Key Insights

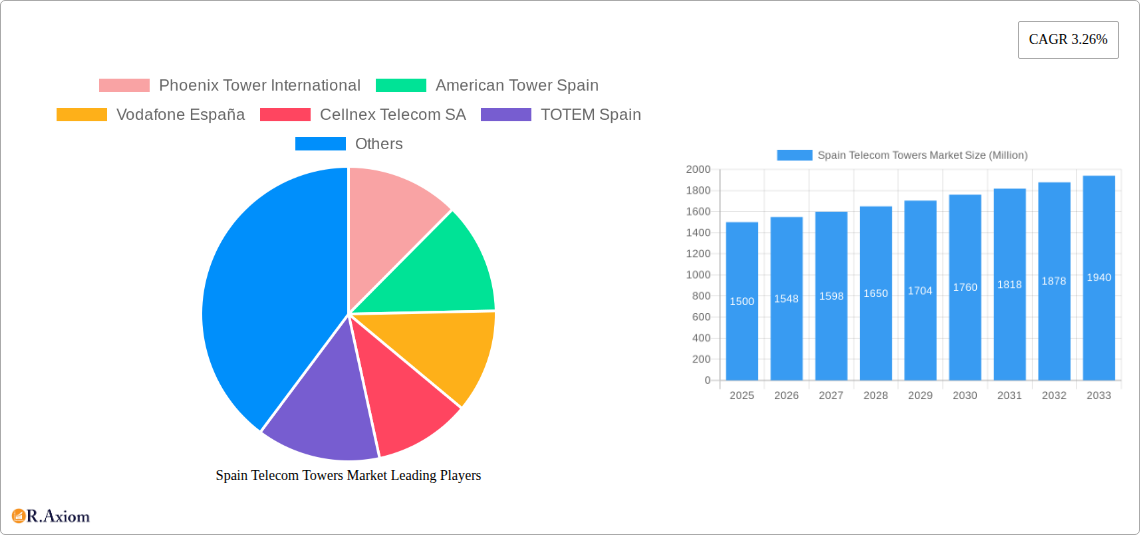

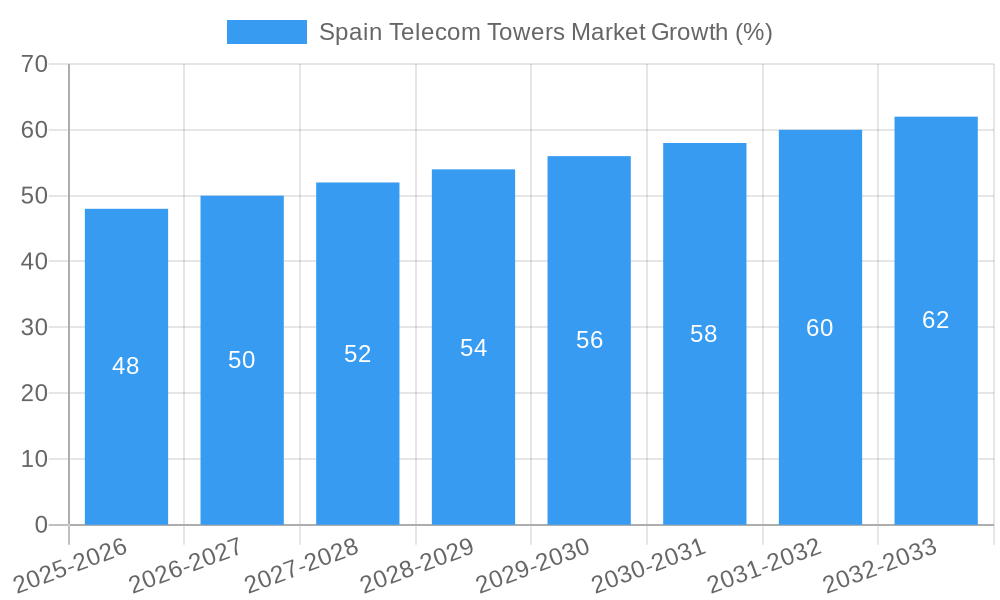

The Spain Telecom Towers market, valued at approximately €1.5 billion in 2025, is projected to experience steady growth, driven by the increasing demand for enhanced mobile broadband services and the expansion of 5G networks across the country. This growth is further fueled by the rising adoption of mobile devices and the consequent surge in data consumption. Key players like Phoenix Tower International, American Tower Spain, and Cellnex Telecom SA are actively investing in infrastructure upgrades and expansions to meet this growing demand, leading to a competitive yet dynamic market landscape. The market's Compound Annual Growth Rate (CAGR) of 3.26% from 2025 to 2033 indicates a consistent, albeit moderate, expansion. This relatively conservative growth rate may be attributed to factors such as economic conditions and regulatory frameworks within Spain's telecommunications sector. However, the increasing focus on network densification and small cell deployments is expected to stimulate growth, particularly in densely populated urban areas. The segmentation of the market likely includes various tower types (macrocells, small cells, etc.), ownership structures (independent, operator-owned), and geographic regions within Spain. Analyzing these segments reveals specific growth opportunities and challenges for different market participants.

The forecast period (2025-2033) anticipates a continued upward trajectory for the Spain Telecom Towers market, influenced by evolving technological advancements, such as the deployment of private 5G networks for industrial applications and the increased use of IoT devices. However, potential restraints could include the high capital expenditure required for infrastructure development and the ongoing challenges associated with securing necessary permits and approvals. A detailed regional analysis would provide granular insights into market performance across different Spanish regions, reflecting varying levels of digital penetration and population density. The competitive landscape is shaped by both major international tower companies and local operators, each vying for market share through strategic acquisitions, partnerships, and innovative solutions. This competitive intensity is likely to drive efficiency improvements and the development of innovative business models within the sector.

Spain Telecom Towers Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Spain Telecom Towers Market, covering the period 2019-2033. It offers invaluable insights for industry stakeholders, investors, and strategic decision-makers seeking to understand market dynamics, growth opportunities, and competitive landscapes. The report incorporates extensive data analysis, market forecasts, and expert insights, delivering actionable intelligence to navigate the evolving telecom infrastructure landscape in Spain.

Spain Telecom Towers Market Market Concentration & Innovation

The Spanish telecom towers market exhibits a moderately concentrated structure, with a few major players dominating the landscape. Cellnex Telecom SA and American Tower Spain hold significant market share, followed by others such as Vodafone España, Telefónica, and Totem Spain. The precise market share distribution varies across regions and segments. Mergers and acquisitions (M&A) activity have played a crucial role in shaping market concentration, with deal values ranging from xx Million to xx Million in recent years.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx, indicating a moderately concentrated market.

- Innovation Drivers: The demand for 5G infrastructure, densification of networks, and the need for improved network coverage are driving innovation. This includes advancements in tower technology, such as the deployment of taller towers and the use of small cells.

- Regulatory Framework: The regulatory environment in Spain impacts the market, influencing the licensing, deployment, and operation of telecom towers. Changes in regulations can create both opportunities and challenges for market players.

- Product Substitutes: While traditional macro towers remain dominant, alternatives like small cells and distributed antenna systems (DAS) are emerging as substitutes in specific applications.

- End-User Trends: The increasing demand for high-speed data and mobile broadband services is driving the growth of the telecom towers market. The rising adoption of IoT devices and smart city initiatives further accelerates this growth.

- M&A Activities: Consolidation is a major trend in the market, with larger players acquiring smaller companies to expand their footprint and gain access to new technologies. Recent M&A deals have resulted in significant changes in market share distribution.

Spain Telecom Towers Market Industry Trends & Insights

The Spain Telecom Towers Market is experiencing robust growth driven by several key factors. The rising demand for mobile broadband services, fueled by the proliferation of smartphones and the growing adoption of data-intensive applications, is a major growth driver. The nationwide rollout of 5G networks is significantly accelerating tower infrastructure development. The government's initiatives to improve digital infrastructure also contribute to the market's expansion. The market is witnessing a shift towards colocation, with multiple operators sharing tower infrastructure to reduce costs and improve efficiency. This trend leads to increased tower utilization rates and optimizes network deployment strategies. Competitive dynamics are intense, with existing players constantly striving to improve their service offerings, expand their network coverage, and secure new contracts. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%. Market penetration of 5G towers is expected to reach xx% by 2033.

Dominant Markets & Segments in Spain Telecom Towers Market

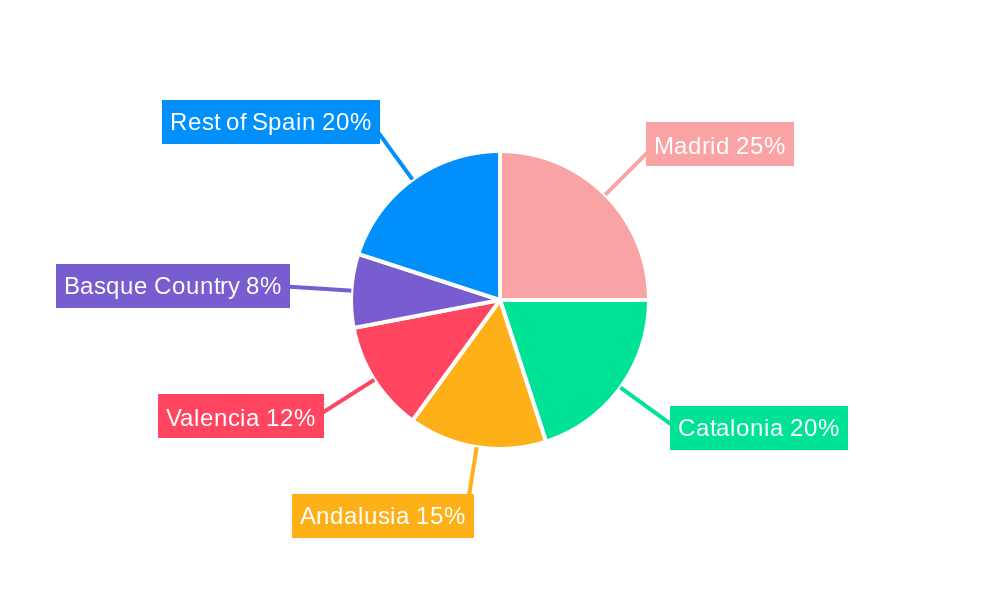

The major metropolitan areas of Spain, including Madrid and Barcelona, represent the most dominant segments of the telecom tower market. These areas demonstrate higher population density and consequently higher demand for network coverage. The strong economic activity and the concentration of businesses and industries in these regions further drive the demand for reliable and high-capacity telecom infrastructure.

- Key Drivers for Dominant Markets:

- High Population Density: Major cities have high population density, creating the need for extensive network infrastructure.

- Robust Economic Activity: Strong economic activity fuels investments in telecommunication infrastructure.

- Government Initiatives: Government support for digital infrastructure development provides incentives for building out networks.

- Advanced Infrastructure: Existing infrastructure facilitates the deployment and upgrade of telecom networks.

The detailed dominance analysis reveals that Madrid and Barcelona account for approximately xx% of the overall market share. The ongoing investments in network upgrades and expansion in these regions, alongside the burgeoning adoption of 5G technology, continue to solidify their leading position. Other significant regions include Valencia, Seville, and Málaga, although their market shares remain considerably smaller than Madrid and Barcelona.

Spain Telecom Towers Market Product Developments

Recent product innovations focus on enhancing tower capacity and efficiency. This includes the implementation of intelligent power management systems, which optimize energy consumption and reduce operational costs. The adoption of advanced materials and designs leads to improved tower strength and durability. Moreover, the integration of fiber optic cables within towers supports high-bandwidth connectivity and seamless data transmission. These developments align with the increasing demand for high-speed data services and the ongoing expansion of 5G networks. The improved market fit is evident in the growing number of tower deployments across Spain.

Report Scope & Segmentation Analysis

This report segments the Spain Telecom Towers Market based on several factors:

By Tower Type: Macro towers, small cells, rooftop towers, and other tower types. Each segment shows varied growth projections influenced by factors like deployment costs, network requirements, and geographical limitations.

By Operator Type: MNOs (Mobile Network Operators), MVNOs (Mobile Virtual Network Operators), and other operators. This segmentation reveals the diverse competitive dynamics impacting market shares and investment patterns within the industry.

By Region: The report provides a granular analysis of major regions in Spain, offering regional-specific market sizes, growth projections, and competitive landscapes. This regional breakdown allows for a better understanding of market disparities and helps strategic planning by operators.

Key Drivers of Spain Telecom Towers Market Growth

Several factors fuel the growth of the Spain Telecom Towers Market. Firstly, the rising demand for high-speed mobile data services, driven by the proliferation of smartphones and data-intensive applications, necessitates enhanced network infrastructure. Secondly, the government’s initiatives to promote digitalization and expand broadband connectivity, including 5G rollout, are key drivers. Thirdly, the increasing adoption of Internet of Things (IoT) devices and applications further expands the demand for robust telecommunication networks. Finally, the ongoing consolidation and M&A activity among telecom operators create opportunities for growth in the sector.

Challenges in the Spain Telecom Towers Market Sector

The Spanish telecom towers market faces several challenges. Regulatory hurdles, including permitting and licensing processes, can delay tower construction and deployment. Supply chain disruptions, particularly related to sourcing raw materials, can impact project timelines and costs. Furthermore, the intense competition among tower operators can create pricing pressures and limit profitability. The increasing operational expenses associated with maintaining and upgrading the tower infrastructure also pose a significant challenge.

Emerging Opportunities in Spain Telecom Towers Market

Several emerging opportunities exist for the Spanish telecom towers market. The expanding 5G network rollout presents significant opportunities for tower infrastructure development. The integration of private 5G networks in diverse industries, such as manufacturing and logistics, creates new demand for specialized tower solutions. The increasing adoption of small cells and other densification technologies expands the scope of tower deployments. Furthermore, the opportunities associated with IoT and smart city initiatives provide substantial growth potential.

Leading Players in the Spain Telecom Towers Market Market

- Phoenix Tower International

- American Tower Spain

- Vodafone España

- Cellnex Telecom SA

- Totem Spain

- Orange SA

- Vantage Towers

- Telefónic

Key Developments in Spain Telecom Towers Market Industry

- June 2024: Telefónica (Movistar) deployed high-performance 5G in the 3.5 GHz band across over 1,000 municipalities, significantly expanding 5G coverage nationwide. This development boosts demand for supporting tower infrastructure.

- May 2024: O2 (Movistar) launched 5G Standalone (5G SA) services in multiple cities, signaling further investment in 5G network capabilities and associated tower infrastructure.

Strategic Outlook for Spain Telecom Towers Market Market

The Spain Telecom Towers Market presents significant growth potential driven by the ongoing 5G rollout, increasing demand for mobile data services, and government initiatives promoting digitalization. The strategic focus should be on capitalizing on the opportunities presented by the expanding 5G network, investing in advanced tower technologies, and exploring partnerships to optimize resource utilization and network deployment. The future market potential is substantial, with continued growth projected across various segments due to the increasing need for reliable and high-capacity telecommunications infrastructure.

Spain Telecom Towers Market Segmentation

-

1. Ownership

- 1.1. Operator-owned

- 1.2. Private-owned

- 1.3. MNO Captive sites

-

2. Installation

- 2.1. Rooftop

- 2.2. Ground-based

-

3. Fuel Type

- 3.1. Renewable

- 3.2. Non-renewable

Spain Telecom Towers Market Segmentation By Geography

- 1. Spain

Spain Telecom Towers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.26% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Connecting/Improving Connectivity to Rural Areas5.1.2 5G deployments are a major catalyst for growth in the cell-tower leasing environment; Improving and Catering to Increasing Data Needs

- 3.3. Market Restrains

- 3.3.1. Connecting/Improving Connectivity to Rural Areas5.1.2 5G deployments are a major catalyst for growth in the cell-tower leasing environment; Improving and Catering to Increasing Data Needs

- 3.4. Market Trends

- 3.4.1. 5G Deployments Are a Major Catalyst for Growth in the Cell-tower Leasing Environment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Telecom Towers Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 5.1.1. Operator-owned

- 5.1.2. Private-owned

- 5.1.3. MNO Captive sites

- 5.2. Market Analysis, Insights and Forecast - by Installation

- 5.2.1. Rooftop

- 5.2.2. Ground-based

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Renewable

- 5.3.2. Non-renewable

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Phoenix Tower International

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 American Tower Spain

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vodafone España

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cellnex Telecom SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TOTEM Spain

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Orange SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vantage Towers

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Telefónic

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Phoenix Tower International

List of Figures

- Figure 1: Spain Telecom Towers Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Spain Telecom Towers Market Share (%) by Company 2024

List of Tables

- Table 1: Spain Telecom Towers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Spain Telecom Towers Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 3: Spain Telecom Towers Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 4: Spain Telecom Towers Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 5: Spain Telecom Towers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Spain Telecom Towers Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 7: Spain Telecom Towers Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 8: Spain Telecom Towers Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 9: Spain Telecom Towers Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Telecom Towers Market?

The projected CAGR is approximately 3.26%.

2. Which companies are prominent players in the Spain Telecom Towers Market?

Key companies in the market include Phoenix Tower International, American Tower Spain, Vodafone España, Cellnex Telecom SA, TOTEM Spain, Orange SA, Vantage Towers, Telefónic.

3. What are the main segments of the Spain Telecom Towers Market?

The market segments include Ownership, Installation, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Connecting/Improving Connectivity to Rural Areas5.1.2 5G deployments are a major catalyst for growth in the cell-tower leasing environment; Improving and Catering to Increasing Data Needs.

6. What are the notable trends driving market growth?

5G Deployments Are a Major Catalyst for Growth in the Cell-tower Leasing Environment.

7. Are there any restraints impacting market growth?

Connecting/Improving Connectivity to Rural Areas5.1.2 5G deployments are a major catalyst for growth in the cell-tower leasing environment; Improving and Catering to Increasing Data Needs.

8. Can you provide examples of recent developments in the market?

June 2024: Spanish telecommunications operator Telefónica, operating under the Movistar brand, successfully deployed high-performance 5G in the 3.5 GHz band across more than 1,000 municipalities in Spain. The carrier announced that this spectrum allowed it to deploy 5G technology across nearly all of Spain, encompassing both rural and urban regions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Telecom Towers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Telecom Towers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Telecom Towers Market?

To stay informed about further developments, trends, and reports in the Spain Telecom Towers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence