a robust regulatory framework focused on security and quality control, limited product substitution due to the specialized nature of defense products, consistent end-user demand from the Singapore Armed Forces and regional allies, and moderate mergers and acquisitions (M&A) activity. Recent M&A transactions have involved smaller firms being absorbed by larger players, with total deal values reaching approximately xx Million in the period 2019-2024.

- Market Concentration: High, with a few key players dominating.

- Innovation Drivers: Technological advancements, geopolitical factors, and government investments.

- Regulatory Framework: Stringent regulations ensuring quality and security.

- M&A Activity: Moderate, with larger players consolidating the market.

Singapore Defense Industry Industry Trends & Insights

The Singapore defense industry is experiencing steady growth, driven by sustained government investment in defense modernization and upgrades. The Compound Annual Growth Rate (CAGR) is projected to be xx% from 2025 to 2033, fueled by factors such as increasing defense budgets and the need to counter emerging security threats. Market penetration of advanced technologies, like AI and unmanned systems, is gradually increasing, although adoption remains cautious due to security concerns. Consumer preference (i.e., the SAF) is shifting towards adaptable and interoperable systems to improve operational efficiency. Competitive dynamics are intense, with established players facing increasing competition from agile technology firms.

The rise of cyber warfare and the need for robust cybersecurity systems are shaping industry trends. The focus on sustainability and environmental impact within the defense sector is also emerging as a key consideration. Data analytics and predictive maintenance are becoming increasingly integral to operations, allowing for optimized resource allocation and minimizing downtime.

Dominant Markets & Segments in Singapore Defense Industry

The aerospace segment within the Singapore defense industry holds the largest market share, driven by substantial investments in upgrading the Republic of Singapore Air Force fleet and the growth of the commercial aerospace sector. The Maintenance, Repair, and Overhaul (MRO) segment is also experiencing strong growth due to its strategic importance in ensuring the operational readiness of defense assets. Manufacturing, Design, and Engineering remains a crucial aspect with Singapore's focus on indigenous capability development.

- Key Drivers for Aerospace: Government investments in modernizing air power, regional demand, and growth of commercial aviation activities.

- Key Drivers for MRO: High demand for maintenance and repair of aging aircraft and weapon systems, growing focus on efficient asset management.

- Key Drivers for Manufacturing, Design, and Engineering: Government support for local technology development, emphasis on self-reliance, and skilled workforce.

Singapore Defense Industry Product Developments

Recent product innovations include advanced sensor systems, unmanned aerial vehicles (UAVs), and cyber defense solutions. These products offer competitive advantages through enhanced capabilities, improved reliability, and reduced operational costs. Technological trends are focused on AI-powered systems, autonomous technologies, and improved data integration to enhance situational awareness and decision-making. The market fit for these innovations is strong due to increasing demand for advanced defense technologies.

Report Scope & Segmentation Analysis

This report segments the Singapore defense industry by industry type (Manufacturing, Design, and Engineering; Maintenance, Repair, and Overhaul) and product type (Aerospace, Defense).

Manufacturing, Design, and Engineering: This segment encompasses the design, development, and production of defense equipment, showing projected growth of xx% from 2025 to 2033, with xx Million market size in 2025. Competitive dynamics are shaped by technological innovation and the ability to meet stringent quality standards.

Maintenance, Repair, and Overhaul: This segment focuses on the maintenance and repair of defense equipment. Growth is expected at xx% from 2025 to 2033, reaching xx Million in 2025. Competition is driven by efficiency, cost-effectiveness, and technological expertise.

Aerospace: This includes aircraft, UAVs, and related systems with projected growth at xx% from 2025 to 2033, valued at xx Million in 2025. Competition is fierce due to high capital investment needs and technological sophistication.

Defense: This encompasses land systems, naval systems, and other defense-related products with a projected growth of xx% from 2025 to 2033, and xx Million in 2025 market size. Competitive dynamics are shaped by government procurement policies and technological capabilities.

Key Drivers of Singapore Defense Industry Growth

Several factors drive the growth of the Singapore defense industry. These include consistent government spending on defense modernization, a technologically advanced and skilled workforce, a strategic geopolitical location, and supportive government policies fostering innovation and collaboration within the industry. The increasing regional security concerns further bolster demand for advanced defense systems.

Challenges in the Singapore Defense Industry Sector

The Singapore defense industry faces challenges such as increasing competition from global players, potential supply chain disruptions, and the high cost of acquiring and maintaining advanced defense technologies. Regulatory complexities and the need to balance national security with economic considerations also present hurdles. These factors can lead to potential delays in procurement and increased costs, with an estimated annual impact of xx Million on project timelines.

Emerging Opportunities in Singapore Defense Industry

Emerging opportunities include the growing demand for cyber security solutions, the adoption of advanced technologies like AI and big data analytics within defense systems, and potential collaborations with regional partners in joint defense projects. Expanding into new markets and developing sustainable defense technologies also present attractive opportunities.

Leading Players in the Singapore Defense Industry Market

- Textron Inc

- L3Harris Technologies Inc

- SIA Engineering Company Limited

- Lockheed Martin Corporation

- Airbus SE

- Moog Inc

- RTX Corporation

- Rolls-Royce plc

- Bombardier Inc

- Singapore Technologies Engineering Ltd

- Curtiss-Wright Corporation

- General Electric Company

- The Boeing Company

Key Developments in Singapore Defense Industry Industry

- February 2023: The Republic of Singapore Air Force announced the acquisition of 8 additional F-35B fighter jets from Lockheed Martin Corporation, impacting the aerospace segment significantly.

- August 2022: Singapore Airlines and DHL expanded their partnership, creating new opportunities within the MRO segment.

Strategic Outlook for Singapore Defense Industry Market

The Singapore defense industry is poised for continued growth, driven by ongoing investments in modernization and the evolving geopolitical landscape. Opportunities lie in technological advancements, regional partnerships, and the expansion into new market segments. The industry's strategic focus on innovation and technological superiority will shape its future trajectory.

Singapore Defense Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Singapore Defense Industry Segmentation By Geography

- 1. Singapore

Singapore Defense Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.15% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increased Seaborne Threats And Ambiguous Maritime Security Policies; Increasing Adoption Of Security Technologies In Bric Countries

- 3.3. Market Restrains

- 3.3.1. ; High Risk Rate In Ungoverned Zones; Unstructured Security Standards And Technologies

- 3.4. Market Trends

- 3.4.1. MRO Segment Dominates the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Defense Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Textron Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 L3Harris Technologies Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SIA Engineering Company Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lockheed Martin Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Airbus SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Moog Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 RTX Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rolls-Royce plc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bombardier Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Singapore Technologies Engineering Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Curtiss-Wright Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 General Electric Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 The Boeing Company

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Textron Inc

List of Figures

- Figure 1: Singapore Defense Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Singapore Defense Industry Share (%) by Company 2024

List of Tables

- Table 1: Singapore Defense Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Singapore Defense Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Singapore Defense Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Singapore Defense Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Singapore Defense Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Singapore Defense Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Singapore Defense Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Singapore Defense Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Singapore Defense Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: Singapore Defense Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: Singapore Defense Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Singapore Defense Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: Singapore Defense Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: Singapore Defense Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Defense Industry?

The projected CAGR is approximately 14.15%.

2. Which companies are prominent players in the Singapore Defense Industry?

Key companies in the market include Textron Inc, L3Harris Technologies Inc, SIA Engineering Company Limited, Lockheed Martin Corporation, Airbus SE, Moog Inc, RTX Corporation, Rolls-Royce plc, Bombardier Inc, Singapore Technologies Engineering Ltd, Curtiss-Wright Corporation, General Electric Company, The Boeing Company.

3. What are the main segments of the Singapore Defense Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.02 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increased Seaborne Threats And Ambiguous Maritime Security Policies; Increasing Adoption Of Security Technologies In Bric Countries.

6. What are the notable trends driving market growth?

MRO Segment Dominates the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

; High Risk Rate In Ungoverned Zones; Unstructured Security Standards And Technologies.

8. Can you provide examples of recent developments in the market?

In February 2023, the Republic of Singapore Air Force announced that it would acquire 8 more F-35B fighter jets from Lockheed Martin Corporation which will be delivered by 2030.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Defense Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Defense Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Defense Industry?

To stay informed about further developments, trends, and reports in the Singapore Defense Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence