Key Insights

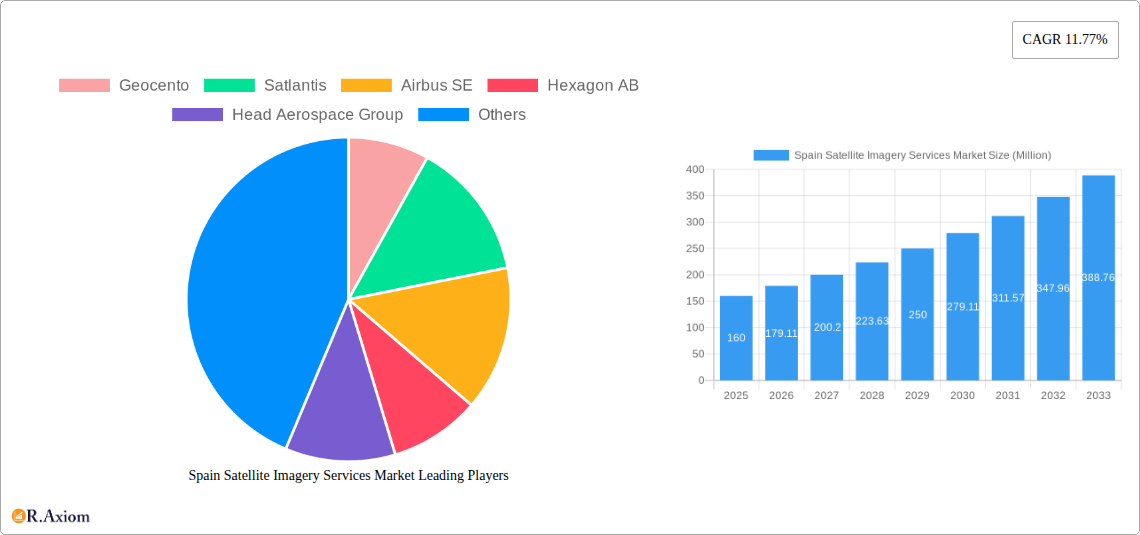

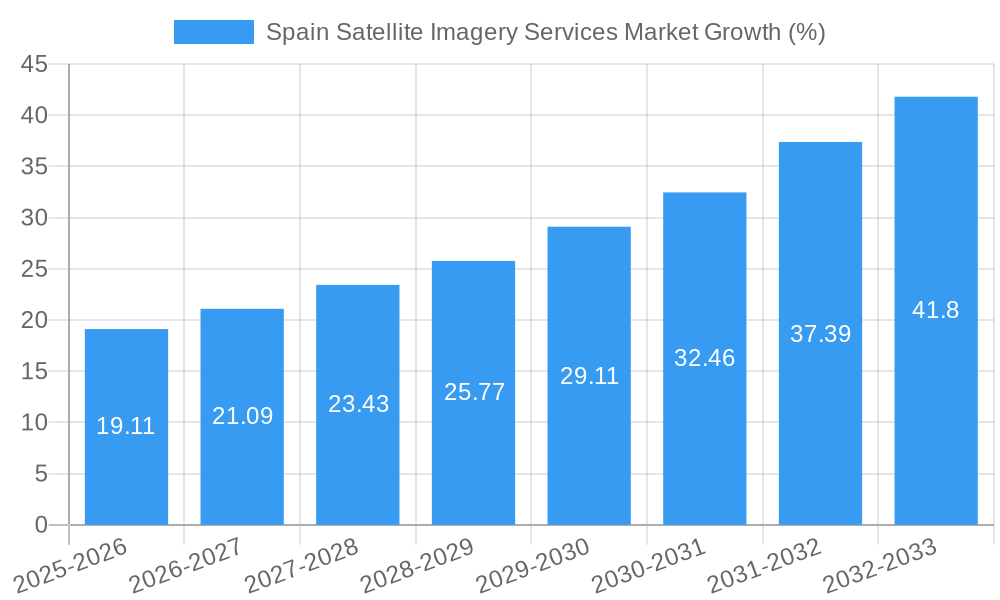

The Spain Satellite Imagery Services market, valued at €160 million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 11.77% from 2025 to 2033. This expansion is driven by several key factors. Increasing government investments in infrastructure development, particularly within the construction and transportation sectors, fuel demand for precise geospatial data. Furthermore, the growing importance of sustainable resource management and environmental monitoring initiatives within Spain's agricultural and forestry sectors are propelling market growth. Enhanced surveillance and security requirements, coupled with the nation's commitment to disaster preparedness and mitigation, contribute significantly to the market's upward trajectory. Technological advancements in satellite imagery resolution and analytical capabilities are also boosting market adoption across various applications, including conservation research and intelligence gathering. The competitive landscape features both established international players like Airbus SE and Maxar Technologies, alongside emerging regional companies, fostering innovation and driving market expansion. The government sector remains a dominant end-user, followed by the construction, transportation, and military & defense sectors. The market's segmentation by application reveals high demand for geospatial data acquisition and mapping, closely followed by natural resource management and surveillance & security applications.

The forecast period (2025-2033) projects substantial growth driven by continued technological advancements leading to improved image quality, increased processing speeds, and the rise of cloud-based analytics platforms. Further expansion is expected through strategic partnerships between satellite imagery providers and data analytics firms, facilitating the development of customized solutions for specific industry needs. While the market faces challenges such as data privacy concerns and potential regulatory hurdles, the overall outlook remains positive, with substantial opportunities for growth in the coming years. The continued modernization of Spain’s infrastructure and the nation's strategic focus on technological advancement suggest that the demand for satellite imagery services will only increase. The market's fragmented nature, however, creates both opportunities for smaller companies to specialize and challenges for larger companies in maintaining market share.

Spain Satellite Imagery Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Spain Satellite Imagery Services Market, offering valuable insights for industry stakeholders, investors, and businesses seeking to understand this dynamic sector. The report covers the period from 2019 to 2033, with 2025 as the base year and a forecast period extending to 2033. The historical period analyzed is 2019-2024. The market is segmented by application and end-user, providing granular analysis for informed decision-making.

Spain Satellite Imagery Services Market Market Concentration & Innovation

The Spain satellite imagery services market exhibits a moderately concentrated landscape, with a few dominant players and several smaller, specialized firms. Market share is largely held by multinational corporations, with regional players vying for smaller segments. The market concentration ratio (CR5) is estimated at xx%, indicating a moderate level of consolidation. However, ongoing innovation and technological advancements are fostering increased competition.

Key innovation drivers include the development of higher-resolution sensors, the emergence of hyperspectral imaging, advancements in data analytics and AI-powered interpretation, and the increasing accessibility of cloud-based geospatial platforms. The regulatory framework in Spain, while generally supportive of the space sector, faces challenges in data privacy and security. This can affect data acquisition and usage, potentially hindering growth in certain applications like surveillance. Product substitutes, such as aerial photography and LiDAR, remain competitive in specific niches, while others are complementary.

End-user trends are shifting towards greater demand for value-added services like data analytics and customized solutions. M&A activity in this sector has been relatively steady, with deal values averaging xx Million annually over the past five years. Notable transactions include (but are not limited to) partnerships between satellite imagery providers and data analytics companies to expand service offerings.

- Market Concentration: CR5 estimated at xx%

- Key Players: Geocento, Satlantis, Airbus SE, Hexagon AB, Head Aerospace Group, Maxar Technologies Inc., Satellite Imaging Corporation, Galileo Group Inc., Planet Labs PBC, European Space Imaging (EUSI) GmbH (List not exhaustive)

- M&A Activity: Average deal value: xx Million (2019-2024)

Spain Satellite Imagery Services Market Industry Trends & Insights

The Spain Satellite Imagery Services Market is experiencing robust growth, driven by increasing demand across various sectors. The market is projected to register a CAGR of xx% during the forecast period (2025-2033), reaching a market value of xx Million by 2033. This growth is fueled by several factors, including rising government spending on defense and infrastructure projects, the growing adoption of precision agriculture techniques, and the increasing need for effective disaster management solutions.

Technological disruptions, such as the introduction of hyperspectral imaging and improved data processing capabilities, are enhancing the quality and utility of satellite imagery. Consumer preferences are shifting towards readily available, cloud-based solutions and data analytics capabilities, impacting service delivery models. Competitive dynamics are shaped by factors such as technological innovation, pricing strategies, and the ability to provide value-added services. Market penetration is high in sectors like government and defense, while opportunities remain for expansion in other applications.

Dominant Markets & Segments in Spain Satellite Imagery Services Market

The Government sector is the dominant end-user segment in the Spanish satellite imagery market, accounting for approximately xx% of the total market value in 2025. This is due to increasing government investment in national security, infrastructure development, and environmental monitoring. The Geospatial Data Acquisition and Mapping application segment is the largest by application, representing xx% of the market.

- Dominant End-User Segment: Government (Key drivers: National security, infrastructure development, environmental monitoring, disaster response).

- Dominant Application Segment: Geospatial Data Acquisition and Mapping (Key drivers: Urban planning, infrastructure development, precision agriculture).

- Regional Variations: Higher adoption rates are observed in urbanized areas and regions with significant infrastructure projects.

Detailed Dominance Analysis: The Government segment's dominance stems from its significant budgetary allocations for defense, intelligence gathering, and infrastructure projects. Similarly, the high demand for precise mapping and data acquisition in urban planning, infrastructure development, and related fields fuels the growth of the Geospatial Data Acquisition and Mapping application segment. The integration of satellite imagery with GIS systems further enhances its utility across various sectors, contributing to its market leadership.

Spain Satellite Imagery Services Market Product Developments

Recent product innovations focus on higher resolution imagery, advanced analytics capabilities, and user-friendly cloud-based platforms. Companies are increasingly offering integrated solutions combining satellite imagery with data analytics and GIS capabilities. Competitive advantages stem from superior image quality, faster processing times, advanced analytics algorithms, and comprehensive customer support. These technological trends are aligning with the market need for efficient, accessible, and insightful data solutions.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Spain Satellite Imagery Services Market, segmented by application and end-user.

By Application:

- Geospatial Data Acquisition and Mapping: This segment is projected to experience significant growth due to increasing urbanization and infrastructure development. Market size in 2025 is estimated at xx Million.

- Natural Resource Management: This segment is driven by the need for sustainable resource management and environmental monitoring. Market size in 2025 is estimated at xx Million.

- Surveillance and Security: This segment benefits from increasing government investment in national security. Market size in 2025 is estimated at xx Million.

- Conservation and Research: The need for biodiversity monitoring and conservation efforts is driving growth in this sector. Market size in 2025 is estimated at xx Million.

- Disaster Management: This segment’s growth is linked to the increasing frequency of natural disasters. Market size in 2025 is estimated at xx Million.

- Intelligence: Government spending on intelligence gathering is a key driver for this sector. Market size in 2025 is estimated at xx Million.

By End-User:

- Government: This is the largest segment, driven by significant budgetary allocations.

- Construction: Demand is driven by infrastructure projects and urban development.

- Transportation and Logistics: Satellite imagery is used for route optimization and infrastructure monitoring.

- Military and Defense: This sector benefits from government investments in national security.

- Forestry and Agriculture: Precision agriculture and forest management are key drivers.

- Others: This encompasses a diverse range of sectors utilizing satellite imagery.

Key Drivers of Spain Satellite Imagery Services Market Growth

Several factors contribute to the growth of the Spanish satellite imagery services market: Increased government spending on infrastructure and defense projects, growing adoption of precision agriculture techniques, rising demand for effective disaster management solutions, and advancements in satellite technology offering higher-resolution imagery and enhanced analytics capabilities. Government initiatives promoting technological innovation further stimulate market expansion.

Challenges in the Spain Satellite Imagery Services Market Sector

The market faces challenges including high initial investment costs for satellite imagery acquisition and processing, concerns regarding data privacy and security, and competition from alternative technologies like aerial photography. Fluctuations in government spending and economic downturns also influence market growth. Supply chain disruptions can impact the availability of satellite imagery products and services.

Emerging Opportunities in Spain Satellite Imagery Services Market

The market presents numerous opportunities, particularly in the adoption of AI-powered analytics, integration with IoT devices, and the development of specialized services targeting niche sectors. Expanding into new applications, such as environmental monitoring and renewable energy development, also offers significant growth potential. The development of user-friendly cloud-based platforms could further democratize access to satellite imagery data.

Leading Players in the Spain Satellite Imagery Services Market Market

- Geocento

- Satlantis

- Airbus SE (Airbus SE)

- Hexagon AB (Hexagon AB)

- Head Aerospace Group

- Maxar Technologies Inc. (Maxar Technologies Inc.)

- Satellite Imaging Corporation

- Galileo Group Inc.

- Planet Labs PBC (Planet Labs PBC)

- European Space Imaging (EUSI) GmbH

Key Developments in Spain Satellite Imagery Services Market Industry

- July 2023: Maxar Technologies launched its Maxar Geospatial Platform (MGP), enhancing access to high-resolution imagery and analytics. This significantly improves data accessibility and usability, boosting market competition.

- September 2022: Planet Labs introduced Tanager satellites, offering hyperspectral imagery capabilities. This technological advancement opens up new applications and improves the quality of data, impacting market competition and driving innovation.

Strategic Outlook for Spain Satellite Imagery Services Market Market

The Spain Satellite Imagery Services Market holds significant growth potential, driven by technological advancements, increasing government investment, and the expanding adoption of satellite imagery across various sectors. Future market expansion hinges on embracing innovative technologies, enhancing data accessibility, and developing customized solutions to meet the specific needs of diverse end-users. The market's future appears bright, with continued growth expected in the coming years.

Spain Satellite Imagery Services Market Segmentation

-

1. Application

- 1.1. Geospatial Data Acquisition and Mapping

- 1.2. Natural Resource Management

- 1.3. Surveillance and Security

- 1.4. Conservation and Research

- 1.5. Disaster Management

- 1.6. Intelligence

-

2. End-User

- 2.1. Government

- 2.2. Construction

- 2.3. Transportation and Logistics

- 2.4. Military and Defense

- 2.5. Forestry and Agriculture

- 2.6. Others

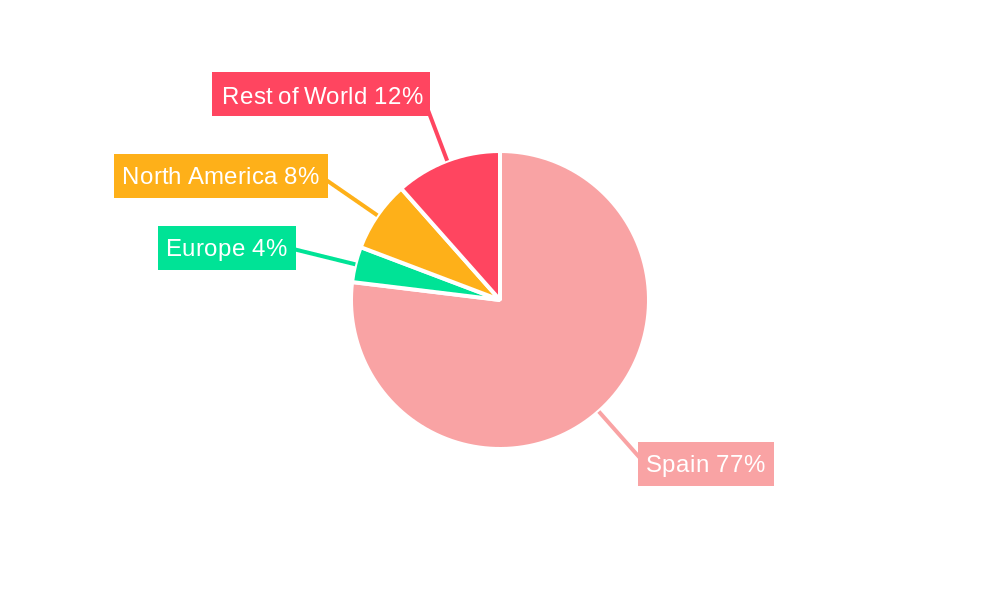

Spain Satellite Imagery Services Market Segmentation By Geography

- 1. Spain

Spain Satellite Imagery Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.77% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Location-based Services; Satellite data usage is increasing

- 3.3. Market Restrains

- 3.3.1. Strict government regulations; High-resolution Images Offered by Other Imaging Technologies

- 3.4. Market Trends

- 3.4.1. Surveillance and Security is Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Satellite Imagery Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Geospatial Data Acquisition and Mapping

- 5.1.2. Natural Resource Management

- 5.1.3. Surveillance and Security

- 5.1.4. Conservation and Research

- 5.1.5. Disaster Management

- 5.1.6. Intelligence

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Government

- 5.2.2. Construction

- 5.2.3. Transportation and Logistics

- 5.2.4. Military and Defense

- 5.2.5. Forestry and Agriculture

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Geocento

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Satlantis

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Airbus SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hexagon AB

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Head Aerospace Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Maxar Technologies Inc *List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Satellite Imaging Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Galileo Group Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Planet Labs PBC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 European Space Imaging (EUSI) GmbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Geocento

List of Figures

- Figure 1: Spain Satellite Imagery Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Spain Satellite Imagery Services Market Share (%) by Company 2024

List of Tables

- Table 1: Spain Satellite Imagery Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Spain Satellite Imagery Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Spain Satellite Imagery Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Spain Satellite Imagery Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Spain Satellite Imagery Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Spain Satellite Imagery Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 7: Spain Satellite Imagery Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 8: Spain Satellite Imagery Services Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Satellite Imagery Services Market?

The projected CAGR is approximately 11.77%.

2. Which companies are prominent players in the Spain Satellite Imagery Services Market?

Key companies in the market include Geocento, Satlantis, Airbus SE, Hexagon AB, Head Aerospace Group, Maxar Technologies Inc *List Not Exhaustive, Satellite Imaging Corporation, Galileo Group Inc, Planet Labs PBC, European Space Imaging (EUSI) GmbH.

3. What are the main segments of the Spain Satellite Imagery Services Market?

The market segments include Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.16 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Location-based Services; Satellite data usage is increasing.

6. What are the notable trends driving market growth?

Surveillance and Security is Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Strict government regulations; High-resolution Images Offered by Other Imaging Technologies.

8. Can you provide examples of recent developments in the market?

July 2023: Maxar Technologies, a provider of comprehensive space services and secure, precise geospatial intelligence, announced the initial release of its new Maxar Geospatial Platform (MGP), enabling fast and easy access to the world's most advanced Earth intelligence. MGP will simplify geospatial data and analytics discovery, purchasing, and integration.MGP users will have access to Maxar's industry-leading geospatial content, including high-resolution satellite imagery, stunning imagery base maps, 3D models, analysis-ready data, and image-based change detection and analytic outputs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Satellite Imagery Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Satellite Imagery Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Satellite Imagery Services Market?

To stay informed about further developments, trends, and reports in the Spain Satellite Imagery Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence