Key Insights

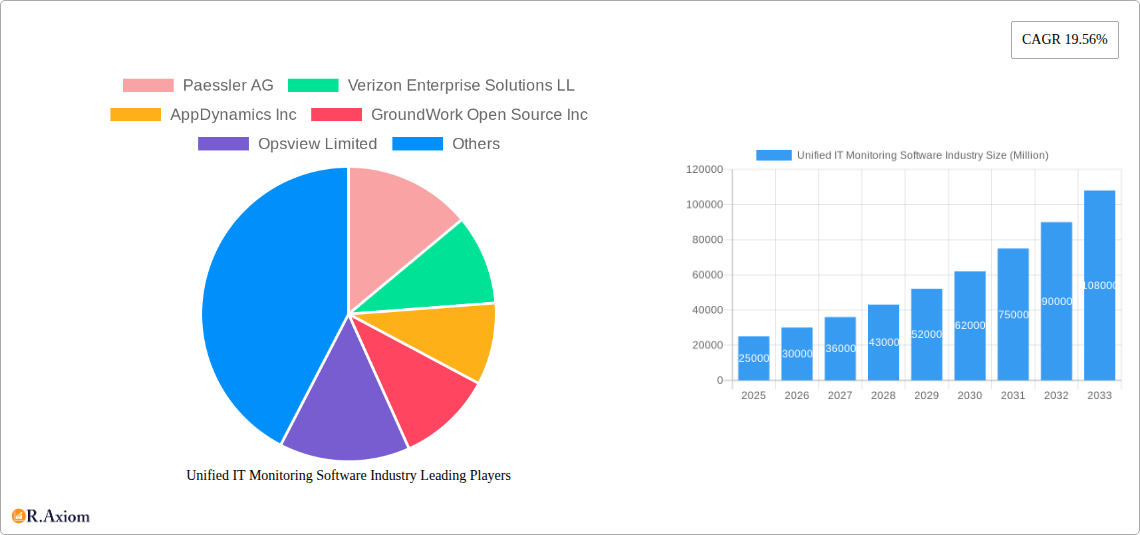

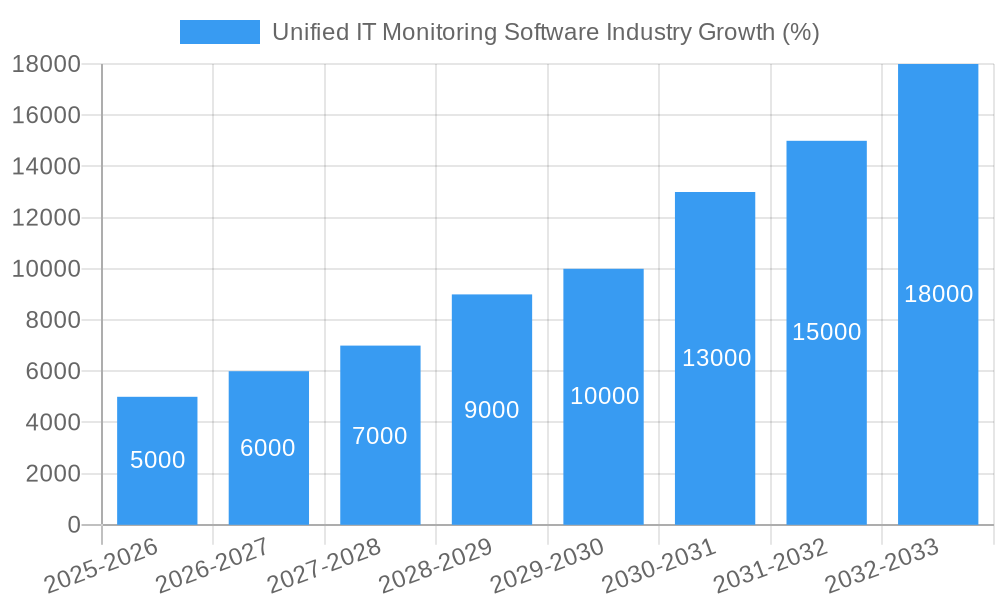

The Unified IT Monitoring Software market is experiencing robust growth, projected to reach a substantial size driven by the increasing complexity of IT infrastructures and the rising demand for proactive performance management. The 19.56% CAGR from 2019 to 2024 indicates a significant expansion, expected to continue throughout the forecast period (2025-2033). Key drivers include the adoption of cloud computing, the proliferation of IoT devices, and the growing need for enhanced cybersecurity. Businesses across diverse sectors, including BFSI, healthcare, and manufacturing, are increasingly reliant on efficient IT monitoring solutions to ensure operational efficiency, minimize downtime, and improve overall productivity. The market segmentation reveals a strong preference for cloud-based deployments, reflecting the ongoing shift towards flexible and scalable IT infrastructure. The competitive landscape is characterized by a mix of established players and emerging innovators, each offering a range of solutions and services tailored to specific customer needs. The market's growth is further fueled by trends such as AI-powered analytics for predictive maintenance and automated incident management, leading to improved IT operational efficiency and reduced costs.

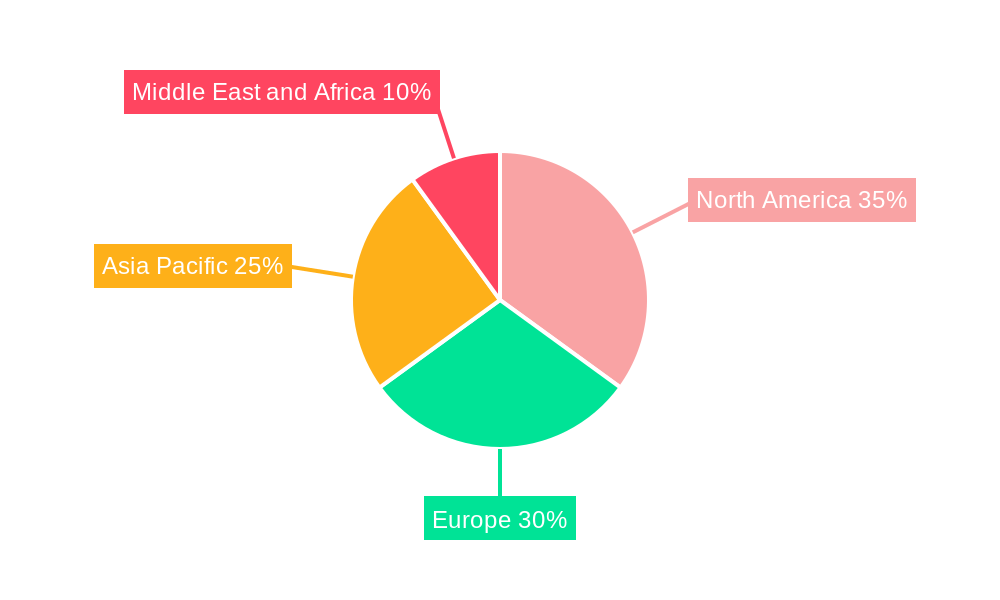

While the market presents significant opportunities, certain restraints, such as the high cost of implementation for some sophisticated solutions and the need for specialized expertise, might hinder wider adoption. However, the continuous advancements in technology, coupled with the increasing awareness of the importance of robust IT monitoring, are anticipated to mitigate these challenges. The geographic distribution of the market is expected to be diverse, with North America and Europe maintaining significant market share due to high technological advancement and early adoption. However, the Asia-Pacific region is poised for considerable growth, driven by increasing digitalization and infrastructure investments. Looking forward, the Unified IT Monitoring Software market is projected to continue its upward trajectory, driven by technological innovation and the growing need for proactive IT management across diverse industries. The market's evolution will continue to be shaped by the interplay of technological advancements, evolving business needs, and the strategic moves of key market players.

This comprehensive report provides a detailed analysis of the Unified IT Monitoring Software market, offering actionable insights for stakeholders across the value chain. The study covers the period 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report leverages a robust methodology incorporating primary and secondary research, providing a granular view of market dynamics, segmentation, leading players, and future growth prospects. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Unified IT Monitoring Software Industry Market Concentration & Innovation

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the Unified IT Monitoring Software market. The market exhibits a moderately concentrated structure, with key players holding significant market share. However, the presence of several smaller, agile companies fosters innovation and competition.

- Market Share: While precise market share data for individual companies requires access to proprietary information, we estimate that the top 5 players (including Paessler AG, Verizon Enterprise Solutions, AppDynamics, Broadcom, and Dynatrace) collectively hold approximately xx% of the market.

- M&A Activity: The Unified IT Monitoring Software industry has witnessed significant merger and acquisition (M&A) activity in recent years, with deal values exceeding xx Million in the period 2019-2024. These activities reflect strategic consolidation within the industry and the pursuit of expanding market reach and technological capabilities. Examples include (specific deals and values would require further research).

- Innovation Drivers: Key innovation drivers include the increasing complexity of IT infrastructures, the growth of cloud computing, the adoption of DevOps methodologies, and the rising demand for enhanced security and operational efficiency.

- Regulatory Frameworks: Regulatory compliance, particularly around data privacy and security (e.g., GDPR, CCPA), is a significant factor influencing product development and market operations.

- Product Substitutes: While direct substitutes are limited, some functionalities of Unified IT Monitoring Software might be partially addressed through individual monitoring tools or open-source solutions, but lack the unified and comprehensive approach offered by specialized software.

- End-User Trends: End-users increasingly demand more user-friendly interfaces, AI-driven analytics, and proactive monitoring capabilities to reduce downtime and improve operational efficiency.

Unified IT Monitoring Software Industry Industry Trends & Insights

The Unified IT Monitoring Software market is experiencing robust growth, fueled by several key trends:

The market is driven by the increasing adoption of cloud-based solutions, the proliferation of IoT devices, and the growing demand for real-time insights into IT infrastructure performance. Technological disruptions, such as the rise of AI/ML in monitoring and automation, are significantly impacting market dynamics. Consumer preferences are shifting towards solutions offering enhanced scalability, ease of use, and integration capabilities. Competitive dynamics are characterized by both intense competition among established players and the emergence of new entrants offering innovative solutions. The market demonstrates a high level of fragmentation with several established players, each holding a significant but not dominant market share. Increased customer demand for seamless cloud monitoring, IoT device support, and heightened security is further driving growth. The competitive landscape is highly dynamic, with companies constantly striving for innovation and differentiation. The market penetration of Unified IT Monitoring Software is expected to increase steadily across various end-user verticals, with the xx segment expected to show the highest adoption rate by 2033.

Dominant Markets & Segments in Unified IT Monitoring Software Industry

This section analyzes the dominant market segments, focusing on regional, country, and vertical breakdowns. While precise market dominance data needs deeper research, preliminary analysis offers these insights:

- By Component: The Solution segment is expected to dominate due to the increasing demand for comprehensive monitoring platforms. The Services segment will show significant growth due to the need for implementation, support, and managed services.

- By Deployment: The Cloud segment is projected to be the dominant deployment model due to its scalability, cost-effectiveness, and ease of access. However, On-Premise deployments will still hold a substantial share for organizations with stringent security or compliance requirements.

- By End-user Vertical: The IT & Telecommunication and BFSI sectors are currently the largest consumers of Unified IT Monitoring Software due to their reliance on critical IT infrastructure and stringent regulatory compliance needs. However, growth is expected across all verticals, including Healthcare and Life Sciences, Manufacturing and Retail, as organizations increasingly prioritize IT efficiency and resilience. Key Drivers: The rapid digitization across all sectors is a critical growth driver. Furthermore, government initiatives promoting digital transformation, robust IT infrastructure investments, and favorable economic policies are also key drivers for specific regions and verticals.

Unified IT Monitoring Software Industry Product Developments

Recent product innovations focus on enhanced AI/ML capabilities for predictive analytics, improved integration with cloud platforms, and enhanced security features. These innovations deliver significant competitive advantages by providing users with more accurate insights, proactive alerts, and simplified management of complex IT environments. The market is moving towards agentless monitoring solutions to reduce deployment complexity and improve operational efficiency. The focus is shifting from purely reactive monitoring to proactive and predictive approaches leveraging AI/ML for improved efficiency and reduced downtime.

Report Scope & Segmentation Analysis

The report provides a detailed segmentation analysis across the following parameters:

- By Component: Solution and Services. The Solution segment is projected to grow at a CAGR of xx% during the forecast period, while Services is expected to grow at xx%. The competitive dynamics in both segments are intense, with several players competing on features, pricing, and service quality.

- By Deployment: On-Premise and Cloud. The Cloud deployment segment is predicted to dominate and grow at a faster rate (xx%) than the On-Premise segment (xx%), driven by increasing cloud adoption. Competition is fierce in both segments with vendors offering a range of flexible deployment options.

- By End-user Vertical: BFSI, Healthcare and Life Sciences, Manufacturing, IT & Telecommunication, Retail, and Other. Each vertical exhibits unique growth dynamics, influenced by factors like industry-specific regulations, digital transformation strategies, and IT infrastructure maturity. The IT & Telecommunication and BFSI sectors are projected to be the fastest growing due to their inherent need for robust, reliable IT infrastructure.

Key Drivers of Unified IT Monitoring Software Industry Growth

The Unified IT Monitoring Software market is driven by several key factors:

- Technological advancements: AI/ML-powered analytics, automation, and agentless monitoring are significantly enhancing the capabilities of Unified IT Monitoring Software, improving efficiency and reducing operational costs.

- Economic factors: Businesses are increasingly recognizing the financial benefits of improved IT uptime and reduced operational risks, leading to greater adoption of sophisticated monitoring solutions.

- Regulatory compliance: Stricter data security regulations worldwide necessitate robust monitoring solutions that ensure compliance and mitigate risks associated with data breaches.

Challenges in the Unified IT Monitoring Software Industry Sector

Despite strong growth, the Unified IT Monitoring Software industry faces several challenges:

- Integration complexities: Integrating multiple monitoring tools into a unified platform can be technically challenging and time-consuming, impacting deployment and adoption rates.

- Data security concerns: The sheer volume of data collected by monitoring solutions raises concerns around data security and privacy, requiring robust security measures.

- Cost of implementation and maintenance: The initial investment and ongoing maintenance costs for Unified IT Monitoring Software solutions can be significant for some businesses.

Emerging Opportunities in Unified IT Monitoring Software Industry

The Unified IT Monitoring Software market presents exciting growth opportunities:

- Expansion into new markets: Untapped potential exists in emerging economies and industry verticals, particularly those undergoing rapid digital transformation.

- Integration with IoT devices: The proliferation of IoT devices creates opportunities for expanded monitoring capabilities across diverse connected environments.

- Development of AI/ML-driven solutions: Advanced analytics and automation powered by AI/ML can enhance the predictive capabilities of Unified IT Monitoring Software.

Leading Players in the Unified IT Monitoring Software Industry Market

- Paessler AG

- Verizon Enterprise Solutions

- AppDynamics Inc

- GroundWork Open Source Inc

- Opsview Limited

- Broadcom Inc

- Juniper Networks Inc

- Zenoss Inc

- Zoho Corporation

- Acronis International GmbH

- Dynatrace LLC

Key Developments in Unified IT Monitoring Software Industry Industry

- July 2022: New Relic launches agentless monitoring for SAP® solutions, enhancing observability for enterprises running critical processes on SAP systems. This development significantly improves IT support operations by leveraging existing SAP data and avoiding intrusive agent installations.

- September 2022: Riverbed launches Alluvio IQ, a cloud-native SaaS service for unified observability, injecting more automation and visibility into complex networks, including remote and hybrid environments. This helps free up IT teams for strategic initiatives amid resource constraints.

Strategic Outlook for Unified IT Monitoring Software Market

The Unified IT Monitoring Software market is poised for sustained growth, driven by increasing digital transformation across various industries, the rise of cloud computing, and the adoption of advanced technologies like AI/ML. The market will continue to consolidate, with mergers and acquisitions playing a significant role in shaping the competitive landscape. Opportunities exist for players who can develop innovative solutions that address the challenges of complexity, security, and integration in increasingly diverse and dynamic IT environments. Future growth will hinge on vendors' ability to deliver user-friendly, scalable, and secure solutions capable of providing actionable insights into complex IT ecosystems.

Unified IT Monitoring Software Industry Segmentation

-

1. Component

- 1.1. Solution

- 1.2. Services

-

2. Deployment

- 2.1. On-Premise

- 2.2. Cloud

-

3. End-user Vertical

- 3.1. BFSI

- 3.2. Healthcare and Life Sciences

- 3.3. Manufacturing

- 3.4. IT & Telecommunication

- 3.5. Retail

- 3.6. Other End-user Vertical

Unified IT Monitoring Software Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

Unified IT Monitoring Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 19.56% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Adoption for Networking Solutions by Enterprises; Increasing Cyber Safety and Security Concerns Among Organisations

- 3.3. Market Restrains

- 3.3.1. Uncertain Regulatory Standards and Frameworks

- 3.4. Market Trends

- 3.4.1. BFSI Sector Will Experience Significant Growth and Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Unified IT Monitoring Software Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Solution

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. On-Premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. BFSI

- 5.3.2. Healthcare and Life Sciences

- 5.3.3. Manufacturing

- 5.3.4. IT & Telecommunication

- 5.3.5. Retail

- 5.3.6. Other End-user Vertical

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Unified IT Monitoring Software Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Solution

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. On-Premise

- 6.2.2. Cloud

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. BFSI

- 6.3.2. Healthcare and Life Sciences

- 6.3.3. Manufacturing

- 6.3.4. IT & Telecommunication

- 6.3.5. Retail

- 6.3.6. Other End-user Vertical

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Unified IT Monitoring Software Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Solution

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. On-Premise

- 7.2.2. Cloud

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. BFSI

- 7.3.2. Healthcare and Life Sciences

- 7.3.3. Manufacturing

- 7.3.4. IT & Telecommunication

- 7.3.5. Retail

- 7.3.6. Other End-user Vertical

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Unified IT Monitoring Software Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Solution

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. On-Premise

- 8.2.2. Cloud

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. BFSI

- 8.3.2. Healthcare and Life Sciences

- 8.3.3. Manufacturing

- 8.3.4. IT & Telecommunication

- 8.3.5. Retail

- 8.3.6. Other End-user Vertical

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Middle East and Africa Unified IT Monitoring Software Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Solution

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. On-Premise

- 9.2.2. Cloud

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. BFSI

- 9.3.2. Healthcare and Life Sciences

- 9.3.3. Manufacturing

- 9.3.4. IT & Telecommunication

- 9.3.5. Retail

- 9.3.6. Other End-user Vertical

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. North America Unified IT Monitoring Software Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Unified IT Monitoring Software Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Unified IT Monitoring Software Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Middle East and Africa Unified IT Monitoring Software Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Paessler AG

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Verizon Enterprise Solutions LL

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 AppDynamics Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 GroundWork Open Source Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Opsview Limited

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Broadcom Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Juniper Networks Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Zenoss Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Zoho Corporation

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Acronis International GmbH

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Dynatrace LLC

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Paessler AG

List of Figures

- Figure 1: Global Unified IT Monitoring Software Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Unified IT Monitoring Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Unified IT Monitoring Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Unified IT Monitoring Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Unified IT Monitoring Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Unified IT Monitoring Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Unified IT Monitoring Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Unified IT Monitoring Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Unified IT Monitoring Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Unified IT Monitoring Software Industry Revenue (Million), by Component 2024 & 2032

- Figure 11: North America Unified IT Monitoring Software Industry Revenue Share (%), by Component 2024 & 2032

- Figure 12: North America Unified IT Monitoring Software Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 13: North America Unified IT Monitoring Software Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 14: North America Unified IT Monitoring Software Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 15: North America Unified IT Monitoring Software Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 16: North America Unified IT Monitoring Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Unified IT Monitoring Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Unified IT Monitoring Software Industry Revenue (Million), by Component 2024 & 2032

- Figure 19: Europe Unified IT Monitoring Software Industry Revenue Share (%), by Component 2024 & 2032

- Figure 20: Europe Unified IT Monitoring Software Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 21: Europe Unified IT Monitoring Software Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 22: Europe Unified IT Monitoring Software Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 23: Europe Unified IT Monitoring Software Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 24: Europe Unified IT Monitoring Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Unified IT Monitoring Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Unified IT Monitoring Software Industry Revenue (Million), by Component 2024 & 2032

- Figure 27: Asia Pacific Unified IT Monitoring Software Industry Revenue Share (%), by Component 2024 & 2032

- Figure 28: Asia Pacific Unified IT Monitoring Software Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 29: Asia Pacific Unified IT Monitoring Software Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 30: Asia Pacific Unified IT Monitoring Software Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 31: Asia Pacific Unified IT Monitoring Software Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 32: Asia Pacific Unified IT Monitoring Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Unified IT Monitoring Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: Middle East and Africa Unified IT Monitoring Software Industry Revenue (Million), by Component 2024 & 2032

- Figure 35: Middle East and Africa Unified IT Monitoring Software Industry Revenue Share (%), by Component 2024 & 2032

- Figure 36: Middle East and Africa Unified IT Monitoring Software Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 37: Middle East and Africa Unified IT Monitoring Software Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 38: Middle East and Africa Unified IT Monitoring Software Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 39: Middle East and Africa Unified IT Monitoring Software Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 40: Middle East and Africa Unified IT Monitoring Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Unified IT Monitoring Software Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 4: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 5: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Unified IT Monitoring Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Unified IT Monitoring Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Unified IT Monitoring Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Unified IT Monitoring Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 15: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 16: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 17: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 19: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 20: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 21: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 23: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 24: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 25: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 27: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 28: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 29: Global Unified IT Monitoring Software Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Unified IT Monitoring Software Industry?

The projected CAGR is approximately 19.56%.

2. Which companies are prominent players in the Unified IT Monitoring Software Industry?

Key companies in the market include Paessler AG, Verizon Enterprise Solutions LL, AppDynamics Inc, GroundWork Open Source Inc, Opsview Limited, Broadcom Inc, Juniper Networks Inc, Zenoss Inc, Zoho Corporation, Acronis International GmbH, Dynatrace LLC.

3. What are the main segments of the Unified IT Monitoring Software Industry?

The market segments include Component, Deployment, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Adoption for Networking Solutions by Enterprises; Increasing Cyber Safety and Security Concerns Among Organisations.

6. What are the notable trends driving market growth?

BFSI Sector Will Experience Significant Growth and Drive the Market.

7. Are there any restraints impacting market growth?

Uncertain Regulatory Standards and Frameworks.

8. Can you provide examples of recent developments in the market?

July 2022 - New Relic Launches Agentless Monitoring for SAP® Solutions, the industry's first native observability solution delivered agentless for enterprises running critical business processes on SAP systems. The solution empowers IT teams to better support business operations by harnessing existing SAP data sources to access all necessary telemetry data. It also avoids installing intrusive monitoring agents in SAP production servers or relying on third-party connectors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Unified IT Monitoring Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Unified IT Monitoring Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Unified IT Monitoring Software Industry?

To stay informed about further developments, trends, and reports in the Unified IT Monitoring Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence