Key Insights

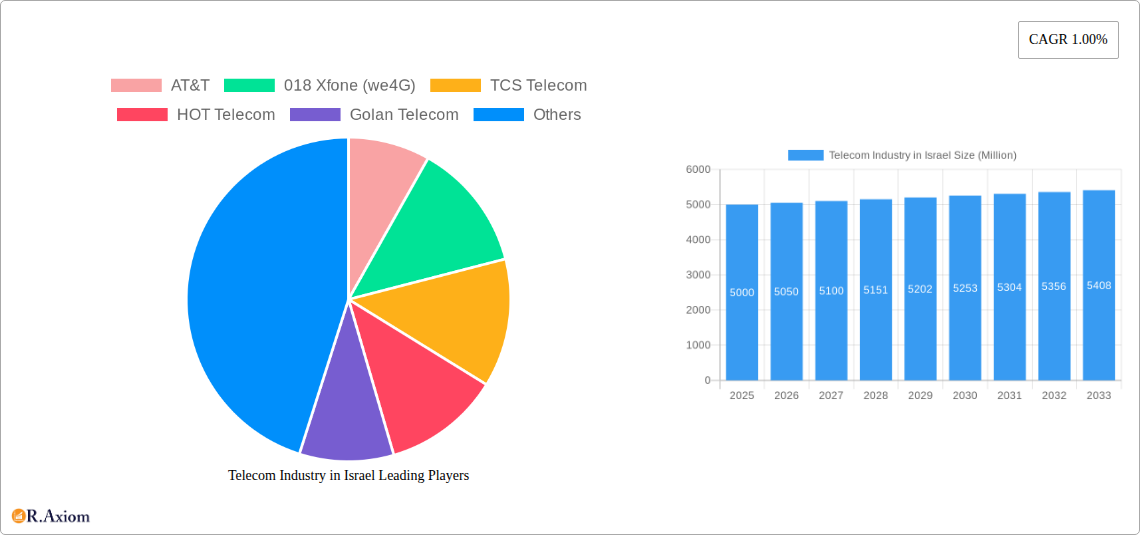

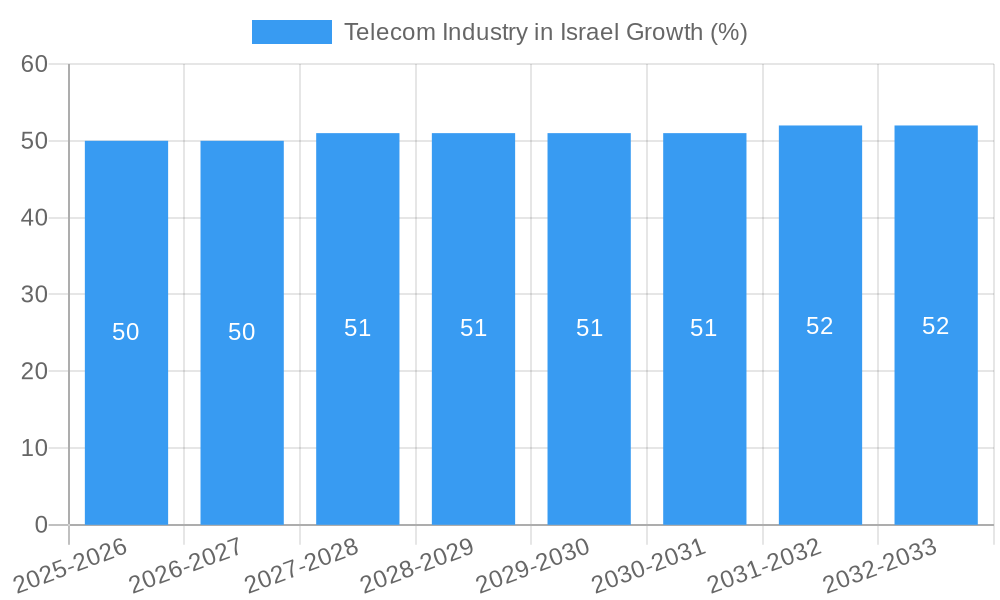

The Israeli telecommunications market, valued at approximately $X billion in 2025 (assuming a logical value based on similar-sized markets and the provided CAGR), is projected to experience modest growth with a Compound Annual Growth Rate (CAGR) of 1.00% from 2025 to 2033. This relatively low growth rate reflects a mature market characterized by high penetration rates for mobile and fixed-line services. Key drivers include the increasing demand for high-speed data services fueled by the rise of streaming, cloud computing, and the Internet of Things (IoT). The market is segmented into Voice Services, Wireless Data and Messaging Services (including internet and handset data packages, and package discounts), and OTT and PayTV Services. Competitive pressures among major players like AT&T, 018 Xfone, TCS Telecom, HOT Telecom, Golan Telecom, Orange, Pelephone, Telefonica, Cellcom, and Bezeq are intense, leading to price wars and ongoing innovation in service offerings. Growth will likely be driven by advancements in 5G technology, the expansion of fiber-optic infrastructure, and the increasing adoption of bundled services. However, regulatory constraints and economic factors could temper growth in the forecast period.

The market's evolution will likely see a continued shift toward data-centric services, with a decline in traditional voice revenue. The rise of Over-The-Top (OTT) providers poses a significant challenge to traditional telecom operators, necessitating strategic partnerships and investments in new technologies to maintain market share. The increasing demand for superior customer experience and personalized services will be crucial differentiators in this competitive landscape. The market's relative stability, coupled with a focus on technological advancements and service innovation, will likely determine the extent of future growth, with the potential for accelerated growth driven by 5G rollout and associated applications. The strategic decisions made by major players regarding investments in infrastructure, service offerings, and customer relationship management will heavily influence the market trajectory in the coming years.

Telecom Industry in Israel: Market Analysis & Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the Israeli Telecom industry, covering the period 2019-2033, with a focus on market dynamics, key players, and future growth prospects. The report leverages extensive primary and secondary research, offering actionable insights for industry stakeholders, investors, and strategic decision-makers. We forecast a market value of xx Million by 2033.

Telecom Industry in Israel Market Concentration & Innovation

The Israeli telecom market exhibits a moderate level of concentration, with several major players dominating the landscape. Bezeq, Cellcom, and Pelephone hold significant market share in various segments. However, the presence of smaller, more agile competitors like Golan Telecom and HOT Telecom fosters innovation and competitive pricing. The market is characterized by a strong regulatory framework set by the Ministry of Communications (MoC), which influences infrastructure sharing, spectrum allocation, and pricing policies. Substitutes, such as VoIP services and OTT platforms, exert pressure on traditional voice and messaging services. Consumer trends favor data-intensive services, driving investment in network infrastructure upgrades. M&A activity has been moderate in recent years, with deals primarily focusing on infrastructure sharing and expanding network coverage, such as the August 2022 deal between Pelephone and PHI Networks. The total value of M&A deals in the period 2019-2024 is estimated at xx Million.

- Market Share (Estimated 2025): Bezeq (xx%), Cellcom (xx%), Pelephone (xx%), HOT Telecom (xx%), Others (xx%).

- M&A Deal Values (2019-2024): xx Million (Estimated).

- Key Innovation Drivers: 5G deployment, cloud-based services, IoT adoption, and digital transformation initiatives.

Telecom Industry in Israel Industry Trends & Insights

The Israeli telecom market demonstrates consistent growth, driven by increasing smartphone penetration, rising demand for data services, and the expansion of broadband internet access. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected at xx%, fueled by the growing adoption of 5G technology and the proliferation of smart devices. Technological disruptions, such as the rise of OTT platforms and cloud-based services, present both challenges and opportunities for incumbents. Consumer preferences are shifting towards bundled packages, flexible contracts, and value-added services. Competitive dynamics are intense, with operators focusing on network quality, customer service, and innovative pricing strategies to gain market share. Market penetration of mobile broadband services is approaching saturation, with ongoing focus shifting to the quality and speed of existing coverage.

Dominant Markets & Segments in Telecom Industry in Israel

The Israeli telecom market is largely dominated by the mobile and fixed-line services segments.

Wireless: Data and Messaging Services: This segment is the largest and fastest-growing, driven by the increasing demand for high-speed mobile internet, and social media. Key drivers include:

- High smartphone penetration rates

- Expanding 4G and 5G coverage

- Growing demand for data-intensive applications.

Voice Services: While declining in terms of revenue, voice services still form a significant part of the market, particularly for fixed-line services.

- Strong regulatory frameworks promoting competition and affordability.

OTT and Pay TV Services: This segment is experiencing rapid growth, with increasing competition from global and local players. Key drivers include:

- Rising disposable income

- Growing demand for on-demand entertainment

- Advances in streaming technology.

Telecom Industry in Israel Product Developments

Recent product innovations focus on enhancing data speeds and expanding service offerings. Operators are investing heavily in 5G infrastructure, launching innovative data packages tailored to individual user needs, and providing value-added services such as cloud storage and cybersecurity solutions. Competition is driving the development of attractive bundled packages combining fixed-line and mobile services, along with OTT and Pay TV offerings. These developments emphasize the ongoing quest for market fit by emphasizing customer experience and tailoring to individual needs.

Report Scope & Segmentation Analysis

This report segments the Israeli telecom market by service type: Voice Services, Wireless Data and Messaging Services (including internet and handset data packages and package discounts), and OTT and Pay TV Services. Growth projections are provided for each segment based on historical data and current market trends. Market sizes are estimated for the base year (2025) and forecasted for the period 2025-2033. The competitive dynamics within each segment are analyzed, highlighting key players and their strategies.

Key Drivers of Telecom Industry in Israel Growth

The growth of the Israeli telecom industry is primarily driven by several factors: rising smartphone penetration, increasing demand for data-intensive services (driven by factors such as high internet usage rates and the popularity of streaming services), government investments in infrastructure development (including the ongoing rollout of 5G networks), and a dynamic regulatory environment that encourages competition and innovation. The strong digital economy in Israel is also a major catalyst for growth.

Challenges in the Telecom Industry in Israel Sector

The Israeli telecom sector faces challenges such as intense competition leading to price pressures, high infrastructure investment costs, the need for continuous technological upgrades to maintain market competitiveness, and regulatory requirements that demand continued adaptation. Furthermore, securing spectrum licenses and navigating complex regulatory processes can present difficulties. These combined factors affect profitability and margins.

Emerging Opportunities in Telecom Industry in Israel

Emerging opportunities include the expansion of 5G networks, growth in IoT applications, increasing adoption of cloud-based services, the rising demand for cybersecurity solutions, and the potential for the development of new value-added services in the rapidly evolving digital landscape. These developments hold promising growth potential for telecom operators in Israel.

Leading Players in the Telecom Industry in Israel Market

- AT&T

- 018 Xfone (we4G)

- TCS Telecom

- HOT Telecom

- Golan Telecom

- Orange

- Pelephone

- Telefonica

- Cellcom

- Bezeq

Key Developments in Telecom Industry in Israel Industry

- July 2022: CYTA's participation in the USD 850 Million East Med Corridor (EMC) submarine cable system, boosting Israel's international connectivity.

- August 2022: The MoC's approval of passive infrastructure cooperation deals between Pelephone and PHI Networks and the subsequent joint venture between Partner Communications and HOT Mobile, signifying increased collaboration and efficiency in network infrastructure.

Strategic Outlook for Telecom Industry in Israel Market

The future of the Israeli telecom market is bright, driven by continuous technological advancements, increasing demand for data services, and government support for infrastructure development. Opportunities exist in expanding 5G coverage, developing innovative data packages, and providing value-added services to meet the growing needs of consumers and businesses. Further M&A activity is likely, with a focus on infrastructure consolidation and service diversification. The focus on strategic partnerships and investments in emerging technologies will be crucial for achieving sustained growth and maintaining competitiveness in the dynamic market.

Telecom Industry in Israel Segmentation

-

1. Services

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

Telecom Industry in Israel Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Telecom Industry in Israel REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising demand for 5G; Growth of IoT usage in Telecom

- 3.3. Market Restrains

- 3.3.1. Lack of Human Expertise and Empathy; Nascency of the Technology

- 3.4. Market Trends

- 3.4.1. Rising demand for fixed broadband services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Telecom Industry in Israel Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. North America Telecom Industry in Israel Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Services

- 6.1.1. Voice Services

- 6.1.1.1. Wired

- 6.1.1.2. Wireless

- 6.1.2. Data and

- 6.1.3. OTT and PayTV Services

- 6.1.1. Voice Services

- 6.1. Market Analysis, Insights and Forecast - by Services

- 7. South America Telecom Industry in Israel Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Services

- 7.1.1. Voice Services

- 7.1.1.1. Wired

- 7.1.1.2. Wireless

- 7.1.2. Data and

- 7.1.3. OTT and PayTV Services

- 7.1.1. Voice Services

- 7.1. Market Analysis, Insights and Forecast - by Services

- 8. Europe Telecom Industry in Israel Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Services

- 8.1.1. Voice Services

- 8.1.1.1. Wired

- 8.1.1.2. Wireless

- 8.1.2. Data and

- 8.1.3. OTT and PayTV Services

- 8.1.1. Voice Services

- 8.1. Market Analysis, Insights and Forecast - by Services

- 9. Middle East & Africa Telecom Industry in Israel Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Services

- 9.1.1. Voice Services

- 9.1.1.1. Wired

- 9.1.1.2. Wireless

- 9.1.2. Data and

- 9.1.3. OTT and PayTV Services

- 9.1.1. Voice Services

- 9.1. Market Analysis, Insights and Forecast - by Services

- 10. Asia Pacific Telecom Industry in Israel Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Services

- 10.1.1. Voice Services

- 10.1.1.1. Wired

- 10.1.1.2. Wireless

- 10.1.2. Data and

- 10.1.3. OTT and PayTV Services

- 10.1.1. Voice Services

- 10.1. Market Analysis, Insights and Forecast - by Services

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 AT&T

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 018 Xfone (we4G)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 TCS Telecom

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HOT Telecom

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Golan Telecom

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Orange

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pelephone

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Telefonica

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cellcom

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bezeq

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 AT&T

List of Figures

- Figure 1: Global Telecom Industry in Israel Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Israel Telecom Industry in Israel Revenue (Million), by Country 2024 & 2032

- Figure 3: Israel Telecom Industry in Israel Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Telecom Industry in Israel Revenue (Million), by Services 2024 & 2032

- Figure 5: North America Telecom Industry in Israel Revenue Share (%), by Services 2024 & 2032

- Figure 6: North America Telecom Industry in Israel Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Telecom Industry in Israel Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Telecom Industry in Israel Revenue (Million), by Services 2024 & 2032

- Figure 9: South America Telecom Industry in Israel Revenue Share (%), by Services 2024 & 2032

- Figure 10: South America Telecom Industry in Israel Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Telecom Industry in Israel Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe Telecom Industry in Israel Revenue (Million), by Services 2024 & 2032

- Figure 13: Europe Telecom Industry in Israel Revenue Share (%), by Services 2024 & 2032

- Figure 14: Europe Telecom Industry in Israel Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe Telecom Industry in Israel Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa Telecom Industry in Israel Revenue (Million), by Services 2024 & 2032

- Figure 17: Middle East & Africa Telecom Industry in Israel Revenue Share (%), by Services 2024 & 2032

- Figure 18: Middle East & Africa Telecom Industry in Israel Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa Telecom Industry in Israel Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Telecom Industry in Israel Revenue (Million), by Services 2024 & 2032

- Figure 21: Asia Pacific Telecom Industry in Israel Revenue Share (%), by Services 2024 & 2032

- Figure 22: Asia Pacific Telecom Industry in Israel Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Telecom Industry in Israel Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Telecom Industry in Israel Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Telecom Industry in Israel Revenue Million Forecast, by Services 2019 & 2032

- Table 3: Global Telecom Industry in Israel Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Telecom Industry in Israel Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Global Telecom Industry in Israel Revenue Million Forecast, by Services 2019 & 2032

- Table 6: Global Telecom Industry in Israel Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Telecom Industry in Israel Revenue Million Forecast, by Services 2019 & 2032

- Table 11: Global Telecom Industry in Israel Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of South America Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Telecom Industry in Israel Revenue Million Forecast, by Services 2019 & 2032

- Table 16: Global Telecom Industry in Israel Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United Kingdom Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: France Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Spain Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Russia Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Benelux Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Nordics Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Telecom Industry in Israel Revenue Million Forecast, by Services 2019 & 2032

- Table 27: Global Telecom Industry in Israel Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Turkey Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Israel Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: GCC Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: North Africa Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: South Africa Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Middle East & Africa Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Telecom Industry in Israel Revenue Million Forecast, by Services 2019 & 2032

- Table 35: Global Telecom Industry in Israel Revenue Million Forecast, by Country 2019 & 2032

- Table 36: China Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: India Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Japan Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: South Korea Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: ASEAN Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Oceania Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Asia Pacific Telecom Industry in Israel Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Telecom Industry in Israel?

The projected CAGR is approximately 1.00%.

2. Which companies are prominent players in the Telecom Industry in Israel?

Key companies in the market include AT&T, 018 Xfone (we4G), TCS Telecom, HOT Telecom, Golan Telecom, Orange, Pelephone, Telefonica, Cellcom, Bezeq.

3. What are the main segments of the Telecom Industry in Israel?

The market segments include Services.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising demand for 5G; Growth of IoT usage in Telecom.

6. What are the notable trends driving market growth?

Rising demand for fixed broadband services.

7. Are there any restraints impacting market growth?

Lack of Human Expertise and Empathy; Nascency of the Technology.

8. Can you provide examples of recent developments in the market?

August 2022: The Ministry of Communications (MoC) approved a passive infrastructure cooperation deal between the cellco, Pelephone, and PHI Networks. Later, it would begin the joint venture partnership between Partner Communications and HOT Mobile. This deal aimed to expand its passive infrastructure cooperation at cell sites.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Telecom Industry in Israel," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Telecom Industry in Israel report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Telecom Industry in Israel?

To stay informed about further developments, trends, and reports in the Telecom Industry in Israel, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence