Key Insights

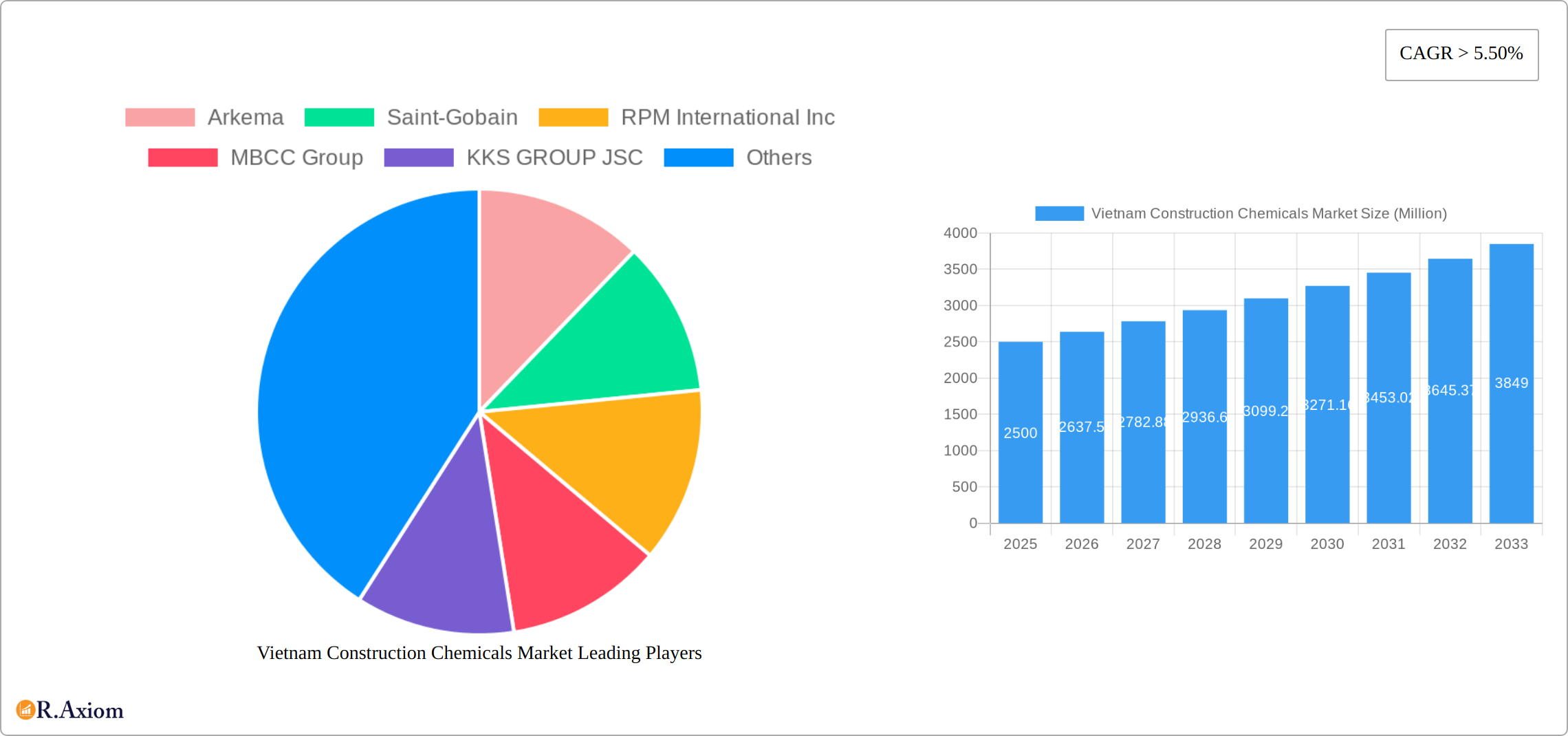

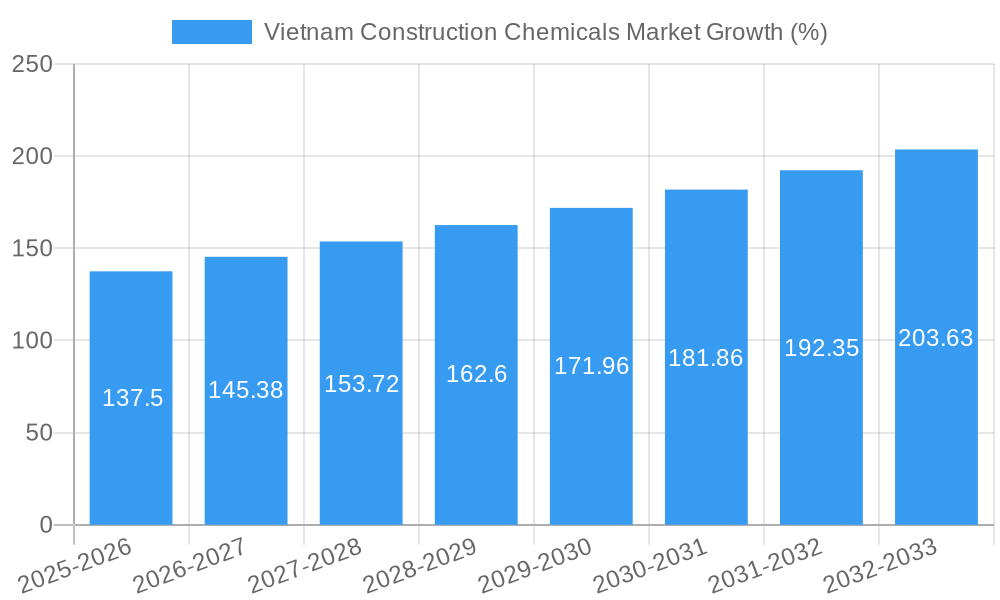

The Vietnam construction chemicals market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 5.50% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, Vietnam's ongoing infrastructure development initiatives, including substantial investments in transportation networks, industrial parks, and urban renewal projects, create significant demand for construction chemicals. Secondly, the burgeoning residential sector, driven by a growing population and increasing urbanization, further fuels market expansion. The rising adoption of advanced construction techniques and a growing preference for high-performance building materials are also contributing factors. Specific product segments like adhesives and sealants are expected to witness particularly strong growth due to their versatility and improved functionalities. While challenges like fluctuating raw material prices and potential supply chain disruptions exist, the overall market outlook remains positive. The market's segmentation across end-use sectors (commercial, industrial & institutional, infrastructure, residential) and product types (adhesives, membranes, sealants, coatings, fire retardants) presents diverse opportunities for market players. Key players such as Arkema, Saint-Gobain, and Sika are strategically positioned to capitalize on this growth, leveraging their established brand reputation and technological expertise.

The market's competitive landscape is characterized by both multinational corporations and local players. Larger companies benefit from established distribution networks and R&D capabilities, allowing them to offer innovative and high-quality products. However, local companies often possess a strong understanding of the regional market and can offer competitive pricing. This dynamic interplay fosters innovation and competitive pricing, ultimately benefiting the end-user. Future growth will be influenced by government policies promoting sustainable construction practices and the adoption of environmentally friendly building materials. The market is expected to witness increased demand for sustainable construction chemicals, which are increasingly preferred for their reduced environmental impact and improved performance. Overall, the Vietnam construction chemicals market is poised for continued expansion, presenting significant opportunities for both established and emerging players.

Vietnam Construction Chemicals Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Vietnam construction chemicals market, covering the period from 2019 to 2033. With a focus on key market segments, leading players, and emerging trends, this report offers invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report utilizes data from the historical period (2019-2024), the base year (2025), and projects the market's trajectory through the forecast period (2025-2033). The total market size is estimated to be xx Million in 2025 and is expected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Vietnam Construction Chemicals Market Concentration & Innovation

The Vietnam construction chemicals market exhibits a moderately concentrated landscape, with several multinational players and a growing number of domestic companies competing. Key players such as Arkema, Saint-Gobain, RPM International Inc, MBCC Group, Sika A, MAPEI S p A, and Fosroc Inc hold significant market share, while local companies like KKS GROUP JSC and Bestmix Corporation cater to specific niche segments. The market concentration ratio (CR4 or CR8) for 2025 is estimated at xx%.

Innovation in the sector is driven by the need for sustainable, high-performance products that meet stringent environmental regulations and construction demands. This is reflected in the development of eco-friendly materials, improved durability solutions, and advanced technologies for application efficiency.

Regulatory frameworks, including those concerning environmental protection and product safety, significantly influence market dynamics. Stringent standards promote the adoption of safer and more sustainable products. The presence of substitute materials, such as traditional building components, poses a competitive challenge. However, the superior performance and long-term cost-effectiveness of construction chemicals contribute to their continued adoption.

Recent M&A activity, exemplified by Sika's acquisition of MBCC Group in May 2023, underscores the ongoing consolidation within the sector. This deal, valued at xx Million, significantly reshaped the market landscape and enhanced the acquiring company's product portfolio and market reach. Such activities are expected to further consolidate the market in the coming years.

Vietnam Construction Chemicals Market Industry Trends & Insights

The Vietnam construction chemicals market is experiencing robust growth fueled by several factors. Rapid urbanization, infrastructure development driven by government initiatives (e.g., the development of industrial parks and transportation infrastructure), and rising disposable incomes are key drivers. The country's expanding construction sector is projected to boost demand for construction chemicals significantly. This translates into a projected market size of xx Million in 2025, with a CAGR of xx% expected during the forecast period (2025-2033).

Technological advancements in the manufacturing and application of construction chemicals are transforming the industry. The adoption of sustainable and high-performance materials is gaining traction. Consumers are increasingly demanding energy-efficient and eco-friendly solutions, influencing product development strategies. Competitive dynamics are intense, with multinational and domestic players vying for market share through product innovation, strategic partnerships, and aggressive marketing efforts. Market penetration of advanced construction chemicals remains relatively low compared to developed markets, indicating substantial future growth potential.

Dominant Markets & Segments in Vietnam Construction Chemicals Market

The Vietnamese construction chemicals market exhibits robust growth across diverse end-use sectors, driven by a confluence of factors including significant government investment, rapid urbanization, and a burgeoning middle class with increased disposable income. This translates into a heightened demand for both residential and commercial construction, significantly impacting the market's trajectory.

- Infrastructure: This segment holds a dominant position, fueled by substantial government initiatives focused on large-scale infrastructure projects encompassing roads, bridges, ports, and other crucial elements of national development. The considerable government funding allocated to these projects, coupled with the ongoing need for robust and resilient infrastructure, ensures continued market expansion in this sector.

- Residential: The residential construction sector experiences vigorous growth, propelled by a rapidly expanding population and a corresponding increase in disposable incomes. This leads to a surge in demand for new housing and related construction activities, making it a key driver of market growth.

- Commercial & Industrial: This segment demonstrates consistent growth, underpinned by robust foreign direct investment (FDI) and the expansion of industrial parks across the country. This influx of investment stimulates construction activities, further boosting demand for construction chemicals.

- Product Segment: Adhesives, sealants, and coatings comprise a substantial portion of the market share, owing to their widespread application across various construction phases. The increasing adoption of stringent safety regulations and requirements has fueled the growth of membranes and fire retardants, highlighting the importance of safety and compliance within the sector. Furthermore, the growing interest in sustainable construction practices is driving demand for eco-friendly alternatives within these product segments.

While the Southern region currently exhibits the highest market penetration due to the concentration of construction activities and industrial hubs, balanced regional growth is anticipated in the coming years as development expands nationwide.

Vietnam Construction Chemicals Market Product Developments

Recent product innovations focus on enhancing performance, sustainability, and ease of application. Manufacturers are introducing eco-friendly products with reduced VOCs and improved lifecycle performance. Advanced formulations are improving adhesion strength, durability, and water resistance. Technological trends, such as nanotechnology and bio-based materials, are shaping product development. This focus on improved functionality and environmental considerations is enhancing the market fit of these new products.

Report Scope & Segmentation Analysis

This report segments the Vietnam construction chemicals market by end-use sector (Commercial, Industrial & Institutional, Infrastructure, Residential) and product type (Adhesives, Membranes, Sealants, Coatings, Fire Retardants). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. The infrastructure segment is expected to exhibit the highest growth rate, while the residential segment is expected to contribute a significant market share. Among product types, adhesives and sealants are predicted to dominate due to widespread usage.

Key Drivers of Vietnam Construction Chemicals Market Growth

Several factors contribute to the market's growth. Government initiatives promoting infrastructure development and urbanization directly impact market expansion. The rising disposable incomes among the population boost spending on housing and construction, fueling demand. Technological advancements in producing high-performance and sustainable construction chemicals are also significant contributors to growth.

Challenges in the Vietnam Construction Chemicals Market Sector

Challenges facing the market include fluctuating raw material prices, potential supply chain disruptions, and intense competition from both domestic and international players. Stringent environmental regulations and quality standards can increase production costs. Ensuring consistent product quality while maintaining competitive pricing remains a key challenge for many companies.

Emerging Opportunities in Vietnam Construction Chemicals Market

Opportunities abound, particularly in the burgeoning infrastructure sector and the rising demand for sustainable construction materials. Growth in the offshore wind turbine market (as seen with MBCC Group's new plant in Taiwan) provides a promising niche for specialized products. Increased focus on green building practices creates opportunities for manufacturers of eco-friendly construction chemicals.

Leading Players in the Vietnam Construction Chemicals Market Market

- Arkema

- Saint-Gobain

- RPM International Inc

- MBCC Group

- KKS GROUP JSC

- Fosroc Inc

- Sika A

- MAPEI S p A

- Bestmix Corporation

- MC-Bauchemie

Key Developments in Vietnam Construction Chemicals Market Industry

- May 2023: Sika acquired MBCC Group, significantly impacting market consolidation and product offerings.

- February 2023: Master Builders Solutions opened a new offshore grout production plant in Taiwan, signaling growth in specialized segments.

- November 2022: Saint-Gobain's Chryso launched CHRYSO Dem Aqua 800, demonstrating innovation in eco-friendly mold release agents.

Strategic Outlook for Vietnam Construction Chemicals Market Market

The Vietnam construction chemicals market holds significant potential for growth. Continued infrastructure development, urbanization, and the increasing adoption of sustainable construction practices will be key catalysts. Companies focused on innovation, sustainability, and efficient supply chains are well-positioned to capitalize on this growth opportunity. The market's future trajectory is bright, driven by both domestic and foreign investment in Vietnam's expanding construction industry.

Vietnam Construction Chemicals Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Product

-

2.1. Adhesives

-

2.1.1. By Sub Product

- 2.1.1.1. Hot Melt

- 2.1.1.2. Reactive

- 2.1.1.3. Solvent-borne

- 2.1.1.4. Water-borne

-

2.1.1. By Sub Product

-

2.2. Anchors and Grouts

- 2.2.1. Cementitious Fixing

- 2.2.2. Resin Fixing

- 2.2.3. Other Types

-

2.3. Concrete Admixtures

- 2.3.1. Accelerator

- 2.3.2. Air Entraining Admixture

- 2.3.3. High Range Water Reducer (Super Plasticizer)

- 2.3.4. Retarder

- 2.3.5. Shrinkage Reducing Admixture

- 2.3.6. Viscosity Modifier

- 2.3.7. Water Reducer (Plasticizer)

-

2.4. Concrete Protective Coatings

- 2.4.1. Acrylic

- 2.4.2. Alkyd

- 2.4.3. Epoxy

- 2.4.4. Polyurethane

- 2.4.5. Other Resin Types

-

2.5. Flooring Resins

- 2.5.1. Polyaspartic

-

2.6. Repair and Rehabilitation Chemicals

- 2.6.1. Fiber Wrapping Systems

- 2.6.2. Injection Grouting Materials

- 2.6.3. Micro-concrete Mortars

- 2.6.4. Modified Mortars

- 2.6.5. Rebar Protectors

-

2.7. Sealants

- 2.7.1. Silicone

-

2.8. Surface Treatment Chemicals

- 2.8.1. Curing Compounds

- 2.8.2. Mold Release Agents

- 2.8.3. Other Product Types

-

2.9. Waterproofing Solutions

- 2.9.1. Membranes

-

2.1. Adhesives

Vietnam Construction Chemicals Market Segmentation By Geography

- 1. Vietnam

Vietnam Construction Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Consumption for Polyethylene Terephthalate in the Packaging Sector; Significant Demand of Polyester Fibers from the Textile Sector in Asia Pacific

- 3.3. Market Restrains

- 3.3.1. Toxic Effects of Terephthalic Acid

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Construction Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Adhesives

- 5.2.1.1. By Sub Product

- 5.2.1.1.1. Hot Melt

- 5.2.1.1.2. Reactive

- 5.2.1.1.3. Solvent-borne

- 5.2.1.1.4. Water-borne

- 5.2.1.1. By Sub Product

- 5.2.2. Anchors and Grouts

- 5.2.2.1. Cementitious Fixing

- 5.2.2.2. Resin Fixing

- 5.2.2.3. Other Types

- 5.2.3. Concrete Admixtures

- 5.2.3.1. Accelerator

- 5.2.3.2. Air Entraining Admixture

- 5.2.3.3. High Range Water Reducer (Super Plasticizer)

- 5.2.3.4. Retarder

- 5.2.3.5. Shrinkage Reducing Admixture

- 5.2.3.6. Viscosity Modifier

- 5.2.3.7. Water Reducer (Plasticizer)

- 5.2.4. Concrete Protective Coatings

- 5.2.4.1. Acrylic

- 5.2.4.2. Alkyd

- 5.2.4.3. Epoxy

- 5.2.4.4. Polyurethane

- 5.2.4.5. Other Resin Types

- 5.2.5. Flooring Resins

- 5.2.5.1. Polyaspartic

- 5.2.6. Repair and Rehabilitation Chemicals

- 5.2.6.1. Fiber Wrapping Systems

- 5.2.6.2. Injection Grouting Materials

- 5.2.6.3. Micro-concrete Mortars

- 5.2.6.4. Modified Mortars

- 5.2.6.5. Rebar Protectors

- 5.2.7. Sealants

- 5.2.7.1. Silicone

- 5.2.8. Surface Treatment Chemicals

- 5.2.8.1. Curing Compounds

- 5.2.8.2. Mold Release Agents

- 5.2.8.3. Other Product Types

- 5.2.9. Waterproofing Solutions

- 5.2.9.1. Membranes

- 5.2.1. Adhesives

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Arkema

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Saint-Gobain

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 RPM International Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MBCC Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 KKS GROUP JSC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fosroc Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sika A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MAPEI S p A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bestmix Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 MC-Bauchemie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Arkema

List of Figures

- Figure 1: Vietnam Construction Chemicals Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Construction Chemicals Market Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Construction Chemicals Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Construction Chemicals Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Vietnam Construction Chemicals Market Revenue Million Forecast, by End Use Sector 2019 & 2032

- Table 4: Vietnam Construction Chemicals Market Volume K Tons Forecast, by End Use Sector 2019 & 2032

- Table 5: Vietnam Construction Chemicals Market Revenue Million Forecast, by Product 2019 & 2032

- Table 6: Vietnam Construction Chemicals Market Volume K Tons Forecast, by Product 2019 & 2032

- Table 7: Vietnam Construction Chemicals Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Vietnam Construction Chemicals Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Vietnam Construction Chemicals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Vietnam Construction Chemicals Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Vietnam Construction Chemicals Market Revenue Million Forecast, by End Use Sector 2019 & 2032

- Table 12: Vietnam Construction Chemicals Market Volume K Tons Forecast, by End Use Sector 2019 & 2032

- Table 13: Vietnam Construction Chemicals Market Revenue Million Forecast, by Product 2019 & 2032

- Table 14: Vietnam Construction Chemicals Market Volume K Tons Forecast, by Product 2019 & 2032

- Table 15: Vietnam Construction Chemicals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Vietnam Construction Chemicals Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Construction Chemicals Market?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the Vietnam Construction Chemicals Market?

Key companies in the market include Arkema, Saint-Gobain, RPM International Inc, MBCC Group, KKS GROUP JSC, Fosroc Inc, Sika A, MAPEI S p A, Bestmix Corporation, MC-Bauchemie.

3. What are the main segments of the Vietnam Construction Chemicals Market?

The market segments include End Use Sector, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumption for Polyethylene Terephthalate in the Packaging Sector; Significant Demand of Polyester Fibers from the Textile Sector in Asia Pacific.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Toxic Effects of Terephthalic Acid.

8. Can you provide examples of recent developments in the market?

May 2023: Sika, a global leader in construction chemicals, acquired the MBCC Group, including its waterproofing solutions, anchors & grouts, flooring resins, repair & rehabilitation chemicals, and other businesses, with the exception of its concrete admixture operations in Europe, North America, Australia, and New Zealand.February 2023: Master Builders Solutions, an MBCC Group brand, inaugurated a new offshore grout production plant in Taichung, Taiwan, in order to meet the ongoing demand of the offshore wind turbine market.November 2022: Saint-Gobain's subsidiary, Chryso, introduced CHRYSO Dem Aqua 800, a vegetable oil emulsion-based mold release agent for different concrete applications to provide excellent surface finish quality, mold protection, HSE profile, and optimized consumption.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Construction Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Construction Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Construction Chemicals Market?

To stay informed about further developments, trends, and reports in the Vietnam Construction Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence