Key Insights

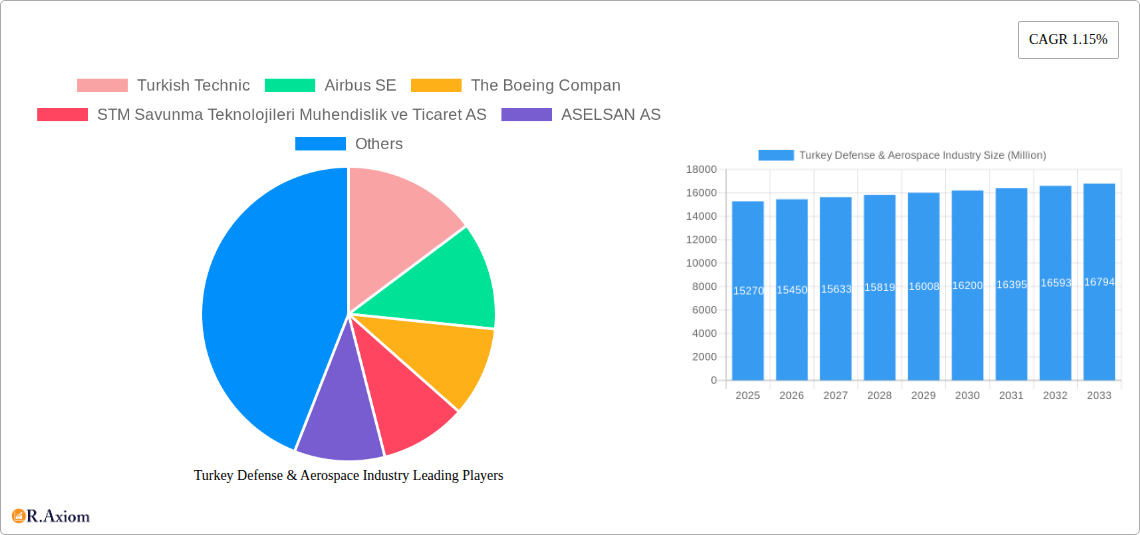

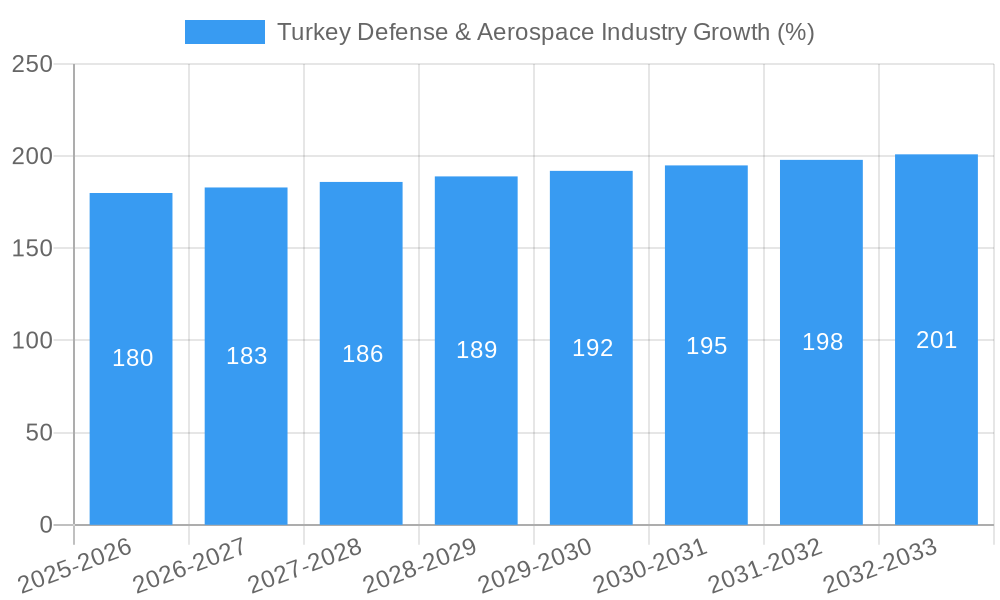

The Turkish defense and aerospace industry, valued at $15.27 billion in 2025, is poised for moderate growth, exhibiting a Compound Annual Growth Rate (CAGR) of 1.15% from 2025 to 2033. This growth is driven by several factors. Firstly, Turkey's strategic geopolitical location and increasing national security concerns necessitate significant investment in defense capabilities. This fuels demand for domestically produced defense systems and contributes to the expansion of the aerospace sector, particularly in areas like unmanned aerial vehicles (UAVs) and advanced weapon systems. Secondly, the Turkish government actively promotes indigenous technological development and manufacturing within the defense industry, fostering a robust domestic supply chain. This initiative supports the growth of key players like Turkish Technic, ASELSAN, and ROKETSAN, stimulating innovation and competition. However, global economic fluctuations and potential shifts in regional geopolitical dynamics present challenges. Economic downturns could impact government spending on defense, while regional instability could influence investment priorities. The industry's segmentation into manufacturing, design & engineering, and maintenance, repair, and overhaul (MRO), along with aerospace and defense sub-sectors, provides a diversified landscape that allows for varied growth opportunities. The continued emphasis on technological advancement and collaborations with international partners will be crucial for navigating these challenges and achieving sustainable growth.

The market segmentation further reveals a strong focus on domestic capabilities. While collaborations with international giants like Airbus and Boeing exist for technology transfer and access to global markets, the emphasis remains firmly on fostering domestic technological prowess. The involvement of companies like FNSS Savunma Sistemleri (focused on land systems) and HAVELSAN (specializing in software and systems) highlights a strategic move towards self-reliance in critical defense technologies. The long-term forecast indicates continued, albeit gradual, growth fueled by ongoing modernization efforts, the need for robust cybersecurity infrastructure within the defense sector, and consistent government support for research and development in this vital industry. The Turkish defense and aerospace industry represents a compelling blend of national ambition and strategic partnerships, positioning it for continued expansion in the coming years.

This comprehensive report provides an in-depth analysis of the Turkey Defense & Aerospace Industry, covering market size, growth drivers, competitive landscape, and future outlook from 2019 to 2033. The report leverages extensive primary and secondary research to offer actionable insights for industry stakeholders, including manufacturers, suppliers, investors, and government agencies. The study period spans from 2019-2024 (Historical Period), with 2025 as the Base Year and Estimated Year, and forecasts extending to 2033 (Forecast Period: 2025-2033).

Turkey Defense & Aerospace Industry Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory landscape, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities within the Turkish defense and aerospace industry. The Turkish defense industry demonstrates a mix of large, established players and emerging smaller companies. Market share is concentrated among a few key players, particularly in certain segments like aerospace manufacturing. However, a vibrant ecosystem of SMEs contributes significantly to innovation and specialization.

- Market Concentration: The top 5 players account for approximately xx% of the total market value in 2025 (estimated). This concentration is influenced by government contracts and a push for domestic production.

- Innovation Drivers: Government investment in R&D, a focus on technological self-sufficiency, and the increasing demand for advanced defense systems drive innovation. Collaboration with international partners also plays a significant role.

- Regulatory Framework: The Turkish government actively shapes the industry through regulations, procurement policies, and strategic partnerships. These policies both encourage domestic production and collaboration with foreign companies.

- Product Substitutes: While direct substitutes are limited, the industry faces indirect competition from alternative technologies and solutions. For example, the emergence of drone technology impacts traditional air defense procurement.

- End-User Trends: The Turkish Armed Forces' modernization drive and the increasing need for advanced technological capabilities are key end-user trends shaping market growth. Export opportunities also represent a significant growth driver.

- M&A Activities: The value of M&A deals in the Turkish defense and aerospace industry totalled approximately xx Million in the period 2019-2024. Consolidation is expected to continue, driven by the need for economies of scale and access to advanced technologies.

Turkey Defense & Aerospace Industry Industry Trends & Insights

The Turkey defense and aerospace industry is experiencing significant growth, driven by several key factors. A strong emphasis on domestic production, government investment in R&D, and modernization initiatives within the Turkish Armed Forces are fundamental growth drivers. Technological advancements, particularly in areas like UAVs, air defense systems, and aerospace manufacturing, significantly impact the industry's trajectory.

The Compound Annual Growth Rate (CAGR) for the industry is projected to be xx% during the forecast period (2025-2033), with market penetration steadily increasing across various segments. The growing importance of technological self-sufficiency and the country’s strategic geopolitical position contribute to this upward trend. Competitive dynamics are intense, with both domestic and international companies vying for market share. Consumer preferences, primarily driven by the Turkish Armed Forces, focus on advanced capabilities, affordability, and technological sophistication.

Dominant Markets & Segments in Turkey Defense & Aerospace Industry

The Turkish defense and aerospace industry is characterized by a strong domestic focus, with significant growth seen across both aerospace and defense segments. Manufacturing, design, and engineering represent a substantial portion of the industry's activities, underpinned by the government's push for self-reliance.

Dominant Segments:

Industry:

- Manufacturing, Design, and Engineering: This segment holds a dominant position, driven by significant government investments, a focus on indigenous capabilities, and export potential. Key drivers include government support through funding, incentives, and policy, a skilled workforce, and an increasingly robust supply chain.

- Maintenance, Repair, & Overhaul (MRO): This segment is experiencing substantial growth due to the increasing age of existing military equipment and a growing commercial aviation sector. Key drivers include increasing operational hours of military aircraft and an expanding commercial fleet in Turkey.

Type:

- Aerospace: Significant growth is observed in areas like UAV development, aircraft manufacturing (through partnerships and domestic capabilities), and related technologies. Key drivers include the rising demand for technologically advanced aircraft and the government's efforts to build a domestic aerospace industry.

- Defense: This segment shows continued growth, stimulated by the modernization of the Turkish Armed Forces and increasing demand for sophisticated defense systems, particularly air defense systems and ground-based combat systems. Key drivers include the expanding military budget and the government's increased focus on domestic production of military hardware.

The Ankara and Istanbul regions are major hubs for this industry, benefiting from well-established infrastructure, skilled labor, and proximity to government agencies.

Turkey Defense & Aerospace Industry Product Developments

Recent product innovations demonstrate a clear emphasis on technological advancement and meeting specific operational needs. The development of the Sungur air defense missile system by Roketsan exemplifies this trend. This system, designed to counter UAVs, jets, and helicopters, highlights the focus on indigenous technological capabilities. The ongoing development and refinement of unmanned aerial vehicles (UAVs) represent another key area of innovation, positioning Turkey as a notable player in this global technology domain. These developments leverage cutting-edge technologies and cater to both military and civilian applications.

Report Scope & Segmentation Analysis

This report segments the Turkish Defense & Aerospace Industry based on:

Industry:

- Manufacturing, Design, and Engineering: This segment is projected to experience a CAGR of xx% during the forecast period (2025-2033). Competitive dynamics are characterized by both domestic and international players.

- Maintenance, Repair, & Overhaul (MRO): This segment is forecast to grow at a CAGR of xx%, driven by the expansion of the commercial and military fleets. Competition is intensifying amongst specialized MRO providers.

Type:

- Aerospace: The Aerospace segment is projected to achieve a CAGR of xx% due to government investment in the sector. Competition is driven by technological advancements and international collaborations.

- Defense: The defense segment is anticipated to have a CAGR of xx% fueled by government spending on military modernization. Competition is characterized by intense rivalry among domestic and international defense contractors.

Key Drivers of Turkey Defense & Aerospace Industry Growth

Several factors fuel the growth of Turkey's defense and aerospace sector:

- Government Investments: Significant government investment in R&D and infrastructure is a cornerstone of this growth.

- Technological Advancements: Continuous innovation in areas such as UAVs and missile technology drive market expansion.

- Modernization of Armed Forces: The Turkish Armed Forces’ modernization drive creates substantial demand for new equipment and technologies.

- Geopolitical Factors: Turkey’s geopolitical position and its role in regional security contribute to the demand for advanced defense capabilities.

Challenges in the Turkey Defense & Aerospace Industry Sector

The industry faces several challenges:

- Supply Chain Disruptions: Global supply chain issues can impact the availability of components and materials, impacting production schedules.

- Technological Dependence: Dependence on foreign technologies in certain areas limits the country's self-reliance.

- Intense Competition: Competition from both domestic and international companies is fierce.

- Economic Fluctuations: Economic downturns can negatively impact government spending on defense and aerospace projects.

Emerging Opportunities in Turkey Defense & Aerospace Industry

The Turkish defense and aerospace industry is brimming with opportunities:

- Export Market Expansion: Growing export potential for Turkish-made defense and aerospace products presents significant opportunity.

- Technological Specialization: Focusing on niche technologies and developing specialized expertise offers a path to competitiveness.

- Private Sector Participation: Increased private sector involvement can accelerate innovation and drive growth.

- International Collaborations: Partnerships with international companies can boost technological capabilities and market access.

Leading Players in the Turkey Defense & Aerospace Industry Market

- Turkish Technic

- Airbus SE

- The Boeing Company

- STM Savunma Teknolojileri Muhendislik ve Ticaret AS

- ASELSAN AS

- FNSS Savunma Sistemleri AS

- KOC Holding AS

- HAVELSAN AS

- Mechanical and Chemical Industry Company (MKEK)

- TUSAS (Turkish Aerospace Industries)

- ROKETSAN AS

- BMC Otomotiv Sanayi ve Ticaret AS

Key Developments in Turkey Defense & Aerospace Industry Industry

- September 2023: Turkish Airlines placed an order for ten Airbus A350-900 aircraft, expanding its existing fleet of 14 A350-900s. This signifies continued investment in its air travel infrastructure.

- July 2022: Turkish Airlines received delivery of an Airbus A350, followed by two more in August 2022. These aircraft were originally intended for Aeroflot but were diverted to Turkish Airlines due to sanctions on Russia. This illustrates the impact of geopolitical events on the industry.

- July 2022: The Turkish Defense Association (SSB) announced the delivery of the first batch of the domestically produced Sungur Weapon System by Roketsan. This demonstrates Turkey's commitment to indigenous defense technology and its capabilities in developing advanced weaponry.

Strategic Outlook for Turkey Defense & Aerospace Industry Market

The Turkish defense and aerospace industry is poised for continued growth, driven by sustained government investment, technological advancements, and a strong focus on domestic production. The industry's strategic importance to Turkey's national security and its potential for export expansion further solidify its promising future. The continuous modernization of the Turkish Armed Forces and the country’s active role in regional security will ensure sustained demand for advanced defense systems and aerospace technologies in the coming years. Opportunities abound for companies that can effectively leverage technological innovation and strategic partnerships.

Turkey Defense & Aerospace Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Turkey Defense & Aerospace Industry Segmentation By Geography

- 1. Turkey

Turkey Defense & Aerospace Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.15% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Aerospace Segment to Witness Highest Grwoth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Turkey Defense & Aerospace Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Turkey

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Turkish Technic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Airbus SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Boeing Compan

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 STM Savunma Teknolojileri Muhendislik ve Ticaret AS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ASELSAN AS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FNSS Savunma Sistemleri AS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 KOC Holding AS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 HAVELSAN AS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mechanical and Chemical Industry Company (MKEK)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TUSAS (Turkish Aerospace Industries)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 ROKETSAN AS

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 BMC Otomotiv Sanayi ve Ticaret AS

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Turkish Technic

List of Figures

- Figure 1: Turkey Defense & Aerospace Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Turkey Defense & Aerospace Industry Share (%) by Company 2024

List of Tables

- Table 1: Turkey Defense & Aerospace Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Turkey Defense & Aerospace Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Turkey Defense & Aerospace Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Turkey Defense & Aerospace Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Turkey Defense & Aerospace Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Turkey Defense & Aerospace Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Turkey Defense & Aerospace Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Turkey Defense & Aerospace Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Turkey Defense & Aerospace Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: Turkey Defense & Aerospace Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: Turkey Defense & Aerospace Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Turkey Defense & Aerospace Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: Turkey Defense & Aerospace Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: Turkey Defense & Aerospace Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Turkey Defense & Aerospace Industry?

The projected CAGR is approximately 1.15%.

2. Which companies are prominent players in the Turkey Defense & Aerospace Industry?

Key companies in the market include Turkish Technic, Airbus SE, The Boeing Compan, STM Savunma Teknolojileri Muhendislik ve Ticaret AS, ASELSAN AS, FNSS Savunma Sistemleri AS, KOC Holding AS, HAVELSAN AS, Mechanical and Chemical Industry Company (MKEK), TUSAS (Turkish Aerospace Industries), ROKETSAN AS, BMC Otomotiv Sanayi ve Ticaret AS.

3. What are the main segments of the Turkey Defense & Aerospace Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Aerospace Segment to Witness Highest Grwoth During the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

September 2023: Turkish Airlines placed an order for ten Airbus A350-900 aircraft. Currently, Turkish Airlines operates a fleet of 14 A350-900s.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Turkey Defense & Aerospace Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Turkey Defense & Aerospace Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Turkey Defense & Aerospace Industry?

To stay informed about further developments, trends, and reports in the Turkey Defense & Aerospace Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence