Key Insights

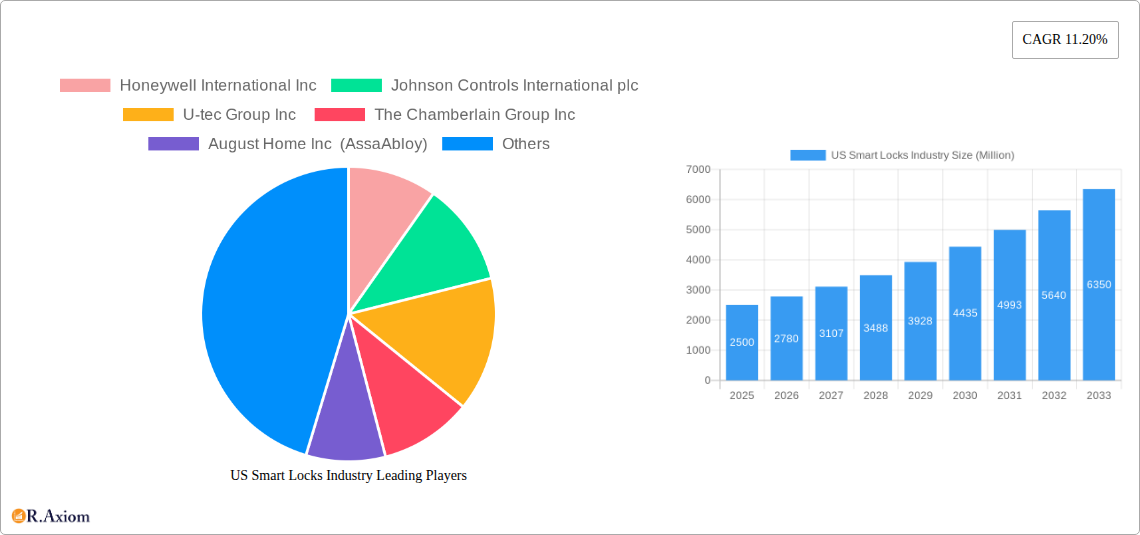

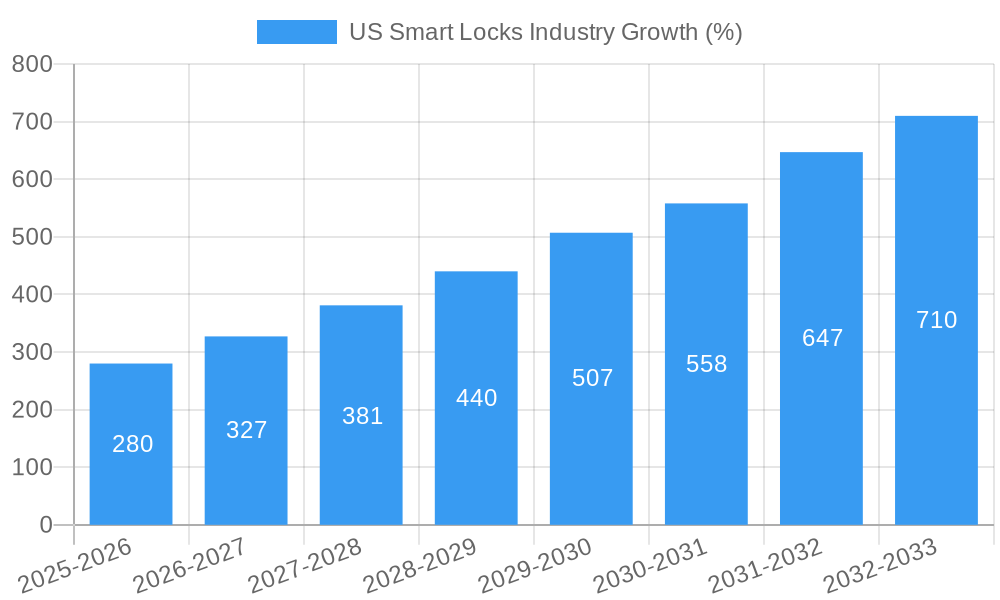

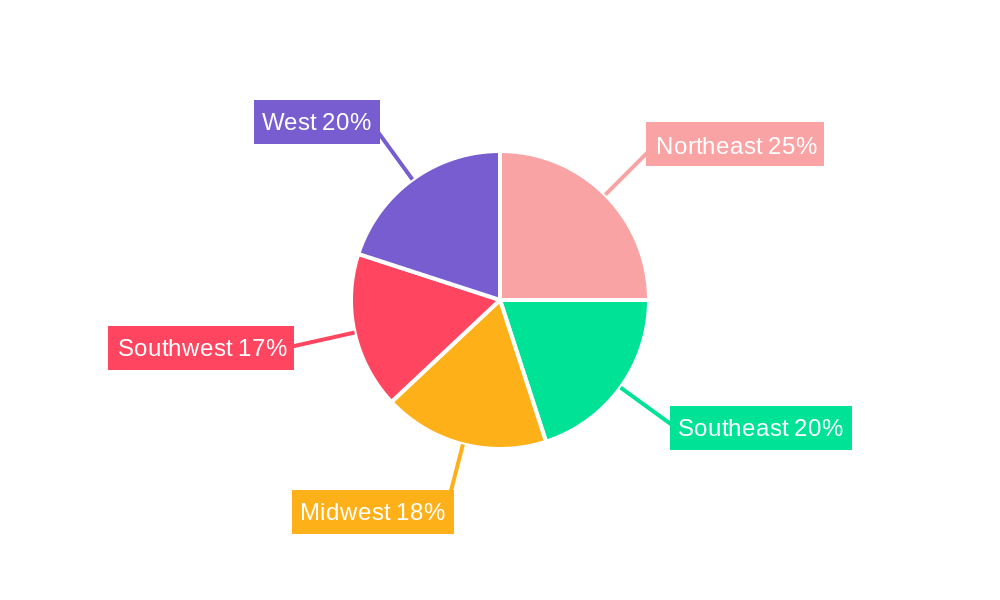

The US smart lock market, valued at approximately $2.5 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 11.2% from 2025 to 2033. This surge is driven primarily by increasing consumer demand for enhanced home security, convenience, and integration with smart home ecosystems. The residential segment dominates the market, fueled by rising disposable incomes and a growing preference for technologically advanced solutions. However, the commercial sector is also demonstrating significant growth potential, driven by the need for improved access control and remote management in office buildings, hotels, and other commercial properties. Key trends include the increasing adoption of keyless entry systems, integration with voice assistants (like Alexa and Google Assistant), and the rise of advanced features such as biometric authentication and remote locking/unlocking capabilities. Despite this positive outlook, market growth faces some restraints, including concerns about data security and privacy, as well as the relatively higher initial cost of smart locks compared to traditional mechanical locks. The market is highly competitive, with major players like Honeywell, Johnson Controls, and Assa Abloy vying for market share through innovation and strategic partnerships. The diverse product landscape, encompassing deadbolt locks, padlocks, and lever handles, caters to a wide range of consumer needs and preferences. Regional variations exist, with the Northeast and West Coast potentially exhibiting faster growth due to higher adoption rates of smart home technology.

The projected market size for 2033, based on the provided CAGR of 11.2%, suggests a substantial increase. Using a compound interest calculation, the estimated value in 2033 would be approximately $8.1 billion. This significant growth highlights the long-term potential of the US smart lock market. Market segmentation by end-user (residential and commercial) and type (deadbolt, padlock, other) provides crucial insights for strategic decision-making. Furthermore, regional analysis across the United States, breaking down sales by Northeast, Southeast, Midwest, Southwest, and West, allows for a more granular understanding of market dynamics and opportunities for targeted marketing and distribution strategies. Competition amongst established players is intense, encouraging continuous innovation in terms of features, design, and integration capabilities to capture consumer preference.

This comprehensive report provides a detailed analysis of the US smart locks industry, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this rapidly evolving market. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033, and a base year of 2025. The market is segmented by end-user (residential and commercial) and by type (deadbolt, padlock, other types). The report analyzes market size, growth drivers, challenges, opportunities, and competitive dynamics, providing actionable insights for strategic decision-making. Expected market value in Million USD is provided throughout.

US Smart Locks Industry Market Concentration & Innovation

The US smart locks market is characterized by a moderately concentrated landscape, with key players holding significant market share. Honeywell International Inc, Johnson Controls International plc, and Allegion plc are among the established leaders, leveraging their brand recognition and extensive distribution networks. However, smaller players like August Home Inc (AssaAbloy) and Kwikset (Spectrum Brands) are also making significant contributions through innovation and targeted marketing. Market share data for 2024 indicates that the top three players hold approximately xx% of the market collectively, while the remaining players share the rest.

Innovation Drivers:

- Technological advancements: Integration with smart home ecosystems, biometric authentication, and enhanced security features are driving innovation.

- Consumer demand: Growing awareness of smart home technology and a desire for increased home security are fueling demand for smart locks.

- Government regulations: Increasing focus on cybersecurity and data privacy is leading to the development of more secure and compliant smart lock solutions.

Mergers & Acquisitions (M&A) Activity: The industry has witnessed significant M&A activity in recent years, driven by companies seeking to expand their product portfolios, gain access to new technologies, or strengthen their market presence. While precise deal values are often confidential, M&A transactions over the past five years are estimated to be in the range of xx Million USD.

US Smart Locks Industry Industry Trends & Insights

The US smart locks market is experiencing robust growth, driven by several key factors. The market is projected to reach xx Million USD by 2025 and xx Million USD by 2033, exhibiting a CAGR of xx% during the forecast period. This growth is fueled by increasing consumer adoption of smart home technologies, rising concerns about home security, and the growing popularity of convenient access solutions. The market penetration of smart locks in residential settings is currently estimated at xx%, with significant potential for future growth. Technological disruptions, such as the adoption of advanced connectivity protocols and the integration of AI-powered features, are further accelerating market expansion. Consumer preferences are shifting towards seamless integration with existing smart home systems, enhanced security features, and user-friendly interfaces. The competitive landscape is dynamic, with both established players and emerging startups vying for market share through product innovation and strategic partnerships.

Dominant Markets & Segments in US Smart Locks Industry

The residential segment currently dominates the US smart locks market, accounting for approximately xx% of total revenue in 2024. This is driven by high consumer demand for improved home security and convenience. However, the commercial segment is also experiencing significant growth, driven by increasing adoption of smart access control systems in offices, hotels, and other commercial buildings.

Residential Segment Key Drivers:

- Rising disposable incomes and increased homeownership rates.

- Growing awareness of smart home technology and its benefits.

- Strong preference for enhanced security and convenience.

Commercial Segment Key Drivers:

- Demand for enhanced security and access control in commercial buildings.

- Cost-effectiveness of smart locks compared to traditional systems.

- Growing adoption of smart building technologies.

Within the product type segment, deadbolt smart locks hold the largest market share, followed by other types (lever handles, mortise locks), and padlocks holding the smallest share. This is mainly due to the versatility and widespread usage of deadbolt locks in both residential and commercial settings.

US Smart Locks Industry Product Developments

The US smart locks market is witnessing continuous product innovation, with companies introducing smart locks with enhanced security features, improved connectivity, and user-friendly interfaces. Key technological trends include the integration of biometric authentication (fingerprint, facial recognition), advanced encryption protocols, and seamless integration with leading smart home platforms (Amazon Alexa, Google Assistant). These advancements are enhancing the market fit by catering to the growing consumer demand for secure, convenient, and user-friendly access control solutions.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the US smart locks market, segmented by end-user (residential and commercial) and by type (deadbolt, padlock, other types). Residential segment is projected to grow at a CAGR of xx% during the forecast period, driven by high consumer demand. The commercial segment is anticipated to grow at a CAGR of xx%, spurred by increasing adoption in various commercial settings. Within the product type segment, deadbolt smart locks are expected to maintain their dominant position, while other types are projected to witness strong growth driven by increasing diversity in product offerings and expanding applications. Competitive dynamics are highly dynamic, with established players and emerging companies continually vying for market share through innovation and strategic partnerships.

Key Drivers of US Smart Locks Industry Growth

The growth of the US smart locks industry is driven by a confluence of technological, economic, and regulatory factors. The increasing adoption of smart home technology and the growing consumer preference for convenience are major drivers. Economic factors such as rising disposable incomes and increased homeownership rates fuel market expansion. Furthermore, government regulations emphasizing enhanced security and data privacy are indirectly pushing the market by creating a demand for more secure and compliant smart lock solutions.

Challenges in the US Smart Locks Industry Sector

The US smart locks industry faces several challenges, including regulatory hurdles related to data privacy and cybersecurity. Supply chain disruptions and increased material costs can also impact profitability. Intense competition from both established players and new entrants requires companies to continuously innovate and adapt to maintain market share. The cost of integrating smart locks into existing infrastructure presents a barrier to adoption, especially in older buildings.

Emerging Opportunities in US Smart Locks Industry

Emerging opportunities in the US smart locks market include the integration of advanced technologies such as AI and machine learning for enhanced security and improved user experience. Expansion into new markets, such as multi-family dwellings and commercial spaces with unique access requirements, presents significant potential. The increasing demand for user-friendly interfaces and customized solutions creates opportunities for specialized product offerings.

Leading Players in the US Smart Locks Industry Market

- Honeywell International Inc

- Johnson Controls International plc

- U-tec Group Inc

- The Chamberlain Group Inc

- August Home Inc (AssaAbloy)

- Allegion plc

- Kwikset (Spectrum Brands)

- Crestron Electronics Inc

- Master Lock (Fortune Brands Home & Security)

Key Developments in US Smart Locks Industry Industry

- April 2021: Yale launched Linus Smart Lock, integrating with leading smart home systems, voice assistants, and home share platforms. This launch significantly impacted market dynamics by enhancing user convenience and accessibility.

Strategic Outlook for US Smart Locks Industry Market

The US smart locks market is poised for continued growth, driven by technological advancements, increasing consumer adoption, and expanding applications across residential and commercial sectors. The integration of innovative features, such as biometric authentication and enhanced cybersecurity measures, will further drive market expansion. Companies that invest in research and development, focus on user experience, and establish strong distribution channels will be well-positioned to capitalize on future market opportunities.

US Smart Locks Industry Segmentation

-

1. End-user

- 1.1. Residential

- 1.2. Commercial

-

2. Type

- 2.1. Deadbolt

- 2.2. Padlock

- 2.3. Other Types (Lever Handles, Mortise)

US Smart Locks Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

US Smart Locks Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Smart Home Adoption

- 3.2.2 Increase of Home break-ins

- 3.2.3 Thereby Aiding in the Market Growth for Residential Segment

- 3.3. Market Restrains

- 3.3.1. Diminishing Profit Margins and Ongoing Changes in Macro-environment

- 3.4. Market Trends

- 3.4.1. Commercial Segment is Expected to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. US Smart Locks Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Deadbolt

- 5.2.2. Padlock

- 5.2.3. Other Types (Lever Handles, Mortise)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 6. Northeast US Smart Locks Industry Analysis, Insights and Forecast, 2019-2031

- 7. Southeast US Smart Locks Industry Analysis, Insights and Forecast, 2019-2031

- 8. Midwest US Smart Locks Industry Analysis, Insights and Forecast, 2019-2031

- 9. Southwest US Smart Locks Industry Analysis, Insights and Forecast, 2019-2031

- 10. West US Smart Locks Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Johnson Controls International plc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 U-tec Group Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Chamberlain Group Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 August Home Inc (AssaAbloy)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Allegion plc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kwikset (Spectrum Brands)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Crestron Electronics Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Master Lock (Fortune Brands Home & Security)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: US Smart Locks Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: US Smart Locks Industry Share (%) by Company 2024

List of Tables

- Table 1: US Smart Locks Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: US Smart Locks Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: US Smart Locks Industry Revenue Million Forecast, by End-user 2019 & 2032

- Table 4: US Smart Locks Industry Volume K Unit Forecast, by End-user 2019 & 2032

- Table 5: US Smart Locks Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 6: US Smart Locks Industry Volume K Unit Forecast, by Type 2019 & 2032

- Table 7: US Smart Locks Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: US Smart Locks Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: US Smart Locks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: US Smart Locks Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Northeast US Smart Locks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Northeast US Smart Locks Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Southeast US Smart Locks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Southeast US Smart Locks Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Midwest US Smart Locks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Midwest US Smart Locks Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Southwest US Smart Locks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Southwest US Smart Locks Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: West US Smart Locks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: West US Smart Locks Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: US Smart Locks Industry Revenue Million Forecast, by End-user 2019 & 2032

- Table 22: US Smart Locks Industry Volume K Unit Forecast, by End-user 2019 & 2032

- Table 23: US Smart Locks Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 24: US Smart Locks Industry Volume K Unit Forecast, by Type 2019 & 2032

- Table 25: US Smart Locks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: US Smart Locks Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 27: United States US Smart Locks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: United States US Smart Locks Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Canada US Smart Locks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Canada US Smart Locks Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Mexico US Smart Locks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Mexico US Smart Locks Industry Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Smart Locks Industry?

The projected CAGR is approximately 11.20%.

2. Which companies are prominent players in the US Smart Locks Industry?

Key companies in the market include Honeywell International Inc, Johnson Controls International plc, U-tec Group Inc , The Chamberlain Group Inc, August Home Inc (AssaAbloy), Allegion plc, Kwikset (Spectrum Brands), Crestron Electronics Inc, Master Lock (Fortune Brands Home & Security).

3. What are the main segments of the US Smart Locks Industry?

The market segments include End-user, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Smart Home Adoption. Increase of Home break-ins. Thereby Aiding in the Market Growth for Residential Segment.

6. What are the notable trends driving market growth?

Commercial Segment is Expected to Grow Significantly.

7. Are there any restraints impacting market growth?

Diminishing Profit Margins and Ongoing Changes in Macro-environment.

8. Can you provide examples of recent developments in the market?

April 2021: Yale launched Linus Smart Lock with the abiity to connect with leading smart home systems, voice assistants, and home share platforms for effortless door control and access management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Smart Locks Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Smart Locks Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Smart Locks Industry?

To stay informed about further developments, trends, and reports in the US Smart Locks Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence